Natural Resource Tops Earnings, Down Y/Y - Analyst Blog

May 07 2013 - 9:18AM

Zacks

Natural Resource Partners L.P. (NRP) reported

first quarter 2013 earnings of 43 cents per unit, down 8.5% from

the year-ago earnings.

Earnings, however, surpassed the Zacks Consensus Estimate by

4.9%. GAAP and pro forma earnings were identical owing to the

absence of one-time items.

Total Revenue

Natural Resource Partners’ revenue recorded a 3% upsurge

totaling $94.3 million driven by rise in revenues other than coal

royalty partially offset by a decline in coal royalty revenue.

The reported quarter revenue topped the Zacks Consensus Estimate

by 6.0%.

Natural Resource Partners Production Update

Coal production during the quarter rose sharply by 14% from the

year-ago quarter to 13.8 million tons. Metallurgical coal

contributed 27% to the overall production, lower than the year-ago

share of 30%.

Natural Resource Partners production in the Appalachian region

grew 5% year over year. This was further supported by expansion in

production across the Illinois, Northern River Powder and Gulf

coast basins.

Coal royalty revenue slipped 9% to $54.4 million from the

prior-year quarter. This happened due to lower realizations from

the Central Appalachian operations. Average coal royalty per ton

also declined 20% year over year.

Revenues other than coal royalty, surged 25% to $39.9 million in

the reported quarter.

Operational Highlights

Total operating costs and expenses of Natural Resource Partners

during the quarter totaled $31.8 million, up 17.6% from the

prior-year quarter. A 19% and 29.5% increase in depreciation,

depletion and amortization as well as general and administrative

expenses led to the cost upturn.

Interest expenses rose to $14.6 million from $13.6 million in

the year-ago quarter.

Financial Screening

Cash from operating activities during the quarter was $43.9

million versus $49.5 million in the prior-year quarter.

In the first quarter, distributable cash flow was $44.5 million,

down 10.1% from the year-ago period. This was due to lower revenues

from coal royalty.

Cash and cash equivalents as of Mar 31, 2013 were $76.2 million

versus $149.4 million as of Dec 31, 2012. The substantial decrease

in Natural Resource Partners' cash balance from the year-ago

quarter was due to acquisitions, and principal and interest

payments.

Long-term debt as of Mar 31, 2013 was $1.1 billion versus $0.9

billion as of Dec 31, 2012.

Outlook

With natural gas price on the rise, Natural Resource Partners

anticipates improvement in the U.S. steam coal market. The

partnership’s leeses are ready to welcome any encouraging signs in

the market but are in no hurry to reopen mines and are waiting a

little before going for an increase in production level.

Other Coal Company Releases

Alpha Natural Resources (ANR) reported a loss

of 47 cents per share for the first quarter of 2013, narrower than

the Zacks Consensus Estimate of a loss of 58 cents.

Walter Energy Inc. (WLT) posted operating loss

per share in the first quarter of 2013 of 64 cents, much narrower

than the Zacks Consensus Estimate of a loss of 88 cents.

Arch Coal Inc. (ACI) reported first-quarter

2013 pro forma loss of 34 cents per share, marginally wider than

the Zacks Consensus Estimate of a loss of 32 cents.

Our View

Natural Resource Partners delivered promising results in the

first quarter 2013 with both earnings and revenue beating our

expectations. The partnership’s diversified asset basket lends

constancy to its revenue stream. The acquisition of stake in OCI

Wyoming is expected to provide significant upside given the

increasing demand for soda ash in Asia.

Moreover, Natural Resource Partners is expected to gain from

higher metallurgical coal demand on the back of thriving steel

markets in India, China and South America.

On the other hand, transportation cost pressure and expiration

of contract with a Clint Group affiliate would pose challenges to

Natural Resource Partners.

The partnership currently retains a Zacks Rank #3 (Hold).

Headquartered in Houston, Texas, Natural Resource Partners L.P.

engages in the business of owning and managing mineral reserve

properties. It primarily owns coal, oil and gas reserves across the

US, generating royalty income for the partnership.

ARCH COAL INC (ACI): Free Stock Analysis Report

ALPHA NATRL RES (ANR): Free Stock Analysis Report

NATURAL RSRC LP (NRP): Free Stock Analysis Report

WALTER ENERGY (WLT): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

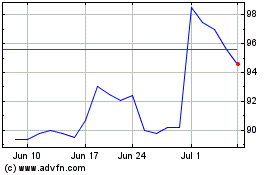

Natural Resource Partners (NYSE:NRP)

Historical Stock Chart

From Jun 2024 to Jul 2024

Natural Resource Partners (NYSE:NRP)

Historical Stock Chart

From Jul 2023 to Jul 2024