J.P. Morgan Launches Private Markets Data Solutions for Institutional Investors

October 22 2024 - 9:00AM

Business Wire

Fusion by J.P. Morgan releases a new suite of private markets

data services that delivers standardized data aggregated from

multiple vendors and sources, allowing investors to analyze their

complete portfolio across private and publicly traded holdings.

J.P. Morgan today announced the launch of its Private Markets

Data Solutions for institutional investors, available through

Fusion by J.P. Morgan. This is a comprehensive data management

solution for private assets that enables investors, both General

Partners (GP) and Limited Partners (LP), to analyze and gain

transparency into their complete portfolio across public and

private holdings and eliminate the manual processes of managing

this operational workflow at scale.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20241016890254/en/

Flowchart shows the capabilities of J.P.

Morgan Fusion’s new suite of private markets data services.

(Graphic: Business Wire)

The growth of alternative portfolios has presented investors

with unique data challenges. The lack of a single, standardized

source for private markets means investors are left with incomplete

and fragmented data that is difficult to analyze. The process of

manually extracting and integrating data from unstructured sources

is time-consuming, costly, and error prone. Managing multiple

vendors, data feeds, and portfolio administrators complicates data

consolidation and transparency, affecting decision-making and

necessitating specialized expertise and scalable technology, which

further escalates costs and delays time to market.

Fusion minimizes the need for resource-intensive processes by

offloading this workload to algorithms that work automatically,

accelerating time to insights. Data is ingested from J.P. Morgan

Securities Services and portfolio administrators, which is then

complemented with reference data from vendors. Developed by J.P.

Morgan’s data experts, Fusion’s proprietary AI-ML technology helps

correct discrepancies and incompleteness and applies standard

identifiers for consistency and easy interoperability. Clients

receive standardized, enriched data that is consistent across

diverse asset classes like private equity, real estate, venture

capital, natural resources, and infrastructure, while preserving

granular detail and linkage.

Tim Fitzgerald, Global Head of Securities Services, said,

“Securities Services is committed to helping clients meet the

challenges of an increasingly competitive private asset market with

innovative data-driven solutions. Our platform empowers clients

with more information to drive their decision making, while

optimizing their workflow.”

To offer clients a single source for more complete, high-quality

data that works across public and private assets, Fusion has

incorporated data from Aumni, J.P. Morgan's private capital

platform, and external leading data providers like Canoe

Intelligence, MSCI Private Capital Solutions, and PitchBook.

Investors can analyze and manage their data with the Fusion Data

Explorer tool, allowing them to drill down into underlying assets

and navigate across linked data points, for a deeper understanding

of their holdings.

Gerard Francis, Head of Fusion, said, “Fusion is uniquely

positioned to integrate private markets and client investment data,

leveraging proprietary graph technology and AI-ML models for

comprehensive portfolio transparency and interoperability. Our

cloud-native platform supports data from multiple portfolio

administrators and vendors, ensuring seamless integration,

scalability, and a streamlined experience without legacy

infrastructure constraints."

Fusion’s Data Mesh supports a variety of cloud-native channels,

designed to simplify the process of integrating Fusion data into

clients’ existing technology stack. For business users, the newly

launched Fusion Drive enables desktop applications like Excel,

Tableau, and Alteryx to connect directly to Fusion data, and

receive updates automatically.

Learn more:

fusion.jpmorgan.com/solutions/private-markets

Key Capabilities:

- Private markets data integration: Fusion takes in

reference data from leading providers like Aumni (J.P. Morgan’s

private capital platform), Canoe Intelligence, MSCI Private Capital

Solutions, and PitchBook.

- Data ingestion from multiple fund and portfolio

administrators: Fusion supports portfolio data from J.P. Morgan

Securities Services and other portfolio administrators that clients

use. Data is harmonized for seamless interoperability across

administrators.

- Data normalization: Data is normalized to look and feel

the same, so it’s ready to be used across investors’ operating

models. Fusion models data for clarity and consistency, applying

standard identifiers and linking relevant datapoints.

- Complete portfolio view and Data Explorer: Investors can

view, analyze, and drill down into private market data using an

intuitive exploration tool. The linked data model enables

interoperability between private and public asset classes,

portfolios and accounts, to easily dive deep and analyze.

- Data management: Fusion gives clients powerful controls

to apply rules-based adjustments and overrides to data. This

functionality allows users to ensure data is fit-for-purpose across

multiple lines of business without altering the underlying data or

linkage.

- Data Mesh: Fusion offers a suite of cloud-native

channels for clients to integrate Fusion data directly into their

tech stacks, including API, Jupyter Notebook, Snowflake, Databricks

and more. Connect data directly to your desktop applications with

Fusion Drive.

About Fusion by J.P.

Morgan

Fusion is a cloud-native data technology solution that provides

data management, analytics and reporting for institutional

investors. Fusion builds on J.P. Morgan’s global operating model

and rich data foundation as an industry-leading Securities Services

provider to deliver benefits of scale and reduce costs. With a

broad array of integrated solutions that span investment

strategies, fund structures, asset types and geographies, J.P.

Morgan Securities Services delivers the expertise, scale and

capabilities to help our clients protect and grow their assets,

optimize efficiency and maximize opportunities in diverse global

markets.

About the Commercial & Investment

Bank

J.P. Morgan’s Commercial & Investment Bank is a global

leader in banking, payments, markets and securities services.

Start-ups, companies, governments and institutions entrust us with

their business in more than 100 countries worldwide. With $35.8

trillion of assets under custody and $966 billion in deposits, the

Commercial & Investment Bank provides strategic advice, raises

capital, manages risk, offers payment solutions, safeguards assets

and extends liquidity in global markets. Further information about

J.P. Morgan is available at www.jpmorgan.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241016890254/en/

Media Contact: Gurpreet Kaur 212-270-8894

gurpreet.x3.kaur@jpmorgan.com

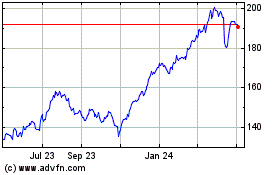

JP Morgan Chase (NYSE:JPM)

Historical Stock Chart

From Oct 2024 to Nov 2024

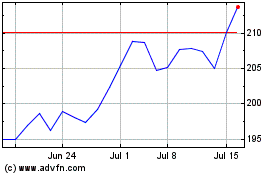

JP Morgan Chase (NYSE:JPM)

Historical Stock Chart

From Nov 2023 to Nov 2024