FALSE000170305600017030562024-01-192024-01-19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

| | | | | | | | |

| | |

| FORM 8-K | |

| | |

| CURRENT REPORT | |

| | |

| Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934 |

Date of Report (Date of earliest event reported): January 19, 2024 | | | | | | | | |

| | |

| | |

| ADT Inc. | |

| (Exact name of registrant as specified in its charter) |

| | |

| | | | | | | | |

| Delaware | 001-38352 | 47-4116383 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | | | | | |

| 1501 Yamato Road Boca Raton, Florida 33431 | |

| (Address of principal executive offices) | |

(561) 988-3600

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | | ADT | | New York Stock Exchange |

| | | | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.05 Costs Associated with Exit or Disposal Activities.

Exit from Solar Business

As previously disclosed, in November 2023, ADT Inc. (the “Company” or “ADT”) announced a plan to streamline its solar business to focus on the top performing markets and rationalize the overhead and infrastructure of the business. As part of this plan, the Company closed a significant number of branches that operate the solar business along with making associated headcount reductions.

On January 19, 2024, the Company’s board of directors (the “Board of Directors”) approved a plan to fully exit the residential solar business, which may include the transition of components of the business to other parties, after a strategic review of the business and continued macroeconomic and industry pressures. The exit from the residential solar business is expected to be completed during 2024.

The Company expects to incur cash expenditures and other non-cash charges related to the exit in 2024. At the time of this filing, the Company has determined that it is unable in good faith to provide an estimate of the total amount or range of amounts of major types of costs, including employee separation costs, contract terminations, and other related costs, expected to be incurred in connection with this exit plan. The Company plans to file an amendment to this Current Report on Form 8-K once these estimates or a range of estimates of such charges are determined.

Item 7.01 Regulation FD Disclosure.

Common Stock Dividends

On January 24, 2024, the Company issued a press release (the “Press Release”) announcing the exit from the residential solar business and the authorization of the Share Repurchase Plan (defined below). A copy of the Press Release is being furnished herewith as Exhibit 99.1 and an accompanying investor presentation (the “Investor Presentation”) is being furnished herewith as Exhibit 99.2; both are incorporated herein by reference in their entirety.

In this Press Release, the Company also announced a 57% increase in the quarterly cash dividend to $0.055 per share to holders of the Company’s common stock and Class B common stock of record on March 14, 2024. The dividend will be paid on or about April 4, 2024.

The information contained in this Item 7.01, including Exhibits 99.1 and 99.2, is furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall it be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 8.01 Other Information.

Share Repurchase Plan

On January 24, 2024, the Company's Board of Director's announced a share repurchase plan (the “Share Repurchase Plan”), pursuant to which the Company is authorized to repurchase, through late January 2025, up to a maximum aggregate amount of $350 million of shares of the Company's common stock under this Share Repurchase Plan.

The Company may effect these repurchases pursuant to one or more open market or private transactions, including pursuant to a plan that qualifies for the affirmative defense provided by Rule 10b5‐1 under the Exchange Act, or pursuant to one or more accelerated share repurchase agreements.

The Company is not obligated to repurchase any of its shares of common stock, and the timing and amount of any repurchases will depend on legal requirements, market conditions, stock price, the availability of the safe harbor provided by Rule 10b-18 under the Exchange Act, alternative uses of capital, and other factors.

Forward Looking Statements

ADT has made statements in this filing that are forward-looking and therefore subject to risks and uncertainties, including those described below. All statements, other than statements of historical fact, included in this document are, or could be, “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and the applicable rules and regulations of the Securities and Exchange Commission (the “SEC”) and are made in reliance on the safe harbor protections provided thereunder. These forward-looking statements relate to, among other things, the Company exiting the residential solar business and the expected costs and benefits of such exit; the repurchase of shares of the Company’s common stock under the authorized share repurchase program; the Company’s ability to reduce debt or improve leverage ratios, or to achieve or maintain its long‑term leverage goals; the integration of the strategic bulk purchase of customer accounts; any stated or implied outcomes with regards to the foregoing; and other matters. Without limiting the generality of the preceding sentences, any time the Company uses the words “expects,” “intends,” “will,” “anticipates,” “believes,” “confident,” “continue,” “propose,” “seeks,” “could,” “may,” “should,” “estimates,” “forecasts,” “might,” “goals,” “objectives,” “targets,” “planned,” “projects,” and, in each case, their negative or other various or comparable terminology, and similar expressions, the Company intends to clearly express that the information deals with possible future events and is forward-looking in nature. However, the absence of these words or similar expressions does not mean that a statement is not forward-looking. These forward-looking statements are based on management’s current beliefs and assumptions and on information currently available to management. ADT cautions that these statements are subject to risks and uncertainties, many of which are outside of ADT’s control, and could cause future events or results to be materially different from those stated or implied in this filing, including among others, factors relating to uncertainties as to any difficulties with respect to ADT’s planned exit of the residential solar business, including expenses associated with the separation of certain solar branches and personnel; the effect of the announcement of ADT exiting the residential solar business on ADT’s ability to retain and hire key personnel and to maintain relationships with customers, suppliers and other business partners; risks related to the possible diversion of management’s attention from ADT’s core CSB business operations as a result of ADT announcing its exit from the residential solar business; uncertainties as to ADT’s ability and the amount of time necessary to realize the expected benefits of the planned exit from the residential solar business and the recent strategic bulk purchase of customer accounts; activity in repurchasing shares of ADT’s common stock under the authorized share repurchase program; dividend rates or yields for any future quarter; and risks that are described in the Company’s Amended Annual Report, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and other filings with the SEC, including the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained therein. Any forward-looking statement made in this filing speaks only as of the date on which it is made. ADT undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future developments, or otherwise.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

| Exhibit | Description |

| |

| |

| 104 | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| Date: | January 24, 2024 | ADT Inc. |

| | | |

| | By: | /s/ David W. Smail |

| | | David W. Smail |

| | | Executive Vice President, Chief Legal Officer and Secretary |

ADT Provides Solar Business Update and Advances Capital Allocation Strategy Exits Residential Solar Business Increases Quarterly Dividend by 57% and Authorizes $350 Million Share Repurchase Program Continues to Strengthen Balance Sheet Schedules Fourth Quarter and Full Year 2023 Reporting Date BOCA RATON, Fla., Jan. 24, 2024 – ADT Inc. (NYSE: ADT), the most trusted brand in smart home and small business security, today announced it will be exiting its residential solar business. The Company will remain focused on cash flow generation and capital-efficient growth within its core security and smart home business. As part of this continued focus, ADT is also advancing its capital allocation strategy, including a cash dividend increase and authorization of a new share repurchase program. “The decision to exit solar operations was made after careful deliberation, and we expect this strategic action to drive substantial operational and financial benefits to ADT,” said ADT Chairman, President and CEO, Jim DeVries. “We want to acknowledge and thank our employees, partners, and customers as we work through this transition.” Solar Business Update Over the first nine months of 2023, ADT’s core business exhibited strong performance, while the solar business faced challenges, including operational difficulties and macroeconomic headwinds causing deterioration of conditions industrywide. As a result of these challenges, the Solar segment generated an Adjusted EBITDA loss of $89 million during this period. Following the previously announced restructuring of its solar footprint and a detailed strategic review, ADT’s Board of Directors has approved the exit of this segment, which may include the transfer of components of the business to other parties. The Company expects to incur certain one-time exit charges and cash expenditures with potential offsets from asset sales or reduced tax expenses. As previously disclosed, as of September 30, 2023, the goodwill balance for the Solar reporting unit was zero. At this time, the Company is still analyzing the estimated net amount or range of amounts expected to be incurred in connection with this plan. Exhibit 99.1 Strong Cash Flowing Core Business Propelling Capital Allocation Update Supported by ADT’s confidence in the strong cash flow generation of its core business, today the Company is also announcing the following: • Dividend Increase – The Company’s Board of Directors has declared a quarterly cash dividend of $0.055 per share, payable on April 4, 2024, to shareholders of record at the close of business on March 14, 2024. The quarterly dividend represents a 57% increase over the previous quarterly dividend. • Share Repurchase Authorization – The Company’s Board of Directors has authorized a $350 million share repurchase program. As the Company executes share repurchases, the Board will periodically review the remaining authorization as part of its capital allocation strategy. • Balance Sheet Fortification – Consistent with the plan from its third quarter earnings announcement, on December 29, 2023, the Company repaid $500 million of First Lien Senior Secured Notes due 2024, completing an overall 2023 reduction of ADT’s total debt by approximately $2 billion. Further, following two corporate rating upgrades in 2023, the Company improved borrowing costs and extended debt maturities and in 2024, will have only $150 million of maturities and amortization payments. The Company remains focused on achieving its targeted net leverage ratio of less than 3.0x. • Core Investment – On December 20, 2023, the Company closed on a strategic bulk purchase of approximately 57,000 customer accounts for $89 million cash with attractive returns. This portfolio of customers is concentrated in a few key geographies, all of which align with existing platforms, enabling strong economies of scale upon integration. This transaction was not included in prior cash flow guidance. Fourth Quarter and Full Year 2023 Earnings Conference Call More details and an update on the business will be provided when the Company releases its fourth quarter and full year 2023 results on February 28, 2024. Following the release, management will host a conference call at 10 a.m. ET to discuss the financial results and lead a question-and-answer session. Participants may listen to a live webcast through the investor relations website at investor.adt.com. A replay of the webcast will be available on the website within 24 hours of the live event. Alternatively, participants may listen to the live call by dialing 1-404-975-4839 (domestic) or 1-833-470-1428 (international) and providing the access code 533961. An audio replay will be available for two weeks following the call and can be accessed by dialing 1-866- 813-9403 (domestic) or 1-929-458-6194 (international) and providing the access code 375946. About ADT Inc. ADT provides safe, smart and sustainable solutions for people, homes and small businesses. Through innovative offerings, unrivaled safety and a premium customer experience, all delivered by the largest network of smart home security professionals in the U.S., we empower people to protect and connect to what matters most. For more information, visit www.adt.com. ADT Contacts Investor Relations: investorrelations@adt.com; 888-238-8525 Media Relations: media@adt.com Forward-Looking Statements ADT has made statements in this press release that are forward-looking and therefore subject to risks and uncertainties, including those described below. All statements, other than statements of historical fact, included in this document are, or could be, “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and the applicable rules and regulations of the Securities and Exchange Commission (the “SEC”) and are made in reliance on the safe harbor protections provided thereunder. These forward-looking statements relate to, among other things, the Company exiting the residential solar business and the expected costs and benefits of such exit; the repurchase of shares of the Company’s common stock under the authorized share repurchase program; the Company’s ability to reduce debt or improve leverage ratios, or to achieve or maintain its long-term leverage goals; the integration of the strategic bulk purchase of customer accounts; any stated or implied outcomes with regards to the foregoing; and other matters. Without limiting the generality of the preceding sentences, any time the Company uses the words “expects,” “intends,” “will,” “anticipates,” “believes,” “confident,” “continue,” “propose,” “seeks,” “could,” “may,” “should,” “estimates,” “forecasts,” “might,” “goals,” “objectives,” “targets,” “planned,” “projects,” and, in each case, their negative or other various or comparable terminology, and similar expressions, the Company intends to clearly express that the information deals with possible future events and is forward-looking in nature. However, the absence of these words or similar expressions does not mean that a statement is not forward-looking. These forward-looking statements are based on management’s current beliefs and assumptions and on information currently available to management. ADT cautions that these statements are subject to risks and uncertainties, many of which are outside of ADT’s control, and could cause future events or results to be materially different from those stated or implied in this press release, including among others, factors relating to uncertainties as to any difficulties with respect to ADT’s planned exit of the residential solar business, including expenses associated with the separation of certain solar branches and personnel; the effect of the announcement of ADT exiting the residential solar business on ADT’s ability to retain and hire key personnel and to maintain relationships with customers, suppliers and other business partners; risks related to the possible diversion of management’s attention from ADT’s core CSB business operations as a result of ADT announcing its exit from the residential solar business; uncertainties as to ADT’s ability and the amount of time necessary to realize the expected benefits of the planned exit from the residential solar business and the recent strategic bulk purchase of customer accounts; activity in repurchasing shares of ADT’s common stock under the authorized share repurchase program; dividend rates or yields for any future quarter; and risks that are described in the Company’s Amended Annual Report, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and other filings with the SEC, including the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained therein. Any forward-looking statement made in this press release speaks only as of the date on which it is made. ADT undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future developments, or otherwise. Non-GAAP Measures The Company is not providing forward-looking guidance for U.S. GAAP financial measures or a quantitative reconciliation to the most directly comparable GAAP measures for its forward-looking non-GAAP measures because the GAAP measures cannot be reliably estimated and the reconciliations cannot be performed without unreasonable effort due to their dependence on future uncertainties and adjusting items that the Company cannot reasonably predict at this time but which may be material. Net Leverage Ratio is a non-GAAP measure. Net Leverage Ratio is calculated as the ratio of net debt to last twelve months (“LTM”) Adjusted EBITDA (discussed below). Net debt is calculated as GAAP total debt excluding the Receivables Facility, including capital leases, minus cash and cash equivalents. We define Adjusted EBITDA as GAAP income or loss from continuing operations adjusted for (i) interest; (ii) taxes; (iii) depreciation and amortization, including depreciation of subscriber system assets and other fixed assets and amortization of dealer and other intangible assets; (iv) amortization of deferred costs and deferred revenue associated with subscriber acquisitions; (v) share-based compensation expense; (vi) merger, restructuring, integration, and other items such as separation costs; (vii) losses on extinguishment of debt; (viii) radio conversion costs net of any related incremental revenue earned; (ix) adjustments related to acquisitions, such as contingent consideration and purchase accounting adjustments, or dispositions; (x) impairment charges; and (xi) other income/gain or expense/loss items such as changes in fair value of certain financial instruments or financing and consent fees.

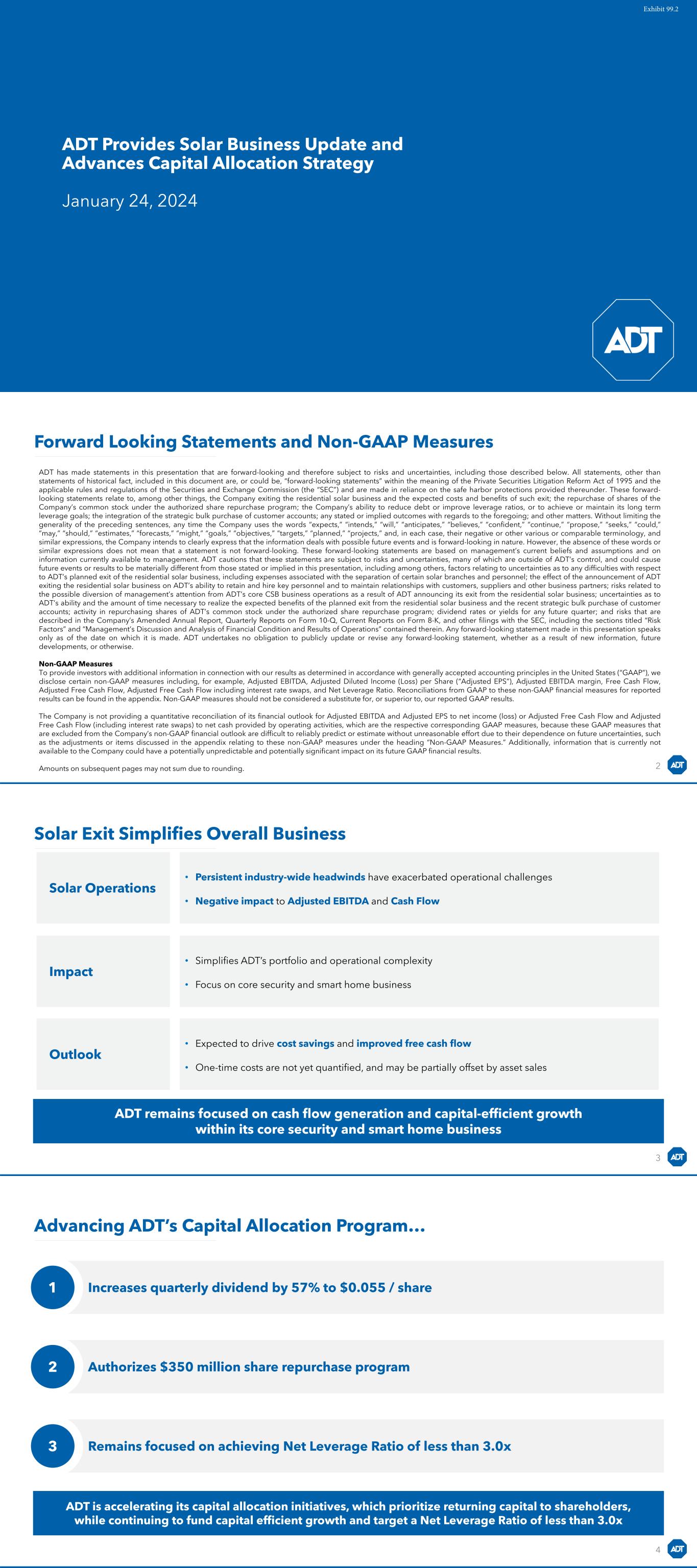

ADT Provides Solar Business Update and Advances Capital Allocation Strategy January 24, 2024 Exhibit 99.2 Forward Looking Statements and Non-GAAP Measures 2 ADT has made statements in this presentation that are forward-looking and therefore subject to risks and uncertainties, including those described below. All statements, other than statements of historical fact, included in this document are, or could be, “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and the applicable rules and regulations of the Securities and Exchange Commission (the “SEC”) and are made in reliance on the safe harbor protections provided thereunder. These forward- looking statements relate to, among other things, the Company exiting the residential solar business and the expected costs and benefits of such exit; the repurchase of shares of the Company’s common stock under the authorized share repurchase program; the Company’s ability to reduce debt or improve leverage ratios, or to achieve or maintain its long term leverage goals; the integration of the strategic bulk purchase of customer accounts; any stated or implied outcomes with regards to the foregoing; and other matters. Without limiting the generality of the preceding sentences, any time the Company uses the words “expects,” “intends,” “will,” “anticipates,” “believes,” “confident,” “continue,” “propose,” “seeks,” “could,” “may,” “should,” “estimates,” “forecasts,” “might,” “goals,” “objectives,” “targets,” “planned,” “projects,” and, in each case, their negative or other various or comparable terminology, and similar expressions, the Company intends to clearly express that the information deals with possible future events and is forward-looking in nature. However, the absence of these words or similar expressions does not mean that a statement is not forward-looking. These forward-looking statements are based on management’s current beliefs and assumptions and on information currently available to management. ADT cautions that these statements are subject to risks and uncertainties, many of which are outside of ADT’s control, and could cause future events or results to be materially different from those stated or implied in this presentation, including among others, factors relating to uncertainties as to any difficulties with respect to ADT’s planned exit of the residential solar business, including expenses associated with the separation of certain solar branches and personnel; the effect of the announcement of ADT exiting the residential solar business on ADT’s ability to retain and hire key personnel and to maintain relationships with customers, suppliers and other business partners; risks related to the possible diversion of management’s attention from ADT’s core CSB business operations as a result of ADT announcing its exit from the residential solar business; uncertainties as to ADT’s ability and the amount of time necessary to realize the expected benefits of the planned exit from the residential solar business and the recent strategic bulk purchase of customer accounts; activity in repurchasing shares of ADT’s common stock under the authorized share repurchase program; dividend rates or yields for any future quarter; and risks that are described in the Company’s Amended Annual Report, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and other filings with the SEC, including the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained therein. Any forward-looking statement made in this presentation speaks only as of the date on which it is made. ADT undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future developments, or otherwise. Non-GAAP Measures To provide investors with additional information in connection with our results as determined in accordance with generally accepted accounting principles in the United States (“GAAP”), we disclose certain non-GAAP measures including, for example, Adjusted EBITDA, Adjusted Diluted Income (Loss) per Share (“Adjusted EPS”), Adjusted EBITDA margin, Free Cash Flow, Adjusted Free Cash Flow, Adjusted Free Cash Flow including interest rate swaps, and Net Leverage Ratio. Reconciliations from GAAP to these non-GAAP financial measures for reported results can be found in the appendix. Non-GAAP measures should not be considered a substitute for, or superior to, our reported GAAP results. The Company is not providing a quantitative reconciliation of its financial outlook for Adjusted EBITDA and Adjusted EPS to net income (loss) or Adjusted Free Cash Flow and Adjusted Free Cash Flow (including interest rate swaps) to net cash provided by operating activities, which are the respective corresponding GAAP measures, because these GAAP measures that are excluded from the Company’s non-GAAP financial outlook are difficult to reliably predict or estimate without unreasonable effort due to their dependence on future uncertainties, such as the adjustments or items discussed in the appendix relating to these non-GAAP measures under the heading “Non-GAAP Measures.” Additionally, information that is currently not available to the Company could have a potentially unpredictable and potentially significant impact on its future GAAP financial results. Amounts on subsequent pages may not sum due to rounding. Solar Exit Simplifies Overall Business 3 Solar Operations • Persistent industry-wide headwinds have exacerbated operational challenges • Negative impact to Adjusted EBITDA and Cash Flow Outlook • Expected to drive cost savings and improved free cash flow • One-time costs are not yet quantified, and may be partially offset by asset sales ADT remains focused on cash flow generation and capital-efficient growth within its core security and smart home business Impact • Simplifies ADT’s portfolio and operational complexity • Focus on core security and smart home business Advancing ADT’s Capital Allocation Program… 4 ADT is accelerating its capital allocation initiatives, which prioritize returning capital to shareholders, while continuing to fund capital efficient growth and target a Net Leverage Ratio of less than 3.0x Increases quarterly dividend by 57% to $0.055 / share1 Authorizes $350 million share repurchase program2 Remains focused on achieving Net Leverage Ratio of less than 3.0x3

…Across ADT’s Capital Allocation Initiatives 5 Maximize Shareholder Returns • Authorized $350M share repurchase program Continue to Pay Down Debt • Google and State Farm Partnerships: Innovative and customer-centric offerings to grow RMR and install revenue via capital-efficient subscriber acquisition • Opportunistic Bulk Purchases: Acquired ~57K subscribers for $89M in Dec. 2023 Significant FCF of core business will focus on capital efficient growth and return of capital to shareholders Fund Growth and Capex to Yield Attractive Returns 4.4x 3.9x 3.3x <3.0x 2021 2022 9/30/23 Post Commercial Divestiture Target Targeting Net Leverage Ratio <3.0x Targeting ~20%+ IRR per New CSB Subscriber Raising Quarterly Dividend by 57% to $0.055 / Share 3.5% 2.2% 1.6% ADT Adjusted for Dividend Increase ADT S&P 500 Median Note: Dividend yields based on closing stock prices as of January 23, 2024. Dividend Yield Investment Thesis for ADT Remains Strong with an Attractive Financial Profile 6 Large and expanding addressable market with opportunities to meaningfully increase share Growing business with industry-leading scale positioned to benefit from secular tailwinds Compelling unit economics that support increased investment for growth Resilient cash flow profile with stable recurring revenue base Large opportunity with strategic partnerships Attractive debt profile with disciplined capital allocation framework to drive long-term value for our shareholders 1 2 3 4 5 6 7 Non-GAAP Measures ADT sometimes uses information (“non-GAAP financial measures”) that is derived from the consolidated financial statements, but that is not presented in accordance with accounting principles generally accepted in the U.S. (“GAAP”). Under SEC rules, non-GAAP financial measures may be considered in addition to results prepared in accordance with GAAP, but should not be considered a substitute for, or, superior to GAAP results. The following information includes definitions of our non-GAAP financial measures used in this presentation, reasons our management believes these measures are useful to investors regarding our financial condition and results of operations, additional purposes, if any, for which our management uses the non-GAAP financial measures, and limitations to using these non-GAAP financial measures, as well as reconciliations of these non-GAAP financial measures to the most comparable GAAP measures. The limitations of non-GAAP financial measures are best addressed by considering these measures in conjunction with the appropriate GAAP measures. In addition, computations of these non-GAAP measures may not be comparable to other similarly titled measures reported by other companies. The Company is not providing forward-looking guidance for U.S. GAAP financial measures or a quantitative reconciliation to the most directly comparable GAAP measures for its forward-looking non-GAAP measures because the GAAP measures cannot be reliably estimated and the reconciliations cannot be performed without unreasonable effort due to their dependence on future uncertainties and adjusting items that the Company cannot reasonably predict at this time but which may be material. Beginning in the third quarter of 2023 the Company is presenting the results of the commercial business as a discontinued operation (with the exception of certain costs previously reflected in the Commercial segment that do not qualify to be presented as discontinued operations and are now reflected in the CSB segment). Except for Free Cash Flow, Adjusted Free Cash Flow, and Adjusted Free Cash Flow (including interest rate swaps) (further defined below) which, consistent with the presentation of the GAAP measure, net cash provided by (used in) operating activities, continue to reflect the results of both continuing and discontinued operations (through the date of sale). We define Free Cash Flow as cash flows from operating activities less cash outlays related to capital expenditures. We define capital expenditures to include accounts purchased through our network of authorized dealers or third parties outside of our authorized dealer network, subscriber system asset expenditures, and purchases of property and equipment. These items are subtracted from cash flows from operating activities because they represent long term investments that are required for normal business activities. We define Adjusted Free Cash Flow as Free Cash Flow adjusted for net cash flows related to (i) net proceeds from our consumer receivables facility; (ii) financing and consent fees; (iii) restructuring and integration; (iv) integration- related capital expenditures; (v) radio conversion costs net of any related incremental revenue collected; and (vi) other payments or receipts that may mask our operating results or business trends. Adjusted Free Cash Flow including interest rate swaps reflects Adjusted Free Cash Flow plus net cash settlements on interest rate swaps presented within net cash provided by (used in) financing activities. We believe the presentations of these non-GAAP measures are appropriate to provide investors with useful information about our ability to repay debt, make other investments, and pay dividends. We believe the presentation of Adjusted Free Cash Flow is also a useful measure of our cash flow attributable to our normal business activities, inclusive of the net cash flows associated with the acquisition of subscribers, as well as our ability to repay other debt, make other investments, and pay dividends. Further, Adjusted Free Cash Flow including interest rate swaps is a useful measure of Adjusted Free Cash Flow inclusive of all cash interest. There are material limitations to using these non-GAAP measures. These non-GAAP measures adjust for cash items that are ultimately within management’s discretion to direct, and therefore, may imply that there is less or more cash available than the most comparable GAAP measure. These non-GAAP measures are not intended to represent residual cash flow for discretionary expenditures since debt repayment requirements and other non-discretionary expenditures are not deducted. Free Cash Flow, Adjusted Free Cash Flow, and Adjusted Free Cash Flow including interest rate swaps (in millions) Twelve Months Ended September 30, 2023 Income (loss) from continuing operations $ (8) Interest expense, net 549 Income tax expense (benefit) (13) Depreciation and intangible asset amortization 1,413 Amortization of deferred subscriber acquisition costs 181 Amortization of deferred subscriber acquisition revenue (287) Share-based compensation expense 45 Merger, restructuring, integration, and other(1) 58 Goodwill impairment(2) 511 Change in fair value of other financial instruments(3) (94) Adjusted EBITDA (from continuing operations) $ 2,356 Adjusted EBITDA from continuing operations ("Adjusted EBITDA") We believe the presentation of Adjusted EBITDA provides useful information to investors about our operating profitability adjusted for certain non-cash items, non-routine items that we do not expect to continue at the same level in the future, as well as other items that are not core to our operations. Further, we believe Adjusted EBITDA provides a meaningful measure of operating profitability because we use it for evaluating our business performance, making budgeting decisions, and comparing our performance against that of other peer companies using similar measures. We define Adjusted EBITDA as income or loss from continuing operations adjusted for (i) interest; (ii) taxes; (iii) depreciation and amortization, including depreciation of subscriber system assets and other fixed assets and amortization of dealer and other intangible assets; (iv) amortization of deferred costs and deferred revenue associated with subscriber acquisitions; (v) share-based compensation expense; (vi) merger, restructuring, integration, and other items such as separation costs; (vii) losses on extinguishment of debt; (viii) radio conversion costs net of any related incremental revenue earned; (ix) adjustments related to acquisitions, such as contingent consideration and purchase accounting adjustments, or dispositions; (x) impairment charges; and (xi) other income/gain or expense/loss items such as changes in fair value of certain financial instruments or financing and consent fees. There are material limitations to using Adjusted EBITDA as it does not reflect certain significant items, which directly affect our income or loss from continuing operations (the most comparable GAAP measure). Note: Amounts may not sum due to rounding. Amounts are recast to reflect the presentation of the commercial business as discontinued operations. 1. During 2023, includes integration and third-party costs related to the strategic optimization of the Solar business operations following the ADT Solar acquisition. 2. Represents goodwill impairment charges related to the Solar reporting unit. 3. In connection with the State Farm investment, amounts represent the change in fair value of a contingent forward purchase contract related to the tender offer during 2022. 8 GAAP to Non-GAAP Reconciliations

(in millions) Twelve Months Ended December 31, 2022 December 31, 2021 Net income (loss) $ 133 $ (341) Interest expense, net 265 458 Income tax expense (benefit) 49 (130) Depreciation and intangible asset amortization 1,694 1,915 Amortization of deferred subscriber acquisition costs 163 126 Amortization of deferred subscriber acquisition revenue (244) (172) Share-based compensation expense 67 61 Merger, restructuring, integration, and other 22 38 Goodwill impairment(1) 201 — Loss on extinguishment of debt — 37 Change in fair value of other financial instruments(2) 63 — Radio conversion costs, net(3) 3 211 Non-cash acquisition-related adjustments and other(4) 31 10 Historical Adjusted EBITDA (as reported) $ 2,447 $ 2,213 Historical Adjusted EBITDA (as reported) We believe the presentation of historical Adjusted EBITDA provides useful information to investors about our operating profitability adjusted for certain non-cash items, non-routine items that we do not expect to continue at the same level in the future, as well as other items that are not core to our operations. Further, we believe historical Adjusted EBITDA provides a meaningful measure of operating profitability because we use it for evaluating our business performance, making budgeting decisions, and comparing our performance against that of other peer companies using similar measures. We define historical Adjusted EBITDA as net income or loss adjusted for (i) interest; (ii) taxes; (iii) depreciation and amortization, including depreciation of subscriber system assets and other fixed assets and amortization of dealer and other intangible assets; (iv) amortization of deferred costs and deferred revenue associated with subscriber acquisitions; (v) share-based compensation expense; (vi) merger, restructuring, integration, and other; (vii) losses on extinguishment of debt; (viii) radio conversion costs net of any related incremental revenue earned; and (ix) other income/gain or expense/loss items such as changes in fair value of certain financial instruments, impairment charges, financing and consent fees, or acquisition-related adjustments. There are material limitations to using historical Adjusted EBITDA as it does not reflect certain significant items, which directly affect our net income or loss (the most comparable GAAP measure). Historical Adjusted EBITDA includes results of the Company's continuing and discontinued operations. Amounts are as reported prior to the presentation of the commercial business as a discontinued operation. Notes: Amounts may not sum due to rounding. 1. Represents a goodwill impairment charge related to the Solar reporting unit in Q3 2022. 2. In connection with the State Farm investment, amounts represent the change in fair value of a contingent forward purchase contract related to the tender offer during 2022. 3. Represents net costs associated with replacing cellular technology used in many of our security systems pursuant to a replacement program. 4. Primarily represents amortization of the customer backlog intangible asset during Q4 2021 and Q1 2022 related to the ADT Solar Acquisition. 9 GAAP to Non-GAAP Reconciliations GAAP to Non-GAAP Reconciliations Net Leverage Ratio and Net Leverage Ratio (as adjusted) are calculated as the ratio of net debt or net debt (as adjusted) to last twelve months (“LTM”) Adjusted EBITDA. Net debt is calculated as total debt excluding the Receivables Facility, including capital leases, minus cash and cash equivalents. Net debt (as adjusted) is calculated as net debt excluding the estimated total debt paydown using the proceeds from the divestiture of the commercial business. Refer to the discussion on Adjusted EBITDA for descriptions of the differences between Adjusted EBITDA and income (loss) from continuing operations, which is the most comparable GAAP measure. We believe these measures are useful measure of the Company's credit position and progress towards leverage targets. There are material limitations to using these measures as the Company may not always be able to use cash to repay debt on a dollar-for-dollar basis. 1. Debt instruments are stated at face value. 2. Calculated using net debt post commercial divestiture. 3. Calculated using net debt as reported. (in millions) September 30, 2023 Total debt (book value) $ 9,668 LTM Income (loss) from continuing operations $ (8) Debt to income (loss) from continuing operations ratio (1274.4x) (in millions) September 30, 2023 First lien term loans 3,343 First lien and ADT notes 4,700 Receivables facility 423 Finance leases and other 89 Total first lien debt $ 8,555 Second lien notes 1,300 Total debt(1) $ 9,855 Less: Cash and cash equivalents (239) Less: Receivables Facility (423) Net debt $ 9,194 Less: debt reduced by net proceeds of commercial divestiture 1,518 Net debt (as adjusted)(2) $ 7,676 LTM Adjusted EBITDA from continuing operations $ 2,356 Net leverage ratio (as adjusted)(2) 3.3x Note: Amounts may not sum due to rounding. 10 Leverage Ratios and Net Debt GAAP to Non-GAAP Reconciliations 1. Debt instruments are stated at face value. (in millions) December 31, 2022 December 31, 2021 Total debt (book value) $ 9,829 $ 9,693 LTM net income (loss) $ 133 $ (341) Debt to net income (loss) ratio 74.1x (28.4x) Net Leverage Ratio (as reported) is calculated as the ratio of net debt to last twelve months (“LTM”) Historical Adjusted EBITDA. Net debt is calculated as total debt excluding the Receivables Facility, including capital leases, minus cash and cash equivalents. Refer to the discussion on Historical Adjusted EBITDA for descriptions of the differences between Historical Adjusted EBITDA and net income (loss), which is the most comparable GAAP measure. We believe Net Leverage Ratio is a useful measure of the Company's credit position and progress towards leverage targets. There are material limitations to using Net Leverage Ratio as the Company may not always be able to use cash to repay debt on a dollar-for-dollar basis. (in millions) December 31, 2022 December 31, 2021 Revolver $ — $ 25 First lien term loan 2,730 2,758 First lien and ADT notes 5,550 5,550 Receivables facility 355 199 Finance leases and other 97 98 Total first lien debt $ 8,732 $ 8,630 Second lien notes 1,300 1,300 Total debt(1) $ 10,032 $ 9,930 Less: Cash and cash equivalents (257) (24) Receivables Facility (355) (199) Net debt $ 9,420 $ 9,706 LTM Historical Adjusted EBITDA (as reported) $ 2,447 $ 2,213 Net leverage ratio (as reported) 3.9x 4.4x Note: Amounts may not sum due to rounding. Amounts are recast to reflect the presentation of the Commercial Business as discontinued operations. 11 Historical Leverage Ratios (As previously reported) and Net Debt

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

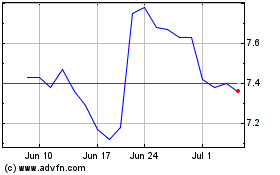

ADT (NYSE:ADT)

Historical Stock Chart

From Oct 2024 to Nov 2024

ADT (NYSE:ADT)

Historical Stock Chart

From Nov 2023 to Nov 2024