0001818383FALSE00018183832023-11-012023-11-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

_____________________________

FORM 8-K

_____________________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 1, 2023

_____________________________

MediaAlpha, Inc.

(Exact Name of Registrant as Specified in Its Charter)

_____________________________

| | | | | | | | |

| Delaware | 001-39671 | 85-1854133 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | | |

700 South Flower Street, Suite 640 Los Angeles, California | 90017 |

| (Address of Principal Executive Offices) | (Zip Code) |

(213) 316-6256

(Registrant’s telephone number, including area code)

(Not Applicable)

(Former name or former address, if changed since last report)

| | | | | |

| Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): |

| |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A common stock, $0.01 par value | | MAX | | New York Stock Exchange |

| | | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company o If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o |

ITEM 2.02 – Results of Operations and Financial Condition.

On November 1, 2023, MediaAlpha, Inc. (“MediaAlpha”) issued a press release and an accompanying shareholder letter announcing its financial results as of and for the third quarter ended September 30, 2023, and its financial outlook for the fourth quarter of 2023. Copies of the press release and shareholder letter are furnished as Exhibit 99.1 and Exhibit 99.2, respectively, to this Form 8-K and are incorporated by reference herein.

This information shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

MediaAlpha refers to non-GAAP financial information in the press release and shareholder letter. A reconciliation of these non-GAAP financial measures to the comparable GAAP financial measures is contained in each document.

ITEM 9.01 – Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

Exhibit No. | Description |

99.1 | |

99.2 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| MediaAlpha, Inc. |

| | |

| Date: November 1, 2023 | By: | /s/ Jeffrey B. Coyne |

| | Name: | Jeffrey B. Coyne |

| | Title: | General Counsel & Secretary |

MEDIAALPHA ANNOUNCES THIRD QUARTER 2023

FINANCIAL RESULTS

•Revenue of $75 million, down 16% year over year

•Transaction Value of $109 million, down 26% year over year

•Transaction Value from Property & Casualty down 46% year over year to $45 million

•Transaction Value from Health up 11% year over year to $51 million

Los Angeles, CA (November 1, 2023) – MediaAlpha, Inc. (NYSE: MAX), today announced its financial results for the third quarter ended September 30, 2023.

“Our third quarter results reflected solid execution, as we grew Adjusted EBITDA year over year despite continued challenging market conditions in our property & casualty (P&C) insurance vertical,” said Steve Yi, MediaAlpha CEO. “In the fourth quarter, we expect continued Adjusted EBITDA growth year over year, driven by gross margin expansion and disciplined expense management. We continue to see the benefits of insurance shopping migrating to online channels, and we expect growth to accelerate in 2024 as the P&C cycle turns and carrier advertising spending starts to normalize.”

Third Quarter 2023 Financial Results

•Revenue of $74.6 million, a decrease of 16% year over year;

•Transaction Value of $109.0 million, a decrease of 26% year over year;

•Gross margin of 16.5%, compared with 14.2% in the third quarter of 2022;

•Contribution Margin(1) of 20.2%, compared with 17.4% in the third quarter of 2022;

•Net loss was $(18.7) million, compared with $(21.2) million in the third quarter of 2022; and

•Adjusted EBITDA(1) was $3.6 million, compared with $2.2 million in the third quarter of 2022.

(1)A reconciliation of GAAP to Non-GAAP financial measures has been provided at the end of this press release. An explanation of these measures is also included below under the heading “Non-GAAP Financial Measures.”

Financial Outlook

Our guidance for the fourth quarter of 2023 reflects ongoing weakness in customer acquisition spend levels by P&C carriers as they continue to prioritize profitability over growth. As a result, we expect Transaction Value in our P&C insurance vertical to be similar to Q3 2023 levels, approximately 20% lower year over year. We expect fourth quarter Transaction Value in our Health vertical to be roughly flat year over year.

For the fourth quarter of 2023, MediaAlpha currently expects the following:

•Transaction Value between $145 million - $160 million, representing a 10% year-over-year decrease at the midpoint of the guidance range;

•Revenue between $106 million - $116 million, representing a 10% year-over-year decrease at the midpoint of the guidance range;

•Adjusted EBITDA between $9.5 million and $11.5 million, representing a 16% year-over-year increase at the midpoint of the guidance range. We are projecting our operating expenses, net of Adjusted EBITDA addbacks, to be approximately $0.5 to $1.0 million higher than Q3 2023 levels due in part to seasonality.

With respect to the Company’s projection of Adjusted EBITDA under “Financial Outlook,” MediaAlpha is not providing a reconciliation of Adjusted EBITDA to net income (loss) because the Company is unable to predict with reasonable certainty the reconciling items that may affect net income (loss) without unreasonable effort, including equity-based compensation, transaction expenses and income tax expense. These reconciling items are uncertain, depend on various factors and could significantly impact, either individually or in the aggregate, the corresponding GAAP measures for the applicable period.

For a detailed explanation of the Company’s non-GAAP measures, please refer to the appendix section of this press release.

Conference Call Information

MediaAlpha will host a Q&A conference call today to discuss the Company's third quarter 2023 results and its financial outlook for the fourth quarter of 2023 at 2:00 p.m. Pacific Time (5:00 p.m. Eastern Time). A live audio webcast of the call will be available on the MediaAlpha Investor Relations website at https://investors.mediaalpha.com. To register for the webcast, click here. Participants may also dial-in, toll-free, at (888) 330-2022 or (646) 960-0690, with passcode 3195092. An audio replay of the conference call will be available following the call and available on the MediaAlpha Investor Relations website at https://investors.mediaalpha.com.

We have also posted to our investor relations website a letter to shareholders. We have used, and intend to continue to use, our investor relations website at https://investors.mediaalpha.com as a means of disclosing material nonpublic information and for complying with our disclosure obligations under Regulation FD. Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including without limitation statements regarding our expectation of double-digit year-over-year growth in Adjusted EBITDA in the fourth quarter of 2023, driven primarily by continued gross margin expansion and disciplined expense management; our expectation of accelerated top and bottom line growth in 2024 as P&C carrier advertising spending normalizes; and our financial outlook for the fourth quarter of 2023. These forward-looking statements reflect our current views with respect to, among other things, future events and our financial performance. These statements are often, but not always, made through the use of words or phrases such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “continue,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “projection,” “would,” and “outlook,” or the negative version of those words or other comparable words or phrases of a future or forward-looking nature. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about our industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond our control. Accordingly, we caution you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. Although we believe that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements.

There are or will be important factors that could cause our actual results to differ materially from those indicated in these forward-looking statements, including those more fully described in MediaAlpha’s filings with the Securities and Exchange Commission (“SEC”), including the Form 10-K filed on February 27, 2023. These factors should not be construed as exhaustive. MediaAlpha disclaims any obligation to update any forward-looking statements to reflect events or circumstances that occur after the date of this press release.

Non-GAAP Financial Measures and Operating Metrics

This press release includes Adjusted EBITDA and Contribution Margin, which are non-GAAP financial measures. The Company also presents Transaction Value, which is an operating metric not presented in accordance with GAAP. See the appendix for definitions of Adjusted EBITDA, Contribution, Contribution Margin and Transaction Value, as well as reconciliations to the corresponding GAAP financial metrics, as applicable.

We present Transaction Value, Adjusted EBITDA and Contribution Margin because they are used extensively by our management and board of directors to manage our operating performance, including evaluating our operational performance against budget and assessing our overall operating efficiency and operating leverage. Accordingly, we believe that Transaction Value, Adjusted EBITDA and Contribution Margin provide useful information to investors and others in understanding and evaluating our operating results in the same manner as our management team and board of directors. Each of Transaction Value, Adjusted EBITDA and Contribution Margin has limitations as a financial measure and investors should not consider it in isolation or as a substitute for analysis of our results as reported under GAAP.

Contacts:

Investors

Denise Garcia

Hayflower Partners

Denise@HayflowerPartners.com

MediaAlpha, Inc. and subsidiaries

Consolidated Balance Sheets

(Unaudited; in thousands, except share data and per share amounts)

| | | | | | | | | | | |

| September 30,

2023 | | December 31,

2022 |

| Assets | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 15,196 | | | $ | 14,542 | |

| Accounts receivable, net of allowance for credit losses of $314 and $575, respectively | 33,051 | | | 59,998 | |

| Prepaid expenses and other current assets | 2,773 | | | 5,880 | |

| Total current assets | 51,020 | | | 80,420 | |

| Intangible assets, net | 27,744 | | | 32,932 | |

| Goodwill | 47,739 | | | 47,739 | |

| | | |

| Other assets | 6,529 | | | 8,990 | |

| Total assets | $ | 133,032 | | | $ | 170,081 | |

| Liabilities and stockholders' deficit | | | |

| Current liabilities | | | |

| Accounts payable | $ | 38,749 | | | $ | 53,992 | |

| Accrued expenses | 12,708 | | | 14,130 | |

| Current portion of long-term debt | 8,797 | | | 8,770 | |

| Total current liabilities | 60,254 | | | 76,892 | |

| Long-term debt, net of current portion | 167,697 | | | 174,300 | |

| | | |

| Other long-term liabilities | 4,760 | | | 4,973 | |

| Total liabilities | $ | 232,711 | | | $ | 256,165 | |

| Commitments and contingencies (Note 7) | | | |

| Stockholders' (deficit): | | | |

| Class A common stock, $0.01 par value - 1.0 billion shares authorized; 46.6 million and 43.7 million shares issued and outstanding as of September 30, 2023 and December 31, 2022, respectively | 466 | | | 437 | |

| Class B common stock, $0.01 par value - 100 million shares authorized; 18.1 million and 18.9 million shares issued and outstanding as of September 30, 2023 and December 31, 2022, respectively | 181 | | | 189 | |

| Preferred stock, $0.01 par value - 50 million shares authorized; 0 shares issued and outstanding as of September 30, 2023 and December 31, 2022 | — | | | — | |

| Additional paid-in capital | 503,303 | | | 465,523 | |

| Accumulated deficit | (520,196) | | | (482,142) | |

| Total stockholders' (deficit) attributable to MediaAlpha, Inc. | $ | (16,246) | | | $ | (15,993) | |

| Non-controlling interests | (83,433) | | | (70,091) | |

| Total stockholders' (deficit) | $ | (99,679) | | | $ | (86,084) | |

| Total liabilities and stockholders' deficit | $ | 133,032 | | | $ | 170,081 | |

MediaAlpha, Inc. and subsidiaries

Consolidated Statements of Operations

(Unaudited; in thousands, except share data and per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Revenue | $ | 74,573 | | | $ | 89,017 | | | $ | 270,975 | | | $ | 335,065 | |

| Costs and operating expenses | | | | | | | |

| Cost of revenue | 62,277 | | | 76,343 | | | 226,545 | | | 285,149 | |

| Sales and marketing | 6,101 | | | 6,853 | | | 19,802 | | | 22,034 | |

| Product development | 4,296 | | | 5,291 | | | 14,525 | | | 16,168 | |

| General and administrative | 16,648 | | | 11,105 | | | 50,473 | | | 40,569 | |

| Total costs and operating expenses | 89,322 | | | 99,592 | | | 311,345 | | | 363,920 | |

| (Loss) from operations | (14,749) | | | (10,575) | | | (40,370) | | | (28,855) | |

| Other (income) expense, net | (100) | | | 8,602 | | | 1,165 | | | 8,123 | |

| Interest expense | 3,947 | | | 2,593 | | | 11,397 | | | 5,908 | |

| Total other expense, net | 3,847 | | | 11,195 | | | 12,562 | | | 14,031 | |

| (Loss) before income taxes | (18,596) | | | (21,770) | | | (52,932) | | | (42,886) | |

| Income tax expense (benefit) | 102 | | | (544) | | | 330 | | | 1,210 | |

| Net (loss) | $ | (18,698) | | | $ | (21,226) | | | $ | (53,262) | | | $ | (44,096) | |

| Net (loss) attributable to non-controlling interest | (5,196) | | | (6,740) | | | (15,208) | | | (13,395) | |

| Net (loss) attributable to MediaAlpha, Inc. | $ | (13,502) | | | $ | (14,486) | | | $ | (38,054) | | | $ | (30,701) | |

| Net (loss) per share of Class A common stock | | | | | | | |

| -Basic and diluted | $ | (0.29) | | | $ | (0.34) | | | $ | (0.84) | | | $ | (0.74) | |

| | | | | | | |

| Weighted average shares of Class A common stock outstanding | | | | | | | |

| -Basic and diluted | 46,229,672 | | | 42,210,186 | | | 45,095,417 | | | 41,592,783 | |

| | | | | | | |

MediaAlpha, Inc. and subsidiaries

Consolidated Statements of Cash Flows

(Unaudited; in thousands)

| | | | | | | | | | | |

| Nine Months Ended

September 30, |

| 2023 | | 2022 |

| Cash flows from operating activities | | | |

| Net (loss) | $ | (53,262) | | | $ | (44,096) | |

| Adjustments to reconcile net (loss) to net cash provided by operating activities: | | | |

| Non-cash equity-based compensation expense | 43,943 | | | 44,216 | |

| Non-cash lease expense | 508 | | | 539 | |

| Depreciation expense on property and equipment | 275 | | | 295 | |

| Amortization of intangible assets | 5,188 | | | 4,064 | |

| Amortization of deferred debt issuance costs | 597 | | | 626 | |

| Change in fair value of contingent consideration | — | | | (6,591) | |

| Impairment of cost method investment | 1,406 | | | 8,594 | |

| Credit losses | (220) | | | (109) | |

| Deferred taxes | — | | | 1,054 | |

| Tax receivable agreement liability adjustments | 6 | | | (576) | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | 27,167 | | | 42,840 | |

| Prepaid expenses and other current assets | 3,059 | | | 5,451 | |

| Other assets | 375 | | | 322 | |

| Accounts payable | (15,243) | | | (19,452) | |

| Accrued expenses | 1,138 | | | (2,223) | |

| Net cash provided by operating activities | $ | 14,937 | | | $ | 34,954 | |

| Cash flows from investing activities | | | |

| Purchases of property and equipment | (60) | | | (93) | |

| Cash consideration paid in connection with CHT acquisition | — | | | (49,677) | |

| Net cash (used in) investing activities | $ | (60) | | | $ | (49,770) | |

| Cash flows from financing activities | | | |

| Proceeds received from: | | | |

| Revolving credit facility | — | | | 25,000 | |

| Payments made for: | | | |

| Repayments on revolving line of credit | — | | | (15,000) | |

| | | |

| Repayments on long-term debt | (7,125) | | | (7,125) | |

| | | |

| Repurchases of Class A common stock | — | | | (5,008) | |

| Contributions from QLH’s members | 196 | | | — | |

| Distributions | (1,572) | | | (590) | |

| Payments pursuant to tax receivable agreement | (2,822) | | | (216) | |

| Shares withheld for taxes on vesting of restricted stock units | (2,900) | | | (2,601) | |

| Net cash (used in) financing activities | $ | (14,223) | | | $ | (5,540) | |

| Net increase (decrease) in cash and cash equivalents | 654 | | | (20,356) | |

| Cash and cash equivalents, beginning of period | 14,542 | | | 50,564 | |

| Cash and cash equivalents, end of period | $ | 15,196 | | | $ | 30,208 | |

Key business and operating metrics and Non-GAAP financial measures

Transaction Value

We define “Transaction Value” as the total gross dollars transacted by our partners on our platform. Transaction Value is a driver of revenue, with differing revenue recognition based on the economic relationship we have with our partners. Our partners use our platform to transact via Open and Private Marketplace transactions. In our Open Marketplace model, Transaction Value is equal to revenue recognized and revenue share payments to our supply partners represent costs of revenue. In our Private Marketplace model, revenue recognized represents a platform fee billed to the demand partner or supply partner based on an agreed-upon percentage of the Transaction Value for the Consumer Referrals transacted, and accordingly there are no associated costs of revenue. We utilize Transaction Value to assess revenue and to assess the overall level of transaction activity through our platform. We believe it is useful to investors to assess the overall level of activity on our platform and to better understand the sources of our revenue across our different transaction models and verticals.

The following table presents Transaction Value by platform model for the three and nine months ended September 30, 2023 and 2022:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| (dollars in thousands) | | 2023 | | 2022 | | 2023 | | 2022 |

| Open Marketplace transactions | | $ | 73,053 | | | $ | 86,279 | | | $ | 263,568 | | | $ | 324,008 | |

| Percentage of total Transaction Value | | 67.0 | % | | 58.8 | % | | 61.6 | % | | 57.0 | % |

| Private Marketplace transactions | | 35,963 | | | 60,438 | | | 164,524 | | | 244,592 | |

| Percentage of total Transaction Value | | 33.0 | % | | 41.2 | % | | 38.4 | % | | 43.0 | % |

| Total Transaction Value | | $ | 109,016 | | | $ | 146,717 | | | $ | 428,092 | | | $ | 568,600 | |

The following table presents Transaction Value by vertical for the three and nine months ended September 30, 2023 and 2022:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| (dollars in thousands) | | 2023 | | 2022 | | 2023 | | 2022 |

| Property & Casualty insurance | | $ | 44,715 | | | $ | 83,165 | | | $ | 223,305 | | | $ | 343,179 | |

| Percentage of total Transaction Value | | 41.0 | % | | 56.7 | % | | 52.2 | % | | 60.4 | % |

| Health insurance | | 51,210 | | | 46,190 | | | 161,450 | | | 152,839 | |

| Percentage of total Transaction Value | | 47.0 | % | | 31.5 | % | | 37.7 | % | | 26.9 | % |

| Life insurance | | 7,566 | | | 11,580 | | | 26,042 | | | 36,438 | |

| Percentage of total Transaction Value | | 6.9 | % | | 7.9 | % | | 6.1 | % | | 6.4 | % |

Other(1) | | 5,525 | | | 5,782 | | | 17,295 | | | 36,144 | |

| Percentage of total Transaction Value | | 5.1 | % | | 3.9 | % | | 4.0 | % | | 6.4 | % |

| Total Transaction Value | | $ | 109,016 | | | $ | 146,717 | | | $ | 428,092 | | | $ | 568,600 | |

(1)Our other verticals include Travel, Education and Consumer Finance.

Contribution and Contribution Margin

We define “Contribution” as revenue less revenue share payments and online advertising costs, or, as reported in our consolidated statements of operations, revenue less cost of revenue (i.e., gross profit), as adjusted to exclude the following items from cost of revenue: equity-based compensation; salaries, wages, and related costs; internet and hosting costs; amortization; depreciation; other services; and merchant-related fees. We define “Contribution Margin” as Contribution expressed as a percentage of revenue for the same period. Contribution and Contribution Margin are non-GAAP financial measures that we present to supplement the financial information we present on a GAAP basis. We use Contribution and Contribution Margin to measure the return on our relationships with our supply partners (excluding certain fixed costs), the financial return on and efficacy of our online advertising costs to drive consumers to our proprietary websites, and our operating leverage. We do not use Contribution and Contribution Margin as measures of overall profitability. We present Contribution and Contribution Margin because they are used by our management and board of directors to manage our operating performance, including evaluating our operational performance against budget and assessing our overall operating efficiency and operating leverage. For example, if Contribution increases and our headcount costs and other operating expenses remain steady, our Adjusted EBITDA and operating leverage increase. If Contribution Margin decreases, we may choose to re-evaluate and re-negotiate our revenue share agreements with our supply partners, to make optimization and pricing changes with respect to our bids for keywords from primary traffic acquisition sources, or to change our overall cost structure with respect to headcount, fixed costs and other costs. Other companies may calculate Contribution and Contribution Margin differently than we do. Contribution and Contribution Margin have their limitations as analytical tools, and you should not consider them in isolation or as substitutes for analysis of our results presented in accordance with GAAP.

The following table reconciles Contribution with gross profit, the most directly comparable financial measure calculated and presented in accordance with GAAP, for the three and nine months ended September 30, 2023 and 2022:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| (in thousands) | | 2023 | | 2022 | | 2023 | | 2022 |

| Revenue | | $ | 74,573 | | | $ | 89,017 | | | $ | 270,975 | | | $ | 335,065 | |

| Less cost of revenue | | (62,277) | | | (76,343) | | | (226,545) | | | (285,149) | |

| Gross profit | | 12,296 | | | 12,674 | | | 44,430 | | | 49,916 | |

| Adjusted to exclude the following (as related to cost of revenue): | | | | | | | | |

| Equity-based compensation | | 1,012 | | | 999 | | | 2,959 | | | 2,637 | |

| Salaries, wages, and related | | 878 | | | 989 | | | 2,832 | | | 2,679 | |

| Internet and hosting | | 138 | | | 126 | | | 418 | | | 349 | |

| Other expenses | | 179 | | | 189 | | | 513 | | | 531 | |

| Depreciation | | 9 | | | 12 | | | 30 | | | 30 | |

| Other services | | 514 | | | 492 | | | 1,795 | | | 1,598 | |

| Merchant-related fees | | 11 | | | 40 | | | 14 | | | 99 | |

| Contribution | | 15,037 | | | 15,521 | | | 52,991 | | | 57,839 | |

| Gross margin | | 16.5 | % | | 14.2 | % | | 16.4 | % | | 14.9 | % |

| Contribution Margin | | 20.2 | % | | 17.4 | % | | 19.6 | % | | 17.3 | % |

Adjusted EBITDA

We define “Adjusted EBITDA” as net income excluding interest expense, income tax benefit (expense), depreciation expense on property and equipment, amortization of intangible assets, as well as equity-based compensation expense and certain other adjustments as listed in the table below. Adjusted EBITDA is a non-GAAP financial measure that we present to supplement the financial information we present on a GAAP basis. We monitor and present Adjusted EBITDA because it is a key measure used by our management to understand and evaluate our operating performance, to establish budgets and to develop operational goals for managing our business. We believe that Adjusted EBITDA helps identify underlying trends in our business that could otherwise be masked by the effect of the expenses that we exclude in the calculations of Adjusted EBITDA. Accordingly, we believe that Adjusted EBITDA provides useful information to investors and others in understanding and evaluating our operating results, enhancing the overall understanding of our past performance and future prospects. In addition, presenting Adjusted EBITDA provides investors with a metric to evaluate the capital efficiency of our business.

Adjusted EBITDA is not presented in accordance with GAAP and should not be considered in isolation of, or as an alternative to, measures presented in accordance with GAAP. There are a number of limitations related to the use of Adjusted EBITDA rather than net income, which is the most directly comparable financial measure calculated and presented in accordance with GAAP. These limitations include the fact that Adjusted EBITDA excludes interest expense on debt, income tax benefit (expense), equity-based compensation expense, depreciation and amortization, and certain other adjustments that we consider useful information to investors and others in understanding and evaluating our operating results. In addition, other companies may use other measures to evaluate their performance, including different definitions of “Adjusted EBITDA,” which could reduce the usefulness of our Adjusted EBITDA as a tool for comparison.

The following table reconciles Adjusted EBITDA with net (loss), the most directly comparable financial measure calculated and presented in accordance with GAAP, for the three and nine months ended September 30, 2023 and 2022:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| (in thousands) | | 2023 | | 2022 | | 2023 | | 2022 |

| Net (loss) | | $ | (18,698) | | | $ | (21,226) | | | $ | (53,262) | | | $ | (44,096) | |

| Equity-based compensation expense | | 14,454 | | | 14,600 | | | 43,943 | | | 44,216 | |

| Interest expense | | 3,947 | | | 2,593 | | | 11,397 | | | 5,908 | |

| Income tax expense (benefit) | | 102 | | | (544) | | | 330 | | | 1,210 | |

| Depreciation expense on property and equipment | | 87 | | | 98 | | | 275 | | | 295 | |

| Amortization of intangible assets | | 1,730 | | | 1,704 | | | 5,188 | | | 4,064 | |

Transaction expenses(1) | | 5 | | | 106 | | | 553 | | | 636 | |

| | | | | | | | |

SOX implementation costs(2) | | — | | | — | | | — | | | 110 | |

Fair value adjustment to contingent consideration(3) | | — | | | (3,746) | | | — | | | (6,591) | |

| Impairment of cost method investment | | — | | | 8,594 | | | 1,406 | | | 8,594 | |

| | | | | | | | |

Changes in TRA related liability(4) | | — | | | 13 | | | 6 | | | (577) | |

Changes in Tax Indemnification Receivable(5) | | (20) | | | (15) | | | (48) | | | (44) | |

Settlement of federal and state income tax refunds(6) | | — | | | — | | | 3 | | | 92 | |

Legal expenses(7) | | 1,979 | | | — | | | 3,418 | | | — | |

Reduction in force costs (8) | | — | | | — | | | 1,233 | | | — | |

| Adjusted EBITDA | | $ | 3,586 | | | $ | 2,177 | | | $ | 14,442 | | | $ | 13,817 | |

(1)Transaction expenses consist of immaterial expenses and $0.6 million of legal, and accounting fees incurred by us for the three and nine months ended September 30, 2023, respectively, in connection with the amendment to the 2021 Credit Facilities, the tender offer filed by the Company's largest shareholder in May 2023, and a resale registration statement filed with the SEC. For the three and nine months ended September 30, 2022, transaction expenses consist of $0.1 million and $0.6 million of expenses, respectively, incurred by us in connection with our acquisition of CHT.

(2)SOX implementation costs consist of $0.1 million of expenses for the nine months ended September 30, 2022 for third-party consultants to assist us with the development, implementation, and documentation of new and enhanced internal controls and processes for compliance with SOX Section 404(b) for fiscal 2021.

(3)Fair value adjustment to contingent consideration consists of $3.7 million and $6.6 million of gain for the three and nine months ended September 30, 2022, respectively, in connection with the remeasurement of the contingent consideration for the acquisition of CHT as of September 30, 2022.

(4)Changes in TRA related liability consist of immaterial expenses for the nine months ended September 30, 2023, and immaterial expenses and $0.6 million of income for the three and nine months ended September 30, 2022, respectively, due to a change in the estimated future state tax benefits and other changes in the estimate resulting in reductions of the TRA liability.

(5)Changes in Tax Indemnification Receivable consists of immaterial income for the three and nine months ended September 30, 2023 and 2022, related to a reduction in the tax indemnification receivable recorded in connection with the Reorganization Transactions. The reduction also resulted in a benefit of the same amount which has been recorded within income tax expense (benefit).

(6)Settlement of federal and state tax refunds consist of immaterial expenses incurred by us for the nine months ended September 30, 2023, and $0.1 million of expense incurred by us for the nine months ended September 30, 2022, related to a payment to White Mountains for state tax refunds for the period prior to the Reorganization Transactions related to 2020 tax returns. The settlement also resulted in a benefit of the same amount which has been recorded within income tax expense (benefit).

(7)Legal expenses of $2.0 million and $3.4 million for the three and nine months ended September 30, 2023, respectively, consist of legal fees incurred in connection with the civil investigative demand received from the Federal Trade Commission (FTC) in February 2023 and costs associated with a legal settlement unrelated to our core operations.

(8)Reduction in force costs for the nine months ended September 30, 2023 consist of $1.2 million of severance benefits provided to the terminated employees in connection with the RIF Plan. Additionally, equity-based compensation expense includes $0.3 million of charges related to the RIF Plan for the nine months ended September 30, 2023.

| | | | | |

| |

|

|

SHAREHOLDER LETTER Q3 2023 |

|

| |

| |

| | | | | | | | | | | |

| Q3 | |

| (in millions, except percentages) | 2022 | 2023 | YoY Change |

| | | |

| Revenue | $89.0 | $74.6 | (16)% |

Transaction Value 1 | $146.7 | $109.0 | (26)% |

| | | | |

| | | | |

| Gross Profit | $12.7 | $12.3 | (3)% |

Contribution 1 | $15.5 | $15.0 | (3)% |

| | | |

| | | | |

| Net (Loss) | $(21.2) | $(18.7) | (12)% |

Adjusted EBITDA 1 | $2.2 | $3.6 | 65% |

| | | |

| | | |

__________________

1.See “Key Business and Operating Metrics and Non-GAAP Financial Measures” for additional information regarding non-GAAP metrics used in this shareholder letter.

Our third quarter 2023 results came in at or above the high end of our guidance ranges, as we remained focused on execution in a difficult market environment. The cyclical decline in auto insurance advertising continued to adversely impact our Property & Casualty (P&C) insurance vertical, resulting in a 46% year-over-year decline in P&C Transaction Value, in line with our expectations. Despite this decline, Adjusted EBITDA increased by $1.4 million year over year, driven primarily by continued expense discipline, as well as by higher gross margins which largely offset the impact of the lower revenue level. Our ability to generate positive Adjusted EBITDA in the current market environment is a tribute to the efficiency of our business model and the agility of our team.

In our P&C vertical, customer acquisition spend remains at cyclically low levels as carriers continue to focus on underwriting profitability, and we expect this to persist for the remainder of 2023. The good news is that P&C Transaction Value has been relatively stable since June. While P&C Transaction Value typically declines between the third and fourth quarters due to seasonal factors, we expect fourth quarter P&C Transaction Value to be similar to the third quarter level this year. Although it remains hard to predict the slope of the recovery, we are cautiously optimistic the new year will provide a fresh start as carriers reset annual marketing budgets and ongoing rate increases help restore underwriting profitability.

Turning to our Health insurance vertical, third quarter Transaction Value grew 11% year over year, in line with our expectations. We expect fourth quarter Health Transaction Value to be roughly flat year over year as continued strength in under 65 health is offset by near-term weakness in Medicare as the industry adapts to recent regulatory changes. As a reminder, the fourth quarter typically represents about 40% of full year Transaction Value in our Health vertical due to the timing of the Medicare Annual Enrollment Period (AEP) and Affordable Care Act (ACA) Open Enrollment Period (OEP).

Our balance sheet and cash flow remain solid, and we expect to remain in compliance with the financial covenants under our credit agreement. From a capital deployment standpoint, we continue to focus on preserving financial flexibility and using any excess cash flow to reduce net debt. Other capital deployment activities, including share buybacks and acquisition, remain on hold for now.

Looking forward, we expect positive year-over-year Adjusted EBITDA growth in the fourth quarter, driven by continued gross margin expansion and disciplined expense management. In the years to come, we expect growth to accelerate as P&C carrier acquisition spend returns to normalized levels and as we capitalize on the significant growth in digital customer acquisition in our Health vertical. We continue to be very confident in our long-term prospects in both our P&C and Health verticals, which we expect to drive meaningful growth in our business and shareholder value over the long term.

| | |

| Financial Discussion - Transaction Value and Revenue Metrics |

Transaction Value declined 26% year over year to $109.0 million in Q3 2023, driven primarily by a 46% decline in the P&C vertical. Transaction Value represents the total gross investment in customer acquisition executed by our partners on our platform and is one of the key metrics that reflects our ability to drive value for our partners and increase our share of wallet as budgets increasingly migrate online.

Transaction Value generated from our insurance verticals was $103.5 million in Q3 2023, down 27% year over year.

Transaction Value from our P&C insurance vertical declined 46% year over year to $44.7 million, driven by significant year-over-year reductions in customer acquisition spending by many of our carrier partners due to ongoing underwriting profitability concerns. Although our carrier partners continue to work through their profitability issues, we have seen a stabilization in carrier spend on our platform since June. While we do not expect P&C carriers to significantly increase customer acquisition spending through the end of this year, we expect to be in a strong position to capture an outsized share of the increase in marketing spend as underwriting results improve.

Transaction Value from our Health insurance vertical increased 11% year over year to $51.2 million, due primarily to higher demand for clicks and leads within our under-65 health insurance vertical.

Transaction Value from our Life insurance vertical declined 35% year over year to $7.6 million, driven by reduced shopping activity as mortality concerns related to COVID-19 continued to ease.

Transaction Value from our Other vertical, which includes travel and consumer finance, declined 4% year over year to $5.5 million, driven primarily by reduced shopping activity.

We generated $74.6 million of total revenue in Q3 2023, down 16% year over year, driven by lower revenue from our P&C insurance vertical.

Revenue from our P&C insurance vertical declined 27% year over year to $31.9 million in Q3 2023, driven by lower marketing budgets from the largest carriers due to the aforementioned profitability concerns, offset in part by a higher mix of transactions via our Open Marketplace. This was driven by a lower share of transactions on our platform coming from a major P&C demand partner that disproportionately utilizes our Private Marketplace option. While we recognize the full amount of Transaction Value from Open Marketplace transactions as revenue, in Private Marketplace transactions we recognize only our platform fee as revenue.

Revenue from our Health insurance vertical increased 2% year over year to $34.0 million in Q3 2023, driven by increased demand for clicks and leads. Health revenue increased by a lower percentage than Transaction Value due to a lower mix of transactions via our Open Marketplace.

Revenue from our Life insurance vertical declined 23% year over year to $5.3 million in Q3 2023, as mortality concerns related to COVID continued to ease and shopping activity decreased.

Revenue from our Other vertical, which consists of travel and consumer finance, declined 31% year over year to $3.3 million in Q3 2023, driven primarily by lower revenue from our travel vertical. Revenue declined by a higher percentage than Transaction Value due to the lower travel revenue, which we recognize on a gross basis.

| | |

Financial Discussion - Profitability |

Gross profit was $12.3 million in Q3 2023, a year-over-year decrease of 3%. Contribution, which generally represents revenue less revenue share payments and online advertising costs, was $15.0 million in Q3 2023, a year-over-year decrease of 3%. The year-over-year declines in Gross Profit and Contribution were driven primarily by the lower Revenue level, offset in part by higher Contribution Margins. Contribution Margin was 20.2% in Q3 2023, compared with 17.4% in Q3 2022. The increase in margin was driven by higher margins in both our P&C and Health verticals as well as favorable trends in our mix of Open Marketplace and Private Marketplace transactions.

Net loss was $18.7 million in Q3 2023, a year-over-year decrease of 12%. The decrease in net loss was driven primarily by an impairment charge related to a cost method investment of $8.6 million, offset in part by a $3.7 million gain on measurement of contingent consideration related to the CHT acquisition, which were recorded in Q3 2022 but did not recur in the current period. This was offset in part by a $2.1 million increase in legal expenses, the majority of which were related to the civil investigative demand received from the Federal Trade Commission with the balance from a legal settlement unrelated to our core operations, and a $1.4 million increase in interest expense due to higher interest rates on our credit facilities.

Adjusted EBITDA was $3.6 million in Q3 2023, a year-over-year increase of 65%. Adjusted EBITDA margin was 4.8% in Q3 2023, compared with 2.4% in Q3 2022. The increase was driven primarily by a reduction in headcount costs due largely to the reduction-in-force plan implemented during Q2 2023, along with other operating expense reductions, offset in part by the lower gross profit level.

Financial Discussion - Q4 2023 Outlook 1 | | | | | | | | | | | | | | |

| | Q4 2023 |

Transaction Value 2 | | $145 million | - | $160 million |

| Y/Y Growth | | (14)% | | (5)% |

| | | | |

| | | | |

| Revenue | | $106 million | - | $116 million |

| Y/Y Growth | | (15)% | | (6)% |

| | | | |

| | | | |

Adjusted EBITDA 2 | | $9.5 million | - | $11.5 million |

| Y/Y Growth | | 5% | | 27% |

Our guidance for Q4 2023 reflects ongoing weakness in customer acquisition spend levels by P&C carriers as they continue to prioritize profitability over growth. As a result, we expect Transaction Value in our P&C insurance vertical to be similar to Q3 2023 levels, approximately 20% lower year over year. We expect fourth quarter Transaction Value in our Health vertical to be roughly flat year over year.

Transaction Value: For Q4 2023, we expect Transaction Value to be in the range of $145 million - $160 million, a year-over-year decrease of 10% at the midpoint.

Revenue: For Q4 2023, we expect revenue to be in the range of $106 million - $116 million, a year-over-year decrease of 10% at the midpoint.

Adjusted EBITDA: For Q4 2023, we expect Adjusted EBITDA to be between $9.5 million and $11.5 million, a year-over-year increase of 16% at the midpoint. We are projecting our operating expenses, net of Adjusted EBITDA addbacks, to be approximately $0.5 to $1.0 million higher than Q3 2023 levels due in part to seasonality.

Thank you, | | | | | | | | |

| Steve Yi | | Patrick Thompson |

| Chief Executive Officer, President and Co-Founder | | Chief Financial Officer & Treasurer |

1 With respect to the Company’s projection of Adjusted EBITDA under “Financial Discussion – Q4 2023 Outlook”, MediaAlpha is not providing a reconciliation of Adjusted EBITDA to net income (loss) because the Company is unable to predict with reasonable certainty the reconciling items that may affect net income (loss) without unreasonable effort, including equity-based compensation, transaction expenses and income tax expense. These reconciling items are uncertain, depend on various factors and could significantly impact, either individually or in the aggregate, the GAAP measures for the applicable period.

2 See “Key Business and Operating Metrics and Non-GAAP Financial Measures” for additional information regarding non-GAAP metrics used in this shareholder letter.

| | |

Key Business and Operating Metrics and Non-GAAP Financial Measures |

In addition to traditional financial metrics, we rely upon certain business and operating metrics that are not presented in accordance with GAAP to estimate the volume of spending on our platform, estimate and recognize revenue, evaluate our business performance and facilitate our operations. Such business and operating metrics should not be considered in isolation from, or as an alternative to, measures presented in accordance with GAAP and should be considered together with other operating and financial performance measures presented in accordance with GAAP. Also, such business and operating metrics may not necessarily be comparable to similarly titled measures presented by other companies.

Transaction Value

We define “Transaction Value” as the total gross dollars transacted by our partners on our platform. Transaction Value is a driver of revenue, with differing revenue recognition based on the economic relationship we have with our partners. Our partners use our platform to transact via Open and Private Marketplace transactions. In our Open Marketplace model, Transaction Value is equal to revenue recognized and revenue share payments to our supply partners represent costs of revenue. In our Private Marketplace model, revenue recognized represents a platform fee billed to the demand partner or supply partner based on an agreed-upon percentage of the Transaction Value for the Consumer Referrals transacted, and accordingly there are no associated costs of revenue. We utilize Transaction Value to assess revenue and to assess the overall level of transaction activity through our platform. We believe it is useful to investors to assess the overall level of activity on our platform and to better understand the sources of our revenue across our different transaction models and verticals.

The following table presents Transaction Value by platform model for the three and nine months ended September 30, 2023 and 2022:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| (in thousands) | 2023 | | 2022 | | 2023 | | 2022 |

| Open Marketplace transactions | $ | 73,053 | | | $ | 86,279 | | | $ | 263,568 | | | $ | 324,008 | |

| Percentage of total Transaction Value | 67.0 | % | | 58.8 | % | | 61.6 | % | | 57.0 | % |

| Private Marketplace transactions | 35,963 | | | 60,438 | | | 164,524 | | | 244,592 | |

| Percentage of total Transaction Value | 33.0 | % | | 41.2 | % | | 38.4 | % | | 43.0 | % |

| Total Transaction Value | $ | 109,016 | | | $ | 146,717 | | | $ | 428,092 | | | $ | 568,600 | |

The following table presents Transaction Value by vertical for the three and nine months ended September 30, 2023 and 2022:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| (in thousands) | 2023 | | 2022 | | 2023 | | 2022 |

| Property & Casualty insurance | $ | 44,715 | | | $ | 83,165 | | | $ | 223,305 | | | $ | 343,179 | |

| Percentage of total Transaction Value | 41.0 | % | | 56.7 | % | | 52.2 | % | | 60.4 | % |

| Health insurance | 51,210 | | | 46,190 | | | 161,450 | | | 152,839 | |

| Percentage of total Transaction Value | 47.0 | % | | 31.5 | % | | 37.7 | % | | 26.9 | % |

| Life insurance | 7,566 | | | 11,580 | | | 26,042 | | | 36,438 | |

| Percentage of total Transaction Value | 6.9 | % | | 7.9 | % | | 6.1 | % | | 6.4 | % |

| Other | 5,525 | | | 5,782 | | | 17,295 | | | 36,144 | |

| Percentage of total Transaction Value | 5.1 | % | | 3.9 | % | | 4.0 | % | | 6.4 | % |

| Total Transaction Value | $ | 109,016 | | | $ | 146,717 | | | $ | 428,092 | | | $ | 568,600 | |

Contribution and Contribution Margin

We define “Contribution” as revenue less revenue share payments and online advertising costs, or, as reported in our consolidated statements of operations, revenue less cost of revenue (i.e., gross profit), as adjusted to exclude the following items from cost of revenue: equity-based compensation; salaries, wages, and related costs; internet and hosting costs; amortization; depreciation; other services; and merchant-related fees. We define “Contribution Margin” as Contribution expressed as a percentage of revenue for the same period. Contribution and Contribution Margin are non-GAAP financial measures that we present to supplement the financial information we present on a GAAP basis. We use Contribution and Contribution Margin to measure the return on our relationships with our supply partners (excluding certain fixed costs), the financial return on and efficacy of our online advertising costs to drive consumers to our proprietary websites, and our operating leverage. We do not use Contribution and Contribution Margin as measures of overall profitability. We present Contribution and Contribution Margin because they are used by our management and board of directors to manage our operating performance, including evaluating our operational performance against budget and assessing our overall operating efficiency and operating leverage. For example, if Contribution increases and our headcount costs and other operating expenses remain steady, our Adjusted EBITDA and operating leverage increase. If Contribution Margin decreases, we may choose to re-evaluate and re-negotiate our revenue share agreements with our supply partners, to make optimization and pricing changes with respect to our bids for keywords from primary traffic acquisition sources, or to change our overall cost structure with respect to headcount, fixed costs and other costs. Other companies may calculate Contribution and Contribution Margin differently than we do. Contribution and Contribution Margin have their limitations as analytical tools, and you should not consider them in isolation or as substitutes for analysis of our results presented in accordance with GAAP.

The following table reconciles Contribution with gross profit, the most directly comparable financial measure calculated and presented in accordance with GAAP, for the three and nine months ended September 30, 2023 and 2022:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| (in thousands) | 2023 | | 2022 | | 2023 | | 2022 |

| Revenue | $ | 74,573 | | | $ | 89,017 | | | $ | 270,975 | | | $ | 335,065 | |

| Less cost of revenue | (62,277) | | | (76,343) | | | (226,545) | | | (285,149) | |

| Gross profit | $ | 12,296 | | | $ | 12,674 | | | $ | 44,430 | | | $ | 49,916 | |

| Adjusted to exclude the following (as related to cost of revenue): | | | | | | | |

| Equity-based compensation | 1,012 | | | 999 | | | 2,959 | | | 2,637 | |

| Salaries, wages, and related | 878 | | | 989 | | | 2,832 | | | 2,679 | |

| Internet and hosting | 138 | | | 126 | | | 418 | | | 349 | |

| Other expenses | 179 | | | 189 | | | 513 | | | 531 | |

| Depreciation | 9 | | | 12 | | | 30 | | | 30 | |

| Other services | 514 | | | 492 | | | 1,795 | | | 1,598 | |

| Merchant-related fees | 11 | | | 40 | | | 14 | | | 99 | |

| Contribution | $ | 15,037 | | | $ | 15,521 | | | $ | 52,991 | | | $ | 57,839 | |

| Gross margin | 16.5 | % | | 14.2 | % | | 16.4 | % | | 14.9 | % |

| Contribution Margin | 20.2 | % | | 17.4 | % | | 19.6 | % | | 17.3 | % |

Consumer Referrals

We define “Consumer Referral” as any consumer click, call or lead purchased by a buyer on our platform. Click revenue is recognized on a pay-per-click basis and revenue is earned and recognized when a consumer clicks on a listed buyer’s advertisement that is presented subsequent to the consumer’s search (e.g., auto insurance quote search or health insurance quote search). Call revenue is earned and recognized when a consumer transfers to a buyer and remains engaged for a requisite duration of time, as specified by each buyer. Lead revenue is recognized when we deliver data leads to buyers. Data leads are generated either through insurance carriers, insurance-focused research destination websites or other financial websites that make the data leads available for purchase through our platform, or when consumers complete a full quote request on our proprietary websites. Delivery occurs at the time of lead transfer. The data we generate from each Consumer Referral feeds into our analytics model to generate conversion probabilities for each unique consumer, enabling discovery of predicted return and cost per sale across the platform and helping us to improve our platform technology. We monitor the number of Consumer Referrals on our platform in order to measure Transaction Value, revenue and overall business performance across our verticals and platform models.

The following table presents the percentages of total Transaction Value generated from clicks, calls and leads for the three and nine months ended September 30, 2023 and 2022:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Clicks | 66.1 | % | | 76.7 | % | | 73.0 | % | | 77.9 | % |

| Calls | 19.9 | % | | 15.1 | % | | 16.0 | % | | 12.7 | % |

| Leads | 14.0 | % | | 8.2 | % | | 11.0 | % | | 9.4 | % |

Adjusted EBITDA

We define “Adjusted EBITDA” as net income excluding interest expense, income tax benefit (expense), depreciation expense on property and equipment, amortization of intangible assets, as well as equity-based compensation expense and certain other adjustments as listed in the table below. We define “Adjusted EBITDA Margin” as Adjusted EBITDA as a percentage of revenue. Adjusted EBITDA is a non-GAAP financial measure that we present to supplement the financial information we present on a GAAP basis. We monitor and present Adjusted EBITDA because it is a key measure used by our management to understand and evaluate our operating performance, to establish budgets and to develop operational goals for managing our business. We believe that Adjusted EBITDA helps identify underlying trends in our business that could otherwise be masked by the effect of the expenses that we exclude in the calculations of Adjusted EBITDA. Accordingly, we believe that Adjusted EBITDA provides useful information to investors and others in understanding and evaluating our operating results, enhancing the overall understanding of our past performance and future prospects. In addition, presenting Adjusted EBITDA provides investors with a metric to evaluate the capital efficiency of our business.

Adjusted EBITDA is not presented in accordance with GAAP and should not be considered in isolation of, or as an alternative to, measures presented in accordance with GAAP. There are a number of limitations related to the use of Adjusted EBITDA rather than net income, which is the most directly comparable financial measure calculated and presented in accordance with GAAP. These limitations include the fact that Adjusted EBITDA excludes interest expense on debt, income tax benefit (expense), equity-based compensation expense, depreciation and amortization, and certain other adjustments that we consider useful information to investors and others in understanding and evaluating our operating results. In addition, other companies may use other measures to evaluate their performance, including different definitions of “Adjusted EBITDA,” which could reduce the usefulness of our Adjusted EBITDA as a tool for comparison.

The following table reconciles Adjusted EBITDA with net (loss), the most directly comparable financial measure calculated and presented in accordance with GAAP, for the three and nine months ended September 30, 2023 and 2022:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| (in thousands) | 2023 | | 2022 | | 2023 | | 2022 |

| Net (loss) | $ | (18,698) | | | $ | (21,226) | | | $ | (53,262) | | | $ | (44,096) | |

| Equity-based compensation expense | 14,454 | | | 14,600 | | | 43,943 | | | 44,216 | |

| Interest expense | 3,947 | | | 2,593 | | | 11,397 | | | 5,908 | |

| Income tax expense (benefit) | 102 | | | (544) | | | 330 | | | 1,210 | |

| Depreciation expense on property and equipment | 87 | | | 98 | | | 275 | | | 295 | |

| Amortization of intangible assets | 1,730 | | | 1,704 | | | 5,188 | | | 4,064 | |

| Transaction expenses(1) | 5 | | | 106 | | | 553 | | | 636 | |

| | | | | | | |

| SOX implementation costs(2) | — | | | — | | | — | | | 110 | |

| Fair value adjustment to contingent consideration(3) | — | | | (3,746) | | | — | | | (6,591) | |

| Impairment of cost method investment | — | | | 8,594 | | | 1,406 | | | 8,594 | |

| | | | | | | |

| Changes in TRA related liability(4) | — | | | 13 | | | 6 | | | (577) | |

| Changes in Tax Indemnification Receivable(5) | (20) | | | (15) | | | (48) | | | (44) | |

| Settlement of federal and state income tax refunds(6) | — | | | — | | | 3 | | | 92 | |

| Legal expenses(7) | 1,979 | | | — | | | 3,418 | | | — | |

| Reduction in force costs (8) | — | | | — | | | 1,233 | | | — | |

| Adjusted EBITDA | $ | 3,586 | | | $ | 2,177 | | | $ | 14,442 | | | $ | 13,817 | |

(1)Transaction expenses consist of immaterial expenses and $0.6 million of legal, and accounting fees incurred by us for the three and nine months ended September 30, 2023, respectively, in connection with the amendment to the 2021 Credit Facilities, the tender offer filed by the Company's largest shareholder in May 2023, and a resale registration statement filed with the SEC. For the three and nine months ended September 30, 2022, transaction expenses consist of $0.1 million and $0.6 million of expenses, respectively, incurred by us in connection with our acquisition of CHT.

(2)SOX implementation costs consist of $0.1 million of expenses for the nine months ended September 30, 2022 for third-party consultants to assist us with the development, implementation, and documentation of new and enhanced internal controls and processes for compliance with SOX Section 404(b) for fiscal 2021.

(3)Fair value adjustment to contingent consideration consists of $3.7 million and $6.6 million of gain for the three and nine months ended September 30, 2022, respectively, in connection with the remeasurement of the contingent consideration for the acquisition of CHT as of September 30, 2022.

(4)Changes in TRA related liability consist of immaterial expenses for the nine months ended September 30, 2023, and immaterial expenses and $0.6 million of income for the three and nine months ended September 30, 2022, respectively, due to a change in the estimated future state tax benefits and other changes in the estimate resulting in reductions of the TRA liability.

(5)Changes in Tax Indemnification Receivable consists of immaterial income for the three and nine months ended September 30, 2023 and 2022, related to a reduction in the tax indemnification receivable recorded in connection with the Reorganization Transactions. The reduction also resulted in a benefit of the same amount which has been recorded within income tax expense (benefit).

(6)Settlement of federal and state tax refunds consist of immaterial expenses incurred by us for the nine months ended September 30, 2023, and $0.1 million of expense incurred by us for the nine months ended September 30, 2022, related to a payment to White Mountains for state tax refunds for the period prior to the Reorganization Transactions related to 2020 tax returns. The settlement also resulted in a benefit of the same amount which has been recorded within income tax expense (benefit).

(7)Legal expenses of $2.0 million and $3.4 million for the three and nine months ended September 30, 2023, respectively, consist of legal fees incurred in connection with the civil investigative demand received from the Federal Trade Commission (FTC) in February 2023 and costs associated with a legal settlement unrelated to our core operations.

(8)Reduction in force costs for the nine months ended September 30, 2023 consist of $1.2 million of severance benefits provided to the terminated employees in connection with the RIF Plan. Additionally, equity-based compensation expense includes $0.3 million of charges related to the RIF Plan for the nine months ended September 30, 2023.

Forward-Looking Statements

This shareholder letter contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including without limitation statements regarding our expected Transaction Value levels in our P&C and Health verticals in the fourth quarter of 2023; our expectation of improved demand in our P&C vertical in 2024 as carrier underwriting profitability improves; our expectation that we will remain in compliance with our debt covenants; our expectation of positive year-over-year Adjusted EBITDA growth in the fourth quarter; our expectation of accelerated growth in the years to come as P&C carrier acquisition spend returns to normalized levels and as we see significant growth in digital customer acquisition in our Health vertical; our confidence in our long-term growth prospects in both our P&C and Health verticals, which we expect to drive meaningful long-term growth in our business and shareholder value; and our financial outlook for the fourth quarter of 2023. These forward-looking statements reflect our current views with respect to, among other things, future events and our financial performance. These statements are often, but not always, made through the use of words or phrases such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “continue,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “projection,” “would,” and “outlook,” or the negative version of those words or other comparable words or phrases of a future or forward-looking nature. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about our industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond our control. Accordingly, we caution you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. Although we believe that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements.

There are or will be important factors that could cause our actual results to differ materially from those indicated in these forward-looking statements, including those more fully described in MediaAlpha’s filings with the Securities and Exchange Commission (“SEC”), including the Form 10-K filed on February 27, 2023. These factors should not be construed as exhaustive. MediaAlpha disclaims any obligation to update any forward-looking statements to reflect events or circumstances that occur after the date of this shareholder letter.

v3.23.3

Cover

|

Nov. 01, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 01, 2023

|

| Entity Registrant Name |

MediaAlpha, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39671

|

| Entity Tax Identification Number |

85-1854133

|

| Entity Address, Address Line One |

700 South Flower Street

|

| Entity Address, Address Line Two |

Suite 640

|

| Entity Address, City or Town |

Los Angeles

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

90017

|

| City Area Code |

213

|

| Local Phone Number |

316-6256

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A common stock, $0.01 par value

|

| Trading Symbol |

MAX

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001818383

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

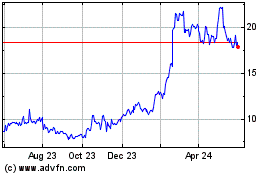

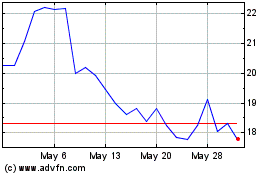

MediaAlpha (NYSE:MAX)

Historical Stock Chart

From Jun 2024 to Jul 2024

MediaAlpha (NYSE:MAX)

Historical Stock Chart

From Jul 2023 to Jul 2024