Adoption of Blend's Close solution has cut closing times to 20

minutes and reduced loan processing from 7 days to 48 hours,

enhancing efficiency and borrower satisfaction

Blend, the leading origination platform for digital banking

solutions, is pleased to announce the successful implementation of

its Close solution at SouthState Bank (SouthState), resulting in

significant enhancements to borrower experience and operational

efficiency.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20241021622665/en/

SouthState, a regional bank with $44 billion in assets and over

1 million customers across the southeastern United States, sought

Blend’s Close solution to overcome the inefficiencies of its

traditional, paper-based process. Since adopting Blend’s Close

technology, which is embedded directly within the mortgage platform

and supports all types of closings from traditional to fully online

closings with a remote notary, SouthState has transformed its

broader mortgage operations.

“The number one thing for us was how robust the Blend Close

solution is,” said SouthState’s Director of Mortgage Strategic

Initiatives, Shane Horan. “Blend offers all the various types of

eClose scenarios, from a hybrid without an e-note, a hybrid with an

e-note, and all the way up to a full RON closing with a Blend

notary. That was truly the clear benefit for us.”

Key Partnership Outcomes

Enhancing The Customer Experience With

Faster & More Convenient Closings

With Blend’s Close solution, SouthState has drastically reduced

closing times, enabling some fully virtual closings to be completed

in as little as 20 minutes—compared to more than an hour for

traditional wet-sign closings. The ability to close loans remotely

from anywhere offers significant flexibility and convenience for

SouthState customers, especially benefiting military personnel

deployed overseas, individuals with spouses abroad, and borrowers

unable to attend in-person closings.

Unlocking Loan Officer Capacity and

Enhancing Borrower Relationships

This faster and more flexible closing experience has not only

boosted borrower satisfaction, but also enabled SouthState’s loan

officers to dedicate more time to building relationships with

borrowers, rather than handling administrative tasks. The

streamlined process facilitates faster in-person hybrid closings as

well, with fewer documents to sign.

As stated by Shane Horan: “Getting face-to-face time with

borrowers is really the main concern for our LOs. They don't want

to miss the closing because they feel like they have that borrower

relationship to foster. Now they're able to do that virtually and

still get the same benefits in a much shorter period of time. And

even for a hybrid close, there are fewer documents that have to be

signed, so it’s a much quicker process in-person too.”

Boosting Operational Efficiency with

Shorter Loan Cycle Times

The ability to close loans faster and reach more remote

borrowers has also translated into improved financial and

operational outcomes for SouthState. Since implementing Blend

Close, the biggest benefit the SouthState mortgage team has seen is

across operational efficiency, which ultimately leads to cost

reduction across the board. As a Fannie Mae and Freddie Mac seller

servicer, the SouthState team has been able to send loans to Fannie

and Freddie in just 24 to 48 hours — whereas before adopting a

digital close solution, it could take up to five to seven business

days.

Read the full case study here.

About Blend

Blend (NYSE: BLND) is the leading origination platform for

digital banking solutions. Financial providers—from large banks,

fintechs, and credit unions to community and independent mortgage

banks—use Blend’s platform to transform banking experiences for

their customers. Blend powers billions of dollars in financial

transactions every day. To learn more, visit blend.com.

About SouthState Bank

SouthState Corporation (NYSE: SSB) is a financial services

company headquartered in Winter Haven, Florida. SouthState Bank,

N.A., the company’s nationally chartered bank subsidiary, provides

consumer, commercial, mortgage and wealth management solutions to

more than one million customers throughout Florida, Alabama,

Georgia, the Carolinas and Virginia. The bank also serves clients

coast to coast through its correspondent banking division.

Additional information is available at SouthStateBank.com.

Forward-Looking Disclaimer

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. These statements generally relate to future events, future

performance or expectations and involve substantial risks and

uncertainties. Forward-looking statements in this press release may

include, but are not limited to, our expectations regarding our

product roadmap, future products/features, the timing of new

product/feature introductions, market size and growth

opportunities, macroeconomics and industry conditions, capital

expenditures, plans for future operations, competitive position,

technological capabilities and strategic relationships, as well as

assumptions relating to the foregoing. The forward-looking

statements contained in this press release are subject to risks and

uncertainties that could cause actual outcomes to differ materially

from the outcomes predicted. In some cases, you can identify

forward-looking statements by terminology such as “may,” “will,”

“should,” “expect,” “plan,” “anticipate,” “could,” “would,”

“intend,” “target,” “project,” “contemplate,” “believe,”

“estimate,” “predict,” “potential” or “continue” or the negative of

these terms or other comparable terminology that concern Blend’s

expectations, strategy, plans or intentions. You should not put

undue reliance on any forward-looking statements. Forward-looking

statements should not be read as a guarantee of future performance

or results and will not necessarily be accurate indications of the

times at, or by which such performance or results will be achieved,

if at all. Further information on these risks and uncertainties are

set forth in our filings with the Securities and Exchange

Commission. All forward-looking statements in this press release

are based on information available to Blend and assumptions and

beliefs as of the date hereof. New risks and uncertainties emerge

from time to time, and it is not possible for us to predict all

risks and uncertainties that could have an impact on the

forward-looking statements contained in this press release. Except

as required by law, Blend does not undertake any obligation to

publicly update or revise any forward-looking statement, whether as

a result of new information, future developments, or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241021622665/en/

Press Contact Chloé Demeunynck Corporate Communications

press@blend.com

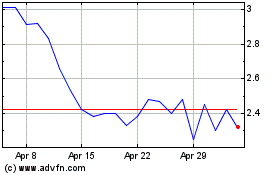

Blend Labs (NYSE:BLND)

Historical Stock Chart

From Oct 2024 to Nov 2024

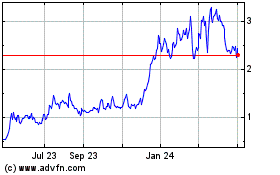

Blend Labs (NYSE:BLND)

Historical Stock Chart

From Nov 2023 to Nov 2024