Cencora, Inc. (NYSE: COR) today announced that it has entered

into a definitive agreement to acquire Retina Consultants of

America (“RCA”), a leading management services organization (MSO)

of retina specialists, from Webster Equity Partners.

“The acquisition of RCA will allow Cencora to broaden our

relationships with community providers in a high growth segment and

build on our leadership in specialty,” said Bob Mauch, President

& CEO of Cencora. “With a compelling value proposition for

physicians, an impressive leadership team and strong clinical

research capabilities, RCA is well-positioned at the forefront of

retinal care. We intend to use our leading operational

infrastructure to help RCA enhance the provider experience, drive

innovative new research and create better outcomes for patients.

Following our recent investment in OneOncology, the addition of RCA

will allow us to expand our MSO solutions and drive differentiated

value across the healthcare system for manufacturers, providers and

patients.”

“We are pleased to enter our next phase of growth with the

support of a leading global pharmaceutical solutions organization,”

said Robby Grabow, Chief Executive Officer of RCA. “With additional

resources to support the continued execution of our growth

strategy, we will be better positioned to continue expanding our

physician network and enhancing the quality of care we

provide.”

“The ability to become a part of Cencora and its purpose-driven

culture, will further advance RCA’s mission of saving sight and

improving the lives of our patients and communities we serve

through innovation,” said David Brown, MD, Co-Chair of RCA’s

Medical Leadership Board. “Our cultural alignment and shared focus

on driving innovation will allow us to unlock new opportunities

together and advance the caliber of retina care.”

The proposed transaction will build on Cencora’s key strategic

imperatives and areas of focus by:

- Adding a leader in the community provider space to

Cencora: RCA is the leading MSO in the retina space and a

trusted healthcare provider. RCA’s nearly 300 retina specialists

across 23 states provide high-quality care to patients with

physicians conducting over 2 million visits annually.

- Expanding Cencora’s leadership in Specialty: As the

specialty landscape continues to evolve, providers are increasingly

seeking partners to assist with managing their practices while

retaining their autonomy and patient-centric approach. The addition

of RCA will add to Cencora’s capabilities in Specialty and expand

its MSO business, broadening physician and manufacturer

relationships as well as Cencora’s value proposition to all its

stakeholders.

- Investing in innovation and contributing to Rx

outcomes: RCA has an impressive clinical track record and

operates a premier clinical research network with 40 clinical trial

sites spanning Phases I-IV and 400 dedicated full-time research

employees. Cencora expects to use its suite of manufacturer

services to enhance RCA’s research program and outcomes,

maintaining its position as a partner of choice to pharmaceutical

innovators in the retina space.

Transaction Details

Cencora will acquire RCA for approximately $4.6 billion in cash,

subject to a customary working capital and net-debt adjustment.

RCA’s affiliated practices, physicians and management will retain a

minority interest in RCA, with Cencora holding approximately 85%

ownership in RCA upon closing. Additionally, Cencora will

potentially pay up to $500 million in aggregate contingent

consideration in fiscal year 2027 and fiscal year 2028, subject to

the successful completion of certain predefined business

objectives.

The transaction is subject to the satisfaction of customary

closing conditions, including receipt of required regulatory

approvals.

Upon closing, the acquisition of RCA is expected to be

approximately $0.35 accretive, net of estimated financing costs, to

Cencora’s adjusted diluted EPS (a non-GAAP financial measure

defined herein) for its first twelve months. Cencora plans to fund

the transaction through a combination of existing cash on hand and

new debt financing. Cencora’s fiscal year 2025 guidance does not

currently include the impact of the RCA acquisition, which will be

incorporated into expectations following the transaction close.

“Cencora is committed to maintaining its strong investment grade

credit rating and will prioritize de-leveraging in the years

following transaction close,” said Jim Cleary, EVP & Chief

Financial Officer.

Advisors

Lazard is serving as exclusive financial advisor, and

Freshfields LLP, Sidley Austin LLP and Morgan, Lewis & Bockius

LLP are serving as legal advisors to Cencora. Goldman Sachs &

Co. LLC and Rothschild & Co are serving as financial advisors,

and Goodwin Procter LLP and ReedSmith LLP are serving as legal

advisors to RCA.

About Cencora

Cencora is a leading global pharmaceutical solutions

organization centered on improving the lives of people and animals

around the world. Cencora partners with pharmaceutical innovators

across the value chain to facilitate and optimize market access to

therapies. Care providers depend on Cencora for the secure,

reliable delivery of pharmaceuticals, healthcare products, and

solutions. Cencora’s 46,000+ worldwide team members contribute to

positive health outcomes through the power of Cencora’s purpose:

Cencora is united in its responsibility to create healthier

futures. Cencora is ranked #10 on the Fortune 500 and #24 on the

Global Fortune 500 with more than $290 billion in annual revenue.

Learn more at investor.cencora.com.

About Webster Equity

Partners

Founded in 2003, Webster is a private equity firm that focuses

on high impact growth strategies that seek to deliver optimal

outcomes for its investors, portfolio companies and the communities

that it serves. Its mission is to deliver superior returns to our

partners through the investment in and development of purpose

driven patient-centric healthcare organizations dedicated to

providing best of class clinical care and service to their

patients. (https://websterequitypartners.com/)

Cencora’s Cautionary Note Regarding Forward-Looking

Statements

Certain of the statements contained in this press release are

“forward-looking statements” within the meaning of Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended (the “Securities

Exchange Act”). Such forward-looking statements may include,

without limitation, statements about the proposed transaction with

RCA, the expected timetable for completing the proposed

transaction, the benefits of the proposed transaction, future

opportunities for Cencora and RCA and any other statements

regarding Cencora’s or RCA’s future operations, financial or

operating results, anticipated business levels, future earnings,

planned activities, anticipated growth, market opportunities,

strategies, and other expectations for future periods. Words such

as “aim,” “anticipate,” “believe,” “can,” “continue,” “could,”,

“estimate,” "expect," “intend,” “may,” “might,” “on track,”

“opportunity,” “plan,” “possible,” “potential,” “predict,”

“project,” “seek,” “should,” “strive,” “sustain,” “synergy,”

“target,” “will,” “would” and similar expressions are intended to

identify forward-looking statements, but the absence of these words

does not mean that a statement is not forward-looking. Because

forward-looking statements inherently involve risks and

uncertainties, actual future results may differ materially from

those expressed or implied by such forward-looking statements.

Factors that could cause or contribute to such differences include,

but are not limited to: the parties’ ability to meet expectations

regarding the timing of the proposed transaction; the parties’

ability to consummate the proposed transaction; the regulatory

approvals required for the proposed transaction not being obtained

on the terms expected or on the anticipated schedule or at all;

inherent uncertainties involved in the estimates and judgments used

in the preparation of financial statements and the providing of

estimates of financial measures, in accordance with GAAP and

related standards, or on an adjusted basis; Cencora’s or RCA’s

failure to achieve expected or targeted future financial and

operating performance and results; the possibility that Cencora may

be unable to achieve expected benefits, synergies and operating

efficiencies in connection with the proposed transaction within the

expected time frames or at all; business disruption being greater

than expected following the proposed transaction; the recruiting

and retention of key physicians and employees being more difficult

following the proposed transaction; the effect of any changes in

customer and supplier relationships and customer purchasing

patterns; the impacts of competition; changes in the economic and

financial conditions of the business of Cencora or RCA; Cencora's

de-leveraging plans and the ability of Cencora to maintain its

investment grade rating; and uncertainties and matters beyond the

control of management and other factors described under “Risk

Factors” in Cencora’s Annual Reports on Form 10-K, Quarterly

Reports on Form 10-Q and other filings with the SEC. You can access

Cencora’s filings with the SEC through the SEC website at

www.sec.gov or through Cencora’s website, and Cencora strongly

encourages you to do so. Except as required by applicable law,

Cencora undertakes no obligation to update any statements herein

for revisions or changes after the date of this communication.

This press release is neither an offer to sell nor a

solicitation of an offer to buy any securities of Cencora. Any such

offer will only be made pursuant to a prospectus filed with the SEC

or pursuant to one or more exemptions from the registration

requirements of the Securities Act of 1933, as amended.

Supplemental Information Regarding

Non-GAAP Financial Measure

To supplement the financial measures prepared in accordance with

U.S. generally accepted accounting principles (GAAP), Cencora uses

the non-GAAP financial measure described below. The non-GAAP

financial measure should be viewed in addition to, and not in lieu

of, financial measures calculated in accordance with GAAP. This

supplemental measure may vary from, and may not be comparable to,

similarly titled measures by other companies.

The non-GAAP financial measure is presented because Cencora’s

management uses non-GAAP financial measures to evaluate Cencora’s

operating performance, to perform financial planning, and to

determine incentive compensation. Therefore, Cencora believes that

the presentation of the non-GAAP financial measure provides useful

supplementary information to, and facilitates additional analysis

by, investors. The presented non-GAAP financial measure excludes

items that management does not believe reflect Cencora’s core

operating performance because such items are outside the control of

Cencora or are inherently unusual, non-operating, unpredictable,

non-recurring, or non-cash.

Cencora does not provide a reconciliation for this non-GAAP

financial measure on a forward-looking basis to the most comparable

GAAP financial measure on a forward-looking basis because it is

unable to provide a meaningful or accurate calculation or

estimation of reconciling items and the information is not

available without unreasonable effort due to the uncertainty and

potential variability of reconciling items, which are dependent on

future events, are out of Cencora’s control and/or cannot be

reasonably predicted, and the probable significance of which cannot

be determined.

This press release includes adjusted diluted earnings per share

(“EPS”), which represents diluted earnings per share determined in

accordance with GAAP adjusted for specific items, including the per

share impact of: gains from antitrust litigation settlements;

Turkey highly inflationary impact; LIFO expense (credit);

acquisition-related intangibles amortization; litigation and opioid

expenses (credit); acquisition-related deal and integration

expenses; restructuring and other expenses; impairment of goodwill;

the gain on the divestiture of non-core businesses; the gain (loss)

on the currency remeasurement related to 2020 Swiss tax reform; and

the gain (loss) on the remeasurement of an equity investment, in

each case net of the tax effect calculated using the applicable

effective tax rate for those items. In addition, the per share

impact of certain discrete tax items primarily attributable to an

adjustment of a foreign valuation allowance, and the per share

impact of certain expenses related to 2020 Swiss tax reform are

also excluded from adjusted diluted earnings per share. Cencora’s

management believes that this non-GAAP financial measure is useful

to investors because it eliminates the per share impact of items

that are outside the control of Cencora that are not considered to

be indicative of ongoing operating performance due to their

inherent unusual, non-operating, unpredictable, non-recurring, or

non-cash nature.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241105587321/en/

Investors: Bennett S. Murphy 610-727-3693

Bennett.Murphy@cencora.com Media: Lauren

Esposito 215-460-6981

Lauren.Esposito@cencora.com

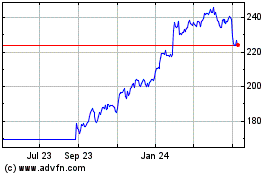

Cencora (NYSE:COR)

Historical Stock Chart

From Oct 2024 to Nov 2024

Cencora (NYSE:COR)

Historical Stock Chart

From Nov 2023 to Nov 2024