Lincoln Financial Group Shares Insights Into Investors' Mindsets Through Its Quarterly Overview of Market Trends

July 08 2024 - 9:00AM

Business Wire

From investment considerations in an election year to watching

the Fed’s next move, Lincoln Financial's flagship market chartbook,

the Market Intel Exchange, delves into themes impacting the

market

Today, Lincoln Financial Group (NYSE: LNC) released its

quarterly edition of Market Intel Exchange, a comprehensive

analysis of market trends and themes currently on the minds of

investors, curated from the company’s investment expertise and

industry-leading asset management partnerships. In conjunction with

the Market Intel Exchange, Jayson Bronchetti, Chief Investment

Officer, shares a high-level overview of the themes, using visuals

from the report in the company’s CIO Perspectives video.

Key insights from the latest edition of the Market Intel

Exchange include:

Investment considerations during an election year: With

the 2024 presidential election in full swing, investors are keeping

a close eye on how the results may affect investment portfolios and

various market sectors. Research from the report shows that in past

election years, the average return for the S&P 500 was 11.5% --

only modestly lower than the average return in every calendar year

since 1928. This year, stocks were up more than 15% in the first

half, and S&P 500 companies reported their strongest

year-over-year earnings growth rate since early 2022 in the first

quarter. As investors wait to see who the next U.S. President will

be, history shows that the economic backdrop and fundamentals drive

capital markets – not the short-term political noise elections tend

to bring with them. Investors who stayed the course and avoided the

temptation to sit on the sidelines during election years have

historically been rewarded with better investment outcomes1.

The economic backdrop drives Fed action, not elections:

Investors are wondering if decisions on monetary policy may be

influenced by the upcoming presidential race. The Federal Reserve

has consistently demonstrated its independence from political

agendas, rather focusing on its dual mandate of price stability and

maximum employment. This autonomy is critical, as it helps ensure

that decisions are made based on what’s believed to be in the best

interest of the economy, not on who is running for office. Since

1980, the central bank has adjusted interest rates in every

election year except 2012, when rates were near zero and the

economy was still healing from the global financial crisis. This

historical trend helps highlight the unwavering commitment to their

dual mandate, prioritizing the health of the economy over political

motives.

Tracking economic trends in anticipation of the Fed’s next

move: A handful of key data points on growth, inflation, the

consumer and the labor market can help investors keep a pulse on

the health of the overall economy and the likelihood of any

potential shifts in monetary policy. This quarter’s report tracks

these top economic trends in anticipation of the Fed’s next move.

While the economy remains resilient, recent trends show a slowing –

but still growing economy – while Federal Reserve Chair Powell

continues to emphasize that the decision on the rate outlook will

be very data-dependent and met with a cautious approach.

“Lincoln has long-served as a trusted source of experience and

thought leadership on economic trends for our stakeholders, our

sales force and our customers – a role we take very seriously.

Through our longstanding relationships with our asset management

partners, along with our internal team of seasoned investment

professionals, we are proud to continue to provide financial

professionals and their clients with the deep-dive perspectives

needed when making important investment decisions,” said

Bronchetti.

More insights from Lincoln Financial and its network of asset

management partners can be found on the Market Insights page on

LincolnFinancial.com.

About Lincoln Financial Group Lincoln Financial Group

helps people to plan, protect and retire with confidence. As of

December 31, 2023, approximately 17 million customers trust our

guidance and solutions across four core businesses – annuities,

life insurance, group protection, and retirement plan services. As

of March 31, 2024, the company had $310 billion in end-of-period

account balances, net of reinsurance. Headquartered in Radnor, Pa.,

Lincoln Financial Group is the marketing name for Lincoln National

Corporation (NYSE: LNC) and its affiliates. Learn more at

LincolnFinancial.com.

LCN-6758221-070224

________________________________________ 1 Source: Lincoln

Financial Group Market Intel Exchange, July 2024

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240708705477/en/

Tina Madon 800-237-2920 Investor Relations

InvestorRelations@LFG.com

Sarah Boxler 215-495-8439 Media Relations

Sarah.Boxler@LFG.com

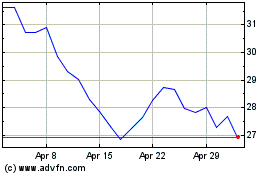

Lincoln National (NYSE:LNC)

Historical Stock Chart

From Oct 2024 to Nov 2024

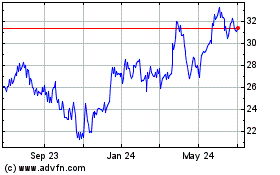

Lincoln National (NYSE:LNC)

Historical Stock Chart

From Nov 2023 to Nov 2024