| | | | | | | | |

| As filed with the Securities and Exchange Commission on July 7, 2023 |

| | No. 333-_____ |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549

___________________ | |

FORM S-3

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

___________________ |

CALLON PETROLEUM COMPANY

(Exact name of registrant as specified in its charter) |

Delaware (State or other jurisdiction of incorporation or organization) | | 64-0844345

(I.R.S. Employer Identification No.) |

One Briarlake Plaza

2000 W. Sam Houston Parkway S., Suite 2000

Houston, Texas 77042

(281) 589-5200

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices) ___________________

Michol L. Ecklund Senior Vice President, General Counsel and Corporate Secretary One Briarlake Plaza 2000 W. Sam Houston Parkway S., Suite 2000 Houston, Texas 77042 (281) 589-5200 |

(Name, address, including zip code, and telephone number, including area code, of agent for service) ___________________

Copies to: |

Sean T. Wheeler, P.C.

Michael W. Rigdon, P.C.

Kirkland & Ellis LLP 609 Main Street

Houston, Texas 77002

United States

(713) 836-3600 |

Approximate date of commencement of proposed sale to the public: From time to time after this registration statement becomes effective. ___________________ |

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐ |

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒ |

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐ |

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☒ |

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐ |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. Large accelerated filer ☒ Accelerated filer ☐

Non-accelerated filer ☐ Smaller reporting company ☐

Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐ |

Prospectus

Callon Petroleum Company

6,267,385 Shares of Common Stock

This prospectus covers the resale by the selling shareholder identified in this prospectus of up to an aggregate of 6,267,385 shares of common stock, par value $0.01 per share (“common stock”), of Callon Petroleum Company (“Callon,” the “Company,” “we” or “us”), issued to the selling shareholder pursuant to that certain Membership Interest Purchase Agreement, dated May 3, 2023, by and among Percussion Petroleum Management II, LLC, Percussion Petroleum Operating II, LLC and the Company (the “Purchase Agreement,” and the transactions under the Purchase Agreement, the “Percussion Transaction”).

We are not selling any shares of common stock under this prospectus, and we will not receive any of the proceeds from the sale or other disposition of shares of common stock by the selling shareholder.

These securities may be offered and sold by the selling shareholder from time to time in accordance with the provisions set forth under “Plan of Distribution.” The selling shareholder may offer and sell these securities to or through one or more underwriters, dealers or agents, who may receive compensation in the form of discounts, concessions or commissions, or directly to purchasers, on a continuous or delayed basis. The selling shareholder may offer and sell these securities at various times in amounts, at prices and on terms to be determined by market conditions and other factors at the time of such offerings. This prospectus describes the general terms of these securities and the general manner in which the selling shareholder will offer and sell these securities. A prospectus supplement, if needed, will describe the specific manner in which the selling shareholder will offer and sell these securities and also may add, update or change information contained or incorporated by reference in this prospectus. The names of any underwriters and the specific terms of a plan of distribution, if needed, will be stated in the prospectus supplement.

Our common stock is listed on The New York Stock Exchange (the “NYSE”) under the symbol “CPE.”

INVESTING IN OUR COMMON STOCK INVOLVES A NUMBER OF RISKS. SEE “RISK FACTORS” ON PAGE 4 TO READ ABOUT FACTORS YOU SHOULD CAREFULLY CONSIDER BEFORE INVESTING IN OUR COMMON STOCK.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is July 7, 2023.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we have filed with the SEC using a “shelf” registration process. Using this process, the selling shareholder may offer the securities described in this prospectus in one or more offerings. This prospectus provides you with a general description of us and the securities that may be offered by the selling shareholder. Each time securities are offered by the selling shareholder pursuant to this prospectus, the selling shareholder may be required to provide you with this prospectus and, in certain cases, a prospectus supplement that will contain specific information about the selling shareholder and the terms of the securities being offered. The prospectus supplement may also add to, update or change the information contained in this prospectus. If there is any inconsistency between the information in this prospectus and any prospectus supplement, you should rely on the information in the prospectus supplement. Please carefully read this prospectus and any prospectus supplement, in addition to the information contained in the documents we refer to under the heading “Where You Can Find More Information” and “Information Incorporated by Reference.”

Neither we nor the selling shareholder have authorized anyone to provide you with any information or to make any representations other than those contained in this prospectus or in any free writing prospectus made available by us. We and the selling shareholder take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you.

You should assume that the information appearing in this prospectus is accurate only as of the date on the cover of this prospectus and that any information we have incorporated by reference is accurate only as of the date of the document incorporated by reference. Our business, financial condition, results of operations and prospects may have changed since the date indicated on the cover page of such documents.

The distribution of this prospectus may be restricted by law in certain jurisdictions. You should inform yourself about and observe these restrictions. This prospectus does not constitute, and may not be used in connection with, an offer or solicitation by anyone in any jurisdiction in which the offer or solicitation is not authorized, or in which the person making the offer or solicitation is not qualified to do so, or to any person to whom it is unlawful to make the offer or solicitation.

SUMMARY

We are an independent oil and natural gas company focused on the acquisition, exploration and sustainable development of high-quality assets in the Permian Basin in West Texas.

We are a Delaware corporation with our principal executive office located at One Briarlake Plaza, 2000 W. Sam Houston Parkway S., Suite 2000, Houston, Texas 77042. Our telephone number at that address is (281) 589-5200. Our common stock is listed on the NYSE under the symbol “CPE.”

THE OFFERING

| | | | | |

| Common stock offered by the selling shareholder |

6,267,385 shares. |

| Terms of the offering | The selling shareholder will determine when and how it sells the shares of common stock offered in this prospectus, as described in “Plan of Distribution.” |

| Use of proceeds | We will not receive any of the proceeds from the sale of the shares of common stock being offered in this prospectus. See “Use of Proceeds.” |

| NYSE symbol | Our common stock is listed on the NYSE under the symbol “CPE.” |

| Risk factors | You should read the “Risk Factors” section of this prospectus for a discussion of factors to consider carefully before deciding to invest in shares of our common stock. |

RISK FACTORS

Before making an investment decision, you should carefully consider the risks described under “Risk Factors” in our most recent Annual Report on Form 10-K and in subsequent Quarterly Reports on Form 10-Q, together with all of the other information appearing in this prospectus or any applicable prospectus supplement or documents incorporated by reference herein or therein. The risks so described are not the only risks facing our company. Additional risks not presently known to us or that we currently deem immaterial may also impair our business operations. Our business, financial condition and results of operations could be materially adversely affected by any of these risks. Furthermore, the trading price of our securities could decline due to any of these risks, and you may lose all or part of your investment.

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

This prospectus, any accompanying prospectus supplement and the documents incorporated by reference herein or therein may include “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. In some cases, you can identify forward-looking statements in this prospectus, any accompanying prospectus supplement and the documents incorporated by reference herein or therein by words such as “anticipate,” “project,” “intend,” “estimate,” “expect,” “believe,” “predict,” “budget,” “projection,” “goal,” “plan,” “forecast,” “target” or similar expressions.

All statements, other than statements of historical facts, included in this prospectus, any accompanying prospectus supplement and the documents incorporated by reference herein or therein that address activities, events or developments that we expect or anticipate will or may occur in the future are forward-looking statements, including such things as:

•our oil and natural gas reserve quantities and the discounted present value of these reserves;

•the amount and nature of our capital expenditures;

•our future drilling and development plans and our potential drilling locations;

•the timing and amount of future capital and operating costs;

•production decline rates from our wells being greater than expected;

•commodity price risk management activities and the impact on our average realized prices;

•business strategies and plans of management;

•our ability to efficiently integrate recent acquisitions; and

•prospect development and property acquisitions.

We caution you that the forward-looking statements contained or incorporated by reference in this prospectus, any accompanying prospectus supplement and the documents incorporated by reference herein or therein are subject to all of the risks and uncertainties, many of which are beyond our control, incident to the exploration for and development, production and sale of oil and natural gas. We disclose these and other important factors that could cause our actual results to differ materially from our expectations under “Risk Factors” in Part I, Item 1A of our 2022 Annual Report on Form 10-K and in all Quarterly Reports on Form 10-Q filed subsequently thereto.

In addition, there are risks and uncertainties relating to the Percussion Transaction, which include the following:

•the Percussion Transaction may not be accretive, and may be dilutive, to Callon’s earnings per share, which may negatively affect the market price of Callon common stock; and

•the ultimate timing, outcome, and results of integrating the assets acquired in the Percussion Transaction.

Should one or more of these risks or uncertainties occur, or should underlying assumptions prove incorrect, our actual results and plans could differ materially from those expressed in any forward-looking statements. Additional risks or uncertainties that are not currently known to us, that we currently deem to be immaterial, or that could apply to any company could also materially adversely affect our business, financial condition, or future results. Any forward-looking statement speaks only as of the date of which such statement is made and the Company undertakes no obligation to correct or update any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by applicable law.

In addition, we caution that reserve engineering is a process of estimating oil and natural gas accumulated underground and cannot be measured exactly. Accuracy of reserve estimates depend on a number of factors including data available at the point in time, engineering interpretation of the data, and assumptions used by the reserve engineers as it relates to price and cost estimates and recoverability. New results of drilling, testing, and

production history may result in revisions of previous estimates and, if significant, would impact future development plans. As such, reserve estimates may differ from actual results of oil and natural gas quantities ultimately recovered.

Except as required by applicable law, all forward-looking statements attributable to us are expressly qualified in their entirety by this cautionary statement. This cautionary statement should also be considered in connection with any subsequent written or oral forward-looking statements that we or persons acting on our behalf may issue.

USE OF PROCEEDS

We are not selling any shares of common stock under this prospectus, and we will not receive any of the proceeds from the sale of shares of common stock by the selling shareholder. All shares of common stock offered by this prospectus are being registered for the account of the selling shareholder.

SELLING SHAREHOLDER

This prospectus covers the possible resale by the selling shareholder identified in this prospectus of up to an aggregate of 6,267,385 shares of our common stock issued to the selling shareholder pursuant to the Purchase Agreement upon consummation of the Percussion Transaction. The filing of the registration statement of which this prospectus forms a part is pursuant to our obligations under a registration rights agreement with the selling shareholder with respect to the shares of common stock issued in the Percussion Transaction (the “Registration Rights Agreement”). Under the Registration Rights Agreement, we agreed to pay certain offering expenses in connection with the registration of the selling shareholder's securities and to indemnify the selling shareholder against certain liabilities.

Of the 6,267,385 shares issued to the selling shareholder under the Purchase Agreement, an aggregate of 5,551,112 shares of our common stock were issued by the Company directly to the selling shareholder on July 3, 2023. We refer to these shares as the “Directly Issued Shares.” An aggregate of 716,273 shares of common stock have been deposited into escrow with American Stock Transfer & Trust Company (“AST”) under the terms of an escrow agreement to support the sellers’ indemnification obligations under the Purchase Agreement (the “Indemnity Obligations”). We refer to these shares as the “Indemnity Holdback Shares.” The Indemnity Obligations are further supported by cash deposited into escrow by the Company. The Indemnity Obligations can be satisfied in cash, with Indemnity Holdback Shares or a combination of both, at the election of the selling shareholder. The Indemnity Obligations will be satisfied in accordance with the terms of the Purchase Agreement and related escrow agreements and (i) at approximately 6 months after July 3, 2023, all or a portion of the Indemnity Holdback Shares constituting not more than 50% of the value of the Indemnity Holdback Shares and escrowed cash not then subject to outstanding claims with respect to Indemnity Obligations will be released to the selling shareholder, at the selling shareholder's election, and (ii) at approximately 15 months after July 3, 2023, any remaining Indemnity Holdback Shares not then subject to outstanding claims with respect to Indemnity Obligations may be released to the selling shareholder. The table below reflects both the Directly Issued Shares and the Indemnity Holdback Shares.

The information contained in the table below in respect of the selling shareholder (including the number of shares of common stock beneficially owned and the number of shares of common stock offered) has been obtained from the selling shareholder and has not been independently verified by us. We may supplement this prospectus from time to time in the future to update or change the information concerning the selling shareholder, including the name of the selling shareholder and the number of shares of common stock that may be offered and sold by the selling shareholder. The registration for resale of the shares of common stock does not necessarily mean that the selling shareholder will sell all or any of these shares. In addition, the selling shareholder may have sold, transferred or otherwise disposed of, or may sell, transfer or otherwise dispose of, at any time and from time to time, shares of common stock in transactions exempt from the registration requirements of the Securities Act, after the date on which it provided the information set forth in the table below.

The information set forth in the following table regarding the beneficial ownership after resale of the shares of common stock is based upon the assumption that the selling shareholder will sell all of the shares of common stock beneficially owned by it that are covered by this prospectus. Beneficial ownership is determined in accordance with the rules of the SEC and includes voting or investment power with respect to shares of common stock and the right to acquire such voting or investment power within 60 days through the exercise of any option, warrant or other right. The selling shareholder named in the table has not held any position or office or had any other material relationship with us or our affiliates during the three years prior to the date of this prospectus. The inclusion of any shares of common stock in this table does not constitute an admission of beneficial ownership for the selling shareholder named below. As of July 5, 2023, we had 68,155,741 shares of common stock issued and outstanding.

| | | | | | | | | | | | | | |

| Shares Beneficially Owned Prior to the Offering | Shares of Common Stock Offered Hereby | Shares of Common Stock Beneficially Owned After Completion of the Offering(1) |

| Name of Selling Shareholder | Number | Percentage |

| | | | |

Percussion Petroleum Management II, LLC(2)(3) | 6,267,385 | 6,267,385 | — | — |

| | | | |

(1) Assumes the selling shareholder sells all of the shares of common stock offered pursuant to this prospectus.

(2) Percussion Petroleum Management II, LLC ("Percussion Management II") is the holder of the shares of common stock. Percussion Management II is controlled by Percussion Petroleum II, LLC ("Percussion Petroleum II"). As a result of the foregoing relationships, each of Percussion Management II and Percussion Petroleum II may be deemed to have shared voting and investment control over the shares of common stock held by Percussion Management II.

(3) Consists of 5,551,112 Directly Issued Shares held by the selling shareholder and 716,273 Indemnity Holdback Shares held in escrow by AST for the benefit of the selling shareholder and will be released as described above assuming that the selling shareholder will have no Indemnity Obligations under the Purchase Agreement.

PLAN OF DISTRIBUTION

The offered shares are being registered to permit the selling shareholder to offer and sell the offered shares from time to time after the date of this prospectus. We will not receive any of the proceeds from the sale or other distribution of the common stock. We will bear the fees and expenses incurred by us in connection with our obligation to register the offered securities pursuant to the Registration Rights Agreement. If the shares are sold through underwriters or broker-dealers, we will not be responsible for underwriting discounts or commissions or agents’ commissions.

The selling shareholder may act independently of us in making decisions with respect to the timing, manner and size of each of its sales. The selling shareholder and certain of its successors, including certain transferees and assignees, may make sales of the shares of common stock included in this prospectus from time to time through one or more methods specified herein or through a combination of any of such methods or any other method permitted pursuant to applicable law. Such offers and sales may be made directly to purchasers, through underwriters, to dealers or through agents, on any stock exchange on which the shares are listed or otherwise at prices and under terms prevailing at the time of the sale, at prices related to the then-current market price, at fixed prices, at varying prices determined at the time of sale, at privately negotiated prices or any other method permitted pursuant to applicable law. Such sales may be effected by a variety of methods, including the following:

•in market transactions or on any national securities exchange or quotation service or over-the-counter market on which the shares may be listed or quoted at the time of sale;

•in transactions other than on such exchanges or services or in the over-the-counter market;

•in privately negotiated transactions;

•through one or more underwriters on a firm commitment or best-efforts basis, including through overnight underwritten offerings or bought deals;

•through the writing or settlement of options or other hedging transactions (including the issuance by the selling shareholder of derivative securities), whether the options or such other derivative securities are listed on an options exchange or otherwise;

•through the settlement of certain short sales entered into after the date of this prospectus;

•purchases by the broker-dealer as principal, and resale by the broker-dealer for its account pursuant to this prospectus;

•a block trade in which the broker-dealer so engaged will attempt to sell the shares as agent, but may resell all or a portion of the block as principal in order to facilitate the transaction, or in crosses in which the same broker acts as agent on both sides;

•in a public auction;

•transactions in which a broker-dealer may agree with the selling shareholder to sell a specified number of such shares at a stipulated price per share;

•transactions in which the broker-dealer as agent solicits purchasers and ordinary brokerage transactions by the broker-dealer as agent;

•an offering at other than a fixed price on or through the facilities of any stock exchange on which the shares are then listed or to or through a market maker other than on that stock exchange;

•an exchange distribution and/or secondary distribution in accordance with the rules of the applicable exchange;

•by direct or indirect distribution to employees, directors, members, managers, general or limited partners, affiliates or stockholders of the selling shareholder;

•through any combination of the foregoing methods of sale; or

•through any other method permitted pursuant to applicable law.

Additionally, the selling shareholder may elect to make a direct or indirect distribution of the shares of common stock to its direct or indirect members, partners or shareholders pursuant to the registration statement of which this prospectus is a part. To the extent that such direct or indirect members, partners or shareholders are not affiliates of ours, such direct or indirect members, partners or shareholders would thereby receive freely tradeable shares of common stock pursuant to the distribution through a registration statement.

The selling shareholder may enter into derivative transactions with third parties or sell securities not covered by this prospectus to third parties in privately negotiated transactions.

The selling shareholder may enter into hedging transactions with broker-dealers or any other person, in connection with such broker dealer or other person who may in turn engage in short sales of the shares of common stock in the course of hedging the positions they assume. The selling shareholder also may sell shares short and deliver shares covered by this prospectus to close out the short positions or loan, pledge, or grant a security interest in, some or all the shares owned by it to broker-dealers that in turn may sell such shares. The selling shareholder may also enter into option or other transactions with broker-dealers or other financial institutions or create one or more derivative securities which require the delivery to such broker-dealer or other financial institution of securities offered by this prospectus, which securities such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The selling shareholder may also directly make offers to sell some or all of the shares of common stock included in this prospectus to, or solicit offers to purchase such shares from, purchasers from time to time.

If the selling shareholder uses one or more underwriters in the sale, the underwriters will acquire the securities for their own account, and they may resell these securities from time to time in one or more transactions, including negotiated transactions, at a fixed public offering price or at varying prices determined at the time of sale. The securities may be offered and sold to the public either through underwriting syndicates represented by one or more managing underwriters or directly by one or more of such firms. In connection with those sales, underwriters may be deemed to have received compensation from the selling shareholder in the form of underwriting discounts or commissions and may also receive commissions from purchasers of the shares for which they may act as agents. Underwriters may resell the shares to or through dealers, and those dealers may receive compensation in the form of one or more discounts, concessions or commissions from the underwriters and commissions from purchasers for which they may act as agents.

Broker-dealers engaged by the selling shareholder may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions or discounts from the selling shareholder (or, if any broker-dealer acts as agent for the purchaser of common stock, from the purchaser) in amounts to be negotiated, but, except as set forth in a supplement to this prospectus, in the case of an agency transaction not in excess of a customary brokerage commission in compliance with Financial Industry Regulatory Authority (“FINRA”) Rule 5110; and in the case of a principal transaction a markup or markdown in compliance with FINRA Rule 2121.

From time to time, the selling shareholder may sell the shares of common stock included in this prospectus to one or more dealers acting as principals. The dealers, which may be deemed to be “underwriters” as that term is defined in the Securities Act, may then resell the shares to purchasers.

The selling shareholder may designate broker-dealers as agents from time to time to solicit offers from purchasers to purchase the shares of common stock included in this prospectus, or to sell such shares in ordinary brokerage transactions, on its behalf. Such broker-dealers may be deemed to be “underwriters” as that term is defined in the Securities Act in such offering.

The selling shareholder or its underwriters, broker-dealers, or agents may make sales of the shares of common stock that are deemed to be an “at-the-market offering” as defined in Rule 415 of the Securities Act, which includes sales of such shares made directly on or through any stock exchange on which the shares are listed, the existing trading market for the shares, or in the over-the-counter market or otherwise.

From time to time, the selling shareholder may pledge, hypothecate or grant a security interest in some or all of the shares of common stock owned by it. In the event of default, the pledgees, secured parties or persons to whom the shares have been hypothecated, to the extent registration rights are transferable and are transferred upon foreclosure, may offer and sell common stock from time to time under this prospectus, or, to the extent required under the applicable securities laws, under an amendment to this prospectus under Rule 424 or other applicable provision of the Securities Act. The number of shares offered under this prospectus by the selling shareholder will decrease as

and when such events occur. In addition, the selling shareholder may, from time to time, sell the shares short, and, in those instances, this prospectus may be delivered in connection with the short sales, and the shares offered under this prospectus may be used to cover short sales.

In addition to the transactions described above, the selling shareholder may sell the shares of common stock included in this prospectus under Rule 144 or in compliance with any other available exemptions from the registration requirements under the Securities Act, if, when and to the extent such exemption is available to it at the time of such sale, rather than pursuant to this prospectus.

The selling shareholder may decide to sell all or a portion of the securities offered by it pursuant to this prospectus or may decide not to sell any securities under this prospectus. In addition, the selling shareholder may transfer, sell or dispose of the securities by other means not described in this prospectus.

The selling shareholder and any other persons participating in the sale or distribution of shares of common stock will be subject to applicable provisions of the Exchange Act and the rules and regulations thereunder, including Regulation M. Regulation M may limit the timing of purchases and sales of any of the shares by the selling shareholder and any other such persons. In addition, Regulation M may restrict the ability of any person engaged in the distribution of the shares to engage in market-making activities with respect to the shares being distributed for a period of up to five business days before the distribution. This may affect the marketability of the shares and the ability of any person or entity to engage in market-making activities with respect to the shares.

To the extent required, the securities to be sold, the name of the selling shareholder, the respective purchase prices and public offering prices, the names of any agents, dealers or underwriters and any applicable commissions or discounts with respect to a particular offering will be set forth in an accompanying prospectus supplement or, if appropriate, a post-effective amendment to the registration statement that includes this prospectus.

We have agreed to indemnify, in certain circumstances, the selling shareholder against certain liabilities to which it may become subject in connection with the sale of the shares of common stock included in this prospectus, including liabilities arising under the Securities Act. The selling shareholder has agreed to indemnify us in certain circumstances against certain liabilities to which we may become subject in connection with the sale of such shares, including liabilities arising under the Securities Act. We have also agreed that if the indemnification described above is held by a court or government agency of competent jurisdiction to be unavailable to any indemnified party or is insufficient to hold them harmless in respect of any losses, then each such indemnifying party, in lieu of indemnifying such indemnified party, shall contribute to the amount paid or payable by such indemnified party as a result of such loss in such proportion as is appropriate to reflect the relative fault of the indemnifying party on the one hand and of such indemnified party on the other in connection with the statements or omissions that resulted in such losses, as well as any other relevant equitable considerations. We and the selling shareholder may agree to indemnify underwriters, dealers and agents who participate in the distribution of the shares included in this prospectus against certain liabilities to which they may become subject in connection with the sale of such shares, including liabilities arising under the Securities Act.

Certain of the underwriters and their affiliates may engage in transactions with and may perform services for us or our affiliates in the ordinary course of business.

We have agreed to pay the expenses of the registration of the shares of common stock offered and sold by the selling shareholder under the registration statement of which this prospectus forms a part, including, but not limited to, all registration and filing fees.

A prospectus and accompanying prospectus supplement in electronic form may be made available on the websites maintained by the underwriters of a given offering. The underwriters may agree to allocate a number of securities for sale to their online brokerage account holders. Such allocations of securities for internet distributions will be made on the same basis as other allocations. In addition, securities may be sold by the underwriters to securities dealers who resell securities to online brokerage account holders.

To the extent required, this prospectus may be amended or supplemented from time to time to describe a specific plan of distribution. The place and time of delivery for the securities in respect of which this prospectus is delivered will be set forth in the accompanying prospectus supplement.

In connection with offerings of securities under the registration statement of which this prospectus forms a part and in compliance with applicable law, underwriters, brokers or dealers may engage in transactions that stabilize or maintain the market price of the securities at levels above those that might otherwise prevail in the open market. Specifically, underwriters, brokers or dealers may over-allot in connection with offerings, creating a short position in

the securities for their own accounts. For the purpose of covering a syndicate short position or stabilizing the price of the securities, the underwriters, brokers or dealers may place bids for the securities or effect purchases of the securities in the open market. Finally, the underwriters may impose a penalty whereby selling concessions allowed to syndicate members or other brokers or dealers for distribution of the securities in offerings may be reclaimed by the syndicate if the syndicate repurchases previously distributed securities in transactions to cover short positions, in stabilization transactions or otherwise. These activities may stabilize, maintain or otherwise affect the market price of the securities, which may be higher than the price that might otherwise prevail in the open market, and, if commenced, may be discontinued at any time. These transactions may be effected on or through any stock exchange on which the shares are listed, the existing trading market for the shares, or in the over-the-counter market or otherwise.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC (File No. 001-14039). The SEC maintains an Internet site that contains reports, proxy and information statements and other information regarding registrants that file electronically with the SEC. The address of the site is http://www.sec.gov.

We also make available free of charge on our website, at www.callon.com under the “Investors” section, all of the documents that we file with the SEC as soon as reasonably practicable after we electronically file those documents with the SEC. Information contained on, or that can be accessed through, our website is not incorporated by reference into this prospectus, and you should not consider such information as part of this prospectus.

This prospectus is part of a registration statement that we filed with the SEC and does not contain all of the information that you can find in that registration statement and its exhibits. The full registration statement, including exhibits to the registration statement, provides additional information about us and the common stock offered under this prospectus and may be obtained from the SEC or us, as provided above. Statements contained in this prospectus as to the contents of any contract or other document referred to are not necessarily complete and in each instance such statement is qualified by reference to each such contract or document filed with or incorporated by reference as part of the registration statement.

INFORMATION INCORPORATED BY REFERENCE

The SEC allows us to “incorporate by reference” into this prospectus the information we provide in other documents filed by us with the SEC. The information incorporated by reference is an important part of this prospectus and any prospectus supplement. We incorporate by reference the following documents that we have filed with the SEC (other than portions of these documents that are either (i) described in paragraph (e) of Item 201 of Registration S-K or paragraphs (d)(l)-(3) and (e)(5) of Item 407 of Regulation S- K or (ii) deemed to have been furnished and not filed in accordance with SEC rules, including pursuant to Item 2.02 or Item 7.01 of any Current Report on Form 8-K (including any financial statements or exhibits relating thereto furnished pursuant to Item 9.01), unless otherwise indicated therein):

•our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, filed on February 23, 2023;

•our Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2023, filed on May 3, 2023;

•our definitive Proxy Statement on Schedule 14A, filed on March 13, 2023;

•our Current Reports on Form 8-K filed on February 13, 2023, April 26, 2023, May 8, 2023, May 18, 2023, July 3, 2023 and July 7, 2023; and

•the description of our common stock set forth in our Registration Statement on Form 8-A, including any amendment or report filed for purposes of updating such description, filed on November 17, 1995, including any future amendment or report for the purpose of updating such description, including the description filed as Exhibit 4.2 to our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, filed with the SEC on February 23, 2023.

In addition, all documents subsequently filed by us with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act (other than portions of these documents that are either (i) described in paragraph (e) of Item 201 of Registration S-K or paragraphs (d)(l)-(3) and (e)(5) of Item 407 of Regulation S-K or (ii) deemed to have been furnished and not filed in accordance with SEC rules, including pursuant to Item 2.02 or Item 7.01 of any Current Report on Form 8-K (including any financial statements or exhibits relating thereto furnished pursuant to Item 9.01), unless otherwise indicated therein), until all offerings under the registration statement of which this prospectus is a part are completed or terminated, will be considered to be incorporated by reference into this prospectus and to be a part of this prospectus from the dates of the filing of such documents. The most recent information that we file with the SEC automatically updates and supersedes more dated information.

We will provide, without charge, to each person, including any beneficial owner, to whom a copy of this prospectus is delivered, upon written or oral request of such person, a copy of any or all of the reports and documents referred to above that have been incorporated by reference into this prospectus. You should direct requests for those documents to:

Callon Petroleum Company

One Briarlake Plaza

2000 W. Sam Houston Parkway S., Suite 2000

Houston, Texas 77042

(281) 589-5200

LEGAL MATTERS

The validity of the securities offered by this prospectus will be passed upon for us by Kirkland & Ellis LLP. If any legal matters relating to offerings made in connection with this prospectus are passed upon by counsel for underwriters, dealers or agents, such counsel will be named in the prospectus supplement relating to any such offering.

EXPERTS

The audited consolidated financial statements and management’s assessment of the effectiveness of internal control over financial reporting of Callon Petroleum Company incorporated by reference in this prospectus and elsewhere in the registration statement have been so incorporated by reference in reliance upon the reports of Grant Thornton LLP, independent registered public accountants, upon the authority of said firm as experts in accounting and auditing.

The information incorporated by reference in this prospectus relating to certain estimated quantities of Callon’s proved reserves and future revenue have been derived from reports prepared by DeGolyer and MacNaughton, independent petroleum engineers, as stated in their report with respect thereto. All such information is incorporated in this prospectus in reliance upon the authority of said firm as experts with respect to the matters covered by their report and the giving of their report.

The financial statements of Percussion Petroleum II, LLC as of December 31, 2022 and 2021 and for each of the two years in the period ended December 31, 2022, incorporated by reference in this Prospectus, have been audited by Weaver and Tidwell, L.L.P., an independent auditor, as stated in their report. Such financial statements are incorporated by reference in reliance upon the report of such firm given their authority as experts in accounting and auditing.

The information incorporated by reference in this prospectus relating to certain estimated quantities of Percussion Petroleum Operating II, LLC’s proved reserves and future revenue have been derived from reports prepared by Netherland, Sewell & Associates, Inc., independent petroleum engineers, as stated in their report with respect thereto. All such information is incorporated in this prospectus in reliance upon the authority of said firm as experts with respect to the matters covered by their report and the giving of their report.

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution

The following table sets for the various expenses expected to be incurred in connection with the sale and distribution of the securities being registered hereby. Unless otherwise stated in any prospectus supplement relating to an offering by selling shareholder, all such expenses, other than underwriting discounts and commissions, will be paid by us.

SEC registration fee $24,014.46

Printing expenses *

Accounting and engineers’ fees and expenses *

Legal fees and expenses *

Transfer agent fees and expenses *

Miscellaneous *

Total *

* Estimated expenses are not presently known.

Item 15. Indemnification of Directors and Officers.

Callon is a Delaware corporation subject to the applicable indemnification provisions of the General Corporation Law of the State of Delaware. Section 145 of the General Corporation Law of the State of Delaware provides generally and in pertinent part that a Delaware corporation may indemnify its directors, officers, employees and agents (or persons serving at the request of the Company as a director, officer, employee or agent of another entity) against expenses, judgments, fines, and settlements actually and reasonably incurred by them in connection with any civil, criminal, administrative, or investigative suit or action except actions by or in the right of the corporation if, in connection with the matters in issue, they acted in good faith and in a manner they reasonably believed to be in or not opposed to the best interests of the corporation, and in connection with any criminal suit or proceeding, if in connection with the matters in issue, they had no reasonable cause to believe their conduct was unlawful. Section 145 further provides that in connection with the defense or settlement of any action by or in the right of the corporation, a Delaware corporation may indemnify its directors, officers, employees and agents (or persons serving at the request of the Company as a director, officer, employee or agent of another entity) against expenses actually and reasonably incurred by them if, in connection with the matters in issue, they acted in good faith and in a manner they reasonably believed to be in or not opposed to the best interests of the corporation, except that no indemnification may be made in respect of any claim, issue, or matter as to which such person has been adjudged liable to the corporation unless the Delaware Court of Chancery or other court in which such action or suit is brought approves such indemnification. Section 145 further permits a Delaware corporation to grant its directors and officers additional rights of indemnification through bylaw provisions and otherwise, and or purchase indemnity insurance on behalf of its directors and officers.

Article Eight of our Certificate of Incorporation (as amended, the “Certificate of Incorporation”) and Article IX of our Amended and Restated Bylaws (the “Bylaws”) provide, in general, that we may indemnify our directors, officers, employees and agents (or persons serving at the request of the Company as a director, officer, employee or agent of another entity) to the full extent of Delaware law.

Article IX of the Bylaws provides that we shall indemnify, to the full extent that we shall have power under applicable law to do so and in a manner permitted by such law, any of our officers or directors (including those persons serving as an officer or director of another entity at our request) who is party to a suit or other proceeding by reason of his or her position as an officer or director against all judgements, fines, expenses and amounts paid in settlement actually and reasonably incurred by him or her in connection with such suit or proceeding if he or she acted in good faith and in a manner he or she reasonably believed to be in or not opposed to the best interests of the Company, and, with respect to any criminal action or proceeding, had no reasonable cause to believe his or her conduct was unlawful. We may only indemnify an officer or director who brought the suit or proceeding if our board of directors had previously authorized such suit or proceeding. The rights to indemnification provided by our Bylaws include the right to advancement of expenses, to the full extent that it shall have power under applicable law to do so and in a manner permitted by such law, to the extent such person undertakes to repay all amounts advanced if it shall ultimately be determined by final judicial decision from which there is no further right to appeal that such person is not entitled to be indemnified for such expense.

Section 145 further authorizes a corporation to purchase and maintain insurance on behalf of any person who is or was a director, officer, employee or agent of the corporation or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation or enterprise, against any liability asserted against him and incurred by him in any such capacity, or liability insurance policies that indemnify our directors and officers and those of our subsidiaries against various liabilities, including certain liabilities arising under the Securities Act and the Exchange Act that may be incurred by them in their capacity as such.

The indemnification rights set forth above shall not be exclusive of any other right which an indemnified person may have or hereafter acquire under any statute, provision of the Certificate of Incorporation or Bylaws, agreement, vote of shareholders or disinterested directors or otherwise.

Item 16. Exhibits

| | | | | |

| Exhibit Number |

Description |

| 1.1* | Underwriting Agreement |

| 2.1 | |

| 3.1 | |

| 3.2 | |

| 3.3 | |

| 3.4 | |

| 3.5 | |

| 3.6 | |

| 4.1 | |

| 4.2 | |

| 4.3 | |

| 5.1+ | |

| 23.1+ | |

| 23.2+ | |

| 23.3+ | |

| 23.4+ | |

| 23.5+ | |

| 24.1+ | |

| 107+ | |

| |

* To be filed, if necessary, by amendment or as an exhibit to a document filed under the Exchange Act and incorporated by reference herein.

+ Filed herewith.

Item 17. Undertakings

(a) The undersigned registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) to include any prospectus required by Section 10(a)(3) of the Securities Act;

(ii) to reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the SEC pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

(iii) to include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

provided, however, that subparagraphs (a)(1)(i), (a)(1)(ii) and (a)(1)(iii) do not apply if the registration statement is on Form S-3, Form SF-3, or Form F-3 and the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the SEC by the registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2) That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4) That, for the purpose of determining liability under the Securities Act to any purchaser:

(i) Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

(ii) Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5) or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(l)(i), (vii) or (x) for the purpose of providing the information required by Section 10(a) of the Securities Act shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date;

(5) That, for the purpose of determining liability of the registrant under the Securities Act to any purchaser in the initial distribution of the securities, the undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

(i) Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424;

(ii) Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant;

(iii) The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant or its securities provided by or on behalf of the undersigned registrant; and

(iv) Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

(b) The undersigned registrant hereby undertakes that, for the purpose of determining any liability under the Securities Act, each filing of the registrant’s annual report pursuant to Section 13(a) or 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in this registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c) Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-3 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in Houston, Texas on the 7th day of July 2023.

| | | | | |

| CALLON PETROLEUM COMPANY |

| |

| By: | /s/ Joseph C. Gatto, Jr. |

| Name: | Joseph C. Gatto, Jr. |

| Title: | President, Chief Executive Officer and Director |

POWER OF ATTORNEY

KNOW ALL MEN BY THESE PRESENTS, that each individual whose signature appears below hereby constitutes and appoints Joseph C. Gatto, Jr., Kevin Haggard, and Michol L. Ecklund, and each of them, his or her true and lawful attorney-in-fact and agent, with full power of substitution and resubstitution, for him or her and in his or her name, place and stead, in any and all capacities, to (i) act on, sign and file with the Securities and Exchange Commission any and all amendments (including post-effective amendments) to this registration statement together with all schedules and exhibits thereto and any subsequent registration statement filed pursuant to Rule 462(b) under the Securities Act of 1933, as amended, together with all schedules and exhibits thereto, (ii) act on, sign and file such certificates, instruments, agreements and other documents as may be necessary or appropriate in connection therewith, (iii) act on and file any supplement to any prospectus included in this registration statement or any such amendment or any subsequent registration statement filed pursuant to Rule 462(b) under the Securities Act of 1933, as amended and (iv) take any and all actions which may be necessary or appropriate to be done, as fully for all intents and purposes as he or she might or could do in person, hereby approving, ratifying and confirming all that such agent, proxy and attorney-in-fact or any of his substitutes may lawfully do or cause to be done by virtue thereof.

Pursuant to the requirements of the Securities Act of 1933, as amended, this registration statement has been signed by the following persons in the capacities indicated on July 7, 2023.

| | | | | |

| Signature | Title |

| |

| /s/ Joseph C. Gatto, Jr. | President, Chief Executive Officer, and Director |

Joseph C. Gatto, Jr. | (Principal Executive Officer) |

| |

| /s/ Kevin Haggard | Senior Vice President and Chief Financial Officer |

Kevin Haggard | (Principal Financial Officer) |

| |

| /s/ Gregory F. Conaway | Vice President and Chief Accounting Officer |

Gregory F. Conaway | (Principal Accounting Officer) |

| |

| /s/ Matthew R. Bob | Chairman of the Board |

Matthew R. Bob | |

| |

/s/ Frances Aldrich Sevilla-Sacasa | Director |

| Frances Aldrich Sevilla-Sacasa | |

| |

/s/ James E. Craddock | Director |

| James E. Craddock | |

| |

/s/ Barbara J. Faulkenberry | Director |

| Barbara J. Faulkenberry | |

| |

/s/ Anthony J. Nocchiero | Director |

| Anthony J. Nocchiero | |

| |

/s/ Mary Shafer-Malicki | Director |

| Mary Shafer-Malicki | |

| |

/s/ Steven A. Webster | Director |

| Steven A. Webster | |

Exhibit 107

Calculation of Filing Fee Table

Form S-3

(Form Type)

Callon Petroleum Company

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered and Carry Forward Securities

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Security

Type | | Security

Class

Title | | Fee

Calculation or

Carry

Forward Rule | | Amount

Registered(1)(2) | | Proposed

Maximum

Offering

Price Per

Security(3) | | Maximum

Aggregate Offering

Price | | Fee Rate | | Amount of

Registration Fee |

| Newly Registered Securities |

| Fees to Be Paid | | Equity | | Common Stock,

par value $0.01

per share(1) | | Rule 457(c) | | 6,267,385 | | $34.77 | | $217,916,976 | | 0.00011020 | | $24,014.46 |

| Fees Previously Paid | | — | | — | | — | | — | | — | | — | | — | | — |

| Carry Forward Securities |

| Carry Forward Securities | | — | | — | | — | | — | | — | | — | | — | | — |

| | Total Offering Amounts | | | | $217,916,976 | | | | $24,014.46 |

| | Total Fees Previously Paid | | | | | | | | — |

| | Total Fee Offsets | | | | | | | | — |

| | Net Fee Due | | | | | | | | $24,014.46 |

| | | | | |

| (1) | Represents securities registered for resale by the selling stockholders named in the registration statement. |

| (2) | Pursuant to Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”), the shares being registered hereunder include such indeterminate number of shares of common stock and preferred stock as may be issuable with respect to the shares being registered hereunder as a result of stock splits, stock dividends or similar transactions. |

| (3) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(c) of the Securities Act and based upon the average of the high and low prices of the common stock as reported on The New York Stock Exchange on June 29, 2023. |

Exhibit 5.1

| | | | | | | | |

|

| 609 Main Street Houston, TX 77002 United States +1 713 836 3600 www.kirkland.com | Facsimile:

+1 713 836 3601 |

July 7, 2023

Callon Petroleum Company

One Briarlake Plaza

2000 W. Sam Houston Parkway S., Suite 2000

Houston, Texas 77042

Ladies and Gentlemen:

We are issuing this opinion letter in our capacity as special counsel to Callon Petroleum Company, a Delaware corporation (the “Company”), in connection with the preparation of the Registration Statement on Form S-3ASR (as amended or supplemented, the “Registration Statement”) filed with the Securities and Exchange Commission (the “Commission”) on July 7, 2023 under the Securities Act of 1933, as amended (the “Securities Act”), by the Company. The Registration Statement relates to the sale from time to time, pursuant to Rule 415 of the General Rules and Regulations promulgated under the Securities Act, of up to 6,267,385 shares of common stock, par value $0.01 per share, of the Company (the “Shares”) to be sold by certain stockholders of the Company (the “Selling Stockholders”).

In connection with the registration of the Shares, we have examined originals, or copies certified or otherwise identified to our satisfaction, of such documents, corporate records and other instruments as we have deemed necessary for the purposes of this opinion, including (i) the Registration Statement and the exhibits thereto, (ii) the organizational documents of the Company and (iii) the minutes and records of the corporate proceedings of the Company with respect to the issuance of the Shares and the Registration Statement and the exhibits thereto.

For purposes of this opinion, we have assumed the authenticity of all documents submitted to us as originals, the conformity to the originals of all documents submitted to us as copies and the authenticity of the originals of all documents submitted to us as copies. We have also assumed the legal capacity of all natural persons, the genuineness of the signatures of persons signing all documents in connection with which this opinion is rendered, the authority of such persons signing on behalf of the parties thereto other than the Company and the due authorization, execution and delivery of all documents by the parties thereto other than the Company. We have not independently established or verified any facts relevant to the opinions expressed herein, but have relied upon statements and representations of the officers and other representatives of the Company and others as to factual matters.

We have also assumed that:

(i)the Registration Statement will be effective and will comply with all applicable laws at the time the Shares are offered or sold as contemplated by the Registration Statement;

(ii)if applicable, a prospectus supplement or term sheet, as applicable (“Prospectus Supplement”) will have been prepared and filed with the Commission describing the Shares offered thereby and will comply with all applicable laws; and

| | |

| Austin Beijing Boston Chicago Dallas Hong Kong Houston London Los Angeles Munich New York Palo Alto Paris San Francisco Shanghai Washington, D.C. |

| | | | | |

|

Callon Petroleum Company July 7, 2023 Page 2 | |

(iii)all Shares will be sold in compliance with applicable federal and state securities laws and in the manner stated in the Registration Statement and, if applicable, the appropriate Prospectus Supplement.

Based upon and subject to the foregoing qualifications, assumptions and limitations and the further limitations set forth below, we are of the opinion that, with respect to the Shares to be offered by the Selling Stockholders pursuant to the Registration Statement, such Shares are validly issued, fully paid and nonassessable.

Our opinion expressed above is subject to the qualifications that we express no opinion as to the applicability of, compliance with, or effect of any laws except the General Corporation Law of the State of Delaware, including the applicable provisions of the Delaware constitution and reported judicial decisions interpreting these laws.

We hereby consent to the filing of this opinion with the Commission as Exhibit 5.1 to the Registration Statement. We also consent to the reference to our firm under the heading “Legal Matters” in the Registration Statement. In giving this consent, we do not thereby admit that we are in the category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations of the Commission.

We do not find it necessary for the purposes of this opinion, and accordingly we do not purport to cover herein, the application of the securities or “Blue Sky” laws of the various states to the sale of the Shares.

This opinion is limited to the specific issues addressed herein, and no opinion may be inferred or implied beyond that expressly stated herein. This opinion speaks only as of the date hereof, and we assume no obligation to revise or supplement this opinion should the present federal securities laws of the United States or the General Corporation Law of the State of Delaware be changed by legislative action, judicial decision or otherwise after the date hereof.

This opinion is furnished to you in connection with the filing of the Registration Statement in accordance with the requirements of Item 601(b)(5) of Regulation S-K under the Securities Act, and is not to be used, circulated, quoted or otherwise relied upon for any other purpose. No opinion is expressed herein as to any matter pertaining to the contents of the Registration Statement, other than as to the specific issues addressed herein, and no opinion may be inferred or implied beyond that expressly stated herein.

Sincerely,

/s/ Kirkland & Ellis LLP

Kirkland & Ellis LLP

| | |

| Austin Beijing Boston Chicago Dallas Hong Kong Houston London Los Angeles Munich New York Palo Alto Paris San Francisco Shanghai Washington, D.C. |

Exhibit 23.2

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We have issued our reports dated February 23, 2023 with respect to the consolidated financial statements and internal control over financial reporting of Callon Petroleum Company included in the Annual Report on Form 10-K for the year ended December 31, 2022, which are incorporated by reference in this Registration Statement. We consent to the incorporation by reference of the aforementioned reports in this Registration Statement, and to the use of our name as it appears under the caption “Experts.”

/s/ GRANT THORNTON LLP

Houston, Texas

July 7, 2023

Exhibit 23.3

Consent of Independent Auditors

We consent to the incorporation by reference in the Registration Statement (Form S-3) and related prospectus of Callon Petroleum Company of our report dated April 28, 2023, except for unaudited supplemental information described in Note 12, as to which the date is June 30, 2023, with respect to the consolidated balance sheets of Percussion Petroleum II, LLC as of December 31, 2022 and 2021 and the related consolidated statements of operations, changes in members’ equity, and cash flows for the years ended December 31, 2022 and 2021, and the related notes to the consolidated financial statements, which report appears in the Current Report on Form 8-K of Callon Petroleum Company dated July 7, 2023.

We also consent to the reference to us under the caption “Experts” in the Form S-3.

/s/ Weaver and Tidwell, L.L.P.

Houston, Texas

July 7, 2023

Exhibit 23.4

DeGolyer and MacNaughton

5001 Spring Valley Road

Suite 800 East

Dallas, Texas 75244

July 7, 2023

Callon Petroleum Company

2000 W. Sam Houston Parkway S.

Suite 2000

Houston, Texas 77042

Ladies and Gentlemen:

We hereby consent to the incorporation by reference in the Registration Statement on Form S-3, to be filed with the United States Securities and Exchange Commission on or about July 7, 2023, of the use of the name DeGolyer and MacNaughton, the references to us and to our reserves reports for the years ended December 31, 2020, December 31, 2021, and December 31, 2022, the references to DeGolyer and MacNaughton as an independent petroleum engineering consulting firm, and the references to our report of third party dated February 9, 2023, containing our opinion on the proved reserves, as of December 31, 2022, attributable to certain properties in which Callon Petroleum Company has represented it holds an interest, each as contained in Callon Petroleum Company’s Annual Report on Form 10-K for the year ended December 31, 2022.

We further consent to the references to DeGolyer and MacNaughton under the heading "EXPERTS" in the Registration Statement.

| | | | | |

| Very truly yours, |

| |

| /s/ DeGolyer and MacNaughton |

| |

| DeGOLYER and MacNAUGHTON |

| Texas Registered Engineering Firm F-716 |

| |

Exhibit 23.5

CONSENT OF INDEPENDENT PETROLEUM ENGINEERS AND GEOLOGISTS

We hereby consent to the references to our firm, in the context in which they appear, and to the references to and the incorporation by reference of our reserves report, dated June 22, 2023, relating to the proved oil and gas reserves of Percussion Petroleum Operating II, LLC as of December 31, 2022, included in or made a part of this Registration Statement on Form S-3, including any amendments thereto (the “Registration Statement”), of Callon Petroleum Company, in accordance with the requirements of the Securities Act of 1933, as amended. We also consent to the references to us under the heading “Experts” contained in the Registration Statement.

| | | | | |

|

|

| NETHERLAND, SEWELL & ASSOCIATES, INC. |

| |

| By: /s/ Richard B. Talley, Jr. |

| Richard B. Talley, Jr., P.E. |

| Chief Executive Officer |

| |

| Houston, Texas | |

| July 7, 2023 | |

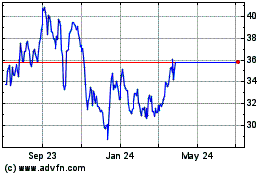

Callon Petroleum (NYSE:CPE)

Historical Stock Chart

From Jul 2024 to Jul 2024

Callon Petroleum (NYSE:CPE)

Historical Stock Chart

From Jul 2023 to Jul 2024