— Product revenue of $2.65 billion, a 6%

increase compared to Q2 2023 —

— Company raises full year product revenue

guidance to $10.65 to $10.85 billion —

— FDA accepted NDA for vanzacaftor triple in CF

with Priority Review and PDUFA target action date of January 2,

2025; additionally, MAA submissions validated in EU and U.K. —

— FDA accepted NDA for suzetrigine (VX-548) for

moderate-to-severe acute pain with Priority Review and PDUFA target

action date of January 30, 2025 —

— Advancing broad and deep clinical pipeline

with multiple milestones expected in H2:24 —

Vertex Pharmaceuticals Incorporated (Nasdaq: VRTX) today

reported consolidated financial results for the second quarter

ended June 30, 2024, and raised its full year product revenue

guidance to $10.65 to $10.85 billion.

“Vertex delivered another strong quarter of revenue growth

coupled with outstanding execution across the business, and we are

increasing our full year product revenue guidance,” said Reshma

Kewalramani, M.D., Chief Executive Officer, and President of

Vertex. “Our focus for the second half of the year remains on

commercial execution in CF and the global launch of CASGEVY,

readying for the upcoming potential launches of the vanzacaftor

triple in CF and suzetrigine in acute pain, while rapidly advancing

a robust pipeline that is poised to deliver value for patients and

shareholders for the long term.”

Second Quarter 2024

Results

Product revenue increased 6% to $2.65 billion compared to

the second quarter of 2023, primarily driven by the continued

strong performance of TRIKAFTA®/KAFTRIO®, including in younger age

groups. Net product revenue in the second quarter of 2024 increased

7% to $1.61 billion in the U.S. and increased 5% to $1.03 billion

outside the U.S., compared to the second quarter of 2023.

Combined GAAP and Non-GAAP R&D and SG&A expenses

were $1.3 billion and $978 million, respectively, compared to $1.0

billion and $928 million, respectively, in the second quarter of

2023. The increases were due to increased investments to support

launches of Vertex's therapies globally and continued investment in

support of multiple programs that have advanced in mid- and

late-stage clinical development.

Acquired IPR&D expenses were $4.4 billion compared to

$111 million in the second quarter of 2023 due to $4.4 billion of

Acquired IPR&D (AIPR&D) expenses associated with Vertex’s

acquisition of Alpine Immune Sciences.

GAAP and Non-GAAP effective tax rates were (6.0)% and

(10.0)%, respectively, compared to 21.2% and 21.0%, respectively,

for the second quarter of 2023, primarily due to the impact of

non-deductible AIPR&D expenses, which drove Vertex’s pre-tax

loss in the second quarter of 2024. Please refer to Note 1 for

further details on Vertex’s GAAP to Non-GAAP tax adjustments.

GAAP and Non-GAAP net losses were $3.6 billion and $3.3

billion, respectively, compared to net income of $916 million and

$1.0 billion for the second quarter of 2023, respectively, given

the impact of the Alpine AIPR&D expense in the second quarter

of 2024.

Cash, cash equivalents and total marketable securities as

of June 30, 2024 were $10.2 billion, compared to $13.7 billion as

of December 31, 2023. The reduction in Vertex’s cash, cash

equivalent and marketable securities balance compared to December

31, 2023, was due to the cash consideration paid to acquire Alpine

in the second quarter of 2024, partially offset by positive cash

flows provided by other operating activities.

Full Year 2024 Financial

Guidance

Vertex today raised its full year product revenue guidance from

$10.55-$10.75 billion to $10.65-$10.85 billion. Vertex’s product

revenue guidance includes expectations for continued growth in CF

as well as for the launch of CASGEVY® in approved indications and

geographies. Given the impact of the Alpine acquisition, for 2024,

Vertex is now providing guidance for both combined GAAP and

Non-GAAP R&D and SG&A expenses and for AIPR&D expenses.

Vertex continues to expect combined Non-GAAP R&D and SG&A

expenses to be in a range of $4.2 billion to $4.3 billion for the

full year. This includes Vertex’s expectations for continued

investment in multiple mid- and late-stage clinical development

programs and commercial and manufacturing capabilities and the

inclusion of Alpine operating expenses for the remainder of 2024.

Vertex now expects 2024 AIPR&D expenses of approximately $4.6

billion for the full year, including the Alpine acquisition-related

charge in the second quarter of 2024.

Vertex’s updated financial guidance is summarized below:

Current FY 2024

Previous FY 2024

Total product revenues

$10.65 to $10.85 billion

$10.55 to $10.75 billion

Combined GAAP R&D and SG&A

expenses (2)

$5.0 to $5.2 billion

$4.8 to $5.0 billion*

Combined Non-GAAP R&D and SG&A

expenses (2)

Unchanged

$4.2 to $4.3 billion*

AIPR&D expenses

$4.6 billion**

$0.125 billion

Non-GAAP effective tax rate

~100%***

20% to 21%

*

Guidance ranges provided on May 6, 2024

included combined GAAP R&D, AIPR&D and SG&A expenses of

$4.9-$5.1 billion and combined Non-GAAP R&D, AIPR&D and

SG&A expenses of $4.3-$4.4 billion. Included in both ranges

were approximately $125 million for AIPR&D expenses.

**

Includes Alpine AIPR&D expense of $4.4

billion.

***

Vertex’s full year Non-GAAP tax rate is

impacted by the Alpine AIPR&D expense, which is non-deductible

for tax.

Key Business Highlights

Marketed Products and Potential

Near-Term Launch Opportunities

Cystic Fibrosis (CF)

Portfolio

Vertex anticipates the number of CF patients taking its

medicines will continue to grow through new approvals and

reimbursement for the treatment of younger patients. Recent and

anticipated progress includes:

- The U.S. Food and Drug Administration (FDA) accepted the New

Drug Application (NDA) for the once-daily vanzacaftor triple in

people with CF 6 years and older and assigned Priority Review with

a Prescription Drug User Fee Act (PDUFA) target action date of

January 2, 2025. Vertex also received validation of its vanzacaftor

triple Marketing Authorization Application (MAA) submissions from

the European Medicines Agency (EMA) in the European Union (EU), and

the Medicines and Healthcare products Regulatory Agency (MHRA) in

the U.K. Vertex has also completed regulatory submissions for the

vanzacaftor triple in Canada, Australia, New Zealand and

Switzerland.

- Vertex announced an extended long-term reimbursement agreement

with NHS England providing access to KAFTRIO, SYMKEVI® and ORKAMBI®

and continued access to KALYDECO® for all existing and future

eligible CF patients in England. Vertex has entered into similar

agreements in Wales, Northern Ireland and Scotland. The agreements,

which also include access to any future license extensions of these

medicines, are a result of the National Institute for Health and

Care Excellence’s (NICE) and the Scottish Medicines Consortium’s

(SMC) positive recommendations for Vertex’s CFTR modulators.

- In May, the European Commission granted approval to KALYDECO

for the treatment of infants with CF ages 1 month to less than 4

months with specific mutations in the CFTR gene. KALYDECO now

represents the first and only medicine approved in Europe to treat

the underlying cause of CF for this age group.

- In July, Health Canada granted approval to TRIKAFTA for the

treatment of people with CF with 152 rare responsive mutations in

the CFTR gene. This represents the first approval outside of the

United States where the mutations were approved based on in vitro

data.

- Vertex has submitted regulatory applications to the FDA and EMA

for TRIKAFTA/KAFTRIO for the treatment of people with CF and rare

responsive mutations.

CASGEVY for the treatment of sickle

cell disease (SCD) and transfusion-dependent beta thalassemia

(TDT)

CASGEVY is a non-viral, ex vivo CRISPR/Cas9 gene-edited cell

therapy for eligible patients with SCD or TDT that has been shown

to reduce or eliminate vaso-occlusive crises (VOCs) for patients

with SCD and transfusion requirements for patients with TDT.

CASGEVY is approved in the U.S., Great Britain, the EU, the Kingdom

of Saudi Arabia (KSA), and the Kingdom of Bahrain (Bahrain) for the

treatment of both SCD and TDT, and launches are ongoing.

- Vertex has completed regulatory submissions for CASGEVY for SCD

and TDT in Switzerland and in Canada, where it received Priority

Review.

- As of mid-July, Vertex has activated more than 35 authorized

treatment centers (ATCs) globally and increasing numbers of

patients across all regions have initiated cell collection.

- The French National Authority for Health (HAS) approved

Vertex’s request for the implementation of an early access program

(EAP) for the use of CASGEVY in indicated patients with SCD. HAS

previously approved the implementation of an EAP for CASGEVY in

indicated patients with TDT in the first quarter of 2024.

- Vertex continues to generate data from CLIMB-111, CLIMB-121 and

the long-term follow-up study of CASGEVY and presented positive

long-term data at the 2024 Annual European Hematology Association

(EHA) Congress in June. These long-term data from more than 100

patients dosed with CASGEVY, with the longest follow-up of more

than five years, confirm the transformative, consistent, and

durable clinical benefits of CASGEVY over time.

Suzetrigine (VX-548) for the treatment

of moderate to severe acute pain

Vertex has discovered multiple selective small molecule

inhibitors of NaV1.8 with the goal of creating a new class of pain

medicines that has the potential to provide effective pain relief

without the limitations of opioids and other currently available

medicines.

- The FDA accepted the NDA submission for suzetrigine for the

treatment of moderate-to-severe acute pain and granted Priority

Review with a PDUFA target action date of January 30, 2025.

Suzetrigine has already been granted FDA Fast Track and

Breakthrough Therapy designations for the treatment of

moderate-to-severe acute pain.

Select Clinical-Stage R&D

Pipeline

Cystic Fibrosis

Vertex continues to pursue next-in-class, small molecule, oral

CFTR modulators for the ~90% of people with CF who may benefit from

such an approach, as well as a nebulized mRNA therapy for the more

than 5,000 people with CF who do not make CFTR protein and cannot

benefit from CFTR modulators.

- Vanzacaftor/tezacaftor/deutivacaftor, the next-in-class

triple oral small molecule combination, in cystic fibrosis

- Vertex initiated a study in children with cystic fibrosis ages

2 to 5 years who have at least one F508del mutation or a mutation

responsive to triple combination CFTR modulators.

- Consistent with its commitment to serial innovation and

bringing as many patients as possible to normal levels of CFTR

function, Vertex continues to advance new oral small molecule

combination therapies through preclinical and clinical development.

The most advanced next-wave CFTR modulators have completed, or are

in the process of completing, Phase 1 clinical trials.

- VX-522, nebulized mRNA therapy

- Vertex completed the single ascending dose (SAD) portion of the

Phase 1/2 study of VX-522 in people with CF late last year, and the

multiple ascending dose (MAD) portion of the study is ongoing.

Vertex expects to complete the trial and share data from this study

in the first half of 2025.

Sickle Cell Disease and Transfusion-Dependent Beta

Thalassemia

- Vertex has completed enrollment in two global Phase 3 studies

of CASGEVY in children 5 to 11 years of age with SCD or TDT and the

trials are ongoing.

- Vertex continues to work on preclinical assets for gentler

conditioning for CASGEVY, which could broaden the eligible patient

population to more than 150,000 people in the U.S. and Europe

alone.

Acute Pain

- Vertex is enrolling and dosing a Phase 1 trial for an

intravenous formulation of VX-993, a next-generation selective

NaV1.8 pain signal inhibitor.

- Vertex is on track to initiate a Phase 2 study this quarter

with an oral formulation of VX-993 for the treatment of moderate to

severe acute pain following bunionectomy surgery.

Peripheral Neuropathic Pain (PNP)

- Vertex is on track to initiate the Phase 3 pivotal program of

suzetrigine in patients with painful diabetic peripheral neuropathy

(DPN), a type of PNP, this quarter. The pivotal program is designed

with two identical randomized controlled trials of approximately

1,100 patients each, studying suzetrigine at a once-daily 70mg

dose. The primary endpoint is the change from baseline in the

weekly average of daily pain intensity on the numeric pain rating

scale (NPRS) at week 12 compared to placebo. The study also

includes an active comparator arm of pregabalin, and a key

secondary endpoint is non-inferiority on change from baseline to

week 12 in NPRS score versus pregabalin. The FDA has granted

suzetrigine Breakthrough Therapy Designation in DPN.

- Vertex has completed enrollment in its Phase 2 study of

suzetrigine in painful lumbosacral radiculopathy (LSR), a condition

representing more than 40% of patients suffering from PNP. Vertex

expects to share results from this study in late 2024.

- Vertex is on track to initiate a Phase 2 study this quarter

with an oral formulation of VX-993 for the treatment of DPN.

Consistent with its commitment to serial innovation and

leadership in pain, Vertex also continues to develop additional

NaV1.8 inhibitors and NaV1.7 inhibitors, for stand-alone use or in

combination, for the treatment of acute and peripheral neuropathic

pain.

APOL1-Mediated Kidney Disease (AMKD)

Vertex has discovered and advanced multiple oral, small molecule

inhibitors of APOL1 function, pioneering a new class of medicines

that targets an underlying genetic driver of this kidney

disease.

- Vertex continues to enroll and dose patients with AMKD in the

Phase 3 portion of the global Phase 2/3 pivotal clinical trial, in

which a 45 mg once-daily dose of inaxaplin is compared to placebo,

on top of standard of care.

- The study is designed to have a pre-planned interim analysis at

Week 48 evaluating estimated glomerular filtration rate (eGFR)

slope, a measure of kidney function, supported by a percent change

from baseline in proteinuria, in the inaxaplin arm versus placebo.

If positive, the interim analysis may serve as the basis for Vertex

to seek accelerated approval in the U.S.

IgA Nephropathy (IgAN) and Other B Cell-Mediated

Diseases

Vertex is developing povetacicept, a dual inhibitor of the BAFF

and APRIL pathways, as a potentially best-in-class approach to

treat IgA nephropathy, a serious progressive, autoimmune kidney

disease that can lead to end-stage renal disease. IgAN is the most

common form of glomerulonephritis worldwide, affecting

approximately 130,000 people in the U.S. alone, and there are

currently no approved therapies that target its underlying cause.

Vertex is also studying povetacicept in other serious B

cell-mediated diseases, including autoimmune kidney diseases and

autoimmune cytopenias.

- Following successful end-of-phase 2 regulatory interactions,

Vertex is on track to initiate the Phase 3 clinical trial of

povetacicept in IgA nephropathy (the RAINIER study) this

quarter.

- RAINIER is a global pivotal trial of povetacicept 80 mg vs.

placebo on top of standard of care in approximately 480 people with

IgAN. The study is designed to have a pre-planned interim analysis

evaluating urine protein creatinine ratio (UPCR) for the

povetacicept arm versus placebo after a certain number of patients

reach 36 weeks of treatment. If positive, the interim analysis may

serve as the basis for Vertex to seek accelerated approval in the

U.S. Final analysis will occur at two years of treatment, with a

primary endpoint of total eGFR slope through Week 104.

- The RUBY3 (autoimmune kidney diseases) and RUBY4 (autoimmune

cytopenias) Phase 2 basket trials are ongoing with data readouts

from certain cohorts expected later this year and into 2025.

Type 1 Diabetes (T1D)

Vertex is evaluating cell therapies using stem cell-derived,

fully differentiated, insulin-producing islet cells to replace the

endogenous insulin-producing islet cells that are destroyed in

people with T1D, with the goal of developing a potential one-time

functional cure for this disease.

- VX-880, fully differentiated islet cells with standard

immunosuppression:

- Vertex announced positive results from the ongoing Phase 1/2

study at the American Diabetes Association 84th Scientific Sessions

Conference in June 2024.

- All 12 patients who received the full dose of VX-880 as a

single infusion demonstrated islet cell engraftment and

glucose-responsive insulin production.

- All of these patients achieved ADA-recommended HbA1c levels

<7.0% and >70% time-in-range, and 11 of 12 patients reduced

or eliminated use of exogenous insulin.

- All three of the patients with at least 12 months of follow-up,

and therefore evaluable for the primary endpoint, met the primary

endpoint of elimination of severe hypoglycemic events (SHEs) with

HbA1c <7.0%, and the secondary endpoint of insulin

independence.

- Based on these positive results, Vertex has expanded the Phase

1/2 study to include 37 total patients. Vertex has completed

enrollment and dosing in the original Phase 1/2 17-patient

study.

- VX-264, fully differentiated islet cells encapsulated in an

immunoprotective device:

- The clinical trial for VX-264, which encapsulates the same

VX-880 islet cells in a novel device so that treatment with

immunosuppressants is not required, is a global, multi-part, Phase

1/2 study.

- Vertex has completed Part A of the study. As with the VX-880

study, patients in Part A receive a low dose with a stagger period

between dosing. Part B of the Phase 1/2 is underway and enrolling

and dosing. In Part B, patients receive the full target dose with a

stagger period between patients, and in Part C, patients will

receive the full target dose with no stagger.

- Hypoimmune, edited fully differentiated islet cells:

- Vertex’s hypoimmune cell program involves using CRISPR/Cas9 to

gene edit the same stem cell-derived, fully differentiated VX-880

islet cells to protect the cells from the immune system. This

research-stage program continues to make progress.

Myotonic Dystrophy Type 1 (DM1)

Vertex is evaluating multiple approaches that target the

underlying cause of DM1, the most prevalent muscular dystrophy in

adults with ~110,000 people living with the disease in the U.S. and

Europe, and no approved therapies. Vertex’s lead approach, VX-670,

in-licensed from Entrada Therapeutics, is an oligonucleotide linked

to a cyclic peptide to promote effective delivery into the cell and

its nucleus, which holds the potential to address the underlying

cause of DM1.

- Vertex continues to enroll and dose patients in the global

Phase 1/2 clinical trial for VX-670 in people with DM1 and expects

to complete the single ascending dose (SAD) portion of the study by

the end of 2024.

- Following completion of the SAD portion of the trial, Vertex

will move into the MAD portion, where both the safety and efficacy

of VX-670 will be evaluated.

Autosomal Dominant Polycystic Kidney Disease (ADPKD)

Vertex is developing small molecule correctors that restore

function to the variant polycystin 1 (PC1) protein, with the goal

of addressing the underlying cause of ADPKD, the most common

genetic kidney disease, affecting approximately 250,000 people in

the U.S. and Europe.

- Vertex is enrolling and dosing a Phase 1 clinical trial in

healthy volunteers for VX-407, a first-in-class small molecule

corrector that targets the underlying cause of ADPKD in patients

with a subset of variants in the PKD1 gene, which encodes the PC1

protein, estimated to be ~25,000 (or ~10%) of the overall patient

population.

Alpha-1 Antitrypsin Deficiency (AATD)

Vertex is working to address the underlying genetic cause of

alpha-1 antitrypsin (AAT) deficiency by developing novel small

molecule correctors of Z-AAT protein folding, with a goal of

increasing the secretion of functional AAT into the blood and

addressing both the lung and the liver aspects of AAT

deficiency.

- Based on Phase 1 biomarker analyses, Vertex has determined that

VX-634 and VX-668, two investigational small molecule AAT

correctors, would not deliver transformative efficacy for people

with AATD. As such, Vertex has discontinued development of both

molecules.

- Consistent with its portfolio approach to research and

development, Vertex is using the learnings from VX-634, VX-668 and

prior molecules to continue to optimize the small molecule

corrector and other approaches in the preclinical research

phase.

Investments in External Innovation

- In May, Vertex completed its previously announced acquisition

of Alpine Immune Sciences for approximately $5.0 billion in cash,

including Alpine’s lead asset povetacicept, resulting in an

approximate $4.4 billion charge to AIPR&D expenses in the

second quarter of 2024.

Non-GAAP Financial

Measures

In this press release, Vertex's financial results and financial

guidance are provided in accordance with accounting principles

generally accepted in the United States (GAAP) and using certain

non-GAAP financial measures. In particular, non-GAAP financial

results and guidance exclude from Vertex's pre-tax income (loss)

(i) stock-based compensation expense, (ii) intangible asset

amortization expense, (iii) gains or losses related to the fair

value of the company's strategic investments, (iv) increases or

decreases in the fair value of contingent consideration, (v)

acquisition-related costs, and (vi) other adjustments. The

company's non-GAAP financial results also exclude from its

provision for income taxes the estimated tax impact related to its

non-GAAP adjustments to pre-tax income (loss) described above and

certain discrete items. These results should not be viewed as a

substitute for the company’s GAAP results and are provided as a

complement to results provided in accordance with GAAP. Management

believes these non-GAAP financial measures help indicate underlying

trends in the company's business, are important in comparing

current results with prior period results and provide additional

information regarding the company's financial position that the

company believes is helpful to an understanding of its ongoing

business. Management also uses these non-GAAP financial measures to

establish budgets and operational goals that are communicated

internally and externally, to manage the company's business and to

evaluate its performance. The company’s calculation of non-GAAP

financial measures likely differs from the calculations used by

other companies. A reconciliation of the GAAP financial results to

non-GAAP financial results is included in the attached financial

information.

The company provides guidance regarding combined R&D and

SG&A expenses and effective tax rate on a non-GAAP basis. The

guidance regarding Acquired IPR&D expenses does not include

estimates associated with any potential future business development

transactions, including collaborations, asset acquisitions and/or

licensing of third-party intellectual property rights. The company

does not provide guidance regarding its GAAP effective tax rate

because it is unable to forecast with reasonable certainty the

impact of excess tax benefits related to stock-based compensation

and the possibility of certain discrete items, which could be

material.

Vertex Pharmaceuticals

Incorporated

Consolidated Statements of

Income

(in millions, except per share

amounts)(unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Product revenues, net

$

2,645.6

$

2,493.2

$

5,336.2

$

4,868.0

Costs and expenses:

Cost of sales

371.9

308.6

714.5

575.5

Research and development expenses

966.6

785.7

1,755.7

1,528.3

Acquired in-process research and

development expenses

4,449.1

110.5

4,525.9

457.6

Selling, general and administrative

expenses

372.2

262.6

714.9

503.7

Change in fair value of contingent

consideration

0.5

(0.6

)

0.4

(2.5

)

Total costs and expenses

6,160.3

1,466.8

7,711.4

3,062.6

(Loss) income from operations

(3,514.7

)

1,026.4

(2,375.2

)

1,805.4

Interest income

156.5

144.7

337.7

267.3

Interest expense

(9.9

)

(11.2

)

(20.3

)

(22.6

)

Other (expense) income, net

(23.1

)

1.6

(54.3

)

2.9

(Loss) income before provision for income

taxes

(3,391.2

)

1,161.5

(2,112.1

)

2,053.0

Provision for income taxes

202.4

245.8

381.9

437.5

Net (loss) income

$

(3,593.6

)

$

915.7

$

(2,494.0

)

$

1,615.5

Net (loss) income per common share:

Basic

$

(13.92

)

$

3.55

$

(9.66

)

$

6.27

Diluted

$

(13.92

)

$

3.52

$

(9.66

)

$

6.21

Shares used in per share calculations:

Basic

258.1

257.7

258.1

257.6

Diluted

258.1

260.4

258.1

260.3

Vertex Pharmaceuticals

Incorporated

Product Revenues

(in millions)(unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

TRIKAFTA/KAFTRIO

$

2,449.2

$

2,240.4

$

4,932.8

$

4,337.1

Other CF products

196.4

252.8

403.4

530.9

Product revenues, net

$

2,645.6

$

2,493.2

$

5,336.2

$

4,868.0

Vertex Pharmaceuticals

Incorporated

Reconciliation of GAAP to

Non-GAAP Financial Information

(in millions, except

percentages)(unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

GAAP cost of sales

$

371.9

$

308.6

$

714.5

$

575.5

Stock-based compensation expense

(1.8

)

(1.8

)

(3.6

)

(3.7

)

Intangible asset amortization expense

(5.1

)

—

(10.1

)

—

Non-GAAP cost of sales

$

365.0

$

306.8

$

700.8

$

571.8

GAAP research and development

expenses

$

966.6

$

785.7

$

1,755.7

$

1,528.3

Stock-based compensation expense

(97.1

)

(74.5

)

(216.5

)

(150.8

)

Acquisition-related costs (3)

(172.3

)

(2.8

)

(172.3

)

(5.6

)

Non-GAAP research and development

expenses

$

697.2

$

708.4

$

1,366.9

$

1,371.9

GAAP selling, general and

administrative expenses

$

372.2

$

262.6

$

714.9

$

503.7

Stock-based compensation expense

(55.3

)

(43.0

)

(126.0

)

(87.2

)

Acquisition-related costs (3)

(36.5

)

—

(36.5

)

—

Non-GAAP selling, general and

administrative expenses

$

280.4

$

219.6

$

552.4

$

416.5

Combined non-GAAP R&D and SG&A

expenses

$

977.6

$

928.0

$

1,919.3

$

1,788.4

GAAP other (expense) income,

net

$

(23.1

)

$

1.6

$

(54.3

)

$

2.9

Decrease (increase) in fair value of

strategic investments

12.7

0.4

39.7

(6.0

)

Non-GAAP other (expense) income,

net

$

(10.4

)

$

2.0

$

(14.6

)

$

(3.1

)

GAAP provision for income taxes

$

202.4

$

245.8

$

381.9

$

437.5

Tax adjustments (1)

98.2

23.6

179.8

46.3

Non-GAAP provision for income

taxes

$

300.6

$

269.4

$

561.7

$

483.8

GAAP effective tax rate

(6.0

)%

21.2

%

(18.1

)%

21.3

%

Non-GAAP effective tax rate

(10.0

)%

21.0

%

(37.3

)%

21.1

%

Vertex Pharmaceuticals

Incorporated

Reconciliation of GAAP to

Non-GAAP Financial Information (continued)

(in millions, except per share

amounts)(unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

GAAP operating (loss) income

$

(3,514.7

)

$

1,026.4

$

(2,375.2

)

$

1,805.4

Stock-based compensation expense

154.2

119.3

346.1

241.7

Intangible asset amortization expense

5.1

—

10.1

—

Increase (decrease) in fair value of

contingent consideration

0.5

(0.6

)

0.4

(2.5

)

Acquisition-related costs (3)

208.8

2.8

208.8

5.6

Non-GAAP operating (loss)

income

$

(3,146.1

)

$

1,147.9

$

(1,809.8

)

$

2,050.2

GAAP net (loss) income

$

(3,593.6

)

$

915.7

$

(2,494.0

)

$

1,615.5

Stock-based compensation expense

154.2

119.3

346.1

241.7

Intangible asset amortization expense

5.1

—

10.1

—

Decrease (increase) in fair value of

strategic investments

12.7

0.4

39.7

(6.0

)

Increase (decrease) in fair value of

contingent consideration

0.5

(0.6

)

0.4

(2.5

)

Acquisition-related costs (3)

208.8

2.8

208.8

5.6

Total non-GAAP adjustments to pre-tax

(loss) income

381.3

121.9

605.1

238.8

Tax adjustments (1)

(98.2

)

(23.6

)

(179.8

)

(46.3

)

Non-GAAP net (loss) income

$

(3,310.5

)

$

1,014.0

$

(2,068.7

)

$

1,808.0

Net (loss) income per diluted common

share:

GAAP

$

(13.92

)

$

3.52

$

(9.66

)

$

6.21

Non-GAAP

$

(12.83

)

$

3.89

$

(8.02

)

$

6.95

Shares used in diluted per share

calculations:

GAAP and Non-GAAP

258.1

260.4

258.1

260.3

Notes

1: In the three and six months

ended June 30, 2024 and 2023, “Tax adjustments” included the

estimated income taxes related to non-GAAP adjustments to the

company's pre-tax income (loss) and excess tax benefits related to

stock-based compensation.

2: The difference between the

company’s full year 2024 combined GAAP R&D and SG&A

expenses and combined non-GAAP R&D and SG&A expenses

guidance relates primarily to $600 million to $700 million of

stock-based compensation expense and $209 million of compensation

expense primarily related to cash-settled unvested Alpine equity

awards.

3: In the three and six months

ended June 30, 2024, “Acquisition-related costs” included primarily

related to compensation expense associated with cash-settled

unvested Alpine equity awards.

Vertex Pharmaceuticals

Incorporated

Condensed Consolidated Balance

Sheets

(in millions)(unaudited)

June 30, 2024

December 31, 2023

Assets

Cash, cash equivalents and marketable

securities

$

5,795.5

$

11,218.3

Accounts receivable, net

1,656.1

1,563.4

Inventories

914.6

738.8

Prepaid expenses and other current

assets

575.4

623.7

Total current assets

8,941.6

14,144.2

Property and equipment, net

1,200.9

1,159.3

Goodwill and intangible assets, net

1,925.5

1,927.9

Deferred tax assets

2,185.6

1,812.1

Operating lease assets

569.8

293.6

Long-term marketable securities

4,393.1

2,497.8

Other long-term assets

915.6

895.3

Total assets

$

20,132.1

$

22,730.2

Liabilities and Shareholders'

Equity

Accounts payable and accrued expenses

$

3,267.9

$

3,020.2

Other current liabilities

279.3

527.2

Total current liabilities

3,547.2

3,547.4

Long-term finance lease liabilities

346.6

376.1

Long-term operating lease liabilities

586.8

348.6

Other long-term liabilities

876.8

877.7

Shareholders' equity

14,774.7

17,580.4

Total liabilities and shareholders'

equity

$

20,132.1

$

22,730.2

Common shares outstanding

258.0

257.7

About Vertex

Vertex is a global biotechnology company that invests in

scientific innovation to create transformative medicines for people

with serious diseases. The company has approved medicines that

treat the underlying causes of multiple chronic, life-shortening

genetic diseases — cystic fibrosis, sickle cell disease and

transfusion-dependent beta thalassemia — and continues to advance

clinical and research programs in these diseases. Vertex also has a

robust clinical pipeline of investigational therapies across a

range of modalities in other serious diseases where it has deep

insight into causal human biology, including acute and neuropathic

pain, APOL1-mediated kidney disease, IgA nephropathy, autosomal

dominant polycystic kidney disease, type 1 diabetes, myotonic

dystrophy type 1 and alpha-1 antitrypsin deficiency.

Vertex was founded in 1989 and has its global headquarters in

Boston, with international headquarters in London. Additionally,

the company has research and development sites and commercial

offices in North America, Europe, Australia, Latin America and the

Middle East. Vertex is consistently recognized as one of the

industry's top places to work, including 14 consecutive years on

Science magazine's Top Employers list and one of Fortune’s 100 Best

Companies to Work For. For company updates and to learn more about

Vertex's history of innovation, visit www.vrtx.com or follow us on

LinkedIn, Facebook, Instagram, YouTube and Twitter/X.

Special Note Regarding Forward-Looking Statements

This press release contains forward-looking statements that are

subject to risks, uncertainties and other factors. All statements

other than statements of historical fact are statements that could

be deemed forward-looking statements, including all statements

regarding the intent, belief, or current expectation of Vertex and

members of the Vertex senior management team. Forward-looking

statements are not purely historical and may be accompanied by

words such as “anticipates,” “may,” “forecasts,” “expects,”

“intends,” “plans,” “potentially,” “believes,” “seeks,”

“estimates,” and other words and terms of similar meaning. Such

statements include, without limitation, Dr. Kewalramani's

statements in this press release, the information provided

regarding future financial performance and operations, the section

captioned “Full Year 2024 Financial Guidance” and statements

regarding (i) expectations for Vertex’s continued growth in CF,

including through new approvals and reimbursements for the

treatment of younger patients, (ii) expectations, plans, and status

of the potential near-term commercial launch of the vanzacaftor

triple, (iii) expectations regarding long-term reimbursement

agreements and access to our CF medicines in Europe and the U.K.,

(iv) our beliefs regarding the anticipated benefits of CASGEVY, our

expectations regarding the number of patients initiating cell

collection, and our beliefs with respect to the long-term follow-up

study of CASGEVY, (v) expectations regarding the potential benefits

and commercial success of the product candidates in our pain

program, including plans and status of the potential near-term

commercial launch of suzetrigine for the treatment of

moderate-to-severe acute pain, (vi) plans to continue to advance

new oral small molecule combination therapies for the treatment of

CF (vii) expectations for our VX-522 Phase 1/2 study, including the

potential benefits of this nebulized mRNA therapy and expectations

to complete the trial and share data in the first half of 2025,

(viii) expectations regarding our SCD and TDT program, including

expectations that a gentler conditioning for CASGEVY could broaden

the eligible patient population to more than 150,000 people in the

U.S. and Europe, (ix) plans to initiate a Phase 2 study with an

oral formulation of VX-993 for the treatment of acute pain during

the third quarter of 2024, (x) expectations regarding the study

design and primary endpoint for the Phase 3 pivotal program of

suzetrigine in patients with DPN, including plans to initiate the

study in the third quarter of 2024, expectations to share results

from the Phase 2 study of suzetrigine in LSR in late 2024,

expectations to initiate a Phase 2 study with an oral formulation

of VX-993 for the treatment of DPN in the third quarter of 2024,

and plans to continue to develop NaV1.8 and NaV1.7 inhibitors for

both acute pain and PNP, (xi) expectations regarding the potential

benefits of our AMKD program, including plans for our global Phase

2/3 pivotal clinical trial evaluating inaxaplin in patients with

AMKD, study designs and our expectations that the interim analysis

of this study may serve as the basis to seek accelerated approval

in the U.S., (xii) expectations with respect to povetacicept,

including our beliefs about its potential benefits and therapeutic

scope, plans to initiate a Phase 3 clinical trial in IgAN, study

designs and our expectations that the interim analysis of this

study may serve as the basis to seek accelerated approval in U.S.,

and expectations regarding the RUBY3 and RUBY4 Phase 2 basket

trials, including our expectations on timing for data readouts,

(xiii) expectations regarding our T1D programs, including the

status of each our studies evaluating VX-880 and VX-264, (xiv)

expectations for the potential benefits and clinical status of

VX-670 for the treatment in people with DM1, including plans to

complete the SAD portion of the trial by end of 2024, and move into

the MAD portion of the trial (xv) expectations regarding our ADPKD

program, including the potential benefits of VX-407 and our beliefs

regarding the targeted patient population, and (xvi) expectations

with respect to our plans for our AATD program. While Vertex

believes the forward-looking statements contained in this press

release are accurate, these forward-looking statements represent

the company's beliefs only as of the date of this press release and

there are a number of risks and uncertainties that could cause

actual events or results to differ materially from those expressed

or implied by such forward-looking statements. Those risks and

uncertainties include, among other things, that the company's

expectations regarding its 2024 full year product revenues,

expenses and effective tax rates may be incorrect (including

because one or more of the company's assumptions underlying its

expectations may not be realized), that the company may not be able

to receive adequate reimbursement for CASGEVY on the expected

timeline, or at all, that we are unable to successfully obtain

approval or commercialize suzetrigine as a treatment for acute or

neuropathic pain, that external factors may have different or more

significant impacts on the company's business or operations than

the company currently expects, that data from preclinical testing

or clinical trials, especially if based on a limited number of

patients, may not be indicative of final results or available on

anticipated timelines, that patient enrollment in our trials may be

delayed, that Vertex may not be able to successfully profit from

the acquisition of Alpine Immune Sciences, that the company may not

realize the anticipated benefits from our collaborations with third

parties, that data from the company's development programs may not

support registration or further development of its potential

medicines in a timely manner, or at all, due to safety, efficacy or

other reasons, and that anticipated commercial launches may be

delayed, if they occur at all. Forward-looking statements in this

press release should be evaluated together with the many

uncertainties that affect Vertex’s business, particularly those

risks listed under the heading “Risk Factors” and the other

cautionary factors discussed in Vertex’s periodic reports filed

with the SEC, including Vertex’s annual report on Form 10-K for the

year ended December 31, 2023, and its quarterly reports on Form

10-Q and current reports on Form 8-K, all of which are filed with

the Securities and Exchange Commission (SEC) and available through

the company's website at www.vrtx.com and on the SEC’s website at

www.sec.gov. You should not place undue reliance on these

statements, or the scientific data presented. Vertex disclaims any

obligation to update the information contained in this press

release as new information becomes available.

Conference Call and

Webcast

The company will host a conference call and webcast at 4:30 p.m.

ET. To access the call, please dial (833) 630-2124 (U.S.) or

+1(412) 317-0651 (International) and reference the “Vertex

Pharmaceuticals Second Quarter 2024 Earnings Call.”

The conference call will be webcast live and a link to the

webcast can be accessed through Vertex's website at www.vrtx.com in

the "Investors" section. To ensure a timely connection, it is

recommended that participants register at least 15 minutes prior to

the scheduled webcast. An archived webcast will be available on the

company's website.

(VRTX-E)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240801201006/en/

Vertex Contacts: Investor Relations: Susie Lisa,

CFA, 617-341-6108 Manisha Pai, 617-961-1899 Miroslava Minkova,

617-341-6135

Media: 617-341-6992 mediainfo@vrtx.com

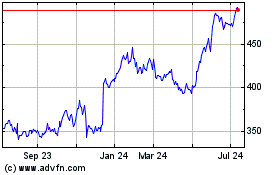

Vertex Pharmaceuticals (NASDAQ:VRTX)

Historical Stock Chart

From Jan 2025 to Feb 2025

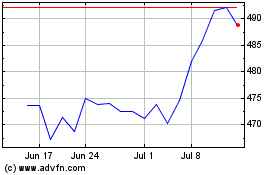

Vertex Pharmaceuticals (NASDAQ:VRTX)

Historical Stock Chart

From Feb 2024 to Feb 2025