Company to Pay Quarterly Cash Dividend of $0.135 Per Share

Shoe Carnival, Inc. (Nasdaq: SCVL) (the “Company”), a leading

retailer of footwear and accessories for the family, announced

today that its Board of Directors approved the payment of a

quarterly cash dividend of $0.135 per share to be paid on January

27, 2025, to shareholders of record as of the close of business on

January 13, 2025.

Additionally, its Board of Directors authorized a new share

repurchase program for up to $50 million of its outstanding common

stock, effective January 1, 2025. The new share repurchase program

will replace an existing $50 million share repurchase program that

was authorized on December 14, 2023, and will expire in accordance

with its terms on December 31, 2024. Additional purchases may be

made under the existing share repurchase program prior to its

expiration.

“This marks our 51st consecutive quarterly dividend and we

continue to drive solid cash flow, funding our operations and

growth strategies without debt. Our strong capital structure,

liquidity management and profitability position us well to continue

delivering enhanced shareholder value and pursuing our vision to be

the nation’s leading family footwear retailer,” commented Mark

Worden, Shoe Carnival’s President and Chief Executive Officer.

Purchases under the new share repurchase program may be made in

the open market or through privately negotiated transactions from

time-to-time through December 31, 2025, and in accordance with

applicable laws, rules and regulations. Repurchases may also be

made pursuant to a Rule 10b5-1 plan, which, if adopted by the

Company, would permit shares to be repurchased in accordance with

pre-determined criteria when the Company might otherwise be

prohibited from doing so under insider trading laws or because of

self-imposed trading blackout periods. The share repurchase program

may be amended, suspended or discontinued at any time and does not

commit the Company to repurchase shares of its common stock. The

Company intends to fund the share repurchase program from cash on

hand and any shares acquired will be available for stock-based

compensation awards and other corporate purposes.

The actual number and value of the shares to be purchased will

depend on the performance of the Company’s stock price and other

market and economic factors.

Future declarations of dividends are subject to approval of the

Board of Directors and will depend on the Company’s results of

operations, financial condition, business conditions and other

factors deemed relevant by the Board of Directors.

About Shoe Carnival

Shoe Carnival, Inc. is one of the nation’s largest family

footwear retailers, offering a broad assortment of dress, casual

and athletic footwear for men, women and children with emphasis on

national name brands. As of December 12, 2024, the Company operates

431 stores in 36 states and Puerto Rico under its Shoe Carnival and

Shoe Station banners and offers shopping at www.shoecarnival.com

and www.shoestation.com. Headquartered in Evansville, IN, Shoe

Carnival, Inc. trades on The Nasdaq Stock Market LLC under the

symbol SCVL. Press releases and annual reports are available on the

Company's website at www.shoecarnival.com.

Cautionary Statement Regarding Forward-Looking

Information

As used herein, “we”, “our” and “us” refer to Shoe Carnival,

Inc. This press release contains forward-looking statements, within

the meaning of the Private Securities Litigation Reform Act of

1995, that involve a number of risks and uncertainties, such as

statements about our future growth, operations, cash flows and

shareholder returns, as well as our growth strategy and profit

transformation.

A number of factors could cause our actual results, performance,

achievements or industry results to be materially different from

any future results, performance or achievements expressed or

implied by these forward-looking statements. These factors include,

but are not limited to: our ability to control costs and meet our

labor needs in a rising wage, inflationary, and/or supply chain

constrained environment; the impact of competition and pricing,

including our ability to maintain current promotional intensity

levels; the effects and duration of economic downturns and

unemployment rates; our ability to achieve expected operating

results from, and planned growth of, our Shoe Station banner, which

includes the recently acquired stores and operations of Rogan’s,

within expected time frames, or at all; the potential impact of

national and international security concerns, including those

caused by war and terrorism, on the retail environment; general

economic conditions in the areas of the continental United States

and Puerto Rico where our stores are located; changes in the

overall retail environment and more specifically in the apparel and

footwear retail sectors; our ability to successfully utilize the

e-commerce sales channel and its impact on traffic and transactions

in our physical stores; the success of the open-air shopping

centers where many of our stores are located and the impact on our

ability to attract customers to our stores; our ability to attract

customers to our e-commerce platform and to successfully grow our

omnichannel sales; the effectiveness of our inventory management,

including our ability to manage key merchandise vendor

relationships and direct-to-consumer initiatives; changes in our

relationships with other key suppliers; changes in the political

and economic environments in, the status of trade relations with,

and the impact of changes in trade policies and tariffs impacting,

China and other countries which are the major manufacturers of

footwear; our ability to successfully manage and execute our

marketing initiatives and maintain positive brand perception and

recognition; our ability to successfully manage our current real

estate portfolio and leasing obligations; changes in weather,

including patterns impacted by climate change; changes in consumer

buying trends and our ability to identify and respond to emerging

fashion trends; the impact of disruptions in our distribution or

information technology operations including at our distribution

center located in Evansville, IN; the impact of natural disasters,

public health and political crises, civil unrest, and other

catastrophic events on our operations and the operations of our

suppliers, as well as on consumer confidence and purchasing in

general; the duration and spread of a public health crisis and the

mitigating efforts deployed, including the effects of government

stimulus on consumer spending; risks associated with the

seasonality of the retail industry; the impact of unauthorized

disclosure or misuse of personal and confidential information about

our customers, vendors and employees, including as a result of a

cybersecurity breach; our ability to effectively integrate Rogan’s,

retain Rogan’s employees, and achieve the expected operating

results, synergies, efficiencies and other benefits from the

Rogan’s acquisition within the expected time frames, or at all;

risks that the Rogan’s acquisition may disrupt our current plans

and operations or negatively impact our relationship with our

vendors and other suppliers; our ability to successfully execute

our business strategy, including the availability of desirable

store locations at acceptable lease terms, our ability to identify,

consummate or effectively integrate future acquisitions, our

ability to implement and adapt to new technology and systems, our

ability to open new stores in a timely and profitable manner,

including our entry into major new markets, and the availability of

sufficient funds to implement our business plans; higher than

anticipated costs associated with the closing of underperforming

stores; the inability of manufacturers to deliver products in a

timely manner; an increase in the cost, or a disruption in the

flow, of imported goods; the impact of regulatory changes in the

United States, including minimum wage laws and regulations, and the

countries where our manufacturers are located; the resolution of

litigation or regulatory proceedings in which we are or may become

involved; continued volatility and disruption in the capital and

credit markets; future stock repurchases under our stock repurchase

program and future dividend payments; and other factors described

in the Company’s SEC filings, including the Company’s latest Annual

Report on Form 10-K. In addition, these forward-looking statements

necessarily depend upon assumptions, estimates and dates that may

be incorrect or imprecise and involve known and unknown risks,

uncertainties and other factors. Accordingly, any forward-looking

statements included in this press release do not purport to be

predictions of future events or circumstances and may not be

realized. Forward-looking statements can be identified by, among

other things, the use of forward-looking terms such as “believes,”

“expects,” “aims,” “on track,” “may,” “will,” “should,” “seeks,”

“pro forma,” “anticipates,” “intends” or the negative of any of

these terms, or comparable terminology, or by discussions of

strategy or intentions. Given these uncertainties, we caution

investors not to place undue reliance on these forward-looking

statements, which speak only as of the date hereof. We disclaim any

obligation to update any of these factors or to publicly announce

any revisions to the forward-looking statements contained in this

press release to reflect future events or developments.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241212014496/en/

Steve R. Alexander Shoe Carnival Investor Relations (812)

867-4034

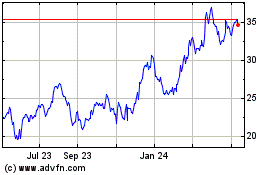

Shoe Carnival (NASDAQ:SCVL)

Historical Stock Chart

From Jan 2025 to Feb 2025

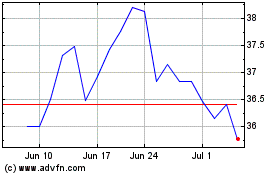

Shoe Carnival (NASDAQ:SCVL)

Historical Stock Chart

From Feb 2024 to Feb 2025