Third-Quarter Reported Diluted EPS grew

49.2% to $1.97, Adjusted Diluted EPS increased by 14.4% to

$1.91 and grew by 18.0% excluding currency

Regulatory News:

Philip Morris International Inc. (PMI) (NYSE: PM) today

announces its 2024 third-quarter and first nine-months

results.1

“In the third quarter, we delivered exceptionally strong

performance, with record quarterly net revenues and earnings per

share,” said Jacek Olczak, Chief Executive Officer. “This reflects

excellent momentum across all regions and categories, with a

reacceleration in IQOS adjusted in-market sales growth, strong ZYN

volumes, and resilient combustible performance.” “As a result of

our strong year-to-date delivery, we are raising our full-year

growth outlook for adjusted diluted EPS to a range of 14% to 15%,

excluding currency.”

Third Quarter

Highlights

- Smoke-free business (SFB): Quarterly shipments of

smoke-free products (SFP), available in 92 markets, reached close

to 40 billion units. The smoke-free business accounted for 38% of

our total net revenues and 40% of gross profit (up by 1.9pp and

2.2pp respectively, versus third-quarter last year), and continues

to deliver superior performance, with net revenues increasing by

14.2% (16.8% organically) and gross profit increasing by 15.9%

(20.2% organically).

- Inhalable smoke-free products: IQOS continues

strengthening its overall position as the second largest nicotine

‘brand’ in markets where present (gaining 1.0pp of combined

cigarette and HTU industry volumes) and driving the growth of the

heat-not-burn category (reaching nearly 77% of global category

volumes). HTU adjusted in-market sales (IMS) volume, which excludes

the net impact of estimated distributor and wholesaler inventory

movements, was up by an estimated 14.8%.

- In Japan, ILUMA i fueled the growth of IQOS, with adjusted IMS

up by 14.3%, the 8th consecutive quarter of double-digit growth.

IQOS HTU adjusted market share increased by 3.2pp to nearly 30%,

driving the overall category to at least 50% of total nicotine

offtake share in 8 major cites, including Tokyo and Yokohama.

- In Europe, IQOS HTU adjusted market share increased by 0.8pp to

9.5%. Adjusted IMS growth reaccelerated to 11.3%, with Italy

recovering well and 8 markets growing in excess of 20%, including

Greece and Germany. Our portfolio of IQOS consumables continues to

expand with both DELIA and LEVIA now being available in 9 markets

each, with further launches planned in Q4.

- Outside Europe and Japan, adjusted IMS growth accelerated and

we grew offtake share in key cities across the globe, including

Seoul, Toronto, Mexico City, Cairo, and Jakarta. Our strong growth

in Indonesia benefits from the expansion of our geographic reach

and consumables portfolio, with premium clove and capsule

products.

In the vaping category, our focused strategy

is delivering good results with excellent volume momentum and unit

cost improvements. Europe is at the forefront, as the closed pod

segment continues to take share from disposables. VEEV continues to

lead the closed pod segment in several markets, including Italy,

Romania, and the Czech Republic.

- Oral SFP2: Shipment volume increased by 24.7% in cans

(22.2% in pouches or pouch equivalents), fueled by ZYN nicotine

pouch growth in the U.S., where shipments reached 149.1 million

cans, representing growth of 41.4% versus prior year as supply

constraints start to ease. Outside the U.S., our nicotine pouch

volume in cans grew by nearly 70%, with notable contributions from

Pakistan and South Africa. The number of markets with ZYN presence

increased to 30, including recent launches in Greece and Czech

Republic.

- Combustibles: Net revenues grew by 5.2% (8.6%

organically), driven by another quarter of high single-digit

pricing and resilient industry volumes. Both our global brands

portfolio and Marlboro achieved their highest quarterly market

shares since the 2008 spin-off.

- Dividend: Increased regular quarterly dividend by 3.8%

to $1.35 per share, or an annualized $5.40 per share.

____________________ 1 Explanation of PMI's use of non-GAAP

measures cited in this document and reconciliations to the most

directly comparable U.S. GAAP measures can be found in the

“Non-GAAP Measures, Glossary and Explanatory Notes” section of this

release, in Exhibit 99.2 to the company's Form 8-K dated October

22, 2024, and at www.pmi.com/2024Q3earnings. 2 Oral smoke-free

products volume excludes snuff, snuff leaf and U.S. chew

Operating Review - Third

Quarter

Total

HTU

Oral SFP3

Cigarettes

Shipment Volume (units bn)

203.0

35.3

4.4

163.2

vs. Q3 2023

2.9%

8.9%

22.2%

1.3%

PMI

Smoke Free

Business

Combustibles

Net Revenues ($ bn)

$9.9

$3.8

$6.1

reported vs. Q3 2023

8.4%

14.2%

5.2%

organic vs. Q3 2023

11.6%

16.8%

8.6%

Gross Profit ($ bn)

$6.5

$2.6

$3.9

reported vs. Q3 2023

9.5%

15.9%

5.7%

organic vs. Q3 2023

13.0%

20.2%

8.7%

Operating Income ($ bn)

$3.7

reported vs. Q3 2023

8.4%

organic vs. Q3 2023

13.8%

Reported Diluted

EPS

Adjusting

Items*

Adjusted Diluted

EPS

Currency Impact

Adjusted Diluted

EPS ex. Currency

EPS

$1.97

$0.06

$1.91

$(0.06)

$1.97

vs. Q3 2023

49.2%

14.4%

18.0%

(*) For a list of adjusting items refer to

page 21

____________________ 3 In pouches or pouch equivalents

Full-Year Forecast

Full-Year

2024

Forecast

2023

Growth

Reported Diluted EPS

$6.20

-

$6.26

$ 5.02

Adjustments:

Asset impairment and exit costs

0.09

0.06

Termination of distribution arrangement in

the Middle East

—

0.04

Impairment of goodwill and other

intangibles

0.01

0.44

Amortization of intangibles(1)

0.42

0.25

Impairment related to Vectura Group's

expected sale

0.13

—

Egypt sales tax charge

0.03

—

Charges related to the war in Ukraine

—

0.03

Swedish Match AB acquisition accounting

related items

—

0.01

Income tax impact associated with Swedish

Match AB financing

(0.01)

(0.11)

South Korea indirect tax charge

—

0.11

Termination of agreement with Foundation

for a Smoke-Free World

—

0.07

Fair value adjustment for equity security

investments

(0.39)

(0.02)

Tax items

(0.03)

0.11

Total Adjustments

0.25

0.99

Adjusted Diluted EPS

$6.45

-

$6.51

$ 6.01

7.3%

-

8.3%

Less: Currency

(0.40)

Adjusted Diluted EPS, excluding

currency

$6.85

-

$6.91

$ 6.01

14.0%

-

15.0%

(1) See forecast assumptions for

details

Reported diluted EPS is forecast to be in a range of $6.20 to

$6.26, at prevailing exchange rates, versus reported diluted EPS of

$5.02 in 2023. Excluding a total 2024 adjustment of $0.25 per

share, this forecast represents a projected increase of 7.3% to

8.3% versus adjusted diluted EPS of $6.01 in 2023. Also excluding

an adverse currency impact of $0.40, at prevailing exchange rates,

this forecast represents a projected increase of 14.0% to 15.0%

versus adjusted diluted EPS of $6.01 in 2023, as outlined in the

above table.

2024 Full-Year Forecast Assumptions

This forecast assumes:

- An estimated total international industry volume growth of up

to 1% for cigarettes and HTUs, excluding China and the U.S.;

- Total cigarette, HTU and oral smoke-free product shipment

volume growth for PMI of 2% to 3% driven by smoke-free

products;

- HTU adjusted IMS to deliver around 13% growth for the full

year, and HTU shipment volumes of around 140 billion units;

- Nicotine pouch shipment volume in the U.S. of 570 to 580

million cans;

- Net revenue growth of around 9.5% on an organic basis;

- Organic operating income growth of 14% to 14.5%;

- An acceleration in organic smoke-free net revenue and gross

profit growth compared to 2023;

- Broadly unchanged net revenue and adjusted operating loss in

the Wellness and Healthcare segment compared to 2023;

- No earnings impact from the May 15, 2024 Fiscal Court in

Dusseldorf ruling related to the legality of a supplemental tax

surcharge on HTUs in Germany, which went into effect in 2022. On

June 19, 2024, a German subsidiary of PMI submitted an appeal;

- No earnings impact from potential impairments of equity

holdings, including potential impairment of PMI’s Canadian

affiliate, Rothmans, Benson & Hedges Inc.;

- Full-year amortization of acquired intangibles of $0.42 per

share, which includes an estimate of amortization of IQOS

commercialization rights in the U.S. following the closing of the

agreement to end our commercial relationship with Altria Group,

Inc. covering IQOS in the U.S. effective May 1, 2024;

- Net financing costs of approximately $1.1 to $1.2 billion;

- An effective tax rate, excluding discrete tax events, of

approximately 21% to 22%;

- Operating cash flow of approximately $11 billion at prevailing

exchange rates, subject to year-end working capital

requirements;

- Capital expenditures of around $1.4 billion, including further

investments in ZYN capacity in the U.S.;

- Net debt to adjusted EBITDA ratio improvement of 0.3x to 0.4x

at prevailing exchange rates as we continue to target a ratio of

around 2x by the end of 2026; and

- No share repurchases in 2024

Factors described in the Forward-Looking and Cautionary

Statements section of this release represent continuing risks to

these projections.

Sale of Vectura Group

In September 2024, PMI announced the sale of its subsidiary

Vectura Group Ltd. (Vectura) to Molex Asia Holdings Ltd., and the

establishment of master service agreements to develop Vectura

Fertin Pharma’s inhaled therapeutics proprietary pipeline. The

transaction is expected to close by the end of 2024, subject to

regulatory approval, which may impact the timing, and other

customary closing conditions. See PMI's Form 8-K dated September

17, 2024 for additional details. In the third quarter of 2024, PMI

recorded an impairment charge of $198 million (previously estimated

to be approximately $220 million at the time of announcement)

related to Vectura's classification as held for sale.

The remaining units of Vectura Fertin Pharma will continue to

operate as a separate company under PMI’s ownership and will be

given a new corporate identity. This business will focus on

developing and commercializing oral consumer health and wellness

offerings and inhaled prescription products for therapy areas that

include pain management and cardiovascular emergencies.

Update on CCAA Proceeding in

Canada

In October 2024, PMI was informed by its deconsolidated Canadian

affiliate, Rothmans, Benson & Hedges Inc. (RBH), that the

court-appointed mediator and monitor in RBH’s Companies’ Creditors

Arrangement Act (CCAA) proceeding filed a proposed plan of

compromise and arrangement outlining certain terms of a

comprehensive resolution of tobacco product-related claims and

litigation in Canada against RBH and its affiliates. See PMI's Form

8-K dated October 18, 2024 for additional details.

Conference Call

A conference call hosted by Emmanuel Babeau, Chief Financial

Officer, will be webcast at 9:00 a.m., Eastern Time, on October 22,

2024. Access the webcast at www.pmi.com/2024Q3earnings.

Financial Review

TOTAL MARKET, CONSOLIDATED SHIPMENT VOLUME

& MARKET SHARE

Total Market Volume

Third-Quarter Estimated international industry volume

(excluding China and the U.S.) for cigarettes and HTUs increased by

1.3%, reflecting increases in the SSEA, CIS & MEA and Europe

Regions, partly offset by decreases in the EA, AU & PMI DF and

Americas Regions, as described in the Regional sections below.

Nine Months Year-to-Date Estimated international industry

volume (excluding China and the U.S.) for cigarettes and HTUs

increased by 1.2%, reflecting an increase in the SSEA, CIS &

MEA Region, partly offset by a decrease in the Americas Region, and

broad stability in the EA, AU & PMI DF and Europe Regions, as

described in the Regional sections below.

Consolidated Shipment Volume

PMI Cigarettes and HTUs

Third-Quarter

Nine Months

Year-to-Date

(million units)

2024

2023

Change

2024

2023

Change

Cigarettes

163,238

161,137

1.3%

464,047

461,855

0.5%

Heated Tobacco Units

35,347

32,471

8.9%

104,025

91,291

13.9%

Total Cigarettes and HTUs

198,585

193,608

2.6%

568,072

553,146

2.7%

PMI Oral SFP(1)

Third-Quarter

Nine Months

Year-to-Date

(million cans)

2024

2023

Change

2024

2023

Change

Nicotine Pouches

164.6

114.6

43.6%

460.2

295.4

55.8%

Snus

61.3

60.3

1.6%

181.5

178.5

1.7%

Moist Snuff

34.1

33.2

2.6%

102.6

102.5

0.1%

Other Oral SFP(2)

0.7

0.9

(20.9)%

2.7

3.3

(17.9)%

Total Oral SFP

260.7

209.0

24.7%

747.0

579.8

28.9%

(1) Excluding snuff, snuff leaf and U.S.

chew

(2) Includes chew bags and tobacco

bits

Note: Sum may not foot due to

rounding.

Third-Quarter PMI's total cigarette and HTU shipment

volume increased by 2.6% (HTU shipments increased by 8.9%, and

cigarette shipments increased by 1.3%), with increases across all

regions except the Americas Region.

PMI’s total oral product shipment volume in cans increased by

24.7%, predominantly reflecting growth in nicotine pouches.

Adjusted in-market sales for HTUs increased by 14.8%, including

growth in Japan of 14.3% and Europe of 11.3%.

Nine Months Year-to-Date PMI's total cigarette and HTU

shipment volume increased by 2.7% (HTU shipments increased by

13.9%, while cigarette shipments were broadly stable).

PMI’s total oral product shipment volume in cans increased by

28.9%, primarily reflecting growth in nicotine pouches.

Adjusted in-market sales for HTUs increased by 12.6%, including

growth in Japan of 13.4% and Europe of 9.2%.

International Share of Market - Cigarettes and HTUs

Third-Quarter

Nine Months

Year-to-Date

2024

2023

Change (pp)

2024

2023

Change (pp)

Total International Market

Share(1)

29.5%

28.9%

0.6

28.7%

28.3%

0.4

Cigarettes

24.2%

24.3%

(0.1)

23.6%

23.7%

(0.1)

HTU

5.3%

4.6%

0.7

5.2%

4.6%

0.6

Cigarette over Cigarette Market

Share(2)

26.0%

25.9%

0.1

25.3%

25.2%

0.1

(1) Defined as PMI's cigarette and heated

tobacco unit in-market sales volume as a percentage of total

industry cigarette and heated tobacco unit sales volume, excluding

China and the U.S., including cigarillos in Japan

(2) Defined as PMI's cigarette in-market

sales volume as a percentage of total industry cigarette sales

volume, excluding China and the U.S., including cigarillos in

Japan

Note: Sum of share of market by product

categories might not foot to total due to rounding.

CONSOLIDATED FINANCIAL SUMMARY

Third-Quarter

Financial Summary

- Quarters Ended

September

30,

Change

Fav./(Unfav.)

Variance

Fav./(Unfav.)

2024

2023

Total

Excl. Curr. &

Acquis.

Total

Cur- rency

Acqui- sitions

Price

Vol/ Mix

Cost/ Other

(in millions)

Net Revenues

$

9,911

$

9,141

8.4

%

11.6

%

770

(289

)

—

689

322

48

Cost of Sales(1)

(3,366

)

(3,165

)

(6.4

)%

(9.0

)%

(201

)

63

21

—

(159

)

(126

)

Marketing, Administration and Research

Costs(2)

(2,891

)

(2,606

)

(10.9

)%

(15.1

)%

(285

)

108

—

—

—

(393

)

Operating Income

$

3,654

$

3,370

8.4

%

11.3

%

284

(118

)

21

689

163

(471

)

Amortization of Intangibles

(256

)

(205

)

(24.9

)%

(24.9

)%

(51

)

—

—

—

—

(51

)

Impairment related to Vectura Group's

expected sale

(198

)

—

—

%

—

%

(198

)

—

—

—

—

(198

)

Egypt sales tax charge

(45

)

—

—

%

—

%

(45

)

—

—

—

—

(45

)

Charges related to the war in Ukraine

—

(19

)

+100

%

+100

%

19

—

—

—

—

19

Termination of agreement with Foundation

for a Smoke-Free World

—

(140

)

+100

%

+100

%

140

—

—

—

—

140

Adjusted Operating Income

$

4,153

$

3,734

11.2

%

13.8

%

419

(118

)

21

689

163

(336

)

Adjusted Operating Income

Margin

41.9

%

40.8

%

1.1

pp

0.9

pp

(1) Includes $14 million in 2024 and $10

million in 2023 related to the special items below.

(2) Includes $485 million in 2024 and $354

million in 2023 related to the special items below.

Net revenues increased by 11.6% on an organic basis, mainly

reflecting: a favorable pricing variance, primarily due to higher

combustible tobacco pricing; and favorable volume/mix, mainly

driven by higher smoke-free products volume.

Adjusted operating income increased by 13.8% on an organic

basis, mainly reflecting: the same factors as for net revenues,

notwithstanding unfavorable cigarette mix; partly offset by higher

manufacturing costs, notably related to tobacco leaf, and higher

marketing, administration and research costs.

Nine Months Year-to-Date

Financial Summary

- Nine Months Ended September 30,

Change

Fav./(Unfav.)

Variance

Fav./(Unfav.)

2024

2023

Total

Excl. Curr. &

Acquis

Total

Cur- rency

Acqui- sitions

Price

Vol/ Mix

Cost/ Other

(in millions)

Net Revenues

$

28,172

$

26,127

7.8

%

11.0

%

2,045

(841

)

—

1,721

1,089

76

Termination of distribution arrangement in

the Middle East

—

(80

)

+100

%

+100

%

80

—

—

—

—

80

Adjusted Net Revenues

$

28,172

$

26,207

7.5

%

10.7

%

1,965

(841

)

—

1,721

1,089

(4

)

Net Revenues

$

28,172

$

26,127

7.8

%

11.0

%

2,045

(841

)

—

1,721

1,089

76

Cost of Sales (1)

(9,906

)

(9,431

)

(5.0

)%

(6.8

)%

(475

)

134

33

—

(473

)

(169

)

Marketing, Administration and Research

Costs (2)

(8,123

)

(7,364

)

(10.3

)%

(9.4

)%

(759

)

(70

)

—

—

—

(689

)

Impairment of Goodwill

—

(665

)

+100

%

+100

%

665

—

—

—

—

665

Operating Income

$

10,143

$

8,667

17.0

%

25.6

%

1,476

(777

)

33

1,721

616

(117

)

Asset Impairment & Exit Costs

(168

)

(109

)

(54.1

)%

(54.1

)%

(59

)

—

—

—

—

(59

)

Impairment related to Vectura Group's

expected sale

(198

)

—

—

%

—

%

(198

)

—

—

—

—

(198

)

Egypt sales tax charge

(45

)

—

—

%

—

%

(45

)

—

—

—

—

(45

)

Termination of distribution arrangement in

the Middle East (3)

—

(80

)

+100

%

+100

%

80

—

—

—

—

80

Impairment of Goodwill and Other

Intangibles (4)

(27

)

(680

)

96.0

%

96.0

%

653

—

—

—

—

653

Amortization of Intangibles

(588

)

(368

)

(59.8

)%

(59.8

)%

(220

)

—

—

—

—

(220

)

Charges related to the war in Ukraine

—

(19

)

+100

%

+100

%

19

—

—

—

—

19

Swedish Match AB acquisition accounting

related items

—

(18

)

+100

%

+100

%

18

—

—

—

—

18

South Korea Indirect Tax Charge

—

(204

)

+100

%

+100

%

204

—

—

—

—

204

Termination of agreement with Foundation

for a Smoke-Free World

—

(140

)

+100

%

+100

%

140

—

—

—

—

140

Adjusted Operating Income

$

11,169

$

10,285

8.6

%

15.8

%

884

(777

)

33

1,721

616

(709

)

Adjusted Operating Income

Margin

39.6

%

39.2

%

0.4

pp

1.9

pp

(1) Includes $46 million in 2024 and $72

million in 2023 related to the special items below.

(2) Includes $980 million in 2024 and $801

million in 2023 related to the special items below.

(3) Included in Net Revenues above.

(4) Includes $665 million impairment of

goodwill in 2023.

Adjusted net revenues increased by 10.7% on an organic basis,

mainly reflecting: a favorable pricing variance, primarily driven

by higher combustible tobacco pricing; and favorable volume/mix,

driven by higher smoke-free products volume, partly offset by

unfavorable cigarette mix.

Adjusted operating income increased by 15.8% on an organic

basis, mainly reflecting: the same factors as for net revenues;

partly offset by higher marketing, administration and research

costs (primarily due to inflationary impacts, notably related to

wages, and higher commercial investments), as well as higher

manufacturing costs, notably related to tobacco leaf and the impact

of the EU single-use plastics directive, partly offset by

productivity.

EUROPE REGION

Total Market, PMI Shipment & Market Share

Commentaries

Third-Quarter The estimated total market for cigarettes

and HTUs in the Region increased by 1.8% to 148.6 billion units,

reflecting a 0.6% increase for cigarettes and continued HTU growth.

The increase in the estimated total market was predominantly due to

Ukraine (up by 9.4%), Italy (up by 3.5%) and Spain (up by 3.8%),

partly offset by France (down by 10.9%), the Netherlands (down by

25.6%), and Belgium (down by 16.2%).

Nine Months Year-to-Date The estimated total market for

cigarettes and HTUs in the Region was broadly stable, reflecting a

1.5% decrease for cigarettes, largely offset by an increase for

HTUs. The decrease in the estimated total market was predominantly

due to France (down by 12.8%), the United Kingdom (down by 11.0%),

and the Netherlands (down by 18.7%), partly offset by Bulgaria (up

by 7.9%), Greece (up by 8.2%), and Poland (up by 1.9%).

Europe Key Data

Third-Quarter

Nine Months

Year-to-Date

Change

Change

2024

2023

% / pp

2024

2023

% / pp

PMI Shipment Volume (million

units)

Cigarettes

43,735

43,365

0.9%

124,291

126,263

(1.6)%

Heated Tobacco Units

14,199

13,155

7.9%

38,474

34,959

10.1%

Total Europe

57,934

56,520

2.5%

162,765

161,222

1.0%

PMI Market Share

Cigarettes

30.1%

30.5%

(0.4)

30.1%

30.4%

(0.3)

Heated Tobacco Units

9.5%

8.6%

0.9

9.7%

8.8%

0.9

Total Europe

39.6%

39.1%

0.5

39.8%

39.1%

0.7

Note: Sum may not foot due to

rounding.

Europe Oral SFP

Third-Quarter

Nine Months

Year-to-Date

2024

2023

Change

2024

2023

Change

PMI Shipment Volume (million

cans)

Nicotine Pouches

11.2

9.1

23.5%

35.3

26.2

34.4%

Snus

60.5

59.5

1.7%

179.2

175.3

2.2%

Other Oral SFP(1)

0.7

0.9

(22.3)%

2.7

3.3

(18.2)%

Total Europe

72.4

69.5

4.2%

217.2

204.9

6.0%

(1) Includes chew bags and tobacco

bits

Note: Sum may not foot due to

rounding.

Third-Quarter PMI's total cigarette and HTU shipment

volume in the Region increased by 2.5% to 57.9 billion units. Total

cigarette and HTU shipment volume increased notably in Ukraine (up

by 12.3%) and Poland (up by 5.7%), and decreased notably in Belgium

(down by 25.8%) as well as the Netherlands (down by 24.9%).

PMI's estimated HTU adjusted in-market sales volume in the

Region increased by 11.3% in the quarter, reflecting continued

growth momentum for IQOS.

PMI's HTU share of the total cigarette and HTU market in the

Region increased by 0.8 pp on an adjusted basis.

Oral SFP shipments increased by 4.2%, primarily driven by

nicotine pouches (up by 23.5%).

Nine Months Year-to-Date PMI's total cigarette and HTU

shipment volume in the Region increased by 1.0% to 162.8 billion

units. Total cigarette and HTU shipment volume increased notably in

Poland (up by 7.1%) and Ukraine (up by 8.7%), and decreased notably

in France (down by 18.4%) as well as the Netherlands (down by

18.2%).

PMI's estimated HTU adjusted in-market sales volume in the

Region increased by 9.2%, reflecting continued growth momentum for

IQOS, partly offset by the impact from the EU characterizing flavor

ban.

PMI's HTU share of the total cigarette and HTU market in the

Region increased by 0.9 pp on an adjusted basis.

Oral SFP shipments increased by 6.0%, driven by growth of

nicotine pouches (up by 34.4%).

Financial Summary

Third-Quarter

Financial Summary

- Quarters Ended

September

30,

Change

Fav./(Unfav.)

Variance

Fav./(Unfav.)

2024

2023

Total

Excl. Curr. &

Acquis.

Total

Cur- rency

Acqui- sitions

Price

Vol/ Mix

Cost/ Other

(in millions)

Net Revenues

$

4,121

$

3,823

7.8

%

8.7

%

298

(35

)

—

228

105

—

Operating Income

$

2,020

$

1,717

17.6

%

15.5

%

303

37

—

228

47

(9

)

Adjustments (1)

(40

)

(148

)

73.0

%

73.0

%

108

—

—

—

—

108

Adjusted Operating Income

$

2,059

$

1,865

10.4

%

8.4

%

194

37

—

228

47

(117

)

Adjusted Operating Income

Margin

50.0

%

48.8

%

1.2

pp

(0.1

)pp

(1) See Schedule 10 in Exhibit 99.2 to the

Form 8-K dated October 22, 2024, for additional detail.

Net revenues increased by 8.7% on an organic basis, reflecting:

a favorable pricing variance, mainly driven by higher combustible

tobacco pricing; and favorable volume/mix, primarily driven by

higher HTU volume, partly offset by adverse cigarette mix.

Adjusted operating income increased by 8.4% on an organic basis,

primarily reflecting: the same factors as for net revenues; partly

offset by higher marketing, administration and research costs.

Nine Months Year-to-Date

Financial Summary

-

Nine Months

Ended

September

30,

Change

Fav./(Unfav.)

Variance

Fav./(Unfav.)

2024

2023

Total

Excl. Curr. &

Acquis.

Total

Cur- rency

Acqui- sitions

Price

Vol/ Mix

Cost/ Other

(in millions)

Net Revenues

$

11,301

$

10,465

8.0

%

7.7

%

836

34

—

596

206

—

Operating Income

$

5,136

$

4,551

12.9

%

12.7

%

585

6

—

596

113

(130

)

Adjustments (1)

(120

)

(251

)

52.1

%

52.1

%

131

—

—

—

—

131

Adjusted Operating Income

$

5,256

$

4,802

9.5

%

9.3

%

454

6

—

596

113

(260

)

Adjusted Operating Income

Margin

46.5

%

45.9

%

0.6

pp

0.7

pp

(1) See Schedule 11 in Exhibit 99.2 to the

Form 8-K dated October 22, 2024, for additional detail.

Net revenues increased by 7.7% on an organic basis, primarily

driven by the same factors as for the quarter.

Adjusted operating income increased by 9.3% on an organic basis,

primarily reflecting: a favorable pricing variance, mainly driven

by higher combustible tobacco pricing; and favorable volume/mix,

primarily driven by higher HTU volume, notwithstanding lower

cigarette volume; partly offset by higher marketing, administration

and research costs as well as manufacturing costs, including the

impact of the EU single-use plastics directive.

SSEA, CIS & MEA REGION

Total Market, PMI Shipment & Market Share

Commentaries

Third-Quarter The estimated total market for cigarettes

and HTUs in the Region increased by 2.0% to 399.4 billion units.

The increase in the estimated total market was mainly due to Egypt

(up by 32.4%), Russia (up by 8.3%), and Turkey (up by 9.4%), partly

offset by Bangladesh (down by 30.8%), Indonesia (down by 3.3%), and

Thailand (down by 17.0%).

Nine Months Year-to-Date The estimated total market for

cigarettes and HTUs in the Region increased by 2.4% to 1,167.0

billion units. The increase in the estimated total market was

mainly due to Turkey (up by 10.4%), Russia (up by 6.4%), and Egypt

(up by 9.4%), partly offset by Bangladesh (down by 4.9%), Thailand

(down by 15.4%), and the Philippines (down by 5.4%).

PMI Shipment Volume

Third-Quarter

Nine Months

Year-to-Date

(million units)

2024

2023

Change

2024

2023

Change

Cigarettes

91,456

89,398

2.3%

259,038

250,344

3.5%

Heated Tobacco Units

7,127

6,088

17.1%

20,142

17,388

15.8%

Total SSEA, CIS & MEA

98,583

95,486

3.2%

279,180

267,732

4.3%

Third-Quarter PMI's total cigarette and HTU shipment

volume in the Region increased by 3.2% to 98.6 billion units,

mainly driven by Turkey (up by 13.1%), partly offset by Indonesia

(down by 8.9%). PMI's estimated HTU adjusted in-market sales volume

increased by 20.9%, with 17.1% HTU shipment volume growth.

Nine Months Year-to-Date PMI's total cigarette and HTU

shipment volume in the Region increased by 4.3% to 279.2 billion

units, mainly driven by Turkey (up by 14.9%), partly offset by

Indonesia (down by 4.6%). PMI's estimated HTU adjusted in-market

sales volume increased by 15.5%, with 15.8% HTU shipment volume

growth.

Financial Summary

Third-Quarter

Financial Summary

- Quarters Ended

September

30,

Change

Fav./(Unfav.)

Variance

Fav./(Unfav.)

2024

2023

Total

Excl. Curr. &

Acquis.

Total

Cur- rency

Acqui- sitions

Price

Vol/ Mix

Cost/ Other

(in millions)

Net Revenues

$

2,964

$

2,777

6.7

%

12.1

%

187

(148

)

—

296

39

—

Operating Income

$

960

$

823

16.6

%

29.8

%

137

(129

)

21

296

21

(72

)

Adjustments (1)

(50

)

(46

)

(7.6

)%

(7.6

)%

(4

)

—

—

—

—

(4

)

Adjusted Operating Income

$

1,009

$

869

16.1

%

28.5

%

140

(129

)

21

296

21

(68

)

Adjusted Operating Income

Margin

34.0

%

31.3

%

2.7

pp

4.6

pp

(1) See Schedule 10 in Exhibit 99.2 to the

Form 8-K dated October 22, 2024, for additional detail.

Net revenues increased by 12.1% on an organic basis, primarily

reflecting: a favorable pricing variance, predominantly driven by

higher combustible tobacco pricing; and favorable volume/mix,

driven by HTU performance.

Adjusted operating income increased by 28.5% on an organic

basis, primarily reflecting: the same factors as for net revenues;

partly offset by higher manufacturing costs (primarily due to

higher cost of tobacco leaf).

Nine Months Year-to-Date

Financial Summary

- Nine Months Ended September 30,

Change

Fav./(Unfav.)

Variance

Fav./(Unfav.)

2024

2023

Total

Excl. Curr. &

Acquis.

Total

Cur- rency

Acqui- sitions

Price

Vol/ Mix

Cost/ Other

(in millions)

Net Revenues

$

8,393

$

7,922

5.9

%

13.4

%

471

(593

)

—

680

306

78

Adjustment (1)

—

(80

)

+100

%

+100

%

80

—

—

—

—

80

Adjusted Net Revenues

$

8,393

$

8,002

4.9

%

12.3

%

391

(593

)

—

680

306

(2

)

Net Revenues

$

8,393

$

7,922

5.9

%

13.4

%

471

(593

)

—

680

306

78

Operating Income

$

2,623

$

2,437

7.6

%

30.9

%

186

(600

)

33

680

117

(44

)

Adjustments (2)

(59

)

(168

)

64.8

%

64.8

%

109

—

—

—

—

109

Adjusted Operating Income

$

2,682

$

2,605

3.0

%

24.7

%

77

(600

)

33

680

117

(152

)

Adjusted Operating Income

Margin

32.0

%

32.6

%

(0.6

)pp

3.6

pp

(1) Termination of distribution

arrangement in the Middle East.

(2) See Schedule 11 in Exhibit 99.2 to the

Form 8-K dated October 22, 2024, for additional detail.

Adjusted net revenues increased by 12.3% on an organic basis,

primarily reflecting: a favorable pricing variance, predominantly

driven by higher combustible tobacco pricing; and favorable

volume/mix, driven by higher cigarette and HTU volume as well as

favorable mix.

Adjusted operating income increased by 24.7% on an organic

basis, primarily reflecting: a favorable pricing variance,

predominantly driven by higher combustible tobacco pricing; and

favorable volume/mix, driven by higher cigarette and HTU volume,

notwithstanding unfavorable cigarette mix; partly offset by higher

manufacturing costs (primarily due to higher cost of tobacco

leaf).

EA, AU AND PMI DF REGION

Total Market, PMI Shipment & Market Share

Commentaries

Third-Quarter The estimated total market for cigarettes

and HTUs in the Region, excluding China, decreased by 1.4% to 82.2

billion units, with a decrease in cigarettes, partly offset by HTU

growth. The decrease in the estimated total market was mainly

driven by Taiwan (down by 10.0%) and Korea (down by 3.2%), partly

offset by International Duty Free (up by 7.2%) and Japan (up by

0.9%).

Nine Months Year-to-Date The estimated total market for

cigarettes and HTUs in the Region, excluding China, was broadly

stable, with a decrease in cigarettes, largely offset by HTU

growth. The decrease in the estimated total market was mainly

driven by Australia (down by 29.0%) and Korea (down by 2.5%),

partly offset by International Duty Free (up by 10.9%) and Japan

(up by 1.0%).

PMI Shipment Volume

Third-Quarter

Nine Months

Year-to-Date

(million units)

2024

2023

Change

2024

2023

Change

Cigarettes

12,806

12,941

(1.0)%

36,246

39,402

(8.0)%

Heated Tobacco Units

13,864

13,099

5.8%

44,937

38,561

16.5%

Total EA, AU & PMI DF

26,670

26,040

2.4%

81,183

77,963

4.1%

Third-Quarter PMI's total cigarette and HTU shipment

volume in the Region increased by 2.4% to 26.7 billion units,

driven by Japan (up by 1.5%), partly offset by Australia (down by

30.0%).

PMI's estimated HTU adjusted in-market sales volume in the

Region increased by 15.5% in the quarter, including growth in Japan

of 14.3%.

Nine Months Year-to-Date PMI's total cigarette and HTU

shipment volume in the Region increased by 4.1% to 81.2 billion

units, driven by Japan (up by 8.9%), partly offset by Australia

(down by 28.2%).

PMI's estimated HTU adjusted in-market sales volume in the

Region increased by 14.7%, including growth in Japan of 13.4%.

Financial Summary

Third-Quarter

Financial Summary

- Quarters Ended

September

30,

Change

Fav./(Unfav.)

Variance

Fav./(Unfav.)

2024

2023

Total

Excl. Curr. &

Acquis.

Total

Cur- rency

Acqui- sitions

Price

Vol/ Mix

Cost/ Other

(in millions)

Net Revenues

$

1,602

$

1,571

2.0

%

7.4

%

31

(85

)

—

71

45

—

Operating Income

$

788

$

769

2.5

%

7.8

%

19

(41

)

—

71

(21

)

10

Adjustments (1)

(1

)

(25

)

97.2

%

97.2

%

24

—

—

—

—

24

Adjusted Operating Income

$

789

$

794

(0.6

)%

4.5

%

(5

)

(41

)

—

71

(21

)

(14

)

Adjusted Operating Income

Margin

49.3

%

50.5

%

(1.2

)pp

(1.3

)pp

(1) See Schedule 10 in Exhibit 99.2 to the

Form 8-K dated October 22, 2024, for additional detail.

Net revenues increased by 7.4% on an organic basis, reflecting:

a favorable pricing variance and favorable volume/mix, mainly

driven by higher HTU volume, partly offset by lower cigarette

volume.

Adjusted operating income increased by 4.5% on an organic basis,

reflecting: favorable pricing variance, partly offset by

unfavorable volume/mix, driven by cigarettes, and higher marketing,

administration and research costs.

Nine Months Year-to-Date

Financial Summary

- Nine Months Ended September 30,

Change

Fav./(Unfav.)

Variance

Fav./(Unfav.)

2024

2023

Total

Excl. Curr. &

Acquis.

Total

Cur- rency

Acqui- sitions

Price

Vol/ Mix

Cost/ Other

(in millions)

Net Revenues

$

4,959

$

4,771

3.9

%

10.5

%

188

(314

)

—

289

213

—

Operating Income

$

2,304

$

1,963

17.4

%

30.5

%

341

(257

)

—

289

53

256

Adjustments (1)

(2

)

(250

)

99.1

%

99.1

%

248

—

—

—

—

248

Adjusted Operating Income

$

2,306

$

2,213

4.2

%

15.8

%

93

(257

)

—

289

53

8

Adjusted Operating Income

Margin

46.5

%

46.4

%

0.1

pp

2.2

pp

(1) See Schedule 11 in Exhibit 99.2 to the

Form 8-K dated October 22, 2024, for additional detail.

Net revenues increased by 10.5% on an organic basis, reflecting:

a favorable pricing variance and favorable volume/mix, mainly

driven by higher HTU volume, partly offset by lower cigarette

volume.

Adjusted operating income increased by 15.8% on an organic

basis, primarily driven by the same factors as for net

revenues.

AMERICAS REGION

Total Market, PMI Shipment & Market Share

Commentaries

Third-Quarter The estimated total market for cigarettes

and HTUs in the Region, excluding the U.S., decreased by 0.7% to

46.5 billion units, primarily reflecting a decline in the cigarette

market. The decrease in the estimated total market was mainly due

to Canada (down by 15.4%) and Mexico (down by 5.8%), partly offset

by Brazil (up by 12.3%).

Nine Months Year-to-Date The estimated total market for

cigarettes and HTUs in the Region, excluding the U.S., decreased by

2.1% to 136.1 billion units, primarily reflecting a decline for

cigarettes. The decrease in the estimated total market was mainly

due to Argentina (down by 11.5%) and Canada (down by 13.1%), partly

offset by Brazil (up by 8.5%).

PMI Shipment Volume

Third-Quarter

Nine Months

Year-to-Date

(million units)

2024

2023

Change

2024

2023

Change

Cigarettes

15,241

15,433

(1.2)%

44,472

45,846

(3.0)%

Heated Tobacco Units

157

129

21.7%

472

383

23.2%

Total Americas

15,398

15,562

(1.1)%

44,944

46,229

(2.8)%

Note: Sum may not foot due to

rounding.

Americas Oral SFP1

Third-Quarter

Nine Months

Year-to-Date

2024

2023

Change

2024

2023

Change

PMI Shipment Volume (million

cans)

Nicotine Pouches

149.6

105.4

41.9%

416.3

268.5

55.0%

Moist Snuff

34.1

33.2

2.6%

102.6

102.5

0.1%

Snus

0.7

0.8

(4.3)%

2.2

3.2

(30.0)%

Total Americas

184.4

139.4

32.3%

521.1

374.2

39.3%

(1) Excluding U.S. chew;

Note: Volumes of other oral SFP introduced

in Q3'24 are not material. Sum may not foot due to rounding.

Third-Quarter PMI's total cigarette and HTU shipment

volume in the Region decreased by 1.1% to 15.4 billion units,

mainly due to Mexico (down by 5.9%) and Argentina (down by 4.3%),

partly offset by Brazil (up by 13.6%).

Oral products shipments increased by 32.3%, predominantly driven

by ZYN nicotine pouches in the U.S.

Nine Months Year-to-Date PMI's total cigarette and HTU

shipment volume in the Region decreased by 2.8% to 44.9 billion

units, mainly due to Argentina (down by 11.6%), partly offset by

Brazil (up by 10.8%).

Cigar shipment volume decreased by 14.6%, predominantly due to

trade inventory movements in the prior-year around the April 2023

price increase. Gross profit for cigars grew robustly.

Oral products shipments increased by 39.3%, predominantly driven

by ZYN nicotine pouches in the U.S.

Financial Summary

Third-Quarter

Financial Summary

- Quarters Ended

September

30,

Change

Fav./(Unfav.)

Variance

Fav./(Unfav.)

2024

2023

Total

Excl. Curr. &

Acquis.

Total

Cur- rency

Acqui- sitions

Price

Vol/ Mix

Cost/ Other

(in millions)

Net Revenues

$

1,148

$

895

28.3

%

30.5

%

253

(20

)

—

92

133

48

Operating Income

$

137

$

98

39.8

%

20.4

%

39

19

—

92

116

(188

)

Adjustments (1)

(198

)

(131

)

(51.3

)%

(51.3

)%

(67

)

—

—

—

—

(67

)

Adjusted Operating Income

$

336

$

229

46.7

%

38.4

%

107

19

—

92

116

(121

)

Adjusted Operating Income

Margin

29.3

%

25.6

%

3.7

pp

1.5

pp

(1) See Schedule 10 in Exhibit 99.2 to the

Form 8-K dated October 22, 2024, for additional detail.

Net revenues increased by 30.5% on an organic basis, primarily

reflecting: a favorable pricing variance and favorable volume/mix,

both predominantly driven by nicotine pouches in the U.S., partly

offset by lower cigarette volume and unfavorable cigarette mix

outside of the U.S.

Adjusted operating income increased by 38.4% on an organic

basis, mainly reflecting: favorable volume/mix and price variance,

mainly due to the same factors as for net revenues; partly offset

by higher marketing, administration and research costs, including

incremental investment in the U.S.

Nine Months Year-to-Date

Financial Summary

-

Nine Months

Ended

September

30,

Change

Fav./(Unfav.)

Variance

Fav./(Unfav.)

2024

2023

Total

Excl. Curr. &

Acquis.

Total

Cur- rency

Acqui- sitions

Price

Vol/ Mix

Cost/ Other

(in millions)

Net Revenues

$

3,273

$

2,732

19.8

%

18.7

%

541

31

—

146

364

—

Operating Income

$

419

$

524

(20.0

)%

(34.5

)%

(105

)

76

—

146

333

(660

)

Adjustments (1)

(578

)

(226

)

-(100

)%

-(100

)%

(352

)

—

—

—

—

(352

)

Adjusted Operating Income

$

997

$

750

32.9

%

22.8

%

247

76

—

146

333

(309

)

Adjusted Operating Income

Margin

30.5

%

27.5

%

3.0

pp

0.9

pp

(1) See Schedule 11 in Exhibit 99.2 to the

Form 8-K dated October 22, 2024, for additional detail.

Net revenues increased by 18.7% on an organic basis, primarily

reflecting: favorable volume/mix, mainly due to growth of ZYN

nicotine pouches in the U.S., partly offset by cigarette volume

declines outside of the U.S.; and favorable cigarette pricing.

Adjusted operating income increased by 22.8% on an organic

basis, mainly reflecting: favorable price variance and favorable

volume/mix, mainly due to the same factors as for net revenues,

partly offset by higher marketing, administration and research

costs, including incremental investment in the U.S.

WELLNESS AND HEALTHCARE

The results of PMI’s Vectura Fertin Pharma business are reported

in the Wellness and Healthcare segment.

Third-Quarter

Financial Summary

- Quarters Ended

September

30,

Change

Fav./(Unfav.)

Variance

Fav./(Unfav.)

2024

2023

Total

Excl. Curr. &

Acquis.

Total

Cur- rency

Acqui- sitions

Price

Vol/ Mix

Cost/ Other

(in millions)

Net Revenues

$

76

$

75

1.3

%

2.7

%

1

(1

)

—

2

—

—

Operating Income / (Loss)

$

(251

)

$

(37

)

-(100

)%

-(100

)%

(214

)

(4

)

—

2

—

(212

)

Adjustments (1)

(211

)

(14

)

-(100

)%

-(100

)%

(197

)

—

—

—

—

(197

)

Adjusted Operating Income /

(Loss)

$

(40

)

$

(23

)

(73.9

)%

(56.5

)%

(17

)

(4

)

—

2

—

(16

)

Adjusted Operating Income / (Loss)

Margin

(52.6

)%

(30.7

)%

(21.9

)pp

(16.1

)pp

(1) See Schedule 10 in Exhibit 99.2 to the

Form 8-K dated October 22, 2024, for additional detail.

Net revenues increased by 2.7% on an organic basis. The adjusted

operating loss of $40 million was primarily due to R&D and

administration costs.

Nine Months Year-to-Date

Financial Summary

- Nine Months Ended

September

30,

Change

Fav./(Unfav.)

Variance

Fav./(Unfav.)

2024

2023

Total

Excl. Curr. &

Acquis.

Total

Cur- rency

Acqui- sitions

Price

Vol/ Mix

Cost/ Other

(in millions)

Net Revenues

$

246

$

237

3.8

%

3.4

%

9

1

—

10

—

(2

)

Operating Income / (Loss)

$

(339

)

$

(808

)

58.0

%

58.3

%

469

(2

)

—

10

—

461

Adjustments (1)

(266

)

(723

)

63.2

%

63.2

%

457

—

—

—

—

457

Adjusted Operating Income /

(Loss)

$

(72

)

$

(85

)

15.3

%

17.6

%

13

(2

)

—

10

—

4

Adjusted Operating Income / (Loss)

Margin

(29.3

)%

(35.9

)%

6.6

pp

7.3

pp

(1) See Schedule 11 in Exhibit 99.2 to the

Form 8-K dated October 22, 2024, for additional detail.

Net revenues increased by 3.4% on an organic basis. The adjusted

operating loss of $72 million was primarily due to R&D and

administration costs.

Philip Morris International: Delivering a Smoke-Free

Future

Philip Morris International (PMI) is a leading international

tobacco company, actively delivering a smoke-free future and

evolving its portfolio for the long term to include products

outside of the tobacco and nicotine sector. The company’s current

product portfolio primarily consists of cigarettes and smoke-free

products. Since 2008, PMI has invested over $12.5 billion to

develop, scientifically substantiate and commercialize innovative

smoke-free products for adults who would otherwise continue to

smoke, with the goal of completely ending the sale of cigarettes.

This includes the building of world-class scientific assessment

capabilities, notably in the areas of pre-clinical systems

toxicology, clinical and behavioral research, as well as

post-market studies. In 2022, PMI acquired Swedish Match – a leader

in oral nicotine delivery – creating a global smoke-free champion

led by the companies’ IQOS and ZYN brands. The U.S. Food and Drug

Administration has authorized versions of PMI’s IQOS devices and

consumables and Swedish Match’s General snus as Modified Risk

Tobacco Products and renewal applications for these products are

presently pending before the FDA. As of June 30, 2024, PMI's

smoke-free products were available for sale in 90 markets, and PMI

estimates that 36.5 million adults around the world use PMI's

smoke-free products. The smoke-free business accounted for

approximately 38% of PMI’s total first-nine months 2024 net

revenues. With a strong foundation and significant expertise in

life sciences, PMI announced in February 2021 its ambition to

expand into wellness and healthcare areas and aims to enhance life

through the delivery of seamless health experiences. References to

“PMI”, “we”, “our” and “us” mean Philip Morris International Inc.,

including its subsidiaries. For more information, please visit

www.pmi.com and www.pmiscience.com.

Forward-Looking and Cautionary Statements

This press release contains projections of future results and

goals and other forward-looking statements, including statements

regarding expected financial or operational performance; capital

allocation plans; investment strategies; regulatory outcomes;

market expectations; and business plans and strategies. Achievement

of future results is subject to risks, uncertainties and inaccurate

assumptions. In the event that risks or uncertainties materialize,

or underlying assumptions prove inaccurate, actual results could

vary materially from those contained in such forward-looking

statements. Pursuant to the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1995, PMI is identifying

important factors that, individually or in the aggregate, could

cause actual results and outcomes to differ materially from those

contained in any forward-looking statements made by PMI.

PMI's business risks include: excise tax increases and

discriminatory tax structures; increasing marketing and regulatory

restrictions that could reduce our competitiveness, eliminate our

ability to communicate with adult consumers, or ban certain of our

products in certain markets or countries; health concerns relating

to the use of tobacco and other nicotine-containing products and

exposure to environmental tobacco smoke; litigation related to

tobacco and/or nicotine use and intellectual property; intense

competition; the effects of global and individual country economic,

regulatory and political developments, natural disasters and

conflicts; the impact and consequences of Russia's invasion of

Ukraine; changes in adult smoker behavior; the impact of natural

disasters and pandemics on PMI's business; lost revenues as a

result of counterfeiting, contraband and cross-border purchases;

governmental investigations; unfavorable currency exchange rates

and currency devaluations, and limitations on the ability to

repatriate funds; adverse changes in applicable corporate tax laws;

adverse changes in the cost, availability, and quality of tobacco

and other agricultural products and raw materials, as well as

components and materials for our electronic devices; and the

integrity of its information systems and effectiveness of its data

privacy policies. PMI's future profitability may also be adversely

affected should it be unsuccessful in its attempts to introduce,

commercialize, and grow smoke-free products or if regulation or

taxation do not differentiate between such products and cigarettes;

if it is unable to successfully introduce new products, promote

brand equity, enter new markets or improve its margins through

increased prices and productivity gains; if it is unable to expand

its brand portfolio internally or through acquisitions and the

development of strategic business relationships; if it is unable to

attract and retain the best global talent, including women or

diverse candidates; or if it is unable to successfully integrate

and realize the expected benefits from recent transactions and

acquisitions. Future results are also subject to the lower

predictability of our smoke-free products performance.

PMI is further subject to other risks detailed from time to time

in its publicly filed documents, including PMI's Annual Report on

Form 10-K for the fourth quarter and year ended December 31, 2023,

Quarterly Report on Form 10-Q for the second quarter ended June 30,

2024, and the Quarterly Report on Form 10-Q for the third quarter

ended September 30, 2024, which will be filed in the coming days.

PMI cautions that the foregoing list of important factors is not a

complete discussion of all potential risks and uncertainties. PMI

does not undertake to update any forward-looking statement that it

may make from time to time, except in the normal course of its

public disclosure obligations.

Non-GAAP Measures, Glossary and Explanatory Notes

Reconciliations of non-GAAP measures in this release to the most

directly comparable U.S. GAAP measures can be found in Exhibit 99.2

to the Form 8-K dated October 22, 2024, and at

www.pmi.com/2024Q3earnings. A glossary of key terms, definitions

and explanatory notes is available in the aforementioned Exhibit

99.2 and on the same webpage, where additional financial schedules,

as well as adjustments and other calculations have also been made

available.

Management reviews net revenues, gross profit, operating income,

operating income margin, operating cash flow and earnings per

share, or "EPS," on an adjusted basis, which may exclude the impact

of currency and other items such as acquisitions, asset impairment

and exit costs, tax items and other special items. Additionally,

starting in 2022 and on a comparative basis, for these measures

other than net revenues and operating cash flow, PMI includes

adjustments to add back amortization expense on acquisition related

intangible assets that are recorded as part of purchase accounting

and contribute to PMI’s revenue generation, as well as impairment

of intangible assets, if any. While amortization expense on

acquisition related intangible assets is excluded in these adjusted

measures, the net revenues generated from these acquired intangible

assets are included in the company's adjusted measures, unless

otherwise stated. Currency-neutral and organic growth rates reflect

the way management views underlying performance for these measures.

PMI believes that such measures provide useful insight into

underlying business trends and results. Management reviews these

measures because they exclude changes in currency exchange rates

and other factors that may distort underlying business trends,

thereby improving the comparability of PMI’s business performance

between reporting periods. Furthermore, PMI uses several of these

measures in its management compensation program to promote internal

fairness and a disciplined assessment of performance against

company targets. PMI discloses these measures to enable investors

to view the business through the eyes of management.

Non-GAAP measures used in this release should neither be

considered in isolation nor as a substitute for the financial

measures prepared in accordance with U.S. GAAP.

Diluted EPS

reconciliation

Third-Quarter

2024

2023

% Change

Reported Diluted EPS

$

1.97

$

1.32

49.2

%

Amortization of intangibles

0.12

0.10

Egypt sales tax charge

0.03

—

Impairment related to Vectura Group's

expected sale

0.13

—

Income tax impact associated with Swedish

Match AB financing

(0.10

)

0.09

Charges related to the war in Ukraine

—

0.01

Termination of agreement with Foundation

for a Smoke-Free World

—

0.07

Fair value adjustment for equity security

investments

(0.24

)

(0.03

)

Tax items

—

0.11

Adjusted Diluted EPS

$

1.91

$

1.67

14.4

%

Less: Currency

(0.06

)

Adjusted Diluted EPS, excluding

Currency

$

1.97

$

1.67

18.0

%

Appendix 1

PHILIP MORRIS INTERNATIONAL INC.

and Subsidiaries

Key Market Data

Quarters Ended September

30,

Market

Total Market,

bio units

PMI Shipments, bio

units

PMI Market Share(2), %

Total

Cigarette

HTU

Total

HTU

2024

2023

% Change

2024

2023

% Change

2024

2023

% Change

2024

2023

% Change

2024

2023

pp Change

2024

2023

pp Change

Total(1)(2)

676.7

667.8

1.3

198.6

193.6

2.6

163.2

161.1

1.3

35.3

32.5

8.9

29.5

28.9

0.6

5.3

4.6

0.7

Europe

France

6.8

7.6

(10.9)

2.4

2.7

(9.0)

2.4

2.6

(9.4)

—

—

—

41.0

42.2

(1.2)

0.6

0.7

(0.1)

Germany(3)

19.7

19.3

2.1

7.0

6.9

0.3

5.9

6.0

(2.7)

1.1

0.9

20.9

37.9

38.4

(0.5)

5.9

4.9

1.0

Italy(3)

20.1

19.4

3.5

10.5

10.4

0.9

7.2

6.8

5.0

3.3

3.6

(6.8)

54.9

53.5

1.4

16.6

16.0

0.6

Poland(3)

15.4

15.2

1.1

6.9

6.5

5.7

5.5

5.2

7.0

1.3

1.3

0.8

44.0

42.0

2.0

8.6

8.4

0.2

Spain

12.3

11.9

3.8

3.6

3.5

3.6

3.2

3.1

2.5

0.4

0.3

14.3

29.6

29.9

(0.3)

2.7

2.3

0.4

SSEA, CIS & MEA

Egypt

21.5

16.2

32.4

6.5

6.4

2.1

6.0

6.1

(1.5)

0.5

0.2

92.8

30.4

40.2

(9.8)

1.9

2.0

(0.1)

Indonesia

75.5

78.1

(3.3)

20.7

22.7

(8.9)

20.3

22.5

(9.7)

0.3

0.2

99.9

27.4

29.0

(1.6)

0.4

0.2

0.2

Philippines

10.4

10.5

(0.9)

5.3

5.7

(7.9)

5.2

5.6

(8.3)

0.1

0.1

39.4

50.7

54.5

(3.8)

0.7

0.5

0.2

Russia

58.8

54.3

8.3

19.0

17.1

11.4

14.5

12.9

11.9

4.6

4.2

9.9

32.9

31.8

1.1

8.1

7.7

0.4

Turkey

41.2

37.7

9.4

21.4

18.9

13.1

21.4

18.9

13.1

—

—

—

52.0

50.3

1.7

—

—

—

EA, AU & PMI DF

Australia

1.3

1.8

(28.3)

0.5

0.7

(30.0)

0.5

0.7

(30.0)

—

—

—

37.2

38.1

(0.9)

—

—

—

Japan(2)

38.6

38.2

0.9

15.7

15.5

1.5

4.2

4.3

(3.0)

11.5

11.2

3.2

41.4

39.5

1.9

30.0

26.5

3.5

South Korea

18.2

18.8

(3.2)

3.7

3.7

(1.2)

2.2

2.4

(9.0)

1.5

1.3

12.6

19.9

19.6

0.3

8.2

7.1

1.1

Americas

Argentina

6.1

6.6

(6.4)

3.9

4.0

(4.3)

3.9

4.0

(4.3)

—

—

—

62.7

61.4

1.3

—

—

—

Mexico

7.3

7.7

(5.8)

4.6

4.9

(5.9)

4.5

4.8

(6.2)

0.1

—

—

62.7

62.7

—

0.7

0.5

0.2

(1) Market share estimates are calculated

using IMS data, unless otherwise stated

(2) Total market and market share

estimates include cigarillos in Japan

(3) PMI market share reflects estimated

adjusted IMS volume share; Total Market is based on reported

IMS

Note: % change for Total Market and PMI

shipments is computed based on millions of units. "-" indicates

volume below 50 million units and market share below 0.1%

Appendix 2

PHILIP MORRIS INTERNATIONAL INC.

and Subsidiaries

Key Market Data

Nine Months Ended September

30,

Market

Total Market,

bio units

PMI Shipments, bio

units

PMI Market Share(2), %

Total

Cigarette

HTU

Total

HTU

2024

2023

% Change

2024

2023

% Change

2024

2023

% Change

2024

2023

% Change

2024

2023

pp Change

2024

2023

pp Change

Total(1)(2)

1,952.0

1,929.4

1.2

568.1

553.1

2.7

464.0

461.9

0.5

104.0

91.3

13.9

28.7

28.3

0.4

5.2

4.6

0.6

Europe

France

19.8

22.7

(12.8)

8.3

10.2

(18.4)

8.2

10.0

(18.3)

0.1

0.2

(22.1)

40.9

42.3

(1.4)

0.6

0.7

(0.1)

Germany(3)

53.0

53.0

—

20.1

19.8

1.3

17.0

17.7

(4.0)

3.1

2.2

44.7

38.8

39.0

(0.2)

6.1

5.2

0.9

Italy(3)

55.7

55.1

1.2

29.0

29.1

(0.3)

20.9

20.8

0.8

8.1

8.4

(2.9)

53.7

53.6

0.1

17.0

16.6

0.4

Poland(3)

44.5

43.7

1.9

19.4

18.1

7.1

15.4

14.3

7.5

4.0

3.8

5.7

43.5

41.3

2.2

8.9

8.8

0.1

Spain

33.3

33.0

0.7

9.9

9.9

(0.6)

9.0

9.2

(1.9)

0.9

0.8

15.1

29.2

29.4

(0.2)

2.7

2.2

0.5

SSEA, CIS & MEA

Egypt

59.9

54.8

9.4

18.5

18.1

2.0

17.4

17.4

(0.1)

1.1

0.7

55.0

30.6

33.3

(2.7)

1.9

1.6

0.3

Indonesia

221.4

219.5

0.9

60.5

63.5

(4.6)

59.7

63.1

(5.3)

0.8

0.4

+100

27.3

28.9

(1.6)

0.4

0.2

0.2

Philippines

30.4

32.2

(5.4)

15.8

18.0

(12.2)

15.6

17.8

(12.6)

0.2

0.2

33.2

52.0

56.0

(4.0)

0.7

0.5

0.2

Russia

160.7

151.0

6.4

51.9

48.3

7.5

38.9

36.5

6.6

13.0

11.8

10.3

32.3

31.9

0.4

8.5

7.9

0.6

Turkey

111.7

101.2

10.4

57.8

50.3

14.9

57.8

50.3

14.9

—

—

—

51.7

49.7

2.0

—

—

—

EA, AU & PMI DF

Australia

4.0

5.6

(29.0)

1.4

2.0

(28.2)

1.4

2.0

(28.2)

—

—

—

35.8

35.4

0.4

—

—

—

Japan(2)

112.2

111.1

1.0

51.1

47.0

8.9

12.6

13.9

(9.6)

38.5

33.0

16.7

41.1

39.5

1.6

29.6

26.4

3.2

South Korea

52.9

54.3

(2.5)

10.6

10.6

(0.1)

6.3

6.8

(6.8)

4.3

3.8

12.0

20.0

19.5

0.5

8.0

7.0

1.0

Americas

Argentina

19.1

21.6

(11.5)

11.8

13.4

(11.6)

11.8

13.4

(11.6)

—

—

—

61.9

62.0

(0.1)

—

—

—

Mexico

21.0

21.3

(1.4)

12.9

13.2

(2.1)

12.8

13.1

(2.6)

0.2

0.1

61.2

61.6

62.1

(0.5)

0.8

0.5

0.3

(1) Market share estimates are calculated

using IMS data, unless otherwise stated

(2) Total market and market share

estimates include cigarillos in Japan

(3) PMI market share reflects estimated

adjusted IMS volume share; Total Market is based on reported

IMS

Note: % change for Total Market and PMI

shipments is computed based on millions of units. "-" indicates

volume below 50 million units and market share below 0.1%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241021238001/en/

Philip Morris International Investor Relations: Stamford,

CT: +1 (203) 905 2413 Lausanne, Switzerland: +41 582 424 666 Email:

InvestorRelations@pmi.com

Media: Lausanne: +41 582 424 500 Email: David.Fraser@pmi.com

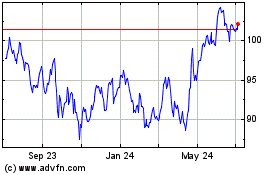

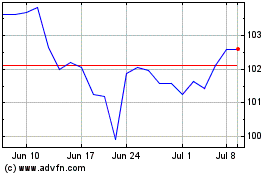

Philip Morris (NYSE:PM)

Historical Stock Chart

From Nov 2024 to Dec 2024

Philip Morris (NYSE:PM)

Historical Stock Chart

From Dec 2023 to Dec 2024