UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13A-16 OR 15D-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of August 2023

Commission File Number: 001-34244

HUDBAY MINERALS INC.

(Translation of registrant’s name into English)

25 York Street, Suite 800

Toronto, Ontario

M5J 2V5, Canada

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F [ ] Form 40-F [X]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): [ ]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): [ ]

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes [ ] No [X]

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- _____________________________

EXPLANATORY NOTE

On August 8, 2023, Hudbay Minerals Inc. (“Hudbay”) filed on the Canadian Securities Administrators’ System for Electronic Document Analysis and Retrieval (SEDAR) website at www.sedarplus.ca the following documents: (1) News Release dated August 8, 2023, (2) Unaudited Condensed Consolidated Interim Financial Statements for the period ended June 30, 2023, (3) Management's Discussion and Analysis of Results of Operations and Financial Condition for the period ended June 30, 2023, (4) Form 52-109F2 Certification of Interim Filings Full Certificate - CEO, (5) Form 52-109F2 Certification of Interim Filings Full Certificate - CFO.

Copies of the filings are attached to this Form 6-K and incorporated herein by reference, as follows:

-

Exhibit 99.1 — News Release dated August 8, 2023

-

Exhibit 99.2 — Unaudited Condensed Consolidated Interim Financial Statements for the period ended June 30, 2023

-

Exhibit 99.3 — Management's Discussion and Analysis of Results of Operations and Financial Condition for the period ended June 30, 2023

-

Exhibit 99.4 — Form 52-109F2 Certification of Interim Filings Full Certificate - CEO

-

Exhibit 99.5 — Form 52-109F2 Certification of Interim Filings Full Certificate - CFO

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

HUDBAY MINERALS INC. |

| |

(registrant) |

| |

|

|

| |

By: |

/s/ Eugene Lei |

| |

Name: |

Eugene Lei |

| |

Title: |

Chief Financial Officer |

Date: August 9, 2023

3

EXHIBIT INDEX

The following exhibits are furnished as part of this Form 6-K:

4

|

TSX, NYSE - HBM

2023 No. 20

|

| |

|

25 York Street, Suite 800

Toronto, Ontario

Canada M5J 2V5

tel 416 362-8181

fax 416 362-7844

hudbay.com |

News Release |

|

|

Hudbay Announces Second Quarter 2023 Results

Toronto, Ontario, August 8, 2023 - Hudbay Minerals Inc. ("Hudbay" or the "company") (TSX, NYSE:HBM) today released its second quarter 2023 financial results. All amounts are in U.S. dollars, unless otherwise noted.

Positioned for Strong Production Growth and Free Cash Flow Generation in the Second Half of 2023

- Reaffirmed full year 2023 consolidated production, cash cost and sustaining cash cost guidance for Hudbay's Peru and Manitoba operations.

- On June 20, 2023, Hudbay completed the acquisition of Copper Mountain Mining Corporation ("Copper Mountain"), creating a 150,000-tonnes-per-year copper producer with three long-life mines in tier-one jurisdictions and a world-class pipeline of organic copper growth projects.

- Copper Mountain owns 75% of the Copper Mountain mine in British Columbia (the "Copper Mountain Mine Joint Venture"), with Mitsubishi Materials Corporation ("MMC") holding the remaining non-controlling interest.

- Hudbay expects to release an updated technical report for the Copper Mountain mine in the fourth quarter, which will include updated annual production and cost estimates for the mine.

- Achieved higher grades from Pampacancha in July with 1.6 million tonnes of ore mined at 0.63% copper and 0.31 grams per tonne gold, consistent with the mine plan and company expectations for higher production in Peru in the third and fourth quarters of 2023.

Second Quarter Operating and Financial Results

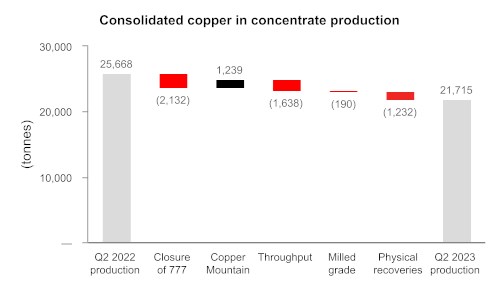

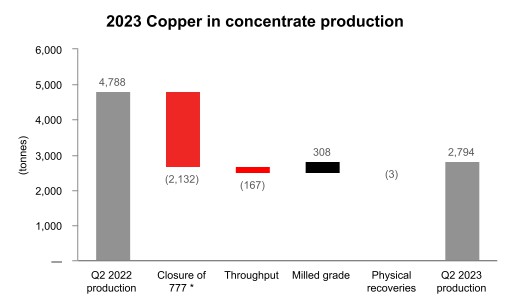

- Consolidated production in the second quarter was 21,715 tonnes of copper and 48,996 ounces of gold, which includes production from the Copper Mountain mine during the 10-day stub period following the June 20, 2023 acquisition date.

- Consolidated cash cost and sustaining cash cost per pound of copper produced, net of by-product credits[i], in the second quarter, were $1.60 and $2.73, respectively, excluding Copper Mountain's costs during the 10-day stub period.

- Peru operations successfully managed through a transitional quarter with elevated stripping activities at Pampacancha completed in June to enable mining high grade portions of the orebody in the second half of 2023. The Peru operations maintained steady performance, producing 17,682 tonnes of copper in the second quarter, which was in line with mine plan expectations. Peru cash cost per pound of copper produced, net of by-product creditsi, in the second quarter was $2.14, in line with quarterly cadence expectations as Pampacancha is expected to deliver higher copper production and precious metal by-product credits in the second half of 2023.

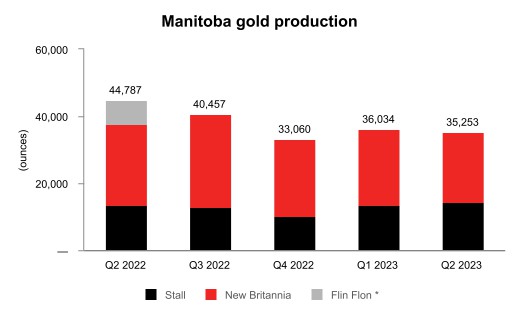

- Manitoba operations produced 35,253 ounces of gold, which was impacted by lower throughput at the Stall mill due to downtime to complete the Stall mill Phase I recovery improvement project tie-ins which resulted in a buildup of surface ore stockpiles at the end of the second quarter. Lalor achieved an 11% increase in ore mined versus the first quarter as the company continues to implement improvements to reduce costs and target higher production levels. Manitoba cash cost per ounce of gold produced, net of by-product creditsi, was $1,097 and is expected to decline to be within the annual guidance range due to higher throughput, gold recoveries and gold grades expected in the second half of 2023.

- Second quarter net loss and loss per share were $14.9 million and $0.05, respectively. After adjusting for $6.8 million of transaction costs incurred during the quarter associated with the acquisition of Copper Mountain and a non-cash gain of $4.7 million related to a quarterly revaluation of the company's closed site environmental reclamation provision, among other items, second quarter adjusted lossi per share was $0.07.

- Operating cash flow before change in non-cash working capital was $55.9 million and adjusted EBITDAi was $81.2 million in the second quarter.

- Cash and cash equivalents declined during the second quarter to $179.7 million and were negatively impacted by lower base metal prices and lower production volumes as a result of scheduled mill maintenance programs, elevated stripping activity in Peru and a buildup of ore stockpiles in Manitoba. Cash and cash equivalents were also impacted by $25.8 million in total transaction costs related to the acquisition of Copper Mountain, $65.9 million of capital investments, primarily related to sustaining capital investments, and a $31.9 million bond interest payment.

Executing on Growth Initiatives and Prudent Financial Planning

• Copper Mountain integration activities are progressing in line with expectations with over 50% of the targeted annualized corporate and tax synergies already achieved to date. The company is focused on advancing its plans to stabilize the operation over the next 12 months, to be further detailed in a technical report, which will include an updated mine plan and mineral reserve and resource estimates, expected to be released in the fourth quarter.

• Copper World pre-feasibility study for Phase I is well-advanced and expected to be released in the third quarter.

• Snow Lake drilling intersected new high-grade copper-gold-silver zone 500 metres northwest of Lalor and indicates the hosting mineralization at Lalor continues down plunge for at least two kilometres.

• Completed the acquisition of the Cook Lake properties in Snow Lake, providing the potential for a new discovery on claims untested by modern geophysics and where historical drilling intersected base metal and gold mineralization at a fraction of Lalor's current known depth.

• Announced the entry into a definitive agreement to acquire all the issued and outstanding common shares of Rockcliff Metals Corp. ("Rockcliff"), which is expected to increase Hudbay's land position within trucking distance of its Snow Lake processing facilities by more than 250%. The transaction is expected to close in the third quarter.

• On July 6, 2023, established framework for a multi-year exploration partnership with Marubeni Corporation focused on the discovery of new deposits within trucking distance of Hudbay's processing facilities in Flin Flon, Manitoba.

• First phase of the Stall recovery improvement project was completed during the second quarter with commissioning completed in May and ramp-up to higher metal recoveries expected in the second half of 2023.

• In connection with the Copper Mountain transaction, Hudbay amended its Revolving Credit Facilities ("RCFs") to (i) exclude the Copper Mountain group from the financial covenant calculations in the RCFs until the Copper Mountain Nordic bonds are repaid in full and (ii) increase the net debt to EBITDA covenant ratio to provide greater financial flexibility during the integration period.

• Subsequent to quarter end, Hudbay drew $90 million from its RCFs to finance the redemption of a portion of Copper Mountain's Nordic bonds, thus improving the company's ability to deleverage and repay debt sooner than the bond maturity.

• On track to deliver annual discretionary spending reduction targets for 2023 with lower growth capital and exploration expenditures compared to 2022. As a result of a continued focus on discretionary spending reductions, total capital expenditures for 2023 are expected to be approximately $15 million lower than guidance levels, representing 5% of total capital expenditure guidance.

"We remain on track to meet our 2023 guidance as we completed many transitional activities in the second quarter that position us for stronger production and improved costs during the second half of 2023," said Peter Kukielski, President and Chief Executive Officer. "The higher grades we are currently mining at Pampacancha, the planned improved throughput and recoveries in Snow Lake and the recent completion of the Copper Mountain acquisition are expected to generate strong free cash flows starting in the third quarter of 2023. With Copper Mountain we have a larger and more resilient operating platform to deliver diversified cash flows to prudently advance our leading organic pipeline of brownfield expansion and greenfield exploration and development opportunities across our portfolio."

Summary of Second Quarter Results

Consolidated copper production in the second quarter of 2023 was 21,715 tonnes, a decrease of 4% compared to the first quarter of 2023 as the company completed the higher volume stripping program at Pampacancha in June and a scheduled mill maintenance program at Constancia, partially offset by a 10-day stub period of production from the newly acquired Copper Mountain mine (the "Copper Mountain Stub Period"). Consolidated gold production in the quarter was 48,996 ounces, a 4% increase over the prior quarter, primarily due to slightly higher gold grades and higher gold recoveries in Peru. Consolidated silver production in the second quarter was 612,310 ounces, a decrease of 13% compared to the first quarter primarily due to lower silver grades in Peru. Consolidated zinc production in the second quarter was 8,758 tonnes, a decline of 11% compared to the first quarter due to lower throughput and zinc head grades at Stall.

Consolidated cash cost per pound of copper produced, net of by-product creditsi, in the second quarter of 2023 was $1.60, compared to $0.85 in the first quarter of 2023. This increase was mainly the result of higher mining, milling and treatment and refining costs and lower copper production. Consolidated cash cost for the first six months of 2023 was above 2023 guidance ranges but remained in line with quarterly cadence expectations, and the company expects consolidated cash cost to decline in the second half of 2023 to be within the full year guidance range. Consolidated sustaining cash cost per pound of copper produced, net of by-product creditsi, was $2.73 in the second quarter of 2023 compared to $1.83 in the first quarter. Consolidated all-in sustaining cash cost per pound of copper produced, net of by-product creditsi, was $2.98 in the second quarter of 2023, higher than $2.07 in the first quarter, primarily due to the same reasons outlined above. Consolidated cash cost and sustaining cash cost for the second quarter and year-to-date exclude Copper Mountain's operations, as no revenues or corresponding cost of sales were recorded during the Copper Mountain Stub Period.

Cash generated from operating activities in the second quarter of 2023 decreased to $24.6 million compared to $71.3 million in the first quarter primarily due to higher operating costs in Peru associated with the scheduled mill maintenance program and higher planned stripping activities at Pampacancha. Operating cash flow before changes in non-cash working capital was $55.9 million during the second quarter of 2023, lower than the first quarter, due to the same reasons noted above.

Net loss and loss per share in the second quarter of 2023 were $14.9 million and $0.05, respectively, compared to net earnings and earnings per share of $5.5 million and $0.02, respectively, in the first quarter. The results were negatively impacted by $6.8 million of transaction costs associated with the acquisition of Copper Mountain and a $1.4 million foreign exchange loss. This was partially offset by a non-cash gain of $4.7 million related to the quarterly revaluation of the environmental reclamation provision at the company's closed sites and a $1.1 million revaluation gain related to the gold prepayment liability.

Adjusted net lossi and adjusted net loss per sharei in the second quarter of 2023 were $18.3 million and $0.07 per share, respectively, after adjusting for $6.8 million of transaction costs associated with the acquisition of Copper Mountain and the non-cash revaluation gain of the environmental reclamation provision, among other items. Second quarter adjusted EBITDAi was $81.2 million, compared to $101.9 million in the first quarter of 2023, as higher operating costs in Peru associated with the scheduled mill maintenance program more than offset higher revenue from an increase in sales volumes.

On June 20, 2023, Hudbay successfully completed its previously announced acquisition of Copper Mountain (the "Copper Mountain Transaction"). Copper Mountain's first shipment of copper concentrate following the acquisition occurred on July 23, 2023 after a brief strike action at the Port of Vancouver earlier in July. As such, Hudbay's second quarter results were not materially affected by Copper Mountain's operations with no revenues or corresponding cost of sales recorded during the Copper Mountain Stub Period. Combined acquisition-related costs incurred were $25.8 million, of which $6.8 million related to Hudbay's legal and advisory fees that were expensed during the second quarter, while the remaining costs were incurred by Copper Mountain prior to completion of the acquisition.

As at June 30, 2023, liquidity included $179.7 million in cash and cash equivalents as well as undrawn availability of $184.1 million under the company's RCFs. Subsequent to quarter end, Hudbay drew $90 million from its RCFs to finance the redemption of $83.3 million of Copper Mountain's bonds, thereby reducing the aggregate amount of Copper Mountain bonds outstanding to $59.7 million and improving the company's ability to deleverage and repay debt sooner than the 2026 bond maturity. Based on expected free cash flow generation in the second half of 2023, Hudbay continues to expect to make progress on its deleveraging targets as outlined in its "3-P" plan for sanctioning Copper World. Current liquidity combined with cash flow from operations is expected to be sufficient to meet liquidity needs for the foreseeable future.

| Consolidated Financial Condition ($000s)3 |

Jun. 30, 2023 |

Mar. 31, 2023 |

Dec. 31, 2022 |

| Cash |

179,734 |

255,563 |

225,665 |

| Total long-term debt |

1,370,682 |

1,225,023 |

1,184,162 |

| Net debt1 |

1,190,948 |

969,460 |

958,497 |

| Working capital2 |

(61,357) |

100,987 |

76,534 |

| Total assets |

5,242,140 |

4,367,982 |

4,325,943 |

| Equity |

2,001,970 |

1,574,521 |

1,571,809 |

1 Net debt is a non-IFRS financial performance measure with no standardized definition under IFRS. For further information, please see the "Non-IFRS Financial Performance Measures" section of this news release.

2 Working capital is determined as total current assets less total current liabilities as defined under IFRS and disclosed on the consolidated interim financial statements. Working capital reflects the full $145 million balance of Copper Mountain Nordic bonds as current, however, subsequent to quarter end, the company drew $90 million from its revolving credit facilities to finance the redemption of a portion of Copper Mountain's Nordic bonds. As of the date hereof, the remaining Copper Mountain Nordic bonds will be presented as long-term as well as the $90 million revolver draw.

3 Following completion of the Copper Mountain acquisition on June 20, 2023, the company's financial condition has been impacted by the inclusion of Copper Mountain as at June 30, 2023 and accordingly there is no comparable period information.

| Consolidated Financial Performance2 |

|

Three Months Ended |

| |

|

Jun. 30, 2023 |

Mar. 31, 2023 |

Jun. 30, 2022 |

| Revenue |

$000s |

312,166 |

295,219 |

415,454 |

| Cost of sales |

$000s |

289,273 |

228,706 |

325,940 |

| Earnings (loss) before tax |

$000s |

(30,731) |

17,430 |

21,504 |

| Earnings (loss) |

$000s |

(14,932) |

5,457 |

32,143 |

| Basic and diluted earnings (loss) per share |

$/share |

(0.05) |

0.02 |

0.12 |

| Adjusted earnings (loss) per share1 |

$/share |

(0.07) |

0.00 |

0.12 |

| Operating cash flow before change in non-cash working capital |

$ millions |

55.9 |

85.6 |

123.9 |

| Adjusted EBITDA1 |

$ millions |

81.2 |

101.9 |

141.4 |

1 Adjusted (loss) earnings per share and adjusted EBITDA are non-IFRS financial performance measures with no standardized definition under IFRS. For further information, please see the "Non-IFRS Financial Performance Measures" section.

2 Following completion of the Copper Mountain acquisition on June 20, 2023, the company's financial performance has not been materially affected by Copper Mountain's operations with no revenues or corresponding cost of sales recorded during the Copper Mountain Stub Period of 2023.

| Consolidated Production and Cost Performance |

|

Three Months Ended |

| |

|

Jun. 30, 2023 |

Mar. 31, 2023 |

Jun. 30, 2022 |

| Contained metal in concentrate and doré produced1 |

|

|

|

|

| Copper |

tonnes |

21,715 |

22,562 |

25,668 |

| Gold |

ounces |

48,996 |

47,240 |

58,645 |

| Silver |

ounces |

612,310 |

702,809 |

864,853 |

| Zinc |

tonnes |

8,758 |

9,846 |

17,053 |

| Molybdenum |

tonnes |

414 |

289 |

390 |

| Payable metal sold |

|

|

|

|

| Copper |

tonnes |

23,078 |

18,541 |

23,650 |

| Gold2 |

ounces |

47,533 |

49,720 |

50,884 |

| Silver2 |

ounces |

805,448 |

541,884 |

738,171 |

| Zinc3 |

tonnes |

8,641 |

5,628 |

20,793 |

| Molybdenum |

tonnes |

314 |

254 |

208 |

| Consolidated cash cost per pound of copper produced4 |

|

|

|

|

| Cash cost |

$/lb |

1.60 |

0.85 |

0.65 |

| Sustaining cash cost |

$/lb |

2.73 |

1.83 |

1.87 |

| All-in sustaining cash cost |

$/lb |

2.98 |

2.07 |

1.93 |

1 Metal reported in concentrate is prior to deductions associated with smelter contract terms. Consolidated production includes production results from Copper Mountain for the Copper Mountain Stub Period.

2 Includes total payable gold and silver in concentrate and in doré sold.

3 For the three months ended June 30, 2023 and the three months ended March 31, 2023 this metric includes payable zinc in concentrate sold. For the three months ended June 30, 2022, this metric also includes payable refined zinc metal sold.

4 Consolidated cash cost, sustaining cash cost and all-in sustaining cash cost per pound of copper produced, net of by-product credits, does not include Copper Mountain production or costs for the Copper Mountain Stub Period at the end of the second quarter of 2023, nor the comparative periods. Cash cost, sustaining cash cost and all-in sustaining cash cost per pound of copper produced, net of by-product credits, gold cash cost, sustaining cash cost per ounce of gold produced, net of by-product credits, are non-IFRS financial performance measures with no standardized definition under IFRS. For further information, please see the "Non-IFRS Financial Performance Measures" section of this news release.

Peru Operations Review

| Peru Operations |

|

Three Months Ended |

| |

|

Jun. 30, 2023 |

Mar. 31, 2023 |

Jun. 30, 2022 |

| Constancia ore mined1 |

tonnes |

3,647,399 |

3,403,181 |

7,017,114 |

| Copper |

% |

0.31 |

0.34 |

0.33 |

| Gold |

g/tonne |

0.04 |

0.04 |

0.04 |

| Silver |

g/tonne |

2.49 |

2.52 |

3.53 |

| Molybdenum |

% |

0.01 |

0.01 |

0.01 |

| Pampacancha ore mined |

tonnes |

2,408,495 |

897,295 |

1,211,387 |

| Copper |

% |

0.36 |

0.49 |

0.29 |

| Gold |

g/tonne |

0.34 |

0.52 |

0.28 |

| Silver |

g/tonne |

2.81 |

5.12 |

4.25 |

| Molybdenum |

% |

0.02 |

0.01 |

0.01 |

| Total ore mined |

tonnes |

6,055,894 |

4,300,476 |

8,228,501 |

| Strip ratio2 |

|

1.74 |

1.84 |

1.22 |

| Ore milled |

tonnes |

7,223,048 |

7,663,728 |

7,770,706 |

| Copper |

% |

0.31 |

0.33 |

0.32 |

| Gold |

g/tonne |

0.09 |

0.08 |

0.09 |

| Silver |

g/tonne |

2.78 |

3.69 |

3.64 |

| Molybdenum |

% |

0.01 |

0.01 |

0.01 |

| Copper recovery |

% |

80.0 |

81.7 |

85.0 |

| Gold recovery |

% |

61.1 |

56.8 |

60.3 |

| Silver recovery |

% |

65.1 |

60.7 |

64.2 |

| Molybdenum recovery |

% |

40.5 |

34.8 |

38.8 |

| Contained metal in concentrate |

|

|

|

|

| Copper |

tonnes |

17,682 |

20,517 |

20,880 |

| Gold |

ounces |

12,998 |

11,206 |

13,858 |

| Silver |

ounces |

419,642 |

552,167 |

584,228 |

| Molybdenum |

tonnes |

414 |

289 |

390 |

| Payable metal sold |

|

|

|

|

| Copper |

tonnes |

21,207 |

16,316 |

18,473 |

| Gold |

ounces |

14,524 |

11,781 |

8,430 |

| Silver |

ounces |

671,532 |

392,207 |

484,946 |

| Molybdenum |

tonnes |

314 |

254 |

208 |

| Combined unit operating cost3,4,5 |

$/tonne |

14.07 |

11.47 |

12.02 |

| Cash cost5 |

$/lb |

2.14 |

1.36 |

1.82 |

| Sustaining cash cost5 |

$/lb |

3.06 |

2.12 |

2.62 |

1 Reported tonnes and grade for ore mined are estimates based on mine plan assumptions and may not reconcile fully to ore milled.

2 Strip ratio is calculated as waste mined divided by ore mined.

3 Reflects combined mine, mill and general and administrative ("G&A") costs per tonne of ore milled. Reflects the deduction of expected capitalized stripping costs.

4 Excludes approximately $1.3 million, or $0.16 per tonne, COVID-related costs during the three months ended June 30, 2022.

5 Combined unit operating cost, cash cost and sustaining cash cost per pound of copper produced, net of by-product credits, are non-IFRS financial performance measures with no standardized definition under IFRS. For further information, please see the "Non-IFRS Financial Performance Measures" section of this news release.

During the second quarter of 2023, the Constancia operations produced 17,682 tonnes of copper, 12,998 ounces of gold, 419,642 ounces of silver and 414 tonnes of molybdenum. With the period of higher planned stripping activities in the Pampacancha pit completed in June and ore mined from Pampacancha in July totaling 1.6 million tonnes at 0.63% copper and 0.31 grams per tonne gold, the company is well on track to achieve the higher expected production in the second half of the year, in line with the full year 2023 Peru production guidance.

Total ore mined in the second quarter of 2023 increased by 41% compared to the first quarter as mining activities returned to normal after the company reduced mining activities in the first quarter to conserve fuel during the period of logistical constraints caused by civil unrest earlier this year.

Ore milled during the second quarter of 2023 was 6% lower than the prior quarter primarily due to a schedule plant maintenance shutdown in the second quarter without a corresponding shutdown in the first quarter. Milled copper grades were slightly lower than the first quarter due to the continued processing of lower-grade ore from stockpiles as the company completed a period of higher planned stripping activities in the Pampacancha pit in June. Recoveries of copper during the second quarter of 2023 remained at low levels, as expected, due to higher levels of impurities in stockpiled ore. Recoveries for gold and silver were 8% and 7% higher, respectively, than the first quarter due to higher gold grades and lower zinc content impurities in ore processed.

Combined mine, mill and G&A unit operating costs in the second quarter of 2023 were 23% higher than the first quarter primarily due to higher costs related to the scheduled plant shutdown and lower milled ore throughput during the quarter.

Peru's cash cost per pound of copper produced, net of by-product creditsi, in the second quarter of 2023 was $2.14, higher than the first quarter primarily due to higher mining, milling and treatment and refining charges and lower copper production. This cost measure remains above the upper end of the 2023 guidance range. However, it is expected to decline meaningfully in the second half of 2023 and the full year cash cost is expected to remain within the 2023 guidance range with higher expected copper production and contributions from precious metal by-product credits from Pampacancha later this year.

Peru's sustaining cash cost per pound of copper produced, net of by-product creditsi, in the second quarter of 2023 was $3.06, higher than the first quarter due to the same factors affecting cash cost noted above.

Manitoba Operations Review

| Manitoba Operations |

|

Three Months Ended |

| |

|

Jun. 30, 2023 |

Mar. 31, 2023 |

Jun. 30, 20221 |

| Lalor |

|

|

|

|

| Ore mined |

tonnes |

413,255 |

373,599 |

412,653 |

| Gold |

g/tonne |

4.07 |

3.96 |

3.73 |

| Copper |

% |

0.81 |

0.57 |

0.70 |

| Zinc |

% |

3.14 |

3.32 |

3.06 |

| Silver |

g/tonne |

23.27 |

18.24 |

23.95 |

| New Britannia |

|

|

|

|

| Ore milled |

tonnes |

141,905 |

143,042 |

144,589 |

| Gold |

g/tonne |

5.82 |

6.05 |

5.69 |

| Copper |

% |

0.77 |

0.61 |

0.73 |

| Zinc |

% |

0.85 |

0.76 |

0.94 |

| Silver |

g/tonne |

25.79 |

22.39 |

19.77 |

| Gold recovery - concentrate |

% |

55.0 |

62.0 |

62.7 |

| Copper recovery - concentrate |

% |

91.2 |

91.7 |

92.4 |

| Silver recovery - concentrate |

% |

57.0 |

61.9 |

62.9 |

| Stall Concentrator |

|

|

|

| Ore milled |

tonnes |

238,633 |

242,619 |

261,417 |

| Gold |

g/tonne |

3.12 |

2.78 |

2.95 |

| Copper |

% |

0.85 |

0.59 |

0.73 |

| Zinc |

% |

4.47 |

4.81 |

4.45 |

| Silver |

g/tonne |

22.15 |

17.14 |

26.31 |

| Gold recovery |

% |

59.9 |

61.9 |

54.6 |

| Copper recovery |

% |

88.5 |

87.0 |

88.0 |

| Zinc recovery |

% |

82.2 |

84.4 |

84.3 |

| Silver recovery |

% |

60.3 |

56.3 |

56.1 |

| Total contained metal in concentrate and doré2 |

|

|

| Gold |

ounces |

35,253 |

36,034 |

44,787 |

| Copper |

tonnes |

2,794 |

2,045 |

4,788 |

| Zinc |

tonnes |

8,758 |

9,846 |

17,053 |

| Silver |

ounces |

180,750 |

150,642 |

280,625 |

| Total payable metal sold |

|

|

|

| Gold3 |

ounces |

33,009 |

37,939 |

42,454 |

| Copper |

tonnes |

1,871 |

2,225 |

5,177 |

| Zinc |

tonnes |

8,641 |

5,628 |

20,793 |

| Silver3 |

ounces |

133,916 |

149,677 |

253,225 |

| Combined unit operating cost4,5 |

C$/tonne |

220 |

216 |

168 |

| Gold cash cost5 |

$/oz |

1,097 |

938 |

(207) |

| Gold sustaining cash cost5 |

$/oz |

1,521 |

1,336 |

519 |

1 The 777 mine and Flin Flon concentrator information for June 30, 2022 is not disclosed in the table above. The operations were closed in June 2022. The relevant comparative information can be found in the Summary of Historical Results section in the Management's Discussion and Analysis for the second quarter of 2023. Total contained metal in concentrate and doré, total payable metal sold, unit cost and cash costs for June 30, 2022 include the impact of the Flin Flon operations.

2 Doré includes sludge, slag and carbon fines in three months ended June 30, 2023 and March 31, 2023.

3 Includes total payable precious metals in concentrate and doré sold.

4 Reflects combined mine, mill and G&A costs per tonne of ore milled.

5 Combined unit operating cost, cash cost and sustaining cash cost per ounce of gold produced, net of by-product credits, are non-IFRS financial performance measures with no standardized definition under IFRS. For further information, please see the "Non-IFRS Financial Performance Measures" section of this news release.

During the second quarter of 2023, the Manitoba operations produced 35,253 ounces of gold, 8,758 tonnes of zinc, 2,794 tonnes of copper and 180,750 ounces of silver. Production of copper and silver was higher than the first quarter due to higher grades and recoveries. Production of gold and zinc was lower than the first quarter due to lower recoveries and lower zinc grades, partially offset by higher gold grades. With the completion of a number of key initiatives aimed to continue to support higher production levels at Lalor, improved metal recoveries at the mills and a prioritization of mining higher gold grade zones at Lalor in the second half of 2023, as planned, full year Manitoba production of all metals remains on track to achieve guidance ranges. However, with a slower ramp-up of gold recoveries associated with the Stall Phase I recovery improvement project in the second quarter, gold production is trending towards the lower end of the 2023 guidance range for Manitoba, while copper and zinc production is trending towards the upper end of the guidance ranges.

The Manitoba team continues to advance several key initiatives to support higher production levels and improved metal recoveries at the Snow Lake operations. Significant progress has been made at Lalor in optimizing development drift size, improving shaft availability and implementing changes to achieve better stope muck fragmentation, which enabled the elimination of inefficient trucking of ore to surface via the ramp late in the second quarter. The first phase of the Stall mill recovery improvement project, consisting of new cyclone packs, state-of-the-art Jameson Cells on the copper and zinc circuits and process control improvements, was completed during the second quarter. Commissioning of the circuits quickly achieved targeted copper and zinc concentrate grades, while gold recovery improvements progressed slower than planned. Changes to optimize the circuit are underway and the company expects to achieve higher gold recoveries in the second half of 2023. Hudbay also implemented tailings deposition improvements that are expected to maximize the Anderson facility tailings capacity and defer incremental dam construction activities to future years.

Hudbay successfully completed planned maintenance of the muck circuit, rock breaker boom change out and repairs and electrical installations at Lalor during the second quarter. Despite this planned maintenance program, ore mined from Lalor increased by 11% in the second quarter compared to the first quarter, averaging over 4,500 tonnes per day. Lalor continues to implement improvements to reduce costs and target higher production levels with a focus on equipment fleet availability and building of longhole inventory. Gold, copper and silver grades mined during the second quarter of 2023 were 3%, 42% and 28% higher, respectively, than the first quarter, while zinc grades were 5% lower than the first quarter, consistent with the mine plan.

The Stall mill processed similar levels of ore compared to the first quarter of 2023, in line with expectations, due to completion of the Phase I recovery improvement project during the quarter and the commissioning of new Jameson cells requiring associated tie-ins of piping, pump boxes and electrical instrumentation, as noted above. As a result of the temporary interruptions introduced by the project tie-ins, there was a buildup of approximately 30,000 tonnes of base metal ore stockpiles above normal levels at the end of second quarter that will be milled during the second half of 2023.

The New Britannia mill continued to achieve consistent production in the second quarter of 2023, averaging approximately 1,560 tonnes per day. Hudbay continues to advance improvement initiatives at New Britannia requiring minimal capital outlays with a focus on reducing reagent and grinding media consumption while further improving overall metal recoveries and copper concentrate grades. There was a buildup of approximately 15,000 tonnes of gold ore stockpiles above normal levels at the end of the second quarter, which will be milled during the second half of 2023.

Combined mine, mill and G&A unit operating costs in the second quarter of 2023 slightly increased compared to the first quarter reflecting slightly lower mill throughput due, in part, to the 45,000 tonnes of additional ore stockpiled above normal operating levels at the end of the second quarter.

Manitoba's cash cost per ounce of gold produced, net of by-product creditsi, in the second quarter was $1,097, higher than the first quarter of 2023, primarily due to higher mining costs, higher treatment and refining charges and lower gold production, partially offset by lower G&A. Gold cash cost is expected to decline in the second half of 2023 and the full year cash cost is expected to remain within the 2023 guidance range.

Sustaining cash cost per ounce of gold produced, net of by-product creditsi, in the second quarter was $1,521, higher than the first quarter due to the same factors affecting cash cost noted above.

Completion of the Copper Mountain Acquisition

On June 20, 2023, Hudbay successfully completed its previously announced acquisition of Copper Mountain, pursuant to which Hudbay has acquired all of the issued and outstanding common shares of Copper Mountain. As a result of the completion of the Copper Mountain Transaction, Copper Mountain became a wholly-owned subsidiary of Hudbay and Hudbay became the indirect owner of 75% of the Copper Mountain Mine Joint Venture. In aggregate, Hudbay issued 84,165,617 Hudbay common shares under the Copper Mountain Transaction to former Copper Mountain shareholders as consideration for their Copper Mountain shares. The Copper Mountain shares were de-listed from the TSX on June 21, 2023 and an application has been submitted with the applicable Canadian securities commissions for Copper Mountain to cease to be a reporting issuer under Canadian securities laws. In connection with the closing, Hudbay appointed Jeane Hull and Paula Rogers, former directors of Copper Mountain, to the board of Hudbay.

The Copper Mountain Transaction creates a premier Americas-focused copper mining company that is well-positioned to deliver sustainable cash flows from an operating portfolio of three long-life mines, as well as compelling organic growth from a world-class pipeline of copper mine expansion and development projects. All assets in the combined portfolio are located in the tier-one mining-friendly jurisdictions of Canada, Peru and the United States. The combined company represents the third largest copper producer in Canada based on 2023 estimated copper production.

Integrating the Copper Mountain Mine

Copper Mountain integration activities are progressing in line with expectations and over 50% of the targeted annualized corporate and tax synergies have already been achieved to date. The company is focused on advancing its plans to stabilize the operation over the next 12 months, including opening up the mine by adding additional mining faces and re-mobilizing idle haul trucks, optimizing the ore feed to the plant and implementing plant improvement initiatives. Further details on Hudbay's plans will be provided in a technical report, including an updated mine plan, revised mineral reserve and resource estimates, and updated annual production and cost estimates for the Copper Mountain mine, which is expected to be released in the fourth quarter.

During the Copper Mountain Stub Period, the Copper Mountain mine produced 1,239 tonnes of copper, 745 ounces of gold and 11,918 ounces of silver. The first copper concentrate shipment following the acquisition date was completed on July 23, 2023 after a brief strike at the Port of Vancouver earlier in July.

As an additional prudent measure to ensure free cash flow generation in the second half of 2023 as Hudbay stabilizes the Copper Mountain operations, subsequent to quarter-end, the Copper Mountain Mine Joint Venture entered into forward sales contracts for a total of 2,000 tonnes of copper production over the five-month period from August to December 2023 at an average price of $3.86 per pound.

Copper World Permitting and Pre-Feasibility Study Well-Advanced

In late 2022, Hudbay submitted the state-level applications for an Aquifer Protection Permit and an Air Quality Permit to the Arizona Department of Environmental Quality. The company expects to receive these two outstanding state permits by early 2024.

In May 2023, Hudbay received a favourable ruling from the U.S. Court of Appeals for the Ninth Circuit that reversed the U.S. Fish and Wildlife Service's designation of the area near Copper World and the former Rosemont project as jaguar critical habitat. While this ruling doesn't impact the state permitting process for Phase I of Copper World, it is expected to simplify the federal permitting process for Phase II of the Copper World project.

Pre-feasibility activities for Phase I are well-advanced and a pre-feasibility study is expected to be released in the third quarter of 2023. Hudbay intends to initiate a minority joint venture partner process prior to commencing a definitive feasibility study, which will allow the potential joint venture partner to participate in the funding of definitive feasibility study activities in 2024 as well as in the final project design for Copper World.

Potential for Snow Lake Mine Life Extension with Discovery of New Mineralized Zones Near Lalor and Significant Regional Land Consolidation

In July 2023, the company announced positive results from its 2023 winter drill program near Lalor in Snow Lake, Manitoba, and significant land consolidation in the Snow Lake region through several strategic transactions. The agreements with multiple land holders will increase Hudbay's holdings in the Snow Lake region by more than 250%. Hudbay intends to explore these claims in hopes of finding a new anchor deposit to maximize and extend the life of Hudbay's Snow Lake operations beyond 2038.

Lalor New Mineralized Zones

The 2023 winter drill program in Snow Lake included the testing of a geophysical anomaly located northwest of Lalor, within 500 metres of existing underground infrastructure. All holes intersected an alteration zone that is known to host the Lalor mineralization. Certain holes intersected several sulphide horizons with both zinc and copper-gold-silver mineralization. Hole CH2303 intersected three mineralized zones, including 7.0 metres of 3.06% zinc and 15.1 grams per tonne silver; 3.5 metres of 3.81% copper, 3.75 grams per tonne gold and 104.5 grams per tonne silver; and 7.5 metres of 3.87% zinc and 7.5 grams per tonne silver. For more information on the drill holes, please refer to Hudbay's news release dated July 27, 2023.

The winter drill program also included testing of the down-plunge copper-gold extensions of the Lalor deposit, in the first drilling in the deeper zones at Lalor since the initial discovery of the copper-gold zones in 2009 and 2010. This initial campaign consisted of eight widely spaced drill holes over a distance of two kilometres, and all holes intersected the zone of strong alteration known to host the Lalor mineralization and have shown many occurrences of disseminated copper sulfides indicating the potential close proximity of one or more higher grade copper-gold feeder zones similar to Lens 27 currently in production at Lalor. These initial results from widely spaced drilling are an encouraging indication that the rocks hosting the rich copper-gold mineralization at Lalor continue down-plunge as predicted by Hudbay's geological models. For more information on the drill holes, please refer to Hudbay's news release dated July 27, 2023.

Hudbay expects to refine targets for its 2024 winter drilling campaign to the northwest and down-plunge from Lalor using the results from geophysical borehole surveys.

Acquisition of Cook Lake Properties in Snow Lake

In late June 2023, Hudbay completed the acquisition of the Cook Lake properties from Glencore plc. The Cook Lake properties are located within ten kilometres and along the same regional trend as the Lalor mine, and have the potential to host a new discovery at depth. The properties include the Cook Lake North and South properties, which are within 30 kilometres of Hudbay's Stall and New Britannia processing facilities.

Hudbay has received data regarding approximately 60,000 metres of historical drilling that was competed on the Cook Lake properties between 1971 and 2012, with an average depth of only 275 metres, which is a fraction of the depth of Lalor's current known mineralization of approximately 600 to 1,500 metres. The historical drill holes appear to have intersected base metal and copper-gold mineralization typical to the Snow Lake region. Although the historical data has not been validated by a qualified person (see "Qualified Person and NI 43-101"), the mineralization indicates that there is the potential for new deposits on the same favourable mineralized horizons as many known deposits in the area, including the Lalor, 1901 and Chisel deposits. The Cook Lake properties are untested by modern deep geophysics, which was the discovery method for the Lalor mine.

Acquisition of Rockcliff to Consolidate Significant Land Package in Snow Lake

On June 19, 2023, Hudbay entered into a definitive agreement to acquire 100% of the issued and outstanding common shares of Rockcliff that it does not already own (the "Rockcliff Transaction"). Under the Rockcliff Transaction, Rockcliff shareholders will receive 0.006776 of a Hudbay common share for each Rockcliff common share held. The enterprise value to Hudbay, net of Rockcliff's cash, is approximately $13 million.

Rockcliff is one of the largest landholders in the Snow Lake area with more than 1,800 square kilometres across all of its properties. The completion of the Rockcliff Transaction will consolidate Hudbay's ownership of the Talbot deposit and provide the company with additional exploration properties in the vicinity of its Stall and New Britannia mills, including the land adjacent to Hudbay's Pen II deposit, which is a low tonnage and high-grade zinc deposit that starts from surface and is located approximately six kilometres by road from the Lalor mine.

Completion of the Rockcliff Transaction is contingent upon court approval from the Ontario Superior Court of Justice (Commercial List), shareholder approval of at least two-thirds of the votes cast by Rockcliff shareholders at a special meeting scheduled to be held on August 31, 2023 and other customary conditions and stock exchange approvals. The Rockcliff Transaction is expected to close in the third quarter of 2023.

Advancing Metallurgical Testwork for the Flin Flon Tailings Reprocessing Opportunity

In 2021, Hudbay identified the opportunity to reprocess Flin Flon tailings where in excess of 100 million tonnes of tailings have been deposited for over 90 years. The company completed confirmatory drilling in 2022 which covered about two-thirds of the facility. The results indicated higher zinc, copper and silver grades than predicted from historical mill records while confirming the historical gold grade. Hudbay is completing metallurgical test work and evaluating metallurgical technologies, including the recent signing of a testwork agreement with Cobalt Blue Holdings Limited ("Cobalt Blue") to assess the processing viability of the Flin Flon tailings using Cobalt Blue's proprietary processing technology that recovers copper, zinc, gold and silver while converting sulphides into stable and benign sulphur.

Other Exploration Update

Constancia In-Mine Exploration

Hudbay continues to execute a limited drill program and technical evaluations at the Constancia deposit to confirm the economic viability of adding an additional mining phase to the current mine plan that would convert a portion of the mineral resources to mineral reserves. The results from this drill program and technical and economic evaluations are expected to be incorporated in the next annual mineral reserve and resource update.

Maria Reyna and Caballito Exploration

Hudbay controls a large, contiguous block of mineral rights with the potential to host satellite mineral deposits in close proximity to the Constancia processing facility, including the past producing Caballito property and the highly prospective Maria Reyna property. Hudbay commenced early exploration activities at Maria Reyna and Caballito after completing a surface rights exploration agreement with the community of Uchucarcco in August 2022. Surface investigation activities together with baseline environmental and archaeological activities necessary to support drill permit applications have been completed. Surface mapping and geochemical sampling confirm that both Caballito and Maria Reyna host sulfide and oxide rich copper mineralization in skarns, hydrothermal breccias and large porphyry intrusive bodies.

Lalor In-Mine Exploration

Hudbay continues to compile results from ongoing infill drilling at Lalor, which will be incorporated into the next annual mineral resource and reserve estimate update.

Flin Flon Exploration Partnership with Marubeni

On July 6, 2023, Hudbay announced the signing of a memorandum of understanding ("MOU") with Marubeni Corporation ("Marubeni") that establishes the framework for a multi-year exploration partnership focused on the discovery of new deposits on Hudbay's mineral properties within trucking distance of the company's processing facilities in Flin Flon, Manitoba. In connection with the MOU, Hudbay and Marubeni have agreed to negotiate the terms of a definitive agreement to govern the relationship between the parties and the Flin Flon properties that would form the subject of the exploration partnership (the "Project Properties"). It is currently contemplated that Marubeni would fund approximately $10 to $15 million of exploration expenditures on the Project Properties and that Hudbay will act as operator and carry out the exploration activities.

Dividend Declared

A semi-annual dividend of C$0.01 per share was declared on August 8, 2023. The dividend will be paid out on September 22, 2023 to shareholders of record as of September 1, 2023.

Website Links

Hudbay:

www.hudbay.com

Management's Discussion and Analysis:

http://www.hudbayminerals.com/files/doc_financials/2023/Q2/MDA823.pdf

Financial Statements:

http://www.hudbayminerals.com/files/doc_financials/2023/Q2/FS823.pdf

Conference Call and Webcast

| Date: |

Wednesday, August 9, 2023 |

| |

|

| Time: |

8:30 a.m. ET |

| |

|

| Webcast: |

www.hudbay.com |

| |

|

| Dial in: |

1-416-915-3239 or 1-800-319-4610 |

Qualified Person and NI 43-101

The technical and scientific information in this news release related to the company's material mineral projects has been approved by Olivier Tavchandjian, P. Geo, Senior Vice President, Exploration and Technical Services. Mr. Tavchandjian is a qualified person pursuant to National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101").

Hudbay cautions that neither the historical information nor the quality assurance and quality control program that was applied during the execution of the Cook Lake drill program has been independently verified by a qualified person and, as such, Hudbay cautions that this information should not be relied upon by investors.

Non-IFRS Financial Performance Measures

Adjusted net earnings (loss), adjusted net earnings (loss) per share, adjusted EBITDA, net debt, cash cost, sustaining and all-in sustaining cash cost per pound of copper produced, cash cost and sustaining cash cost per ounce of gold produced and combined unit cost are non-IFRS performance measures. These measures do not have a meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other issuers. These measures should not be considered in isolation or as a substitute for measures prepared in accordance with IFRS and are not necessarily indicative of operating profit or cash flow from operations as determined under IFRS. Other companies may calculate these measures differently.

Management believes adjusted net earnings (loss) and adjusted net earnings (loss) per share provides an alternate measure of the company's performance for the current period and gives insight into its expected performance in future periods. These measures are used internally by the company to evaluate the performance of its underlying operations and to assist with its planning and forecasting of future operating results. As such, the company believes these measures are useful to investors in assessing the company's underlying performance. Hudbay provides adjusted EBITDA to help users analyze the company's results and to provide additional information about its ongoing cash generating potential in order to assess its capacity to service and repay debt, carry out investments and cover working capital needs. Net debt is shown because it is a performance measure used by the company to assess its financial position. Cash cost, sustaining and all-in sustaining cash cost per pound of copper produced are shown because the company believes they help investors and management assess the performance of its operations, including the margin generated by the operations and the company. Cash cost and sustaining cash cost per ounce of gold produced are shown because the company believes they help investors and management assess the performance of its Manitoba operations. Combined unit cost is shown because Hudbay believes it helps investors and management assess the company's cost structure and margins that are not impacted by variability in by-product commodity prices.

The following tables provide detailed reconciliations to the most comparable IFRS measures.

Adjusted Net Earnings (Loss) Reconciliation

| |

|

Three Months Ended |

|

| (in $ millions) |

|

Jun. 30, 2023 |

|

|

Mar. 31, 2023 |

|

|

Jun. 30, 2022 |

|

| (Loss) profit for the period |

|

(14.9 |

) |

|

5.4 |

|

|

32.1 |

|

| Tax (recovery) expense |

|

(15.8 |

) |

|

12.0 |

|

|

(10.6 |

) |

| (Loss) profit before tax |

|

(30.7 |

) |

|

17.4 |

|

|

21.5 |

|

| Adjusting items |

|

|

|

|

|

|

|

|

|

| Mark-to-market adjustments 1 |

|

0.6 |

|

|

6.8 |

|

|

(14.0 |

) |

| Foreign exchange loss (gain) |

|

1.4 |

|

|

0.3 |

|

|

(2.2 |

) |

| Inventory adjustments |

|

0.9 |

|

|

- |

|

|

1.9 |

|

| Variable consideration adjustment - stream revenue and accretion |

|

- |

|

|

(5.0 |

) |

|

- |

|

| Re-evaluation adjustment - environmental provision3 |

|

(4.7 |

) |

|

(8.2 |

) |

|

(60.7 |

) |

| Impairment |

|

- |

|

|

- |

|

|

95.0 |

|

| Acquisition related costs |

|

6.8 |

|

|

- |

|

|

- |

|

| Evaluation expenses |

|

- |

|

|

- |

|

|

0.7 |

|

| Insurance recovery |

|

- |

|

|

- |

|

|

(5.7 |

) |

| Restructuring charges - Manitoba 2 |

|

- |

|

|

- |

|

|

3.7 |

|

| Loss on disposal of investments |

|

- |

|

|

0.7 |

|

|

3.1 |

|

| Loss on disposal of plant and equipment and non-current assets - Manitoba & Arizona |

|

0.3 |

|

|

0.1 |

|

|

- |

|

| Adjusted (loss) earnings before income taxes |

|

(25.4 |

) |

|

12.1 |

|

|

43.3 |

|

| Tax recovery (expense) |

|

15.8 |

|

|

(12.0 |

) |

|

10.6 |

|

| Tax impact on adjusting items |

|

(8.7 |

) |

|

- |

|

|

(23.4 |

) |

| Adjusted net (loss) earnings |

|

(18.3 |

) |

|

0.1 |

|

|

30.5 |

|

| Adjusted net (loss) earnings $/share |

|

(0.07 |

) |

|

0.00 |

|

|

0.12 |

|

| Basic weighted average number of common shares outstanding (millions) |

|

272.2 |

|

|

262.0 |

|

|

261.9 |

|

1 Includes changes in fair value of the gold prepayment liability, Canadian junior mining investments, other financial assets and liabilities at fair value through profit or loss and share-based compensation expenses.

2 Includes closure cost for the Flin Flon operations.

3 Changes from movements to environmental reclamation provisions are primarily related to the Flin Flon operations, which were fully depreciated as of June 30, 2022, as well as other Manitoba non-operating sites.

Adjusted EBITDA Reconciliation

| |

|

Three Months Ended |

|

| (in $ millions) |

|

Jun. 30, 2023 |

|

|

Mar. 31, 2023 |

|

|

Jun. 30, 2022 |

|

| (Loss) profit for the period |

|

(14.9 |

) |

|

5.4 |

|

|

32.1 |

|

| Add back: |

|

|

|

|

|

|

|

|

|

| Tax (recovery) expense |

|

(15.8 |

) |

|

12.0 |

|

|

(10.6 |

) |

| Net finance expense |

|

30.5 |

|

|

35.0 |

|

|

24.4 |

|

| Other expenses |

|

13.9 |

|

|

5.0 |

|

|

(1.3 |

) |

| Depreciation and amortization |

|

88.7 |

|

|

67.4 |

|

|

87.3 |

|

| Amortization of deferred revenue and variable consideration adjustment |

|

(18.1 |

) |

|

(15.9 |

) |

|

(19.2 |

) |

| |

|

84.3 |

|

|

108.9 |

|

|

112.7 |

|

| Adjusting items (pre-tax): |

|

|

|

|

|

|

|

|

|

| Re-evaluation adjustment - environmental provision |

|

(4.7 |

) |

|

(8.2 |

) |

|

(60.7 |

) |

| Impairment losses |

|

- |

|

|

- |

|

|

95.0 |

|

| Inventory adjustments |

|

0.9 |

|

|

- |

|

|

1.9 |

|

| Share-based compensation expense (recovery) 1 |

|

0.7 |

|

|

1.2 |

|

|

(7.5 |

) |

| Adjusted EBITDA |

|

81.2 |

|

|

101.9 |

|

|

141.4 |

|

1 Share-based compensation expenses reflected in cost of sales and selling and administrative expenses.

Net Debt Reconciliation

| (in $ thousands) |

|

|

|

| |

|

Jun. 30, 2023 |

|

|

Mar. 31, 2023 |

|

|

Dec. 31, 2022 |

|

| Total long-term debt |

|

1,370,682 |

|

|

1,225,023 |

|

|

1,184,162 |

|

| Cash |

|

(179,734 |

) |

|

(255,563 |

) |

|

(225,665 |

) |

| Net debt |

|

1,190,948 |

|

|

969,460 |

|

|

958,497 |

|

Copper Cash Cost Reconciliation

| Consolidated |

|

Three Months Ended |

|

| Net pounds of copper produced1 |

|

|

|

|

|

|

|

|

|

| (in thousands) |

|

Jun. 30, 2023 |

|

|

Mar. 31, 2023 |

|

|

Jun. 30, 2022 |

|

| Peru |

|

38,982 |

|

|

45,233 |

|

|

46,032 |

|

| Manitoba |

|

6,160 |

|

|

4,508 |

|

|

10,556 |

|

| Net pounds of copper produced |

|

45,142 |

|

|

49,741 |

|

|

56,588 |

|

1 Contained copper in concentrate.

| Consolidated |

|

Three Months Ended |

|

| |

|

Jun. 30, 2023 |

|

|

Mar. 31, 2023 |

|

|

Jun. 30, 2022 |

|

| Cash cost per pound of copper produced |

|

$000s |

|

|

$/lb |

|

|

$000s |

|

|

$/lb |

|

|

$000s |

|

|

$/lb |

|

| Mining |

|

73,335 |

|

|

1.62 |

|

|

64,538 |

|

|

1.30 |

|

|

86,800 |

|

|

1.53 |

|

| Milling |

|

69,869 |

|

|

1.55 |

|

|

61,039 |

|

|

1.23 |

|

|

65,684 |

|

|

1.16 |

|

| Refining (zinc) |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

14,379 |

|

|

0.26 |

|

| G&A |

|

20,975 |

|

|

0.47 |

|

|

26,555 |

|

|

0.53 |

|

|

41,930 |

|

|

0.74 |

|

| Onsite costs |

|

164,179 |

|

|

3.64 |

|

|

152,132 |

|

|

3.06 |

|

|

208,793 |

|

|

3.69 |

|

| Treatment & refining |

|

26,670 |

|

|

0.59 |

|

|

18,495 |

|

|

0.37 |

|

|

15,033 |

|

|

0.27 |

|

| Freight & other |

|

17,766 |

|

|

0.39 |

|

|

17,776 |

|

|

0.36 |

|

|

20,076 |

|

|

0.35 |

|

| Cash cost, before by-product credits |

|

208,615 |

|

|

4.62 |

|

|

188,403 |

|

|

3.79 |

|

|

243,902 |

|

|

4.31 |

|

| By-product credits |

|

(136,417 |

) |

|

(3.02 |

) |

|

(146,111 |

) |

|

(2.94 |

) |

|

(207,191 |

) |

|

(3.66 |

) |

| Cash cost, net of by-product credits |

|

72,198 |

|

|

1.60 |

|

|

42,292 |

|

|

0.85 |

|

|

36,711 |

|

|

0.65 |

|

| Consolidated |

|

Three Months Ended |

|

| |

|

Jun. 30, 2023 |

|

|

Mar. 31, 2023 |

|

|

Jun. 30, 2022 |

|

| Supplementary cash cost information |

|

$000s |

|

|

$/lb1 |

|

|

$000s |

|

|

$/lb1 |

|

|

$000s |

|

|

$/lb1 |

|

| By-product credits2: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Zinc |

|

21,896 |

|

|

0.48 |

|

|

17,374 |

|

|

0.35 |

|

|

88,548 |

|

|

1.56 |

|

| Gold3 |

|

86,026 |

|

|

1.91 |

|

|

93,479 |

|

|

1.88 |

|

|

91,317 |

|

|

1.61 |

|

| Silver3 |

|

17,281 |

|

|

0.38 |

|

|

11,998 |

|

|

0.24 |

|

|

17,956 |

|

|

0.32 |

|

| Molybdenum & other |

|

11,214 |

|

|

0.25 |

|

|

23,260 |

|

|

0.47 |

|

|

9,370 |

|

|

0.17 |

|

| Total by-product credits |

|

136,417 |

|

|

3.02 |

|

|

146,111 |

|

|

2.94 |

|

|

207,191 |

|

|

3.66 |

|

| Reconciliation to IFRS: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash cost, net of by-product credits |

|

72,198 |

|

|

|

|

|

42,292 |

|

|

|

|

|

36,711 |

|

|

|

|

| By-product credits |

|

136,417 |

|

|

|

|

|

146,111 |

|

|

|

|

|

207,191 |

|

|

|

|

| Treatment and refining charges |

|

(26,670 |

) |

|

|

|

|

(18,495 |

) |

|

|

|

|

(15,033 |

) |

|

|

|

| Share-based compensation expense |

|

60 |

|

|

|

|

|

79 |

|

|

|

|

|

(632 |

) |

|

|

|

| Inventory adjustments |

|

906 |

|

|

|

|

|

- |

|

|

|

|

|

1,933 |

|

|

|

|

| Change in product inventory |

|

15,114 |

|

|

|

|

|

(9,409 |

) |

|

|

|

|

4,494 |

|

|

|

|

| Royalties |

|

2,578 |

|

|

|

|

|

706 |

|

|

|

|

|

3,971 |

|

|

|

|

| Depreciation and amortization4 |

|

88,670 |

|

|

|

|

|

67,422 |

|

|

|

|

|

87,305 |

|

|

|

|

| Cost of sales5 |

|

289,273 |

|

|

|

|

|

228,706 |

|

|

|

|

|

325,940 |

|

|

|

|

1 Per pound of copper produced.

2 By-product credits are computed as revenue per financial statements, including amortization of deferred revenue and pricing and volume adjustments.

3 Gold and silver by-product credits do not include variable consideration adjustments with respect to stream arrangements. Variable consideration adjustments are cumulative adjustments to gold and silver stream deferred revenue primarily associated with the net change in mineral reserves and resources or amendments to the mine plan that would change the total expected deliverable ounces under the precious metal streaming arrangement. For the three months ended June 30, 2023, the variable consideration adjustments were $nil, for the three months ended March 31, 20233 - $4,885 and for the three months ended June 30, 2022 - $nil.

4 Depreciation is based on concentrate sold.

5 As per IFRS financial statements.

| Peru |

|

Three Months Ended |

|

| (in thousands) |

|

Jun. 30, 2023 |

|

|

Mar. 31, 2023 |

|

|

Jun. 30, 2022 |

|

| Net pounds of copper produced1 |

|

38,982 |

|

|

45,233 |

|

|

46,032 |

|

1 Contained copper in concentrate.

| Peru |

|

Three Months Ended |

|

| |

|

Jun. 30, 2023 |

|

|

Mar. 31, 2023 |

|

|

Jun. 30, 2022 |

|

| Cash cost per pound of copper produced |

|

$000s |

|

|

$/lb |

|

|

$000s |

|

|

$/lb |

|

|

$000s |

|

|

$/lb |

|

| Mining |

|

31,654 |

|

|

0.81 |

|

|

26,786 |

|

|

0.59 |

|

|

32,300 |

|

|

0.70 |

|

| Milling |

|

54,676 |

|

|

1.40 |

|

|

46,191 |

|

|

1.03 |

|

|

44,731 |

|

|

0.97 |

|

| G&A |

|

14,867 |

|

|

0.38 |

|

|

16,466 |

|

|

0.36 |

|

|

18,677 |

|

|

0.41 |

|

| Onsite costs |

|

101,197 |

|

|

2.59 |

|

|

89,443 |

|

|

1.98 |

|

|

95,708 |

|

|

2.08 |

|

| Treatment & refining |

|

17,097 |

|

|

0.44 |

|

|

10,603 |

|

|

0.24 |

|

|

9,226 |

|

|

0.20 |

|

| Freight & other |

|

12,424 |

|

|

0.32 |

|

|

12,427 |

|

|

0.27 |

|

|

12,297 |

|

|

0.26 |

|

| Cash cost, before by-product credits |

|

130,718 |

|

|

3.35 |

|

|

112,473 |

|

|

2.49 |

|

|

117,231 |

|

|

2.54 |

|

| By-product credits |

|

(47,193 |

) |

|

(1.21 |

) |

|

(50,899 |

) |

|

(1.13 |

) |

|

(33,268 |

) |

|

(0.72 |

) |

| Cash cost, net of by-product credits |

|

83,525 |

|

|

2.14 |

|

|

61,574 |

|

|

1.36 |

|

|

83,963 |

|

|

1.82 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Peru |

|

Three Months Ended |

|

| |

|

Jun. 30, 2023 |

|

|

Mar. 31, 2023 |

|

|

Jun. 30, 2022 |

|

| Supplementary cash cost information |

|

$000s |

|

|

$/lb1 |

|

|

$000s |

|

|

$/lb1 |

|

|

$000s |

|

|

$/lb1 |

|

| By-product credits2: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gold3 |

|

21,638 |

|

|

0.55 |

|

|

19,301 |

|

|

0.43 |

|

|

14,191 |

|

|

0.31 |

|

| Silver3 |

|

14,341 |

|

|

0.37 |

|

|

8,577 |

|

|

0.19 |

|

|

11,687 |

|

|

0.25 |

|

| Molybdenum |

|

11,214 |

|

|

0.29 |

|

|

23,021 |

|

|

0.51 |

|

|

7,390 |

|

|

0.16 |

|

| Total by-product credits |

|

47,193 |

|

|

1.21 |

|

|

50,899 |

|

|

1.13 |

|

|

33,268 |

|

|

0.72 |

|

| Reconciliation to IFRS: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash cost, net of by-product credits |

|

83,525 |

|

|

|

|

|

61,574 |

|

|

|

|

|

83,963 |

|

|

|

|

| By-product credits |

|

47,193 |

|

|

|

|

|

50,899 |

|

|

|

|

|

33,268 |

|

|

|

|

| Treatment and refining charges |

|

(17,097 |

) |

|

|

|

|

(10,603 |

) |

|

|

|

|

(9,226 |

) |

|

|

|

| Inventory adjustments |

|

- |

|

|

|

|

|

- |

|

|

|

|

|

(97 |

) |

|

|

|

| Share-based compensation expenses |

|

29 |

|

|

|

|

|

(14 |

) |

|

|

|

|

(100 |

) |

|

|

|

| Change in product inventory |

|

27,078 |

|

|

|

|

|

(11,135 |

) |

|

|

|

|

(8,394 |

) |

|

|

|

| Royalties |

|

2,479 |

|

|

|

|

|

665 |

|

|

|

|

|

1,117 |

|

|

|

|

| Depreciation and amortization4 |

|

67,340 |

|

|

|

|

|

41,960 |

|

|

|

|

|

47,811 |

|

|

|

|

| Cost of sales5 |

|

210,547 |

|

|

|

|

|

133,346 |

|

|

|

|

|

148,342 |

|

|

|

|

1 Per pound of copper produced.

2 By-product credits are computed as revenue per financial statements, including amortization of deferred revenue and pricing and volume adjustments.

3 Gold and silver by-product credits do not include variable consideration adjustments with respect to stream arrangements.

4 Depreciation is based on concentrate sold.

5 As per IFRS financial statements.

Copper Sustaining and All-in Sustaining Cash Cost Reconciliation

| Consolidated |

|

Three Months Ended |

|

| |

|

Jun. 30, 2023 |

|

|

Mar. 31, 2023 |

|

|

Jun. 30, 2022 |

|

| All-in sustaining cash cost per pound of copper produced |

|

$000s |

|

|

$/lb |

|

|

$000s |

|

|

$/lb |

|

|

$000s |

|

|

$/lb |

|

| Cash cost, net of by-product credits |

|

72,198 |

|

|

1.60 |

|

|

42,292 |

|

|

0.85 |

|

|

36,711 |

|

|

0.65 |

|

| Cash sustaining capital expenditures |

|

48,253 |

|

|

1.07 |

|

|

47,869 |

|

|

0.96 |

|

|

65,173 |

|

|

1.15 |

|

| Royalties |

|

2,578 |

|

|

0.06 |

|

|

706 |

|

|

0.02 |

|

|

3,971 |

|

|

0.07 |

|

| Sustaining cash cost, net of by-product credits |

|

123,029 |

|

|

2.73 |

|

|

90,867 |

|

|

1.83 |

|

|

105,855 |

|

|

1.87 |

|

| Corporate selling and administrative expenses & regional costs |

|

9,603 |

|

|

0.21 |

|

|

10,215 |

|

|

0.20 |

|

|

2,479 |

|

|

0.04 |

|

| Accretion and amortization of decommissioning and community agreements1 |

|

1,792 |

|

|

0.04 |

|

|

1,958 |

|

|

0.04 |

|

|

874 |

|

|

0.02 |

|

| All-in sustaining cash cost, net of by-product credits |

|

134,424 |

|

|

2.98 |

|

|

103,040 |

|

|

2.07 |

|

|