Statement of Changes in Beneficial Ownership (4)

March 24 2021 - 4:47PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Eckel Jeffrey |

2. Issuer Name and Ticker or Trading Symbol

Hannon Armstrong Sustainable Infrastructure Capital, Inc.

[

HASI

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

__X__ Director _____ 10% Owner

__X__ Officer (give title below) _____ Other (specify below)

President and CEO |

|

(Last)

(First)

(Middle)

1906 TOWNE CENTRE BLVD. SUITE 370 |

3. Date of Earliest Transaction

(MM/DD/YYYY)

3/11/2021 |

|

(Street)

ANNAPOLIS, MD 21401

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Common stock, par value $0.01 per share | 3/22/2021 | | S | | 50000 (1) | D | $53.89 (2) | 627367 (3) | I | By Jeffrey W. Eckel Revocable Trust |

| Common stock, par value $0.01 per share | 3/11/2021 | | G |

V

| 1280 | D | $0 | 626087 (3) | I | By Jeffrey W. Eckel Revocable Trust |

| Common stock, par value $0.01 per share | 3/11/2021 | | G |

V

| 780 | D | $0 | 45220 (4) | I | By Chesapeake Power Foundation |

| Common stock, par value $0.01 per share | | | | | | | | 121650 | D | |

| Common stock, par value $0.01 per share | | | | | | | | 107661 (5) | I | By Chesapeake Power LLC |

| Common stock, par value $0.01 per share | | | | | | | | 42000 (6) | I | By spouse |

| Common stock, par value $0.01 per share | | | | | | | | 2536 (7) | I | By grandson |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| LTIP Units | (8)(9) | | | | | | | (8)(9) | (10) | Common stock, par value $0.01 per share | 372750.0 | | 372750 | I | By HASI Management HoldCo LLC (11) |

| Explanation of Responses: |

| (1) | 50,000 of these shares were sold pursuant to a Rule 10b5-1 trading plan, dated March 8, 2021. |

| (2) | The price reported in Column 4 is a weighted average price. These shares were sold in multiple transactions at prices ranging from $52.09 to $55.30, inclusive, on March 22, 2021. The reporting person undertakes to provide Hannon Armstrong Sustainable Infrastructure Capital, Inc. (the "Company"), any security holder of the Company, or the staff of the Securities and Exchange Commission, upon request, full information regarding the number of shares sold at each separate price within the ranges set forth in this footnote. |

| (3) | These shares are held by the Jeffrey W. Eckel Revocable Trust, of which Jeffrey W. Eckel is the sole trustee and beneficiary. |

| (4) | These shares are held by the Chesapeake Power Foundation, the activities of which Jeffrey W. Eckel has the sole ability to direct. |

| (5) | These shares are held by Chesapeake Power, LLC, of which Jeffrey W. Eckel is the sole member. |

| (6) | These shares are held by the reporting person's spouse. The reporting person disclaims ownership other than to the extent of his pecuniary interest. |

| (7) | The reporting person acts as custodian for his grandson under the Uniform Gifts to Minors Act. The reporting person disclaims beneficial ownership of these securities, and this report shall not be deemed an admission that the reporting person is the beneficial owner of such securities for purposes of Section 16 or for any other purpose. |

| (8) | 372,750 units of limited partner interest ("OP Units") in Hannon Armstrong Sustainable Infrastructure, LP (the "Partnership") are issuable upon the vesting and conversion of 372,750 long-term incentive plan units ("LTIP Units") in the Partnership. The LTIP Units were granted to the Reporting Person under the Issuer's 2013 Equity Incentive Plan, as amended. |

| (9) | Vested LTIP Units, after achieving parity with OP Units (as described in the Partnership's Amended and Restated Agreement of Limited Partnership (the "Partnership Agreement")), are eligible to be converted into OP Units on a one-for-one basis upon the satisfaction of conditions set forth in the Partnership Agreement. Upon conversion of LTIP Units into OP Units, the Reporting Person will have the right to cause the Partnership to redeem a portion of the Reporting Person's OP Units for cash in an amount equal to the market value (as defined in the Partnership Agreement) of an equivalent number of shares of common stock, par value $0.01 per share, of Hannon Armstrong Sustainable Infrastructure Capital, Inc. (the "Issuer"), or at the Issuer's option, shares of the Issuer's common stock on a one-for-one basis, subject to certain adjustments. |

| (10) | N/A |

| (11) | These LTIP Units are held by HASI Management HoldCo LLC ("HoldCo LLC"). The Reporting Person is a member of HoldCo LLC. The LTIP Units reported represent only the number of LTIP Units in which the Reporting Person has a pecuniary interest in accordance with his proportionate interest in HoldCo LLC. The Reporting Person is voluntarily reporting his proportionate interest in HoldCo LLC's ownership of LTIP Units. The Reporting Person disclaims beneficial ownership other than to the extent of his pecuniary interest. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Eckel Jeffrey

1906 TOWNE CENTRE BLVD. SUITE 370

ANNAPOLIS, MD 21401 | X |

| President and CEO |

|

Signatures

|

| /s/ Jeffrey Eckel | | 3/24/2021 |

| **Signature of Reporting Person | Date |

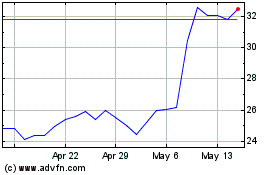

HA Sustainable Infrastru... (NYSE:HASI)

Historical Stock Chart

From Oct 2024 to Nov 2024

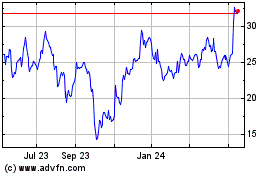

HA Sustainable Infrastru... (NYSE:HASI)

Historical Stock Chart

From Nov 2023 to Nov 2024