00000804246/302025Q1falsehttp://fasb.org/us-gaap/2024#OtherAssetsNoncurrent http://fasb.org/us-gaap/2024#PrepaidExpenseAndOtherAssetsCurrenthttp://fasb.org/us-gaap/2024#OtherAssetsNoncurrent http://fasb.org/us-gaap/2024#PrepaidExpenseAndOtherAssetsCurrenthttp://fasb.org/us-gaap/2024#AccruedLiabilitiesCurrent http://fasb.org/us-gaap/2024#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2024#AccruedLiabilitiesCurrent http://fasb.org/us-gaap/2024#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2024#AccountsPayableCurrenthttp://fasb.org/us-gaap/2024#AccountsPayableCurrentxbrli:sharesiso4217:USDiso4217:USDxbrli:sharespg:segmentxbrli:purepg:countrypg:taxable_jurisdictionpg:audit00000804242024-07-012024-09-300000080424us-gaap:CommonStockMember2024-07-012024-09-300000080424pg:A0.500NotesDue2024Member2024-07-012024-09-300000080424pg:A0.625NotesDue2024Member2024-07-012024-09-300000080424pg:A1.375NotesDue2025Member2024-07-012024-09-300000080424pg:A0.110NotesDue2026Member2024-07-012024-09-300000080424pg:A3.250EURNotesDue2026Member2024-07-012024-09-300000080424pg:A4.875EURNotesDueMay2027Member2024-07-012024-09-300000080424pg:A1.200NotesDue2028Member2024-07-012024-09-300000080424pg:A3.150EURONotesDue2028Member2024-07-012024-09-300000080424pg:A1.250NotesDue2029Member2024-07-012024-09-300000080424pg:A1.800NotesDue2029Member2024-07-012024-09-300000080424pg:A6.250GBPNotesDueJanuary2030Member2024-07-012024-09-300000080424pg:A0.350NotesDue2030Member2024-07-012024-09-300000080424pg:A0.230NotesDue2031Member2024-07-012024-09-300000080424pg:A3.250EURNotesDue2031Member2024-07-012024-09-300000080424pg:A5.250GBPNotesDueJanuary2033Member2024-07-012024-09-300000080424pg:A3.200EURNotesDue2034Member2024-07-012024-09-300000080424pg:A1.875NotesDue2038Member2024-07-012024-09-300000080424pg:A0.900NotesDue2041Member2024-07-012024-09-3000000804242024-09-3000000804242023-07-012023-09-3000000804242024-06-300000080424us-gaap:CommonStockMember2024-06-300000080424us-gaap:PreferredStockMember2024-06-300000080424us-gaap:AdditionalPaidInCapitalMember2024-06-300000080424pg:ReserveforESOPDebtRetirementMember2024-06-300000080424us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-300000080424us-gaap:TreasuryStockCommonMember2024-06-300000080424us-gaap:RetainedEarningsMember2024-06-300000080424us-gaap:NoncontrollingInterestMember2024-06-300000080424us-gaap:RetainedEarningsMember2024-07-012024-09-300000080424us-gaap:NoncontrollingInterestMember2024-07-012024-09-300000080424us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-07-012024-09-300000080424us-gaap:CommonStockMember2024-07-012024-09-300000080424us-gaap:TreasuryStockCommonMember2024-07-012024-09-300000080424us-gaap:AdditionalPaidInCapitalMember2024-07-012024-09-300000080424us-gaap:PreferredStockMember2024-07-012024-09-300000080424pg:ReserveforESOPDebtRetirementMember2024-07-012024-09-300000080424us-gaap:CommonStockMember2024-09-300000080424us-gaap:PreferredStockMember2024-09-300000080424us-gaap:AdditionalPaidInCapitalMember2024-09-300000080424pg:ReserveforESOPDebtRetirementMember2024-09-300000080424us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-09-300000080424us-gaap:TreasuryStockCommonMember2024-09-300000080424us-gaap:RetainedEarningsMember2024-09-300000080424us-gaap:NoncontrollingInterestMember2024-09-300000080424us-gaap:CommonStockMember2023-06-300000080424us-gaap:PreferredStockMember2023-06-300000080424us-gaap:AdditionalPaidInCapitalMember2023-06-300000080424pg:ReserveforESOPDebtRetirementMember2023-06-300000080424us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300000080424us-gaap:TreasuryStockCommonMember2023-06-300000080424us-gaap:RetainedEarningsMember2023-06-300000080424us-gaap:NoncontrollingInterestMember2023-06-3000000804242023-06-300000080424us-gaap:RetainedEarningsMember2023-07-012023-09-300000080424us-gaap:NoncontrollingInterestMember2023-07-012023-09-300000080424us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-012023-09-300000080424us-gaap:CommonStockMember2023-07-012023-09-300000080424us-gaap:TreasuryStockCommonMember2023-07-012023-09-300000080424us-gaap:AdditionalPaidInCapitalMember2023-07-012023-09-300000080424us-gaap:PreferredStockMember2023-07-012023-09-300000080424pg:ReserveforESOPDebtRetirementMember2023-07-012023-09-300000080424us-gaap:CommonStockMember2023-09-300000080424us-gaap:PreferredStockMember2023-09-300000080424us-gaap:AdditionalPaidInCapitalMember2023-09-300000080424pg:ReserveforESOPDebtRetirementMember2023-09-300000080424us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-300000080424us-gaap:TreasuryStockCommonMember2023-09-300000080424us-gaap:RetainedEarningsMember2023-09-300000080424us-gaap:NoncontrollingInterestMember2023-09-3000000804242023-09-300000080424us-gaap:ProductConcentrationRiskMemberus-gaap:SalesRevenueNetMemberpg:FabricHomeCareSegmentMemberpg:FabricCareMember2024-07-012024-09-300000080424us-gaap:ProductConcentrationRiskMemberus-gaap:SalesRevenueNetMemberpg:FabricHomeCareSegmentMemberpg:FabricCareMember2023-07-012023-09-300000080424us-gaap:ProductConcentrationRiskMemberus-gaap:SalesRevenueNetMemberpg:FabricHomeCareSegmentMemberpg:HomeCareMember2024-07-012024-09-300000080424us-gaap:ProductConcentrationRiskMemberus-gaap:SalesRevenueNetMemberpg:FabricHomeCareSegmentMemberpg:HomeCareMember2023-07-012023-09-300000080424us-gaap:ProductConcentrationRiskMemberus-gaap:SalesRevenueNetMemberpg:BabyFeminineFamilyCareSegmentMemberpg:BabyCareMember2024-07-012024-09-300000080424us-gaap:ProductConcentrationRiskMemberus-gaap:SalesRevenueNetMemberpg:BabyFeminineFamilyCareSegmentMemberpg:BabyCareMember2023-07-012023-09-300000080424us-gaap:ProductConcentrationRiskMemberus-gaap:SalesRevenueNetMemberpg:BeautySegmentMemberpg:HairCareMember2024-07-012024-09-300000080424us-gaap:ProductConcentrationRiskMemberus-gaap:SalesRevenueNetMemberpg:BeautySegmentMemberpg:HairCareMember2023-07-012023-09-300000080424us-gaap:ProductConcentrationRiskMemberus-gaap:SalesRevenueNetMemberpg:BabyFeminineFamilyCareSegmentMemberpg:FamilyCareMember2024-07-012024-09-300000080424us-gaap:ProductConcentrationRiskMemberus-gaap:SalesRevenueNetMemberpg:BabyFeminineFamilyCareSegmentMemberpg:FamilyCareMember2023-07-012023-09-300000080424us-gaap:ProductConcentrationRiskMemberus-gaap:SalesRevenueNetMemberpg:GroomingSegmentMemberpg:GroomingMember2024-07-012024-09-300000080424us-gaap:ProductConcentrationRiskMemberus-gaap:SalesRevenueNetMemberpg:GroomingSegmentMemberpg:GroomingMember2023-07-012023-09-300000080424us-gaap:ProductConcentrationRiskMemberus-gaap:SalesRevenueNetMemberpg:HealthCareSegmentMemberpg:OralCareMember2024-07-012024-09-300000080424us-gaap:ProductConcentrationRiskMemberus-gaap:SalesRevenueNetMemberpg:HealthCareSegmentMemberpg:OralCareMember2023-07-012023-09-300000080424us-gaap:ProductConcentrationRiskMemberus-gaap:SalesRevenueNetMemberpg:HealthCareSegmentMemberpg:PersonalHealthCareMember2024-07-012024-09-300000080424us-gaap:ProductConcentrationRiskMemberus-gaap:SalesRevenueNetMemberpg:HealthCareSegmentMemberpg:PersonalHealthCareMember2023-07-012023-09-300000080424us-gaap:ProductConcentrationRiskMemberus-gaap:SalesRevenueNetMemberpg:BabyFeminineFamilyCareSegmentMemberpg:FeminineCareMember2024-07-012024-09-300000080424us-gaap:ProductConcentrationRiskMemberus-gaap:SalesRevenueNetMemberpg:BabyFeminineFamilyCareSegmentMemberpg:FeminineCareMember2023-07-012023-09-300000080424us-gaap:ProductConcentrationRiskMemberus-gaap:SalesRevenueNetMemberpg:BeautySegmentMemberpg:PersonalCareMember2024-07-012024-09-300000080424us-gaap:ProductConcentrationRiskMemberus-gaap:SalesRevenueNetMemberpg:BeautySegmentMemberpg:PersonalCareMember2023-07-012023-09-300000080424us-gaap:ProductConcentrationRiskMemberus-gaap:SalesRevenueNetMemberpg:BeautySegmentMemberpg:SkinCareMember2024-07-012024-09-300000080424us-gaap:ProductConcentrationRiskMemberus-gaap:SalesRevenueNetMemberpg:BeautySegmentMemberpg:SkinCareMember2023-07-012023-09-300000080424us-gaap:ProductConcentrationRiskMemberus-gaap:SalesRevenueNetMember2024-07-012024-09-300000080424us-gaap:ProductConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-07-012023-09-300000080424pg:BeautySegmentMember2024-07-012024-09-300000080424pg:BeautySegmentMember2023-07-012023-09-300000080424pg:GroomingSegmentMember2024-07-012024-09-300000080424pg:GroomingSegmentMember2023-07-012023-09-300000080424pg:HealthCareSegmentMember2024-07-012024-09-300000080424pg:HealthCareSegmentMember2023-07-012023-09-300000080424pg:FabricHomeCareSegmentMember2024-07-012024-09-300000080424pg:FabricHomeCareSegmentMember2023-07-012023-09-300000080424pg:BabyFeminineFamilyCareSegmentMember2024-07-012024-09-300000080424pg:BabyFeminineFamilyCareSegmentMember2023-07-012023-09-300000080424us-gaap:CorporateMember2024-07-012024-09-300000080424us-gaap:CorporateMember2023-07-012023-09-300000080424pg:BeautySegmentMember2024-06-300000080424pg:GroomingSegmentMember2024-06-300000080424pg:HealthCareSegmentMember2024-06-300000080424pg:FabricHomeCareSegmentMember2024-06-300000080424pg:BabyFeminineFamilyCareSegmentMember2024-06-300000080424pg:BeautySegmentMember2024-09-300000080424pg:GroomingSegmentMember2024-09-300000080424pg:HealthCareSegmentMember2024-09-300000080424pg:FabricHomeCareSegmentMember2024-09-300000080424pg:BabyFeminineFamilyCareSegmentMember2024-09-300000080424pg:GilletteMember2024-09-300000080424pg:A25BpsIncreaseDiscountRateMemberus-gaap:IndefinitelivedIntangibleAssetsMemberpg:GilletteMember2023-12-310000080424pg:A25bpsDecreaseLongTermGrowthMemberus-gaap:IndefinitelivedIntangibleAssetsMemberpg:GilletteMember2023-12-310000080424pg:A50BpsDecreaseLongTermRoyaltyMemberus-gaap:IndefinitelivedIntangibleAssetsMemberpg:GilletteMember2023-12-310000080424us-gaap:EmployeeStockOptionMember2023-07-012023-09-300000080424us-gaap:EmployeeStockOptionMember2024-07-012024-09-300000080424us-gaap:PensionPlansDefinedBenefitMember2024-07-012024-09-300000080424us-gaap:PensionPlansDefinedBenefitMember2023-07-012023-09-300000080424us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2024-07-012024-09-300000080424us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-07-012023-09-300000080424us-gaap:InterestRateContractMemberus-gaap:FairValueHedgingMember2024-09-300000080424us-gaap:InterestRateContractMemberus-gaap:FairValueHedgingMember2024-06-300000080424us-gaap:ForeignExchangeContractMemberus-gaap:NetInvestmentHedgingMember2024-09-300000080424us-gaap:ForeignExchangeContractMemberus-gaap:NetInvestmentHedgingMember2024-06-300000080424us-gaap:DesignatedAsHedgingInstrumentMember2024-09-300000080424us-gaap:DesignatedAsHedgingInstrumentMember2024-06-300000080424us-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMember2024-09-300000080424us-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMember2024-06-300000080424us-gaap:UnderlyingOtherMemberus-gaap:FairValueHedgingMember2024-09-300000080424us-gaap:UnderlyingOtherMemberus-gaap:FairValueHedgingMember2024-06-300000080424us-gaap:UnderlyingOtherMemberus-gaap:NetInvestmentHedgingMember2024-09-300000080424us-gaap:UnderlyingOtherMemberus-gaap:NetInvestmentHedgingMember2024-06-300000080424us-gaap:ForeignExchangeContractMember2024-07-012024-09-300000080424us-gaap:ForeignExchangeContractMember2023-07-012023-09-300000080424us-gaap:InterestRateContractMemberus-gaap:FairValueHedgingMember2024-07-012024-09-300000080424us-gaap:InterestRateContractMemberus-gaap:FairValueHedgingMember2023-07-012023-09-300000080424us-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMember2024-07-012024-09-300000080424us-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMember2023-07-012023-09-300000080424us-gaap:AccumulatedNetInvestmentGainLossIncludingPortionAttributableToNoncontrollingInterestMember2024-06-300000080424us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetGainLossIncludingPortionAttributableToNoncontrollingInterestMember2024-06-300000080424us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2024-06-300000080424us-gaap:AccumulatedNetInvestmentGainLossIncludingPortionAttributableToNoncontrollingInterestMember2024-07-012024-09-300000080424us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetGainLossIncludingPortionAttributableToNoncontrollingInterestMember2024-07-012024-09-300000080424us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2024-07-012024-09-300000080424us-gaap:AccumulatedNetInvestmentGainLossIncludingPortionAttributableToNoncontrollingInterestMember2024-09-300000080424us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetGainLossIncludingPortionAttributableToNoncontrollingInterestMember2024-09-300000080424us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2024-09-300000080424srt:MinimumMember2024-07-012024-09-300000080424srt:MaximumMember2024-07-012024-09-300000080424srt:MinimumMember2024-09-300000080424srt:MaximumMember2024-09-300000080424us-gaap:CostOfSalesMember2024-07-012024-09-300000080424us-gaap:SellingGeneralAndAdministrativeExpensesMember2024-07-012024-09-300000080424us-gaap:OtherNonoperatingIncomeExpenseMember2024-07-012024-09-300000080424us-gaap:EmployeeSeveranceMember2024-06-300000080424us-gaap:FacilityClosingMember2024-06-300000080424us-gaap:OtherRestructuringMember2024-06-300000080424us-gaap:EmployeeSeveranceMember2024-07-012024-09-300000080424us-gaap:FacilityClosingMember2024-07-012024-09-300000080424us-gaap:OtherRestructuringMember2024-07-012024-09-300000080424us-gaap:EmployeeSeveranceMember2024-09-300000080424us-gaap:FacilityClosingMember2024-09-300000080424us-gaap:OtherRestructuringMember2024-09-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark one) | | | | | | | | |

| x | True | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Quarterly Period Ended September 30, 2024

OR | | | | | | | | |

| o | False | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

THE PROCTER & GAMBLE COMPANY

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Ohio | OH | 1-434 | | 31-0411980 |

| (State of Incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification Number) |

| One Procter & Gamble Plaza | | Cincinnati | OH | |

One Procter & Gamble Plaza, Cincinnati, Ohio | 45202 |

| (Address of principal executive offices) | (Zip Code) |

(513) 983-1100

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

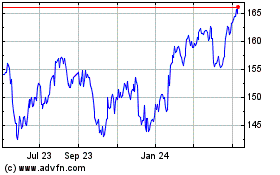

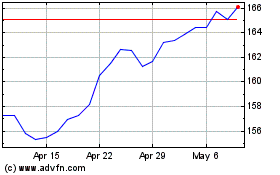

| Common Stock, without Par Value | PG | NYSE |

| 0.500% Notes due 2024 | PG24A | NYSE |

| 0.625% Notes due 2024 | PG24B | NYSE |

| 1.375% Notes due 2025 | PG25 | NYSE |

| 0.110% Notes due 2026 | PG26D | NYSE |

| 3.250% EUR Notes due 2026 | PG26F | NYSE |

| 4.875% EUR Notes due May 2027 | PG27A | NYSE |

| 1.200% Notes due 2028 | PG28 | NYSE |

| 3.150% EUR Notes due 2028 | PG28B | NYSE |

| 1.250% Notes due 2029 | PG29B | NYSE |

| 1.800% Notes due 2029 | PG29A | NYSE |

| 6.250% GBP Notes due January 2030 | PG30 | NYSE |

| 0.350% Notes due 2030 | PG30C | NYSE |

| 0.230% Notes due 2031 | PG31A | NYSE |

| 3.250% EUR Notes due 2031 | PG31B | NYSE |

| 5.250% GBP Notes due January 2033 | PG33 | NYSE |

| 3.200% EUR Notes due 2034 | PG34C | NYSE |

| 1.875% Notes due 2038 | PG38 | NYSE |

| 0.900% Notes due 2041 | PG41 | NYSE |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes þ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | þ | | | Accelerated filer | ¨ | |

| Non-accelerated filer | ¨ | | | Smaller reporting company | ¨ | False |

| | | | | Emerging growth company | ¨ | False |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No þ False

There were 2,355,041,729 shares of Common Stock outstanding as of September 30, 2024.

| | | | | | | | | | | |

| FORM 10-Q TABLE OF CONTENTS | Page |

| PART I | Item 1. | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| PART II | Item 1. | | |

| Item 1A. | | |

| Item 2. | | |

| Item 5. | | |

| Item 6. | | |

| | | |

The Procter & Gamble Company 1

PART I. FINANCIAL INFORMATION

| | | | | |

| Item 1. | Financial Statements |

THE PROCTER & GAMBLE COMPANY AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF EARNINGS | | | | | | | | | | | | | | | |

| Three Months Ended September 30 | | |

| Amounts in millions except per share amounts | 2024 | | 2023 | | | | |

| NET SALES | $ | 21,737 | | | $ | 21,871 | | | | | |

| Cost of products sold | 10,421 | | | 10,501 | | | | | |

| Selling, general and administrative expense | 5,519 | | | 5,604 | | | | | |

| OPERATING INCOME | 5,797 | | | 5,767 | | | | | |

| Interest expense | (238) | | | (225) | | | | | |

| Interest income | 135 | | | 128 | | | | | |

| Other non-operating income/(expense), net | (554) | | | 132 | | | | | |

| EARNINGS BEFORE INCOME TAXES | 5,140 | | | 5,802 | | | | | |

| Income taxes | 1,152 | | | 1,246 | | | | | |

| NET EARNINGS | 3,987 | | | 4,556 | | | | | |

| Less: Net earnings attributable to noncontrolling interests | 28 | | | 35 | | | | | |

| NET EARNINGS ATTRIBUTABLE TO PROCTER & GAMBLE | $ | 3,959 | | | $ | 4,521 | | | | | |

| | | | | | | |

NET EARNINGS PER COMMON SHARE (1) | | | | | | | |

| Basic | $ | 1.65 | | | $ | 1.89 | | | | | |

| Diluted | $ | 1.61 | | | $ | 1.83 | | | | | |

(1)Basic net earnings per common share and Diluted net earnings per common share are calculated on Net earnings attributable to Procter & Gamble.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME | | | | | | | | | | | | | | | |

| Three Months Ended September 30 | | |

| Amounts in millions | 2024 | | 2023 | | | | |

| NET EARNINGS | $ | 3,987 | | | $ | 4,556 | | | | | |

| OTHER COMPREHENSIVE INCOME/(LOSS), NET OF TAX | | | | | | | |

| Foreign currency translation | 1,026 | | | (409) | | | | | |

| Unrealized gains/(losses) on investment securities | 2 | | | (1) | | | | | |

| Unrealized gains/(losses) on defined benefit postretirement plans | (21) | | | 45 | | | | | |

| TOTAL OTHER COMPREHENSIVE INCOME/(LOSS), NET OF TAX | 1,007 | | | (366) | | | | | |

| TOTAL COMPREHENSIVE INCOME | 4,994 | | | 4,190 | | | | | |

| Less: Comprehensive income attributable to noncontrolling interests | 28 | | | 33 | | | | | |

| TOTAL COMPREHENSIVE INCOME ATTRIBUTABLE TO PROCTER & GAMBLE | $ | 4,965 | | | $ | 4,157 | | | | | |

See accompanying Notes to Consolidated Financial Statements.

2 The Procter & Gamble Company

THE PROCTER & GAMBLE COMPANY AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS | | | | | | | | | | | | | | | | | | | | | | | |

| Amounts in millions | | | | | September 30, 2024 | | June 30, 2024 |

| Assets | | | | | | | |

| CURRENT ASSETS | | | | | | | |

| Cash and cash equivalents | | | | | $ | 12,156 | | | $ | 9,482 | |

| Accounts receivable | | | | | 6,314 | | | 6,118 | |

| INVENTORIES | | | | | | | |

| Materials and supplies | | | | | 1,820 | | | 1,617 | |

| Work in process | | | | | 921 | | | 929 | |

| Finished goods | | | | | 4,546 | | | 4,470 | |

| Total inventories | | | | | 7,287 | | | 7,016 | |

| Prepaid expenses and other current assets | | | | | 1,692 | | | 2,095 | |

| TOTAL CURRENT ASSETS | | | | | 27,449 | | | 24,709 | |

| PROPERTY, PLANT AND EQUIPMENT, NET | | | | | 22,506 | | | 22,152 | |

| GOODWILL | | | | | 40,970 | | | 40,303 | |

| TRADEMARKS AND OTHER INTANGIBLE ASSETS, NET | | | | 22,053 | | | 22,047 | |

| OTHER NONCURRENT ASSETS | | | | | 13,503 | | | 13,158 | |

| TOTAL ASSETS | | | | | $ | 126,482 | | | $ | 122,370 | |

| | | | | | | |

| Liabilities and Shareholders' Equity | | | | | | | |

| CURRENT LIABILITIES | | | | | | | |

| Accounts payable | | | | | $ | 15,350 | | | $ | 15,364 | |

| Accrued and other liabilities | | | | | 10,661 | | | 11,073 | |

| Debt due within one year | | | | | 10,409 | | | 7,191 | |

| TOTAL CURRENT LIABILITIES | | | | | 36,420 | | | 33,627 | |

| LONG-TERM DEBT | | | | | 25,744 | | | 25,269 | |

| DEFERRED INCOME TAXES | | | | | 6,420 | | | 6,516 | |

| OTHER NONCURRENT LIABILITIES | | | | | 5,757 | | | 6,398 | |

| TOTAL LIABILITIES | | | | | 74,341 | | | 71,811 | |

| SHAREHOLDERS’ EQUITY | | | | | | | |

| Preferred stock | | | | | 791 | | | 798 | |

| Common stock – shares issued – | September 2024 | | 4,009.2 | | | | | |

| June 2024 | | 4,009.2 | | | 4,009 | | | 4,009 | |

| Additional paid-in capital | | | | | 68,102 | | | 67,684 | |

| Reserve for ESOP debt retirement | | | | | (707) | | | (737) | |

| Accumulated other comprehensive loss | | | | | (10,893) | | | (11,900) | |

| Treasury stock | | | | | (134,823) | | | (133,379) | |

| Retained earnings | | | | | 125,361 | | | 123,811 | |

| Noncontrolling interest | | | | | 300 | | | 272 | |

| TOTAL SHAREHOLDERS’ EQUITY | | | | | 52,141 | | | 50,559 | |

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | $ | 126,482 | | | $ | 122,370 | |

See accompanying Notes to Consolidated Financial Statements.

The Procter & Gamble Company 3

THE PROCTER & GAMBLE COMPANY AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2024 |

Dollars in millions;

shares in thousands | Common Stock | Preferred Stock | Additional Paid-In Capital | Reserve for ESOP Debt Retirement | Accumulated Other Comprehensive Income/(Loss) | Treasury Stock | Retained Earnings | Noncontrolling Interest | Total Shareholders' Equity |

| Shares | Amount |

| BALANCE JUNE 30, 2024 | 2,357,051 | | $4,009 | | $798 | | $67,684 | | ($737) | | ($11,900) | | ($133,379) | | $123,811 | | $272 | | $50,559 | |

| Net earnings | | | | | | | | 3,959 | | 28 | | 3,987 | |

| Other comprehensive income/(loss) | | | | | | 1,006 | | | | 1 | | 1,007 | |

Dividends and dividend equivalents ($1.0065 per share): | | | | | | | | | | |

| Common | | | | | | | | (2,378) | | | (2,378) | |

| Preferred | | | | | | | | (72) | | | (72) | |

| Treasury stock purchases | (11,552) | | | | | | | (1,942) | | | | (1,942) | |

| Employee stock plans | 8,769 | | | | 417 | | | | 492 | | | | 910 | |

| Preferred stock conversions | 774 | | | (7) | | 1 | | | | 6 | | | | — | |

| ESOP debt impacts | | | | | 30 | | | | 41 | | | 71 | |

| Noncontrolling interest, net | | | | — | | | | | | — | | — | |

| BALANCE SEPTEMBER 30, 2024 | 2,355,042 | | $4,009 | | $791 | | $68,102 | | ($707) | | ($10,893) | | ($134,823) | | $125,361 | | $300 | | $52,141 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2023 |

Dollars in millions;

shares in thousands | Common Stock | Preferred Stock | Additional Paid-In Capital | Reserve for ESOP Debt Retirement | Accumulated Other Comprehensive Income/(Loss) | Treasury Stock | Retained Earnings | Noncontrolling Interest | Total Shareholders' Equity |

| Shares | Amount |

| BALANCE JUNE 30, 2023 | 2,362,120 | | $4,009 | | $819 | | $66,556 | | ($821) | | ($12,220) | | ($129,736) | | $118,170 | | $288 | | $47,065 | |

| Net earnings | | | | | | | | 4,521 | | 35 | | 4,556 | |

| Other comprehensive income/(loss) | | | | | | (363) | | | | (2) | | (366) | |

Dividends and dividend equivalents ($0.9407 per share): | | | | | | | | | | |

| Common | | | | | | | | (2,225) | | | (2,225) | |

| Preferred | | | | | | | | (70) | | | (70) | |

| Treasury stock purchases | (9,843) | | | | | | | (1,508) | | | | (1,508) | |

| Employee stock plans | 3,721 | | | | 265 | | | | 209 | | | | 474 | |

| Preferred stock conversions | 888 | | | (7) | | 1 | | | | 6 | | | | — | |

| ESOP debt impacts | | | | | 39 | | | | 48 | | | 87 | |

| Noncontrolling interest, net | | | | — | | | | | | — | | — | |

| BALANCE SEPTEMBER 30, 2023 | 2,356,886 | | $4,009 | | $812 | | $66,822 | | ($782) | | ($12,583) | | ($131,029) | | $120,443 | | $321 | | $48,014 | |

See accompanying Notes to Consolidated Financial Statements.

4 The Procter & Gamble Company

THE PROCTER & GAMBLE COMPANY AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS | | | | | | | | | | | |

| Three Months Ended September 30 |

| Amounts in millions | 2024 | | 2023 |

| CASH, CASH EQUIVALENTS AND RESTRICTED CASH, BEGINNING OF PERIOD | $ | 9,482 | | | $ | 8,246 | |

| OPERATING ACTIVITIES | | | |

| Net earnings | 3,987 | | | 4,556 | |

| Depreciation and amortization | 728 | | | 702 | |

| Share-based compensation expense | 105 | | | 125 | |

| Deferred income taxes | 184 | | | 102 | |

| Loss/(gain) on sale of assets | 794 | | | (3) | |

| | | |

| | | |

| Change in accounts receivable | (134) | | | (830) | |

| Change in inventories | (188) | | | (142) | |

| Change in accounts payable and accrued and other liabilities | (648) | | | 857 | |

| Change in other operating assets and liabilities | (558) | | | (671) | |

| Other | 32 | | | 208 | |

| TOTAL OPERATING ACTIVITIES | 4,302 | | | 4,904 | |

| INVESTING ACTIVITIES | | | |

| Capital expenditures | (993) | | | (925) | |

| Proceeds from asset sales | 45 | | | 3 | |

| Acquisitions, net of cash acquired | (6) | | | — | |

| Other investing activity | (154) | | | (300) | |

| TOTAL INVESTING ACTIVITIES | (1,108) | | | (1,222) | |

| FINANCING ACTIVITIES | | | |

| Dividends to shareholders | (2,445) | | | (2,290) | |

| Additions to short-term debt with original maturities of more than three months | 4,090 | | | 2,179 | |

| Reductions in short-term debt with original maturities of more than three months | (571) | | | (1,906) | |

| Net additions/(reductions) to other short-term debt | (444) | | | 2,172 | |

| | | |

| Reductions in long-term debt | (70) | | | (1,004) | |

| Treasury stock purchases | (1,939) | | | (1,500) | |

| Impact of stock options and other | 745 | | | 312 | |

| TOTAL FINANCING ACTIVITIES | (634) | | | (2,038) | |

| EFFECT OF EXCHANGE RATE CHANGES ON CASH, CASH EQUIVALENTS AND RESTRICTED CASH | 116 | | | (156) | |

| CHANGE IN CASH, CASH EQUIVALENTS AND RESTRICTED CASH | 2,675 | | | 1,487 | |

| CASH, CASH EQUIVALENTS AND RESTRICTED CASH, END OF PERIOD | $ | 12,156 | | | $ | 9,733 | |

See accompanying Notes to Consolidated Financial Statements.

The Procter & Gamble Company 5

THE PROCTER & GAMBLE COMPANY AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. Basis of Presentation

The accompanying unaudited Consolidated Financial Statements of The Procter & Gamble Company and subsidiaries ("the Company," "Procter & Gamble," "P&G," "we" or "our") should be read in conjunction with the Company’s Annual Report on Form 10-K for the fiscal year ended June 30, 2024. We have prepared these statements in conformity with accounting principles generally accepted in the United States (U.S. GAAP) pursuant to the rules and regulations of the U.S. Securities and Exchange Commission (SEC) for interim financial information. Note that certain columns and rows may not add due to rounding. In the opinion of management, the accompanying Consolidated Financial Statements contain all normal recurring adjustments necessary to present fairly the financial position, results of operations and cash flows for the interim periods reported. However, the results of operations included in such financial statements may not necessarily be indicative of annual results.

2. New Accounting Pronouncements and Policies

In November 2023, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) No. 2023-07, “Segment Reporting: Improvements to Reportable Segment Disclosures.” This guidance requires disclosure of incremental segment information on an annual and interim basis. This amendment is effective for our fiscal year ending June 30, 2025 and our interim periods within the fiscal year ending June 30, 2026. The guidance will require additional disclosures in the Segment Information footnote, but will not have a material impact on our Consolidated Financial Statements.

In December 2023, the FASB issued ASU No. 2023-09, “Income Taxes: Improvements to Income Tax Disclosures.” This guidance requires consistent categories and greater disaggregation of information in the rate reconciliation and disclosures of income taxes paid by jurisdiction. This amendment is effective for our fiscal year ending June 30, 2026. We are currently assessing the impact of this guidance on our disclosures.

No other new accounting pronouncement issued or effective during the fiscal year had, or is expected to have, a material impact on our Consolidated Financial Statements.

3. Segment Information

Under U.S. GAAP, our operating segments are aggregated into five reportable segments: 1) Beauty, 2) Grooming, 3) Health Care, 4) Fabric & Home Care and 5) Baby, Feminine & Family Care. Our five reportable segments are comprised of:

•Beauty: Hair Care (Conditioners, Shampoos, Styling Aids, Treatments); Personal Care (Antiperspirants and Deodorants, Personal Cleansing); Skin Care (Facial Moisturizers, Cleaners and Treatments);

•Grooming: Grooming (Appliances, Female Blades & Razors, Male Blades & Razors, Pre- and Post-Shave Products, Other Grooming);

•Health Care: Oral Care (Toothbrushes, Toothpaste, Other Oral Care); Personal Health Care (Gastrointestinal, Pain Relief, Rapid Diagnostics, Respiratory, Vitamins/Minerals/Supplements, Other Personal Health Care);

•Fabric & Home Care: Fabric Care (Fabric Enhancers, Laundry Additives, Laundry Detergents); Home Care (Air Care, Dish Care, P&G Professional, Surface Care); and

•Baby, Feminine & Family Care: Baby Care (Baby Wipes, Taped Diapers and Pants); Feminine Care (Adult Incontinence, Menstrual Care); Family Care (Paper Towels, Tissues, Toilet Paper).

Amounts in millions of dollars except per share amounts or as otherwise specified.

6 The Procter & Gamble Company

Operating segments as a percentage of consolidated net sales are as follows:

| | | | | | | | | | | | | | | |

| % of Net sales by operating segment (1) |

| Three Months Ended September 30 | | |

| 2024 | | 2023 | | | | |

| Fabric Care | 23 | % | | 23 | % | | | | |

| Home Care | 13 | % | | 12 | % | | | | |

| Baby Care | 9 | % | | 9 | % | | | | |

| Hair Care | 9 | % | | 9 | % | | | | |

| Family Care | 8 | % | | 8 | % | | | | |

| Grooming | 8 | % | | 8 | % | | | | |

| Oral Care | 8 | % | | 8 | % | | | | |

| Personal Health Care | 7 | % | | 6 | % | | | | |

| Feminine Care | 6 | % | | 7 | % | | | | |

Personal Care (2) | 6 | % | | 6 | % | | | | |

Skin Care (2) | 3 | % | | 4 | % | | | | |

| Total | 100 | % | | 100 | % | | | | |

(1)% of Net sales by operating segment excludes sales recorded in Corporate.

(2)Effective July 1, 2024, the Beauty reportable business segment separated Skin and Personal Care into individual operating segments, Skin Care and Personal Care. This transition included separation of the management team, strategic decision-making, innovation plans, financial targets, budgets and management reporting.

The following is a summary of reportable segment results:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30 | | |

| | Net Sales | | Earnings/(Loss) Before Income Taxes | | Net Earnings/(Loss) | | | | | | |

| Beauty | 2024 | $ | 3,892 | | | $ | 1,067 | | | $ | 840 | | | | | | | |

| 2023 | 4,097 | | | 1,249 | | | 971 | | | | | | | |

| Grooming | 2024 | 1,723 | | | 522 | | | 426 | | | | | | | |

| 2023 | 1,724 | | | 533 | | | 421 | | | | | | | |

| Health Care | 2024 | 3,147 | | | 953 | | | 741 | | | | | | | |

| 2023 | 3,074 | | | 889 | | | 689 | | | | | | | |

| Fabric & Home Care | 2024 | 7,710 | | | 2,077 | | | 1,621 | | | | | | | |

| 2023 | 7,646 | | | 2,031 | | | 1,569 | | | | | | | |

| Baby, Feminine & Family Care | 2024 | 5,102 | | | 1,383 | | | 1,066 | | | | | | | |

| 2023 | 5,186 | | | 1,408 | | | 1,075 | | | | | | | |

| Corporate | 2024 | 163 | | | (862) | | | (707) | | | | | | | |

| 2023 | 144 | | | (308) | | | (168) | | | | | | | |

| Total Company | 2024 | $ | 21,737 | | | $ | 5,140 | | | $ | 3,987 | | | | | | | |

| 2023 | 21,871 | | | 5,802 | | | 4,556 | | | | | | | |

4. Goodwill and Intangible Assets

Goodwill is allocated by reportable segment as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Beauty | | Grooming | | Health Care | | Fabric & Home Care | | Baby, Feminine & Family Care | | Total Company |

| Goodwill at June 30, 2024 | $ | 13,723 | | | $ | 12,633 | | | $ | 7,638 | | | $ | 1,810 | | | $ | 4,499 | | | $ | 40,303 | |

| Acquisitions and divestitures | — | | | — | | | — | | | — | | | — | | | — | |

| Translation and other | 251 | | | 179 | | | 151 | | | 20 | | | 67 | | | 667 | |

| Goodwill at September 30, 2024 | $ | 13,974 | | | $ | 12,812 | | | $ | 7,789 | | | $ | 1,831 | | | $ | 4,566 | | | $ | 40,970 | |

Goodwill increased from June 30, 2024, primarily due to currency translation.

Amounts in millions of dollars except per share amounts or as otherwise specified.

The Procter & Gamble Company 7

Identifiable intangible assets at September 30, 2024, were comprised of:

| | | | | | | | | | | |

| Gross Carrying Amount | | Accumulated Amortization |

| Intangible assets with determinable lives | $ | 9,107 | | | $ | (6,700) | |

| Intangible assets with indefinite lives | 19,646 | | | — | |

| Total identifiable intangible assets | $ | 28,754 | | | $ | (6,700) | |

Intangible assets with determinable lives consist of brands, patents, technology and customer relationships. The intangible assets with indefinite lives primarily consist of brands. The amortization expense of determinable-lived intangible assets for the three months ended September 30, 2024 and 2023, was $83 and $87, respectively.

Goodwill and indefinite-lived intangible assets are not amortized but are tested at least annually for impairment. We use the income method to estimate the fair value of these assets, which is based on forecasts of the expected future cash flows attributable to the respective assets. When appropriate, the market approach, which leverages comparable company revenue and earnings multiples, is weighted with the income approach to estimate fair value. If the resulting fair value is less than the asset's carrying value, that difference represents an impairment. Our annual impairment testing for goodwill and indefinite-lived intangible assets occurs during the three months ended December 31. Other than our Gillette indefinite-lived intangible asset, our goodwill reporting units and indefinite-lived intangible assets have fair values that significantly exceed their underlying carrying values.

As previously disclosed, the carrying value of the Gillette indefinite-lived intangible asset was impaired during the year ended June 30, 2024. The impairment charge arose due to a higher discount rate, weakening of several currencies relative to the U.S. dollar and the impact of a new restructuring program focused primarily in certain Enterprise Markets, including Argentina and Nigeria. Following the impairment charge, the carrying value of the Gillette indefinite-lived intangible asset was $12.8 billion, which was equivalent to the estimated fair value as of December 31, 2023.

While we have concluded that no triggering event has occurred during the quarter ended September 30, 2024, the Gillette indefinite-lived intangible asset is susceptible to further impairment risk. Adverse changes in the business or in the macroeconomic environment, including foreign currency devaluation, increasing global inflation, or market contraction from an economic recession, could reduce the underlying cash flows used to estimate the fair value of the Gillette indefinite-lived intangible asset and trigger a further impairment charge.

The most significant assumptions utilized in the determination of the estimated fair value of the Gillette indefinite-lived intangible asset are the net sales growth rates (including residual growth rates), discount rate and royalty rates.

Net sales growth rates could be negatively impacted by reductions or changes in demand for our Gillette products, which may be caused by, among other things: changes in the use and frequency of grooming products, shifts in demand away from one or more of our higher priced products to lower priced products or potential supply chain constraints. In addition, relative global and country/regional macroeconomic factors could result in additional and prolonged devaluation of other countries' currencies relative to the U.S. dollar. The residual growth rates represent the expected rate at which the Gillette brand is expected to grow beyond the shorter-term business planning period. The residual growth rates utilized in our fair value estimates are consistent with the brand operating plans and approximate expected long-term category market growth rates. The residual growth rate depends on overall market growth rates, the competitive environment, inflation, relative currency exchange rates and business activities that impact market share. As a result, the residual growth rate could be adversely impacted by a sustained deceleration in category growth, grooming habit changes, devaluation of currencies against the U.S. dollar or an increased competitive environment.

The discount rate, which is consistent with a weighted average cost of capital that is likely to be expected by a market participant, is based upon industry required rates of return, including consideration of both debt and equity components of the capital structure. Our discount rate may be impacted by adverse changes in the macroeconomic environment, volatility in the equity and debt markets or other country specific factors, such as further devaluation of currencies against the U.S. dollar. Spot rates as of the fair value measurement date are utilized in our fair value estimates for cash flows outside the U.S.

The royalty rate used to determine the estimated fair value for the Gillette indefinite-lived intangible asset is driven by historical and estimated future profitability of the underlying Gillette business. The royalty rate may be impacted by significant adverse changes in long-term operating margins.

Amounts in millions of dollars except per share amounts or as otherwise specified.

8 The Procter & Gamble Company

We performed a sensitivity analysis for the Gillette indefinite-lived intangible asset as part of our annual impairment testing during the three months ended December 31, 2023, utilizing reasonably possible changes in the assumptions for the discount rate, the short-term and residual growth rates and the royalty rate to demonstrate the potential impacts to estimated fair values. The table below provides, in isolation, the estimated fair value impacts related to a 25 basis-point increase in the discount rate, a 25 basis-point decrease in our short-term and residual growth rates or a 50 basis-point decrease in our royalty rate, which may result in an additional impairment of the Gillette indefinite-lived intangible asset.

| | | | | | | | | | | | | | | | | |

| Approximate Percent Change in Estimated Fair Value |

| +25 bps Discount Rate | | -25 bps Growth Rates | | -50 bps Royalty Rate |

| Gillette indefinite-lived intangible asset | (5) | % | | (5) | % | | (4) | % |

5. Earnings Per Share

Basic net earnings per common share are calculated by dividing Net earnings attributable to Procter & Gamble less preferred dividends by the weighted average number of common shares outstanding during the period. Diluted net earnings per common share are calculated by dividing Net earnings attributable to Procter & Gamble by the diluted weighted average number of common shares outstanding during the period. The diluted shares include the dilutive effect of stock options and other share-based awards based on the treasury stock method and the assumed conversion of preferred stock.

Net earnings per common share were calculated as follows: | | | | | | | | | | | | | | | |

| CONSOLIDATED AMOUNTS | Three Months Ended September 30 | | |

| 2024 | | 2023 | | | | |

| Net earnings | $ | 3,987 | | | $ | 4,556 | | | | | |

| Less: Net earnings attributable to noncontrolling interests | 28 | | | 35 | | | | | |

| Net earnings attributable to P&G | 3,959 | | | 4,521 | | | | | |

| Less: Preferred dividends | 72 | | | 70 | | | | | |

| Net earnings attributable to P&G available to common shareholders (Basic) | $ | 3,887 | | | $ | 4,450 | | | | | |

| | | | | | | |

| SHARES IN MILLIONS | | | | | | | |

| Basic weighted average common shares outstanding | 2,356.2 | | | 2,360.0 | | | | | |

| Add effect of dilutive securities: | | | | | | | |

Convertible preferred shares (1) | 71.9 | | | 74.6 | | | | | |

Stock options and other unvested equity awards (2) | 37.9 | | | 40.6 | | | | | |

| Diluted weighted average common shares outstanding | 2,466.0 | | | 2,475.2 | | | | | |

| | | | | | | |

| NET EARNINGS PER COMMON SHARE | | | | | | | |

| Basic | $ | 1.65 | | | $ | 1.89 | | | | | |

| Diluted | $ | 1.61 | | | $ | 1.83 | | | | | |

(1)An overview of preferred shares can be found in our Annual Report on Form 10-K for the fiscal year ended June 30, 2024.

(2)Excludes approximately 1 million for the three months ended September 30, 2024 and 2023 respectively, of weighted average stock options outstanding because the exercise price of these options was greater than their average market value or their effect was antidilutive.

6. Share-Based Compensation and Postretirement Benefits

The following table provides a summary of our share-based compensation expense and postretirement benefit impacts:

| | | | | | | | | | | | | | | |

| Three Months Ended September 30 | | |

| 2024 | | 2023 | | | | |

| Share-based compensation expense | $ | 105 | | | $ | 125 | | | | | |

| Net periodic benefit cost for pension benefits | 37 | | | 57 | | | | | |

| Net periodic benefit (credit) for other retiree benefits | (180) | | | (156) | | | | | |

Amounts in millions of dollars except per share amounts or as otherwise specified.

The Procter & Gamble Company 9

7. Risk Management Activities and Fair Value Measurements

As a multinational company with diverse product offerings, we are exposed to market risks, such as changes in interest rates, currency exchange rates and commodity prices. There have been no significant changes in our risk management policies or activities during the three months ended September 30, 2024.

The Company has not changed its valuation techniques used in measuring the fair value of any financial assets and liabilities during the period. The Company recognizes transfers between levels within the fair value hierarchy, if any, at the end of each quarter. There were no transfers between levels during the periods presented. Also, there was no significant activity within the Level 3 assets and liabilities during the periods presented. Except for the impairment of the Gillette indefinite-lived intangible asset discussed in Note 4, there were no significant assets or liabilities that were re-measured at fair value on a non-recurring basis during the three months ended September 30, 2024 or during the fiscal year ended June 30, 2024.

Cash equivalents were $10.7 billion and $8.0 billion as of September 30, 2024 and June 30, 2024, respectively, and are classified as Level 1 within the fair value hierarchy. The Company had no other material investments in debt or equity securities during the periods presented.

The fair value of long-term debt was $29.0 billion and $27.7 billion as of September 30, 2024 and June 30, 2024, respectively. This includes the current portion of long-term debt instruments ($3.9 billion and $3.8 billion as of September 30, 2024 and June 30, 2024, respectively). Certain long-term debt (debt designated as a fair value hedge) is recorded at fair value. All other long-term debt is recorded at amortized cost but is measured at fair value for disclosure purposes. We consider our debt to be Level 2 in the fair value hierarchy. Fair values are generally estimated based on quoted market prices for identical or similar instruments.

Disclosures about Financial Instruments

The notional amounts and fair values of financial instruments used in hedging transactions as of September 30, 2024 and June 30, 2024, are as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Notional Amount | | Fair Value Asset | | Fair Value (Liability) |

| September 30, 2024 | | June 30, 2024 | | September 30, 2024 | | June 30, 2024 | | September 30, 2024 | | June 30, 2024 |

| DERIVATIVES IN FAIR VALUE HEDGING RELATIONSHIPS |

| Interest rate contracts | $ | 3,127 | | | $ | 2,993 | | | $ | — | | | $ | — | | | $ | (249) | | | $ | (325) | |

| DERIVATIVES IN NET INVESTMENT HEDGING RELATIONSHIPS |

| Foreign currency interest rate contracts | $ | 12,531 | | | $ | 10,140 | | | $ | — | | | $ | 119 | | | $ | (310) | | | $ | (31) | |

| TOTAL DERIVATIVES DESIGNATED AS HEDGING INSTRUMENTS | $ | 15,658 | | | $ | 13,133 | | | $ | — | | | $ | 119 | | | $ | (559) | | | $ | (356) | |

| | | | | | | | | | | |

| DERIVATIVES NOT DESIGNATED AS HEDGING INSTRUMENTS |

| Foreign currency contracts | $ | 3,900 | | | $ | 3,192 | | | $ | 36 | | | $ | 1 | | | $ | (3) | | | $ | (23) | |

| | | | | | | | | | | |

| TOTAL DERIVATIVES AT FAIR VALUE | $ | 19,558 | | | $ | 16,325 | | | $ | 36 | | | $ | 120 | | | $ | (562) | | | $ | (379) | |

The fair value of the interest rate derivative asset/(liability) directly offsets the cumulative amount of the fair value hedging adjustment included in the carrying amount of the underlying debt obligation. The carrying amount of the underlying debt obligation, which includes the unamortized discount or premium and the fair value adjustment, was $2.9 billion and $2.7 billion as of September 30, 2024 and June 30, 2024, respectively. In addition to the foreign currency derivative contracts designated as net investment hedges, certain of our foreign currency denominated debt instruments are designated as net investment hedges. The carrying value of those debt instruments designated as net investment hedges, which includes the adjustment for the foreign currency transaction gain or loss on those instruments, was $12.6 billion and $11.9 billion as of September 30, 2024 and June 30, 2024, respectively. The increase in notional balance of the derivative instruments designated as net investment hedges is primarily driven by the Company's decision to leverage favorable interest rate spreads in the foreign currency swap market.

Derivative assets are presented in Prepaid expenses and other current assets or Other noncurrent assets. Derivative liabilities are presented in Accrued and other liabilities or Other noncurrent liabilities. Changes in the fair value of net investment hedges are recognized in the Foreign currency translation component of Other comprehensive income (OCI). All of the Company's derivative assets and liabilities measured at fair value are classified as Level 2 within the fair value hierarchy.

Certain of the Company's financial instruments used in hedging transactions are governed by industry standard netting and collateral agreements with counterparties. If the Company's credit rating were to fall below the levels stipulated in the agreements, the counterparties could demand either collateralization or termination of the arrangements. The aggregate fair value of the instruments covered by these contractual features that are in a liability position was $559 and $307 as of

Amounts in millions of dollars except per share amounts or as otherwise specified.

10 The Procter & Gamble Company

September 30, 2024 and June 30, 2024, respectively. The Company has not been required to post collateral as a result of these contractual features.

Before tax gains and losses on our financial instruments in hedging relationships are categorized as follows:

| | | | | | | | | | | | | | | |

| Amount of Gain/(Loss) Recognized in OCI on Derivatives |

| Three Months Ended September 30 | | |

| 2024 | | 2023 | | | | |

DERIVATIVES IN NET INVESTMENT HEDGING RELATIONSHIPS (1) (2) | | | | |

| Foreign currency interest rate contracts | $ | (501) | | | $ | 285 | | | | | |

(1) For the derivatives in net investment hedging relationships, the amount of gain excluded from effectiveness testing, which was recognized in earnings, was $50 and $67 for the three months ended September 30, 2024 and 2023, respectively.

(2) In addition to the foreign currency derivative contracts designated as net investment hedges, certain of our foreign currency denominated debt instruments are designated as net investment hedges. The amount of gain/(loss) recognized in Accumulated other comprehensive income (AOCI) for such instruments was $(611) and $344 for the three months ended September 30, 2024 and 2023, respectively.

| | | | | | | | | | | | | | | |

| Amount of Gain/(Loss) Recognized in Earnings |

| Three Months Ended September 30 | | |

| 2024 | | 2023 | | | | |

| DERIVATIVES IN FAIR VALUE HEDGING RELATIONSHIPS | | | | |

| Interest rate contracts | $ | 76 | | | $ | 11 | | | | | |

| DERIVATIVES NOT DESIGNATED AS HEDGING INSTRUMENTS | | | | |

| Foreign currency contracts | $ | 126 | | | $ | (71) | | | | | |

The gains on the derivatives in fair value hedging relationships are fully offset by the mark-to-market impact of the related exposure. These are both recognized in Interest expense. The gains/(losses) on derivatives not designated as hedging instruments are substantially offset by the currency mark-to-market of the related exposure. These are both recognized in Selling, general and administrative expense (SG&A).

8. Accumulated Other Comprehensive Income/(Loss)

The table below presents the changes in Accumulated other comprehensive income/(loss) attributable to Procter & Gamble (AOCI), including the reclassifications out of AOCI by component: | | | | | | | | | | | | | | | | | | | | | | | |

| Investment Securities | | Postretirement Benefit Plans | | Foreign Currency Translation | | Total AOCI |

| Balance at June 30, 2024, net of tax | $ | 10 | | | $ | 613 | | | $ | (12,522) | | | $ | (11,900) | |

| Other comprehensive income/(loss), before tax: | | | | | | | |

| OCI before reclassifications | 2 | | | (15) | | | 13 | | | (1) | |

| Amounts reclassified to the Consolidated Statement of Earnings | — | | | (14) | | | 752 | | | 738 | |

| Total other comprehensive income/(loss), before tax | 2 | | | (29) | | | 765 | | | 737 | |

| Tax effect | — | | | 8 | | | 261 | | | 269 | |

| Total other comprehensive income/(loss), net of tax | 2 | | | (21) | | | 1,026 | | | 1,007 | |

| Less: OCI attributable to noncontrolling interests, net of tax | — | | | 1 | | | — | | | 1 | |

| Balance at September 30, 2024, net of tax | $ | 12 | | | $ | 591 | | | $ | (11,496) | | | $ | (10,893) | |

The below provides additional details on amounts reclassified from AOCI into the Consolidated Statement of Earnings:

•Postretirement benefit plan amounts are reclassified from AOCI into Other non-operating income/(expense) and included in the computation of net periodic postretirement costs.

•Foreign currency translation amounts are reclassified from AOCI into Other non-operating income/(expense). These amounts relate to accumulated foreign currency translation losses recognized due to the substantial liquidation of operations in certain Enterprise Markets, including Argentina.

9. Commitments and Contingencies

Litigation

We are subject, from time to time, to certain legal proceedings and claims arising out of our business, which cover a wide range of matters, including antitrust and trade regulation, product liability, advertising, contracts, environmental, patent and trademark matters, labor and employment matters and tax. While considerable uncertainty exists, in the opinion of management and our

Amounts in millions of dollars except per share amounts or as otherwise specified.

The Procter & Gamble Company 11

counsel, the ultimate resolution of the various lawsuits and claims will not materially affect our financial position, results of operations or cash flows.

We are also subject to contingencies pursuant to environmental laws and regulations that in the future may require us to take action to correct the effects on the environment of prior manufacturing and waste disposal practices. Based on currently available information, we do not believe the ultimate resolution of environmental remediation will materially affect our financial position, results of operations or cash flows.

Income Tax Uncertainties

The Company is present in approximately 70 countries and over 150 taxable jurisdictions and, at any point in time, has 30–40 jurisdictional audits underway at various stages of completion. We evaluate our tax positions and establish liabilities for uncertain tax positions that may be challenged by local authorities and may not be fully sustained, despite our belief that the underlying tax positions are fully supportable. Uncertain tax positions are reviewed on an ongoing basis and are adjusted in light of changing facts and circumstances, including progress of tax audits, developments in case law and closing of statutes of limitations. Such adjustments are reflected in the tax provision as appropriate. We have tax years open ranging from 2010 and forward. We are generally not able to reliably estimate the timing and ultimate settlement amounts until the close of an audit. Based on information currently available, we do not anticipate over the next 12-month period any significant audit activity concluding related to uncertain tax positions for which we have existing accrued liabilities.

Additional information on the Commitments and Contingencies of the Company can be found in our Annual Report on Form 10-K for the fiscal year ended June 30, 2024.

10. Supplier Finance Programs

The Company has an ongoing program to negotiate extended payment terms with its suppliers consistent with market practices. The Company also supports a Supply Chain Finance program (“SCF”) with several global financial institutions. Under SCF, the Company maintains an accounts payable system to facilitate participating suppliers' ability to sell receivables from the Company to a SCF bank. These participating suppliers negotiate their sales of receivables arrangements directly with the respective SCF bank. The Company is not party to those agreements, but the SCF banks allow the suppliers to utilize the Company’s creditworthiness in establishing credit spreads and associated costs. Under this model, this arrangement generally provides the suppliers with more favorable terms than they would be able to secure on their own. The Company has no economic interest in a supplier’s decision to sell a receivable. Once a qualifying supplier chooses to participate in SCF, the supplier selects which individual Company invoices to sell to the SCF bank. The Company’s obligations to its suppliers, including the amounts due and scheduled payment dates, are not impacted by the supplier’s decisions to finance amounts under these arrangements. The Company does not provide any form of guarantee under these financing arrangements. Our payment terms for suppliers under this program generally range from 60 to 180 days. All outstanding amounts related to suppliers participating in SCF are recorded within Accounts payable in our Consolidated Balance Sheets, and the associated payments are included in operating activities within our Consolidated Statements of Cash Flows. The amount due to suppliers participating in SCF and included in Accounts payable was approximately $5.7 billion as of September 30, 2024 and $5.6 billion as of June 30, 2024.

11. Restructuring Program

The Company has historically incurred an ongoing annual level of restructuring-type activities to maintain a competitive cost structure, including manufacturing and workforce optimization. Before tax costs incurred under the ongoing program have generally ranged from $250 to $500 annually. Consistent with our historical policies for restructuring-type activities, the restructuring program charges will be funded by and included within Corporate for management and segment reporting.

In the fiscal year ended June 30, 2024, the Company started a limited market portfolio restructuring of its business operations, primarily in certain Enterprise Markets, including Argentina and Nigeria, to address challenging macroeconomic and fiscal conditions. During the period ended September 30, 2024, the Company completed this limited market portfolio restructuring with the substantial liquidation of its operations in Argentina and recorded approximately $0.8 billion after tax of incremental charges, comprised primarily of non-cash charges for accumulated foreign currency translation losses previously included in Accumulated other comprehensive income/(loss). The total incremental restructuring charges incurred under the program beginning in the three-month period ended December 31, 2023, through the three-month period ended September 30, 2024, were approximately $1.2 billion after tax.

For the three months ended September 30, 2024, the Company incurred total before tax charges of $886 including $41 in Costs of products sold, $54 in SG&A and $791 in Other non-operating income/(expense).

Amounts in millions of dollars except per share amounts or as otherwise specified.

12 The Procter & Gamble Company

The following table presents restructuring activity for the three months ended September 30, 2024:

| | | | | | | | | | | | | | | | | | | | | | | |

| Separation Costs | | Asset-Related Costs | | Other Costs | | Total |

| RESERVE JUNE 30, 2024 | $ | 133 | | | $ | — | | | $ | 32 | | | $ | 166 | |

| Costs incurred for the three months ended September 30, 2024 | 16 | | | 30 | | | 839 | | | 886 | |

| Costs paid/settled for the three months ended September 30, 2024 | (33) | | | (30) | | | (815) | | | (879) | |

| RESERVE SEPTEMBER 30, 2024 | $ | 116 | | | $ | — | | | $ | 56 | | | $ | 172 | |

Separation Costs

Employee separation costs relate to severance packages that are primarily voluntary and the amounts calculated are based on salary levels and past service periods.

Asset-Related Costs

Asset-related costs consist of both asset write-downs and accelerated depreciation for manufacturing consolidations. Asset write-downs relate to the establishment of a new fair value basis for assets held-for-sale or for disposal. These assets are written down to the lower of their current carrying basis or amounts expected to be realized upon disposal, less minor disposal costs. Charges for accelerated depreciation relate to long-lived assets that will be taken out of service prior to the end of their normal service period.

Other Costs

Other restructuring-type charges are incurred as a direct result of the restructuring plan. Such charges include accumulated foreign currency translation losses, asset removal and termination of contracts related to Enterprise Market portfolio restructuring.

| | | | | |

| Item 2. | Management's Discussion and Analysis of Financial Condition and Results of Operations |

Forward-Looking Statements

Certain statements in this report, other than purely historical information, including estimates, projections, statements relating to our business plans, objectives and expected operating results, and the assumptions upon which those statements are based, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements may appear throughout this report, including without limitation, the following sections: “Management's Discussion and Analysis,” “Risk Factors” and "Notes 4 and 9 to the Consolidated Financial Statements." These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result” and similar expressions. Forward-looking statements are based on current expectations and assumptions, which are subject to risks and uncertainties that may cause results to differ materially from those expressed or implied in the forward-looking statements. We undertake no obligation to update or revise publicly any forward-looking statements, whether because of new information, future events or otherwise, except to the extent required by law.

Risks and uncertainties to which our forward-looking statements are subject include, without limitation: (1) the ability to successfully manage global financial risks, including foreign currency fluctuations, currency exchange or pricing controls; (2) the ability to successfully manage local, regional or global economic volatility, including reduced market growth rates, and to generate sufficient income and cash flow to allow the Company to effect the expected share repurchases and dividend payments; (3) the ability to successfully manage uncertainties related to changing political and geopolitical conditions and potential implications such as exchange rate fluctuations, market contraction, boycotts, sanctions or other trade controls; (4) the ability to manage disruptions in credit markets or to our banking partners or changes to our credit rating; (5) the ability to maintain key manufacturing and supply arrangements (including execution of supply chain optimizations and sole supplier and sole manufacturing plant arrangements) and to manage disruption of business due to various factors, including ones outside of our control, such as natural disasters, acts of war or terrorism or disease outbreaks; (6) the ability to successfully manage cost fluctuations and pressures, including prices of commodities and raw materials and costs of labor, transportation, energy, pension and healthcare; (7) the ability to compete with our local and global competitors in new and existing sales channels, including by successfully responding to competitive factors such as prices, promotional incentives and trade terms for products; (8) the ability to manage and maintain key customer relationships; (9) the ability to protect our reputation and brand equity by successfully managing real or perceived issues, including concerns about safety, quality, ingredients, efficacy, packaging content, supply chain practices or similar matters that may arise; (10) the ability to successfully manage the financial, legal, reputational and operational risk associated with third-party relationships, such as our suppliers, contract manufacturers, distributors, contractors and external business partners; (11) the ability to rely on and maintain key company and third-party information and operational technology systems, networks and services and maintain the security and functionality of such systems, networks and services and the data contained therein; (12) the ability to successfully manage the demand, supply and operational challenges, as well as governmental responses or mandates, associated with a disease outbreak, including

Amounts in millions of dollars except per share amounts or as otherwise specified.

The Procter & Gamble Company 13

epidemics, pandemics or similar widespread public health concerns; (13) the ability to stay on the leading edge of innovation, obtain necessary intellectual property protections and successfully respond to changing consumer habits, evolving digital marketing and selling platform requirements and technological advances attained by, and patents granted to, competitors; (14) the ability to successfully manage our ongoing acquisition, divestiture and joint venture activities, in each case to achieve the Company’s overall business strategy and financial objectives, without impacting the delivery of base business objectives; (15) the ability to successfully achieve productivity improvements and cost savings and manage ongoing organizational changes while successfully identifying, developing and retaining key employees, including in key growth markets where the availability of skilled or experienced employees may be limited; (16) the ability to successfully manage current and expanding regulatory and legal requirements and matters (including, without limitation, those laws and regulations involving product liability, product and packaging composition, manufacturing processes, intellectual property, labor and employment, antitrust, privacy, cybersecurity and data protection, artificial intelligence, tax, the environment, due diligence, risk oversight, accounting and financial reporting) and to resolve new and pending matters within current estimates; (17) the ability to manage changes in applicable tax laws and regulations; and (18) the ability to successfully achieve our ambition of reducing our greenhouse gas emissions and delivering progress towards our environmental sustainability priorities. A detailed discussion of risks and uncertainties that could cause actual results and events to differ materially from those projected herein is included in the section titled "Economic Conditions and Uncertainties" and the section titled "Risk Factors" (Part II, Item 1A) of this Form 10-Q.

Purpose, Approach and Non-GAAP Measures

The purpose of Management's Discussion and Analysis (MD&A) is to provide an understanding of Procter & Gamble's financial condition, results of operations and cash flows by focusing on changes in certain key measures from year to year. The MD&A is provided as a supplement to, and should be read in conjunction with, our Consolidated Financial Statements and accompanying Notes.

The MD&A is organized in the following sections:

•Overview

•Summary of Results – Three Months Ended September 30, 2024

•Economic Conditions and Uncertainties

•Results of Operations – Three Months Ended September 30, 2024

•Segment Results – Three Months Ended September 30, 2024

•Liquidity and Capital Resources

•Measures Not Defined by U.S. GAAP

Throughout the MD&A we refer to measures used by management to evaluate performance, including unit volume growth, net sales, net earnings, diluted net earnings per common share (diluted EPS) and operating cash flow. We also refer to a number of financial measures that are not defined under U.S. GAAP, consisting of organic sales growth, Core earnings per share (Core EPS), adjusted free cash flow and adjusted free cash flow productivity. The explanation at the end of the MD&A provides the definition of these non-GAAP measures, details on the use and the derivation of these measures, as well as reconciliations to the most directly comparable U.S. GAAP measure.

Management also uses certain market share and market consumption estimates to evaluate performance relative to competition despite some limitations on the availability and comparability of share and consumption information. References to market share and consumption in the MD&A are based on a combination of vendor-purchased traditional brick-and-mortar and online data in key markets as well as internal estimates. All market share references represent the percentage of sales of our products in dollar terms on a constant currency basis relative to all product sales in the category. The Company measures quarter to date market share through the most recent period for which market share data is available, which typically reflects a lag time of one or two months as compared to the end of the reporting period. Management also uses unit volume growth to evaluate drivers of changes in net sales. Organic volume growth reflects year-over-year changes in unit volume excluding the impacts of acquisitions and divestitures and certain one-time items, if applicable, and is used to explain changes in organic sales. Certain columns and rows may not add due to rounding.

OVERVIEW

P&G is a global leader in the fast-moving consumer goods industry, focused on providing branded consumer packaged goods of superior quality and value to our consumers around the world. Our products are sold in approximately 180 countries and territories, primarily through mass merchandisers, e-commerce (including social commerce) channels, grocery stores, membership club stores, drug stores, department stores, distributors, wholesalers, specialty beauty stores (including airport duty-free stores), high-frequency stores, pharmacies, electronics stores and professional channels. We also sell direct to individual consumers. We have on-the-ground operations in approximately 70 countries.

Our market environment is highly competitive with global, regional and local competitors. In many of the markets and industry segments in which we sell our products, we compete against other branded products as well as retailers' private-label brands. Additionally, many of the product segments in which we compete are differentiated by price tiers (referred to as super-

14 The Procter & Gamble Company

premium, premium, mid-tier and value-tier products). We believe we are well positioned in the industry segments and markets in which we operate, often holding a leadership or significant market share position.

The table below lists our reportable segments, including the product categories and brand composition within each segment.

| | | | | | | | |

| Reportable Segments | Product Categories (Sub-Categories) | Major Brands |

| Beauty | Hair Care (Conditioners, Shampoos, Styling Aids, Treatments) | Head & Shoulders, Herbal Essences, Pantene, Rejoice |

Personal Care (1) (Antiperspirants and Deodorants, Personal Cleansing) | Native, Old Spice, Safeguard, Secret |

Skin Care (1) (Facial Moisturizers, Cleaners and Treatments) | Olay, SK-II |

| Grooming | Grooming (Appliances, Female Blades & Razors, Male Blades & Razors, Pre- and Post-Shave Products, Other Grooming) | Braun, Gillette, Venus |

| Health Care | Oral Care (Toothbrushes, Toothpastes, Other Oral Care) | Crest, Oral-B |

Personal Health Care (Gastrointestinal, Pain Relief, Rapid Diagnostics, Respiratory, Vitamins/Minerals/Supplements, Other Personal Health Care) | Metamucil, Neurobion, Pepto-Bismol, Vicks |

| Fabric & Home Care | Fabric Care (Fabric Enhancers, Laundry Additives, Laundry Detergents) | Ariel, Downy, Gain, Tide |

Home Care (Air Care, Dish Care, P&G Professional, Surface Care) | Cascade, Dawn, Fairy, Febreze, Mr. Clean, Swiffer |

| Baby, Feminine & Family Care | Baby Care (Baby Wipes, Taped Diapers and Pants) | Luvs, Pampers |

Feminine Care (Adult Incontinence, Menstrual Care) | Always, Always Discreet, Tampax |

Family Care (Paper Towels, Tissues, Toilet Paper) | Bounty, Charmin, Puffs |

(1) Effective July 1, 2024, the Beauty reportable business segment separated Skin and Personal Care into individual operating segments, Skin Care and Personal Care. This transition included separation of the management team, strategic decision-making, innovation plans, financial targets, budgets and management reporting.

Throughout the MD&A, we reference business results by region, which are comprised of North America, Europe, Greater China, Latin America, Asia Pacific and India, Middle East and Africa (IMEA).

The following table provides the percentage of net sales and net earnings by reportable business segment (excluding Corporate) for the three months ended September 30, 2024:

| | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2024 | | |

| Net Sales | | Net Earnings | | | | |

| Beauty | 18 | % | | 17 | % | | | | |

| Grooming | 8 | % | | 9 | % | | | | |

| Health Care | 15 | % | | 16 | % | | | | |

| Fabric & Home Care | 36 | % | | 35 | % | | | | |

| Baby, Feminine & Family Care | 24 | % | | 23 | % | | | | |

| Total Company | 100 | % | | 100 | % | | | | |

RECENT DEVELOPMENTS

Limited Market Portfolio Restructuring

In the fiscal year ended June 30, 2024, the Company started a limited market portfolio restructuring of its business operations, primarily in certain Enterprise Markets, including Argentina and Nigeria, to address challenging macroeconomic and fiscal conditions. During the period ended September 30, 2024, the Company completed this limited market portfolio restructuring with the substantial liquidation of its operations in Argentina and recorded incremental restructuring charges of approximately $0.8 billion after tax, comprised primarily of non-cash charges for accumulated foreign currency translation losses previously included in Accumulated other comprehensive income/(loss). The total incremental restructuring charges incurred under the program beginning in the three-month period ended December 31, 2023, through the three-month period ended September 30, 2024, were approximately $1.2 billion after tax.

Consistent with our historical policies for ongoing restructuring-type activities, resulting charges were funded by and included within Corporate for segment reporting. Restructuring charges above the normal ongoing level of restructuring costs are

The Procter & Gamble Company 15

reported as non-core charges. For more details on the restructuring program, refer to Note 11 to the Consolidated Financial Statements.

SUMMARY OF RESULTS – Three Months Ended September 30, 2024

The following are highlights of results for the three months ended September 30, 2024, versus the three months ended September 30, 2023:

•Net sales decreased 1% to $21.7 billion versus the prior year period. Net sales increased 2% in Health Care, 1% in Fabric & Home Care and decreased 5% in Beauty and 2% in Baby, Feminine & Family Care. Net sales in Grooming were unchanged. Organic sales, which exclude the impacts of acquisitions and divestitures and foreign exchange, increased 2%. Organic sales increased 4% in Health Care, 3% in Grooming and Fabric & Home Care and decreased 2% in Beauty. Organic sales in Baby, Feminine & Family Care were unchanged.

•Net earnings were $4.0 billion, a decrease of $569 million, or 12%, versus the prior year period due primarily to higher restructuring charges related to the substantial liquidation of operations in certain Enterprise Markets, including Argentina.

•Net earnings attributable to Procter & Gamble were $4.0 billion, a decrease of $562 million, or 12%, versus the prior year period.

•Diluted EPS decreased 12% to $1.61 due to the decrease in net earnings. Core EPS, which excludes incremental restructuring charges, increased 5% to $1.93.

•Operating cash flow was $4.3 billion. Adjusted free cash flow, which is defined as operating cash flow less capital expenditures and excluding payments for the transitional tax resulting from the U.S. Tax Act, was $3.9 billion. Adjusted free cash flow productivity, which is defined as adjusted free cash flow as a percentage of net earnings excluding a non-cash charge for accumulated foreign currency translation losses due to the substantial liquidation of operations in Argentina, was 82%.

ECONOMIC CONDITIONS AND UNCERTAINTIES