0000354707false00003547072023-10-302023-10-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report: October 30, 2023

| | | | | | | | |

| Exact Name of Registrant | Commission | I.R.S. Employer |

| as Specified in Its Charter | File Number | Identification No. |

| Hawaiian Electric Industries, Inc. | 1-8503 | 99-0208097 |

State of Hawaii

(State or other jurisdiction of incorporation)

1001 Bishop Street, Suite 2900, Honolulu, Hawaii 96813

(Address of principal executive offices and zip code)

Registrant’s telephone number, including area code:

(808) 543-5662

Not applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to 12(b) of the Act: | | | | | | | | | | | |

| Registrant | Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Hawaiian Electric Industries, Inc. | Common Stock, Without Par Value | HE | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule12b-2 of the Securities Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the

Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

On October 30, 2023, HEI issued a news release, “American Savings Bank Reports Third Quarter 2023 Financial Results.” This news release is furnished as Exhibit 99.“

Item 9.01 Financial Statements and Exhibits.

| | | | | |

(d) Exhibits | |

| News release, dated October 30, 2023, “American Savings Bank Reports Third Quarter 2023 Financial Results” |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

The information furnished in connection with this current report on Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the Exchange Act), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | |

| HAWAIIAN ELECTRIC INDUSTRIES, INC. | | |

| (Registrant) | | |

| /s/ Scott T. DeGhetto | | |

| Scott T. DeGhetto | | |

| Executive Vice President, | | |

| Chief Financial Officer and Treasurer | | |

| (Principal Financial Officer) | | |

| | |

Date: October 30, 2023 | | |

| | |

Exhibit 99

| | | | | | | | |

| NEWS RELEASE |

October 30, 2023 | |

| Contact: | Mateo Garcia | Telephone: (808) 543-7300 |

| Director, Investor Relations | E-mail: ir@hei.com |

AMERICAN SAVINGS BANK REPORTS THIRD QUARTER 2023 FINANCIAL RESULTS

3Q 2023 Net Income of $11.4 million

$8.6 Million of Maui Wildfire-Related Expenses, Including $5.9 Million of Additional Provision

Solid Credit Quality and Capital Position

Liquidity Remains Strong

HONOLULU - American Savings Bank, F.S.B. (ASB), a wholly owned subsidiary of Hawaiian Electric Industries, Inc. (NYSE - HE), today reported third quarter 2023 net income of $11.4 million, compared to $20.2 million in the second quarter of 2023 and $20.8 million in the third quarter of 2022. Core net income1 for the third quarter of 2023 was $17.6 million.

“American Savings Bank continues to be well-positioned to support our community with a strong capital position, excellent credit quality, lending capacity and ample liquidity,” said Ann Teranishi, president and chief executive officer of ASB. “Despite the economic impacts of the wildfires, our customers and business have proved resilient. I’m very proud of our ASB teammates for delivering exceptional service through this difficult period. Our hearts are with the people of Maui, and we remain committed to supporting the recovery and rebuild effort.”

Financial Highlights

Third quarter 2023 net interest income was $62.6 million compared to $63.2 million in the second, or linked quarter of 2023 and $65.7 million in the third quarter of 2022. The lower net interest income compared to the linked and prior year quarters was primarily due to higher interest expense from rising deposit costs resulting from growth in higher yielding certificates of deposit. The lower net interest income compared to the prior year quarter also included higher interest expense from increased wholesale borrowings, and lower interest and dividends on

1 Core net income is a non-GAAP measure which excludes Maui wildfire-related after-tax costs. See the “Explanation of ASB’s Use of Certain Unaudited Non-GAAP Measures” and the related GAAP reconciliation.

investment securities. Net interest margin for the third quarter of 2023 was 2.70%, compared to 2.75% in the linked quarter, and 2.96% in the third quarter of last year.

The third quarter 2023 provision for credit losses was $8.8 million, compared to $0.04 million in the linked quarter and a $0.2 million negative provision for credit losses in the third quarter of 2022. The higher provision for credit losses for the quarter was primarily due to $5.9 million in additional credit reserves related to borrowers impacted by the Maui wildfires and the resulting economic disruption. As of September 30, 2023, ASB’s allowance for credit losses to outstanding loans was 1.23% compared to 1.13% as of June 30, 2023 and 1.24% as of September 30, 2022.

The net charge-off ratio for the third quarter of 2023 was 0.07%, compared to 0.14% in the linked quarter and 0.03% in the third quarter of 2022. Nonaccrual loans as a percentage of total loans receivable held for investment were 0.16%, compared to 0.22% in the linked quarter and 0.35% in the prior year quarter.

Noninterest income was $15.3 million in the third quarter of 2023 compared to $15.6 million in the linked quarter and $13.0 million in the third quarter of 2022. The decrease compared to the linked quarter was primarily due to a gain on sale of real estate recognized in the linked quarter and lower fee income, partially offset by higher bank-owned life insurance income. The increase compared to the prior year quarter was primarily due to higher bank-owned life insurance income.

Noninterest expense was $56.3 million compared to $53.8 million in the linked quarter and $51.6 million in the third quarter of 2022. The increase compared to the linked and prior year quarters was primarily due to wildfire-related expenses incurred during the quarter, including $1.3 million in professional services costs and $1.0 million in other extraordinary expenses.

Total loans were $6.2 billion as of September 30, 2023, up 3.6% from December 31, 2022, primarily reflecting growth in the commercial real estate and residential mortgage portfolios.

Total deposits were $8.2 billion as of September 30, 2023, an increase of 0.7% from December 31, 2022. Core deposits declined 5.1%, while certificates of deposits increased 71.8%. As of September 30, 2023, 87% of deposits were F.D.I.C. insured or fully collateralized, up slightly from 86% as of June 30, 2023, with approximately 77% of deposits F.D.I.C. insured. For the third quarter of 2023, the average cost of funds was 1.02%, up 19 basis points versus the linked quarter and up 89 basis points versus the prior year quarter.

Wholesale funding totaled $750 million as of September 30, 2023, unchanged from June 30, 2023.

For the third quarter of 2023, return on average equity was 9.2%, compared to 16.2% in the linked quarter and 15.1% in the third quarter of 2022. Return on average assets was 0.47% for the third quarter of 2023, compared to 0.84% in the linked quarter and 0.89% in the prior year quarter. Excluding Maui wildfire-related costs, core returns on average equity and average assets2 were 14.3% and 0.73%, respectively.

In the third quarter of 2023, ASB paid dividends of $14.0 million to HEI. ASB had a Tier 1 leverage ratio of 7.7% as of September 30, 2023.

HEI EARNINGS RELEASE, HEI WEBCAST AND CONFERENCE CALL TO DISCUSS EARNINGS AND 2023 GUIDANCE

Concurrent with ASB’s regulatory filing 30 days after the end of the quarter, ASB announced its third quarter 2023 financial results today. Please note that these reported results relate only to ASB and are not necessarily indicative of HEI’s consolidated financial results for the third quarter 2023.

HEI plans to announce its third quarter 2023 consolidated financial results on Thursday, November 9, 2023 and will also conduct a webcast and conference call at 11:30 a.m. Hawaii time (4:30 p.m. Eastern time) that same day to discuss its consolidated earnings, including ASB’s earnings, and 2023 guidance.

To listen to the conference call, dial 1-888-660-6377 (U.S.) or 1-929-203-0797 (international) and enter passcode 2393042. Parties may also access presentation materials (which include reconciliation of non-GAAP measures) and/or listen to the conference call by visiting the conference call link on HEI’s website at www.hei.com under “Investor Relations,” sub-heading “News and Events — Events and Presentations.”

A replay will be available online and via phone. The online replay will be available on HEI’s website about two hours after the event. An audio replay will also be available about two hours after the event through November 23, 2023. To access the audio replay, dial 1-800-770-2030 (U.S.) or 1-647-362-9199 (international) and enter passcode 2393042.

HEI and Hawaiian Electric Company, Inc. (Hawaiian Electric) intend to continue to use HEI’s website, www.hei.com, as a means of disclosing additional information; such disclosures

___________________

2 Core returns on average equity and average assets are non-GAAP measures which exclude Maui wildfire-related after-tax costs. See the “Explanation of ASB’s Use of Certain Unaudited Non-GAAP Measures” and the related GAAP reconciliation.

will be included in the Investor Relations section of the website. Accordingly, investors should routinely monitor the Investor Relations section of HEI’s website, in addition to following HEI’s, Hawaiian Electric’s and ASB’s press releases, HEI’s and Hawaiian Electric’s Securities and Exchange Commission (SEC) filings and HEI’s public conference calls and webcasts. Investors may sign up to receive e-mail alerts via the Investor Relations section of the website. The information on HEI’s website is not incorporated by reference into this document or into HEI’s and Hawaiian Electric’s SEC filings unless, and except to the extent, specifically incorporated by reference.

Investors may also wish to refer to the Public Utilities Commission of the State of Hawaii (PUC) website at https://hpuc.my.site.com/cdms/s/ to review documents filed with, and issued by, the PUC. No information on the PUC website is incorporated by reference into this document or into HEI’s and Hawaiian Electric’s SEC filings.

The HEI family of companies provides the energy and financial services that empower much of the economic and community activity of Hawaii. HEI’s electric utility, Hawaiian Electric, supplies power to approximately 95% of Hawaii’s population and is undertaking an ambitious effort to decarbonize its operations and the broader state economy. Its banking subsidiary, ASB, is one of Hawaii’s largest financial institutions, providing a wide array of banking and other financial services and working to advance economic growth, affordability and financial fitness. HEI also helps advance Hawaii’s sustainability goals through investments by its non-regulated subsidiary, Pacific Current. For more information, visit www.hei.com.

NON-GAAP MEASURES

Core net income is a non-GAAP measure which excludes Maui wildfire-related after-tax costs. See “Explanation of ASB’s Use of Certain Unaudited Non-GAAP Measures” and related GAAP reconciliations at the end of this release.

FORWARD-LOOKING STATEMENTS

This release may contain “forward-looking statements,” which include statements that are predictive in nature, depend upon or refer to future events or conditions, and usually include words such as “will,” “expects,” “anticipates,” “intends,” “plans,” “believes,” “predicts,” “estimates” or similar expressions. In addition, any statements concerning future financial performance, ongoing business strategies or prospects or possible future actions are also forward-looking statements. Forward-looking statements are based on current expectations and projections about future events and are subject to risks, uncertainties and the accuracy of assumptions concerning HEI and its subsidiaries, the performance of the industries in which they do business

and economic, political and market factors, among other things. These forward-looking statements are not guarantees of future performance.

Forward-looking statements in this release should be read in conjunction with the “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors” discussions (which are incorporated by reference herein) set forth in HEI’s Annual Report on Form 10-K for the year ended December 31, 2022 and HEI’s other periodic reports that discuss important factors that could cause HEI’s results to differ materially from those anticipated in such statements. These forward-looking statements speak only as of the date of the report, presentation or filing in which they are made. Except to the extent required by the federal securities laws, HEI, Hawaiian Electric, ASB and their subsidiaries undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

###

American Savings Bank, F.S.B.

STATEMENTS OF INCOME DATA

(Unaudited) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended | | Nine months ended September 30 |

| (in thousands) | | September 30,

2023 | | June 30,

2023 | | September 30,

2022 | | 2023 | | 2022 |

| Interest and dividend income | | | | | | | | | | |

| Interest and fees on loans | | $ | 71,540 | | | $ | 67,966 | | | $ | 53,365 | | | $ | 204,348 | | | $ | 147,499 | |

| Interest and dividends on investment securities | | 14,096 | | | 13,775 | | | 15,052 | | | 42,508 | | | 43,729 | |

| Total interest and dividend income | | 85,636 | | | 81,741 | | | 68,417 | | | 246,856 | | | 191,228 | |

| Interest expense | | | | | | | | | | |

| Interest on deposit liabilities | | 14,446 | | | 9,661 | | | 1,704 | | | 30,944 | | | 3,572 | |

| Interest on other borrowings | | 8,598 | | | 8,852 | | | 1,055 | | | 25,171 | | | 1,199 | |

| Total interest expense | | 23,044 | | | 18,513 | | | 2,759 | | | 56,115 | | | 4,771 | |

| Net interest income | | 62,592 | | | 63,228 | | | 65,658 | | | 190,741 | | | 186,457 | |

| Provision for credit losses | | 8,835 | | | 43 | | | (186) | | | 10,053 | | | (692) | |

| Net interest income after provision for credit losses | | 53,757 | | | 63,185 | | | 65,844 | | | 180,688 | | | 187,149 | |

| Noninterest income | | | | | | | | | | |

| Fees from other financial services | | 4,703 | | | 5,009 | | | 4,763 | | | 14,391 | | | 15,066 | |

| Fee income on deposit liabilities | | 4,924 | | | 4,504 | | | 4,879 | | | 14,027 | | | 14,122 | |

| Fee income on other financial products | | 2,440 | | | 2,768 | | | 2,416 | | | 7,952 | | | 7,663 | |

| Bank-owned life insurance | | 2,303 | | | 1,955 | | | 122 | | | 5,683 | | | 661 | |

| Mortgage banking income | | 341 | | | 230 | | | 181 | | | 701 | | | 1,630 | |

| Gain on sale of real estate | | — | | | 495 | | | — | | | 495 | | | 1,002 | |

| | | | | | | | | | |

| Other income, net | | 627 | | | 678 | | | 633 | | | 2,106 | | | 1,480 | |

| Total noninterest income | | 15,338 | | | 15,639 | | | 12,994 | | | 45,355 | | | 41,624 | |

| Noninterest expense | | | | | | | | | | |

| Compensation and employee benefits | | 29,902 | | | 29,394 | | | 28,597 | | | 89,500 | | | 83,478 | |

| Occupancy | | 5,154 | | | 5,539 | | | 5,577 | | | 16,281 | | | 16,996 | |

| Data processing | | 5,133 | | | 5,095 | | | 4,509 | | | 15,240 | | | 13,144 | |

| Services | | 3,627 | | | 2,689 | | | 2,751 | | | 8,911 | | | 7,712 | |

| Equipment | | 3,125 | | | 2,957 | | | 2,432 | | | 8,728 | | | 7,163 | |

| Office supplies, printing and postage | | 1,022 | | | 1,109 | | | 1,123 | | | 3,296 | | | 3,256 | |

| Marketing | | 984 | | | 834 | | | 925 | | | 2,834 | | | 2,877 | |

| | | | | | | | | | |

| Other expense | | 7,399 | | | 6,152 | | | 5,643 | | | 19,742 | | | 14,542 | |

| Total noninterest expense | | 56,346 | | | 53,769 | | | 51,557 | | | 164,532 | | | 149,168 | |

| Income before income taxes | | 12,749 | | | 25,055 | | | 27,281 | | | 61,511 | | | 79,605 | |

| Income taxes | | 1,384 | | | 4,851 | | | 6,525 | | | 11,380 | | | 17,513 | |

| Net income | | $ | 11,365 | | | $ | 20,204 | | | $ | 20,756 | | | $ | 50,131 | | | $ | 62,092 | |

| Comprehensive income (loss) | | $ | (22,866) | | | $ | 12,994 | | | $ | (78,186) | | | $ | 27,120 | | | $ | (248,126) | |

| OTHER BANK INFORMATION (annualized %, except as of period end) | | | | | | | | |

| Return on average assets | | 0.47 | | | 0.84 | | | 0.89 | | | 0.70 | | | 0.90 | |

| Return on average equity | | 9.19 | | | 16.20 | | | 15.11 | | | 13.62 | | | 13.65 | |

| Return on average tangible common equity | | 11.02 | | | 19.40 | | | 17.77 | | | 16.36 | | | 15.79 | |

| Net interest margin | | 2.70 | | | 2.75 | | | 2.96 | | | 2.77 | | | 2.87 | |

| Efficiency ratio | | 72.30 | | | 68.18 | | | 65.55 | | | 69.69 | | | 65.40 | |

| Net charge-offs to average loans outstanding | | 0.07 | | | 0.14 | | | 0.03 | | | 0.11 | | | 0.01 | |

| As of period end | | | | | | | | | | |

| Nonaccrual loans to loans receivable held for investment | | 0.16 | | | 0.22 | | | 0.35 | | | | | |

| Allowance for credit losses to loans outstanding | | 1.23 | | | 1.13 | | | 1.24 | | | | | |

| Tangible common equity to tangible assets | | 3.9 | | | 4.3 | | | 4.0 | | | | | |

| Tier-1 leverage ratio | | 7.7 | | | 7.8 | | | 7.7 | | | | | |

| Dividend paid to HEI (via ASB Hawaii, Inc.) ($ in millions) | | $ | 14.0 | | | $ | 11.0 | | | $ | 5.0 | | | $ | 39.0 | | | $ | 32.0 | |

This information should be read in conjunction with the consolidated financial statements and the notes thereto in HEI filings with the SEC. Results of operations for interim periods are not necessarily indicative of results to be expected for future interim periods or the full year.

American Savings Bank, F.S.B.

BALANCE SHEETS DATA

(Unaudited) | | | | | | | | | | | | | | |

| (in thousands) | September 30, 2023 | December 31, 2022 |

| Assets | | | | |

| Cash and due from banks | | $ | 139,059 | | | $ | 153,042 | |

| Interest-bearing deposits | | 124,531 | | | 3,107 | |

| Cash and cash equivalents | | 263,590 | | | 156,149 | |

| Investment securities | | | | |

| Available-for-sale, at fair value | | 1,266,412 | | | 1,429,667 | |

| Held-to-maturity, at amortized cost | | 1,212,005 | | | 1,251,747 | |

| Stock in Federal Home Loan Bank, at cost | | 18,000 | | | 26,560 | |

| Loans held for investment | | 6,191,006 | | | 5,978,906 | |

| Allowance for credit losses | | (76,366) | | | (72,216) | |

| Net loans | | 6,114,640 | | | 5,906,690 | |

| Loans held for sale, at lower of cost or fair value | | 2,171 | | | 824 | |

| Other | | 698,420 | | | 692,143 | |

| Goodwill | | 82,190 | | | 82,190 | |

| Total assets | | $ | 9,657,428 | | | $ | 9,545,970 | |

| Liabilities and shareholder’s equity | | | | |

| Deposit liabilities–noninterest-bearing | | $ | 2,573,010 | | | $ | 2,811,077 | |

| Deposit liabilities–interest-bearing | | 5,651,341 | | | 5,358,619 | |

| Other borrowings | | 750,000 | | | 695,120 | |

| Other | | 224,136 | | | 212,269 | |

| Total liabilities | | 9,198,487 | | | 9,077,085 | |

| Common stock | | 1 | | | 1 | |

| Additional paid-in capital | | 357,742 | | | 355,806 | |

| Retained earnings | | 460,824 | | | 449,693 | |

| Accumulated other comprehensive loss, net of tax benefits | | | | |

| Net unrealized losses on securities | $ | (350,234) | | | $ | (328,904) | | |

| Retirement benefit plans | (9,392) | | (359,626) | | (7,711) | | (336,615) | |

| Total shareholder’s equity | | 458,941 | | | 468,885 | |

| Total liabilities and shareholder’s equity | | $ | 9,657,428 | | | $ | 9,545,970 | |

This information should be read in conjunction with the consolidated financial statements and the notes thereto in HEI filings with the SEC.

Explanation of ASB’s Use of Certain Unaudited Non-GAAP Measures

HEI and ASB management use certain non-GAAP measures to evaluate the performance of HEI and the bank.

Management believes these non-GAAP measures provide useful information and are a better indicator of the companies’ core operating activities. Core earnings and other financial measures as presented here may not be comparable to similarly titled measures used by other companies. The accompanying tables provide a reconciliation of reported GAAP1 earnings to non-GAAP core earnings and returns on average equity and average assets for the bank.

The reconciling adjustments from GAAP earnings to core earnings are limited to the costs related to the recent Maui wildfires. Management does not consider these items to be representative of the company’s fundamental core earnings.

Reconciliation of GAAP1 to non-GAAP Measures

American Savings Bank F.S.B.

Unaudited

| | | | | | | | | | | | | | |

| (in thousands) | | Three months ended September 30, 2023 | | Nine months ended September 30, 2023 |

| Maui wildfire related costs | | | | |

| Pretax expenses: | | | | |

| | | | |

| Provision for credit losses | | $ | 5,900 | | | $ | 5,900 | |

| Professional services expense | | 1,300 | | | 1,300 | |

| Other expenses | | 1,357 | | | 1,357 | |

| Pretax expenses | | 8,557 | | | 8,557 | |

| Current income tax benefits | | (2,293) | | | (2,293) | |

| After-tax expenses | | $ | 6,264 | | | $ | 6,264 | |

| | | | |

| ASB net income | | | | |

| GAAP (as reported) | | $ | 11,365 | | | $ | 50,131 | |

| Excluding expense related to Maui wildfire (after tax): | | | | |

| | | | |

| | | | |

| Provision for credit losses | | 4,319 | | | 4,319 | |

| Professional services expense | | 952 | | | 952 | |

| Other expenses | | 993 | | | 993 | |

| Maui wildfire related cost (after tax) | | 6,264 | | 6,264 | |

| Non-GAAP (core) net income | | $ | 17,629 | | | $ | 56,395 | |

| | | | | | | | | | | | | | |

| | Three months ended September 30, 2023 | | Nine months ended September 30, 2023 |

| Ratios (annualized %) | | | | |

| | | | |

Based on GAAP1 | | | | |

| Return on average assets | | 0.47 | | | 0.70 | |

| Return on average equity | | 9.19 | | | 13.62 | |

| Return on average tangible common equity | | 11.02 | | | 16.36 | |

| Efficiency ratio | | 72.30 | | | 69.69 | |

| Based on Non-GAAP (core) | | | | |

| Return on average assets | | 0.73 | | | 0.78 | |

| Return on average equity | | 14.25 | | | 15.32 | |

| Return on average tangible common equity | | 17.09 | | | 18.40 | |

| Efficiency ratio | | 68.89 | | | 68.56 | |

1 Accounting principles generally accepted in the United States of America

v3.23.3

Cover

|

Oct. 30, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Oct. 30, 2023

|

| Entity Registrant Name |

Hawaiian Electric Industries, Inc.

|

| Entity File Number |

1-8503

|

| Entity Tax Identification Number |

99-0208097

|

| Entity Incorporation, State or Country Code |

HI

|

| Entity Address, Address Line One |

1001 Bishop Street, Suite 2900

|

| Entity Address, City or Town |

Honolulu

|

| Entity Address, State or Province |

HI

|

| Entity Address, Postal Zip Code |

96813

|

| City Area Code |

808

|

| Local Phone Number |

543-5662

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of each class |

Common Stock, Without Par Value

|

| Trading Symbol |

HE

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000354707

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

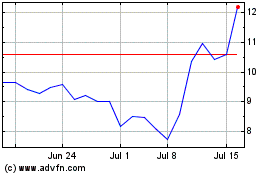

Hawaiian Electric Indust... (NYSE:HE)

Historical Stock Chart

From Nov 2024 to Dec 2024

Hawaiian Electric Indust... (NYSE:HE)

Historical Stock Chart

From Dec 2023 to Dec 2024