Summit State Bank (Nasdaq: SSBI) today reported net income for the

first quarter ended March 31, 2023 increased $181,000, or 5%, to

$4,116,000, or $0.62 per diluted share, compared to net income of

$3,935,000, or $0.59 per diluted share for the first quarter ended

March 31, 2022. Steady deposit growth and reduced operating

expenses contributed to profitability for the quarter.

Additionally, a quarterly dividend of $0.12 per share was declared

for common shareholders.

The Board of Directors declared a quarterly cash

dividend of $0.12 per share on April 24, 2023. The quarterly

dividend will be paid on May 18, 2023 to shareholders of record on

May 11, 2023.

“We posted strong first quarter earnings, fueled

by solid net interest income growth, continued non-interest income

generation, and lower non-interest expenses,” said Brian Reed,

President and CEO. “While the net interest margin decrease was

primarily related to pressure from the funding side of the balance

sheet, we remain prudent with all new loan pricing, as customer

deposits are still our main source of loan funding. Despite unusual

challenges presented to us by rapidly rising interest rates, highly

publicized bank failures and continued discussion of a pending

economic recession, we continue to implement new strategies to help

our customers while also growing our operations.”

First Quarter 2023 Financial

Highlights (at or for the three months ended March 31,

2023)

- Net income was $4,116,000, or $0.62

per diluted share, compared to $3,935,000, or $0.59 per diluted

share, in the first quarter of 2022 and $4,553,000, or $0.68 per

diluted share, for the quarter ended December 31, 2022.

- Provision for credit losses was

$400,000, compared to $135,000 in the first quarter a year

ago.

- Net interest margin was 3.69%,

compared to 4.29% in the preceding quarter and 4.28% in the first

quarter a year ago.

- First quarter revenues (net

interest income plus noninterest income) increased 1.3% to

$11,996,000, compared to $11,837,000 in the first quarter a year

ago.

- Annualized return on average assets

was 1.47%, compared to 1.66% in the first quarter of 2022.

- Annualized return on average equity

was 18.38%, compared to 18.69% in the first quarter a year

ago.

- Net loans increased $89,452,000 to

$907,623,000 at March 31, 2023, compared to $818,171,000 one year

earlier.

- Net loans decreased $6,084,000

during the quarter to $907,623,000 at March 31, 2023, compared to

$913,707,000 three months earlier. The Bank’s loan growth was

reduced due to the sale of approximately $23,000,000 of SBA

guaranteed loan balances in the first quarter of 2023.

- Total deposits increased 22% to

$1,015,652,000 at March 31, 2023 compared to $831,934,000 at March

31, 2022 and increased 6% when compared to the prior quarter end.

Deposit growth during the quarter consisted primarily of core

customer deposits gathered from the Bank’s existing five-branch

network.

- The Bank maintains reserves at the

high-end when compared to peers as exhibited by some increases in

non-performing loans and decreases in delinquent loans, resulting

in an increase in nonperforming loans to gross loans to 1.13% and

nonperforming assets to total assets to 0.91%, at March 31, 2023.

This is compared to nonperforming loans to gross loans of 0.40% and

nonperforming assets to total assets of 0.34% at December 31, 2022

and 0% for both of these ratios as March 31, 2022.

- Tangible book value was $13.76 per

share, compared to $12.52 per share a year ago.

- Declared a quarterly cash dividend of $0.12 per share for the

three months ended March 31, 2023, December 31, 2022 and March 31,

2022.

Operating Results

For the first quarter of 2023, the annualized

return on average assets was 1.47% and the annualized return on

average equity was 18.38%. This compared to an annualized return on

average assets of 1.66% and an annualized return on average equity

of 18.69%, respectively, for the first quarter of 2022. These

results were above the 1.14% return on average assets and 12.95%

return on average equity posted by the 158 bank index peers that

make up the Dow Jones U.S. MicroCap Bank index as of December 31,

2022.*

Summit’s net interest margin was 3.69% in the

first quarter of 2023, compared to 4.29% in the preceding quarter

and 4.28% in the first quarter of 2022. “Our net interest margin

was impacted during the first quarter by higher funding costs due

to the rapid rise in market interest rates. The cost of deposits in

the first quarter was 1.79% as customers continue to seek higher

rates,” said Reed.

Interest and dividend income increased 35% to

$14,648,000 in the first quarter of 2023 compared to $10,879,000 in

the first quarter of 2022. The increase in interest income is

attributable to a $2,520,000 increase in loan interest yield

primarily driven by increased loan volume and secondarily by

increased rates, $894,000 increase in interest on deposits with

banks and $336,000 increase in investment interest.

Non-interest income increased slightly in the

first quarter of 2023 to $1,961,000 compared to $1,955,000 in the

first quarter of 2022. The Bank recognized $1,435,000 in gains on

sales of SBA and USDA guaranteed loan balances in the first quarter

of 2023 compared to $1,546,000 in gains on sales of SBA guaranteed

loans balances in the first quarter of 2022.

Operating expenses decreased in the first

quarter of 2023 to $5,818,000 compared to $6,286,000 in the first

quarter of 2022. The decrease is primarily due to a $845,000

reduction in stock appreciation rights expense offset by a $257,000

increase in salaries and benefits net of deferred fees and

costs.

Balance Sheet Review

Net loans increased 11% to $907,623,000 at March

31, 2023 compared to $818,171,000 at March 31, 2022 and decreased

1% compared to December 31, 2022.

Total deposits increased 22% to $1,015,652,000

at March 31, 2023 compared to $831,934,000 at March 31, 2022 and

increased 6% when compared to the prior quarter end. Most of the

deposit increase year-over-year was due to the Bank’s ongoing focus

on growing local deposits organically. At March 31, 2023,

noninterest bearing demand deposit accounts decreased 9% compared

to a year ago and represented 23% of total deposits; savings, NOW

and money market accounts decreased 11% compared to a year ago and

represented 36% of total deposits, and CDs increased 298% compared

to a year ago and comprised 41% of total deposits. The average cost

of deposits was 1.79% in the first quarter of 2023, compared to

0.35% in the first quarter of 2022.

Shareholders’ equity was $92,665,000 at March

31, 2023, compared to $88,546,000 three months earlier and

$83,708,000 a year earlier. The increase in shareholders’ equity

compared to a year ago was primarily due to an increase of

$13,901,000 in retained earnings offset by the $5,147,000 increase

in accumulated other comprehensive income; this change was related

to an increase in the unrealized loss on available for sale

securities reflecting the increase in market interest rates during

the year. At March 31, 2023 tangible book value was $13.76 per

share, compared to $13.15 three months earlier, and $12.52 at March

31, 2022.

Summit State Bank continues to maintain capital

levels in excess of the requirements to be categorized as

“well-capitalized” with tangible equity to tangible assets of 7.99%

at March 31, 2023, compared to 8.10% at December 31, 2022, and

8.90% at March 31, 2022. The decrease compared to March 2022 is due

to the Bank’s assets outgrowing the retention of capital to build

liquidity.

Credit Quality

Nonperforming assets were $10,411,000, or 0.91%

of total assets, at March 31, 2023, and consisted of five loans;

two loans totaling $9,085,000 are real estate secured commercial

loans and three loans totaling $1,326,000 are commercial and

agriculture secured loans. There were no nonperforming assets at

March 31, 2022.

Due to strong loan production when compared to

the first quarter of 2022 and increases in expected losses, the

Bank recorded a $400,000 provision for credit loss expense in the

first quarter of 2023. This compared to $135,000 provision for

credit loss expense in the first quarter of 2022. The allowance for

credit losses to total loans was 1.65% on March 31, 2023 and 1.50%

on March 31, 2022.

“We remain focused on being a reliable resource

for our customers and communities through all economic cycles,”

said Reed. “While recent developments in the banking markets have

been unsettling in the short term, we believe that with our strong

deposit franchise, solid capital levels, enhanced liquidity

position, and good credit quality we are well positioned to grow in

the year ahead.”

About Summit State Bank

Summit State Bank, a local community bank, has

total assets of $1,147 million and total equity of $93 million at

March 31, 2023. Headquartered in Sonoma County, the Bank

specializes in providing exceptional customer service and

customized financial solutions to aid in the success of local small

businesses and nonprofits throughout Sonoma County.

Summit State Bank is committed to embracing the

diverse backgrounds, cultures and talents of its employees to

create high performance and support the evolving needs of its

customers and community it serves. At the center of diversity is

inclusion, collaboration, and a shared vision for delivering

superior service to customers and results for shareholders.

Presently, 63% of management are women and minorities with 60%

represented on the Executive Management Team. Through the

engagement of its team, Summit State Bank has received many

esteemed awards including: Best Business Bank, Best Places to Work

in the North Bay, Top Community Bank Loan Producer, Raymond James

Bankers Cup, Super Premier Performing Bank, and Piper Sandler

SM-ALL Star. Summit State Bank’s stock is traded on the Nasdaq

Global Market under the symbol SSBI. Further information can be

found at www.summitstatebank.com.

*As of December 31, 2022, the Dow Jones U.S.

MicroCap Bank Index tracked 158 banks with total common market

capitalization under $250 million for the following ratios: Return

on average assets (ROAA) 1.14%, and return on average equity (ROAE)

12.95%.

Forward-looking Statements

The financial results in this release are

preliminary. Final financial results and other disclosures will be

reported in Summit State Bank’s quarterly report on Form 10-Q for

the period ended March 31, 2023 and may differ materially from the

results and disclosures in this release due to, among other things,

the completion of final review procedures, the occurrence of

subsequent events or the discovery of additional information.

Except for historical information contained

herein, the statements contained in this news release, are

forward-looking statements within the meaning of the “safe harbor”

provisions of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. This release may contain forward-looking statements that

are subject to risks and uncertainties. Such risks and

uncertainties may include but are not necessarily limited to

fluctuations in interest rates, inflation, government regulations

and general economic conditions, and competition within the

business areas in which the Bank will be conducting its operations,

including the real estate market in California and other factors

beyond the Bank’s control. Such risks and uncertainties could cause

results for subsequent interim periods or for the entire year to

differ materially from those indicated. You should not place undue

reliance on the forward-looking statements, which reflect

management’s view only as of the date hereof. The Bank undertakes

no obligation to publicly revise these forward-looking statements

to reflect subsequent events or circumstances.

|

|

|

|

|

|

|

|

|

|

|

|

SUMMIT STATE BANK |

|

STATEMENTS OF INCOME |

|

(In thousands except earnings per share data) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

|

|

|

March 31, 2023 |

|

December 31, 2022 |

|

March 31, 2022 |

|

|

|

|

|

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

Interest and dividend income: |

|

|

|

|

|

|

|

Interest and fees on loans |

$ |

12,939 |

|

|

$ |

13,097 |

|

|

$ |

10,419 |

|

|

|

Interest on deposits with banks |

|

906 |

|

|

|

369 |

|

|

|

12 |

|

|

|

Interest on investment securities |

|

719 |

|

|

|

624 |

|

|

|

383 |

|

|

|

Dividends on FHLB stock |

|

84 |

|

|

|

98 |

|

|

|

65 |

|

|

|

|

|

Total interest income |

|

14,648 |

|

|

|

14,187 |

|

|

|

10,880 |

|

|

Interest expense: |

|

|

|

|

|

|

|

Deposits |

|

4,400 |

|

|

|

2,380 |

|

|

|

710 |

|

|

|

Federal Home Loan Bank advances |

|

119 |

|

|

|

463 |

|

|

|

193 |

|

|

|

Junior Subordinated Debt |

|

94 |

|

|

|

94 |

|

|

|

94 |

|

|

|

|

|

Total interest expense |

|

4,612 |

|

|

|

2,936 |

|

|

|

997 |

|

|

|

|

|

Net interest income before provision for credit losses |

|

10,035 |

|

|

|

11,251 |

|

|

|

9,883 |

|

|

Provision for credit losses on loans |

|

400 |

|

|

|

807 |

|

|

|

135 |

|

|

Reversal of credit losses on unfunded loan commitments |

|

(33 |

) |

|

|

(145 |

) |

|

|

(24 |

) |

|

|

|

|

Net interest income after provision for (reversal of) credit |

|

|

|

|

|

|

|

|

|

losses on loans and unfunded loan commitments |

|

9,668 |

|

|

|

10,589 |

|

|

|

9,772 |

|

|

Non-interest income: |

|

|

|

|

|

|

|

Service charges on deposit accounts |

|

208 |

|

|

|

219 |

|

|

|

209 |

|

|

|

Rental income |

|

39 |

|

|

|

37 |

|

|

|

79 |

|

|

|

Net gain on loan sales |

|

1,435 |

|

|

|

1,762 |

|

|

|

1,546 |

|

|

|

Net (loss) gain on securities |

|

- |

|

|

|

(3 |

) |

|

|

6 |

|

|

|

Other income |

|

279 |

|

|

|

117 |

|

|

|

115 |

|

|

|

|

|

Total non-interest income |

|

1,960 |

|

|

|

2,132 |

|

|

|

1,955 |

|

|

Non-interest expense: |

|

|

|

|

|

|

|

Salaries and employee benefits |

|

3,793 |

|

|

|

3,873 |

|

|

|

3,964 |

|

|

|

Occupancy and equipment |

|

452 |

|

|

|

506 |

|

|

|

409 |

|

|

|

Other expenses |

|

1,573 |

|

|

|

2,016 |

|

|

|

1,913 |

|

|

|

|

|

Total non-interest expense |

|

5,819 |

|

|

|

6,394 |

|

|

|

6,286 |

|

|

|

|

|

Income before provision for income taxes |

|

5,810 |

|

|

|

6,326 |

|

|

|

5,441 |

|

|

Provision for income taxes |

|

1,695 |

|

|

|

1,773 |

|

|

|

1,505 |

|

|

|

|

|

Net income |

$ |

4,115 |

|

|

$ |

4,552 |

|

|

$ |

3,936 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings per common share |

$ |

0.62 |

|

|

$ |

0.68 |

|

|

$ |

0.59 |

|

|

Diluted earnings per common share |

$ |

0.62 |

|

|

$ |

0.68 |

|

|

$ |

0.59 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic weighted average shares of common stock outstanding |

|

6,688 |

|

|

|

6,688 |

|

|

|

6,685 |

|

|

Diluted weighted average shares of common stock outstanding |

|

6,688 |

|

|

|

6,688 |

|

|

|

6,685 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SUMMIT STATE BANK |

|

|

BALANCE SHEETS |

|

|

(In thousands except share data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31, 2023 |

|

December 31, 2022 |

March 31, 2022 |

|

|

|

|

|

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and due from banks |

$ |

116,569 |

|

|

$ |

77,567 |

|

|

$ |

65,897 |

|

|

|

|

|

|

Total cash and cash equivalents |

|

116,569 |

|

|

|

77,567 |

|

|

|

65,897 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment securities: |

|

|

|

|

|

|

|

|

Available-for-sale (at fair value; amortized cost of $97,951, |

|

|

|

|

|

|

|

|

|

$98,017 and $69,131) |

|

84,841 |

|

|

|

83,785 |

|

|

|

63,332 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans, less allowance for credit losses of $15,252, $14,839 and

$12,453 |

|

907,623 |

|

|

|

913,707 |

|

|

|

818,171 |

|

|

|

Bank premises and equipment, net |

|

5,507 |

|

|

|

5,461 |

|

|

|

5,584 |

|

|

|

Investment in Federal Home Loan Bank stock (FHLB), at cost |

|

4,737 |

|

|

|

4,737 |

|

|

|

4,320 |

|

|

|

Goodwill |

|

|

4,119 |

|

|

|

4,119 |

|

|

|

4,119 |

|

|

|

Affordable housing tax credit investments |

|

8,773 |

|

|

|

8,881 |

|

|

|

9,136 |

|

|

|

Accrued interest receivable and other assets |

|

14,854 |

|

|

|

17,086 |

|

|

|

11,728 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets |

$ |

1,147,023 |

|

|

$ |

1,115,342 |

|

|

$ |

982,285 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND |

|

|

|

|

|

|

|

SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposits: |

|

|

|

|

|

|

|

|

|

Demand - non interest-bearing |

$ |

232,825 |

|

|

$ |

252,033 |

|

|

$ |

256,253 |

|

|

|

|

Demand - interest-bearing |

|

153,214 |

|

|

|

143,767 |

|

|

|

152,823 |

|

|

|

|

Savings |

|

63,895 |

|

|

|

67,117 |

|

|

|

61,563 |

|

|

|

|

Money market |

|

148,433 |

|

|

|

137,362 |

|

|

|

174,447 |

|

|

|

|

Time deposits that meet or exceed the FDIC insurance limit |

|

84,800 |

|

|

|

141,691 |

|

|

|

29,585 |

|

|

|

|

Other time deposits |

|

332,485 |

|

|

|

220,685 |

|

|

|

157,263 |

|

|

|

|

|

|

Total deposits |

|

1,015,652 |

|

|

|

962,656 |

|

|

|

831,934 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Federal Home Loan Bank advances |

|

23,000 |

|

|

|

41,000 |

|

|

|

48,500 |

|

|

|

Junior subordinated debt |

|

5,909 |

|

|

|

5,905 |

|

|

|

5,895 |

|

|

|

Affordable housing commitment |

|

4,435 |

|

|

|

4,677 |

|

|

|

6,573 |

|

|

|

Accrued interest payable and other liabilities |

|

5,362 |

|

|

|

12,560 |

|

|

|

5,677 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities |

|

1,054,357 |

|

|

|

1,026,797 |

|

|

|

898,579 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shareholders' equity |

|

|

|

|

|

|

|

|

Preferred stock, no par value; 20,000,000 shares authorized; |

|

|

|

|

|

|

|

|

|

no shares issued and outstanding |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

|

Common stock, no par value; shares authorized - 30,000,000

shares; |

|

|

|

|

|

|

|

|

|

issued and outstanding 6,732,699, 6,732,699 and 6,684,759 |

|

37,217 |

|

|

|

37,179 |

|

|

|

37,014 |

|

|

|

|

Retained earnings |

|

64,678 |

|

|

|

61,386 |

|

|

|

50,777 |

|

|

|

|

Accumulated other comprehensive loss, net |

|

(9,230 |

) |

|

|

(10,019 |

) |

|

|

(4,083 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total shareholders' equity |

|

92,666 |

|

|

|

88,547 |

|

|

|

83,708 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and shareholders' equity |

$ |

1,147,023 |

|

|

$ |

1,115,344 |

|

|

$ |

982,287 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial Summary |

|

(Dollars in thousands except per share data) |

|

|

|

|

|

|

|

|

|

|

|

As of and for the |

|

|

|

Three Months Ended |

|

|

|

March 31, 2023 |

|

December 31, 2022 |

|

March 31, 2022 |

|

|

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

Statement of Income Data: |

|

|

|

|

|

|

|

Net interest income |

|

$ |

10,035 |

|

|

$ |

11,251 |

|

|

$ |

9,882 |

|

|

Provision for credit losses on loans |

|

|

400 |

|

|

|

807 |

|

|

|

135 |

|

|

Reversal of credit losses on unfunded loan commitments |

|

(33 |

) |

|

|

(145 |

) |

|

|

(24 |

) |

|

Non-interest income |

|

|

1,961 |

|

|

|

2,132 |

|

|

|

1,955 |

|

|

Non-interest expense |

|

|

5,818 |

|

|

|

6,395 |

|

|

|

6,286 |

|

|

Provision for income taxes |

|

|

1,695 |

|

|

|

1,773 |

|

|

|

1,505 |

|

|

Net income |

|

$ |

4,116 |

|

|

$ |

4,553 |

|

|

$ |

3,935 |

|

|

|

|

|

|

|

|

|

|

Selected per Common Share Data: |

|

|

|

|

|

|

|

Basic earnings per common share |

|

$ |

0.62 |

|

|

$ |

0.68 |

|

|

$ |

0.59 |

|

|

Diluted earnings per common share |

|

$ |

0.62 |

|

|

$ |

0.68 |

|

|

$ |

0.59 |

|

|

Dividend per share |

|

$ |

0.12 |

|

|

$ |

0.12 |

|

|

$ |

0.12 |

|

|

Book value per common share (1) |

|

$ |

13.76 |

|

|

$ |

13.15 |

|

|

$ |

12.52 |

|

|

|

|

|

|

|

|

|

|

Selected Balance Sheet Data: |

|

|

|

|

|

|

|

Assets |

|

$ |

1,147,023 |

|

|

$ |

1,115,343 |

|

|

$ |

982,287 |

|

|

Loans, net |

|

|

907,623 |

|

|

|

913,707 |

|

|

|

818,171 |

|

|

Deposits |

|

|

1,015,652 |

|

|

|

962,655 |

|

|

|

831,934 |

|

|

Average assets |

|

|

1,135,912 |

|

|

|

1,070,000 |

|

|

|

959,680 |

|

|

Average earning assets |

|

|

1,104,134 |

|

|

|

1,040,154 |

|

|

|

935,736 |

|

|

Average shareholders' equity |

|

|

90,814 |

|

|

|

86,675 |

|

|

|

85,405 |

|

|

Nonperforming loans |

|

|

10,411 |

|

|

|

3,756 |

|

|

|

- |

|

|

Total nonperforming assets |

|

|

10,411 |

|

|

|

3,756 |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

Selected Ratios: |

|

|

|

|

|

|

|

Return on average assets (2) |

|

|

1.47% |

|

|

|

1.69% |

|

|

|

1.66% |

|

|

Return on average common shareholders' equity (2) |

|

|

18.38% |

|

|

|

20.84% |

|

|

|

18.69% |

|

|

Efficiency ratio (3) |

|

|

48.50% |

|

|

|

47.77% |

|

|

|

53.13% |

|

|

Net interest margin (2) |

|

|

3.69% |

|

|

|

4.29% |

|

|

|

4.28% |

|

|

Common equity tier 1 capital ratio |

|

|

9.44% |

|

|

|

9.41% |

|

|

|

9.41% |

|

|

Tier 1 capital ratio |

|

|

9.44% |

|

|

|

9.41% |

|

|

|

9.41% |

|

|

Total capital ratio |

|

|

11.28% |

|

|

|

11.27% |

|

|

|

11.27% |

|

|

Tier 1 leverage ratio |

|

|

8.30% |

|

|

|

8.53% |

|

|

|

8.53% |

|

|

Common dividend payout ratio (4) |

|

|

20.03% |

|

|

|

17.73% |

|

|

|

20.39% |

|

|

Average shareholders' equity to average assets |

|

|

7.99% |

|

|

|

8.10% |

|

|

|

8.90% |

|

|

Nonperforming loans to total loans |

|

|

1.13% |

|

|

|

0.40% |

|

|

|

0.00% |

|

|

Nonperforming assets to total assets |

|

|

0.91% |

|

|

|

0.34% |

|

|

|

0.00% |

|

|

Allowance for credit losses to total loans |

|

|

1.65% |

|

|

|

1.60% |

|

|

|

1.50% |

|

|

Allowance for credit losses to nonperforming loans |

|

|

146.49% |

|

|

|

395.09% |

|

|

N/A |

|

|

|

|

|

|

(1) Total shareholders' equity divided by total common shares

outstanding. |

|

|

|

(2) Annualized. |

|

|

|

(3) Non-interest expenses to net interest and non-interest income,

net of securities gains. |

|

|

|

|

|

(4) Common dividends divided by net income available for common

shareholders. |

|

|

|

|

|

|

|

|

|

|

Contact: Brian Reed, President and CEO, Summit State

Bank (707) 568-4908

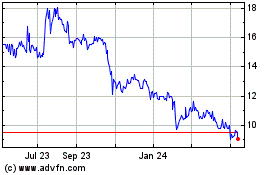

Summit State Bank (NASDAQ:SSBI)

Historical Stock Chart

From Apr 2024 to May 2024

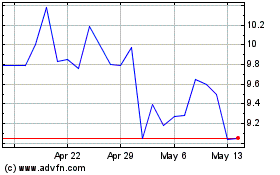

Summit State Bank (NASDAQ:SSBI)

Historical Stock Chart

From May 2023 to May 2024