Hess Midstream Operations LP Announces Pricing of Upsized Private Offering of Senior Notes Due 2029

May 08 2024 - 5:15PM

Business Wire

Hess Midstream Operations LP (the “Issuer”), a consolidated

subsidiary of Hess Midstream LP (NYSE: HESM) (“HESM” and, together

with the Issuer, “Hess Midstream”), today announced that it has

priced $600 million aggregate principal amount of 6.500% senior

unsecured notes due 2029 (the “Notes”) at par in a private

offering. The aggregate principal amount of the offering was

increased from the previously announced offering size of $500

million. Hess Midstream intends to use the net proceeds from the

offering to reduce indebtedness outstanding under its revolving

credit facility and any remaining net proceeds for general

corporate purposes. The private offering of the Notes is expected

to close on May 16, 2024, subject to the satisfaction of customary

closing conditions.

The Notes are being sold only to persons reasonably believed to

be “qualified institutional buyers” in the United States pursuant

to Rule 144A and outside the United States to non-U.S. Persons in

compliance with Regulation S under the Securities Act of 1933, as

amended (the “Securities Act”). The Notes have not been and will

not be registered under the Securities Act or any state securities

laws and may not be offered or sold in the United States absent

registration or an applicable exemption from the registration

requirements of the Securities Act and applicable state laws.

This press release is neither an offer to sell nor a

solicitation of an offer to buy the Notes or any other securities

and shall not constitute an offer to sell or a solicitation of an

offer to buy, or a sale of, the Notes or any other securities in

any jurisdiction in which such offer, solicitation or sale is

unlawful.

About Hess Midstream LP

HESM is a fee-based, growth-oriented, midstream company that

owns, operates, develops and acquires a diverse set of midstream

assets to provide services to Hess Corporation and third-party

customers. HESM owns oil, gas and produced water handling assets

that are primarily located in the Bakken and Three Forks Shale

plays in the Williston Basin area of North Dakota.

Forward Looking Statements

This press release contains “forward-looking statements” within

the meaning of U.S. federal securities laws. Words such as

“anticipate,” “estimate,” “expect,” “forecast,” “guidance,”

“could,” “may,” “should,” “would,” “believe,” “intend,” “project,”

“plan,” “predict,” “will,” “target” and similar expressions

identify forward-looking statements, which are not historical in

nature. Forward-looking statements are subject to certain known and

unknown risks and uncertainties that could cause actual results to

differ materially from our historical experience and our current

projections or expectations of future results expressed or implied

by these forward-looking statements. You should keep in mind the

risk factors and other cautionary statements in the filings made by

HESM with the U.S. Securities and Exchange Commission, which are

available to the public. HESM undertakes no obligation to, and does

not intend to, update these forward-looking statements to reflect

events or circumstances occurring after this press release. You are

cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date of this press

release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240508560541/en/

Investor: Jennifer Gordon (212)

536-8244

Media: Lorrie Hecker (212) 536-8250

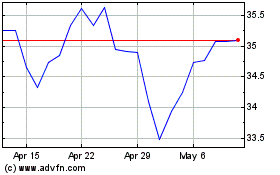

Hess Midstream (NYSE:HESM)

Historical Stock Chart

From Oct 2024 to Nov 2024

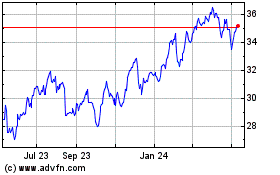

Hess Midstream (NYSE:HESM)

Historical Stock Chart

From Nov 2023 to Nov 2024