August Data Heighten Pressure on Industrial Stocks--update

August 22 2019 - 1:39PM

Dow Jones News

By Akane Otani

One of the hardest-hit areas of the stock market in recent

months is under fresh pressure after a series of reports showed the

manufacturing sector in decline.

Industrial stocks, ranging from heavy-machinery manufacturers

like Caterpillar Inc. to engine maker Cummins Inc., have lagged

behind the S&P 500 as investors have grown increasingly worried

about the sector's health.

Economic data released Thursday added to the group's woes. One

key gauge of manufacturing activity, IHS Markit's flash

manufacturing purchasing managers index, clocked in at 49.9 for

August. That was the lowest reading since 2009 and an indication

that manufacturing activity, which is defined as expanding when

readings are above 50, contracted for the first time in years.

Data from the Federal Reserve Bank of Kansas City also

disappointed, with the bank's manufacturing production index

declining further to -2 from -6 in July.

Those reports gave investors additional reasons to shy away from

the industrial sector.

The group has fallen 3.9% in August through Wednesday, more than

the broader S&P 500's 1.9% decline. Caterpillar has lost 11%,

while farm machinery maker Deere & Co. has fallen 6.5%, and

power and hand tool maker Stanley Black & Decker Inc. has

dropped 6.2%.

Shares of transportation companies that help move raw goods and

materials around the country have also taken a hit. The Dow Jones

Transportation Average, which tracks truckers, railroads and

airlines, is down 5.6% for the month through Wednesday, on track

for its biggest monthly decline since May.

The slide in industrial stocks matters to investors because many

have been trying to gauge whether increasingly disappointing

manufacturing data are foreshadowing a broader pattern of economic

decline or just showing isolated weakness for now.

Activity in the services sector has remained strong for the most

part. That is a reassuring sign for investors, who note that

manufacturing activity, while important, accounts for a relatively

small portion of overall economic growth.

The bad news: Downturns in the manufacturing sector have

typically preceded weakening in the services sector over the past

25 years, according to Simon MacAdam, global economist at Capital

Economics.

The caveat? "The extent of the slowdown has varied a lot and has

depended on broader economic conditions than simply the health of

the manufacturing sector," Mr. MacAdam said in a research note.

To receive our Markets newsletter every morning in your inbox,

click here.

Write to Akane Otani at akane.otani@wsj.com

(END) Dow Jones Newswires

August 22, 2019 13:24 ET (17:24 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

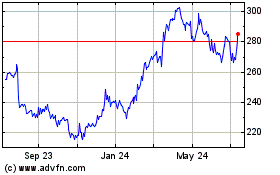

Cummins (NYSE:CMI)

Historical Stock Chart

From Jun 2024 to Jul 2024

Cummins (NYSE:CMI)

Historical Stock Chart

From Jul 2023 to Jul 2024