0001840856FALSE00018408562024-08-082024-08-080001840856us-gaap:CommonClassAMember2024-08-082024-08-080001840856us-gaap:WarrantMember2024-08-082024-08-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_________________________________________

FORM 8-K

_________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 8, 2024

_________________________________________

SOUNDHOUND AI, INC.

(Exact name of registrant as specified in its charter)

_________________________________________

| | | | | | | | | | | | | | |

| Delaware | | 001-40193 | | 85-1286799 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | | | | | |

5400 Betsy Ross Drive Santa Clara, CA | | 95054 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (408) 441-3200

(Former name or former address, if changed since last report)

_________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Class A Common Stock, $0.0001 par value per share | | SOUN | | The Nasdaq Stock Market LLC |

| Warrants, each exercisable for one share of Class A Common Stock at an exercise price of $11.50 per share, subject to adjustment | | SOUNW | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operations and Financial Condition.

On August 8, 2024, SoundHound AI, Inc. (the “Company”) issued a press release announcing financial results and operational highlights for the second quarter ended June 30, 2024. A copy of the press release is furnished as Exhibit 99.1 to this current report on Form 8-K. The Company is also furnishing as Exhibit 99.2 to this current report on Form 8-K the condensed consolidated balance sheets of the Company as of June 30, 2024, and the related condensed consolidated statements of operations and comprehensive loss and condensed consolidated statements of cash flows for the period ended June 30, 2024.

Item 9.01. Financial Statement and Exhibits.

| | | | | | | | |

| Exhibit Number | | Description |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File (formatted as inline XBRL) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Current Report on Form 8-K to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

Dated: August 8, 2024 | SoundHound AI, Inc. |

| | | |

| By: | /s/ Keyvan Mohajer |

| | Name: | Keyvan Mohajer |

| | Title: | Chief Executive Officer |

SoundHound AI Reports 54% Growth and Record Q2 Revenue of $13.5 Million; Closes Quarter With Over $200 Million in Cash

Acquires Amelia, an enterprise conversational AI leader, to significantly expand to new verticals across finance, insurance, and healthcare

SANTA CLARA, Calif.--(BUSINESS WIRE)--SoundHound AI, Inc. (Nasdaq: SOUN), a global leader in voice artificial intelligence, today reported its financial results for the second quarter 2024.

“This has been a milestone quarter, with strong customer momentum across all of our key industries – including several new global brands,” said Keyvan Mohajer, CEO and Co-Founder of SoundHound AI. “And today we announced a significant acquisition that will expand SoundHound’s reach across multiple new enterprise verticals. We believe the demand for voice and conversational AI is increasing and are committed to strengthening our leadership position in this growing market.”

Second Quarter Financial Highlights

•Reported revenue was $13.5 million, an increase of 54% year-over-year

•GAAP gross margin was 63%; non-GAAP gross margin was 67%

•GAAP earnings per share was a loss of ($0.11); non-GAAP earnings per share was a loss of ($0.04)

•GAAP net loss was ($37.3) million; non-GAAP net loss was ($14.8) million

•Adjusted EBITDA was ($13.8) million

•Cumulative subscriptions & bookings backlog1 customer metric was $723 million and roughly doubled year-over-year

•Annual run rate of over 5 billion queries, second quarter up approximately 90% year-over-year

•Completed conversion of all preferred equity into class A common stock

•Prepaid $100 million debt in the quarter; saving over $55 million in interest and fees over the remaining life of the loan

•Strong cash balance of $201 million at the end of the second quarter

“We continued to realize strong growth in the second quarter while meaningfully improving our capital structure," said Nitesh Sharan, CFO of SoundHound AI. "This is allowing us to further accelerate our organic business while capitalizing on high-impact M&A. Today’s acquisition of Amelia is a key step towards harnessing the huge growth potential in conversational AI and helps us scale even faster.”

Business Highlights

Customer Service

•Acquired Amelia to accelerate and scale SoundHound AI’s customer service offering. The combined companies will bring together decades of experience in conversational AI to offer best-in-class customer service support to a broad range of new verticals. These include some of the very largest multinational enterprise brands, top 15 global banks, and Fortune 500 organizations, with the combined company spanning nearly 200 marquee customers.

•Signed one of the largest pizza chains in the world on an AI roadmap to introduce SoundHound’s phone ordering services to thousands of stores.

•Beef ‘O’ Brady’s rolled out SoundHound’s voice AI ordering system to all corporate locations, and opened it up to franchisees with plans for the family sports bar and grill chain to go live with customers in more than 20 states across the U.S.

•Dynamic Interaction, SoundHound’s next generation drive-thru AI interface, launched with multiple top global QSR brands.

•Employee Assist, SoundHound’s voice AI offering for back-of-house staff, added customers with multiple brands – including two prominent coffee shop chains.

•SoundHound’s Smart Answering has extended the company’s customer service offering beyond restaurants, and signed up a number of customers in various verticals with multi-location brands.

•Acquired Allset to fast-track the company's vision of a voice commerce ecosystem. A food ordering platform, with nearly 7,000 restaurant partners, Allset is designed for local pick-up, allowing consumers and restaurants to bypass delivery app fees.

Automotive

•Peugeot, Vauxhall, Opel, Citröen, and Alfa Romeo all went into full production with SoundHound Chat AI across multiple markets and languages. In total, six Stellantis brands are now in production with SoundHound’s voice assistant with generative AI.

•U.S. EV manufacturer will soon go into production with the SoundHound Chat AI voice assistant across its full fleet of market-leading vehicles – the first U.S. OEM to integrate an assistant with generative AI capabilities.

•In partnership with Stellantis, SoundHound has signed a new contract to provide the voice assistant for three of their brands in Latin America.

•Expanded on an existing customer relationship with a growing EV manufacturer in Europe to add SoundHound Chat AI to their digital assistant.

Partnerships

•SoundHound partnered with Perplexity to bring cutting-edge online LLMs to SoundHound Chat AI. Users can now ask a more complex set of questions and the assistant is able to answer across multiple channels including phones, cars, and smart devices.

•Connex2X, an innovative aftermarket connected vehicle company, partnered with SoundHound to integrate leading voice AI technology into its connected vehicle products.

1)See section ‘Certain Defined Terms’ at the end of this press release for additional information.

Second Quarter 2024 Financial Measures1

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Three Months Ended (thousands, unless otherwise noted) | | June 30, 2024 | | June 30, 2023 | | Change |

| Revenues | | $ | 13,462 | | $ | 8,751 | | | 54 | % |

| GAAP gross profit | | $ | 8,482 | | $ | 6,921 | | | 23 | % |

| GAAP gross margin | | | 63.0% | | | 79.1% | | | (16.1) | pp |

| Non-GAAP gross profit | | $ | 8,951 | | $ | 7,002 | | | 28 | % |

| Non-GAAP gross margin | | | 66.5% | | | 80.0% | | | (13.5) | pp |

| GAAP operating loss | | $ | (21,985) | | | $ | (16,483) | | | | 33 | % |

| Non-GAAP adjusted EBITDA | | $ | (13,848) | | | $ | (10,082) | | | | 37 | % |

| GAAP net loss | | $ | (37,322) | | | $ | (23,307) | | | | 60 | % |

| Non-GAAP net loss | | $ | (14,821) | | | $ | (16,069) | | | | (8) | % |

| GAAP net loss per share | | $ | (0.11) | | | $ | (0.11) | | | $ | — | |

| Non-GAAP net loss per share | | $ | (0.04) | | | $ | (0.07) | | | $ | 0.03 | |

1)Please see tables below for a reconciliation from GAAP to non-GAAP.

Liquidity and Cash Flows

The company’s total cash was $201 million at June 30, 2024.

Condensed Cash Flow Statement

| | | | | | | | | | | | | | | | | | | | |

Six Months Ended (thousands) | | June 30, 2024 | | June 30, 2023 |

| Cash flows: | | | | | | |

| Net cash used in operating activities | | $ | (40,440) | | | $ | (34,201) | |

| Net cash used in investing activities | | | (4,788) | | | | (293) | |

| Net cash provided by financing activities | | | 137,030 | | | | 154,558 | |

| Effects of exchange rate changes on cash | | | 130 | | | | — | |

| Net change in cash and cash equivalents | | $ | 91,932 | | | $ | 120,064 | |

Business Outlook

Incorporating today’s announcement of the acquisition of Amelia, SoundHound is updating its revenue outlook for 2024 and 2025. SoundHound now expects its full year 2024 revenue to exceed $80 million and its 2025 revenue outlook to exceed $150 million.

Additional Information

For more information please see the company’s SEC filings which can be obtained on the company’s website at investors.soundhound.com. The financial statements will be posted on the website, and will be included when the company files its 8-K. The financial data presented in this press release should be considered preliminary until the company files its 10-Q.

Conference Call and Webcast

Keyvan Mohajer, Co-Founder and CEO, and Nitesh Sharan, CFO will host a live audio conference call and webcast today at 2:00 p.m. Pacific Time/5:00 p.m. Eastern Time. A live webcast and replay will also be accessible at investors.soundhound.com.

About SoundHound AI

SoundHound (Nasdaq: SOUN), a global leader in conversational intelligence, offers voice AI solutions that let businesses offer incredible conversational experiences to their customers. Built on proprietary technology, SoundHound’s voice AI delivers best-in-class speed and accuracy in numerous languages to product creators across automotive, TV, and IoT, and to customer service industries via groundbreaking AI-driven products like Smart Answering, Smart Ordering, and Dynamic Drive-Thru, an AI-powered multimodal food ordering solution. Along with SoundHound Chat AI, a powerful voice assistant with integrated Generative AI, SoundHound powers millions of products and services, and processes billions of interactions each year for world class businesses. www.soundhound.com

Forward Looking Statements and Other Disclosures

This press release contains forward-looking statements, which are not historical facts, within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In some cases, you can identify forward-looking statements by the use of words such as “may,” “could,” “expect,” “intend,” “plan,” “seek,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “continue,” “likely,” “will,” “would” and variations of these terms and similar expressions, or the negative of these terms or similar expressions. These forward-looking statements include, but are not limited to, statements concerning our expected financial performance, our ability to implement our business strategy and anticipated business and operations, the potential utility of and market for our products and services, our ability to achieve revenue from our cumulative bookings backlog and subscription bookings backlog, and guidance for financial results for 2024. Such forward-looking statements are necessarily based upon estimates and assumptions that, while considered reasonable by us and our management, are inherently uncertain. As a result, readers are cautioned not to place undue reliance on these forward-looking statements. Our actual results may differ materially from those expressed or implied by these forward-looking statements as a result of risks and uncertainties impacting SoundHound’s business including, our ability to successfully launch and commercialize new products and services and derive significant revenue, our ability to develop

the bespoke products and services required under the contracts included in our bookings backlog and subscription backlog, including, but not limited to, our ability to convert customer adoption of Smart Ordering into realized revenue, our ability to predict or measure supply chain disruptions at our customers, our market opportunity and our ability to acquire new customers and retain existing customers, unexpected costs, charges or expenses resulting from our 2024 acquisitions, the ability of our 2024 acquisitions to be accretive on the company's financial results, the timing and impact of our growth initiatives, level of product service failures that could lead our customers to use competitors’ services, our ability to predict direct and indirect customer demand for our existing and future products, our ability to hire, retain and motivate employees, the effects of competition, including price competition within our industry segment, technological, regulatory and legal developments that uniquely or disproportionately impact our industry segment, developments in the economy and financial markets and those other factors described in our risk factors set forth in our filings with the Securities and Exchange Commission from time to time, including our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. We do not intend to update or alter our forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable law.

Certain Defined Terms

Cumulative Subscriptions & Bookings Backlog includes the company’s bookings backlog and subscriptions backlog in one holistic metric. Cumulative bookings backlog is derived from committed customer contracts and takes into account the prior quarter end balance of bookings backlog plus new bookings in the current quarter minus associated revenue recognized from bookings from prior periods. Subscriptions backlog refers to potential revenue achievable for the company with current customers where the company is the leading or exclusive provider, and assuming a 4-year ramp up during which time our technologies are being implemented and assuming a successful full roll out of our technologies over a total 5-year duration. Reasonable assumptions about adoption percentages are included, with lower percentages applied to pilot and proof-of-concept customers.

Non-GAAP Measures of Financial Performance

To supplement the company’s financial statements, which are presented on the basis of U.S. generally accepted accounting principles (GAAP), the following non-GAAP measures of financial performance are included in this release: non-GAAP gross profit, non-GAAP gross margin, adjusted EBITDA, non-GAAP net loss and non-GAAP earnings per share.

The company believes that providing this non-GAAP information in addition to the GAAP financial information, allows investors to view the financial results in the way the company views its operating results. The company also believes that providing this information allows investors to not only better understand the company's financial performance, but also, better evaluate the information used by management to evaluate and measure such performance.

As such, the company believes that disclosing non-GAAP financial measures to the readers of its financial statements provides the reader with useful supplemental information that allows for greater transparency in the review of the company’s financial and operational performance.

The company defines its non-GAAP measures by excluding certain items:

The company arrives at non-GAAP gross profit and non-GAAP gross margin by excluding (i) amortization of intangibles (including acquired intangible assets) and (ii) stock-based compensation.

The company arrives at adjusted EBITDA by excluding (i) total interest and other income/(expense), net, (ii) income taxes, (iii) depreciation and amortization expense (including acquired intangible assets), (iv) stock-based compensation, (v) restructuring expense, (vi) change in fair value of contingent consideration for business acquisition, and (vii) acquisition-related costs.

The company arrives at non-GAAP net loss and non-GAAP net loss per share by excluding (i) depreciation and amortization expense (including acquired intangible assets), (ii) stock-based compensation, (iii) restructuring expense, (iv) loss on early extinguishment of debt, (v) change in fair value of contingent consideration for business acquisition, (vi) gain on bargain purchase, and (vii) acquisition-related costs.

Reconciliations of GAAP to these adjusted non-GAAP financial measures are included in the tables below. When analyzing the company's operating results, investors should not consider non-GAAP measures as substitutes for the comparable financial measures prepared in accordance with GAAP.

To the extent that the company presents any forward-looking non-GAAP financial measures, the company does not present a quantitative reconciliation of such measures to the most directly comparable GAAP financial measure (or otherwise present such forward-looking GAAP measures) because it is impractical to do so.

Second Quarter Reconciliation of GAAP Gross Profit to Non-GAAP Gross Profit and GAAP Gross Margin to Non-GAAP Gross Margin

| | | | | | | | | | | | | | | | | | | | |

Three Months Ended (thousands) | | June 30, 2024 | | June 30, 2023 |

GAAP gross profit1 | | $ | 8,482 | | $ | 6,921 |

| Adjustments: | | | | | | |

| Amortization of Intangibles | | | 362 | | | — | |

| Stock-based compensation | | | 107 | | | 81 | |

| Non-GAAP gross profit | | $ | 8,951 | | $ | 7,002 |

| GAAP gross margin | | | 63.0% | | | 79.1% |

| Non-GAAP gross margin | | | 66.5% | | | 80.0% |

1)GAAP gross profit is calculated by subtracting the cost of revenues from revenues.

Second Quarter Reconciliation of GAAP Net Loss to Non-GAAP Adjusted EBITDA

| | | | | | | | | | | | | | | | | | | | |

Three Months Ended (thousands) | | June 30, 2024 | | June 30, 2023 |

| GAAP net loss | | $ | (37,322) | | | $ | (23,307) | |

| Adjustments: | | | | | | |

Interest and other income/(expense), net1 | | | (888) | | | | 5,570 | |

| Loss on early extinguishment of debt | | | 15,587 | | | | 837 | |

| Income taxes | | | 638 | | | | 417 | |

| Depreciation and amortization | | | 1,280 | | | | 703 | |

| Stock-based compensation | | | 7,253 | | | | 5,532 | |

| Restructuring | | | — | | | | 166 | |

| Change in fair value of contingent acquisition liabilities | | | (1,082) | | | | — | |

| Acquisition-related expenses | | | 686 | | | | — | |

| Non-GAAP adjusted EBITDA | | $ | (13,848) | | | $ | (10,082) | |

1)Includes other income/(expense) of $5.0 and $(0.8) million for the three months ended June 30, 2024 and 2023, respectively.

Second Quarter Reconciliation of GAAP Net Loss to Non-GAAP Net Loss and Non-GAAP Net Loss Per Share

| | | | | | | | | | | | | | | | | | | | |

Three Months Ended (thousands) | | June 30, 2024 | | June 30, 2023 |

| GAAP net loss | | $ | (37,322) | | | $ | (23,307) | |

| Adjustments: | | | | | | |

| Depreciation and amortization | | | 1,280 | | | | 703 | |

| Stock-based compensation | | | 7,253 | | | | 5,532 | |

| Restructuring | | | — | | | | 166 | |

| Loss on early extinguishment of debt | | | 15,587 | | | | 837 | |

| Change in fair value of contingent acquisition liabilities | | | (1,082) | | | | — | |

| Gain on bargain purchase | | | (1,223) | | | | — | |

| Acquisition-related expenses | | | 686 | | | | — | |

| Non-GAAP net loss | | $ | (14,821) | | | $ | (16,069) | |

GAAP net loss per share1 | | | (0.11) | | | | (0.11) | |

| Adjustments | | | 0.07 | | | | 0.04 | |

Non-GAAP net loss per share1 | | | (0.04) | | | | (0.07) | |

1)Weighted average common shares outstanding (basic and diluted) for the three months ended June 30, 2024 and 2023 were 331,830,608 and 220,772,111, respectively.

Investors:

Scott Smith

408-724-1498

IR@SoundHound.com

Media:

Fiona McEvoy

415-610-6590

PR@SoundHound.com

SOUNDHOUND AI, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except share and per share data)

| | | | | | | | | | | |

| June 30,

2024 | | December 31,

2023 |

| (Unaudited) | | |

| ASSETS | | | |

| | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 200,156 | | | $ | 95,260 | |

| | | |

| Accounts receivable, net of allowances of $439 and $203 as of June 30, 2024 and December 31, 2023, respectively | 5,059 | | | 4,050 | |

| Contract assets and unbilled receivable, net of allowance for credit losses of $108 and $17 of June 30, 2024 and December 31, 2023, respectively | 14,892 | | | 11,780 | |

| Other current assets | 3,949 | | | 2,452 | |

| Total current assets | 224,056 | | | 113,542 | |

| Restricted cash equivalents, non-current | 811 | | | 13,775 | |

| Right-of-use assets | 4,303 | | | 5,210 | |

| Property and equipment, net | 1,296 | | | 1,515 | |

| Goodwill | 6,039 | | | — | |

| Intangible assets, net | 13,147 | | | — | |

| Deferred tax asset | 10 | | | 11 | |

| Contract assets and unbilled receivable, non-current, net of allowance for credit losses of $171 and $177 of June 30, 2024 and December 31, 2023, respectively | 15,518 | | | 16,492 | |

| Other non-current assets | 1,494 | | | 577 | |

| Total assets | $ | 266,674 | | | $ | 151,122 | |

| | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 4,255 | | | $ | 1,653 | |

| Accrued liabilities | 13,147 | | | 13,884 | |

| Operating lease liabilities | 2,285 | | | 2,637 | |

| Finance lease liabilities | 63 | | | 121 | |

| Income tax liability | 1,888 | | | 1,618 | |

| Deferred revenue | 2,931 | | | 4,310 | |

| Other current liabilities | 968 | | | — | |

| Total current liabilities | 25,537 | | | 24,223 | |

| Operating lease liabilities, net of current portion | 2,175 | | | 3,089 | |

| Deferred revenue, net of current portion | 3,766 | | | 4,910 | |

| Long-term debt | — | | | 84,312 | |

| Contingent acquisition liabilities (Note 17) | 4,410 | | | — | |

| Income tax liability, net of current portion | 2,275 | | | 2,453 | |

| Other non-current liabilities | 4,570 | | | 3,967 | |

| Total liabilities | 42,733 | | | 122,954 | |

| Commitments and contingencies (Note 7) | | | |

| | | |

| Stockholders’ equity: | | | |

| Series A Preferred Stock, $0.0001 par value; 1,000,000 shares authorized; 0 and 475,005 shares issued and outstanding, aggregate liquidation preference of $0 and $16,227 as of June 30, 2024 and December 31, 2023, respectively | — | | | 14,187 | |

| Class A Common Stock, $0.0001 par value; 455,000,000 shares authorized; 315,153,605 and 216,943,349 shares issued and outstanding as of June 30, 2024 and December 31, 2023, respectively | 31 | | | 22 | |

| Class B Common Stock, $0.0001 par value; 44,000,000 shares authorized; 32,735,408 and 37,485,408 shares issued and outstanding as of June 30, 2024 and December 31, 2023, respectively | 3 | | | 4 | |

| Additional paid-in capital | 886,412 | | | 606,135 | |

| Accumulated deficit | (662,710) | | | (592,379) | |

| Accumulated other comprehensive income | 205 | | | 199 | |

| Total stockholders’ equity | 223,941 | | | 28,168 | |

| Total liabilities and stockholders’ equity | $ | 266,674 | | | $ | 151,122 | |

SOUNDHOUND AI, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(In thousands, except share and per share data)

(Unaudited) | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Revenues | $ | 13,462 | | | $ | 8,751 | | | $ | 25,056 | | | $ | 15,458 | |

| Operating expenses: | | | | | | | |

| Cost of revenues | 4,980 | | | 1,830 | | | 9,649 | | | 3,806 | |

| Sales and marketing | 5,655 | | | 5,078 | | | 11,197 | | | 9,953 | |

| Research and development | 15,738 | | | 11,736 | | | 30,616 | | | 25,920 | |

| General and administrative | 9,535 | | | 6,424 | | | 19,802 | | | 13,713 | |

| Change in fair value of contingent acquisition liabilities | (1,082) | | | — | | | 3,080 | | | — | |

| Amortization of intangible assets | 621 | | | — | | | 1,226 | | | — | |

| Restructuring | — | | | 166 | | | — | | | 3,751 | |

| Total operating expenses | 35,447 | | | 25,234 | | | 75,570 | | | 57,143 | |

| Loss from operations | (21,985) | | | (16,483) | | | (50,514) | | | (41,685) | |

| | | | | | | |

| Other expense, net: | | | | | | | |

| Loss on early extinguishment of debt | (15,587) | | | (837) | | | (15,587) | | | (837) | |

| Interest expense | (4,086) | | | (4,735) | | | (9,750) | | | (5,831) | |

| Other income (expense), net | 4,974 | | | (835) | | | 6,453 | | | (1,638) | |

| Total other expense, net | (14,699) | | | (6,407) | | | (18,884) | | | (8,306) | |

| Loss before provision for income taxes | (36,684) | | | (22,890) | | | (69,398) | | | (49,991) | |

| Provision for income taxes | 638 | | | 417 | | | 933 | | | 746 | |

| Net loss | $ | (37,322) | | | $ | (23,307) | | | $ | (70,331) | | | $ | (50,737) | |

| Cumulative dividends attributable to Series A Preferred Stock | (73) | | | (877) | | | (416) | | | (1,559) | |

| Net loss attributable to SoundHound common shareholders | $ | (37,395) | | | $ | (24,184) | | | $ | (70,747) | | | $ | (52,296) | |

| | | | | | | |

| Other comprehensive income: | | | | | | | |

| Unrealized gains on investments | (30) | | | 29 | | | 6 | | | — | |

| Comprehensive loss | $ | (37,425) | | | $ | (24,155) | | | $ | (70,741) | | | $ | (52,296) | |

| | | | | | | |

| Net loss per share: | | | | | | | |

| Basic and diluted | $ | (0.11) | | | $ | (0.11) | | | $ | (0.23) | | | $ | (0.25) | |

| | | | | | | |

| Weighted-average common shares outstanding: | | | | | | | |

| Basic and diluted | 331,830,608 | | | 220,772,111 | | | 309,213,583 | | | 212,970,561 | |

SOUNDHOUND AI, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited) | | | | | | | | | | | |

| Six Months Ended

June 30, |

| 2024 | | 2023 |

| Cash flows used in operating activities: | | | |

| Net loss | $ | (70,331) | | | $ | (50,737) | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | |

| Depreciation and amortization | 2,750 | | | 1,411 | |

| Stock-based compensation | 14,232 | | | 13,947 | |

| Loss on change in fair value of ELOC program | — | | | 1,901 | |

| Amortization of debt issuance cost | 1,524 | | | 1,607 | |

| Non-cash lease amortization | 1,445 | | | 1,714 | |

| Foreign currency gain/loss from remeasurement | (70) | | | — | |

| Change in fair value of contingent acquisition liabilities | 3,080 | | | — | |

| Loss on early extinguishment of debt | 15,587 | | | 837 | |

| Deferred income taxes | (368) | | | — | |

| Other, net | (891) | | | 82 | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable, net | 211 | | | (177) | |

| Other current assets | (1,426) | | | (634) | |

| Contract assets | (2,267) | | | (2,080) | |

| Other non-current assets | (842) | | | 363 | |

| Accounts payable | 1,941 | | | (903) | |

| Accrued liabilities | (625) | | | 5,295 | |

| Operating lease liabilities | (1,720) | | | (1,910) | |

| Deferred revenue | (2,523) | | | (4,625) | |

| Other non-current liabilities | (147) | | | (292) | |

| Net cash used in operating activities | (40,440) | | | (34,201) | |

| | | |

| Cash flows used in investing activities: | | | |

| Purchases of property and equipment | (335) | | | (293) | |

| Payment related to acquisitions, net of cash acquired | (4,453) | | | — | |

| Net cash used in investing activities | (4,788) | | | (293) | |

| | | |

| Cash flows provided by financing activities: | | | |

| Proceeds from the issuance of Series A Preferred Stock, net of issuance costs | — | | | 24,942 | |

| Proceeds from sales of Class A common stock under the ELOC program, net of issuance costs | — | | | 71,455 | |

| Proceeds from sales of Class A common stock under the Sales Agreement and Equity Distribution Agreement | 237,639 | | | — | |

| Proceeds from exercise of stock options and employee stock purchase plan | 10,628 | | | 8,177 | |

| Payment of financing costs associated with the Sales Agreement and Equity Distribution Agreement | (5,639) | | | — | |

| Proceeds from the issuance of long-term debt, net of issuance costs | — | | | 85,087 | |

| Payments on notes payable | (105,540) | | | (35,029) | |

| Payments on finance leases | (58) | | | (74) | |

| Net cash provided by financing activities | 137,030 | | | 154,558 | |

| Effects of exchange rate changes on cash | 130 | | | — | |

| Net change in cash, cash equivalents, and restricted cash equivalents | 91,932 | | | 120,064 | |

| Cash, cash equivalents, and restricted cash equivalents, beginning of period | 109,035 | | | 9,475 | |

| Cash, cash equivalents, and restricted cash equivalents, end of period | $ | 200,967 | | | $ | 129,539 | |

SOUNDHOUND AI, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS – Continued

(In thousands)

(Unaudited)

| | | | | | | | | | | |

| Reconciliation to amounts on the condensed consolidated balance sheets: | | | |

| Cash and cash equivalents | $ | 200,156 | | | $ | 115,764 | |

| Non-current portion of restricted cash equivalents | 811 | | | 13,775 | |

Total cash, cash equivalents, and restricted cash equivalents shown in the condensed consolidated statements of cash flows | $ | 200,967 | | | $ | 129,539 | |

| | | |

| Supplemental disclosures of cash flow information: | | | |

| Cash paid for interest | $ | 3,541 | | | $ | 4,344 | |

| Cash paid for income taxes | $ | 1,274 | | | $ | 1,098 | |

| | | |

| Noncash investing and financing activities: | | | |

| Conversion of Series A Preferred Stock to Class A common stock | $ | 14,187 | | | $ | — | |

| Issuance of Class A Common Stock to settle commitment shares related to the ELOC program | $ | — | | | $ | 915 | |

| Deferred offering costs reclassified to additional paid-in capital | $ | 147 | | | $ | 802 | |

| Unpaid financing costs in connection with the Equity Distribution Agreement | $ | 522 | | | $ | — | |

| Non-cash debt discount | $ | — | | | $ | 4,136 | |

| Property and equipment acquired under accrued liabilities | $ | 92 | | | $ | — | |

| Fair value of Class A common stock and deferred equity consideration issued for SYNQ3 acquisition | $ | 9,687 | | | $ | — | |

| | | |

| Fair value of contingent earnout consideration under SYNQ3 acquisition | $ | 1,676 | | | $ | — | |

| Fair value of contingent holdback consideration under SYNQ3 acquisition | $ | 427 | | | $ | — | |

| Fair value of deferred cash consideration under other acquisition | $ | 195 | | | $ | — | |

| | | |

Cover

|

Aug. 08, 2024 |

| Document Information |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 08, 2024

|

| Entity Registrant Name |

SOUNDHOUND AI, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-40193

|

| Entity Tax Identification Number |

85-1286799

|

| Entity Address, Street |

5400 Betsy Ross Drive

|

| Entity Address, City |

Santa Clara

|

| Entity Address, State |

CA

|

| Entity Address, Postal Zip Code |

95054

|

| City Area Code |

408

|

| Local Phone Number |

441-3200

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001840856

|

| Amendment Flag |

false

|

| Common Class A |

|

| Document Information |

|

| Title of each class |

Class A Common Stock, $0.0001 par value per share

|

| Trading Symbol |

SOUN

|

| Name of each exchange on which registered |

NASDAQ

|

| Warrant |

|

| Document Information |

|

| Title of each class |

Warrants, each exercisable for one share of Class A Common Stock at an exercise price of $11.50 per share, subject to adjustment

|

| Trading Symbol |

SOUNW

|

| Name of each exchange on which registered |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

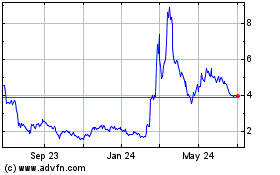

SoundHound AI (NASDAQ:SOUN)

Historical Stock Chart

From Nov 2024 to Dec 2024

SoundHound AI (NASDAQ:SOUN)

Historical Stock Chart

From Dec 2023 to Dec 2024