- Revenue of $63 million, +11% year-over-year; WAU of 45.1

million, +8% year-over-year

- GAAP net loss of $43 million; Adjusted EBITDA loss of $6

million, representing year-over-year margin improvement of 23

percentage points

- Increases full-year 2024 financial outlook

Nextdoor Holdings, Inc. (NYSE: KIND), the essential neighborhood

network, today reported financial results for the second quarter

ended June 30, 2024.

Nextdoor's highlighted metrics for the quarter ended June 30,

2024 include:

- Total Weekly Active Users (WAU) of 45.1 million increased 8%

year-over-year.

- Revenue of $63 million increased 11% year-over-year.

- Net loss was $43 million, compared to $35 million in the

year-ago period.

- Adjusted EBITDA loss was $6 million, compared to $19 million in

the year-ago period.

- Ending cash, cash equivalents, and marketable securities were

$457 million as of June 30, 2024.

"Q2 was a productive quarter at Nextdoor,” said Nextdoor CEO

Nirav Tolia. "We reported an 8% year-over-year increase in WAU and

11% growth in revenue as advertisers are benefiting from improved

functionality and performance on our Nextdoor Ads Platform."

"New users continue to join the platform and engage more deeply,

and with our resources better allocated towards growth, we unlocked

meaningful margin improvement in Q2 and are raising our full-year

2024 outlook. I remain confident Nextdoor is well-positioned for

the next phase of our growth.”

For more detailed information on our operating and financial

results for the second quarter ended June 30, 2024, as well as our

outlook for Q3 and fiscal year 2024, please reference our

Shareholder Letter posted to our Investor Relations website located

at investors.nextdoor.com.

Three Months Ended June

30,

Six Months Ended June

30,

(in thousands)

2024

2023

2024

2023

Revenue

$

63,292

$

56,889

$

116,438

$

106,660

Loss from operations

$

(49,016

)

$

(41,442

)

$

(83,765

)

$

(80,254

)

Net loss

$

(42,781

)

$

(35,403

)

$

(71,042

)

$

(69,119

)

Adjusted EBITDA(1)

$

(5,979

)

$

(18,605

)

$

(19,994

)

$

(40,266

)

(1) The following is a reconciliation of

net loss, the most comparable GAAP measure, to adjusted EBITDA for

the periods presented above:

Three Months Ended June

30,

Six Months Ended June

30,

(in thousands)

2024

2023

2024

2023

Net loss

$

(42,781

)

$

(35,403

)

$

(71,042

)

$

(69,119

)

Depreciation and amortization

1,143

1,454

2,530

2,905

Stock-based compensation

16,235

21,576

35,741

37,392

Interest income

(6,409

)

(6,356

)

(13,255

)

(11,869

)

Provision for income taxes

316

124

515

425

Restructuring charges

25,517

—

25,517

—

Adjusted EBITDA

$

(5,979

)

$

(18,605

)

$

(19,994

)

$

(40,266

)

Net loss % Margin

(68

)%

(62

)%

(61

)%

(65

)%

Adjusted EBITDA % Margin

(9

)%

(33

)%

(17

)%

(38

)%

Nextdoor will host a conference call at 2:00 p.m. PT/5:00 p.m.

ET today to discuss these results and outlook. A live webcast of

our second quarter 2024 earnings release call will be available in

the Events & Presentations section of Nextdoor’s Investor

Relations website. After the live event, the audio recording for

the webcast can be accessed on the same website for approximately

one year.

Nextdoor uses its Investor Relations website

(investors.nextdoor.com), its X handle (http://x.com/Nextdoor), and

its LinkedIn Home Page (linkedin.com/company/nextdoor-com) as a

means of disseminating or providing notification of, among other

things, news or announcements regarding its business or financial

performance, investor events, press releases, and earnings

releases, and as a means of disclosing material nonpublic

information and for complying with its disclosure obligations under

Regulation FD.

Non-GAAP Financial Measures

To supplement our condensed consolidated financial statements,

which are prepared in accordance with GAAP, we present certain

non-GAAP financial measures, such as adjusted EBITDA and adjusted

EBITDA margin, in this press release. Our use of non-GAAP financial

measures has limitations as an analytical tool, and these measures

should not be considered in isolation or as a substitute for

analysis of financial results as reported under GAAP.

We use non-GAAP financial measures in conjunction with financial

measures prepared in accordance with GAAP for planning purposes,

including in the preparation of our annual operating budget, as a

measure of our core operating results and the effectiveness of our

business strategy, and in evaluating our financial performance.

Non-GAAP financial measures provide consistency and comparability

with past financial performance, facilitate period-to-period

comparisons of core operating results, and also facilitate

comparisons with other peer companies, many of which use similar

non-GAAP financial measures to supplement their GAAP results. In

addition, adjusted EBITDA is widely used by investors and

securities analysts to measure a company's operating performance.

We exclude the following items from one or more of our non-GAAP

financial measures: stock-based compensation expense (non-cash

expense calculated by companies using a variety of valuation

methodologies and subjective assumptions), depreciation and

amortization (non-cash expense), interest income, provision for

income taxes, and, if applicable, restructuring charges or

acquisition-related costs.

Investors are cautioned that there are material limitations

associated with the use of non-GAAP financial measures as an

analytical tool. In particular, (1) stock-based compensation

expense has recently been, and will continue to be for the

foreseeable future, a significant recurring expense for our

business and an important part of our compensation strategy, (2)

although depreciation and amortization expense are non-cash

charges, the assets subject to depreciation and amortization may

have to be replaced in the future, and our non-GAAP measures do not

reflect cash capital expenditure requirements for such replacements

or for new capital expenditure requirements, and (3) adjusted

EBITDA does not reflect: (a) changes in, or cash requirements for,

our working capital needs; (b) interest expense, or the cash

requirements necessary to service interest or principal payments on

our debt, which reduces cash available to us; or (c) tax payments

that may represent a reduction in cash available to us. The

non-GAAP measures we use may be different from non-GAAP financial

measures used by other companies, limiting their usefulness for

comparison purposes. We compensate for these limitations by

providing specific information regarding the GAAP items excluded

from these non-GAAP financial measures.

About Nextdoor

Nextdoor (NYSE: KIND) is the neighborhood network. Neighbors,

businesses of all sizes, and public agencies in more than 335,000

neighborhoods across 11 countries turn to Nextdoor to connect to

the neighborhoods that matter to them so that they can thrive. As a

purpose-driven company, Nextdoor leverages innovative technology to

cultivate a kinder world where everyone has a neighborhood they can

rely on — both online and in the real world. Download the app or

join the neighborhood at nextdoor.com. For more information and

assets, visit nextdoor.com/newsroom.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240807162761/en/

Investor Relations: John T. Williams ir@nextdoor.com or visit

investors.nextdoor.com

Media Relations: Kelsey Grady Antonia Gray

press@nextdoor.com

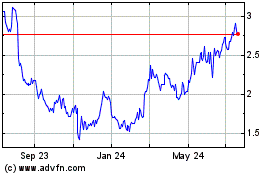

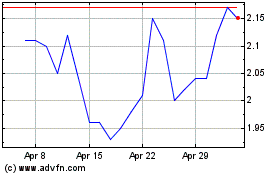

Nextdoor (NYSE:KIND)

Historical Stock Chart

From Feb 2025 to Mar 2025

Nextdoor (NYSE:KIND)

Historical Stock Chart

From Mar 2024 to Mar 2025