Maui Land & Pineapple Company Reports Fiscal 2023 Results

March 28 2024 - 4:29PM

Maui Land & Pineapple Company, Inc. (NYSE: MLP) today reported

financial results covering the year ended December 31, 2023 and the

date and time of their Annual Meeting of Stockholders, which will

be held virtually on Wednesday, May 15, 2024, at 10:00 a.m.,

Hawai‘i Standard Time, via conference call.

“After more than a century in operation and a multi-year focus

on financial stabilization, Maui Land and Pineapple Company entered

2024 debt-free, with a new leadership team and a renewed vision

guiding the company’s next chapter,” said CEO Race Randle. “In

2023, we completed a holistic review of MLP’s premier portfolio of

land and commercial assets and crafted a strategic plan to improve

Maui’s housing supply, revitalize Kapalua Village and Hali‘imaile

Town Centers, and capitalize on exciting growth opportunities.”

“As a long-term shareholder who was born and raised in Hawai‘i,

it is thrilling to see the tremendous progress the new MLP

leadership team has made over the past year,” said MLP majority

shareholder Steve Case. “MLP is now well-positioned to realize its

potential in delivering new value to shareholders while playing a

pivotal role in supporting the Maui community as it seeks to

recover from the tragic wildfires to create a stronger, more

resilient future.”

Fiscal 2023 Highlights

“As expected, the company had reduced revenues from land sales,

which were paused as we identified opportunities to unlock the

potential of the company’s developable land to create value for

shareholders and meet current and future community needs,” said

Randle. “MLP was also intensely focused on assisting in the

aftermath of the August 2023 wildfires, and while MLP’s assets were

not directly affected, the fires resulted in significant loss of

life and property across Maui and contributed to a short-term

decline in the lease revenue from tenants temporarily impacted by

road closures and reduced visitor arrivals. We expect lease revenue

to rebound and reach new heights due to strong demand we are seeing

from our efforts to elevate Kapalua Village and create an authentic

place for makers and local experiences in Hali‘imaile.”

- Operating Revenues – In 2023, MLP began its shift

from selling unimproved land, and has focused efforts to master

plan and add value to the land directly and through working with

proven partners. Land sale revenue of $1,626,000 in 2023 includes

recognition of a land contribution to our first development joint

venture in many years, on 31 acres in

Hali‘imaile. Including land sales, for the year ended

December 31, 2023, the total operating revenues decreased by

$10,045,000 compared to the same period last year as a direct

result of two unimproved land sales closed in 2022 in the amount of

$11,600,000.

- Excluding land sales, the total operating revenues decreased by

$71,000 for the year ended December 31, 2023, compared to the year

ended December 31, 2022, primarily due to a reduction in percentage

rent as a result of the Maui wildfires on August 8, 2023. Although

percentage rents and land licensing from eco-tourism activities

were trending toward an increase from the prior year, estimated

losses of these revenues due to the wildfires

was approximately $700,000.

- Costs and expenses – Operating costs and expenses totaled

$14,260,000 for the year ended December 31, 2023, an increase of

$2,907,000 compared to the year ended December 31, 2022. The

operating costs for the year ended December 31, 2023, included

$1,622,000 of the operating costs and expenses related to one-time

costs of the leadership transition due to $1,372,000 for severance,

accelerated vesting of incentive stock for departing executives and

related legal and consulting fees, and $250,000 for onboarding

costs of new executive team. These costs are not anticipated to

recur in the upcoming quarters with the exception of the monthly

severance paid to the former CEO monthly through March 31, 2025.

Other costs incurred in the year ended December 31, 2023 that were

not incurred previously included $1,354,000 due to stock option

valuation recognized for issued options for the Board of

Directors.

- Net loss – Net loss was ($3,080,000), or ($0.15) per

common share, in the year ended December 31, 2023, compared to net

income of $1,787,000 or $0.09 per common share, in 2022. The net

loss in 2023 was driven by the negative economic and financial

impacts of the Maui wildfires and the one time and additional

first-time expenses incurred. In 2022, although realizing

$11,600,000 in land sales this was offset by a ($7,885,000) GAAP

expense due to partial annuitization of the Company’s qualified

pension plan.

- Adjusted EBITDA (Non-GAAP) – For the year ended December

31, 2023, after adjusting for non-cash income and expenses of

$2,551,000, Adjusted EBITDA was ($529,000). If the Company had not

incurred the one-time cash-based expenses of ($892,000) in 2023 due

to the leadership transition an Adjusted EBITDA of $363,000 would

have been realized.

- Cash and Investments Convertible to Cash (Non-GAAP) – Cash

and investments convertible to cash totaled $8,835,000 on December

31, 2023, a decrease of ($2,657,000) compared to $11,492,000 at

December 31, 2022. $892,000 of the decrease in cash is attributable

to one-time expenses due to employment separations of the former

CEO and Vice President and onboarding transition of the new CEO and

Board Chairman realized in the year ended December 31, 2023.

Non-GAAP Financial Measures

Certain non-GAAP financial measures are presented in this press

release, including Adjusted EBITDA and Cash and Investments

Convertible to Cash, to provide information that may assist

investors in understanding the Company's financial results and

financial condition and assessing its prospects for future

performance. We believe that Adjusted EBITDA is an important

indicator of our operating performance because it excludes items

that are unrelated to, and may not be indicative of, our core

operating results. We believe cash and investments convertible to

cash are important indicators of liquidity because it includes

items that are convertible into cash in the short term. These

non-GAAP financial measures are not intended to represent and

should not be considered more meaningful measures than, or

alternatives to, measures of operating performance or liquidity as

determined in accordance with GAAP. To the extent we utilize such

non-GAAP financial measures in the future, we expect to calculate

them using a consistent method from period to period.

EBITDA is a non-GAAP financial measure defined as net income

(loss) excluding interest, taxes, depreciation and amortization.

Adjusted EBITDA is further adjusted for non-cash stock-based

compensation expense and pension and post-retirement expenses.

Adjusted EBITDA is a key measure used by the Company to evaluate

operating performance, generate future operating plans and make

strategic decisions for the allocation of capital. The Company

presents Adjusted EBITDA to provide information that may assist

investors in understanding its financial results. However, Adjusted

EBITDA is not intended to be a substitute for net income (loss). A

reconciliation of Adjusted EBITDA to the most directly comparable

GAAP financial measure is provided further below.

Cash and investments convertible to cash is a non-GAAP financial

measure defined as cash and cash equivalents plus restricted cash

and investments. Cash and cash investments convertible to cash is a

key measure used by the Company to evaluate internal liquidity.

Additional Information

More information about Maui Land & Pineapple Company’s

fiscal year 2023 operating results are available in the Form 10-K

filed with the Securities and Exchange Commission and posted at

mauiland.com.

About Maui Land & Pineapple

Company

Maui Land & Pineapple Company, Inc. (NYSE: MLP) is dedicated

to the thoughtful stewardship of approximately 22,300 acres of land

along with approximately 268,000 square feet of commercial real

estate where Maui residents thrive in more resilient communities

with additional housing opportunities, food and water security, and

renewed connections of people and place. For over a century MLP has

built a legacy of authentic innovation through conservation,

agriculture, community building and land management. Our mission is

to carefully maximize the use of our assets in a way that

honors the past, meets the critical needs of the present, and

enables a thriving future.

Company assets include land for future residential communities

within the world-renowned Kapalua Resort, home to luxury hotels

such as The Ritz-Carlton Maui and Montage Kapalua Bay, two

championship golf courses, pristine beaches, a network of walking

and hiking trails and the Pu‘u Kukui Watershed, the largest private

nature preserve in Hawai‘i.

Forward-Looking StatementsThis press release

contains forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. These

forward-looking statements include, but are not limited to

statements regarding the Company’s ability to put its land into

productive use, increase housing supply and improve tenanting of

the village centers, fill the vacancies on our commercial

properties, and the non-recurrence of severance costs. These

forward-looking statements are based upon the current beliefs and

expectations of management and are inherently subject to

significant business, economic and competitive uncertainties, and

contingencies, many of which are beyond the control of the Company.

In addition, these forward-looking statements are subject to

assumptions with respect to future business strategies and

decisions that are subject to change. Actual results may differ

materially from the anticipated results discussed in these

forward-looking statements because of possible uncertainties.

Factors that could cause actual results to differ materially from

those expressed in the forward-looking statements are discussed in

the Company's reports (such as Annual Reports on Form 10-K,

Quarterly Reports on Form 10-Q and Current Reports on Form 8-K)

filed with the SEC and available on the SEC's Internet site

(http://www.sec.gov). We undertake no obligation to publicly update

any forward-looking statement, whether written or oral, that may be

made from time to time, whether because of new information, future

developments or otherwise.

# # #

|

CONTACT |

|

|

Investors: |

Wade Kodama | Chief Financial Officer | Maui Land & Pineapple

Company |

| |

e: wade@mauiland.com |

| |

|

| Media: |

Ashley Takitani Leahey | Vice

President | Maui Land & Pineapple Companye:

ashley@mauiland.com Dylan Beesley | Senior Vice President |

Bennet Group Strategic Communicationse: dylan@bennetgroup.com |

|

MAUI LAND & PINEAPPLE COMPANY, INC. AND

SUBSIDIARIESCONSOLIDATED STATEMENTS OF OPERATIONS

AND COMPREHENSIVE INCOME (LOSS) |

|

| |

|

| |

|

Years Ended December 31, |

|

| |

|

2023 |

|

|

2022 |

|

| |

|

(in thousands except per |

|

| |

|

share amounts) |

|

|

OPERATING REVENUES |

|

|

|

|

|

|

|

|

| Real estate |

|

$ |

1,626 |

|

|

$ |

11,600 |

|

| Leasing |

|

|

8,461 |

|

|

|

8,513 |

|

| Resort amenities and

other |

|

|

828 |

|

|

|

847 |

|

| Total Operating Revenues |

|

|

10,915 |

|

|

|

20,960 |

|

| |

|

|

|

|

|

|

|

|

| OPERATING COSTS AND

EXPENSES |

|

|

|

|

|

|

|

|

| Real estate |

|

|

595 |

|

|

|

1,026 |

|

| Leasing |

|

|

4,420 |

|

|

|

3,598 |

|

| Resort amenities and

other |

|

|

1,532 |

|

|

|

1,547 |

|

| General and

administrative |

|

|

3,998 |

|

|

|

2,795 |

|

| Share-based compensation |

|

|

2,846 |

|

|

|

1,278 |

|

| Depreciation |

|

|

869 |

|

|

|

1,109 |

|

| Total Operating Costs and

Expenses |

|

|

14,260 |

|

|

|

11,353 |

|

| |

|

|

|

|

|

|

|

|

| OPERATING INCOME (LOSS) |

|

|

(3,345 |

) |

|

|

9,607 |

|

| Other income |

|

|

707 |

|

|

|

71 |

|

| Pension and other

post-retirement expenses |

|

|

(436 |

) |

|

|

(7,885 |

) |

| Interest expense |

|

|

(6 |

) |

|

|

(6 |

) |

| NET INCOME (LOSS) |

|

|

(3,080 |

) |

|

|

1,787 |

|

| Pension, net of income taxes

of $0 |

|

|

1,370 |

|

|

|

7,381 |

|

| TOTAL COMPREHENSIVE INCOME

(LOSS) |

|

$ |

(1,710 |

) |

|

$ |

9,168 |

|

| |

|

|

|

|

|

|

|

|

| INCOME (LOSS) PER COMMON

SHARE--BASIC AND DILUTED |

|

$ |

(0.15 |

) |

|

$ |

0.09 |

|

|

|

|

|

MAUI LAND & PINEAPPLE COMPANY, INC. AND

SUBSIDIARIESCONSOLIDATED BALANCE

SHEETS |

|

| |

|

| |

|

December 31, |

|

| |

|

2023 |

|

|

2022 |

|

| |

|

(in thousands except share data) |

|

|

ASSETS |

|

|

|

|

|

|

|

|

| CURRENT ASSETS |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

5,700 |

|

|

$ |

8,499 |

|

|

Cash, restricted |

|

|

- |

|

|

|

10 |

|

|

Accounts receivable, net |

|

|

1,166 |

|

|

|

892 |

|

|

Investment in bond securities, current portion |

|

|

2,671 |

|

|

|

2,432 |

|

|

Prepaid expenses and other assets |

|

|

467 |

|

|

|

368 |

|

|

Assets held for sale |

|

|

- |

|

|

|

3,019 |

|

|

Total Current Assets |

|

|

10,004 |

|

|

|

15,220 |

|

| PROPERTY & EQUIPMENT |

|

|

|

|

|

|

|

|

|

Land |

|

|

5,052 |

|

|

|

5,052 |

|

|

Land improvements |

|

|

13,853 |

|

|

|

12,943 |

|

|

Buildings |

|

|

22,869 |

|

|

|

22,869 |

|

|

Machinery and equipment |

|

|

10,500 |

|

|

|

10,360 |

|

|

Total Property & Equipment |

|

|

52,274 |

|

|

|

51,224 |

|

|

Less accumulated depreciation |

|

|

(36,215 |

) |

|

|

(35,346 |

) |

|

Property & Equipment, net |

|

|

16,059 |

|

|

|

15,878 |

|

| OTHER ASSETS |

|

|

|

|

|

|

|

|

|

Investment in bond securities, less current portion |

|

|

464 |

|

|

|

551 |

|

| Investment in joint

venture |

|

|

1,608 |

|

|

|

- |

|

|

Deferred development costs |

|

|

12,815 |

|

|

|

9,566 |

|

|

Other noncurrent assets |

|

|

1,273 |

|

|

|

1,191 |

|

|

Total Other Assets |

|

|

16,160 |

|

|

|

11,308 |

|

| TOTAL ASSETS |

|

$ |

42,223 |

|

|

$ |

42,406 |

|

| |

|

|

|

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS’

EQUITY |

|

|

|

|

|

|

|

|

| LIABILITIES |

|

|

|

|

|

|

|

|

| CURRENT LIABILITIES |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

1,154 |

|

|

$ |

589 |

|

|

Payroll and employee benefits |

|

|

502 |

|

|

|

869 |

|

|

Accrued retirement benefits, current portion |

|

|

142 |

|

|

|

142 |

|

|

Deferred revenue, current portion |

|

|

217 |

|

|

|

227 |

|

|

Other current liabilities |

|

|

465 |

|

|

|

480 |

|

|

Total Current Liabilities |

|

|

2,480 |

|

|

|

2,307 |

|

| LONG-TERM LIABILITIES |

|

|

|

|

|

|

|

|

|

Accrued retirement benefits |

|

|

1,550 |

|

|

|

2,612 |

|

|

Deferred revenue, less current portion |

|

|

1,367 |

|

|

|

1,500 |

|

|

Deposits |

|

|

2,108 |

|

|

|

2,185 |

|

|

Other noncurrent liabilities |

|

|

14 |

|

|

|

30 |

|

|

Total Long-Term Liabilities |

|

|

5,039 |

|

|

|

6,327 |

|

| TOTAL LIABILITIES |

|

|

7,519 |

|

|

|

8,634 |

|

| |

|

|

|

|

|

|

|

|

| COMMITMENTS &

CONTINGENCIES |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

Common stock--$.0001 par value at December 31, 2023 and 2022,

respectively; 43,000,000 shares authorized; 19,615,350 and

19,476,671 shares issued and outstanding at December 31, 2023 and

2022, respectively |

|

|

84,680 |

|

|

|

83,392 |

|

|

Additional paid in capital |

|

|

10,538 |

|

|

|

9,184 |

|

|

Accumulated deficit |

|

|

(53,617 |

) |

|

|

(50,537 |

) |

|

Accumulated other comprehensive loss |

|

|

(6,897 |

) |

|

|

(8,267 |

) |

|

Total Stockholders’ Equity |

|

|

34,704 |

|

|

|

33,772 |

|

| TOTAL LIABILITIES &

STOCKHOLDERS' EQUITY |

|

$ |

42,223 |

|

|

$ |

42,406 |

|

|

|

|

|

MAUI LAND & PINEAPPLE COMPANY, INC. AND

SUBSIDIARIESSUPPLEMENTAL FINANCIAL INFORMATION

(NON-GAAP) UNAUDITED |

|

| |

|

| |

|

Year EndedDecember 31, |

|

| |

|

2023 |

|

|

2022 |

|

| |

|

(in thousands) |

|

|

(in thousands) |

|

|

|

|

|

|

|

|

|

|

|

| NET INCOME (LOSS) |

|

$ |

(3,080 |

) |

|

$ |

1,787 |

|

| |

|

|

|

|

|

|

|

|

| Less: Non-cash revenues

recognized |

|

|

|

|

|

|

|

|

|

Land contributed to BRE2 LLC recognized in real estate

revenues |

|

|

(1,606 |

) |

|

|

- |

|

| Add: Non-cash expenses |

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

6 |

|

|

|

6 |

|

|

Depreciation |

|

|

869 |

|

|

|

1,109 |

|

|

Share-based compensation |

|

|

|

|

|

|

|

|

|

Vesting of Stock Options granted to Board Chair and Directors |

|

|

1,354 |

|

|

|

- |

|

|

Vesting of Stock Compensation granted to Board Chair and

Directors |

|

|

487 |

|

|

|

380 |

|

|

Vesting of employee Incentive Stock |

|

|

1,005 |

|

|

|

898 |

|

|

Pension and other post-retirement expenses |

|

|

436 |

|

|

|

7,885 |

|

| |

|

|

|

|

|

|

|

|

| ADJUSTED EBITDA (LOSS) |

|

$ |

(529 |

) |

|

$ |

12,065 |

|

| |

|

Year EndedDecember 31, |

|

| |

|

2023 |

|

|

2022 |

|

| |

|

(in thousands) |

|

|

(in thousands) |

|

|

|

|

|

|

|

|

|

|

|

| CASH AND INVESTMENTS |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

5,700 |

|

|

$ |

8,499 |

|

| Restricted cash |

|

|

- |

|

|

|

10 |

|

| Investments, current

portion |

|

|

2,671 |

|

|

|

2,432 |

|

| Investments, net of current

portion |

|

|

464 |

|

|

|

551 |

|

| |

|

|

|

|

|

|

|

|

| TOTAL CASH AND INVESTMENTS

CONVERTIBLE TO CASH |

|

$ |

8,835 |

|

|

$ |

11,492 |

|

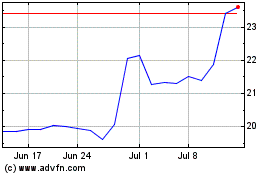

Maui Land and Pineapple (NYSE:MLP)

Historical Stock Chart

From Oct 2024 to Nov 2024

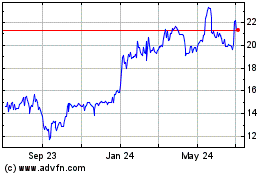

Maui Land and Pineapple (NYSE:MLP)

Historical Stock Chart

From Nov 2023 to Nov 2024