SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of December, 2023

Commission File Number: 001-13382

KINROSS GOLD CORPORATION

(Translation of registrant's name into English)

17th Floor, 25 York Street

Toronto, Ontario M5J 2V5

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F:

Form

20-F ¨ Form 40-F x

EXPLANATORY NOTE

This Current Report on Form 6-K, dated February 14, 2024, is being

furnished for the sole purpose of providing a copy of the Consolidated Financial Statements and Management’s Discussion and Analysis

for the year ended December 31, 2023.

This current report is specifically incorporated by reference into

Kinross Gold Corporation’s Registration Statements on Form S-8 (Registration Nos. 333-180822, 333-180823, 333-180824 filed on April

19, 2012, Registration No. 333-217099 filed on April 3, 2017 and Registration No. 333-262966 filed on February 24, 2022).

EXHIBITS

SIGNATURES

Pursuant to the requirements of Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

KINROSS GOLD CORPORATION |

| |

By: |

/s/

Kar Ng |

| |

Name: |

Kar Ng |

| |

Title: |

Vice-President, Finance |

| |

|

|

| |

Date: |

February 14, 2024 |

Exhibit

99.1

Kinross

Gold Corporation

management’s

discussion and analysis

For

the year ended December 31, 2023

This

management's discussion and analysis ("MD&A"), prepared as of February 14, 2024, relates to the financial condition

and results of operations of Kinross Gold Corporation together with its wholly owned subsidiaries, as at December 31, 2023 and for

the year then ended, and is intended to supplement and complement Kinross Gold Corporation’s audited annual consolidated

financial statements for the year ended December 31, 2023 and the notes thereto (the “financial statements”). Readers

are cautioned that the MD&A contains forward-looking statements about expected future events and financial and operating performance

of the Company, and that actual events may vary from management's expectations. Readers are encouraged to read the Cautionary Statement

on Forward Looking Information included with this MD&A and to consult Kinross Gold Corporation's financial statements for 2023 and

corresponding notes to the financial statements which are available on the Company's web site at www.kinross.com and on www.sedarplus.ca. The financial statements and

MD&A are presented in U.S. dollars. The financial statements have been prepared in accordance with International

Financial Reporting Standards ("IFRS") as issued by the International Accounting Standards Board (“IASB”).

This discussion addresses matters we consider important for an understanding of our financial condition and results of operations as

at and for the year ended December 31, 2023, as well as our outlook.

This

MD&A contains forward-looking statements and should be read in conjunction with the risk factors described in "Risk

Analysis" on pages 36 – 49 of this MD&A and in the “Cautionary Statement on Forward-Looking

Information” on pages 57 – 58 of

this MD&A. For additional discussion of risk factors, please refer to the Company's Annual Information Form for

the year ended December 31, 2022, which is available on the Company's website www.kinross.com and

on www.sedarplus.ca. In certain instances, references are made to relevant notes in the financial statements for additional

information.

Where we say "we", "us",

"our", the "Company" or "Kinross", we mean Kinross Gold Corporation or Kinross Gold Corporation and/or

one or more or all of its subsidiaries, as it may apply. Where we refer to the "industry", we mean the gold mining industry.

| 1. | DESCRIPTION OF THE BUSINESS |

Kinross is engaged in gold mining and

related activities, including exploration and acquisition of gold-bearing properties, the extraction and processing of gold-containing

ore, and reclamation of gold mining properties. Kinross’ gold production and exploration activities are carried out principally

in Canada, the United States, Brazil, Chile, Mauritania and Finland. Gold is produced in the form of doré, which is shipped to

refineries for final processing. Kinross also produces and sells a quantity of silver.

The profitability and operating cash

flow of Kinross are affected by various factors, including the amount of gold and silver produced, the market prices of gold and silver,

operating costs, interest rates, regulatory and environmental compliance, the level of exploration activity and capital expenditures,

general and administrative costs, and other discretionary costs and activities. Kinross is also exposed to fluctuations in currency exchange

rates, political risks, and varying levels of taxation that can impact profitability and cash flow. Kinross seeks to manage the risks

associated with its business operations; however, many of the factors affecting these risks are beyond the Company’s control.

Commodity prices continue to be volatile

as economies around the world continue to experience economic challenges along with political changes and uncertainties. Volatility in

the price of gold and silver impacts the Company's revenue, while volatility in the price of input costs, such as oil, and foreign exchange

rates, particularly the Brazilian real, Chilean peso, Mauritanian ouguiya and Canadian dollar, may have an impact on the Company's operating

costs and capital expenditures.

Segment Profile

Each of the Company's significant

operating mines is generally considered to be a separate segment. The reportable segments are those operations whose operating results

are reviewed by the chief operating decision maker to make decisions about resources to be allocated to the segment and assess its performance.

| | |

| | |

| | |

Ownership

percentage at December 31, | |

| Operating Segments | |

Operator | | |

Location | | |

2023 | | |

2022 | |

| Tasiast | |

| Kinross | | |

| Mauritania | | |

| 100 | % | |

| 100 | % |

| Paracatu | |

| Kinross | | |

| Brazil | | |

| 100 | % | |

| 100 | % |

| La Coipa | |

| Kinross | | |

| Chile | | |

| 100 | % | |

| 100 | % |

| Fort Knox | |

| Kinross | | |

| USA | | |

| 100 | % | |

| 100 | % |

| Round Mountain | |

| Kinross | | |

| USA | | |

| 100 | % | |

| 100 | % |

| Bald Mountain | |

| Kinross | | |

| USA | | |

| 100 | % | |

| 100 | % |

Kinross

Gold Corporation

management’s

discussion and analysis

For

the year ended December 31, 2023

Consolidated Financial and Operating Highlights

| | |

Years

ended December 31, | | |

2023

vs. 2022 | | |

2022 vs.

2021 | |

| (in millions, except

ounces, per share amounts and per ounce amounts) | |

2023 | | |

2022 | | |

2021 | | |

Change | | |

%

Change(h) | | |

Change | | |

% Change(h) | |

| Operating Highlights | |

| | | |

| | | |

| | | |

| | | |

| | |

| | | |

| |

| Total gold equivalent ounces from continuing operations(a),(b) | |

| | | |

| | | |

| | | |

| | | |

| | |

| | | |

| |

| Produced | |

| 2,153,020 | | |

| 1,957,237 | | |

| 1,447,240 | | |

| 195,783 | | |

10 | % | |

| 509,997 | | |

35 | % |

| Sold | |

| 2,179,936 | | |

| 1,927,818 | | |

| 1,446,477 | | |

| 252,118 | | |

13 | % | |

| 481,341 | | |

33 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| | | |

| |

| Financial Highlights from Continuing

Operations(a) | |

| | | |

| | | |

| | | |

| | | |

| | |

| | | |

| |

| Metal sales | |

$ | 4,239.7 | | |

$ | 3,455.1 | | |

$ | 2,599.6 | | |

$ | 784.6 | | |

23 | % | |

$ | 855.5 | | |

33 | % |

| Production cost of sales | |

$ | 2,054.4 | | |

$ | 1,805.7 | | |

$ | 1,218.3 | | |

$ | 248.7 | | |

14 | % | |

$ | 587.4 | | |

48 | % |

| Depreciation, depletion and amortization | |

$ | 986.8 | | |

$ | 784.0 | | |

$ | 695.7 | | |

$ | 202.8 | | |

26 | % | |

$ | 88.3 | | |

13 | % |

| Impairment charges and asset derecognition - net | |

$ | 38.9 | | |

$ | 350.0 | | |

$ | 144.5 | | |

$ | (311.1 | ) | |

nm | | |

$ | 205.5 | | |

142 | % |

| Operating earnings | |

$ | 801.4 | | |

$ | 117.7 | | |

$ | 72.1 | | |

$ | 683.7 | | |

nm | | |

$ | 45.6 | | |

63 | % |

| Net earnings (loss) from continuing operations attributable

to common shareholders | |

$ | 416.3 | | |

$ | 31.9 | | |

$ | (29.9 | ) | |

$ | 384.4 | | |

nm | | |

$ | 61.8 | | |

nm | |

| Basic earnings (loss) per share from continuing operations

attributable to common shareholders | |

$ | 0.34 | | |

$ | 0.02 | | |

$ | (0.02 | ) | |

$ | 0.32 | | |

nm | | |

$ | 0.04 | | |

nm | |

| Diluted earnings (loss) per share from continuing operations

attributable to common shareholders | |

$ | 0.34 | | |

$ | 0.02 | | |

$ | (0.02 | ) | |

$ | 0.32 | | |

nm | | |

$ | 0.04 | | |

nm | |

| Adjusted net earnings from continuing operations attributable

to common shareholders(c) | |

$ | 539.8 | | |

$ | 283.1 | | |

$ | 210.8 | | |

$ | 256.7 | | |

91 | % | |

$ | 72.3 | | |

34 | % |

| Adjusted net earnings from continuing operations per share(c) | |

$ | 0.44 | | |

$ | 0.22 | | |

$ | 0.17 | | |

$ | 0.22 | | |

100 | % | |

$ | 0.05 | | |

29 | % |

| Net cash flow of continuing operations provided from operating

activities | |

$ | 1,605.3 | | |

$ | 1,002.5 | | |

$ | 695.1 | | |

$ | 602.8 | | |

60 | % | |

$ | 307.4 | | |

44 | % |

| Adjusted operating cash flow from continuing operations(c) | |

$ | 1,669.9 | | |

$ | 1,256.5 | | |

$ | 932.1 | | |

$ | 413.4 | | |

33 | % | |

$ | 324.4 | | |

35 | % |

| Capital expenditures from continuing operations(d)

| |

$ | 1,098.3 | | |

$ | 764.2 | | |

$ | 821.7 | | |

$ | 334.1 | | |

44 | % | |

$ | (57.5 | ) | |

(7) | % |

| Attributable(g) capital expenditures from continuing

operations(c) | |

$ | 1,055.0 | | |

$ | 755.0 | | |

$ | 817.7 | | |

$ | 300.0 | | |

40 | % | |

$ | (62.6 | ) | |

(8 | )% |

| Attributable(g) free cash flow from continuing

operations(c) | |

$ | 559.7 | | |

$ | 247.3 | | |

$ | (121.8 | ) | |

$ | 312.4 | | |

126 | % | |

$ | 369.1 | | |

nm | |

| Average realized gold price per ounce from continuing

operations(e) | |

$ | 1,945 | | |

$ | 1,793 | | |

$ | 1,797 | | |

$ | 152 | | |

8 | % | |

$ | (4 | ) | |

(0 | )% |

| Production cost of sales from continuing operations per

equivalent ounce(b) sold(f) | |

$ | 942 | | |

$ | 937 | | |

$ | 842 | | |

$ | 5 | | |

1 | % | |

$ | 95 | | |

11 | % |

| Production cost of sales from continuing operations per

ounce sold on a by-product basis(c) | |

$ | 892 | | |

$ | 912 | | |

$ | 833 | | |

$ | (20 | ) | |

(2) | % | |

$ | 79 | | |

9 | % |

| All-in sustaining cost from continuing operations per

ounce sold on a by-product basis(c) | |

$ | 1,284 | | |

$ | 1,255 | | |

$ | 1,238 | | |

$ | 29 | | |

2 | % | |

$ | 17 | | |

1 | % |

| All-in sustaining cost from continuing operations per

equivalent ounce(b) sold(c) | |

$ | 1,316 | | |

$ | 1,271 | | |

$ | 1,244 | | |

$ | 45 | | |

4 | % | |

$ | 27 | | |

2 | % |

| Attributable(g) all-in cost from continuing

operations per ounce sold on a by-product basis(c) | |

$ | 1,619 | | |

$ | 1,538 | | |

$ | 1,631 | | |

$ | 81 | | |

5 | % | |

$ | (93 | ) | |

(6 | )% |

| Attributable(g) all-in

cost from continuing operations per equivalent ounce(b) sold(c) | |

$ | 1,634 | | |

$ | 1,545 | | |

$ | 1,632 | | |

$ | 89 | | |

6 | % | |

$ | (87 | ) | |

(5 | )% |

| (a) | Results

for the years ended December 31, 2023, 2022 and 2021 are from continuing operations

and exclude results from the Company’s Chirano and Russian operations due to the classification

of these operations as discontinued and their sale in 2022. |

| (b) | “Gold

equivalent ounces” include silver ounces produced and sold converted to a gold

equivalent based on a ratio of the average spot market prices for the commodities for each

period. The ratio for 2023 was 83.13:1 (2022 – 82.90:1 and 2021 – 71.51:1). |

| (c) | The

definition and reconciliation of these non-GAAP financial measures and ratios is included

in Section 11. Non-GAAP financial measures and ratios have no standardized meaning under

IFRS and therefore, may not be comparable to similar measures presented by other issuers. |

| (d) | “Capital

expenditures from continuing operations” is

reported as “Additions to property, plant and equipment” on the consolidated

statements of cash flows. |

| (e) | “Average

realized gold price per ounce from continuing operations” is defined as gold metal

sales from continuing operations divided by total gold ounces sold from continuing operations. |

| (f) | “Production

cost of sales from continuing operations per equivalent ounce sold” is defined as production

cost of sales divided by total gold equivalent ounces sold from continuing operations. |

| (g) | “Attributable” includes Kinross’ 70% share of Manh Choh

costs, capital expenditures and cash flow, as appropriate. |

| (h) | “nm”

means not meaningful. |

Consolidated Financial Performance

This Consolidated Financial Performance

section references production cost of sales from continuing operations per ounce sold on a by-product basis, adjusted net earnings from

continuing operations attributable to common shareholders and adjusted net earnings from continuing operations per share, adjusted operating

cash flow from continuing operations, attributable free cash flow from continuing operations, all-in sustaining cost from continuing operations

per equivalent ounce sold and per ounce sold on a by-product basis, and attributable all-in cost from continuing operations per equivalent

ounce sold and per ounce sold on a by-product basis, all of which are non-GAAP financial measures or ratios. The definitions and reconciliations

of these non-GAAP financial measures and ratios are included in Section 11 of this MD&A.

Kinross

Gold Corporation

management’s

discussion and analysis

For

the year ended December 31, 2023

2023 vs. 2022

Kinross’

production from continuing operations increased by 10% compared to 2022, primarily due to higher production at La Coipa due to

the restart and ramp up of operations in the second half of 2022 and higher mill grades, recoveries, and throughput at Tasiast. These

increases were partially offset by lower production at Bald Mountain due to lower grades and the timing of ounces recovered from the

heap leach pads, consistent with the mine plan.

Metal sales from continuing operations increased by 23% compared to

2022, due to increases in gold equivalent ounces sold and average metal prices realized. Gold equivalent ounces sold from continuing operations

increased to 2,179,936 ounces in 2023 compared to 1,927,818 ounces in 2022, primarily due to the increase in production, as described

above. The average realized gold price from continuing operations was $1,945 per ounce in 2023 compared to $1,793 per ounce in 2022.

Production

cost of sales from continuing operations increased by 14% in 2023 compared to 2022, largely as a result of the restart and ramp

up of operations at La Coipa and an increase in gold equivalent ounces sold at Round Mountain, Paracatu and Tasiast.

Production cost of sales from continuing

operations per equivalent ounce sold and per ounce sold on a by-product basis are comparable to 2022.

In

2023, depreciation, depletion and amortization from continuing operations increased by 26% compared to 2022. The increase was

primarily due to the increase in gold equivalent ounces sold, largely from the restart and ramp up of operations at La Coipa, and changes

to the life-of-mine plan at Round Mountain in the fourth quarter of 2022, partially offset by lower gold equivalent ounces sold at Bald

Mountain.

During the year ended December 31,

2023, the Company recorded a non-cash after-tax impairment charge of $35.8 million related to a reduction in the estimate of recoverable

ounces on the Fort Knox heap leach pads due to changes in estimated recovery rates. The impairment charge was net of an income tax recovery

of $3.1 million. During the year ended December 31, 2022, the Company recorded after-tax impairment charges of $289.3 million related

to metal inventory and property, plant and equipment at Round Mountain. The after-tax impairment charge related to inventory was $87.9

million and was related to a reduction in the estimate of recoverable ounces on the Round Mountain heap leach pads due to changes in

recovery rates resulting from changes to the mine plan. The after-tax property, plant and equipment impairment charge was $201.4 million

and was a result of changes to the mine plan and slope design, as well as increased costs due to inflationary pressure experienced in

the state of Nevada in 2022. The impairment charges to inventory and property, plant and equipment were net of income tax recoveries

of $18.9 million and $41.8 million, respectively.

Operating

earnings increased to $801.4 million in 2023 from $117.7 million in 2022. This increase was primarily due to an increase in margins (metal

sales less production cost of sales) and lower impairment charges in 2023, partially offset by the increase in depreciation, depletion

and amortization, as described above.

During the year ended December 31, 2023, the Company recorded an income

tax expense of $293.2 million, compared to $76.1 million in 2022. The $293.2 million income tax expense recognized in 2023 included $29.3

million of deferred tax expense, compared to a deferred tax recovery of $25.5 million in 2022, resulting from the net foreign currency

translation of tax deductions related to the Company’s operations in Brazil and Mauritania. Income tax expense in 2023 also included

an income tax recovery of $3.1 million related to the impairment charge at Fort Knox compared to an income tax recovery of $60.7 million

in 2022, related to the impairment charges at Round Mountain. The remaining increase in income tax expense is due to differences in the

level of income in the Company’s operating jurisdictions. Kinross' combined federal and provincial statutory tax rate for both 2023

and 2022 was 26.5%.

Net earnings from continuing operations attributable to common shareholders

in 2023 were $416.3 million, or $0.34 per share, compared to $31.9 million, or $0.02 per share, in 2022. The change was primarily a result

of the increase in operating earnings, as described above, partially offset by the increase in income tax expense in 2023.

Adjusted net earnings from continuing operations attributable to common

shareholders in 2023 were $539.8 million, or $0.44 per share, compared to $283.1 million, or $0.22 per share, in 2022. The increase was

primarily due to the increase in operating earnings, as described above.

Net cash flow of continuing operations

provided from operating activities increased to $1,605.3 million in 2023 from $1,002.5 million 2022, primarily due to the increase in

margins and a favourable change in working capital compared to the prior year.

In

2023, adjusted operating cash flow from continuing operations increased to $1,669.9 million compared to $1,256.5 million in 2022,

primarily due to the increase in margins.

Kinross

Gold Corporation

management’s

discussion and analysis

For

the year ended December 31, 2023

Capital

expenditures from continuing operations increased to $1,098.3 million from $764.2 million in 2022, primarily due to an increase

in capital stripping at Tasiast and Fort Knox and increased development activities at Manh Choh.

Attributable

free cash flow from continuing operations increased to $559.7 million from $247.3 million in 2022, due to the increase in net cash flow

of continuing operations provided from operating activities, partially offset by higher capital expenditures, as described above.

All-in

sustaining cost from continuing operations per equivalent ounce sold and per ounce sold on a by-product basis increased by 4%

and 2%, respectively, compared to 2022. Attributable all-in cost from continuing operations per equivalent ounce sold and per ounce sold

on a by-product basis increased by 6% and 5%, respectively, compared to 2022. These increases from 2022 are primarily due to the increases

in production cost of sales and capital expenditures, as described above, partially offset by the increase in ounces sold.

2022 vs. 2021

Kinross’

production from continuing operations in 2022 increased by 35% compared to 2021, primarily due to higher production at Tasiast

due to the temporary suspension of milling operations in 2021 as a result of the mill fire in June of that year, and production

at La Coipa due to the restart and ramp-up in 2022.

Metal

sales from continuing operations increased by 33% in 2022, compared to 2021, largely due to the increase in gold equivalent ounces

sold. Total gold equivalent ounces sold from continuing operations in 2022 increased to 1,927,818 ounces from 1,446,477 ounces in 2021,

primarily due to the increase in production at Tasiast and La Coipa, as described above. The average realized gold price from continuing

operations decreased marginally to $1,793 per ounce in 2022 from $1,797 per ounce in 2021.

Production

cost of sales from continuing operations increased by 48% in 2022, compared to 2021 and production cost of sales from continuing

operations per equivalent ounce sold and per ounce sold on a by-product basis increased by 11% and 9%, respectively, in 2022, compared

to 2021. The increases were primarily due to the increase in gold equivalent ounces sold, and inflationary cost pressure on key consumables,

such as fuel, emulsion and reagents, at all mine sites.

In

2022, depreciation, depletion and amortization from continuing operations increased by 13% compared to 2021, mainly due to increases

at Tasiast and La Coipa due to the increase in gold equivalent ounces sold, partially offset by decreases at Fort Knox due to an increase

in mineral reserves at the end of 2021, and at Bald Mountain due to a decrease in the depreciable asset base.

During

the year ended December 31, 2022, the Company recorded non-cash after-tax impairment charges of $289.3 million related to metal

inventory and property, plant and equipment at Round Mountain. The after-tax inventory impairment charge of $87.9 million related to

a reduction in the estimate of recoverable ounces on the Round Mountain heap leach pads due to changes in recovery rates resulting from

changes to the mine plan. The after-tax property, plant and equipment impairment charge of $201.4 million was a result of changes to

the mine plan and slope design, as well as increased costs due to inflationary pressure experienced in the state of Nevada. The

impairment charges to inventory and property, plant and equipment were net of income tax recoveries of $18.9 million and $41.8 million,

respectively. During the year ended December 31, 2021, the Company recorded after-tax impairment and asset derecognition charges

of $106.1 million related to metal inventory and property, plant and equipment at Bald Mountain. The 2021 after-tax inventory impairment

charge of $69.9 million resulted from a reduction in the estimate of recoverable ounces on the Vantage heap leach pad at December 31,

2021 due to the presence of carbonaceous ore. Property, plant and equipment related to the Vantage heap leach pad was also derecognized,

resulting in an after-tax charge of $36.2 million. The impairment and derecognition charges to inventory and property, plant and

equipment were net of income tax recoveries of $25.3 million and $13.1 million,

respectively.

In

2022, operating earnings from continuing operations were $117.7 million compared to $72.1 million in 2021. The increase was primarily

due to an increase in margins (metal sales less production cost of sales), largely related to higher production at Tasiast as a result

of the temporary suspension of milling operations in the prior year, and the restart of operations at La Coipa in 2022. In addition,

other operating expense decreased due to costs in 2021 associated with the mill fire at Tasiast and stabilizing the north wall at Round

Mountain. These increases to operating earnings were partially offset by the higher impairment charge related to metal inventory and

property, plant and equipment in 2022 in comparison to 2021.

In

2022, the Company recorded an income tax expense from continuing operations of $76.1 million compared to $115.0 million in 2021. The

$76.1 million income tax expense recognized in 2022 included $25.5 million of deferred tax recovery resulting from the net foreign currency

translation of tax deductions related to the Company’s operations in Brazil, and a deferred tax recovery of $60.7 million related

to the impairment charges at Round Mountain. In 2021, the $115.0 million income tax expense included $22.7 million of deferred tax expense

resulting from the net foreign currency translation of tax deductions related to the Company’s operations in Brazil and a deferred

tax recovery of $38.4 million related to the impairment and asset derecognition charges at Bald Mountain. Income tax expense,

excluding these foreign exchange impacts, increased in 2022 compared to 2021, due to the differences in the level of income in the Company’s

operating jurisdictions. Kinross’ combined federal and provincial statutory tax rate for both 2022 and 2021 was 26.5%.

Kinross

Gold Corporation

management’s

discussion and analysis

For

the year ended December 31, 2023

Net

earnings from continuing operations attributable to common shareholders in 2022 were $31.9 million, or $0.02 per share, compared

to a net loss of $29.9 million, or $0.02 per share, in 2021. The increase is a result of the increase in operating earnings from continuing

operations, as described above.

Adjusted

net earnings from continuing operations attributable to common shareholders were $283.1 million, or $0.22 per share, for 2022

compared to $210.8 million, or $0.17 per share, for 2021. The increase is primarily due to the increase in margins, partially offset

by the increases in exploration expense and depreciation, depletion and amortization.

In

2022, net cash flow of continuing operations provided from operating activities increased to $1,002.5 million from $695.1 million

in 2021, and adjusted operating cash flow from continuing operations in 2022 increased to $1,256.5 million from $932.1 million in 2021,

mainly due to the increase in margins, as described above.

Capital

expenditures from continuing operations decreased to $764.2 million compared with $821.7 million in 2021, primarily due to mine

sequencing at Tasiast, Fort Knox and Round Mountain, involving a decrease in capital stripping. These decreases were partially offset

by increased expenditures for development activities at La Coipa and an increase in capital stripping at Bald Mountain.

Attributable

free cash flow from continuing operations increased to $247.3 million in 2022, compared with a net outflow of $121.8 million in 2021,

primarily due to the increase in net cash flow of continuing operations provided from operating activities and decrease in capital expenditures,

as described above.

All-in

sustaining cost from continuing operations per equivalent ounce sold and per ounce sold on a by-product basis in 2022 were comparable

to 2021. Attributable all-in cost from continuing operations per equivalent ounce sold and per ounce sold on a by-product basis decreased

by 5% and 6%, respectively, compared to 2021 primarily due to the increase in gold equivalent ounces sold from continuing operations,

partially offset by the increase in production cost of sales, as described above.

Mineral Reserves1

Kinross’ total estimated proven and probable gold reserves at

December 31, 2023 were approximately 22.76 million ounces, a decrease of 2.78 million ounces from 25.54 million ounces at December 31,

2022. The decrease in estimated gold reserves was mainly a result of production depletion. Amongst the operating sites, 0.3 million ounces

were also removed from proven and probable reserves, mainly at Paracatu.

Proven and probable silver reserves

at December 31, 2023 were approximately 23.7 million ounces, a decrease of 12.4 million ounces from 36.1 million ounces at December 31,

2022. The decrease was primarily due to production depletion, partially offset by an increase of 1.7 million ounces in proven and probable

reserves, mainly at La Coipa.

1 For details concerning mineral

reserve and mineral resource estimates, refer to the Mineral Reserves and Mineral Resources tables and notes in the Company's news release

filed with Canadian and U.S. regulators on February 14, 2024.

Kinross

Gold Corporation

management’s

discussion and analysis

For

the year ended December 31, 2023

| 2. | IMPACT OF KEY ECONOMIC TRENDS |

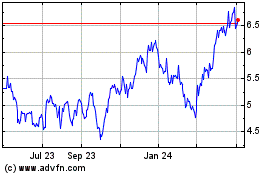

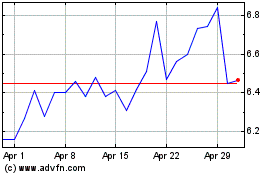

Price of Gold

Source: Bloomberg – based on

daily closing prices

The

price of gold is the largest single factor in determining profitability and cash flow from operations. Therefore, the financial

performance of the Company has been, and is expected to be, closely linked to the price of gold. Historically, the price of gold has

been subject to volatile price movements over short periods of time and is affected by numerous macroeconomic and industry factors

that are beyond the Company’s control. Major influences on the gold price include currency exchange rate fluctuations and the

relative strength of the U.S. dollar, the supply of and demand for gold and macroeconomic factors such as the level of interest

rates and inflation expectations. During 2023, the price of gold fluctuated between a low of $1,811 per ounce in February and a

high of $2,078 per ounce in December, and the average price for the year based on the London Bullion Market Association PM Benchmark

was $1,941 per ounce, compared to the 2022 average price of $1,800 per ounce. Influences on the gold price during 2023 included

geopolitical risks, and volatility in interest rates and the U.S. dollar.

Kinross

Gold Corporation

management’s

discussion and analysis

For

the year ended December 31, 2023

Source:

London Bullion Marketing Association London PM Benchmark

1

“Average realized gold price per ounce” is defined as gold metal sales divided by the total number of gold ounces sold.

In 2023, the Company realized an average

gold price of $1,945 per ounce compared to the average PM Benchmark of $1,941 per ounce.

Kinross

Gold Corporation

management’s

discussion and analysis

For

the year ended December 31, 2023

Gold Supply and Demand Fundamentals

Source: World Gold Council

2023 Gold Demand Trends report

According to the World Gold Council,

total gold supply in 2023 increased by approximately 3% compared to 2022 as both mine supply and recycling grew marginally. The supply

of recycled gold rose 9% due to higher gold prices.

Kinross

Gold Corporation

management’s

discussion and analysis

For

the year ended December 31, 2023

Source: World Gold Council

2023 Gold Demand Trends report

According

to the World Gold Council, annual gold demand decreased in 2023 by approximately 5% compared to a strong 2022. Central bank

purchases persisted in 2023, but declined by 4% during the year, and ETF outflows continued for a third consecutive

year.

Kinross

Gold Corporation

management’s

discussion and analysis

For

the year ended December 31, 2023

Cost Sensitivity

The

Company’s profitability is subject to industry wide cost pressures on development and operating costs with respect to labour, energy,

capital expenditures and consumables in general. Since mining is generally an energy intensive activity, especially in open pit mining,

energy prices can have a significant impact on operations. The cost of fuel as a percentage of operating costs varies amongst the Company’s

mines, and overall, operations experienced fuel price decreases in 2023 compared to 2022. The

volatile fuel prices are primarily due to geopolitical risk and demand and supply dynamics. Kinross manages its exposure to energy

costs by entering, from time to time, into various hedge positions – refer to Section 6 – Liquidity and Capital Resources

for details.

Source: Bloomberg

In order to mitigate the impact of

higher consumable prices, the Company continues to focus on continuous improvement, both by promoting more efficient use of materials

and supplies, and by pursuing more advantageous pricing, whilst increasing performance and without compromising operational integrity.

Kinross

Gold Corporation

management’s

discussion and analysis

For

the year ended December 31, 2023

Currency Fluctuations

Source: Bloomberg

At

the Company’s non-U.S. mining operations and exploration activities, which are primarily located in Brazil, Chile, Mauritania,

and Canada, a portion of operating costs and capital expenditures are denominated in their respective local currencies. Generally, as

the U.S. dollar strengthens, these currencies weaken, and as the U.S. dollar weakens, these foreign currencies strengthen. These currencies

were subject to market volatility over the course of the year. Approximately 65% of the Company’s expected production in

2024 is forecast to come from operations outside the U.S. and costs will continue to be exposed to foreign exchange rate movements. In

order to manage this risk, the Company uses currency hedges for certain foreign currency exposures – refer to Section 6 –

Liquidity and Capital Resources for details.

Kinross

Gold Corporation

management’s

discussion and analysis

For

the year ended December 31, 2023

The

following section of this MD&A represents forward-looking information and users are cautioned that actual results may vary. We refer

to the risks and assumptions contained in the Cautionary Statement on Forward-Looking Information on pages 57 – 58

of this MD&A.

This Outlook section references

all-in sustaining cost per equivalent ounce sold and sustaining, non-sustaining and attributable capital expenditures, which are non-GAAP

ratios and financial measures, as applicable, with no standardized meaning under IFRS and therefore, may not be comparable to similar

measures presented by other issuers. The definitions of these non-GAAP ratios and financial measures and comparable reconciliations are

included in Section 11 of this MD&A.

Attributable2

Production Guidance

In

2024, Kinross expects to produce 2.1 million attributable gold equivalent ounces3 (+/- 5%) from its operations, in line with

total 2023 production of 2,153,020 gold equivalent ounces. Kinross’ annual production is expected to remain stable in 2025 and

2026 at 2.0 million attributable gold equivalent ounces3 (+/- 5%) per year.

In 2024, attributable production is

expected to be higher in the second half of the year, which is largely driven by expected initial production at Manh Choh, as well as

higher production at Paracatu.

Attributable2

Cost Guidance

| | |

2024 | | |

2023 | |

| | |

Guidance | | |

Full-Year | |

| | |

(+/-5%) | | |

Results | |

| Production cost of sales per gold equivalent ounces(4) sold | |

$ |

1,020 | | |

$ | 942 | |

| All-in sustaining cost per equivalent ounce sold(5) | |

$ |

1,360 | | |

$ | 1,316 | |

Attributable

production cost of sales is expected to be $1,020 per equivalent ounces sold4 (+/- 5%) for 2024. In 2023, production

cost of sales was $942 per equivalent ounce sold. The moderate year-over-year increase in 2024 is mainly due to expected higher production

from the Company’s U.S. assets, lower production at Paracatu, and inflationary impacts.

The

Company expects its attributable all-in sustaining cost5 to

be $1,360 per equivalent ounce sold (+/- 5%) for 2024. In 2023, all-in sustaining cost5 was

$1,316 per equivalent ounce sold.

Material assumptions used to forecast

2024 production cost of sales are: a gold price of $2,000 per ounce, a silver price of $25 per ounce, an oil price of $75 per barrel,

and foreign exchange rates of 4.75 Brazilian reais to the U.S. dollar, 800 Chilean pesos to the U.S. dollar, 35 Mauritanian ouguiyas

to the U.S. dollar and 1.30 Canadian dollars to the U.S. dollar.

Taking into account existing currency

and oil hedges, a 10% change in foreign currency exchange rates would be expected to result in an approximate $20 impact on production

cost of sales per equivalent ounce sold; and specific to the Brazilian real and Chilean peso, a 10% change in these exchange rates would

be expected to result in impacts of approximately $40 and $30 on Brazilian and Chilean production cost of sales per equivalent ounce

sold, respectively. A $10 per barrel change in the price of oil would be expected to result in an approximate $3 impact on fuel consumption

costs on production cost of sales per equivalent ounce sold, and a $100 change in the price of gold would be expected to result in an

approximate $4 impact on production cost of sales per equivalent ounce sold as a result of a change in royalties.

2

Attributable guidance includes Kinross’ 70% share of Manh Choh production,

costs and capital expenditures. Attributable guidance figures are non-GAAP financial measures and ratios. Refer to footnote 5.

3

2024 gold equivalent ounce production guidance includes approximately 6.5 million ounces of silver.

4 “Production cost of sales per equivalent ounce sold” is defined as production cost of sales divided

by total gold equivalent ounces sold from continuing operations.

Kinross

Gold Corporation

management’s

discussion and analysis

For

the year ended December 31, 2023

Attributable2

Capital Expenditures5 Guidance

| | |

2024 | | |

2023 | |

| | |

Guidance | | |

Full-Year | |

| | |

(+/-5%) | | |

Results | |

| Attributable sustaining capital expenditures | |

$ | 500.0 | | |

$ | 554.3 | |

| Attributable non-sustaining capital expenditures | |

$ | 550.0 | | |

$ | 500.7 | |

| Total attributable capital expenditures | |

$ | 1,050.0 | | |

$ | 1,055.0 | |

Attributable capital expenditures

for 2024 are forecast to be approximately $1,050 million (+/- 5%). Of this amount, sustaining capital expenditures are expected to be

approximately $500 million, with non-sustaining capital expenditures of approximately $550 million for Tasiast West Branch stripping,

Round Mountain Phase S stripping, the advanced exploration program and project studies at Great Bear, and the completion of Manh Choh,

as well as other growth projects and studies. The 2024 capital expenditures guidance is in line with 2023 results.

Kinross’

attributable capital expenditures outlook for 2025 and 2026 is $850 million and $650 million, respectively, based on currently approved

projects. As Kinross continues to develop and optimize its portfolio for production beyond 2026, other projects may be incorporated into

its capital expenditures, as well as potential inflationary impacts, over the 2024-2025 timeframe.

Other 2024 Guidance

The 2024 forecast for exploration and

business development is $185 million (+/-5%), which includes approximately $160 million (+/-5%) of exploration expenditures on greenfields,

brownfields and minex exploration targets.

The 2024 forecast for general and administrative

expense is $115 million (+/-5%).

Other operating costs for 2024 is expected

to be approximately $100 million, which primarily relates to studies and permitting activities, as well as care and maintenance and reclamation

activities at non-operating sites.

Taxes paid are expected to be $155

million in 2024. Taxes paid are expected to increase by approximately $5 million for every $100 per ounce movement in the realized gold

prices. The forecast effective tax rate (“ETR”)6 for 2024 is expected to be in the range of 33% - 38%.

Depreciation, depletion and amortization

per equivalent ounce sold7 is forecast to be approximately $540 (+/-5%).

The 2024 forecast for interest paid

is $150 million and is comprised of approximately $105 million of capitalized interest and $45 million of interest expense. The 2024 forecast

for interest expense excludes accretion of the Company’s reclamation and remediation obligations, as well as lease liabilities,

which for 2023 totaled $39.1 million.

| 4. | PROJECT

UPDATES AND NEW DEVELOPMENTS |

Great Bear

At the Great

Bear project, the Company’s robust exploration program continues to make excellent progress, execution planning for the advanced

exploration program is well underway, and permitting continues to advance on plan.

Following

the completion of its 2023 drilling program, Kinross has increased Great Bear’s mineral resource estimate to approximately 2.8 million

ounces of measured and indicated resources and approximately 3.3 million ounces of inferred resources. This includes the addition of more

than one million higher-grade, underground inferred ounces, representing a 45% year-over-year increase.

5 These guidance figures are non-GAAP financial measures

and ratios, as applicable, and are defined, and actual results for the year ended December 31, 2023 are reconciled, in Section 11 of

this MD&A. Non-GAAP financial measures and ratios have no standardized meaning under IFRS and therefore, may not be comparable to

similar measures presented by other issuers.

6 The forecast ETR range for 2024 assumes gold price, foreign exchange and

tax rates in the jurisdictions in which the Company operates remain stable and within 2024 guidance assumptions. The ETR does not include

the impact of items which the Company believes are not reflective of the Company’s underlying performance, such as the impact of

net foreign currency translations on tax deductions and taxes related to prior periods. Management believes that the ETR range provides

investors with the ability to better evaluate the Company’s underlying performance. However, the ETR range is not necessarily an

indicator of tax expense recognized under IFRS. The rate is sensitive to the relative proportion of sales between the Company’s

various tax jurisdictions and realized gold prices.

7 Depreciation, depletion and amortization per equivalent ounce sold is defined as depreciation, depletion and amortization, as reported on the consolidated statements

of operations, divided by total gold equivalent ounces sold.

Kinross

Gold Corporation

management’s

discussion and analysis

For

the year ended December 31, 2023

Kinross continues to add higher-grade

material to the underground resource base, as demonstrated by the year-over-year increase in the inferred grade, which increased from

3.6 grams per tonne to 4.5 grams per tonne. While the primary additions were in the LP zone, resources at Hinge and Limb, traditional

Red Lake style deposits proximal to the LP zone, also increased. Further, high-grade intercepts below the resource at Hinge in 2023 demonstrated

the potential for this mineralization to also continue at depth potentially supplementing LP zone production in the future.

Since the last update on November 8,

2023, the Company has received additional assay results, which continue to support the view of a high-grade, large, long-life mining complex

at Great Bear.

Kinross is

progressing provincial permitting, engineering, and execution planning activities for an advanced exploration (AEX) program that would

establish an underground decline to obtain a bulk sample and allow for definition and infill drilling in the LP zone. The mining lease

for the main AEX surface footprint has now been received, providing Kinross with the necessary surface and mining rights to develop the

AEX project, subject to obtaining the required provincial permits.

Detailed engineering

for AEX infrastructure is well underway, and orders have been placed for the onsite camp and high-quality water treatment facility. Procurement

activities for additional infrastructure and site construction activities are progressing well.

Kinross is

targeting a start of the surface construction for the AEX program in the second half of 2024, subject to receipt of permits, with start

of the underground decline planned in mid-2025.

For the main

project, Kinross continues to advance technical studies, including engineering and field test work campaigns, with plans to release the

results of this work in the form of a preliminary economic assessment in the second half of 2024.

The required

Federal Impact Assessment for the main project is underway. The Initial Project Description has been submitted to the Impact Assessment

Agency of Canada, formally kicking off the federal assessment process. The Detailed Project Description is expected to be formally submitted

in the first quarter of 2024. Studies are ongoing and the Company expects to file its Impact Statement in the first half of 2025.

Manh Choh

At the 70% owned Manh Choh project,

of which Kinross is the operator, construction is essentially complete, on budget and on schedule for production in the second half of

2024. Mining activities are well underway including the commencement of ore mining and stockpiling. Transportation of ore to Fort Knox,

where it will be processed, has commenced and will gradually increase throughout the first half of the year.

Modifications to the Fort Knox mill

continue to progress on schedule and on budget. Construction of the conveyors and associated buildings are planned for the first

quarter along with interior piping and mechanical installations. The commissioning and operational readiness team is in place and preparing

for pre-commissioning activities following the mechanical completion of each area.

Tasiast Solar Power Plant

At the Tasiast solar power plant, construction

of the solar field and battery system is now complete, with first solar power delivered to the Tasiast grid in December 2023. Commissioning

of the battery system and energy management system will continue in early 2024, supporting the solar field and battery system integration

and power ramp-up. During the first quarter of 2024, grid scenario testing involving incumbent generators, the solar field, and battery

systems will continue toward ensuring stable power from this new renewable energy source. The Tasiast solar power plant has a continuous

power generation capacity of 34MW and an 18MW battery storage system.

Round Mountain

The extension

strategy at Round Mountain is advancing on plan. At Phase S, the operations team is in place and stripping remains on schedule. For the

heap leach pad expansion, detailed engineering is complete, procurement is in progress, and construction activities remain on track.

At Phase

X, development of the exploration decline is progressing well and more than 50% complete, with approximately 1,475 metres developed so

far, and is approaching the target mineralization. Underground definition drilling commenced in early 2024 and is set to ramp up throughout

the year. The Company expects to begin drilling the primary Phase X target in the second quarter of 2024. At Gold Hill, drilling continues

to progress as planned with an infill program from the bottom of the pit and exploration drilling from surface.

Chile

Kinross’ activities in Chile

are currently focused on La Coipa and potential opportunities to extend its mine life. The Lobo-Marte project continues to provide

optionality as a potential large, low-cost mine upon the conclusion of mining at La Coipa. While the Company focuses its technical resources

on La Coipa, it will continue to engage and build relationships with communities related to Lobo-Marte and government stakeholders.

Kinross

Gold Corporation

management’s

discussion and analysis

For

the year ended December 31, 2023

| 5. | CONSOLIDATED

RESULTS OF OPERATIONS |

Operating

Highlights

| | |

Years ended

December 31, | | |

2023 vs. 2022 | | |

2022 vs. 2021 | |

| (in millions,

except ounces and per ounce amounts) | |

2023 | | |

2022 | | |

2021 | | |

Change | | |

%

Change(d) | | |

Change | | |

%

Change(d) | |

| Operating

Statistics(a) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total

gold equivalent ounces from continuing operations(b) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Produced | |

| 2,153,020 | | |

| 1,957,237 | | |

| 1,447,240 | | |

| 195,783 | | |

| 10 | % | |

| 509,997 | | |

| 35 | % |

| Sold | |

| 2,179,936 | | |

| 1,927,818 | | |

| 1,446,477 | | |

| 252,118 | | |

| 13 | % | |

| 481,341 | | |

| 33 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Gold ounces - sold from continuing

operations | |

| 2,074,989 | | |

| 1,872,342 | | |

| 1,432,396 | | |

| 202,647 | | |

| 11 | % | |

| 439,946 | | |

| 31 | % |

| Silver ounces - sold from continuing

operations (000's) | |

| 8,718 | | |

| 4,647 | | |

| 1,005 | | |

| 4,071 | | |

| 88 | % | |

| 3,642 | | |

| nm | |

| Average

realized gold price per ounce from continuing operations(c) | |

$ | 1,945 | | |

$ | 1,793 | | |

$ | 1,797 | | |

$ | 152 | | |

| 8 | % | |

$ | (4 | ) | |

| (0 | )% |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Financial data from Continuing

Operations | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Metal sales | |

$ | 4,239.7 | | |

$ | 3,455.1 | | |

$ | 2,599.6 | | |

$ | 784.6 | | |

| 23 | % | |

$ | 855.5 | | |

| 33 | % |

| Production cost of sales | |

$ | 2,054.4 | | |

$ | 1,805.7 | | |

$ | 1,218.3 | | |

$ | 248.7 | | |

| 14 | % | |

$ | 587.4 | | |

| 48 | % |

| Depreciation, depletion and amortization | |

$ | 986.8 | | |

$ | 784.0 | | |

$ | 695.7 | | |

$ | 202.8 | | |

| 26 | % | |

$ | 88.3 | | |

| 13 | % |

| Impairment charges and asset derecognition - net | |

$ | 38.9 | | |

$ | 350.0 | | |

$ | 144.5 | | |

$ | (311.1 | ) | |

| nm | | |

$ | 205.5 | | |

| 142 | % |

| Operating earnings | |

$ | 801.4 | | |

$ | 117.7 | | |

$ | 72.1 | | |

$ | 683.7 | | |

| nm | | |

$ | 45.6 | | |

| 63 | % |

| Net earnings

from continuing operations attributable to common shareholders | |

$ | 416.3 | | |

$ | 31.9 | | |

$ | (29.9 | ) | |

$ | 384.4 | | |

| nm | | |

$ | 61.8 | | |

| nm | |

| (a) | Results

for the years ended December 31, 2023, 2022 and 2021 are from continuing operations

and exclude results from the Company’s Chirano and Russian operations due to the classification

of these operations as discontinued and their sale in 2022. |

| (b) | “Gold

equivalent ounces” include silver ounces produced and sold converted to a gold

equivalent based on a ratio of the average spot market prices for the commodities for each

period. The ratio for 2023 was 83.13:1 (2022 – 82.90:1, 2021 – 71.51:1). |

| (c) | “Average

realized gold price per ounce from continuing operations” is defined as gold metal

sales from continuing operations divided by total gold ounces sold from continuing operations. |

| (d) | “nm”

means not meaningful. |

Operating

Earnings (Loss) from Continuing Operations(a) by Segment(b)

| | |

Years

ended December 31, | | |

2023

vs. 2022 | |

|

2022

vs. 2021 | |

| (in millions) | |

2023 | | |

2022 | | |

2021 | | |

Change | | |

%

Change(c) | |

|

Change | | |

%

Change(c) | |

| Operating segments | |

| | | |

| | | |

| | | |

| | | |

| | |

|

| | | |

| | |

| Tasiast | |

$ | 549.6 | | |

$ | 299.5 | | |

$ | (67.0 | ) | |

$ | 250.1 | | |

| 84 | % |

|

| 366.5 | | |

| nm | |

| Paracatu | |

| 407.5 | | |

| 330.9 | | |

| 384.4 | | |

| 76.6 | | |

| 23 | % |

|

| (53.5 | ) | |

| (14 | )% |

| La Coipa | |

| 147.2 | | |

| 81.8 | | |

| (8.4 | ) | |

| 65.4 | | |

| 80 | % |

|

| 90.2 | | |

| nm | |

| Fort Knox | |

| 67.5 | | |

| 58.9 | | |

| 91.9 | | |

| 8.6 | | |

| 15 | % |

|

| (33.0 | ) | |

| (36 | )% |

| Round Mountain | |

| (100.3 | ) | |

| (327.6 | ) | |

| 108.6 | | |

| 227.3 | | |

| nm | |

|

| (436.2 | ) | |

| nm | |

| Bald Mountain | |

| 13.9 | | |

| (5.6 | ) | |

| (174.7 | ) | |

| 19.5 | | |

| nm | |

|

| 169.1 | | |

| nm | |

| Non-operating segments | |

| | | |

| | | |

| | | |

| | | |

| | |

|

| | | |

| | |

| Great Bear | |

| (49.9 | ) | |

| (61.7 | ) | |

| - | | |

| 11.8 | | |

| nm | |

|

| (61.7 | ) | |

| nm | |

| Corporate

and other(b) | |

| (234.1 | ) | |

| (258.5 | ) | |

| (262.7 | ) | |

| 24.4 | | |

| nm | |

|

| 4.2 | | |

| nm | |

| Total | |

$ | 801.4 | | |

$ | 117.7 | | |

$ | 72.1 | | |

$ | 683.7 | | |

| nm | |

|

$ | 45.6 | | |

| 63 | % |

| (a) | Results

for the years ended December 31, 2023, 2022 and 2021 are from continuing operations

and exclude results from the Company’s Chirano and Russian operations due to the classification

of these operations as discontinued and their sale in 2022. |

| (b) | “Corporate

and other” includes operating costs which are not directly related to individual mining

properties such as overhead expenses, gains and losses on disposal of assets and investments,

and other costs relating to corporate, shutdown, and other non-operating assets (including

Kettle River-Buckhorn, Lobo-Marte, Manh Choh and Maricunga). |

| (c) | “nm”

means not meaningful. |

Kinross

Gold Corporation

management’s

discussion and analysis

For

the year ended December 31, 2023

Mining

Operations

Tasiast

(100% ownership and operator) – Mauritania

| | |

Years ended December 31, | |

| | |

2023 | | |

2022 | | |

Change | | |

% Change | |

| Operating Statistics | |

| | | |

| | | |

| | | |

| | |

| Tonnes ore mined (000's) | |

| 9,801 | | |

| 14,689 | | |

| (4,888 | ) | |

| (33 | )% |

| Tonnes processed (000's) | |

| 6,723 | | |

| 6,572 | | |

| 151 | | |

| 2 | % |

| Grade (grams/tonne) | |

| 3.19 | | |

| 2.75 | | |

| 0.44 | | |

| 16 | % |

| Recovery | |

| 92.3 | % | |

| 90.5 | % | |

| 1.8 | % | |

| 2 | % |

| Gold equivalent ounces: | |

| | | |

| | | |

| | | |

| | |

| Produced | |

| 620,793 | | |

| 538,591 | | |

| 82,202 | | |

| 15 | % |

| Sold | |

| 615,065 | | |

| 519,292 | | |

| 95,773 | | |

| 18 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Financial Data (in

millions) | |

| | | |

| | | |

| | | |

| | |

| Metal sales | |

$ | 1,200.8 | | |

$ | 935.0 | | |

$ | 265.8 | | |

| 28 | % |

| Production cost of sales | |

| 406.8 | | |

| 380.1 | | |

| 26.7 | | |

| 7 | % |

| Depreciation, depletion and amortization | |

| 244.4 | | |

| 220.2 | | |

| 24.2 | | |

| 11 | % |

| | |

| 549.6 | | |

| 334.7 | | |

| 214.9 | | |

| 64 | % |

| Other operating (income) expense | |

| (3.9 | ) | |

| 30.3 | | |

| (34.2 | ) | |

| nm | |

| Exploration and business development | |

| 3.9 | | |

| 4.9 | | |

| (1.0 | ) | |

| (20 | )% |

| Segment operating earnings | |

$ | 549.6 | | |

$ | 299.5 | | |

$ | 250.1 | | |

| 84 | % |

Kinross

acquired its 100% interest in the Tasiast mine on September 17, 2010 upon completing its acquisition of Red Back Mining Inc. The

Tasiast mine is an open pit operation located in north-western Mauritania and is approximately 300 kilometres north of the capital, Nouakchott.

2023

vs. 2022

Mine sequencing at Tasiast involved

an increase in capital stripping relating to West Branch 5 and mining a higher-grade section of West Branch 4, resulting in a 33% decrease

in tonnes of ore mined and a 16% increase in mill grades in 2023 compared to 2022. Tasiast achieved higher sustained throughput levels

during the fourth quarter as a result of the planned plant shutdown in February 2023 for 24K project tie-ins and other maintenance, as

well as additional plant optimization and maintenance activities thereafter. The higher grades, recoveries, and throughput, resulted in

increases in gold equivalent ounces produced and sold of 15% and 18%, respectively, in 2023.

Metal

sales in 2023 increased by 28%, compared to 2022, due to the increases in gold equivalent ounces sold and average metal prices realized.

Production cost of sales increased by 7% in 2023 compared to 2022, due to the increase in gold equivalent ounces sold, partially offset

by lower operating waste mined. Depreciation, depletion and amortization increased by 11% compared to 2022, due to an increase in gold

equivalent ounces sold, partially offset by an increase in depreciation capitalized as a result of a higher proportion of mining activities

relating to capital stripping.

Kinross

Gold Corporation

management’s

discussion and analysis

For

the year ended December 31, 2023

Paracatu

(100% ownership and operator) – Brazil

| | |

Years

ended December 31, | |

| | |

2023 | | |

2022 | | |

Change | | |

%

Change | |

| Operating

Statistics | |

| | | |

| | | |

| | | |

| | |

| Tonnes

ore mined (000's) | |

| 53,845 | | |

| 42,252 | | |

| 11,593 | | |

| 27 | % |

| Tonnes

processed (000's) | |

| 60,182 | | |

| 56,422 | | |

| 3,760 | | |

| 7 | % |

| Grade

(grams/tonne) | |

| 0.39 | | |

| 0.41 | | |

| (0.02 | ) | |

| (5 | )% |

| Recovery | |

| 79.1 | % | |

| 77.9 | % | |

| 1.2 | % | |

| 2 | % |

| Gold

equivalent ounces: | |

| | | |

| | | |

| | | |

| | |

| Produced | |

| 587,999 | | |

| 577,354 | | |

| 10,645 | | |

| 2 | % |

| Sold | |

| 592,224 | | |

| 571,164 | | |

| 21,060 | | |

| 4 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Financial

Data (in millions) | |

| | | |

| | | |

| | | |

| | |

| Metal

sales | |

$ | 1,149.6 | | |

$ | 1,021.5 | | |

$ | 128.1 | | |

| 13 | % |

| Production

cost of sales | |

| 538.6 | | |

| 497.6 | | |

| 41.0 | | |

| 8 | % |

| Depreciation,

depletion and amortization | |

| 186.6 | | |

| 185.5 | | |

| 1.1 | | |

| 1 | % |

| | |

| 424.4 | | |

| 338.4 | | |

| 86.0 | | |

| 25 | % |

| Other

operating expense | |

| 11.3 | | |

| 5.6 | | |

| 5.7 | | |

| 102 | % |

| Exploration

and business development | |

| 5.6 | | |

| 1.9 | | |

| 3.7 | | |

| 195 | % |

| Segment

operating earnings | |

$ | 407.5 | | |

$ | 330.9 | | |

$ | 76.6 | | |

| 23 | % |

The

Company acquired a 49% ownership interest in the Paracatu open pit mine, located in the State of Minas Gerais, Brazil, upon the acquisition

of TVX Gold Inc. on January 31, 2003. On December 31, 2004, the Company purchased the remaining 51% of Paracatu from Rio Tinto Plc.

2023

vs. 2022

Planned

mine sequencing at Paracatu, which involved less waste mined in 2023, resulted in a 27% increase in tonnes of ore mined and a 5% decrease

in grade compared to 2022. Tonnes of ore processed increased by 7% compared to 2022, mainly due to an increase in mill availability and

a decrease in ore hardness. The increase in throughput and higher recoveries, partly offset by the lower grade, resulted in an increase

in gold equivalent ounces produced and sold of 2% and 4%, respectively, compared to 2022. Gold equivalent ounces sold in 2023 were higher

than production due to timing of sales.

Metal

sales for 2023 increased by 13% compared to 2022, due to the increases in gold equivalent ounces sold and average metal prices realized.

In 2023, production cost of sales increased by 8%, compared to 2022, largely due to the increase in gold equivalent ounces sold and inflationary

pressures on consumables, contractors and maintenance costs, partially offset by lower fuel costs. Depreciation, depletion and amortization

in 2023 was comparable to 2022.

Kinross

Gold Corporation

management’s

discussion and analysis

For

the year ended December 31, 2023

La

Coipa (100% ownership and operator) – Chile

| | |

Years ended December 31, | |

| | |

2023 | | |

2022 | | |

Change | | |

% Change(b) | |

| Operating Statistics | |

| | | |

| | | |

| | | |

| | |

| Tonnes ore mined (000's) | |

| 4,345 | | |

| 2,850 | | |

| 1,495 | | |

| 52 | % |

| Tonnes processed (000's) | |

| 3,867 | | |

| 1,949 | | |

| 1,918 | | |

| 98 | % |

| Grade (grams/tonne): | |

| | | |

| | | |

| | | |

| | |

| Gold | |

| 1.74 | | |

| 1.23 | | |

| 0.51 | | |

| 41 | % |

| Silver | |

| 107.68 | | |

| 115.50 | | |

| (7.82 | ) | |

| (7 | )% |

| Recovery: | |

| | | |

| | | |

| | | |

| | |

| Gold | |

| 81.3 | % | |

| 81.8 | % | |

| (0.5 | )% | |

| (1 | )% |

| Silver | |

| 56.5 | % | |

| 60.7 | % | |

| (4.2 | )% | |

| (7 | )% |

| Gold equivalent ounces:(a) | |

| | | |

| | | |

| | | |

| | |

| Produced | |

| 260,138 | | |

| 109,576 | | |

| 150,562 | | |

| 137 | % |

| Sold | |

| 268,491 | | |

| 99,915 | | |

| 168,576 | | |

| 169 | % |

| Silver ounces: | |

| | | |

| | | |

| | | |

| | |

| Produced (000's) | |

| 7,670 | | |

| 4,182 | | |

| 3,488 | | |

| 83 | % |

| Sold (000's) | |

| 8,021 | | |

| 3,779 | | |

| 4,242 | | |

| 112 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Financial Data (in millions) | |

| | | |

| | | |

| | | |

| | |

| Metal sales | |

$ | 522.6 | | |

$ | 177.9 | | |

$ | 344.7 | | |

| 194 | % |

| Production cost of sales | |

| 182.8 | | |

| 57.2 | | |

| 125.6 | | |

| nm | |

| Depreciation, depletion and amortization | |

| 187.8 | | |

| 25.6 | | |

| 162.2 | | |

| nm | |

| | |

| 152.0 | | |

| 95.1 | | |

| 56.9 | | |

| 60 | % |

| Other operating (income) expense | |

| (8.2 | ) | |

| 7.7 | | |

| (15.9 | ) | |

| nm | |

| Exploration and business development | |

| 13.0 | | |

| 5.6 | | |

| 7.4 | | |

| 132 | % |

| Segment operating earnings | |

$ | 147.2 | | |

$ | 81.8 | | |

$ | 65.4 | | |

| 80 | % |

| (a) | “Gold

equivalent ounces” include silver ounces produced and sold converted to a gold equivalent

based on a ratio of the average spot market prices for the commodities for each period. The

ratio for 2023 was 83.13:1 (2022 – 82.90:1). |

| (b) | “nm”

means not meaningful. |

Kinross

acquired its 100% interest in the La Coipa open pit mine, located in the Atacama region in Chile, in 2007. In February 2022, the

mine poured its first gold bar after restarting operations following the suspension of activities since October 2013.

2023

vs. 2022

Production restarted at La Coipa in

February 2022 and continued to increase throughout 2022 as throughput ramped up and as grades and recoveries increased. Mining in 2023

continued to focus on Phase 7 and the Puren deposit, with capital development of the Puren deposit largely completed at the end of the

third quarter. A planned mill shutdown in February 2023 for maintenance work to increase reliability and sustain higher throughput levels

impacted tonnes of ore processed early in the year. As a result, throughput improved throughout the year, averaging 12,900 tonnes per

day in the fourth quarter. The continued ramp up and reliability of throughput rates, as well as higher grades, resulted in the significant

increases in gold equivalent ounces produced and sold in 2023. Gold equivalent ounces sold in 2023 were higher than production due to

timing of sales.

Kinross

Gold Corporation

management’s

discussion and analysis

For

the year ended December 31, 2023

Fort

Knox (100% ownership and operator) – USA

| | |

Years ended December 31, | |

| | |

2023 | | |

2022 | | |

Change | | |

% Change(c) | |

| Operating Statistics | |

| | | |

| | | |

| | | |

| | |

| Tonnes ore mined (000's) | |

| 32,705 | | |

| 56,086 | | |

| (23,381 | ) | |

| (42 | )% |

| Tonnes processed (000's)(a) | |

| 36,826 | | |

| 59,353 | | |

| (22,527 | ) | |

| (38 | )% |

| Grade (grams/tonne)(b) | |

| 0.77 | | |

| 0.70 | | |

| 0.07 | | |

| 10 | % |

| Recovery(b) | |

| 79.9 | % | |

| 79.6 | % | |

| 0.3 | % | |

| 0 | % |

| Gold equivalent ounces: | |

| | | |

| | | |

| | | |

| | |

| Produced | |

| 290,651 | | |

| 291,248 | | |

| (597 | ) | |

| (0 | )% |

| Sold | |

| 287,532 | | |

| 291,793 | | |

| (4,261 | ) | |

| (1 | )% |

| | |

| | | |

| | | |

| | | |

| | |

| Financial Data (in millions) | |

| | | |

| | | |

| | | |

| | |

| Metal sales | |

$ | 557.9 | | |

$ | 521.7 | | |

$ | 36.2 | | |

| 7 | % |

| Production cost of sales | |

| 343.5 | | |

| 350.7 | | |

| (7.2 | ) | |

| (2 | )% |

| Depreciation, depletion and amortization | |

| 96.8 | | |

| 109.7 | | |

| (12.9 | ) | |

| (12 | )% |

| Impairment charge | |

| 38.9 | | |

| - | | |

| 38.9 | | |

| nm | |

| | |

| 78.7 | | |

| 61.3 | | |

| 17.4 | | |

| 28 | % |

| Other operating expense (income) | |

| 0.8 | | |

| (3.1 | ) | |

| 3.9 | | |

| nm | |

| Exploration and business development | |

| 10.4 | | |

| 5.5 | | |

| 4.9 | | |

| 89 | % |

| Segment operating earnings | |

$ | 67.5 | | |

$ | 58.9 | | |

$ | 8.6 | | |

| 15 | % |

| (a) | Includes

28,700,000 tonnes placed on the heap leach pads during 2023 (2022 – 50,368,000 tonnes). |

| (b) | Amount

represents mill grade and recovery only. Ore placed on the heap leach pads had an average grade

of 0.22 grams per tonne during 2023 (2022- 0.19 grams per tonne). Due to the nature of heap

leach operations, point-in-time recovery rates are not meaningful. |

| (c) | “nm”

means not meaningful. |

The

Company has been operating the Fort Knox open pit mine, located near Fairbanks, Alaska, since it was acquired in 1998.

2023

vs. 2022

Planned mine sequencing at Fort Knox

in 2023 included Phase 10 capital development and a decrease in ore placed on the Barnes Creek heap leach facility, resulting in a 42%

decrease in tonnes of ore mined and a 38% decrease in tonnes of ore processed in 2023 compared to 2022. Planned mine sequencing also

resulted in a 10% increase in mill grades. Gold equivalent ounces produced and sold were relatively consistent year-over-year.

Metal sales increased by 7% in 2023,

compared to 2022, due to the increase in average metal prices realized. Production cost of sales decreased by 2% in 2023, compared to

2022, primarily due to a decrease in operating waste mined as well as lower reagents and fuel costs, partially offset by higher labour

and contractor costs. Depreciation, depletion, and amortization decreased by 12% in 2023, compared to 2022, due to an increase in depreciation

capitalized as a result of a higher proportion of mining activities relating to capital development, partially offset by an increase in

the depreciable asset base.

During the year ended December 31, 2023, the Company recorded an impairment

charge of $38.9 million related to a reduction in the estimate of recoverable ounces on the heap leach pads due to changes in estimated

recovery rates. The tax impact of the impairment charge was an income tax recovery of $3.1 million.

Kinross

Gold Corporation

management’s

discussion and analysis

For

the year ended December 31, 2023

Round

Mountain (100% ownership and operator) – USA

| | |

Years ended December 31, | |

| | |

2023 | | |

2022 | | |

Change | | |

% Change(c) | |

| Operating Statistics | |

| | | |

| | | |

| | | |

| | |

| Tonnes ore mined (000's) | |

| 28,655 | | |

| 24,502 | | |

| 4,153 | | |

| 17 | % |

| Tonnes processed (000's)(a) | |

| 28,462 | | |

| 26,688 | | |

| 1,774 | | |

| 7 | % |

| Grade (grams/tonne)(b) | |

| 0.78 | | |

| 0.71 | | |

| 0.07 | | |

| 10 | % |

| Recovery(b) | |

| 74.0 | % | |

| 77.5 | % | |

| (3.5 | )% | |

| (5 | )% |

| Gold equivalent ounces: | |

| | | |

| | | |

| | | |

| | |

| Produced | |

| 235,690 | | |

| 226,374 | | |

| 9,316 | | |

| 4 | % |

| Sold | |

| 234,064 | | |

| 227,655 | | |

| 6,409 | | |

| 3 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Financial Data (in millions) | |

| | | |

| | | |

| | | |

| | |

| Metal sales | |

$ | 454.4 | | |

$ | 407.3 | | |

$ | 47.1 | | |

| 12 | % |

| Production cost of sales | |

| 357.7 | | |

| 309.2 | | |

| 48.5 | | |

| 16 | % |

| Depreciation, depletion and amortization | |

| 157.2 | | |

| 60.5 | | |

| 96.7 | | |

| 160 | % |

| Impairment charges | |

| - | | |

| 350.0 | | |

| (350.0 | ) | |

| nm | |

| | |

| (60.5 | ) | |

| (312.4 | ) | |

| 251.9 | | |

| 81 | % |

| Other operating expense | |

| 4.1 | | |

| 5.2 | | |

| (1.1 | ) | |

| (21 | )% |

| Exploration and business development | |

| 35.7 | | |

| 10.0 | | |

| 25.7 | | |

| nm | |

| Segment operating loss | |

$ | (100.3 | ) | |

$ | (327.6 | ) | |

$ | 227.3 | | |

| nm | |

| (a) | Includes

24,768,000 tonnes placed on the heap leach pads during 2023 (2022 – 22,831,000 tonnes). |

| (b) | Amounts

represent mill grade and recovery only. Ore placed on the heap leach pads had an average grade

of 0.39 grams per tonne during 2023 (2022 – 0.32 grams per tonne). Due to the nature of heap

leach operations, point-in-time recovery rates are not meaningful. |

| (c) | “nm”

means not meaningful. |

The Company acquired a 50% ownership

interest in the Round Mountain open pit mine, located in Nye County, Nevada, with the acquisition of Echo Bay Mines Ltd. on January 31, 2003.

On January 11, 2016, the Company acquired the remaining 50% interest in Round Mountain, along with the Bald Mountain gold mine, from Barrick

Gold Corporation (“Barrick”).

2023

vs. 2022

Tonnes of ore mined increased by 17%

and grades increased by 10% compared to 2022, as a result of planned mine sequencing which focused on higher grade ore from Phase W2 during

the second half of 2023. Tonnes of ore processed increased by 7%, compared to 2022, due to the increase in tonnes of ore mined and tonnes