UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________

FORM 6-K

__________________________________

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of June 30, 2024

Commission File Number 001-38332

QIAGEN N.V.

Hulsterweg 82

5912 PL Venlo

The Netherlands

__________________________________

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F x Form 40-F o

QIAGEN N.V.

Form 6-K

Table of Contents

| | | | | | | | |

| Item | | Page |

Other Information | | |

Signatures | | |

Exhibit Index | | |

Other Information

On June 6, 2024, QIAGEN N.V. (NYSE: QGEN; Frankfurt Prime Standard: QIA) issued a press release with details about the decision to discontinue the NeuMoDx 96 and 288 Molecular Systems. The press release is furnished herewith as Exhibit 99.1 and is incorporated by reference herein.

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | |

| QIAGEN N.V. |

| |

| By: | /s/ Roland Sackers |

| Roland Sackers |

| Chief Financial Officer |

| |

| Date: | June 6, 2024 |

Exhibit Index

| | | | | | | | |

Exhibit No. | | Exhibit |

| | |

| | Press Release dated June 6, 2024 |

QIAGEN to discontinue NeuMoDx integrated PCR testing system, support customers during transition period

•NeuMoDx 96 and NeuMoDx 288 Molecular Systems decision taken in light of challenging post-pandemic market development trends

•Reaffirms Q2 2024 outlook, raises full-year 2024 outlook for adjusted diluted EPS to $2.14 CER, has started discussions with NeuMoDx customers to assess impact on 2024 sales

•Restructuring charge of approximately $400 million – including about $300 million of non-cash charges – planned to be recognized primarily in 2024

Venlo, the Netherlands, June 6, 2024 – QIAGEN (NYSE: QGEN; Frankfurt Prime Standard: QIA) today announced a decision to discontinue the NeuMoDx 96 and 288 Molecular Systems in light of the market development trends for these product lines following the COVID-19 pandemic and changing customer needs for integrated PCR-based clinical molecular testing systems.

This decision will allow QIAGEN to refocus resources and efforts on developing and commercializing other innovative solutions within its portfolio, in particular the QIAstat-Dx system for syndromic testing, the QIAcuity portfolio of digital PCR systems and the QIAGEN Digital Insights (QDI) bioinformatics business. These are complemented by QIAGEN building on proven leadership positions in Sample technologies and the QuantiFERON-TB franchise.

QIAGEN understands the impact of this decision on its customers and will continue to provide support for existing NeuMoDx users during a transition period into 2025. This includes ongoing maintenance, technical support, and the provision of necessary consumables for a specified period. Support will also be offered in helping customers transition to other solutions.

“We recognize the valuable role that the NeuMoDx 96 and 288 Molecular Systems have played in many laboratories, especially in the global response to the COVID-19 pandemic. However, the market dynamics have since changed considerably and we do not see a realistic path to developing this system in a value-creating way. We are committed to supporting our NeuMoDx customers throughout this transition,” said Thierry Bernard, CEO of QIAGEN. “This decision underscores our unwavering commitment to focus where we can develop profitable leadership positions, and frees up resources to invest in other portfolio areas.”

For more information please visit our website: https://www.qiagen.com/NeuMoDx

QIAGEN reaffirms Q2 2024 outlook, updates FY 2024 outlook for improved profitability

QIAGEN has reaffirmed its outlook for Q2 2024 for net sales of at least $495 million at constant exchange rates (CER) and adjusted diluted EPS (earnings per share) of $0.52 CER.

For full-year 2024, QIAGEN has updated its outlook for adjusted diluted EPS to at least $2.14 CER (prior at least $2.10 CER). QIAGEN has started discussions with NeuMoDx customers to review implications of

this decision on the 2024 NeuMoDx sales forecast for at least $55 million CER. QIAGEN plans to provide details on the outcome of these discussions with the Q2 2024 results announcement.

Restructuring charge to be recognized primarily in Q2 2024

As a result of this decision, and combined with related actions, QIAGEN expects to incur a pre-tax restructuring charge of approximately $400 million (or about $1.40 per diluted share after taxes), and predominantly in the second quarter of 2024. This charge, which will be excluded from adjusted results, includes approximately $300 million of non-cash items. These include about $90 million for inventory and about $210 million for long-term assets (of which about $120 million for acquired intellectual property). Cash charges involve commitments to customers and suppliers, severance payments and other obligations. Related workforce reductions will be handled in a socially responsible manner with respect for affected employees and in compliance with local labor laws.

About QIAGEN

QIAGEN N.V., a Netherlands-based holding company, is the leading global provider of Sample to Insight solutions that enable customers to gain valuable molecular insights from samples containing the building blocks of life. Our Sample technologies isolate and process DNA, RNA and proteins from blood, tissue and other materials. Assay technologies make these biomolecules visible and ready for analysis. Bioinformatics software and knowledge bases interpret data to report relevant, actionable insights. Automation solutions tie these together in seamless and cost-effective workflows. QIAGEN provides solutions to more than 500,000 customers around the world in Molecular Diagnostics (human healthcare) and Life Sciences (academia, pharma R&D and industrial applications, primarily forensics). As of March 31, 2024, QIAGEN employed approximately 6,000 people in over 35 locations worldwide. Further information can be found at http://www.qiagen.com.

Forward-Looking Statement

Certain statements contained in this press release may be considered forward-looking statements within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E of the U.S. Securities Exchange Act of 1934, as amended. These statements can be identified by the use of forward-looking terminology such as “believe”, “hope”, “plan”, “intend”, “seek”, “may”, “will”, “could”, “should”, “would”, “expect”, “anticipate”, “estimate”, “continue” or other similar words. To the extent that any of the statements contained herein relating to QIAGEN's products, timing for launch and development, marketing and/or regulatory approvals, financial and operational outlook, growth and expansion, collaborations, markets, strategy or operating results, including without limitation its expected adjusted net sales, adjusted diluted earnings results, and adjusted operating income margin, the expected size, make-up and timing of the restructuring charge, its ability to refocus resources and efforts on developing and commercializing other innovative solutions within its portfolio, and its continued support for existing NeuMoDx users during the projected a transition period, are forward-looking, such statements are based on current expectations and assumptions that involve a number of uncertainties and risks. Such uncertainties and risks include, but are not limited to, risks associated with our dependence on the development and success of new products; management of growth and expansion of operations (including the effects of currency fluctuations, tax laws, regulatory processes and dependence on suppliers and logistics services); variability of operating results; integration of acquired businesses; changing relationships with customers, suppliers and strategic partners; competition; rapid or unexpected changes in technologies; fluctuations in demand for QIAGEN’s products (including fluctuations due to general economic conditions, the level and timing of customers’ funding, budgets and other factors, including delays or limits in the amount of reimbursement approvals or public health funding); our ability to obtain regulatory approval of our products; difficulties in successfully adapting QIAGEN’s products to integrated solutions and producing such products; the ability of QIAGEN to identify and develop new products and to differentiate and protect our products from competitors’ products; market acceptance of new products and the integration of acquired technologies and businesses; actions of governments, global or regional economic developments, including inflation and rising interest rates, weather or transportation delays, natural disasters, cyber security breaches, political or public health crises, and its impact on the demand for our products and other aspects

of our business, or other force majeure events; litigation risk, including patent litigation and product liability; debt service obligations; volatility in the public trading price of our common shares; as well as the possibility that expected benefits related to recent or pending acquisitions may not materialize as expected; and the other factors discussed under the heading “Risk Factors” in our most recent Annual Report on Form 20-F. For further information, please refer to the discussions in reports that QIAGEN has filed with, or furnished to, the U.S. Securities and Exchange Commission.

| | | | | | | | | | | | | | |

Contacts | | | | |

Investor Relations | | | Public Relations | |

John Gilardi | +49 152 018 11711 | | Thomas Theuringer | +49 2103 29 11826 |

Domenica Martorana | +49 152 018 11244 | | Lisa Mannagottera | +49 2103 29 14181 |

e-mail: ir@QIAGEN.com | | | e-mail: pr@QIAGEN.com | |

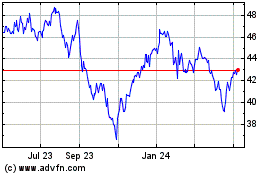

Qiagen NV (NYSE:QGEN)

Historical Stock Chart

From Jun 2024 to Jul 2024

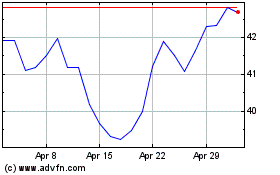

Qiagen NV (NYSE:QGEN)

Historical Stock Chart

From Jul 2023 to Jul 2024