Osisko Gold Royalties Ltd (the “

Company” or

“

Osisko”) (OR: TSX & NYSE) is pleased to

provide an update on its third quarter 2024 preliminary deliveries,

revenues and cash margin, as well as on its cash and debt positions

as of September 30th, 2024. All monetary amounts included in this

report are expressed in Canadian dollars, unless otherwise noted.

PRELIMINARY Q3 2024 RESULTS

Osisko earned 18,408 attributable gold

equivalent ounces1 (“GEOs”) in the third quarter of 2024.

Osisko recorded preliminary revenues from

royalties and streams of $57.3 million during the third quarter and

preliminary cost of sales (excluding depletion) of $2.2 million,

resulting in a quarterly cash margin2 of approximately $55.1

million (or 96.3%).

As at September 30th, 2024, Osisko’s cash

position was $58.5 million. The Company’s revolving credit facility

was drawn by $80.7 million at the end of September 2024, with an

additional amount of $469.3 million available to be drawn plus the

uncommitted accordion of up to $200.0 million. The net debt

position as of September 30, 2024 was reduced to $22.2 million

during the third quarter following debt repayments of

$27.3 million.

Q3 2024 RESULTS CONFERENCE CALL AND WEBCAST

DETAILS

Osisko provides notice of its third quarter 2024

results conference call and webcast.

|

Results Release: |

Wednesday, November 6th, 2024 after market close |

|

|

|

|

Conference Call: |

Wednesday, November 6th, 2024 at 5:00 pm ET |

|

|

|

|

Dial-in Numbers:(Option 1) |

North American Toll-Free: 1 (800) 717-1738Local – Montreal: 1

(514) 400-3792Local – Toronto: 1 (289) 514-5100Local – New York: 1

(646) 307-1865Conference ID: 83490 |

|

|

|

|

Webcast link:(Option 2) |

https://viavid.webcasts.com/starthere.jsp?ei=1691902&tp_key=a7c42fad9d |

|

|

|

|

Replay (available until Friday, December 6th, 2024 at 11:59 PM

ET): |

North American Toll-Free: 1 (888) 660-6264Local – Toronto: 1 (289)

819-1325Local – New York: 1 (646) 517-3975Playback Passcode:

83490# |

|

|

|

|

|

Replay also available on our website at www.osiskogr.com |

|

|

|

Notes:

The figures presented in this press release,

including the cash balance, debt position, revenues and costs of

sales, have not been audited and are subject to change. As the

Corporation has not yet finished its quarter-end procedures, the

anticipated financial information presented in this press release

is preliminary, subject to quarter-end adjustments, and may change

materially.

|

(1) |

Gold Equivalent Ounces |

|

|

|

|

|

GEOs are calculated on a quarterly basis and include royalties and

streams. Silver and copper earned from royalty and stream

agreements are converted to gold equivalent ounces by multiplying

the silver ounces or copper tonnes earned by the average silver or

copper price for the period and dividing by the average gold price

for the period. Diamonds, other metals and cash royalties are

converted into gold equivalent ounces by dividing the associated

revenue earned by the average gold price for the period. |

|

|

Average Metal Prices and Exchange Rate |

|

|

|

|

|

|

|

|

|

Three months ended September 30, |

|

|

|

|

|

2024 |

|

|

2023 |

|

| |

|

|

|

|

|

|

| |

Gold (i) |

$2,474 |

|

$1,928 |

|

| |

Silver (ii) |

$29.43 |

|

$23.57 |

|

| |

Copper (iii) |

$9,210 |

|

$8,356 |

|

| |

|

|

|

|

|

|

|

| |

Exchange rate (US$/Can$)

(iv) |

|

1.3641 |

|

|

1.3414 |

|

|

|

(i) |

The London Bullion Market Association’s pm price in U.S. dollars

per ounce. |

|

|

(ii) |

The London Bullion Market Association’s price in U.S. dollars per

ounce. |

|

|

(iii) |

The London Metal Exchange’s price in U.S. dollars per tonne. |

|

|

(iv) |

Bank of Canada daily rate. |

|

|

|

|

|

(2) |

Non-IFRS Measures |

|

|

|

|

|

The Corporation has included certain performance measures in this

press release that do not have any standardized meaning prescribed

by IFRS Accounting Standards including cash margin in dollars and

in percentage. The presentation of these non-IFRS measures is

intended to provide additional information and should not be

considered in isolation or as a substitute for measures of

performance prepared in accordance with IFRS Accounting Standards.

These measures are not necessarily indicative of operating profit

or cash flow from operations as determined under IFRS Accounting

Standards. As Osisko’s operations are primarily focused on precious

metals, the Corporation presents cash margins as it believes that

certain investors use this information, together with measures

determined in accordance with IFRS Accounting Standards, to

evaluate the Corporation’s performance in comparison to other

companies in the precious metals mining industry who present

results on a similar basis. However, other companies may calculate

these non-IFRS measures differently.Cash margin (in dollars)

represents revenues less cost of sales (excluding depletion). Cash

margin (in percentage) represents the cash margin (in dollars)

divided by revenues. |

| |

(In thousands of dollars) |

Three months endedSeptember 30, 2024 |

|

|

|

|

|

|

| |

Revenues |

$57,255 |

|

| |

Less: Cost of sales (excluding

depletion) |

($2,141 |

) |

| |

Cash margin (in dollars) |

$55,114 |

|

| |

Cash margin (in percentage of

revenues) |

|

96.3% |

|

| |

|

|

|

|

About Osisko Gold Royalties

Ltd

Osisko is an intermediate precious metal royalty

company focused on the Americas that commenced activities in June

2014. Osisko holds a North American focused portfolio of over 185

royalties, streams and precious metal offtakes. Osisko’s portfolio

is anchored by its cornerstone asset, a 3-5% net smelter return

royalty on the Canadian Malartic Complex, one of Canada’s largest

gold mines.

Osisko’s head office is located at 1100 Avenue

des Canadiens-de-Montréal, Suite 300, Montréal, Québec,

H3B 2S2.

| For further

information, please contact Osisko Gold Royalties

Ltd: |

|

|

|

|

Grant MoentingVice President, Capital MarketsTel: (514) 940-0670

x116Cell: (365) 275-1954Email: gmoenting@osiskogr.com |

Heather TaylorVice President, Sustainability and CommunicationsTel:

(514) 940-0670 x105Email: htaylor@osiskogr.com |

| |

|

Forward-Looking Statements

Certain statements contained in this press

release may be deemed “forward-looking statements” within the

meaning of the United States Private Securities Litigation Reform

Act of 1995 and “forward-looking information” within the meaning of

applicable Canadian securities legislation. Forward-looking

statements are statements other than statements of historical fact,

that address, without limitation, future events, that financial

information may be subject to year-end adjustments, the

availability of the uncommitted accordion of the credit facility.

Forward-looking statements are statements that are not historical

facts and are generally, but not always, identified by the words

“expects”, “plans”, “anticipates”, “believes”, “intends”,

“estimates”, “projects”, “potential”, “scheduled” and similar

expressions or variations (including negative variations), or that

events or conditions “will”, “would”, “may”, “could” or “should”

occur. Forward-looking statements are subject to known and unknown

risks, uncertainties and other factors, most of which are beyond

the control of Osisko, and actual results may accordingly differ

materially from those in forward-looking statements. Such risk

factors include, without limitation, (i) with respect to properties

in which Osisko holds a royalty, stream or other interest; risks

related to: (a) the operators of the properties, (b) timely

development, permitting, construction, commencement of production,

ramp-up (including operating and technical challenges), (c)

differences in rate and timing of production from resource

estimates or production forecasts by operators, (d) differences in

conversion rate from resources to reserves and ability to replace

resources, (e) the unfavorable outcome of any challenges or

litigation relating title, permit or license, (f) hazards and

uncertainty associated with the business of exploring, development

and mining including, but not limited to unusual or unexpected

geological and metallurgical conditions, slope failures or

cave-ins, flooding and other natural disasters or civil unrest or

other uninsured risks, (ii) with respect to other external factors:

(a) fluctuations in the prices of the commodities that drive

royalties, streams, offtakes and investments held by Osisko, (b)

fluctuations in the value of the Canadian dollar relative to the

U.S. dollar, (c) regulatory changes by national and local

governments, including permitting and licensing regimes and

taxation policies, regulations and political or economic

developments in any of the countries where properties in which

Osisko holds a royalty, stream or other interest are located or

through which they are held, (d) continued availability of capital

and financing and general economic, market or business conditions,

and (e) responses of relevant governments to infectious diseases

outbreaks and the effectiveness of such response and the potential

impact of such outbreaks on Osisko’s business, operations and

financial condition; (iii) with respect to internal factors: (a)

business opportunities that may or not become available to, or are

pursued by Osisko, (b) the integration of acquired assets or (c)

the determination of Osisko’s PFIC status (d) that financial

information may be subject to year-end adjustments. The

forward-looking statements contained in this press release are

based upon assumptions management believes to be reasonable,

including, without limitation: the absence of significant change in

Osisko’s ongoing income and assets relating to determination of its

PFIC status, and the absence of any other factors that could cause

actions, events or results to differ from those anticipated,

estimated or intended and, with respect to properties in which

Osisko holds a royalty, stream or other interest, (i) the ongoing

operation of the properties by the owners or operators of such

properties in a manner consistent with past practice and with

public disclosure (including forecast of production), (ii) the

accuracy of public statements and disclosures made by the owners or

operators of such underlying properties (including expectations for

the development of underlying properties that are not yet in

production), (iii) no adverse development in respect of any

significant property, (iv) that statements and estimates relating

to mineral reserves and resources by owners and operators are

accurate and (v) the implementation of an adequate plan for

integration of acquired assets.

For additional information on risks,

uncertainties and assumptions, please refer to the most recent

Annual Information Form of Osisko filed on SEDAR+ at

www.sedarplus.ca and EDGAR at www.sec.gov which also provides

additional general assumptions in connection with these statements.

Osisko cautions that the foregoing list of risk and uncertainties

is not exhaustive. Investors and others should carefully consider

the above factors as well as the uncertainties they represent and

the risk they entail. Osisko believes that the assumptions

reflected in those forward-looking statements are reasonable, but

no assurance can be given that these expectations will prove to be

accurate as actual results and prospective events could materially

differ from those anticipated such the forward-looking statements

and such forward-looking statements included in this press release

are not guarantee of future performance and should not be unduly

relied upon. These statements speak only as of the date of this

press release. Osisko undertakes no obligation to publicly update

or revise any forward-looking statements, whether as a result of

new information, future events or otherwise, other than as required

by applicable law.

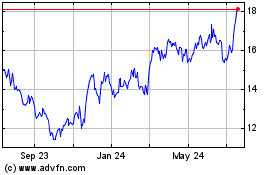

Osisko Gold Royalties (NYSE:OR)

Historical Stock Chart

From Jan 2025 to Feb 2025

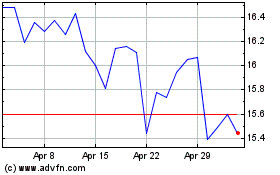

Osisko Gold Royalties (NYSE:OR)

Historical Stock Chart

From Feb 2024 to Feb 2025