Form SD - Specialized disclosure report

September 04 2024 - 6:12PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM SD

Specialized Disclosure Report

FIRST MAJESTIC SILVER CORP.

(Exact name of registrant as specified in its charter)

|

British Columbia, Canada

|

001-34984

|

Not applicable

|

|

(State or other jurisdiction of

incorporation or organization)

|

(Commission File Number)

|

(IRS Employer

Identification No.)

|

|

Suite 1800 - 925 West Georgia Street

Vancouver, British Columbia, Canada

|

V6C 3L2

|

|

(Address of principal executive offices)

|

(Zip Code)

|

David Soares

First Majestic Silver Corp.

(604) 688-3033

(Name and telephone number, including area code, of person to contact in connection with this report)

Check the appropriate box to indicate the rule pursuant to which this form is being filed, and provide the period to which the information in this form applies:

☐ Rule 13p-1 under the Securities Exchange Act (17 CFR 240.13p-1) for the reporting period from January 1 to December 31, ___________.

☒ Rule 13q-1 under the Securities Exchange Act (17 CFR 240.13q-1) for the fiscal year ended December 31, 2023.

SECTION 1 - CONFLICT MINERALS DISCLOSURE

Item 1.01 - Conflict Minerals Disclosure and Report

Not applicable

Item 1.02 - Exhibit

Not applicable

SECTION 2 - RESOURCE EXTRACTION ISSUER DISCLOSURE

Item 2.01 Resource Extraction Issuer Disclosure and Report

First Majestic Silver Corp. ("First Majestic") is subject to Canada's Extractive Sector Transparency Measures Act ("ESTMA"). First Majestic is relying on the alternative reporting provision of Item 2.01 and providing its ESTMA report for the year ended December 31, 2023 to satisfy the requirements of Item 2.01. First Majestic's ESTMA report is available on First Majestic's website at https://firstmajestic.com/investors/reports-filings/ or on the Government of Canada's website at https://natural-resources.canada.ca/our-natural-resources/minerals-mining/services-for-the-mining-industry/extractive-sector-transparency-measures-act/links-estma-reports/18198. The payment disclosure required by Form SD is included as Exhibit 2.01 to this Form SD.

SECTION 3 - EXHIBITS

Item 3.01. Exhibits

The following exhibit is filed as part of this report.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned.

|

FIRST MAJESTIC SILVER CORP.

|

|

|

|

|

|

|

By:

|

/s/ Samir Patel

|

|

September 4, 2024

|

|

|

Samir Patel

|

|

(Date)

|

|

|

General Counsel & Corporate Secretary

|

|

|

UNCLASSIFIED - NON CLASSIFIÉ#

| Extractive Sector Transparency Measures Act - Annual Report |

|

| Reporting Entity Name |

First Majestic Silver Corp. |

|

| Reporting Year |

From |

2023-01-01 |

To: |

2023-12-31 |

Date submitted |

2024-05-10 |

|

| Reporting Entity ESTMA Identification Number |

E313966 |

Original Submission Original Submission

Amended Report Amended Report |

|

|

Other Subsidiaries Included

(optional field) |

|

|

| |

|

| Not Consolidated |

|

|

| |

|

| Not Substituted |

|

|

| |

|

| Attestation by Reporting Entity |

|

|

| In accordance with the requirements of the ESTMA, and in particular section 9 thereof, I attest I have reviewed the information contained in the ESTMA report for the entity(ies) listed above. Based on my knowledge, and having exercised reasonable diligence, the information in the ESTMA report is true, accurate and complete in all material respects for the purposes of the Act, for the reporting year listed above. |

|

| |

|

| |

|

| Full Name of Director or Officer of Reporting Entity |

David Soares |

Date |

2024-05-10 |

|

| Position Title |

Chief Financial Officer |

|

| Extractive Sector Transparency Measures Act - Annual Report |

| Reporting Year |

From: |

2023-01-01 |

To: |

2023-12-31 |

|

|

| Reporting Entity Name |

First Majestic Silver Corp. |

Currency of the Report |

CAD |

| Reporting Entity ESTMA Identification Number |

E313966 |

|

|

| Subsidiary Reporting Entities (if necessary) |

|

|

|

| Payments by Payee |

| Country |

Payee Name1 |

Departments,

Agency, etc —

within Payee that

Received

Payments2 |

Taxes |

Royalties |

Fees |

Production

Entitlements |

Bonuses |

Dividends |

Infrastructure

Improvement

Payments |

Total

Amount paid

to Payee |

Notes34 |

| Mexico |

Government of Mexico |

Tax Administration Service |

38,410,000 |

7,370,000 |

180,000 |

|

|

|

|

45,960,000 |

Payments related to income taxes, 0.5% extraordinary mining duty (Royalties), and "MAP" (Fees). |

| Mexico |

Government of Mexico |

Economy Secretary |

|

|

8,650,000 |

|

|

|

|

8,650,000 |

Payments related to mining concessions (Fees). |

| Mexico |

Government of Mexico |

National Water Commission |

|

|

1,170,000 |

|

|

|

|

1,170,000 |

Payments related to water rights. |

| United States of America |

State of Nevada |

Nevada Division of Taxation |

1,120,000 |

|

|

|

|

|

|

1,120,000 |

Payments related to mining royalties. |

| United States of America |

Government of the United States of America |

Bureau of Land Management |

|

|

720,000 |

|

|

|

|

720,000 |

Payments related to land claims. |

| Switzerland |

Canton of Zurich |

Cantonal Tax Office Zurich |

690,000 |

|

|

|

|

|

|

690,000 |

Payments related to state taxes. |

| United States of America |

Elko County |

Elko County Treasurer |

460,000 |

|

|

|

|

|

|

460,000 |

Payments related to property taxes. |

| Mexico |

Municipality of Chalchihuites |

|

|

|

360,000 |

|

|

|

|

360,000 |

Payments related to property taxes. |

| United States of America |

State of Nevada |

Nevada Department of Environmental Protection |

|

|

290,000 |

|

|

|

|

290,000 |

Payments related to environmental permits. |

| Mexico |

Municipality of Banamichi |

|

|

|

280,000 |

|

|

|

|

280,000 |

Payments related to land licenses. |

| Mexico |

Government of Mexico |

Energy Regulatory Commission |

|

|

110,000 |

|

|

|

|

110,000 |

Payments related to city taxes. |

| Mexico |

Municipality of Ocampo |

|

|

|

110,000 |

|

|

|

|

110,000 |

Payments related to Mine Safety and Health and Internal Revenue Services fees. |

| Mexico |

Government of Mexico |

Secretary of Finance and Administration |

|

|

60,000 |

|

|

|

|

60,000 |

Payments related to vehicles and property taxes. |

| United States of America |

Elko County |

Elko County Recorders Office |

|

|

50,000 |

|

|

|

|

50,000 |

Payments related to mineral claims. |

| United States of America |

State of Nevada |

Nevada Department of Wildlife |

|

|

40,000 |

|

|

|

|

40,000 |

Payments related to permitting fees. |

| Mexico |

Government of Mexico |

Secretary of Communications and Transport |

|

|

30,000 |

|

|

|

|

30,000 |

Payments related to state taxes. |

| Mexico |

Government of the State of Sonora |

|

|

|

30,000 |

|

|

|

|

30,000 |

Payments related to federal income taxes. |

| Mexico |

Government of Mexico |

Secretary of Environment and Natural Resources |

|

|

20,000 |

|

|

|

|

20,000 |

Payments related to environmental permits. |

| Mexico |

Government of Mexico |

Treasury of the Federation |

|

|

20,000 |

|

|

|

|

20,000 |

Payments related to property taxes. |

| Mexico |

Government of Mexico |

National Secretary of Defense |

|

|

10,000 |

|

|

|

|

10,000 |

Payments related to army permissions |

| Mexico |

Government of the State of Durango |

|

|

|

10,000 |

|

|

|

|

10,000 |

Payments related to land claims.

|

| United States of America |

State of Nevada |

Nevada Department of Motor Vehicles |

|

|

10,000 |

|

|

|

|

10,000 |

Payments related to vehicle registration fees. |

| Mexico |

Government of the State of Coahuila de Zaragoza |

|

|

|

10,000 |

|

|

|

|

10,000 |

Payments related to operation permission of SEPIMISA. |

| United States of America |

State of Nevada |

State emergency response commission |

|

|

10,000 |

|

|

|

|

10,000 |

Payments related to Mine Safety and Health and

Internal Revenue Services fees. |

| Additional Notes: |

Payments are converted based on an annual average foreign exchange rate of 13.15 MXN to CAD, 0.69 EUR to CAD, 0.67 CHF to CAD and 0.74 USD to CAD |

| Extractive Sector Transparency Measures Act - Annual Report |

| Reporting Year |

From: |

2023-01-01 |

To: |

2023-12-31 |

|

|

| Reporting Entity Name |

First Majestic Silver Corp. |

Currency of the Report |

CAD |

| Reporting Entity ESTMA Identification Number |

E313966 |

|

|

| Subsidiary Reporting Entities (if necessary) |

|

|

|

| Payments by Project |

| Country |

Project Name1 |

Taxes |

Royalties |

Fees |

Production Entitlements |

Bonuses |

Dividends |

Infrastructure

Improvement Payments |

Total Amount paid

by Project |

Notes23 |

| Mexico |

San Dimas Silver and Gold Mine |

23,610,000 |

2,100,000 |

2,530,000 |

|

|

|

|

28,240,000 |

|

| Mexico |

Santa Elena Silver and Gold Mine |

5,330,000 |

4,740,000 |

3,860,000 |

|

|

|

|

13,930,000 |

|

| Mexico |

La Encantada Silver Mine |

1,910,000 |

530,000 |

420,000 |

|

|

|

|

2,860,000 |

|

| Mexico |

La Parrilla Silver Mine |

|

|

1,940,000 |

|

|

|

|

1,940,000 |

|

| United States of America |

Jerritt Canyon Gold Mine |

1,580,000 |

|

1,120,000 |

|

|

|

|

2,700,000 |

|

| Mexico |

La Guitarra Silver Mine |

|

|

680,000 |

|

|

|

|

680,000 |

|

| Mexico |

Del Toro Silver Mine |

|

|

870,000 |

|

|

|

|

870,000 |

|

| Mexico |

San Martin Silver mine |

20,000 |

|

430,000 |

|

|

|

|

450,000 |

|

| Mexico |

La Luz Silver Project |

|

|

150,000 |

|

|

|

|

150,000 |

|

| Mexico |

La Joya Project |

|

|

70,000 |

|

|

|

|

70,000 |

|

| Mexico |

Corporate |

7,540,000 |

|

100,000 |

|

|

|

|

7,640,000 |

|

| Switzerland |

Corporate |

690,000 |

|

|

|

|

|

|

690,000 |

|

| Additional Notes3: |

(a) Taxes relate to income taxes, property taxes and 7.5% mining royalty paid to Servicio de Administracion Tributar

(b) Royalties relate to 0.5% extraordinary mining duty paid to Secretaria de Administracion Tributar

(c) Fees primarily relate to mining concessions paid to Secretaria de Economia; other fees include water rights, mineral claims, energy rights, environmental permits and aerial permits.

(d) All payments are converted based on an annual average foreign exchange rate of 13.15 MXN to CAD, 0.69 EUR to CAD, 0.67 CHF to CAD and 0.74 USD to CAD. |

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe three character ISO 4217 code for the currency used for reporting purposes. Example: 'USD'.

| Name: |

dei_EntityReportingCurrencyISOCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:currencyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

v3.24.2.u1

Payments, by Category - CAD ($)

|

Taxes |

Royalties |

Fees |

Total Payments |

| Total |

$ 40,680,000

|

$ 7,370,000

|

$ 12,170,000

|

$ 60,220,000

|

v3.24.2.u1

Payments, by Project - 12 months ended Dec. 31, 2023 - CAD ($)

|

Taxes |

Royalties |

Fees |

Total Payments |

| Total |

$ 40,680,000

|

$ 7,370,000

|

$ 12,170,000

|

$ 60,220,000

|

| Corporate Mexico |

|

|

|

|

| Total |

7,540,000

|

|

100,000

|

7,640,000

|

| Corporate Switzerland |

|

|

|

|

| Total |

690,000

|

|

|

690,000

|

| Del Toro Silver Mine |

|

|

|

|

| Total |

|

|

870,000

|

870,000

|

| Jerritt Canyon Gold Mine |

|

|

|

|

| Total |

1,580,000

|

|

1,120,000

|

2,700,000

|

| La Encantada Silver Mine |

|

|

|

|

| Total |

1,910,000

|

530,000

|

420,000

|

2,860,000

|

| La Guitarra Silver Mine |

|

|

|

|

| Total |

|

|

680,000

|

680,000

|

| La Joya Project |

|

|

|

|

| Total |

|

|

70,000

|

70,000

|

| La Luz Silver Project |

|

|

|

|

| Total |

|

|

150,000

|

150,000

|

| La Parrilla Silver Mine |

|

|

|

|

| Total |

|

|

1,940,000

|

1,940,000

|

| San Dimas Silver and Gold Mine |

|

|

|

|

| Total |

23,610,000

|

2,100,000

|

2,530,000

|

28,240,000

|

| San Martin Silver Mine |

|

|

|

|

| Total |

20,000

|

|

430,000

|

450,000

|

| Santa Elena Silver and Gold Mine |

|

|

|

|

| Total |

$ 5,330,000

|

$ 4,740,000

|

$ 3,860,000

|

$ 13,930,000

|

| X |

- Details

| Name: |

rxp_ProjectAxis=ag_CorporateMexicoMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_ProjectAxis=ag_CorporateSwitzerlandMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_ProjectAxis=ag_DelToroSilverMineMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_ProjectAxis=ag_JerrittCanyonGoldMineMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_ProjectAxis=ag_LaEncantadaSilverMineMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_ProjectAxis=ag_LaGuitarraSilverMineMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_ProjectAxis=ag_LaJoyaProjectMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_ProjectAxis=ag_LaLuzSilverProjectMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_ProjectAxis=ag_LaParrillaSilverMineMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_ProjectAxis=ag_SanDimasSilverAndGoldMineMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_ProjectAxis=ag_SanMartinSilverMineMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_ProjectAxis=ag_SantaElenaSilverAndGoldMineMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

v3.24.2.u1

Payments, by Government - 12 months ended Dec. 31, 2023 - CAD ($)

|

Taxes |

Royalties |

Fees |

Total Payments |

| Total |

$ 40,680,000

|

$ 7,370,000

|

$ 12,170,000

|

$ 60,220,000

|

| SWITZERLAND |

|

|

|

|

| Total |

690,000

|

|

|

690,000

|

| SWITZERLAND | Canton of Zurich, Cantonal Tax Office Zurich |

|

|

|

|

| Total |

690,000

|

|

|

690,000

|

| MEXICO |

|

|

|

|

| Total |

38,410,000

|

7,370,000

|

11,050,000

|

56,830,000

|

| MEXICO | Government of Mexico, Economy Secretary |

|

|

|

|

| Total |

|

|

8,650,000

|

8,650,000

|

| MEXICO | Government of Mexico, Energy Regulatory Commission |

|

|

|

|

| Total |

|

|

110,000

|

110,000

|

| MEXICO | Government of Mexico, National Secretary of Defense |

|

|

|

|

| Total |

|

|

10,000

|

10,000

|

| MEXICO | Government of Mexico,National Water Commission |

|

|

|

|

| Total |

|

|

1,170,000

|

1,170,000

|

| MEXICO | Government of Mexico, Secretary of Communications and Transport |

|

|

|

|

| Total |

|

|

30,000

|

30,000

|

| MEXICO | Government of Mexico, Secretary of Environment and Natural Resources |

|

|

|

|

| Total |

|

|

20,000

|

20,000

|

| MEXICO | Government of Mexico, Secretary of Finance and Administration |

|

|

|

|

| Total |

|

|

60,000

|

60,000

|

| MEXICO | Government of Mexico, Tax Administration Service |

|

|

|

|

| Total |

38,410,000

|

$ 7,370,000

|

180,000

|

45,960,000

|

| MEXICO | Government of Mexico, Treasury of the Federation |

|

|

|

|

| Total |

|

|

20,000

|

20,000

|

| MEXICO | Government of the State of Coahuila de Zaragoza |

|

|

|

|

| Total |

|

|

10,000

|

10,000

|

| MEXICO | Government of the State of Durango |

|

|

|

|

| Total |

|

|

10,000

|

10,000

|

| MEXICO | Government of the State of Sonora |

|

|

|

|

| Total |

|

|

30,000

|

30,000

|

| MEXICO | Municipality of Banamichi |

|

|

|

|

| Total |

|

|

280,000

|

280,000

|

| MEXICO | Municipality of Chalchihuites |

|

|

|

|

| Total |

|

|

360,000

|

360,000

|

| MEXICO | Municipality of Ocampo |

|

|

|

|

| Total |

|

|

110,000

|

110,000

|

| UNITED STATES |

|

|

|

|

| Total |

1,580,000

|

|

1,120,000

|

2,700,000

|

| UNITED STATES | Elko County, Elko County Recorders Office |

|

|

|

|

| Total |

|

|

50,000

|

50,000

|

| UNITED STATES | Elko County, Elko County Treasurer |

|

|

|

|

| Total |

460,000

|

|

|

460,000

|

| UNITED STATES | Government of the United States of America, Bureau of Land Management |

|

|

|

|

| Total |

|

|

720,000

|

720,000

|

| UNITED STATES | State of Nevada, Nevada Department of Environmental Protection |

|

|

|

|

| Total |

|

|

290,000

|

290,000

|

| UNITED STATES | State of Nevada, Nevada Department of Motor Vehicles |

|

|

|

|

| Total |

|

|

10,000

|

10,000

|

| UNITED STATES | State of Nevada, Nevada Department of Wildlife |

|

|

|

|

| Total |

|

|

40,000

|

40,000

|

| UNITED STATES | State of Nevada, Nevada Division of Taxation |

|

|

|

|

| Total |

$ 1,120,000

|

|

|

1,120,000

|

| UNITED STATES | State of Nevada, State emergency response commission |

|

|

|

|

| Total |

|

|

$ 10,000

|

$ 10,000

|

| X |

- Details

| Name: |

rxp_CountryAxis=country_CH |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=ag_CantonOfZurichCantonalTaxOfficeZurichMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_CountryAxis=country_MX |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=ag_GovernmentOfMexicoEconomySecretaryMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=ag_GovernmentOfMexicoEnergyRegulatoryCommissionMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=ag_GovernmentOfMexicoNationalSecretaryOfDefenseMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=ag_GovernmentOfMexicoNationalWaterCommissionMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=ag_GovernmentOfMexicoSecretaryOfCommunicationsAndTransportMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=ag_GovernmentOfMexicoSecretaryOfEnvironmentAndNaturalResourcesMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=ag_GovernmentOfMexicoSecretaryOfFinanceAndAdministrationMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=ag_GovernmentOfMexicoTaxAdministrationServiceMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=ag_GovernmentOfMexicoTreasuryOfFederationMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=ag_GovernmentOfStateOfCoahuilaDeZaragozaMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=ag_GovernmentOfStateOfDurangoMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=ag_GovernmentOfStateOfSonoraMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=ag_MunicipalityOfBanamichiMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=ag_MunicipalityOfChalchihuitesMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=ag_MunicipalityOfOcampoMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_CountryAxis=country_US |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=ag_ElkoCountyElkoCountyRecordersOfficeMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=ag_ElkoCountyElkoCountyTreasurerMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=ag_GovernmentOfUnitedStatesOfAmericaBureauOfLandManagementMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=ag_StateOfNevadaNevadaDepartmentOfEnvironmentalProtectionMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=ag_StateOfNevadaNevadaDepartmentOfMotorVehiclesMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=ag_StateOfNevadaNevadaDepartmentOfWildlifeMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=ag_StateOfNevadaNevadaDivisionOfTaxationMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=ag_StateOfNevadaStateEmergencyResponseCommissionMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

v3.24.2.u1

Payments, Details - 12 months ended Dec. 31, 2023 - CAD ($)

|

Amount |

Type |

Country |

Subnat. Juris. |

Govt. |

Project |

| #: 1 |

|

|

|

|

|

|

|

$ 38,410,000

|

Taxes

|

MEXICO

|

|

Government of Mexico, Tax Administration Service

|

|

| #: 2 |

|

|

|

|

|

|

|

7,370,000

|

Royalties

|

MEXICO

|

|

Government of Mexico, Tax Administration Service

|

|

| #: 3 |

|

|

|

|

|

|

|

180,000

|

Fees

|

MEXICO

|

|

Government of Mexico, Tax Administration Service

|

|

| #: 4 |

|

|

|

|

|

|

|

8,650,000

|

Fees

|

MEXICO

|

|

Government of Mexico, Economy Secretary

|

|

| #: 5 |

|

|

|

|

|

|

|

1,170,000

|

Fees

|

MEXICO

|

|

Government of Mexico,National Water Commission

|

|

| #: 6 |

|

|

|

|

|

|

|

1,120,000

|

Taxes

|

UNITED STATES

|

NEVADA

|

State of Nevada, Nevada Division of Taxation

|

|

| #: 7 |

|

|

|

|

|

|

|

720,000

|

Fees

|

UNITED STATES

|

|

Government of the United States of America, Bureau of Land Management

|

|

| #: 8 |

|

|

|

|

|

|

|

690,000

|

Taxes

|

SWITZERLAND

|

ZÜRICH

|

Canton of Zurich, Cantonal Tax Office Zurich

|

|

| #: 9 |

|

|

|

|

|

|

|

460,000

|

Taxes

|

UNITED STATES

|

NEVADA

|

Elko County, Elko County Treasurer

|

|

| #: 10 |

|

|

|

|

|

|

|

360,000

|

Fees

|

MEXICO

|

ZACATECAS

|

Municipality of Chalchihuites

|

|

| #: 11 |

|

|

|

|

|

|

|

290,000

|

Fees

|

UNITED STATES

|

NEVADA

|

State of Nevada, Nevada Department of Environmental Protection

|

|

| #: 12 |

|

|

|

|

|

|

|

280,000

|

Fees

|

MEXICO

|

SONORA

|

Municipality of Banamichi

|

|

| #: 13 |

|

|

|

|

|

|

|

110,000

|

Fees

|

MEXICO

|

|

Government of Mexico, Energy Regulatory Commission

|

|

| #: 14 |

|

|

|

|

|

|

|

110,000

|

Fees

|

MEXICO

|

COAHUILA DE ZARAGOZA

|

Municipality of Ocampo

|

|

| #: 15 |

|

|

|

|

|

|

|

60,000

|

Fees

|

MEXICO

|

|

Government of Mexico, Secretary of Finance and Administration

|

|

| #: 16 |

|

|

|

|

|

|

|

50,000

|

Fees

|

UNITED STATES

|

NEVADA

|

Elko County, Elko County Recorders Office

|

|

| #: 17 |

|

|

|

|

|

|

|

40,000

|

Fees

|

UNITED STATES

|

NEVADA

|

State of Nevada, Nevada Department of Wildlife

|

|

| #: 18 |

|

|

|

|

|

|

|

30,000

|

Fees

|

MEXICO

|

|

Government of Mexico, Secretary of Communications and Transport

|

|

| #: 19 |

|

|

|

|

|

|

|

30,000

|

Fees

|

MEXICO

|

SONORA

|

Government of the State of Sonora

|

|

| #: 20 |

|

|

|

|

|

|

|

20,000

|

Fees

|

MEXICO

|

|

Government of Mexico, Secretary of Environment and Natural Resources

|

|

| #: 21 |

|

|

|

|

|

|

|

20,000

|

Fees

|

MEXICO

|

|

Government of Mexico, Treasury of the Federation

|

|

| #: 22 |

|

|

|

|

|

|

|

10,000

|

Fees

|

MEXICO

|

|

Government of Mexico, National Secretary of Defense

|

|

| #: 23 |

|

|

|

|

|

|

|

10,000

|

Fees

|

MEXICO

|

DURANGO

|

Government of the State of Durango

|

|

| #: 24 |

|

|

|

|

|

|

|

10,000

|

Fees

|

UNITED STATES

|

NEVADA

|

State of Nevada, Nevada Department of Motor Vehicles

|

|

| #: 25 |

|

|

|

|

|

|

|

10,000

|

Fees

|

MEXICO

|

COAHUILA DE ZARAGOZA

|

Government of the State of Coahuila de Zaragoza

|

|

| #: 26 |

|

|

|

|

|

|

|

10,000

|

Fees

|

UNITED STATES

|

NEVADA

|

State of Nevada, State emergency response commission

|

|

| #: 27 |

|

|

|

|

|

|

|

23,610,000

|

Taxes

|

MEXICO

|

|

|

San Dimas Silver and Gold Mine

|

| #: 28 |

|

|

|

|

|

|

|

2,100,000

|

Royalties

|

MEXICO

|

|

|

San Dimas Silver and Gold Mine

|

| #: 29 |

|

|

|

|

|

|

|

2,530,000

|

Fees

|

MEXICO

|

|

|

San Dimas Silver and Gold Mine

|

| #: 30 |

|

|

|

|

|

|

|

5,330,000

|

Taxes

|

MEXICO

|

|

|

Santa Elena Silver and Gold Mine

|

| #: 31 |

|

|

|

|

|

|

|

4,740,000

|

Royalties

|

MEXICO

|

|

|

Santa Elena Silver and Gold Mine

|

| #: 32 |

|

|

|

|

|

|

|

3,860,000

|

Fees

|

MEXICO

|

|

|

Santa Elena Silver and Gold Mine

|

| #: 33 |

|

|

|

|

|

|

|

1,910,000

|

Taxes

|

MEXICO

|

|

|

La Encantada Silver Mine

|

| #: 34 |

|

|

|

|

|

|

|

530,000

|

Royalties

|

MEXICO

|

|

|

La Encantada Silver Mine

|

| #: 35 |

|

|

|

|

|

|

|

420,000

|

Fees

|

MEXICO

|

|

|

La Encantada Silver Mine

|

| #: 36 |

|

|

|

|

|

|

|

1,940,000

|

Fees

|

MEXICO

|

|

|

La Parrilla Silver Mine

|

| #: 37 |

|

|

|

|

|

|

|

1,580,000

|

Taxes

|

UNITED STATES

|

|

|

Jerritt Canyon Gold Mine

|

| #: 38 |

|

|

|

|

|

|

|

1,120,000

|

Fees

|

UNITED STATES

|

|

|

Jerritt Canyon Gold Mine

|

| #: 39 |

|

|

|

|

|

|

|

680,000

|

Fees

|

MEXICO

|

|

|

La Guitarra Silver Mine

|

| #: 40 |

|

|

|

|

|

|

|

870,000

|

Fees

|

MEXICO

|

|

|

Del Toro Silver Mine

|

| #: 41 |

|

|

|

|

|

|

|

20,000

|

Taxes

|

MEXICO

|

|

|

San Martin Silver Mine

|

| #: 42 |

|

|

|

|

|

|

|

430,000

|

Fees

|

MEXICO

|

|

|

San Martin Silver Mine

|

| #: 43 |

|

|

|

|

|

|

|

150,000

|

Fees

|

MEXICO

|

|

|

La Luz Silver Project

|

| #: 44 |

|

|

|

|

|

|

|

70,000

|

Fees

|

MEXICO

|

|

|

La Joya Project

|

| #: 45 |

|

|

|

|

|

|

|

7,540,000

|

Taxes

|

MEXICO

|

|

|

Corporate Mexico

|

| #: 46 |

|

|

|

|

|

|

|

100,000

|

Fees

|

MEXICO

|

|

|

Corporate Mexico

|

| #: 47 |

|

|

|

|

|

|

|

$ 690,000

|

Taxes

|

SWITZERLAND

|

|

|

Corporate Switzerland

|

| X |

- Details

| Name: |

rxp_PmtAxis=1 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=2 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=3 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=4 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=5 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=6 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=7 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=8 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=9 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=10 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=11 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=12 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=13 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=14 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=15 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=16 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=17 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=18 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=19 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=20 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=21 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=22 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=23 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=24 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=25 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=26 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=27 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=28 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=29 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=30 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=31 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=32 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=33 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=34 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=35 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=36 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=37 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=38 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=39 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=40 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=41 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=42 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=43 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=44 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=45 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=46 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_PmtAxis=47 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

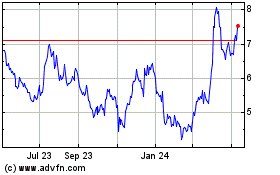

First Majestic Silver (NYSE:AG)

Historical Stock Chart

From Nov 2024 to Dec 2024

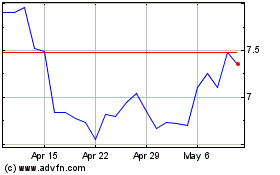

First Majestic Silver (NYSE:AG)

Historical Stock Chart

From Dec 2023 to Dec 2024