Camping World Announces Closing of Offering of Class A Common Stock

November 01 2024 - 4:15PM

Business Wire

Camping World Holdings, Inc. (NYSE:CWH) (“Camping World” or the

“Company”) announced today the closing of the previously announced

underwritten public offering of 14,634,146 shares of its Class A

common stock (the “Class A Common Stock”) at a public offering

price of $20.50 per share pursuant to a registration statement

filed on Form S-3 with the Securities and Exchange Commission (the

“SEC”). Additionally, the Company has granted the underwriters a

30-day option to purchase up to an aggregate of 2,195,121

additional shares of Class A Common Stock. The proceeds of the

offering were used by Camping World to purchase 14,634,146 common

units (or 16,829,267 common units if the underwriters exercise

their option in full to purchase additional shares of Class A

Common Stock) directly from CWGS Enterprises, LLC (“CWGS, LLC”), at

a price per unit equal to the public offering price per share of

Class A common stock in the offering, less the underwriting

discounts and commissions. CWGS, LLC intends to use the net

proceeds from the sale of common units to Camping World for general

corporate purposes, including strengthening the balance sheet,

working capital for growth and debt pay down.

Goldman Sachs & Co. LLC and J.P. Morgan served as joint lead

book-running managers and as representatives of the underwriters

for the offering. BofA Securities, Wells Fargo Securities, KeyBanc

Capital Markets, BMO Capital Markets and Baird also acted as joint

book-running managers for the offering.

The offering was made pursuant to a shelf registration statement

on Form S-3 that was filed with the SEC on October 30, 2024 and was

effective upon filing. The offering was made only by means of a

written prospectus supplement and the accompanying base prospectus

that forms a part of the registration statement.

A copy of the final prospectus supplement is available on the

SEC’s website at www.sec.gov or may also be obtained from any of

the following sources:

- Goldman Sachs & Co. LLC, Attention: Prospectus Department,

200 West Street, New York, NY 10282, by telephone at 866-471-2526

or by email at prospectus-ny@ny.email.gs.com; or

- J.P. Morgan Securities LLC, c/o Broadridge Financial Solutions,

1155 Long Island Avenue, Edgewood, NY 11717 or by email at

prospectus-eq_fi@jpmchase.com and

postsalemanualrequests@broadridge.com.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy, nor shall there be any sale of

these securities in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or

jurisdiction.

About Camping World Holdings,

Inc.

Camping World Holdings, Inc., headquartered in Lincolnshire, IL,

(together with its subsidiaries) is the world’s largest retailer of

RVs and related products and services. Through Camping World and

Good Sam brands, our vision is to build a business that makes Rving

and other outdoor adventures fun and easy. We strive to build

long-term value for our customers, employees, and stockholders by

combining a unique and comprehensive assortment of RV products and

services with a national network of RV dealerships, service centers

and customer support centers along with the industry’s most

extensive online presence and a highly trained and knowledgeable

team of associates serving our customers, the RV lifestyle, and the

communities in which we operate. We also believe that our Good Sam

organization and family of highly specialized services and plans,

including roadside assistance, protection plans and insurance,

uniquely enables us to connect with our customers as stewards of an

outdoor and recreational lifestyle. With RV sales and service

locations in 43 states, Camping World has grown to become the prime

destination for everything RV.

Cautionary Statement Regarding

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. All statements contained in this press release that do not

relate to matters of historical fact should be considered

forward-looking statements, including, without limitation,

statements about the consummation of the offering, the terms of the

offering and the anticipated use of the net proceeds from the

offering. These forward-looking statements are based on

management’s current expectations.

These statements are neither promises nor guarantees, but

involve known and unknown risks, uncertainties and other important

factors that may cause our actual results, performance or

achievements to be materially different from any future results,

performance or achievements expressed or implied by the

forward-looking statements, including, but not limited to, the

following: general economic conditions, including inflation and

interest rates; the availability of financing to us and our

customers; fuel shortages, high prices for fuel or changes in

energy sources; the success of our manufacturers; changes in

consumer preferences; risks related to our strategic review of our

Good Sam business; competition in our industry; risks related to

acquisitions, new store openings and expansion into new markets;

our failure to maintain the strength and value of our brands; our

ability to manage our inventory; fluctuations in our same store

sales; the cyclical and seasonal nature of our business; our

dependence on the availability of adequate capital and risks

related to our debt; risks related to COVID-19; our ability to

execute and achieve the expected benefits of our cost cutting or

restructuring initiatives; our reliance on our fulfillment and

distribution centers; natural disasters, including epidemic

outbreaks; our dependence on our relationships with third party

suppliers and lending institutions; risks associated with selling

goods manufactured abroad; our ability to retain senior executives

and attract and retain other qualified employees; risks associated

with leasing substantial amounts of space; risks associated with

our private brand offerings; we may incur asset impairment charges

for goodwill, intangible assets or other long-lived assets; tax

risks; our private brand offerings exposing us to various risks;

regulatory risks; data privacy and cybersecurity risks; risks

related to our intellectual property; the impact of ongoing or

future lawsuits against us and certain of our officers and

directors; risks related to climate change and other environmental,

social and governance matters; and risks related to our

organizational structure.

These and other important factors discussed under the caption

“Risk Factors” in our Annual Report on Form 10‑K for the year ended

December 31, 2023, as updated by our Quarterly Report on Form 10-Q

for the quarterly period ended September 30, 2024, and our other

reports filed with the SEC could cause actual results to differ

materially from those indicated by the forward-looking statements

made in this press release. Any such forward-looking statements

represent management’s estimates as of the date of this press

release. While we may elect to update such forward-looking

statements at some point in the future, we disclaim any obligation

to do so, even if subsequent events cause our views to change,

except as required under applicable law. These forward-looking

statements should not be relied upon as representing our views as

of any date subsequent to the date of this press release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241101396207/en/

Brett Andress, SVP Corporate Development, and Investor Relations

InvestorRelations@campingworld.com (866) 895-5330

Media Outlets PR-CWGS@CampingWorld.com

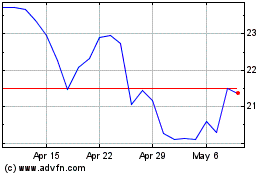

Camping World (NYSE:CWH)

Historical Stock Chart

From Oct 2024 to Nov 2024

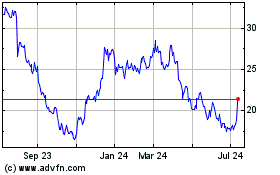

Camping World (NYSE:CWH)

Historical Stock Chart

From Nov 2023 to Nov 2024