Essex Property Trust, Inc. (NYSE: ESS) (the “Company”) announced

today its fourth quarter and full-year 2023 earnings results and

related business activities.

Net Income, Funds from Operations (“FFO”), and Core FFO per

diluted share for the three and twelve months ended December 31,

2023 are detailed below.

Three Months Ended December

31,

Twelve Months Ended December

31,

%

%

2023

2022

Change

2023

2022

Change

Per Diluted

Share

Net Income

$1.02

$2.86

-64.3%

$6.32

$6.27

0.8%

Total FFO

$3.87

$3.77

2.7%

$15.24

$13.70

11.2%

Core FFO

$3.83

$3.77

1.6%

$15.03

$14.51

3.6%

Fourth Quarter and Full-Year 2023

Highlights:

- Reported Net Income per diluted share for the fourth quarter of

2023 of $1.02, compared to $2.86 in the fourth quarter of 2022. For

the full-year 2023, the Company reported Net Income per diluted

share of $6.32 compared to $6.27 in 2022.

- Grew Core FFO per diluted share by 1.6% compared to the fourth

quarter of 2022 and 3.6% compared to the full-year 2022, exceeding

the high-end of the Company’s original guidance range.

- Achieved same-property revenues and net operating income

(“NOI”) growth of 2.9% and 2.3%, respectively, compared to the

fourth quarter of 2022. For the full-year 2023, same-property

revenues and NOI grew 4.4% and 4.3%, respectively, both exceeding

the midpoint of the Company’s original guidance range.

- For the full-year 2023, the Company disposed of one apartment

community in a non-core market for a total contract price of $91.7

million.

- For the full-year 2023, the Company committed $18.8 million to

two preferred equity investments at a weighted average return rate

of 12.6%. The Company received $72.3 million in redemption proceeds

from four preferred equity investments at a weighted average return

rate of 9.1%.

- For the full-year 2023, the Company repurchased 437,026 shares

of its common stock, totaling $95.7 million at an average price per

share of $218.88.

- As of February 2, 2024, the Company’s immediately available

liquidity was approximately $1.6 billion.

Same-Property Operations

Same-property operating results exclude any properties that are

not comparable for the periods presented. The table below

illustrates the percentage change in same-property gross revenues

for the quarter ended December 31, 2023 compared to the quarter

ended December 31, 2022, and the sequential percentage change for

the quarter ended December 31, 2023 compared to the quarter ended

September 30, 2023, by submarket for the Company:

Q4 2023 vs. Q4 2022

Q4 2023 vs. Q3 2023

% of Total

Revenue Change

Revenue Change

Q4 2023 Revenues

Southern California

Los Angeles County

-0.4%

-0.6%

18.4%

Orange County

4.0%

1.8%

10.7%

San Diego County

8.2%

1.3%

9.1%

Ventura County

7.2%

1.5%

4.1%

Total Southern California

3.2%

0.6%

42.3%

Northern California

Santa Clara County

3.7%

-0.7%

19.6%

Alameda County

1.6%

-0.5%

7.7%

San Mateo County

6.1%

1.7%

4.7%

Contra Costa County

3.4%

1.6%

5.4%

San Francisco

0.0%

2.3%

2.5%

Total Northern California

3.3%

0.1%

39.9%

Seattle Metro

1.3%

0.8%

17.8%

Same-Property Portfolio

2.9%

0.5%

100.0%

The table below illustrates the components that drove the change

in same-property revenues on a year-over-year basis for the three

and twelve-month periods ended December 31, 2023 and on a

sequential basis for the three months ended December 31, 2023.

Same-Property Revenue

Components

Q4 2023 vs. Q4

2022

YTD 2023 vs. YTD

2022

Q4 2023 vs. Q3

2023

Scheduled Rents

2.4%

4.4%

0.1%

Delinquencies (1)

-0.4%

-0.7%

0.5%

Cash Concessions

0.7%

0.1%

0.0%

Vacancy

0.0%

0.2%

-0.3%

Other Income

0.2%

0.4%

0.2%

2023 Same-Property Revenue

Growth

2.9%

4.4%

0.5%

- The year-over-year negative impact from delinquencies is

largely due to lower net delinquency in the prior period, which

benefitted from Emergency Rental Assistance payments of $2.6

million and $34.5 million in the fourth quarter and full-year 2022,

respectively. This compares to Emergency Rental Assistance payments

of $0.5 million and $2.6 million in the fourth quarter and

full-year 2023, respectively. For additional details, please see

page S-16 of the accompanying supplemental financial

information.

Year-Over-Year Change

Year-Over-Year Change

Q4 2023 compared to Q4

2022

YTD 2023 compared to YTD

2022

Revenues

Operating

Expenses

NOI

Revenues

Operating

Expenses

NOI

Southern California

3.2%

6.1%

2.1%

4.9%

6.3%

4.3%

Northern California

3.3%

5.5%

2.4%

4.0%

4.1%

4.0%

Seattle Metro

1.3%

-1.6%

2.5%

4.0%

1.4%

5.1%

Same-Property Portfolio

2.9%

4.5%

2.3%

4.4%

4.5%

4.3%

Sequential Change

Q4 2023 compared to Q3

2023

Revenues

Operating

Expenses

NOI

Southern California

0.6%

-1.4%

1.5%

Northern California

0.1%

-0.1%

0.3%

Seattle Metro

0.8%

-5.5%

3.5%

Same-Property Portfolio

0.5%

-1.6%

1.3%

Financial Occupancies

Quarter Ended

12/31/2023

9/30/2023

12/31/2022

Southern California

95.9%

96.3%

96.4%

Northern California

96.2%

96.5%

95.8%

Seattle Metro

96.5%

96.3%

95.8%

Same-Property Portfolio

96.1%

96.4%

96.0%

Investment Activity

Other Investments

In December 2023, the Company received cash proceeds of $40.5

million from the full redemption of one preferred equity investment

yielding a 9.0% rate of return.

Liquidity and Balance Sheet

Common Stock

In the fourth quarter of 2023, the Company did not issue any

shares of common stock through its equity distribution program or

repurchase any shares through its stock repurchase plan. For the

full-year 2023, the Company repurchased 437,026 shares of its

common stock totaling $95.7 million, including commissions, at an

average price per share of $218.88. As of February 2, 2024, the

Company had $302.7 million of purchase authority remaining under

its stock repurchase plan.

Balance Sheet

In the fourth quarter of 2023, the Company recognized a $33.7

million impairment on one preferred equity investment located in

Oakland, CA. The impairment does not impact Total or Core FFO. The

Company stopped accruing income on the investment in the fourth

quarter of 2022 and therefore did not recognize income from this

investment in 2023. The investment is not currently in default.

As of February 2, 2024, the Company had approximately $1.6

billion in liquidity via undrawn capacity on its unsecured credit

facilities, cash and cash equivalents, and marketable

securities.

2024 Full-Year Guidance and Key

Assumptions

Per Diluted

Share

Range

Midpoint

Net Income

$5.05 - $5.59

$5.32

Total FFO

$14.46 - $15.00

$14.73

Core FFO

$14.76 - $15.30

$15.03

Q1 2024 Core FFO

$3.68 - $3.80

$3.74

U.S. Economic

Assumptions

GDP Growth

1.30%

Job Growth

1.20%

ESS Markets

Economic Assumptions

Job Growth

1.30%

Market Rent Growth

1.25%

Estimated Same-Property Portfolio

Growth

Based on 50,884 Apartment Homes

Range

Midpoint Cash-Basis

Midpoint GAAP-Basis

Revenues

0.70% to 2.70%

1.70%

1.80%

Operating Expenses

3.50% to 5.00%

4.25%

4.25%

Net Operating Income

-1.10% to 2.30%

0.60%

0.70%

Key Assumptions

- Acquisition and disposition activities will be influenced by

market conditions and cost of capital, consistent with the

Company’s historical practice of creating NAV and FFO per

share.

- Structured finance redemptions are expected to be $50 - $150

million. The proceeds will be prioritized to fund future

acquisitions, subject to market conditions.

- The Company has minimal development funding needs and does not

currently plan to start any new developments in 2024.

- Revenue generating capital expenditures are expected to be

approximately $50 million at the Company’s pro rata share.

2024 Core FFO Per Diluted Share Guidance

Midpoint versus Full-Year 2023

The table below provides a summary of changes between the

Company’s 2023 Core FFO per diluted share and its 2024 Core FFO per

diluted share guidance midpoint.

2024 Core FFO Per Diluted Share

Guidance Midpoint versus 2023

Midpoint

2023 Core FFO Per Diluted Share

$

15.03

NOI from Consolidated Communities

0.14

Consolidated Net Interest Expense

0.04

Interest and Other Income

0.02

FFO from Co-Investments, including

preferred equity

(0.16)

G&A and Other

(0.04)

2024 Core FFO Per Diluted Share

Guidance Midpoint

$

15.03

For additional details regarding the Company’s 2024 FFO guidance

range, please see page S-14 of the supplemental financial

information.

Conference Call with Management

The Company will host an earnings conference call with

management to discuss its quarterly results on Wednesday, February

7, 2024 at 11:00 a.m. PT (2:00 p.m. ET), which will be broadcast

live via the Internet at www.essex.com, and accessible via phone by

dialing toll-free, (877) 407-0784, or toll/international, (201)

689-8560. No passcode is necessary.

A rebroadcast of the live call will be available online for 30

days and digitally for 7 days. To access the replay online, go to

www.essex.com and select the fourth quarter 2023 earnings link. To

access the replay, dial (844) 512-2921 using the replay pin number

13743418. If you are unable to access the information via the

Company’s website, please contact the Investor Relations Department

at investors@essex.com or by calling (650) 655-7800.

Corporate Profile

Essex Property Trust, Inc., an S&P 500 company, is a fully

integrated real estate investment trust (REIT) that acquires,

develops, redevelops, and manages multifamily residential

properties in selected West Coast markets. Essex currently has

ownership interests in 252 apartment communities comprising

approximately 62,000 apartment homes with an additional property in

active development. Additional information about the Company can be

found on the Company’s website at www.essex.com.

This press release and accompanying supplemental financial

information has been furnished to the Securities and Exchange

Commission electronically on Form 8-K and can be accessed from the

Company’s website at www.essex.com. If you are unable to obtain the

information via the Web, please contact the Investor Relations

Department at (650) 655-7800.

FFO RECONCILIATION

FFO, as defined by the National Association of Real Estate

Investment Trusts (“NAREIT”), is generally considered by industry

analysts as an appropriate measure of performance of an equity

REIT. Generally, FFO adjusts the net income of equity REITs for

non-cash charges such as depreciation and amortization of rental

properties, impairment charges, gains on sales of real estate and

extraordinary items. Management considers FFO and FFO which

excludes non-core items, which is referred to as “Core FFO,” to be

useful supplemental operating performance measures of an equity

REIT because, together with net income and cash flows, FFO and Core

FFO provide investors with additional bases to evaluate the

operating performance and ability of a REIT to incur and service

debt and to fund acquisitions and other capital expenditures and to

pay dividends. By excluding gains or losses related to sales of

depreciated operating properties and land and excluding real estate

depreciation (which can vary among owners of identical assets in

similar condition based on historical cost accounting and useful

life estimates), FFO can help investors compare the operating

performance of a real estate company between periods or as compared

to different companies. By further adjusting for items that are not

considered part of the Company’s core business operations, Core FFO

allows investors to compare the core operating performance of the

Company to its performance in prior reporting periods and to the

operating performance of other real estate companies without the

effect of items that by their nature are not comparable from period

to period and tend to obscure the Company’s actual operating

results. FFO and Core FFO do not represent net income or cash flows

from operations as defined by U.S. generally accepted accounting

principles (“GAAP”) and are not intended to indicate whether cash

flows will be sufficient to fund cash needs. These measures should

not be considered as alternatives to net income as an indicator of

the REIT's operating performance or to cash flows as a measure of

liquidity. FFO and Core FFO do not measure whether cash flow is

sufficient to fund all cash needs including principal amortization,

capital improvements and distributions to stockholders. FFO and

Core FFO also do not represent cash flows generated from operating,

investing or financing activities as defined under GAAP. Management

has consistently applied the NAREIT definition of FFO to all

periods presented. However, there is judgment involved and other

REITs’ calculation of FFO may vary from the NAREIT definition for

this measure, and thus their disclosures of FFO may not be

comparable to the Company’s calculation.

The following table sets forth the Company’s calculation of

diluted FFO and Core FFO for the three and twelve months ended

December 31, 2023 and 2022 (in thousands, except for share and per

share amounts):

Three Months Ended December

31,

Twelve Months Ended December

31,

Funds from Operations attributable to

common stockholders and unitholders

2023

2022

2023

2022

Net income available to common

stockholders

$

65,391

$

185,165

$

405,825

$

408,315

Adjustments:

Depreciation and amortization

138,016

135,758

548,438

539,319

Gains not included in FFO

-

(94,416

)

(59,238

)

(111,839

)

Casualty loss

-

-

433

-

Impairment loss from unconsolidated

co-investments

33,700

2,105

33,700

2,105

Depreciation and amortization from

unconsolidated co-investments

18,259

18,053

71,745

72,585

Noncontrolling interest related to

Operating Partnership units

2,302

6,497

14,284

14,297

Depreciation attributable to third party

ownership and other

(379

)

(357

)

(1,474

)

(1,421

)

Funds from Operations attributable to

common stockholders and unitholders

$

257,289

$

252,805

$

1,013,713

$

923,361

FFO per share – diluted

$

3.87

$

3.77

$

15.24

$

13.70

Expensed acquisition and investment

related costs

$

220

$

1,884

$

595

$

2,132

Tax (benefit) expense on unconsolidated

co-investments (1)

(540

)

(2,373

)

697

(10,236

)

Realized and unrealized (gains) losses on

marketable securities, net

(5,712

)

(5,579

)

(10,006

)

45,547

Provision for credit losses

19

(317

)

70

(381

)

Equity (income) loss from non-core

co-investments (2)

(263

)

6,928

(1,685

)

38,045

Loss on early retirement of debt, net

-

-

-

2

Loss on early retirement of debt from

unconsolidated co-investment

-

-

-

988

Co-investment promote income

-

-

-

(17,076

)

Income from early redemption of preferred

equity investments and notes receivable

-

(811

)

(285

)

(1,669

)

General and administrative and other,

net

4,059

209

6,629

2,536

Insurance reimbursements, legal

settlements, and other, net

(739

)

(315

)

(9,821

)

(5,392

)

Core Funds from Operations attributable

to common stockholders and unitholders

$

254,333

$

252,431

$

999,907

$

977,857

Core FFO per share – diluted

$

3.83

$

3.77

$

15.03

$

14.51

Weighted average number of shares

outstanding diluted (3)

66,447,394

67,003,718

66,514,456

67,374,526

- Represents tax related to net unrealized gains or losses on

technology co-investments.

- Represents the Company's share of co-investment income or loss

from technology co-investments.

- Assumes conversion of all outstanding limited partnership units

in Essex Portfolio, L.P. (the “Operating Partnership”) into shares

of the Company’s common stock and excludes DownREIT limited

partnership units.

Net Operating Income (“NOI”) and Same-Property NOI

Reconciliations

NOI and same-property NOI are considered by management to be

important supplemental performance measures to earnings from

operations included in the Company’s consolidated statements of

income. The presentation of same-property NOI assists with the

presentation of the Company’s operations prior to the allocation of

depreciation and any corporate-level or financing-related costs.

NOI reflects the operating performance of a community and allows

for an easy comparison of the operating performance of individual

communities or groups of communities. In addition, because

prospective buyers of real estate have different financing and

overhead structures, with varying marginal impacts to overhead by

acquiring real estate, NOI is considered by many in the real estate

industry to be a useful measure for determining the value of a real

estate asset or group of assets. The Company defines same-property

NOI as same-property revenues less same-property operating

expenses, including property taxes. Please see the reconciliation

of earnings from operations to NOI and same-property NOI, which in

the table below is the NOI for stabilized properties consolidated

by the Company for the periods presented (dollars in

thousands):

Three Months Ended

Twelve Months Ended

December 31,

December 31,

2023

2022

2023

2022

Earnings from operations

$

130,341

$

228,143

$

584,342

$

595,229

Adjustments:

Corporate-level property management

expenses

11,485

10,172

45,872

40,704

Depreciation and amortization

138,016

135,758

548,438

539,319

Management and other fees from

affiliates

(2,803

)

(2,826

)

(11,131

)

(11,139

)

General and administrative

19,739

16,036

63,474

56,577

Expensed acquisition and investment

related costs

220

1,884

595

2,132

Casualty loss

-

-

433

-

Gain on sale of real estate and land

-

(94,416

)

(59,238

)

(94,416

)

NOI

296,998

294,751

1,172,785

1,128,406

Less: Non-same property NOI

(13,261

)

(17,303

)

(54,179

)

(56,058

)

Same-Property NOI

$

283,737

$

277,448

$

1,118,606

$

1,072,348

Safe Harbor Statement Under The Private

Litigation Reform Act of 1995:

This press release includes “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Forward-looking statements are statements which are not

historical facts, including statements regarding the Company's

expectations, estimates, assumptions, hopes, intentions, beliefs

and strategies regarding the future. Words such as “expects,”

“assumes,” “anticipates,” “may,” “will,” “intends,” “plans,”

“projects,” “believes,” “seeks,” “future,” “estimates,” and

variations of such words and similar expressions are intended to

identify such forward-looking statements. Such forward-looking

statements include, among other things, statements regarding the

Company’s expectations related to the continued evolution of the

work-from-home trend, the Company’s intent, beliefs or expectations

with respect to the timing of completion of current development and

redevelopment projects and the stabilization of such projects, the

timing of lease-up and occupancy of its apartment communities, the

anticipated operating performance of its apartment communities, the

total projected costs of development and redevelopment projects,

co-investment activities, qualification as a REIT under the

Internal Revenue Code of 1986, as amended, the Company’s first

quarter and full-year 2024 guidance (including net income, Total

FFO and Core FFO and related assumptions, including with respect to

GDP growth, job growth and market rent growth), 2024 same-property

revenue, operating expenses and net operating income generally and

in specific regions, the real estate markets in the geographies in

which the Company’s properties are located and in the United States

in general, the adequacy of future cash flows to meet anticipated

cash needs, its financing activities and the use of proceeds from

such activities, the availability of debt and equity financing,

general economic conditions including the potential impacts from

such economic conditions, inflation, the labor market, supply chain

impacts, geopolitical tensions and regional conflicts, trends

affecting the Company’s financial condition or results of

operations, changes to U.S. tax laws and regulations in general or

specifically related to REITs or real estate, changes to laws and

regulations in jurisdictions in which communities the Company owns

are located, and other information that is not historical

information. While the Company's management believes the

assumptions underlying its forward-looking statements are

reasonable, such forward-looking statements involve known and

unknown risks, uncertainties and other factors, many of which are

beyond the Company’s control, which could cause the actual results,

performance or achievements of the Company to be materially

different from any future results, performance or achievements

expressed or implied by such forward-looking statements. The

Company cannot assure the future results or outcome of the matters

described in these statements; rather, these statements merely

reflect the Company’s current expectations of the approximate

outcomes of the matters discussed. Factors that might cause the

Company’s actual results, performance or achievements to differ

materially from those expressed or implied by these forward-looking

statements include, but are not limited to, the following:

potential future outbreaks of infectious diseases or other health

concerns, which could adversely affect the Company’s business and

its tenants, and cause a significant downturn in general economic

conditions, the real estate industry, and the markets in which the

Company's communities are located; the Company may fail to achieve

its business objectives; the actual completion of development and

redevelopment projects may be subject to delays; the stabilization

dates of such projects may be delayed; the Company may abandon or

defer development or redevelopment projects for a number of

reasons, including changes in local market conditions which make

development less desirable, increases in costs of development,

increases in the cost of capital or lack of capital availability,

resulting in losses; the total projected costs of current

development and redevelopment projects may exceed expectations;

such development and redevelopment projects may not be completed;

development and redevelopment projects and acquisitions may fail to

meet expectations; estimates of future income from an acquired

property may prove to be inaccurate; occupancy rates and rental

demand may be adversely affected by competition and local economic

and market conditions; there may be increased interest rates,

inflation, escalated operating costs and possible recessionary

impacts; geopolitical tensions and regional conflicts, and the

related impacts on macroeconomic conditions, including, among other

things, interest rates and inflation; the Company may be

unsuccessful in the management of its relationships with its

co-investment partners; future cash flows may be inadequate to meet

operating requirements and/or may be insufficient to provide for

dividend payments in accordance with REIT requirements; changes in

laws or regulations; the terms of any refinancing may not be as

favorable as the terms of existing indebtedness; unexpected

difficulties in leasing of development projects; volatility in

financial and securities markets; the Company’s failure to

successfully operate acquired properties; unforeseen consequences

from cyber-intrusion; the Company’s inability to maintain our

investment grade credit rating with the rating agencies; government

approvals, actions and initiatives, including the need for

compliance with environmental requirements; and those further

risks, special considerations, and other factors referred to in the

Company’s annual report on Form 10-K for the year ended December

31, 2022, quarterly reports on Form 10-Q, and those risk factors

and special considerations set forth in the Company's other filings

with the SEC which may cause the actual results, performance or

achievements of the Company to be materially different from any

future results, performance or achievements expressed or implied by

such forward-looking statements. All forward-looking statements are

made as of the date hereof, the Company assumes no obligation to

update or supplement this information for any reason, and

therefore, they may not represent the Company’s estimates and

assumptions after the date of this press release.

Definitions and Reconciliations

Non-GAAP financial measures and certain other capitalized terms,

as used in this earnings release, are defined and further explained

on pages S-18.1 through S-18.4, "Reconciliations of Non-GAAP

Financial Measures and Other Terms," of the accompanying

supplemental financial information. The supplemental financial

information is available on the Company's website at

www.essex.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240206039162/en/

Loren Rainey Director, Investor Relations (650) 655-7800

lrainey@essex.com

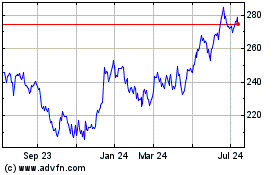

Essex Property (NYSE:ESS)

Historical Stock Chart

From Oct 2024 to Nov 2024

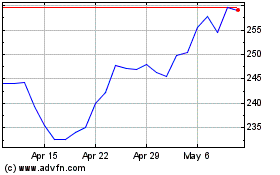

Essex Property (NYSE:ESS)

Historical Stock Chart

From Nov 2023 to Nov 2024