UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For July 2021

Commission File Number: 1-34513

CENOVUS ENERGY INC.

(Translation of registrant’s name into English)

4100, 225 6 Avenue S.W.

Calgary, Alberta, Canada T2P 1N2

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☐ Form 40-F ☒

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Exhibit 99.2, 99.3 and 99.4 to this report, furnished on Form 6-K, shall be incorporated by reference into or as an exhibit to, as applicable, each of the registrant’s Registration Statements under the Securities Act of 1933, as amended: Form F-10 (File No. 333-233702), Form S-8 (File Nos. 333-163397 and 333-251886), Form F-3D (File No. 333-202165).

DOCUMENTS FILED AS PART OF THIS FORM 6-K

See the Exhibit Index to this Form 6-K.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: July 29, 2021

| | | | | | | | | | | | | | | | | |

| | | CENOVUS ENERGY INC. | | |

| | | (Registrant) | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | By: | | /s/ Elizabeth A. McNamara | | |

| | | | Name: | | Elizabeth A. McNamara | | |

| | | | Title: | | Assistant Corporate Secretary | | |

Form 6-K Exhibit Index

| | | | | | | | |

| Exhibit No. | | |

| | |

| | News Release dated July 29, 2021 |

| | |

| | Management’s Discussion and Analysis dated July 28, 2021 for the period ended June 30, 2021 |

| | |

| | Interim Consolidated Financial Statements (unaudited) for the period ended July 30, 2021 |

| | |

| | Supplemental Financial Information (unaudited) – Consolidated Interest Coverage Ratios Exhibit to June 30, 2021 Interim Consolidated Financial Statements |

| | |

| | Form 52-109F2 Full Certificate, dated July 29, 2021, of Alex J. Pourbaix, President & Chief Executive Officer |

| | |

| | Form 52-109F2 Full Certificate, dated July 29, 2021, of Jeffrey R. Hart, Executive Vice-President & Chief Financial Officer |

Cenovus generates $1.8 billion in adjusted funds flow in Q2 2021

Delivers free funds flow of $1.3 billion

Calgary, Alberta (July 29, 2021) – Cenovus Energy Inc. (TSX: CVE) (NYSE: CVE) continues to demonstrate the strengths of the company’s integrated portfolio in its second quarter results, generating cash from operating activities of $1.4 billion, adjusted funds flow of $1.8 billion and free funds flow of $1.3 billion, supporting a reduction in net debt of nearly $1 billion since March 31, 2021. Total production of nearly 770,000 barrels of oil equivalent per day (BOE/d) despite planned turnarounds at several assets, and strong realized commodity prices in the upstream business along with continued recovery of demand for U.S. downstream products drove Cenovus’s strong financial performance, which the company expects will continue through the rest of the year.

“Our results underscore the earnings power of the combined company as we further integrate and deliver on our expanded asset base,” said Alex Pourbaix, Cenovus President & Chief Executive Officer. “We posted a strong second quarter and expect to accelerate deleveraging in the second half of this year.”

Second quarter highlights

•Generated cash from operating activities of $1.4 billion, adjusted funds flow of $1.8 billion and free funds flow of $1.3 billion.

•Increasing production guidance for 2021 by 2% with total capital guidance unchanged.

•On track to achieve $1.2 billion of run-rate synergies and net debt of $10 billion by end of 2021.

| | | | | | | | | | | |

Financial, production & throughput summary |

(For the period ended June 30) | 2021 Q2 | 2020 Q21 | % change1 |

Financial ($ millions, except per share amounts) |

Cash from operating activities | 1,369 | (834) |

|

Adjusted funds flow2,3 | 1,817 | (469) |

|

Per share (basic) | 0.90 | (0.38) |

|

Capital investment | 534 | 147 | 263 |

Free funds flow2,3 | 1,283 | (616) |

|

Net earnings (loss) | 224 | (235) |

|

Per share (basic) | 0.11 | (0.19) |

|

Net debt2 | 12,390 | 8,232 | 51 |

Production and throughput (before royalties, net to Cenovus) |

Oil and NGLs (bbls/d) | 614,900 | 400,050 | 54 |

Natural gas (MMcf/d) | 906 | 392 | 131 |

Total upstream production (BOE/d) | 765,900 | 465,415 | 65 |

Total downstream throughput (bbls/d) | 539,000 | 162,300 | 232 |

1 Comparative figures include Cenovus results prior to the January 1, 2021 closing of the Husky transaction and do not reflect historical data from Husky.

2 Adjusted funds flow, free funds flow and net debt are non-GAAP measures. See Advisory.

3 Prior period has been restated to conform with the current definition of adjusted funds flow.

Overview of Q2 results

Progress on integration and synergies

In the second quarter, integration expenditures of $46 million included costs associated with workforce reductions and consolidation of debt, head offices and IT systems. Integration expenditures for the first six months of 2021 were $291 million, including $34 million in capitalized costs.

Cenovus has reduced its integration costs guidance for 2021 to between $400 million and $450 million. The company remains on pace to realize at least $1 billion in synergies in 2021 and to reach its go-forward annual run-rate of $1.2 billion in synergies by the end of this year. Total integration costs for the Husky transaction are still expected to be in the range of $500 million to $550 million, with the remainder to be spent in 2022.

The company continues to identify additional synergies for its expanded asset base, including further opportunities to apply Cenovus’s in situ operating expertise to improve the performance of assets in Alberta and Saskatchewan. For example, through the application of the company’s operating philosophy, including the use of downhole temperature monitoring data, the Lloydminster thermal projects achieved quarterly average daily production of 97,700 barrels per day (bbls/d) and similar opportunities at the other Oil Sands assets are being evaluated. The marketing team is also leveraging the broader portfolio of assets and transportation contracts to optimize sales and marketing activities for our production.

“We continue to make great progress on our integration and remain focused on accessing the next layer of synergies,” said Pourbaix. “We benefit from a top-tier asset base with a wealth of opportunities to improve returns, all guided by an experienced team with a track record of safe and reliable operations.”

Financial results

Operating margin for the quarter was $2.2 billion, compared with $1.9 billion in the first quarter of 2021 and $291 million in the second quarter of 2020. The improvement over 2020 was primarily driven by higher commodity prices, increased sales volumes and higher downstream throughputs due to the addition of Husky assets. This was delivered while completing several planned turnarounds, speaking to the strength of the company’s overall production base. Second quarter operating margin was also impacted by realized risk management losses and receipt of cash related to a take or pay contract for the Bruderheim crude-by-rail terminal operations.

Adjusted funds flow of $1.8 billion included the impact of integration costs incurred in the quarter. Cash from operating activities was $1.4 billion, including changes in non-cash working capital of $430 million. Free funds flow of $1.3 billion included capital investment in the quarter of $534 million. The company continues to expect total capital expenditures for the year in the range of $2.3 billion to $2.7 billion.

Cenovus generated net earnings of $224 million in the second quarter compared with a net loss of $235 million in the same period of 2020. The improvement in net earnings was driven by higher operating margin, partially offset by higher unrealized risk management losses and integration costs.

The company recorded a realized loss on risk management of $199 million in the second quarter of 2021, primarily related to inventory risk management which was offset by higher revenues from the physical sales. Risk management gains and losses are a result of both inventory risk management and corporate hedging. Inventory risk management is undertaken to ensure that as decisions are made to transport or store barrels, the margin on this transaction is captured. Resulting inventory risk management gains or losses are designed to mirror revenue gains or losses on the related physical transactions. It should be expected that in periods of rising price environments, the company will report inventory risk management losses that are offset by physical positions and vice versa. In the second quarter, crude oil production volumes exceeded sales volumes as the company exercised its ability to store and defer a portion of sales to realize higher price opportunities.

Asset sales update

During the second quarter, as previously announced, Cenovus divested its gross overriding royalty (GORR) in the Marten Hills area of Alberta for gross cash proceeds of $102 million, which were used to repay debt. In addition, Cenovus entered into agreements in June and July to divest assets in the East Clearwater and Kaybob areas of Alberta for total expected cash proceeds of approximately $110 million. Combined net production from the East Clearwater and Kaybob assets was approximately 12,000 BOE/d (about 45% oil and NGLs) and the sale of these assets is now assumed in the updated 2021 Guidance ranges for the Conventional segment. Both sales are expected to close around the middle of the third quarter of 2021 and proceeds will be used for debt reduction. In line with its strategy, Cenovus will pursue further value accretive asset sales through the balance of 2021 to accelerate debt reduction towards its interim net debt target of $10 billion.

Debt Repayment

Net debt at the end of the second quarter was $12.4 billion, compared with $13.3 billion at March 31, 2021, with the nearly $1 billion decrease primarily due to free funds flow of $1.3 billion and an unrealized foreign exchange gain of $150 million on U.S. denominated debt, partially offset by a net change in non-cash working capital of $389 million. The increase in non-cash working capital was related to an increase in inventories and accounts receivable, partially offset by an increase in accounts payable. Inventories increased as U.S. refinery utilization ramped up and product was stored in June for sale at higher prices in the third quarter, and accounts receivable increased mainly due to higher commodity and refined product prices.

Deleveraging remains a top priority and Cenovus expects to meet its interim net debt target of $10 billion within 2021, assuming current commodity prices and foreign exchange rates hold, with a longer-term target of $8 billion or lower. The company will continue to prioritize the balance sheet after reaching $10 billion net debt, however opportunities for incremental shareholder returns and investment in the business will be considered around achievement of the interim target.

Consistent operating performance

Cenovus produced 765,900 BOE/d in the quarter, resulting in a total upstream operating margin of about $1.9 billion. Oil Sands crude oil production of 549,400 bbls/d was driven by record production at Christina Lake and the Lloydminster thermal operations, and partially offset by planned

turnarounds at Foster Creek, Sunrise and several Lloydminster thermal projects. As a result of continued strong performance, Cenovus has updated its 2021 production guidance to between 750,000 BOE/d and 790,000 BOE/d.

In the company’s downstream operations, the Canadian upgrading and refining business had a utilization rate in the second quarter of 94%. The U.S. refineries continued to ramp up throughput to 435,500 bbls/d, in line with increasing demand for refined products and improved market crack spreads. U.S. throughput was affected by planned and unplanned maintenance at the Wood River and Borger refineries, and planned third-party pipeline outages on lines supplying the Lima Refinery. Total downstream operating margin was $291 million.

Health and safety

Cenovus continues to prioritize the health and safety of its staff and neighbouring communities. As provinces in Western Canada continue to roll out vaccination programs and ease COVID-19 restrictions, Cenovus is gradually adjusting the protocols at its operations in those areas, aligned with the direction of governments, public health officials and the company’s internal health and safety experts. Office staff in Western Canada are beginning to return to the workplace, with Calgary employees returning in early September. Staff in other regions previously returned to the office following local guidance. The company continues to closely monitor the evolving situation.

The safety of its people and operations, as well as the protection of the environment, is critical for Cenovus. In June, the company began implementing the Cenovus Operations Integrity Management System, a framework of safety requirements leveraging the best practices of both Cenovus and Husky, which will be used at all sites and facilities.

Operating highlights

Oil Sands

Total crude oil production was 549,400 bbls/d for the Oil Sands segment in the quarter even with planned turnarounds at Foster Creek, Sunrise and several Lloydminster thermal assets. The segment generated operating margin of $1.4 billion in the second quarter, compared with $130 million in the second quarter of 2020. The increase was primarily due to higher average pricing and additional sales volumes from the Husky assets, partially offset by higher transportation and blending costs. Oil sands average netbacks were $32.43/BOE in the quarter, compared with a loss of $4.08/BOE in the second quarter of 2020.

Christina Lake production averaged 230,500 bbls/d in the quarter, an increase of about 7,600 bbls/d from the first quarter of 2021 as re-drilled wells came online and more than 23,000 bbls/d year-over-year, primarily because in the second quarter of 2020 the company voluntarily ran at reduced levels in response to low prices. Production at Foster Creek was 156,800 bbls/d, down approximately 6,300 bbls/d compared with the first quarter of the year and 9,200 bbls/d year-over-year due to a planned turnaround and unplanned operational outages. The application of Cenovus operating techniques at the legacy Husky Lloydminster thermal projects resulted in record quarterly production of 97,700 bbls/d despite turnarounds at several of the operations. Cenovus has increased its Oil Sands

production guidance to between 540,000 bbls/d and 596,000 bbls/d, including an additional 10,000 bbls/d from the Lloydminster thermal business.

Oil sands per-unit transportation costs decreased 14% in the quarter to $7.37/bbl compared with $8.56/bbl in the second quarter of 2020. Transportation costs for Foster Creek production increased 8% to $12.25/bbl in the second quarter compared with 2020 as Cenovus optimized its pipeline capacity out of Alberta to ship more crude to U.S. destinations to obtain higher prices, partially offset by shipping less by rail than in 2020. The per-barrel transportation costs for Christina Lake production decreased to $6.10/bbl from $6.19/bbl in the same period in 2020 as less crude was sold to the U.S. Gulf Coast than the year before, with no volumes shipped by rail. Blending costs in the quarter were driven by higher condensate prices.

Per-barrel operating costs for the segment were $11.91/bbl compared with $7.36/bbl in the second quarter of 2020, due to higher per-unit operating costs of the legacy Husky assets, planned turnarounds at Foster Creek, Sunrise and several Lloydminster thermal projects, and increased AECO pricing and other commodity-linked costs. Cenovus continues to focus on applying its operating techniques to Husky assets to enhance performance, including further expected reductions in operating costs.

Conventional

The Conventional assets generated operating margin of $142 million in the quarter compared with $32 million in the same period a year ago, due to higher realized sales prices on total production of 141,300 BOE/d, which reflected increased volumes from legacy Husky assets.

Per-unit operating costs were $10.41/bbl compared with $9.05/bbl in the second quarter of 2020, primarily due to higher average operating expenses for the legacy Husky assets. The segment had netbacks of $10.00/bbl in the quarter, compared with $2.93/bbl in 2020.

Offshore

The Offshore segment had total production of 73,000 BOE/d, generating operating margin of $340 million, with a netback of $57.06/BOE.

In the Asia Pacific region, sales volumes of 57,800 BOE/d received total realized sales pricing of $67.93/BOE in the quarter, based on long-term contracted pricing for natural gas and annual pricing contracts for NGLs. Operating netback for Asia Pacific production was $58.34/BOE. In Indonesia, a final investment decision was taken by the joint venture partners for the MAC field in the Madura Strait.

Atlantic region production of 15,200 bbls/d received Brent-like realized pricing of $86.07/bbl in the second quarter, with a netback averaging $52.17/bbl.

Cenovus has increased its Offshore production guidance to reflect the strength and consistency of its operations through the first half of 2021.

Downstream

Cenovus’s Downstream segment, with total crude throughput of 539,000 bbls/d, generated operating margin of $291 million in the second quarter compared with $129 million in the same period of 2020, due to assets added in the Husky transaction.

Canadian Manufacturing

With solid average utilization of 94%, the Lloydminster Upgrader and Lloydminster Asphalt Refinery contributed to total Canadian Manufacturing operating margin of $189 million. The facilities have been operating reliably and at near capacity throughout the year, with throughput in the second quarter of 103,500 bbls/d. The Canadian Manufacturing segment had operating expense of $9.89/bbl in the quarter compared with $9.69/bbl in the first quarter of 2021.

Volumes shipped by rail through the Bruderheim terminal were 3,100 bbls/d in the quarter compared with 5,700 bbls/d in the same period of 2020 as Cenovus optimized its expanded pipeline capacity out of Alberta to U.S. destinations. The company received $55 million in cash related to a take-or-pay contract for the Bruderheim operations.

U.S. Manufacturing

Increasing demand for refined products saw throughput in the U.S. Manufacturing segment increase to 435,500 bbls/d, compared with 162,300 bbls/d in 2020. This increase was also due to the addition of legacy Husky assets, offset by planned and unplanned maintenance at the Wood River and Borger refineries, and planned outages on third-party pipelines supplying the Lima Refinery. The planned turnarounds at the Wood River and Borger refineries were completed in the quarter.

Utilization in the second quarter averaged 87%. The segment generated operating margin of $96 million compared with $123 million in the second quarter of 2020, largely due to increased operating expenses related to the turnarounds and the higher cost of purchasing Renewable Identification Numbers (RINs). RINs were priced at $8.12/bbl in the second quarter compared with $2.21/bbl in the same period in 2020. RINs pricing was volatile in the first half of the year, ranging from slightly more than US$4.00/bbl to almost US$10.00/bbl.

Operating margin for the second quarter was comparable to the first quarter of 2021 despite higher benchmark crack spreads and increased throughput rates. Operating margin and gross margin were impacted by higher RINs costs, which increased from $180 million in the first quarter to $305 million in the second quarter, and increased refinery feedstock costs due to higher benchmark WTI prices.

Operating expense in the quarter was $9.96/bbl, compared with $11.91/bbl in the year ago period due to higher throughput year-over-year with the addition of legacy Husky assets and as product demand recovers.

Sustainability

Cenovus has entered into a 15-year power purchase agreement with a partnership between Cold Lake First Nations and Elemental Energy Inc. to buy solar-power produced electricity and the associated emissions offsets. The agreement will help Cenovus mitigate its scope 2 emissions, supporting its

efforts to both reduce greenhouse gas (GHG) emissions and further support Indigenous reconciliation through economic engagement. The 150-megawatt project, to be built in southern Alberta, is expected to begin adding electricity to the provincial grid in 2023.

In June, Cenovus announced its participation in the Oil Sands Pathways to Net Zero initiative, an alliance of five companies with the goal of achieving net zero GHG emissions from their oil sands operations by 2050. The alliance’s net zero ambition will support Canada’s efforts to meet its Paris Agreement commitments and 2050 net zero aspirations.

“We are committed to global climate leadership and to taking bold action to address our emissions challenge, while also helping Canada meet its climate goals and preserving the long-term success of our business and industry, and the benefits it provides,” said Pourbaix. “We will continue working with governments, the clean tech industry and Indigenous communities to make our vision a reality, cementing a spot as the supplier of choice to meet the world’s growing demand for energy.”

Cenovus has released its 2020 Environmental, Social and Governance (ESG) data report, aligning with the Sustainability Accounting Standards Board (SASB) and IPIECA (formerly the International Petroleum Industry Environmental Conservation Association) reporting frameworks. The report includes 2020 performance metrics for Cenovus and Husky and 2016-2019 historical data for Cenovus. Later this year the company will publish a more comprehensive ESG report, aligning with the Task Force on Climate-related Disclosures, and containing pro forma 2020 metrics and revised targets for its five priority areas: climate & GHG emissions, water stewardship, biodiversity, Indigenous reconciliation and inclusion & diversity.

2021 Guidance update

Cenovus has updated its 2021 Guidance. The capital guidance range remains $2.3 billion to $2.7 billion for the year. However it now reflects an increase to the Oil Sands spend of $100 million, which will add production in 2022 including accelerating completion of the Spruce Lake North Lloydminster thermal project and carrying out some redevelopment wells at Christina Lake. This capital increase is offset by a reduction in Downstream of $100 million, which reflects efficiencies identified across the portfolio. The production guidance range for 2021 increased by 2%, including an additional 10,000 bbls/d from Lloydminster thermals and increases in Offshore, partially offset by announced asset sales in the Conventional segment.

The operating cost guidance range for Oil Sands has been increased modestly, reflecting increases in AECO pricing and other commodity-linked costs. While these also impact operating costs for the Lloydminster thermal projects, this is more than offset by efficiencies achieved by applying Cenovus’s operating techniques, and as a result the operating cost range has been reduced. The operating cost guidance for Conventional has also been reduced, reflecting efficiencies achieved there.

See the Guidance document for more detail, including royalties, cash taxes and adjusted funds flow sensitivities, at cenovus.com.

Dividend

For the third quarter of 2021, the Board of Directors declared a dividend of $0.0175 per share, payable on September 30, 2021 to common shareholders of record as of September 15, 2021. The Board also declared a third-quarter dividend on each of the Cumulative Redeemable First Preferred Shares – Series 1, Series 2, Series 3, Series 5 and Series 7 – payable on September 30, 2021, to shareholders of record as of September 15, 2021 as follows:

| | | | | | | | |

Preferred shares dividend summary |

| Rate (%) | Amount ($/share) |

Share series |

Series 1 | 2.577 | 0.16106 |

Series 2 | 1.839 | 0.11588 |

Series 3 | 4.689 | 0.29306 |

Series 5 | 4.591 | 0.28694 |

Series 7 | 3.935 | 0.24594 |

All dividends paid on Cenovus’s common and preferred shares will be designated as "eligible dividends" for Canadian federal income tax purposes. Declaration of dividends is at the sole discretion of the Board and will continue to be evaluated on a quarterly basis.

| | |

Conference call today 9 a.m. Mountain Time (11 a.m. Eastern Time) Cenovus will host a conference call today, July 29, 2021, starting at 9 a.m. MT (11 a.m. ET).

To participate, please dial 888-390-0605 (toll-free in North America) or 416-764-8609 approximately 10 minutes prior to the conference call. A live audio webcast of the conference call will also be available. The webcast will be archived for approximately 90 days. |

Advisory

Basis of Presentation

Cenovus reports financial results in Canadian dollars and presents production volumes on a net to Cenovus before royalties basis, unless otherwise stated. Cenovus prepares its financial statements in accordance with International Financial Reporting Standards (IFRS).

Barrels of Oil Equivalent

Natural gas volumes have been converted to barrels of oil equivalent (BOE) on the basis of six thousand cubic feet (Mcf) to one barrel (bbl). BOE may be misleading, particularly if used in isolation. A conversion ratio of one bbl to six Mcf is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent value equivalency at the wellhead. Given that the value ratio based on the current price of crude oil compared with natural gas is significantly different from the energy equivalency conversion ratio of 6:1, utilizing a conversion on a 6:1 basis is

not an accurate reflection of value.

Non-GAAP Measures and Additional Subtotal

This news release contains references to adjusted funds flow, free funds flow and net debt, which are non-GAAP measures. These measures do not have a standardized meaning as prescribed by IFRS. Readers should not consider these measures in isolation or as a substitute for analysis of the company’s results as reported under IFRS. These measures are defined differently by different companies and therefore are not comparable to similar measures presented by other issuers. For definitions, as well as reconciliations to GAAP measures, and more information on these and other non-GAAP measures and additional subtotals, refer to “Non-GAAP Measures and Additional Subtotals” on page 1 of Cenovus’s Management’s Discussion and Analysis (MD&A) for the period ended June 30, 2021 (available on SEDAR at sedar.com, on EDGAR at sec.gov and Cenovus’s website at cenovus.com).

Forward-looking Information

This news release contains certain forward-looking statements and forward-looking information (collectively referred to as “forward-looking information”) within the meaning of applicable securities legislation, including the U.S. Private Securities Litigation Reform Act of 1995, about Cenovus’s current expectations, estimates and projections about the future of the combined company, based on certain assumptions made in light of experiences and perceptions of historical trends. Although Cenovus believes that the expectations represented by such forward-looking information are reasonable, there can be no assurance that such expectations will prove to be correct.

Forward-looking information in this document is identified by words such as “achieve”, “ambition”, “aspirations”, “commitments”, “committed”, “continue”, “deliver”, “expect”, “focus”, “goal”, “opportunities”, “on pace”, “on track”, “priority”, “remain”, “target”, “vision” and “will” or similar expressions and includes suggestions of future outcomes, including, but not limited to statements about: general and 2021 priorities; delivering at least $1 billion in synergies in 2021 and reaching $1.2 billion in annual run-rate synergies by the end of 2021; achieving $10 billion net debt in 2021 and a longer term net debt target of $8 billion or lower; allocation of free cash flow; leveraging and capturing additional synergies from the acquisition of Husky; status of expected one-time integration-related costs; current and future asset sales and the use of proceeds; full year inventory risk management and corporate hedging programs to manage inventory positions and improve certainty; opportunity for incremental shareholder returns and investment in the business; future reductions of per-barrel operating costs in the Oil Sands segment; our expected results for the remainder of 2021; timing of workforce return to the workplace; implementation of the Cenovus Operations Integrity Management System at all sites and facilities; Cenovus’s ambition to achieve net zero emissions by 2050 and plans to set new ESG targets; Cenovus’s expectations for its participation in the Oil Sands Pathways to Net Zero and the power purchase agreement with a partnership between Cold Lake First Nations and Elemental Energy Inc.; quarterly evaluation of declaring dividends; planned turnarounds; and all statements related to the company’s updated 2021 Guidance.

Developing forward-looking information involves reliance on a number of assumptions and consideration of certain risks and uncertainties, some of which are specific to Cenovus and others that apply to the industry generally. The factors or assumptions on which the forward-looking information in this news release are based include, but are not limited to: Cenovus’s ability to realize the anticipated benefits of the Husky transaction; the allocation of free cash flow to Cenovus’s balance sheet; commodity prices; future narrowing of crude oil differentials; Cenovus’s ability to produce on

an unconstrained basis; Cenovus’s ability to access sufficient insurance coverage to pursue development plans; Cenovus’s ability to deliver safe and reliable operations and demonstrate strong governance; and the assumptions inherent in Cenovus’s updated 2021 Guidance available on cenovus.com.

The risk factors and uncertainties that could cause actual results to differ materially from the forward-looking information in this news release include, but are not limited to: Cenovus’s ability to realize the anticipated benefits of the Husky transaction; the effectiveness of Cenovus’s risk management program; the accuracy of estimates regarding commodity prices, operating and capital costs and currency and interest rates; risks inherent in the operation of Cenovus’s business; ability to successfully complete development plans and improve asset performance; and risks associated with climate change and Cenovus’s assumptions relating thereto.

Except as required by applicable securities laws, Cenovus disclaims any intention or obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Readers are cautioned that the foregoing lists are not exhaustive and are made as at the date hereof. Events or circumstances could cause actual results to differ materially from those estimated or projected and expressed in, or implied by, the forward-looking information. For additional information regarding Cenovus’s material risk factors, the assumptions made, and risks and uncertainties which could cause actual results to differ from the anticipated results, refer to “Risk Management and Risk Factors” and “Advisory” in Cenovus’s MD&A for the period ended June 30, 2021 and to the risk factors, assumptions and uncertainties described in other documents Cenovus files from time to time with securities regulatory authorities in Canada (available on SEDAR at sedar.com, on EDGAR at sec.gov and Cenovus’s website at cenovus.com).

Additional information concerning Husky’s business and assets as of December 31, 2020 may be found in Husky’s MD&A and Annual Information Form, each of which is filed and available on SEDAR under Husky’s profile at sedar.com.

Cenovus Energy Inc.

Cenovus Energy Inc. is an integrated energy company with oil and natural gas production operations in Canada and the Asia Pacific region, and upgrading, refining and marketing operations in Canada and the United States. The company is focused on managing its assets in a safe, innovative and cost-efficient manner, integrating environmental, social and governance considerations into its business plans. Cenovus common shares and warrants are listed on the Toronto and New York stock exchanges, and the company’s preferred shares are listed on the Toronto Stock Exchange. For more information, visit cenovus.com.

Find Cenovus on Facebook, Twitter, LinkedIn, YouTube and Instagram.

Cenovus contacts:

| | | | | |

Investors | Media |

Investor Relations general line | Media Relations general line |

403-766-7711 | 403-766-7751 |

MANAGEMENT’S DISCUSSION AND ANALYSIS

For the periods ended June 30, 2021

This Management’s Discussion and Analysis (“MD&A”) for Cenovus Energy Inc. (which includes references to “we”, “our”, “us”, “its”, the “Company”, or “Cenovus”, and means Cenovus Energy Inc., the subsidiaries of, and partnership interests held by, Cenovus Energy Inc. and its subsidiaries) dated July 28, 2021 should be read in conjunction with our June 30, 2021 unaudited interim Consolidated Financial Statements and accompanying notes (“interim Consolidated Financial Statements”), the December 31, 2020 audited Consolidated Financial Statements and accompanying notes (“Consolidated Financial Statements”) and the December 31, 2020 MD&A (“annual MD&A”). All of the information and statements contained in this MD&A are made as of July 28, 2021, unless otherwise indicated. This MD&A contains forward-looking information about our current expectations, estimates, projections and assumptions. See the Advisory for information on the risk factors that could cause actual results to differ materially and the assumptions underlying our forward-looking information. Cenovus management (“Management”) prepared the MD&A. The interim MD&As and the annual MD&A are reviewed by the Audit Committee and recommended for approval by the Cenovus Board of Directors (“the Board”). Additional information about Cenovus, including our quarterly and annual reports, the Annual Information Form (“AIF”) and Form 40-F, is available on SEDAR at sedar.com, on EDGAR at sec.gov, and on our website at cenovus.com. Information on or connected to our website, even if referred to in this MD&A, does not constitute part of this MD&A. On January 1, 2021, pursuant to a plan of arrangement under the Business Corporations Act (Alberta), Husky Energy Inc. (“Husky”) became a wholly-owned subsidiary of Cenovus. Husky was subsequently amalgamated with Cenovus on March 31, 2021 (the “amalgamation”) under the Canada Business Corporations Act and ceased to make separate filings as a reporting issuer. Unless the context requires otherwise, any reference herein to Husky refers to the business and operations of Husky prior to the amalgamation. In connection with its acquisition of Husky and in accordance with applicable securities laws, Cenovus filed a business acquisition report on March 26, 2021 containing the pro forma financial statements of the combined company as at December 31, 2020. Additional information concerning Husky’s business and assets as at December 31, 2020 may be found in the annual information form of Husky dated February 8, 2021 for the year ended December 31, 2020 (the “Husky AIF”) and Husky’s management’s discussion and analysis of the financial and operating results for the year ended December 31, 2020 (the "Husky MD&A"), each of which is filed and available on SEDAR under Husky’s profile at sedar.com.

Basis of Presentation

This MD&A and the interim Consolidated Financial Statements and comparative information have been prepared in Canadian dollars, (which includes references to “dollar” or “$”), except where another currency has been indicated, and in accordance with International Financial Reporting Standards (“IFRS” or “GAAP”) as issued by the International Accounting Standards Board (“IASB”). Production volumes are presented on a before royalties basis.

Non-GAAP Measures and Additional Subtotals

Certain financial measures in this document do not have a standardized meaning as prescribed by IFRS, such as Netbacks, Adjusted Funds Flow, Free Funds Flow, Net Debt, Capitalization and Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization (“Adjusted EBITDA”) and therefore are considered non-GAAP measures. In addition, Operating Margin is considered an additional subtotal found in Note 1 of our interim Consolidated Financial Statements. These measures may not be comparable to similar measures presented by other issuers. These measures have been described and presented in order to provide shareholders and potential investors with additional measures for analyzing our ability to generate funds to finance our operations and information regarding our liquidity. This additional information should not be considered in isolation or as a substitute for measures prepared in accordance with IFRS. The definition and reconciliation, if applicable, of each non-GAAP measure or additional subtotal is presented in the Operating and Financial Results, Liquidity and Capital Resources, or Advisory sections of this MD&A.

We are a Canadian-based integrated energy company headquartered in Calgary, Alberta. Our common shares and warrants are listed on the Toronto (“TSX”) and New York (“NYSE”) stock exchanges. Our cumulative redeemable preferred shares Series 1, 2, 3, 5 and 7 are listed on the TSX. We are the third largest Canadian-based crude oil and natural gas producer and the second largest Canadian-based refiner and upgrader, with operations in Canada, the United States (“U.S.”) and the Asia Pacific region. Our upstream operations include oil sands projects in northern Alberta, thermal and conventional crude oil, natural gas and natural gas liquids (“NGLs”) projects across Western Canada, crude oil production offshore Newfoundland and Labrador and natural gas and NGLs production offshore China and Indonesia. Our downstream operations include upgrading, refining and retail operations in Canada and the U.S.

Our operations involve activities across the full value chain to develop, transport, produce and market crude oil and natural gas in Canada and internationally. Our physically integrated upstream and downstream operations help us mitigate the impact of volatility in light-heavy crude oil differentials and contributes to our bottom line by capturing value from crude oil and natural gas production through to the sale of finished products like transportation fuels.

During the three months ended June 30, 2021, crude oil production from our Oil Sands assets averaged 549.4 thousand barrels per day which is generally aligned with our downstream crude oil throughput of 539.0 thousand barrels per day. Total upstream production averaged 765.9 thousand barrels of oil equivalent (“BOE”) per day.

Cenovus and Husky Arrangement

On January 1, 2021, Cenovus and Husky Energy Inc. (“Husky”) closed the transaction to combine the two companies through a plan of arrangement (the “Arrangement”) pursuant to which Cenovus acquired all the issued and outstanding common shares of Husky in exchange for common shares and common share purchase warrants of Cenovus. In addition, all of the issued and outstanding Husky preferred shares were exchanged for Cenovus preferred shares with substantially identical terms.

The Arrangement combines high quality oil sands and heavy oil assets with extensive trading, supply and logistics infrastructure, and downstream assets, which creates opportunities to optimize the margin captured across the heavy oil value chain. With the combination of processing capacity and market access outside Alberta for the majority of the Company’s oil sands and heavy oil production, exposure to Alberta heavy oil price differentials is reduced while maintaining exposure to global commodity prices.

Our Strategy

Our strategy remains focused on maximizing shareholder value through cost leadership and realizing the best margins for our products. Our diverse and integrated portfolio will help us to deliver stable cash flow through price cycles while maintaining safe and reliable operations. The Company has a cost-and-market-advantaged asset portfolio, and prioritizes free funds flow generation, balance sheet strength and returns to shareholders. We remain focused on reducing Net Debt (as defined in this MD&A) and sustainably growing shareholder returns. We believe that maintaining a strong balance sheet will help Cenovus navigate through commodity price volatility.

Our financial framework has established an interim Net Debt target of $10 billion and longer term, $8 billion or lower which is in line with a target of a Net Debt to Adjusted EBITDA ratio of less than two times at the bottom of the cycle, which we see as approximately US$45 per barrel WTI. We plan to use our capital allocation framework to evaluate disciplined investments in our portfolio against dividends, share repurchases and managing to the optimal debt level while maintaining investment grade status. Environmental, Social and Governance ("ESG") considerations are embedded into our framework and business plan. Our investment focus will be on areas where we believe we have the greatest competitive advantage to generate the highest returns.

On January 28, 2021, we announced our 2021 budget focused on sustaining capital and generating Free Funds Flow to strengthen the balance sheet, accelerated by capturing transaction-related synergies across the organization. 2021 guidance dated January 28, 2021, and updated on July 28, 2021, is available on our website at cenovus.com.

Our Operations

The Company operates through the following reportable segments:

Upstream Segments

•Oil Sands, includes the development and production of bitumen and heavy oil in northern Alberta and Saskatchewan. Cenovus’s oil sands assets include Foster Creek, Christina Lake, Sunrise (jointly owned with BP Canada Energy Group ULC (“BP Canada”) and operated by Cenovus) and Tucker oil sands projects, as well as Lloydminster thermal and cold and enhanced oil recovery ("EOR") assets. Cenovus jointly owns and operates pipeline gathering systems and terminals through the equity-accounted investment in Husky Midstream Limited Partnership (“HMLP”). The sale and transportation of Cenovus’s production and third-party commodity trading volumes are managed and marketed

through access to capacity on third-party pipelines and storage facilities in both Canada and the U.S. to optimize product mix, delivery points, transportation commitments and customer diversification.

•Conventional, includes assets rich in NGLs and natural gas within the Elmworth-Wapiti, Kaybob‑Edson, Clearwater and Rainbow Lake operating areas in Alberta and British Columbia and interests in numerous natural gas processing facilities. Cenovus’s NGLs and natural gas production is marketed and transported with other third-party commodity trading volumes through access to capacity on third-party pipelines, export terminals and storage facilities, which provides flexibility for market access to optimize product mix, delivery points, transportation commitments and customer diversification.

•Offshore, includes offshore operations, exploration and development activities in China and the east coast of Canada, as well as the equity-accounted investment in the Husky-CNOOC Madura Ltd. (“HCML”) joint venture in Indonesia.

Downstream Segments

•Canadian Manufacturing, includes the owned and operated Lloydminster upgrading and asphalt refining complex which upgrades heavy oil into synthetic crude oil, diesel fuel and asphalt. Cenovus seeks to maximize the value per barrel from its heavy oil production through its integrated network of assets. In addition, Cenovus owns and operates the Bruderheim crude-by-rail terminal and two ethanol plants. Cenovus also markets its production and third-party commodity trading volumes of synthetic crude oil, asphalt and ancillary products.

•U.S. Manufacturing, includes the refining of crude oil to produce diesel fuel, gasoline, jet fuel, asphalt and other products at the wholly-owned Lima Refinery and Superior Refinery, the Wood River and Borger refineries (jointly owned with operator Phillips 66) and the Toledo Refinery (jointly owned with operator BP Products North America Inc. (“BP”)). Cenovus also markets its own and third-party volumes of refined petroleum products including gasoline, diesel and jet fuel.

•Retail, includes the marketing of our own and third-party volumes of refined petroleum products, including gasoline and diesel, through retail, commercial and bulk petroleum outlets, as well as wholesale channels in Canada.

Corporate and Eliminations, primarily includes Cenovus-wide costs for general and administrative, financing activities, foreign exchange gain or loss and gain or loss on risk management on corporate related derivative instruments. Eliminations include adjustments for internal usage of natural gas production between segments, transloading services provided to the Oil Sands segment by the Company’s crude-by-rail terminal and crude oil production used as feedstock by the Canadian Manufacturing and U.S. Manufacturing segments. Eliminations are recorded at transfer prices based on current market prices.

To conform to the presentation adopted for the current period’s operating segments, the following comparatives prior to January 1, 2021, have been reclassified:

•The Company’s market optimization activities, previously reported in the Refining and Marketing segment, have been reclassified to the Oil Sands and Conventional segments.

•The Bruderheim crude-by-rail terminal results, previously reported under the Refining and Marketing segment, have been reclassified to the Canadian Manufacturing segment.

•The refining activities in the U.S. with operator Phillips 66, previously reported in the Refining and Marketing segment, have been reclassified to the U.S. Manufacturing segment.

•The Company’s unrealized gain and loss on risk management, previously reported in the Corporate and Eliminations segment, have been reclassified to the reportable segment to which the derivative instrument relates.

The Arrangement was accounted for using the acquisition method pursuant to IFRS 3, “Business Combinations”. Under the acquisition method, assets and liabilities are measured at their estimated fair value on the date of acquisition with the exception of income tax, stock-based compensation, lease liabilities and right-of-use (“ROU”) assets. The total consideration was allocated to the tangible and intangible assets acquired and liabilities assumed. Comparative figures in this MD&A include Cenovus results prior to the closing of the Arrangement on January 1, 2021, and does not reflect any historical data from Husky. Significant differences on operating and financial results compared with 2020 are primarily the result of the Arrangement.

The preliminary purchase price allocation is based on Management’s best estimate of the assets acquired and liabilities assumed. The Company will finalize the value of net assets acquired by December 31, 2021, and adjustments to initial estimates, including goodwill, may be required. No significant adjustments were made to the preliminary purchase price allocation as at June 30, 2021.

| | |

| QUARTERLY RESULTS OVERVIEW |

During the second quarter, we continued to build on our strong operational performance in the first quarter with our integrated asset base and the improving commodity price environment driving financial results. The strong results helped us reduce our net debt by nearly $1 billion during the three months ended June 30, 2021.

During the quarter we sold our GORR interest in Marten Hills for gross cash proceeds of approximately $100 million. We also entered into definitive agreements to sell assets within the Conventional segment located in the East Clearwater area and the Kaybob area for combined gross proceeds of approximately $110 million. The Kaybob transaction closed in July and the East Clearwater transaction is expected to close in the third quarter of 2021.

Cenovus also focused on health and safety as our top priority while maintaining our low operating and capital cost structure.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Six Months

Ended

June 30, | | | | | | | | | | | | | | | | | | | | | | |

| | 2021 | | 2020 | | | 2019 | |

| ($ millions, except where indicated) | | 2021 | | | 2020 | | | Q2 | | | Q1 | | Q4 | | Q3 | | Q2 | | Q1 | | | Q4 | | Q3 | | Q2 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Production Volumes (MBOE/d) | | 767.6 | | | | 474.0 | | | | 765.9 | | | | 769.3 | | | 467.2 | | | 471.8 | | | 465.4 | | | 482.6 | | | | 467.4 | | | 448.5 | | | 443.3 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Crude Throughput (1) (Mbbls/d) | | 504.2 | | | | 191.7 | | | | 539.0 | | | | 469.1 | | | 169.0 | | | 191.1 | | | 162.3 | | | 221.1 | | | | 227.9 | | | 232.4 | | | 237.0 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Revenues (2) | | 19,727 | | | | 6,135 | | | | 10,577 | | | | 9,150 | | | 3,426 | | | 3,659 | | | 2,174 | | | 3,961 | | | | 4,838 | | | 4,736 | | | 5,603 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Operating Margin (3) | | 4,063 | | | | (298) | | | | 2,184 | | | | 1,879 | | | 625 | | | 594 | | | 291 | | | (589) | | | | 864 | | | 1,080 | | | 1,277 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Cash From (Used in) Operating

Activities | | 1,597 | | | | (709) | | | | 1,369 | | | | 228 | | | 250 | | | 732 | | | (834) | | | 125 | | | | 740 | | | 834 | | | 1,275 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Adjusted Funds Flow (4) | | 2,958 | | | | (623) | | | | 1,817 | | | | 1,141 | | | 333 | | | 407 | | | (469) | | | (154) | | | | 679 | | | 917 | | | 1,075 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Earnings (Loss) | | 444 | | | | (2,032) | | | | 224 | | | | 220 | | | (153) | | | (194) | | | (235) | | | (1,797) | | | | 113 | | | 187 | | | 1,784 | | |

Per Share ($) (5) | | 0.21 | | | | (1.65) | | | | 0.11 | | | | 0.10 | | | (0.12) | | | (0.16) | | | (0.19) | | | (1.46) | | | | 0.09 | | | 0.15 | | | 1.45 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Capital Investment (6) | | 1,081 | | | | 451 | | | | 534 | | | | 547 | | | 242 | | | 148 | | | 147 | | | 304 | | | | 317 | | | 294 | | | 248 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net Debt (7) | | 12,390 | | | | 8,232 | | | | 12,390 | | | | 13,340 | | | 7,184 | | | 7,530 | | | 8,232 | | | 7,421 | | | | 6,513 | | | 6,802 | | | 7,088 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Cash Dividends | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Shares | | 71 | | | | 77 | | | | 36 | | | | 35 | | | — | | | — | | | — | | | 77 | | | | 77 | | | 60 | | | 62 | | |

Per Common Share ($) | | 0.0350 | | | | 0.0625 | | | | 0.0175 | | | | 0.0175 | | | — | | | — | | | — | | | 0.0625 | | | | 0.0625 | | | 0.0500 | | | 0.0500 | | |

| Preferred Shares | | 17 | | | | — | | | | 8 | | | | 9 | | | — | | | — | | | — | | | — | | | | — | | | — | | | — | | |

(1)Represents Cenovus’s net interest in refining operations. The comparative periods have been restated to Cenovus’s net interest.

(2)Comparative figures have been re-presented for portion of inventory write-downs reclassified to royalties.

(3)Additional subtotal found in Note 1 of the interim Consolidated Financial Statements and defined in this MD&A.

(4)Non-GAAP measure defined in this MD&A. Comparative figures have been restated to conform with the definition in this MD&A.

(5)Represented on a basic and diluted per share basis.

(6)Includes expenditures on property, plant and equipment (“PP&E”) and exploration and evaluation (“E&E”) assets.

(7)Non-GAAP measure defined in this MD&A. Includes long-term debt and short-term borrowings assumed at fair value of $6,642 million as part of the Arrangement.

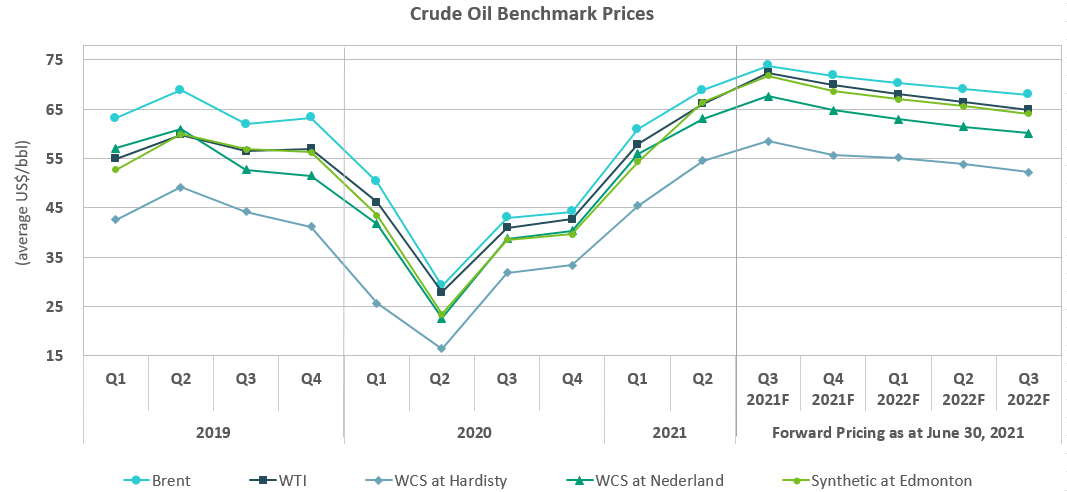

Crude oil prices and market crack spreads continued to improve in the second quarter compared with the first quarter and the first six months of 2020. Rebounding crude oil global demand amid roll out efforts of the novel coronavirus (“COVID-19”) vaccines, economic recoveries, and declines in crude oil inventories drove improved commodity markets.

Operationally, variables under Management's control performed very well. Our upstream production averaged 765.9 thousand BOE per day in the second quarter, compared with 465.4 thousand BOE per day in the second quarter of 2020. Assets acquired in the Arrangement averaged 286.8 thousand BOE per day during the quarter. Christina Lake increased production compared with 2020, and Foster Creek production declined slightly compared with 2020 as we completed a planned maintenance turnaround. Our Lloydminster thermal assets continue to perform well as we apply our operating strategy and production and well delivery techniques.

Our downstream crude throughput averaged 539.0 thousand barrels per day in the second quarter compared with 162.3 thousand barrels per day in the second quarter of 2020. Assets acquired in the Arrangement averaged 330.1 thousand barrels per day of crude throughput during the quarter. The Lloydminster Upgrader and Lloydminster Refinery ran near capacity throughout the quarter. Our U.S. refineries had increased utilization rates driven by increased demand, partially offset by the impact of planned and unplanned outages.

In the second quarter we incurred $46 million of integration expenditures, including capital of $12 million. Year-to-date expenditures, including capital, are approximately $291 million of the $400 million to $450 million expected in 2021 as integration work continues throughout the year.

Following the close of the Arrangement we anticipated that we could achieve approximately $600 million in run-rate synergies within the first six months of 2021. We have achieved this objective.

We prioritize ongoing ESG leadership and integration of sustainability considerations into our business decisions. During the quarter, we announced the Oil Sands Pathways to Net Zero initiative, an alliance of peers working collectively with the federal and provincial governments with a goal to achieve net zero greenhouse gas ("GHG") emissions from oil sands operations by 2050.

In the second quarter we:

•Generated cash flow from operating activities of $1,369 million. Adjusted funds flow was $1,817 million and capital investment was $534 million, resulting in Free Funds Flow of $1,283 million.

•Generated an operating margin of $2,184 million compared with $291 million in the second quarter of 2020, primarily due to higher average realized crude oil, NGLs and natural gas sales prices, higher market crack spreads, and increased sales volumes from assets acquired in the Arrangement.

•Reduced our net debt by nearly $1 billion.

•Sold our GORR interest in Marten Hills for gross cash proceeds of approximately $100 million.

We expect our total capital expenditures to be between $2.3 billion and $2.7 billion in 2021, including sustaining capital of approximately $2.1 billion, and $520 million to $570 million (excluding insurance proceeds) for the Superior Refinery rebuild. We will continue to be disciplined with our capital. Our updated guidance dated July 28, 2021 is available on our website at cenovus.com.

Cenovus remains committed to the health and safety of its workforce and the public while providing essential services. Physical distancing measures continue to be in place to maintain the health and safety of our people and to help mitigate the risk of COVID-19 at our workplaces. We continue to monitor the changing COVID-19 situation and respond accordingly in a timely manner. Work-from-home measures remained in place for the quarter and continue to be in place for all non-essential staff at our combined offices and worksites in Alberta, Saskatchewan and Manitoba, pending further review. The full scope of our operations will continue to take direction from local health authorities regarding their COVID-19 workplace mandates. Staff levels at sites and offices have and will continue to follow guidance received from the applicable federal, provincial, state and local governments and public health officials.

| | |

| OPERATING AND FINANCIAL RESULTS |

Selected Operating Results

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, | |

|

| | | | Percent Change | | | | | | | | | Percent Change | | | | |

| 2021 | | | | | 2020 | | | 2021 | | | | | 2020 | |

| Upstream Production Volumes | | | | | | | | | | | | | | | | | |

Oil Sands (Mbbls/d) | | | | | | | | | | | | | | | | | |

| Foster Creek | 156.8 | | | (6) | | | | 166.0 | | | 159.9 | | | (3) | | | | 164.9 | |

| Christina Lake | 230.5 | | | 11 | | | | 207.2 | | | 226.7 | | | 5 | | | | 215.2 | |

Sunrise (1) | 22.4 | | | | | | — | | | 25.1 | | | | | | — | |

| Lloydminster Thermal | 97.7 | | | | | | — | | | 96.9 | | | | | | — | |

| Tucker | 21.2 | | | | | | — | | | 22.2 | | | | | | — | |

| Lloydminster Cold/EOR | 20.8 | | | | | | — | | | 20.7 | | | | | | — | |

Total Oil Sands Crude Oil | 549.4 | | | 47 | | | | 373.2 | | | 551.5 | | | 45 | | | | 380.1 | |

| | | | | | | | | | | | | | | | | |

Conventional (MBOE/d) | 141.3 | | | 53 | | | | 92.2 | | | 138.6 | | | 48 | | | | 93.9 | |

| | | | | | | | | | | | | | | | | |

Offshore (MBOE/d) | | | | | | | | | | | | | | | | | |

Asia Pacific (2) | 57.8 | | | | | | — | | | 59.3 | | | | | | — | |

| Atlantic | 15.2 | | | | | | — | | | 16.1 | | | | | | — | |

Offshore Total | 73.0 | | | | | | — | | | 75.4 | | | | | | — | |

| | | | | | | | | | | | | | | | | |

Total Production Volumes (MBOE/d) | 765.9 | | | 65 | | | | 465.4 | | | 767.6 | | | 62 | | | | 474.0 | |

| | | | | | | | | | | | | | | | | |

Total Upstream Sales Volumes (3) (MBOE/d) | 673.3 | | | 66 | | | | 406.5 | | | 681.8 | | | 62 | | | | 421.2 | |

| | | | | | | | | | | | | | | | | |

| Downstream Manufacturing Crude Throughput | | | | | | | | | | | | | | | | | |

Canadian Manufacturing (Mbbls/d) | | | | | | | | | | | | | | | | | |

Lloydminster Upgrader | 76.1 | | | | | | — | | | 77.2 | | | | | | — | |

Lloydminster Refinery | 27.4 | | | | | | — | | | 27.6 | | | | | | — | |

Canadian Manufacturing Total | 103.5 | | | | | | — | | | 104.8 | | | | | | — | |

U.S. Manufacturing (Mbbls/d) | | | | | | | | | | | | | | | | | |

Lima Refinery | 160.9 | | | | | | — | | | 142.9 | | | | | | — | |

Wood River and Borger refineries (1) | 208.9 | | | 29 | | | | 162.3 | | | 189.6 | | | (1) | | | | 191.7 | |

Toledo Refinery (1) | 65.7 | | | | | | — | | | 66.9 | | | | | | — | |

U.S. Manufacturing Total | 435.5 | | | 168 | | | | 162.3 | | | 399.4 | | | 108 | | | | 191.7 | |

| | | | | | | | | | | | | | | | | |

Total Throughput (Mbbls/d) | 539.0 | | | 232 | | | | 162.3 | | | 504.2 | | | 163 | | | | 191.7 | |

| | | | | | | | | | | | | | | | | |

Retail (millions of litres/d) | | | | | | | | | | | | | | | | | |

| Fuel sales, including wholesale | 6.7 | | | | | | — | | | 6.6 | | | | | | — | |

(1)Represents Cenovus’s 50 percent interest in Sunrise, Wood River, Borger and Toledo operations.

(2)Reported production volumes reflect Cenovus’s 40 percent interest in the Madura-BD gas project. Revenues and expenses related to the HCML joint venture are accounted for using the equity method for consolidated financial statement purposes.

(3)Has been reduced for natural gas volumes used for internal consumption by the Oil Sands segment of 510 MMcf/d and 515 MMcf/d for the three and six months ended June 30, 2021, respectively (334 MMcf/d and 340 MMcf/d for the three and six months ended June 30, 2020, respectively).

Upstream Production Volumes

Our Oil Sands assets continued their strong performance from the first quarter of 2021. Christina Lake production increased from the first quarter as wells came online. We had a planned turnaround and operational outages at Foster Creek which lowered production compared with the first quarter. Assets acquired in the Arrangement averaged 162.1 thousand barrels per day in the second quarter. Our Lloydminster thermal assets continue to perform well as we apply our operating strategy and production and well delivery techniques. We completed planned maintenance turnaround at Sunrise during the quarter, impacting production.

Conventional production increased compared with the first quarter of 2021 as new wells were brought online. Assets acquired in the Arrangement continued their strong performance, averaging 51.7 thousand BOE per day during the quarter.

In the second quarter, Offshore production declined marginally compared with the first quarter of 2021 averaging 73.0 thousand BOE per day. This was due to planned maintenance in China and Indonesia. Offshore production is entirely from assets acquired in the Arrangement.

Downstream Manufacturing

Crude Throughput by Segment

Crude throughput increased compared with the first quarter as the market continued to improve. During the second quarter, our U.S. refineries averaged a crude utilization rate of 87 percent driven by increased demand, partially offset by the impact of planned and unplanned outages. The Lloydminster Upgrader and Lloydminster Refinery ran at or near capacity throughout the first half of 2021.

At the Wood River and Borger refineries, throughput was impacted by planned maintenance turnarounds that began in the first quarter. The turnaround at Borger was completed in early April and the turnaround at Wood River was completed in mid-May. Throughput at the Wood River and Borger refineries was further impacted, temporarily, by unplanned outages during the second quarter. In addition, the Wood River refinery implemented crude rate reductions in line with market demand.

At the Lima Refinery, throughput was affected in the first quarter of 2021 by a temporary unplanned outage and the impact of winter storm Uri on a key pipeline supplying the Lima Refinery’s feedstock. Throughput ramped up in March as market crack spreads improved. In the second quarter, planned third-party maintenance at the Mid-Valley and West Texas Gulf pipelines reduced throughput, which ramped up upon completion of the maintenance.

At the Toledo Refinery, throughput was optimized in line with market demand in the first half of 2021.

Further information on the changes in our financial and operating results can be found in the Reportable Segments section of this MD&A. Information on our risk management activities can be found in the Risk Management and Risk Factors section of this MD&A and in the notes to the Consolidated Financial Statements.

Selected Consolidated Financial Results

Operating Margin

Operating Margin is an additional subtotal found in Note 1 of the interim Consolidated Financial Statements and is used to provide a consistent measure of the cash generating performance of our assets for comparability of our underlying financial performance between periods. Operating Margin is defined as revenues less purchased product, transportation and blending, operating expenses, plus realized gains less realized losses on risk management activities. Items within the Corporate and Eliminations segment are excluded from the calculation of Operating Margin.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | | | Six Months Ended

June 30, | |

| ($ millions) | | 2021 | | | | 2020 (1) | | | | 2021 | | | | 2020 (1) | |

| Gross Sales | | 12,386 | | | | | 2,286 | | | | | 23,058 | | | | | 6,524 | | |

| Less: Royalties | | 533 | | | | | 21 | | | | | 906 | | | | | 75 | | |

| Revenues | | 11,853 | | | | | 2,265 | | | | | 22,152 | | | | | 6,449 | | |

| Expenses | | | | | | | | | | | | | | | |

| Purchased Product | | 6,363 | | | | | 762 | | | | | 11,430 | | | | | 2,959 | | |

| Transportation and Blending | | 1,802 | | | | | 651 | | | | | 3,602 | | | | | 2,579 | | |

| Operating Expenses | | 1,306 | | | | | 502 | | | | | 2,608 | | | | | 1,126 | | |

| Realized (Gain) Loss on Risk Management Activities | | 198 | | | | | 59 | | | | | 449 | | | | | 83 | | |

| Operating Margin | | 2,184 | | | | | 291 | | | | | 4,063 | | | | | (298) | | |

(1)Inventory write-downs prior to January 1, 2021, have been reclassified to royalties, purchased product, transportation and blending or operating expenses to conform with the current presentation of inventory write-downs.

Operating Margin by Segment

Three Months Ended June 30, 2021

Operating Margin increased in the second quarter of 2021 compared with 2020 primarily due to:

•Higher average crude oil, NGLs and natural gas sales prices resulting from higher benchmark pricing.

•Increased upstream and refined products sales volumes from assets acquired in the Arrangement.

•Increased crude throughput and higher market crack spreads.

These increases in Operating Margin were partially offset by:

•Increased blending costs due to higher condensate prices.

•Product inventory write-downs recognized in the first quarter of 2020 of $345 million and $243 million related to our upstream and downstream assets, respectively, and mostly sold in the second quarter of 2020.

•Higher realized risk management losses due to the settlement of benchmark prices relative to our risk management contract prices.

Six Months Ended June 30, 2021

Operating Margin increased in the first half of 2021 compared with 2020 primarily due to:

•Higher average crude oil, NGLs and natural gas sales prices resulting from higher benchmark pricing.

•Increased upstream sales volumes from assets acquired in the Arrangement.

•Higher Operating Margin from our Canadian Manufacturing and U.S. Manufacturing segments primarily due to increased crude throughput and higher market crack spreads.

These increases in Operating Margin were partially offset by increased blending costs due to higher condensate prices, and higher realized risk management losses due to the settlement of benchmark prices relative to our risk management contract prices.

Cash From (Used in) Operating Activities and Adjusted Funds Flow

Adjusted Funds Flow is a non-GAAP measure commonly used in the oil and gas industry to assist in measuring a company’s ability to finance its capital programs and meet its financial obligations. Adjusted Funds Flow is defined as cash from (used in) operating activities excluding settlement of decommissioning liabilities and net change in non-cash working capital. Non-cash working capital is composed of accounts receivable, inventories (excluding non-cash inventory write-downs and reversals), income tax receivable, accounts payable and income tax payable.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | | | Six Months Ended

June 30, | |

| ($ millions) | | 2021 | | | | 2020 | | | | 2021 | | | | 2020 | |

| Cash From (Used in) Operating Activities | | 1,369 | | | | | (834) | | | | | 1,597 | | | | | (709) | | |

| (Add) Deduct: | | | | | | | | | | | | | | | |

Settlement of Decommissioning Liabilities | | (18) | | | | | (2) | | | | | (29) | | | | | (33) | | |

| Net Change in Non-Cash Working Capital | | (430) | | | | | (363) | | | | | (1,332) | | | | | (53) | | |

Adjusted Funds Flow (1) | | 1,817 | | | | | (469) | | | | | 2,958 | | | | | (623) | | |

(1)The comparative period has been restated to conform with the current period definition of Adjusted Funds Flow.

Cash From Operating Activities and Adjusted Funds Flow were higher in the three months ended June 30, 2021 compared with 2020 due to increased Operating Margin, as discussed above, combined with distributions received from equity-accounted affiliates. The increase was partially offset by higher finance costs and higher general and administrative expenses. The change in non-cash working capital in the second quarter of 2021 was primarily due to an increase in inventories and accounts receivable, partially offset by an increase in accounts payable on June 30, 2021 compared with March 31, 2021.

In the three months ended June 30, 2021, the increase in accounts receivable was primarily due to higher commodity prices partially offset by the receipt of insurance proceeds from the Superior Refinery rebuild project. The increase in inventory was primarily due to higher crude oil inventory related to Foster Creek and Christina Lake combined with higher crude oil and finished goods inventory at Lima. The increase in accounts payable relates to higher feedstock prices in the U.S. Manufacturing segment combined with higher risk management liabilities in the Oil Sands segment.

Cash From Operating Activities and Adjusted Funds Flow were higher in the six months ended June 30, 2021, compared with the first half of 2020 due to increased Operating Margin, as discussed above, combined with distributions received from equity-accounted affiliates. The increase was partially offset by integration costs of $257 million, and long-term incentives of $111 million paid related to the accelerated payout to our employees in connection with the Arrangement, higher finance costs and increased general and administrative expenses. The change in non-cash working capital in the first half of 2021 was primarily due to an increase in inventories and accounts receivable, partially offset by an increase in accounts payable on June 30, 2021 compared with December 31, 2020.

In the six months ended June 30, 2021 the increase in accounts receivable was primarily due to the higher crude oil and refined product pricing in the Oil Sands and U.S. Manufacturing segment, partially offset by lower sales volumes exiting the quarter at Foster Creek and Christina Lake compared with December 2020. The increase in inventory compared with 2020 was primarily due to higher commodity prices and refined product pricing, combined with higher Foster Creek and Christina Lake volumes held in inventory. The increase in accounts payable was primarily due to higher crude oil and feedstock prices combined with an increase in risk management liabilities, partially offset by the settlement of the integration costs, long-term incentive costs to Cenovus employees and the payment of long-term incentives liability assumed as part of the Arrangement.

Net Earnings (Loss)

| | | | | | | | | | | | | | | | | | | | | | | |

| ($ millions) | | Three Months Ended | | | | Six Months

Ended | |

| Net Earnings (Loss) for the Periods Ended June 30, 2020 | | (235) | | | | | (2,032) | | |

| Increase (Decrease) due to: | | | | | | | |

| Operating Margin | | 1,893 | | | | | 4,361 | | |

| Corporate and Eliminations: | | | | | | | |

| Unrealized Foreign Exchange Gain (Loss) | | (96) | | | | | 700 | | |

| Re-measurement of Contingent Payment | | (185) | | | | | (502) | | |

| Integration costs | | (34) | | | | | (257) | | |

| General and Administrative | | (74) | | | | | (260) | | |

| Finance costs | | (93) | | | | | (230) | | |

Other (1) | | 24 | | | | | 13 | | |

| Unrealized Risk Management Gain (Loss) | | (276) | | | | | (122) | | |

| Depreciation, Depletion and Amortization | | (456) | | | | | (558) | | |

| Exploration Expense | | — | | | | | (3) | | |

| Income Tax Recovery (Expense) | | (244) | | | | | (666) | | |

| Net Earnings (Loss) for the Periods Ended June 30, 2021 | | 224 | | | | | 444 | | |

(1)Includes interest income, realized foreign exchange (gains) losses, (gain) loss on divestiture of assets, other (income) loss, net, and share of income (loss) from equity-accounted affiliates, and Corporate and Eliminations revenues, purchased product, transportation and blending, operating expenses, and (gain) loss on risk management.

Net Earnings of $224 million in the second quarter of 2021 was significantly higher than the Net Loss of $235 million in 2020 due to higher Operating Margin, as discussed above. The increase was partially offset by higher unrealized risk management losses, lower unrealized foreign exchange gains, a loss on the re-measurement of the contingent payment of $249 million (2020 – $64 million), and increased finance expenses, depreciation, depletion and amortization (“DD&A”) expense and income tax expense as result of the Arrangement.

On a year-to-date basis, Net Earnings of $444 million was significantly higher than the Net Loss of $2,032 million in the first half of 2020 due to higher Operating Margin, as discussed above, an impairment loss of $315 million in the first quarter of 2020, and gains on unrealized foreign exchange compared with losses in 2020. This was partially offset by a loss on the re-measurement of the contingent payment of $436 million (2020 – $66 million gain), integration costs of $257 million, and higher general and administrative costs, finance costs, DD&A expense and income tax expense as a result of the Arrangement.

Net Debt

Net Debt is a non-GAAP measure used to monitor our capital structure. Net Debt is defined as short-term borrowings, and the current and long-term portions of long-term debt, net of cash and cash equivalents and short-term investments.

| | | | | | | | | | | | | | | | | | | | | | | |

($ millions) As at | | June 30,

2021 | | | | December 31,

2020 | |

| | | | | | | |

| Short-Term Borrowings | | 65 | | | | | 121 | | |

| Long-Term Debt, including current portion | | 13,380 | | | | | 7,441 | | |

| Less: Cash and Cash Equivalents | | (1,055) | | | | | (378) | | |

| Net Debt | | 12,390 | | | | | 7,184 | | |

Net Debt on January 1, 2021, was $13.1 billion, including the fair value of $5.9 billion assumed from the Arrangement. Since the Arrangement, we have reduced our net debt by $701 million, including nearly $1 billion during the second quarter of 2021.

Capital Investment (1) (2)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | | | Six Months Ended

June 30, | |

| ($ millions) | | 2021 | | | | 2020 | | | | 2021 | | | | 2020 | |

| Upstream | | | | | | | | | | | | | | | |

| Oil Sands | | 201 | | | | | 78 | | | | | 419 | | | | | 272 | | |

| Conventional | | 28 | | | | | 11 | | | | | 94 | | | | | 27 | | |

| Offshore | | 35 | | | | | — | | | | | 61 | | | | | — | | |

| | 264 | | | | | 89 | | | | | 574 | | | | | 299 | | |

| Downstream | | | | | | | | | | | | | | | |

| Canadian Manufacturing | | 10 | | | | | 7 | | | | | 14 | | | | | 17 | | |

| U.S. Manufacturing | | 237 | | | | | 39 | | | | | 442 | | | | | 90 | | |

| Retail | | 5 | | | | | — | | | | | 6 | | | | | — | | |

| | 252 | | | | | 46 | | | | | 462 | | | | | 107 | | |

| Corporate and Eliminations | | 18 | | | | | 12 | | | | | 45 | | | | | 45 | | |

| Capital Investment | | 534 | | | | | 147 | | | | | 1,081 | | | | | 451 | | |

(1)Includes expenditures on PP&E and E&E assets.

(2)Prior periods have been reclassified to conform with current period’s operating segments.

Oil Sands capital investment in the first six months of 2021 was primarily for sustaining production focused at Christina Lake, Foster Creek and the Lloydminster thermal assets.

Conventional capital investment focused on predictable short cycle, high return development wells which are expected to improve underlying cost structures through volume enhancement and offset natural declines.

Offshore capital investment in the first six months of 2021 was primarily preservation capital for the West White Rose project in the Atlantic. The West White Rose project was deferred in March of 2020 and remains deferred for 2021 while we continue to evaluate options with our partners.

U.S. Manufacturing capital investment focused primarily on the Superior Refinery rebuild, combined with refining reliability, maintenance and yield optimization projects at the Wood River and Borger refineries.

Drilling Activity

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Gross Stratigraphic Test Wells | | | Gross Production Wells (1) | |

| Six months ended June 30, | | 2021 | 2020 | | | | 2021 | 2020 | |

| Foster Creek | | 17 | | | | | 38 | | | | | — | | | | | — | | |

| Christina Lake | | 25 | | | | | 42 | | | | | 9 | | | | | — | | |

| Lloydminster Thermal | | — | | | | | — | | | | | 15 | | | | | — | | |

| Lloydminster Cold/EOR | | — | | | | | — | | | | | 2 | | | | | — | | |

Other (2) | | 17 | | | | | 75 | | | | | — | | | | | — | | |