Blackwells Capital LLC (“Blackwells”), a shareholder of Braemar

Hotels & Resorts Inc. (“Braemar” or the “Company”) (NYSE: BHR),

today released a presentation titled, “The Continued Buffoonery of

Monty Bennett.”

Additionally, Blackwells is pleased to announce that independent

shareholders of Braemar are speaking out and concurring with

Blackwells’ campaign aims: to terminate the egregious external

management agreement with Ashford Inc. (“Ashford”) and to

reconstitute Braemar’s entrenched Board.

Brancous LP1 (“Brancous”), a large Braemar shareholder, wrote to

Blackwells commending Blackwells’ campaign. Brancous wrote: “we

share Blackwells’ concerns…” and that “[t]he reappointment of Monty

Bennett and Kamal Jafarnia by Ashford Hospitality board…reinforces

our concerns about the governance integrity of Braemar.” Brancous

further commented on “the lackluster performance under the current

board’s leadership” and stated that “it’s troubling to see board

members enriching themselves at the expense of shareholder value.”

A complete copy of the Brancous letter can be found at the end of

this press release.

In addition, Braemar’s second largest shareholder recently

disclosed a June 3, 2024 email that it sent to Monty Bennett. The

email calls for the termination of the external management

agreement with Ashford and for the replacement of members of the

Board. A copy of this letter can be found at

https://www.sec.gov/Archives/edgar/data/1574085/000139834424011207/fp0088636-1_ex3.htm.

Jason Aintabi, Chief Investment Officer of Blackwells, said:

“We are not surprised to see other shareholders speaking out. We

are only surprised that Monty Bennett has remained in his position

as long as he has. He may have his conflicted board to thank for

that, but both he and they are facing a ticking clock until

independent, qualified individuals make their way onto the Board so

Braemar can return value to its rightful owners once and for all.

It’s time to put Monty’s Advisory Agreement where it belongs: in

the trash can.”

Blackwells urges all Braemar shareholders

to vote their proxy on the WHITE universal proxy card “FOR” each of

the Blackwells nominees and the Blackwells proposals. Blackwells

recommends shareholders vote “AGAINST” Braemar’s executive

compensation resolution.

If you have any questions about voting your proxy

or need replacement proxy materials, contact:MacKenzie Partners,

Inc.+1 (800) 322-2885 (toll free for

shareholders)proxy@mackenziepartners.com

Blackwells also encourages shareholders to

review Blackwells’ materials, the details of its engagement with

the Company, information about Blackwells’ nominees, and other

important information at www.NoMoreMonty.com. Shareholders are also

invited to follow Blackwells’ campaign on X at @nomoremonty and

Instagram at @no_more_monty.

Brancous’ letter to Blackwells is copied in full below:

May 16th, 2024

Dear Mr. Aintabi,I am writing to express our support for

Blackwells in its proxy battle with Braemar Hotel & Resorts

board.

The recent developments at Ashford Hospitality Trust have raised

significant concerns. The reappointment of Monty Bennett and Kamal

Jafarnia by Ashford Hospitality board, despite their prior defeat,

highlights entrenched directorship and reinforces our concerns

about the governance integrity of Braemar. These actions at Ashford

Hospitality not only question the independence and accountability

of its board but also raises serious questions about governance

integrity within Braemar. It is crucial for Braemar's board to

recognize these warning signs and prioritize transparency,

accountability, and shareholder interests to regain investor trust

and foster sustainable growth.

We share Blackwells' concerns regarding the intertwined

relationship between Braemar Hotels & Resorts and Ashford Inc.,

especially the conflict of interest arising from Monty Bennett's

dual roles. This situation not only undermines shareholder

interests but also hampers the company's potential for growth and

value creation.

Furthermore, we agree with your assessment of the lackluster

performance under the current board's leadership. While the company

has struggled, it's troubling to see board members enriching

themselves at the expense of shareholder value. Immediate action is

needed to address governance issues and restore shareholder

confidence.

In line with Blackwells' conviction, we support the call for

separation between Braemar Hotels & Resorts and Ashford Inc.

This critical step is imperative not only to safeguard shareholder

interests but also to guarantee unbiased decision-making within

Braemar.

We affirm our commitment to vote in favor of the directors

nominated by Blackwells to the Braemar Hotel & Resorts

board.

Sincerely,

Alejandro Malbran Managing Director Brancous LP1

About Blackwells Capital

Blackwells is a multi-strategy alternative asset management firm

that invests in public and private markets globally. Our public

markets portfolio focuses on currencies, equities, credit and

commodities. When necessary, we engage with public company boards

to drive value for all stakeholders. Our private markets portfolio

includes investments in space, clean energy, infrastructure, real

estate and technology. Further information is available

at www.blackwellscap.com.

Contacts

StockholdersMacKenzie Partners, Inc.Toll Free:

+1 (800) 322-2885proxy@mackenziepartners.com

MediaGagnier CommunicationsDan Gagnier &

Riyaz Lalani646-569-5897blackwells@gagnierfc.com

IMPORTANT ADDITIONAL INFORMATION

Blackwells, Blackwells Onshore I LLC, Jason Aintabi, Michael

Cricenti, Jennifer M. Hill, Betsy L. McCoy and Steven J. Pully

(collectively, the “Participants”) are participants in the

solicitation of proxies from the stockholders of the Company for

the Company’s 2024 annual meeting of stockholders. On April 3,

2024, the Participants filed with the Securities and Exchange

Commission (the “SEC”) their definitive proxy statement and

accompanying WHITE universal proxy card in connection with their

solicitation of proxies from the stockholders of the Company.

ALL STOCKHOLDERS OF THE COMPANY ARE ADVISED TO READ THE

DEFINITIVE PROXY STATEMENT, THE ACCOMPANYING WHITE UNIVERSAL PROXY

CARD AND OTHER DOCUMENTS RELATED TO THE SOLICITATION OF PROXIES BY

THE PARTICIPANTS, AS THEY CONTAIN IMPORTANT INFORMATION, INCLUDING

ADDITIONAL INFORMATION RELATED TO THE PARTICIPANTS AND THEIR DIRECT

OR INDIRECT INTERESTS IN THE COMPANY, BY SECURITY HOLDINGS OR

OTHERWISE.

The definitive proxy statement and an accompanying WHITE

universal proxy card will be furnished to some or all of the

Company’s stockholders and are, along with other relevant

documents, available at no charge on the SEC’s website

at http://www.sec.gov/. In addition, the Participants will

provide copies of the definitive proxy statement without charge,

upon request. Requests for copies should be directed to

Blackwells.

The Company’s board of directors has purported to reject as

invalid our nominations to elect each of Blackwells’ nominees and

determined that our notice is purportedly non-compliant with the

Company’s Fifth Amended and Restated Bylaws, as amended (the

“Bylaws”) and defective. On March 24, 2024, the Company brought

suit against each of the Participants, Blackwells Holding Co. LLC,

Vandewater Capital Holdings, LLC, Blackwells Asset Management LLC

and BW Coinvest Management I LLC in the United States District

Court for the Northern District of Texas (the “District Court”),

seeking injunctive relief against solicitation of proxies by

Blackwells and a declaratory judgment that Blackwells’ nomination

is invalid due to Blackwells’ alleged violations of the Bylaws,

and, as a result, Blackwells’ slate of purported nominees is

invalid and ineligible to stand for election by the Company’s

stockholders. Ultimately, Blackwells believes the Company’s claims

have no merit. On April 11, 2024, Blackwells filed a Complaint in

the District Court against the Company and the Company’s directors.

Blackwells alleges, among other things, that the Company improperly

rejected Blackwells’ nomination notice, breached the Bylaws, and

violated Section 14(a) of the Securities Exchange Act of 1934 by

issuing false and misleading statements and failing to disclose The

Dallas Express as a proxy participant. The action filed by the

Company on March 24, 2024 and the action filed by Blackwells on

April 11, 2024 have been consolidated (the “Consolidated

Litigation”). The Consolidated Litigation is currently stayed. The

outcome of the Consolidated Litigation and any related litigation

may affect our ability to deliver proxies submitted to us on the

WHITE universal proxy card.

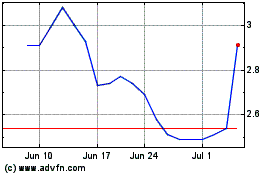

Braemar Hotels and Resorts (NYSE:BHR)

Historical Stock Chart

From Dec 2024 to Jan 2025

Braemar Hotels and Resorts (NYSE:BHR)

Historical Stock Chart

From Jan 2024 to Jan 2025