UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

TO

Tender

Offer Statement under

Section 14(d)(1)

or 13(e)(1) of the Securities Exchange Act of 1934

(Amendment

No. 1)

TSR,

INC.

(Name

of Subject Company (issuer))

VIENNA

ACQUISITION CORPORATION

(Offeror)

a

wholly owned subsidiary of

VIENNA

PARENT CORPORATION

(Parent

of Offeror)

JUSTIN

CHRISTIAN

(Affiliate

of Parent and Offeror)

(Names

of Filing Persons (identifying status as offeror, issuer or other person))

Common

stock, $0.01 par value per share

(Title

of Class of Securities)

872885207

(CUSIP

Number of Class of Securities)

Justin

Christian

President

Vienna

Parent Corporation

9777

N. College Avenue

Indianapolis,

Indiana 46280

Telephone: (317) 493-2000

(Name,

address, and telephone numbers of person authorized to receive notices and communications on behalf of filing persons)

Copy

to:

Stephen

J. Hackman

Pierce

H. Han

Ice

Miller LLP

One

American Square, Suite 2900

Indianapolis,

Indiana 46282

Telephone: (317) 236-2289

| ☐ | Check

the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

Check

the appropriate boxes below to designate any transactions to which the statement relates:

| ☒ |

third-party tender offer subject to Rule 14d-1 |

| ☐ |

issuer tender offer subject to Rule 13e-4 |

| ☐ |

going-private transaction subject to Rule 13e-3 |

| ☐ |

amendment to Schedule 13D under Rule 13d-2 |

Check

the following box if the filing is a final amendment reporting the results of the tender offer: ☐

If

applicable, check the appropriate box(es) below to designate the appropriate rule provision(s) relied upon:

| ☐ |

Rule 13e-4(i) (Cross-Border Issuer Tender Offer) |

| ☐ |

Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) |

This

Amendment No. 1 to the Tender Offer Statement on Schedule TO (this “Amendment”) amends and supplements the Tender Offer

Statement on Schedule TO filed with the Securities and Exchange Commission on May 30, 2024 (as it may be further amended and supplemented

from time to time, the “Schedule TO”) and relates to the offer by Vienna Acquisition Corporation, a Delaware corporation

(“Purchaser”) and a wholly owned subsidiary of Vienna Parent Corporation, an Indiana corporation (“Parent”),

to purchase all of the issued and outstanding shares of common stock, par value $0.01 per share (the “Shares”), of TSR, Inc.,

a Delaware corporation (the “Company”), at a purchase price of $13.40 per Share, net to the stockholder in cash, without

interest and less any applicable tax withholding, upon the terms and subject to the conditions set forth in the Offer to Purchase, dated

May 30, 2024, and in the related Letter of Transmittal (which, together with the Offer to Purchase, as each may be amended or supplemented

from time to time, collectively constitute the “Offer”), copies of which are attached to the Schedule TO as Exhibits (a)(1)(A)

and (a)(1)(B), respectively. Parent and Purchaser are owned and controlled by Justin Christian. Accordingly, Mr. Christian is identified

in this Schedule TO (as reflected above) as a filing person. As a filing person, Justin Christian accepts joint responsibility for the

accuracy of the disclosures made in this Offer to Purchase.

The

Offer will expire at one minute past 11:59 p.m., Eastern Time, on June 27, 2024, unless the Offer is extended or earlier terminated

(such time or such subsequent time to which the expiration of the Offer is extended, the “Expiration Time”). In the case

of an extension of the Expiration Time, a public announcement of such extension will be made no later than 9:00 a.m., Eastern Time, on

the business day after the previously scheduled Expiration Time. The terms and conditions relating to the Offer, including the procedures

regarding the extension of the Expiration Time, are described in Section 1 — “Terms of the Offer” of the Offer

to Purchase.

Except

as otherwise set forth in this Amendment, the information set forth in the Schedule TO remains unchanged and is incorporated herein by

reference to the extent relevant to the items in this Amendment. Capitalized terms used but not defined herein have the respective meanings

ascribed to them in the Schedule TO.

Items

1 through 9 and Item 11

The

Offer to Purchase and Items 1 through 9 and Item 11, to the extent such Items incorporate by reference the information contained in the

Offer to Purchase, are hereby amended and supplemented as follows:

| (a) | The

information set forth in the second paragraph in Section 8 – “Certain Information

Concerning Parent and Purchaser” on page 17 of the Offer to Purchase is amended

and restated in its entirety to read as follows: |

“Parent

is an Indiana corporation formed by Justin Christian, the founder and CEO of Bucher and Christian Consulting, Inc., d/b/a BCforward (“BCforward”).

BCforward itself is not a party to the Merger Agreement, nor is it involved in any part of the Offer. Parent was formed solely

for the purpose of facilitating the acquisition of the Company and has not carried on any activities to date, except for activities incidental

to its formation and activities undertaken in connection with the Transactions and the Financing. Parent is controlled by Mr. Christian,

its President and Chief Executive Officer. The address of Parent’s principal executive offices and Parent’s phone number

at its principal executive offices are as set forth below:

Vienna

Parent Corporation

9777

N. College Avenue

Indianapolis,

IN 46280

(317)

493-2000”

| (b) | The

information set forth in the fourth paragraph in Section 10 – “Background

of the Offer” on page 22 of the Offer to Purchase is amended and restated in its entirety

to read as follows: |

“On March 4, 2024, representatives of Ice Miller sent representatives

of Shulman Rogers a form of the Tender and Support Agreement proposed to be executed by certain stockholders of the Company with a collective

beneficial ownership of approximately 45% of the outstanding Shares. No substantive negotiations on the form or content of the Tender

Agreements occurred between representatives of Shulman Rogers and representatives of Ice Miller. Beginning on May 8, 2024, after the material

terms of the Merger Agreement had been substantially agreed upon, representatives of Ice Miller negotiated directly with separate counsel

to each of the Supporting Stockholders until the final form of the Tender and Support Agreement was agreed upon on May 14, 2024.”

| (c) | The

information set forth in the second sentence of the first paragraph under the caption “Merger

Agreement” on page 24 included in Section 11 – “The Merger Agreement;

Other Agreements” of the Offer to Purchase is amended and restated in its entirety

to read as follows: |

“This

summary is qualified in its entirety by reference to the Merger Agreement itself which has been filed as Exhibit (d)(1) to the Schedule

TO and is incorporated herein by reference.”

| (d) | The

information set forth in the third paragraph under the caption “Tender and Support

Agreements” on page 38 included in Section 11 – “The Merger

Agreement; Other Agreements” of the Offer to Purchase is amended and restated in

its entirety to read as follows: |

“The Tender and Support Agreements provide that, no later than 10

business days after the commencement of the Offer, the Supporting Stockholders will tender into the Offer, and not withdraw, all outstanding

Shares (other than stock options of the Company that are not exercised and performance stock units of the Company that are not settled

during the Support Period (as defined below)) each Supporting Stockholder owns of record or beneficially (within the meaning of Rule 13d-3

under the Exchange Act) as of the date of the Tender and Support Agreements or that the Supporting Stockholder acquires record ownership

or beneficial ownership (within the meaning of Rule 13d-3 promulgated under the Exchange Act) of after such date during the Support Period

(collectively, the “Subject Shares”). In the event a Supporting Stockholder exercises its statutory withdrawal rights, Parent

and Purchaser will allow the applicable Shares to be withdrawn and will pursue available contractual remedies to ensure compliance with

the terms of the applicable Tender and Support Agreement.”

| (e) | The

information set forth in the penultimate paragraph in Section 15 – “Conditions

of the Offer” on page 42 of the Offer to Purchase is amended and restated in its

entirety to read as follows: |

“The

foregoing conditions are for the sole benefit of Parent and Purchaser and, subject to the terms and conditions of the Merger Agreement

and the applicable rules and regulations of the SEC, may be waived by Parent and Purchaser, in whole or in part, in their sole discretion

(except for the Minimum Tender Condition and the Termination Condition, which may not be waived by Parent or Purchaser). If an Offer

Condition is triggered by events that occur during the offer period and before the expiration of the Offer (as it may be extended in

accordance with the terms and conditions of the Merger Agreement), Parent and Purchaser will promptly inform the stockholders whether

they will waive the condition and proceed with the Offer or terminate the Offer for failure of a condition, rather than waiting until

the end of the offer period, unless the condition is one where the satisfaction of the condition may be determined only upon expiration

of the Offer.”

| (f) | The

information set forth in the first sentence of the first paragraph in Section 19 –

“Miscellaneous” on page 45 of the Offer to Purchase is amended and restated

in its entirety to read as follows: |

“The

Offer is not being made to holders of Shares in any jurisdiction in which the making of the Offer or acceptance thereof would not be

in compliance with the laws of such jurisdiction.”

| (g) | The

caption of Schedule I on page 46 of the Offer to Purchase is amended and restated in its

entirety to read “SCHEDULE I – DIRECTORS AND EXECUTIVE OFFICERS OF PURCHASER

AND PARENT AND CERTAIN RELATED PERSONS”; the subcaption on Schedule I that reads

“2. PARENT” is amended and restated in its entirety to read “2.

PARENT AND JUSTIN CHRISTIAN”; and the information set forth in the first paragraph

under the new subcaption “2. PARENT AND JUSTIN CHRISTIAN” on Schedule

I is amended and restated in its entirety to read as follows: |

“The

name, business address, present principal occupation or employment and material occupations, positions, offices or employment for the

past five years of each of the directors and executive officers of Parent and of Justin Christian are set forth below. Parent is controlled

by Mr. Christian, the Chief Executive Officer of BCforward. The business address of each such director and executive officer,

including Mr. Christian, is 9777 N. College Avenue, Indianapolis, IN 46280. The telephone number at such office is (317) 493-2000. All

directors and executive officers listed below, including Mr. Christian, are citizens of the United States.”

SIGNATURES

After

due inquiry and to the best knowledge and belief of the undersigned, each of the undersigned certifies that the information set forth

in this statement is true, complete and correct.

Date:

June 14, 2024

| |

VIENNA ACQUISITION CORPORATION |

| |

|

| |

/s/ Justin Christian |

| |

Name: |

Justin Christian |

| |

Title: |

President |

| |

|

| |

VIENNA PARENT CORPORATION |

| |

|

| |

/s/ Justin Christian |

| |

Name: |

Justin Christian |

| |

Title: |

President |

| |

|

|

| |

JUSTIN CHRISTIAN |

| |

|

| |

/s/ Justin Christian |

| |

Justin Christian |

4

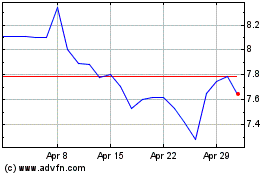

TSR (NASDAQ:TSRI)

Historical Stock Chart

From Feb 2025 to Mar 2025

TSR (NASDAQ:TSRI)

Historical Stock Chart

From Mar 2024 to Mar 2025