Relevate Acquires Gravity Renewables, Doubling Sustainable Baseload Power Capacity and Strengthening Industry Leadership

December 05 2024 - 9:00AM

Relevate Power (“Relevate”), a leader in the redevelopment of

run-of-river hydropower assets, announced its acquisition of

Gravity Renewables, with financing provided by funds managed by

Apollo (NYSE: APO). The acquisition adds 40 MW of high-quality

assets to Relevate Power’s portfolio, more than doubling the

company’s power generation capacity and bringing on board an

experienced operating team.

This acquisition strengthens Relevate Power’s footprint in the

Northeastern United States, where the company’s 21 legacy plants

are located, and where it plans to locate its new remote operations

center. Along with Gravity’s 15 hydroelectric plants and one solar

project, the acquired assets have been awarded over $20 million in

grants from the Department of Energy.

“We are excited to welcome Gravity’s people and assets into the

Relevate Power family,” said Matthew Wenger, CEO of Relevate Power.

“We look forward to working together with our new colleagues and

investing to enhance, preserve, and protect these essential and

historic assets for the benefit of the communities we serve.”

Goksenin Ozturkeri, Chief Investment Officer and deal lead at

Relevate Power, highlighted the strategic importance of the deal:

“This acquisition is a game-changer for Relevate. This is the first

of many acquisitions in our pipeline as we focus on consolidating a

fragmented market and seek to capitalize on further growth

opportunities with Apollo.”

As part of the transaction, an Apollo representative will join

Relevate Power’s Board of Directors, reinforcing a shared

commitment to advancing clean energy solutions.

“We are excited to enter the distributed hydro space and mark

the beginning of a broader relationship with Relevate,” said Brad

Fierstein, Partner at Apollo. “We believe hydropower is an

attractive sector that offers significant growth potential and

strong alignment with the energy transition.”

Benjamin Baker, Managing Director at Greenbacker

Development Opportunities Fund, an investor in Relevate, shared:

“The acquisition of Gravity Renewables is transformational for

Relevate Power, highlighting the increasing need for distributed

sustainable baseload power in our generation mix. We are also

pleased to welcome Apollo to the board of Relevate and look forward

to expanding our relationship.”

King and Spalding and The West Firm served as legal advisors to

Relevate Power, while Vinson & Elkins served as legal advisor

to Apollo Funds.

About Relevate Power

Founded in 2022 from the merger of Independent Power Producers

Dichotomy Power and Clear Energy, along with the power marketing

firm Standard Power, Relevate Power is committed to redeveloping

underutilized hydropower plants, providing affordable, clean energy

to rural America’s most impactful organizations. The company is

backed by Greenbacker Development Opportunities Fund I, LP. and

Aegon Asset Management Real Assets.

For more information, visit www.RelevatePower.com.

About ApolloApollo is a high-growth, global

alternative asset manager. In our asset management business, we

seek to provide our clients excess return at every point along the

risk-reward spectrum from investment grade credit to private

equity. For more than three decades, our investing expertise across

our fully integrated platform has served the financial return needs

of our clients and provided businesses with innovative capital

solutions for growth. Through Athene, our retirement services

business, we specialize in helping clients achieve financial

security by providing a suite of retirement savings products and

acting as a solutions provider to institutions. Our patient,

creative, and knowledgeable approach to investing aligns our

clients, businesses we invest in, our employees, and the

communities we impact, to expand opportunity and achieve positive

outcomes. As of September 30, 2024, Apollo had approximately $733

billion of assets under management. To learn more, please visit

www.apollo.com.

About Greenbacker Development Opportunities

FundGreenbacker Development Opportunities is a

middle-market private equity strategy that invests in growing

sustainable infrastructure platforms serving high-value markets

across the US. The strategy is managed by Greenbacker Capital

Management, LLC.

For more information, please

visit https://greenbackercapital.com/greenbacker-development-opportunities.

Media ContactSilverline CommunicationsClaire

Underwoodclaire@teamsilverline.com

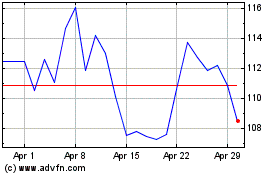

Apollo Global Management (NYSE:APO)

Historical Stock Chart

From Nov 2024 to Dec 2024

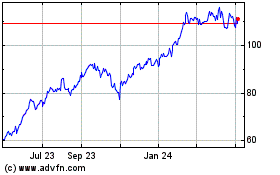

Apollo Global Management (NYSE:APO)

Historical Stock Chart

From Dec 2023 to Dec 2024