UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

Banco Macro S.A.

(Name of Issuer)

Ordinary Shares

(Title of Class of Securities)

05961 W105

(CUSIP Number)

Jeffrey Cohen, Esq.

Linklaters LLP, 1290 Avenue of the Americas, New York, New York

(212) 903 9014

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

September 1, 2023

(Date of Event which Requires Filing of this

Statement)

If the filing person has previously

filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because

of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box: ¨.

Note. Schedules filed in paper format shall include

a signed original and five copies of the schedule, including all exhibits. See §240.13d-7 for other parties to whom copies are to

be sent.

The remainder of this cover page shall be filled out for a reporting

person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing

information which would alter disclosures provided in a prior cover page.

The information

required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities

Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all

other provisions of the Act (however, see the Notes).

| 1 |

NAMES OF REPORTING PERSONS

FIDEICOMISO DE GARANTÍA JHB BMA

(IRS Identification Number: Not Applicable) |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨

(b) ¨ |

| 3 |

SEC USE ONLY

|

|

| 4 |

SOURCE OF FUNDS

OO |

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e)

|

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

City of Buenos Aires, Republic of Argentina (“Argentina”) |

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE VOTING POWER

Not applicable |

| 8 |

SHARED VOTING POWER

Class A Shares: 5,995,996

Class B Shares: 104,473,881 |

| 9 |

SOLE DISPOSITIVE POWER

Not applicable |

| 10 |

SHARED DISPOSITIVE POWER

Class A Shares: 5,995,996

Class B Shares: 104,473,881 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

Class A Shares: 5,995,996

Class B Shares: 104,473,881 |

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

Class A: 53.4%

Class B: 16.6% |

|

| 14 |

TYPE OF REPORTING PERSON

OO |

|

| 1 |

NAMES OF REPORTING PERSONS

BANCO DE SERVICIOS Y TRANSACCIONES S.A., as

Trustee of FIDEICOMISO DE GARANTÍA JHB BMA

(IRS Identification Number: Not Applicable) |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨

(b) ¨ |

| 3 |

SEC USE ONLY

|

|

| 4 |

SOURCE OF FUNDS

OO |

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e)

|

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

City of Buenos Aires, Republic of Argentina (“Argentina”) |

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE VOTING POWER

Not applicable |

| 8 |

SHARED VOTING POWER

Class A Shares: 5,995,9961

Class B Shares: 104,473,8812 |

| 9 |

SOLE DISPOSITIVE POWER

Not applicable |

| 10 |

SHARED DISPOSITIVE POWER

Class A Shares: 5,995,9961

Class B Shares: 104,473,8812 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

Class A Shares: 5,995,9961

Class B Shares: 104,473,8812 |

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

Class A: 53.4%

Class B: 16.6% |

|

| 14 |

TYPE OF REPORTING PERSON

OO |

|

| 1 | Includes 5,995,996 Class A Shares held by FIDEICOMISO DE GARANTÍA

JHB BMA, of which BANCO DE SERVICIOS Y TRANSACCIONES S.A. is trustee. |

| 2 | Includes 104,473,881Class B Shares held by FIDEICOMISO DE GARANTÍA

JHB BMA, of which BANCO DE SERVICIOS Y TRANSACCIONES S.A. is trustee. |

Item 1. Security and Issuer

This statement relates to Class B ordinary shares (the

“Class B Shares”) of Banco Macro S.A. (“Banco Macro”). The Class B Shares have a par value of Ps.1.00.

The Class B Shares are entitled to one (1) vote per share.

The Reporting Persons (as defined in Item 2 herein)

also own Class A shares of Banco Macro (the “Class A Shares” and together with the Class B Shares, the “Shares”).

The Class A Shares have a par value of Ps.1.00 and are entitled to five (5) votes per share. The Class A Shares may be converted into

Class B Shares on a one-for-one basis at the request of the holder. The holder’s ability to convert Class A Shares to Class B Shares

is contingent on the board of directors of Banco Macro verifying after receipt of a conversion request that there is no restriction or

other limitation in effect with respect to such conversion.

The address of Banco Macro’s principal office

and principal place of business is Av. Eduardo Madero 1182, City of Buenos Aires, C1106ACY, Argentina.

Item 2. Identity and Background.

(a)

–(c) and (f) This statement is being filed by Fideicomiso de Garantía JHB BMA (the “Trust”) and Banco

de Servicios y Transacciones S.A. as trustee of the Trust (the “Trustee” and, together with the Trust, collectively,

the “Reporting Persons”). The Trust is a trust organized under the laws of Argentina and serves the purpose of holding

the shares of Banco Macro S.A. that Mr. Jorge Horacio Brito (“Mr. Brito”) held before his death to secure the obligations

of the Heirs (as defined below) under the Shareholders’ Agreement (as defined below). Following the death of Mr. Brito, the change

in shareholder as a result of the transfer of the Shares held by Mr. Brito to the Trust was made subject to the approval of the Argentine

Central Bank (the “Central Bank”). This statement is being filed as a result of the approval by the Central Bank of

the change in shareholder as a result of the transfer of the Shares to the Trust, for the benefit of Milagros Brito, Constanza Brito,

Jorge Pablo Brito, Marcos Brito, Santiago Brito and Mateo Brito (collectively, the “Heirs”) and Ms. Marcela Patricia

Carballo de Brito. The Trustee directly (whether through ownership interest or position) or indirectly may be deemed to control the Trust.

The Trustee may be deemed to have shared voting and investment power with respect to the Shares owned by the Trust. As such, the Trustee

may be deemed to have shared beneficial ownership over such Shares. The address of the Trustee is Tte Gral. Domingo Peron 646 4th floor,

Buenos Aires, Argentina, (C1038AAN). The Trustee is filing this Schedule in its capacity as Trustee of the Trust.

(d) — (e) During the last

five years, the Reporting Persons have not been (i) convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors)

or (ii) a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding

was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject

to, federal or state securities laws or finding any violation with respect to such laws.

Item 3. Source and Amount of Funds or Other Consideration.

The responses of Item 2 to this Schedule 13D are incorporated

herein by reference.

Following Mr. Brito’s death on November 20, 2020,

the transfer of the Shares remained subject to the approval of the Central Bank.

On September 1, 2023, the Central Bank approved the change in

shareholder as a result of the transfer of the Class A Shares and the Class B Shares to the Trust.

No funds were involved in the transaction and the transfer

was made for no consideration.

Item 4. Purpose of Transaction.

The responses of Item 2 and Item 3 to this Schedule 13D

are incorporated herein by reference.

The beneficiaries of the Trust are the Heirs and Ms. Carballo

de Brito. The Trustee directs the voting and disposition of the securities owned by the Trust, solely based on the instructions provided

by a majority of the Heirs. As per the terms of the Trust, all the Heirs have the same voting power within the Trust, except that in case

of a tie, Mr. Jorge Pablo Brito may cast the deciding vote to give instructions to the Trustee.

The Heirs have entered into a shareholders’ agreement dated

as of December 15, 2021 (the “Shareholders’ Agreement”), whereby they agreed to, among other things, vote (or

instruct to vote) in a unified manner, and to certain conditions with respect to the distribution of dividends.

As of the date of this statement, the Trust, for the benefit of

the beneficiaries mentioned herein, owns 5,995,996 Class A Shares and 104,473,881 Class B Shares, equal to 53.4% of the aggregate amount

of outstanding Class A shares and 16.6% of the aggregate amount of outstanding Class B Shares.

The Reporting Persons do not have any plans or proposals

that relate to or would result in any of the transactions described in subparagraphs (a) through (j) of Item 4 of Schedule 13D.

Item 5. Interest in Securities of the Issuer.

| (a) | The information set forth in rows 11 and 13 of the cover pages to this Schedule 13D is incorporated herein by reference. |

| (b) | The information set forth in rows 7 through 10 of the cover pages to this Schedule 13D is incorporated herein by reference. |

| (c) | The information in Item 2 and Item 3 of this statement is hereby

incorporated by reference. The Reporting Persons have not acquired, or disposed of, any Shares of the Issuer during the past 60 days. |

| (d) | Mrs. Marcela Patricia Carballo de Brito has a usufruct right

over 50% of the dividends and other economic rights arising from the Shares, which will expire upon the earliest of (i) December 15,

2031; and (ii) the death of Ms. Marcela Patricia Carballo de Brito. To the best of the Reporting Persons’ knowledge, except as

provided in Item 4 (which is herein incorporated by reference), no other person is known to have the right to receive, or the power to

direct to have the receipt of dividends from, or the proceeds from the sale of, the Class A Shares and the Class B Shares owned by the

Reporting Persons. |

Item 6. Contracts, Agreements, Understandings or Relationships

with Respect to Securities of the Issuer.

The information in Item 4 and Item 5 above is incorporated

herein by reference. To the best knowledge of the Reporting Persons, except as provided herein, there are no contracts, arrangements,

understandings or relationships (legal or otherwise) between the Reporting Persons and any other person with respect to any securities

of the Issuer, finder's fees, joint ventures, loan or option arrangements, puts or calls, guarantees of profits, division of profits or

loss, or the giving or withholding of proxies, or a pledge or contingence, the occurrence of which would give another person voting power

or investment power over the securities of the Issuer.

Item 7. Material to be Filed as Exhibits.

The following documents are filed as exhibits hereto:

SIGNATURES

After reasonable inquiry and to

the best knowledge and belief of the undersigned, the undersigned certify that the information set forth in this statement is true, complete

and correct.

Dated: August 12, 2024

| FIDEICOMISO DE GARANTÍA JHB BMA |

| |

|

| |

|

|

| By: |

/s/ Martin Elias Culeddu |

|

| Name: |

Martin Elias Culeddu |

|

| Title: |

Attorney-in-fact |

|

| |

|

|

| By: |

/s/ Ana Vea Murguia |

|

| Name: |

Ana Vea Murguia |

|

| Title: |

Attorney-in-fact |

|

| |

|

|

| |

|

|

| BANCO DE SERVICIOS Y TRANSACCIONES S.A., as Trustee of FIDEICOMISO DE GARANTÍA JHB BMA |

| |

|

| |

|

|

| By: |

/s/ Martin Elias Culeddu |

|

| Name: |

Martin Elias Culeddu |

|

| Title: |

Attorney-in-fact |

|

| |

|

|

| By: |

/s/ Ana Vea Murguia

|

|

| Name: |

Ana Vea Murguia |

|

| Title: |

Attorney-in-fact |

|

EXHIBIT 99.1

JOINT FILING AGREEMENT

WHEREAS, in accordance with Rule 13d-1(k) under

the Securities and Exchange Act of 1934, as amended (the “Act”), only one joint Statement and any amendments thereto need

be filed whenever one or more persons are required to file such a Statement or any amendments thereto pursuant to Section 13(d) of the

Act with respect to the same securities, provided that said persons agree in writing that such Statement or any amendments thereto is

filed on behalf of each of them;

NOW, THEREFORE, the parties hereto agree as follows:

Fideicomiso de Garantía JHB BMA (the “Trust”)

and Banco de Servicios y Transacciones S.A. as trustee of the Trust do hereby agree, in accordance with Rule 13d-1(k) under the Act, to

file a Statement on Schedule 13D relating to their ownership of Class A Shares and Class B Shares of Banco Macro S.A. and do hereby further

agree that said statement shall be filed on behalf of each of them (this “Agreement”). This Agreement may be executed

in two or more counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument.

Effective: August 12, 2024

| FIDEICOMISO DE GARANTÍA JHB BMA |

| |

| |

|

|

| By: |

/s/ Martin Elias Culeddu |

|

| Name: |

Martin Elias Culeddu |

|

| Title: |

Attorney-in-fact |

|

| |

|

|

| By: |

/s/ Ana Vea Murguia |

|

| Name: |

Ana Vea Murguia |

|

| Title: |

Attorney-in-fact |

|

| |

|

|

| |

|

|

| BANCO DE SERVICIOS Y TRANSACCIONES S.A.,

as Trustee of FIDEICOMISO DE GARANTÍA JHB BMA |

| |

| |

|

|

| By: |

/s/ Martin Elias Culeddu |

|

| Name: |

Martin Elias Culeddu |

|

| Title: |

Attorney-in-fact |

|

| |

|

|

| By: |

/s/ Ana Vea Murguia |

|

| Name: |

Ana Vea Murguia |

|

| Title: |

Attorney-in-fact |

|

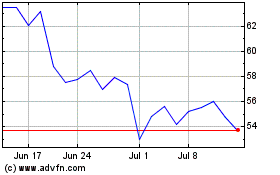

Banco Macro (NYSE:BMA)

Historical Stock Chart

From Nov 2024 to Dec 2024

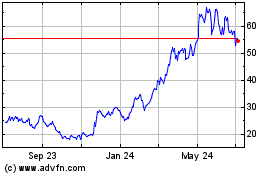

Banco Macro (NYSE:BMA)

Historical Stock Chart

From Dec 2023 to Dec 2024