2013 funds from operations increased 17% to

$1.82 per share

CoreSite Realty Corporation (NYSE:COR), a provider of

network-dense, cloud-enabled, enterprise-class data center products

and services, today announced financial results for the fourth

quarter ended December 31, 2013.

Quarterly and Subsequent

Highlights

- Reported fourth-quarter funds from

operations (“FFO”) of $0.49 per diluted share and unit,

representing a 16.7% increase year over year

- Reported fourth-quarter operating

revenue of $61.4 million, representing an 11.2% increase year over

year

- Executed new and expansion data center

leases representing $3.5 million of annualized GAAP rent at a rate

of $132 of annualized GAAP rent per square foot

- Realized rent growth on signed renewals

of 3.5% on a cash basis and 14.3% on a GAAP basis and rental churn

of 1.9%

- Increased quarterly dividend by 30% to

$0.35 per share; annual rate of $1.40 per share

- Entered into a new $100 million,

five-year, senior unsecured term loan, and subsequently retired the

approximately $58 million loan secured by its SV1 facility

Tom Ray, CoreSite’s Chief Executive Officer, commented, “In the

fourth quarter we continued to see the financial results driven by

execution upon our plan to sell an attractive product mix to

customers benefitting from our strong foundation in the network and

cloud verticals,” Mr. Ray continued, “We also delivered the first

computer room of turn-key data center capacity at NY2 in Secaucus,

New Jersey, in December, and are pleased with sales activity

surrounding the investment. In addition, we delivered the

build-to-suit at SV5 and look forward to completing construction on

our VA2 development in Northern Virginia toward the second half of

the year. 2014 represents a year of strong opportunity for CoreSite

to leverage our network-dense, cloud-enabled data centers with

excellence in customer service. Our primary focus for the balance

of 2014 centers around increasing the productivity of our existing

sales and marketing resources to sell available and pipeline

capacity and deliver attractive returns on capital.”

Financial Results

CoreSite reported FFO attributable to shares and units of $23.1

million for the three months ended December 31, 2013, a 17.2%

increase year over year and an increase of 5.6% quarter over

quarter. On a per diluted share and unit basis, FFO increased 16.7%

to $0.49 for the three months ended December 31, 2013, as compared

to $0.42 per diluted share and unit for the three months ended

December 31, 2012. Total operating revenue for the three months

ended December 31, 2013, was $61.4 million, an 11.2% increase year

over year. Revenue growth in the fourth quarter was diluted by 1.8%

due to CoreSite’s customer at SV3 decreasing its metered power draw

as it transitions out of that facility. CoreSite reported net

income attributable to common shares of $3.1 million, or $0.15 per

diluted share.

Sales Activity

CoreSite executed 122 new and expansion data center leases,

representing $3.5 million of annualized GAAP rent during the fourth

quarter, comprised of 26,276 NRSF at a weighted average GAAP rate

of $132 per NRSF.

CoreSite’s renewal leases signed in the fourth quarter totaled

$6.8 million in annualized GAAP rent, comprised of 50,513 NRSF at a

weighted average GAAP rate of $135 per NRSF. These results reflect

a 3.5% increase in rent on a cash basis and a 14.3% increase on a

GAAP basis. The fourth-quarter rental churn rate was 1.9%.

CoreSite’s fourth-quarter data center lease commencements

totaled 116,052 NRSF at a weighted average GAAP rental rate of $41

per NRSF, which represents $4.8 million of annualized GAAP rent.

These results include a 101,721 NRSF build-to-suit powered shell

lease for a valued and strategic customer at the Santa Clara

Campus. Excluding this lease, commencements totaled 14,331 at a

weighted average GAAP rental rate of $116 per NRSF.

Development Activity

In the fourth quarter, CoreSite completed and delivered the

build-to-suit powered shell building at SV5 on its Santa Clara

campus. Also during the quarter, the company placed into service

the first computer room at the new NY2 data center in Secaucus, New

Jersey, representing an incremental 18,103 NRSF of TKD

capacity.

As of December 31, 2013, CoreSite had 118,300 NRSF of data

center space under construction at three locations. The projects

under construction include a new data center at VA2 (Northern

Virginia), adjacent to VA1, and additional inventory at NY2 (New

York market) and LA2 (Los Angeles). As of December 31, 2013,

CoreSite had incurred $117.9 million of the estimated $170.4

million required to complete these projects.

Balance Sheet and

Liquidity

As of December 31, 2013, CoreSite had $232.5 million of total

long-term debt equal to 2.1x annualized adjusted EBITDA and $347.5

million of long-term debt and preferred stock equal to 3.1x

annualized adjusted EBITDA.

As of December 31, 2013, CoreSite had $174.3 million drawn on

the credit facility and approximately $222.4 million of available

capacity under the facility.

At quarter end, CoreSite had $5.3 million of cash available on

its balance sheet. On January 31, 2014, CoreSite entered into a new

$100 million, five-year, senior unsecured term loan. The term loan

has an accordion feature, which would allow CoreSite to increase

the total commitments by $100 million, to $200 million, under

specified circumstances. CoreSite used the capacity under the term

loan to retire the $58 million mortgage on its SV1 facility and pay

down a portion of the outstanding balance on its revolving credit

facility.

Dividend

On December 6, 2013, CoreSite announced a 30% increase in its

quarterly dividend to $0.35 per share of common stock and common

stock equivalents for the fourth quarter of 2013. The dividend was

paid on January 15, 2014, to shareholders of record on December 31,

2013.

CoreSite also announced on December 6, 2013, a dividend of

$0.4531 per share of Series A preferred stock for the period

October 15, 2013, to January 14, 2014. The preferred dividend was

paid on January 15, 2014, to shareholders of record on December 31,

2013.

2014 Guidance

CoreSite is introducing its 2014 guidance of FFO per diluted

share and unit in the range of $2.00 to $2.10. More detail

regarding the assumptions behind the 2014 annual guidance can be

found on page 21 of the earnings supplemental.

In addition, the company’s estimate of the net income

attributable to common shares is $0.50 to $0.60 per diluted share,

with the difference between FFO and net income being real estate

depreciation and amortization.

This outlook is predicated on current economic conditions,

internal assumptions about CoreSite’s customer base, and the supply

and demand dynamics of the markets in which CoreSite operates. The

guidance does not include the impact of any future financing,

investment or disposition activities, beyond what has already been

disclosed.

Upcoming Conferences and

Events

CoreSite will participate in Citi’s 2014 Global Property CEO

Conference on March 3, 2014, at The Westin Diplomat in Hollywood,

Florida.

Conference Call Details

CoreSite will host a conference call on February 13, 2014, at

12:00 p.m., Eastern time (10:00 a.m., Mountain time), to discuss

its financial results, current business trends and market

conditions.

The call can be accessed live over the phone by dialing

877-407-3982 for domestic callers or 201-493-6780 for international

callers. A replay will be available shortly after the call and can

be accessed by dialing 877-870-5176 for domestic callers or

858-384-5517 for international callers. The passcode for the replay

is 13574365. The replay will be available until February 20,

2014.

Interested parties may also listen to a simultaneous webcast of

the conference call by logging on to CoreSite’s website at

www.CoreSite.com and clicking on the “Investors” tab. The on-line

replay will be available for a limited time immediately following

the call.

About CoreSite

CoreSite Realty Corporation (NYSE:COR) delivers secure and

reliable data center solutions across eight key North American

markets. CoreSite connects, protects and delivers an optimal

performance environment and continued operation of mission-critical

data and IT infrastructure for enterprises and Internet, private

networking, mobility, and cloud service providers. CoreSite's

scalable platform of over two and a half million square feet of

efficient, network-dense, cloud-enabled data center capacity

enables customers to accelerate business performance, reduce

operating costs and increase flexibility across their IT and

communications systems. CoreSite's 350 professionals deliver

best-in-class service by placing customer needs first in supporting

the planning, implementation and operating requirements

foundational to delivering reliable, secure and efficient IT

operating environments.

More than 750 of the world’s leading enterprises, carriers and

mobile operators, content and cloud providers and media and

entertainment companies choose CoreSite to connect, protect and

optimize their performance-sensitive data, applications and

computing workloads. CoreSite provides valuable gateways to global

business opportunities with direct access to more than 275 carriers

and ISPs, inter-site connectivity and CoreSite's Open Cloud

Exchange, which supports rapid, efficient and scalable Ethernet

access to multiple key public clouds, enabling simple, flexible,

multiple-cloud capabilities.

For more information, visit www.CoreSite.com.

Forward Looking Statements

This earnings release and accompanying supplemental information

may contain forward-looking statements within the meaning of the

federal securities laws. Forward-looking statements relate to

expectations, beliefs, projections, future plans and strategies,

anticipated events or trends and similar expressions concerning

matters that are not historical facts. In some cases, you can

identify forward-looking statements by the use of forward-looking

terminology such as “believes,” “expects,” “may,” “will,” “should,”

“seeks,” “approximately,” “intends,” “plans,” “pro forma,”

“estimates” or “anticipates” or the negative of these words and

phrases or similar words or phrases that are predictions of or

indicate future events or trends and that do not relate solely to

historical matters. Forward-looking statements involve known and

unknown risks, uncertainties, assumptions and contingencies, many

of which are beyond CoreSite’s control, that may cause actual

results to differ significantly from those expressed in any

forward-looking statement. These risks include, without limitation:

the geographic concentration of the company’s data centers in

certain markets and any adverse developments in local economic

conditions or the demand for data center space in these markets;

fluctuations in interest rates and increased operating costs;

difficulties in identifying properties to acquire and completing

acquisitions; significant industry competition; the company’s

failure to obtain necessary outside financing; the company’s

failure to qualify or maintain its status as a REIT; financial

market fluctuations; changes in real estate and zoning laws and

increases in real property tax rates; and other factors affecting

the real estate industry generally. All forward-looking statements

reflect the company’s good faith beliefs, assumptions and

expectations, but they are not guarantees of future performance.

Furthermore, the company disclaims any obligation to publicly

update or revise any forward-looking statement to reflect changes

in underlying assumptions or factors, of new information, data or

methods, future events or other changes. For a further discussion

of these and other factors that could cause the company’s future

results to differ materially from any forward-looking statements,

see the section entitled “Risk Factors” in the company’s most

recent annual report on Form 10-K, and other risks described in

documents subsequently filed by the company from time to time with

the Securities and Exchange Commission.

Consolidated Balance Sheet (in thousands)

December 31,

2013

December 31,

2012

Assets: Investments in real estate: Land $ 78,983 $ 85,868

Building and building improvements 717,007 596,405 Leasehold

improvements 95,218 85,907 891,208

768,180 Less: Accumulated depreciation and amortization

(155,704 ) (105,433 ) Net investment in operating properties

735,504 662,747 Construction in progress 157,317

61,328

Net investments in real estate

892,821 724,075 Cash and cash equivalents

5,313 8,130 Accounts and other receivables, net 10,339 9,901 Lease

intangibles, net 11,028 19,453 Goodwill 41,191 41,191 Other assets

55,802 42,582

Total

assets $ 1,016,494 $ 845,332

Liabilities and equity: Liabilities

Revolving credit facility $ 174,250 $

-

Mortgage loan payable 58,250 59,750 Accounts payable and accrued

expenses 67,782 50,624 Deferred rent payable 9,646 4,329 Acquired

below-market lease contracts, net 6,681 8,539 Prepaid rent and

other liabilities 11,578 11,317

Total liabilities 328,187 134,559

Stockholders' equity Series A cumulative

preferred stock 115,000 115,000 Common stock, par value $0.01 209

207 Additional paid-in capital 267,465 259,009 Distributions in

excess of net income (50,264 ) (35,987 ) Total

stockholders' equity 332,410 338,229 Noncontrolling interests

355,897 372,544

Total equity

688,307 710,773

Total

liabilities and equity $ 1,016,494

$ 845,332 Consolidated

Statement of Operations (in thousands, except share and per

share data)

Three Months Ended Year Ended

December 31,

2013

September 30,

2013

December 31,

2012

December 31,

2013

December 31,

2012

Operating revenues: Data center revenue: Rental revenue $

33,988 $ 33,428 $ 30,251 $ 131,080 $ 116,146 Power revenue 15,669

15,979 14,129 59,663 53,672 Interconnection revenue 7,866 7,441

6,369 28,932 21,637 Tenant reimbursement and other 1,885

1,873 2,506 7,317

7,088 Total data center revenue 59,408 58,721 53,255

226,992 198,543 Office, light industrial and other revenue

2,032 1,914 1,997 7,841

8,391 Total operating revenues 61,440 60,635

55,252 234,833 206,934

Operating expenses: Property

operating and maintenance 17,247 17,368 15,206 64,260 61,235 Real

estate taxes and insurance 1,708 2,226 2,461 8,458 8,765

Depreciation and amortization 17,151 16,424 16,336 65,785 64,327

Sales and marketing 3,474 3,206 3,389 14,405 10,330 General and

administrative 7,092 7,045 7,133 27,317 25,910 Rent 5,028 5,082

4,754 19,659 18,711 Transaction costs - 25

37 279 613 Total

operating expenses 51,700 51,376

49,316 200,163 189,891

Operating income 9,740 9,259 5,936 34,670 17,043 Interest

income 14 14 1 32 13 Interest expense (759 ) (708 )

(1,314 ) (2,689 ) (5,236 ) Income before

income taxes 8,995 8,565 4,623 32,013 11,820 Income tax (expense)

benefit 34 (56 ) (45 ) (401 )

(1,104 ) Net income 9,029 8,509 4,578 31,612 10,716 Net

income attributable to noncontrolling interests 3,809

3,524 2,276 12,771

5,668 Net income attributable to CoreSite Realty Corporation

5,220 4,985 2,302 18,841 5,048 Preferred dividends (2,085 )

(2,084 ) (440 ) (8,338 ) (440 ) Net

income attributable to common shares $ 3,135 $ 2,901

$ 1,862 $ 10,503 $ 4,608 Net income per share

attributable to common shares: Basic $ 0.15 $ 0.14 $ 0.09 $ 0.50 $

0.22 Diluted $ 0.15 $ 0.14 $ 0.09 $ 0.49

$ 0.22 Weighted average common shares outstanding:

Basic 20,924,624 20,871,504 20,607,119 20,826,622 20,537,946

Diluted 21,492,301 21,479,971 21,036,794 21,503,212 20,992,290

Reconciliations of Net Income to FFO (in

thousands, except share and per share data)

Three Months Ended Year

Ended

December 31,

2013

September 30,

2013

December 31,

2012

December 31,

2013

December 31,

2012

Net income $ 9,029 $ 8,509 $ 4,578 $ 31,612 $ 10,716 Real estate

depreciation and amortization 16,146 15,443

15,566 62,040 61,700

FFO $ 25,175 $ 23,952 $ 20,144 $ 93,652 $ 72,416 Preferred

stock dividends (2,085 ) (2,084

) (440 ) (8,338 )

(440 ) FFO available to common shareholders and OP unit holders

$ 23,090 $ 21,868 $

19,704 $ 85,314 $ 71,976

Weighted average common shares outstanding - diluted 21,492,301

21,479,971 21,036,794 21,503,212 20,992,290 Weighted average OP

units outstanding - diluted 25,360,848

25,353,942 25,353,709 25,355,567

25,347,936 Total weighted average shares and units

outstanding - diluted 46,853,149 46,833,913 46,390,503 46,858,779

46,340,226 FFO per common share and OP unit - diluted $ 0.49

$ 0.47 $ 0.42 $ 1.82 $ 1.55

Funds From Operations “FFO” is a supplemental

measure of our performance which should be considered along with,

but not as an alternative to, net income and cash provided by

operating activities as a measure of operating performance and

liquidity. We calculate FFO in accordance with the standards

established by the National Association of Real Estate Investment

Trusts (“NAREIT”). FFO represents net income (loss) (computed in

accordance with GAAP), excluding gains (or losses) from sales of

property and impairment write-downs of depreciable real estate,

plus real estate related depreciation and amortization (excluding

amortization of deferred financing costs) and after adjustments for

unconsolidated partnerships and joint ventures. FFO attributable to

common shares and units represents FFO less preferred stock

dividends declared during the period.

Our management uses FFO as a supplemental

performance measure because, in excluding real estate related

depreciation and amortization and gains and losses from property

dispositions, it provides a performance measure that, when compared

year over year, captures trends in occupancy rates, rental rates

and operating costs.

We offer this measure because we recognize

that FFO will be used by investors as a basis to compare our

operating performance with that of other REITs. However, because

FFO excludes depreciation and amortization and captures neither the

changes in the value of our properties that result from use or

market conditions, nor the level of capital expenditures and

capitalized leasing commissions necessary to maintain the operating

performance of our properties, all of which have real economic

effect and could materially impact our financial condition and

results from operations, the utility of FFO as a measure of our

performance is limited. FFO is a non-GAAP measure and should not be

considered a measure of liquidity, an alternative to net income,

cash provided by operating activities or any other performance

measure determined in accordance with GAAP, nor is it indicative of

funds available to fund our cash needs, including our ability to

pay dividends or make distributions. In addition, our calculations

of FFO are not necessarily comparable to FFO as calculated by other

REITs that do not use the same definition or implementation

guidelines or interpret the standards differently from us.

Investors in our securities should not rely on these measures as a

substitute for any GAAP measure, including net income.

Reconciliation of Net Income to EBITDA and

Adjusted EBITDA: (in thousands)

Three Months Ended Year

Ended

December 31,

2013

September 30,

2013

December 31,

2012

December 31,

2013

December 31,

2012

Net income $ 9,029 $ 8,509 $ 4,578 $ 31,612 $ 10,716 Adjustments:

Interest expense, net of interest income 745 694 1,313 2,657 5,223

Income taxes (34 ) 56 45 401 1,104 Depreciation and amortization

17,151 16,424 16,336 65,785

64,327 EBITDA $ 26,891 $ 25,683 $ 22,272 $ 100,455 $ 81,370

Non-cash compensation 1,433 1,759 1,568 6,770 5,650 Transaction

costs / litigation - 25

328 529 2,354

Adjusted EBITDA $ 28,324 $ 27,467

$ 24,168 $ 107,754 $ 89,374

EBITDA is defined as earnings before

interest, taxes, depreciation and amortization. We calculate

adjusted EBITDA by adding our non-cash compensation expense,

transaction costs and litigation expense to EBITDA as well as

adjusting for the impact of gains or losses on early extinguishment

of debt. Management uses EBITDA and adjusted EBITDA as indicators

of our ability to incur and service debt. In addition, we consider

EBITDA and adjusted EBITDA to be appropriate supplemental measures

of our performance because they eliminate depreciation and

interest, which permits investors to view income from operations

without the impact of non-cash depreciation or the cost of debt.

However, because EBITDA and adjusted EBITDA are calculated before

recurring cash charges including interest expense and taxes, and

are not adjusted for capital expenditures or other recurring cash

requirements of our business, their utilization as a cash flow

measurement is limited.

CoreSite Investor Relations ContactGreer Aviv | CoreSite

Investor Relations Director+1 303.405.1012 | +1

303.222.7276Greer.Aviv@CoreSite.com

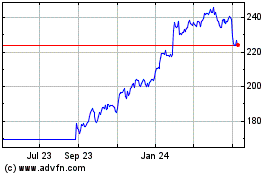

Cencora (NYSE:COR)

Historical Stock Chart

From Jun 2024 to Jul 2024

Cencora (NYSE:COR)

Historical Stock Chart

From Jul 2023 to Jul 2024