Current Report Filing (8-k)

July 11 2022 - 4:11PM

Edgar (US Regulatory)

false000089544700008954472022-07-072022-07-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 11, 2022 (July 7, 2022)

SHOE CARNIVAL, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

Indiana |

0-21360 |

35-1736614 |

(State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

|

|

7500 East Columbia Street Evansville, Indiana |

|

47715 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: (812) 867-4034

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Stock, par value $0.01 per share |

|

SCVL |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

Employment Agreement with Patrick C. Edwards

On July 7, 2022, Shoe Carnival, Inc. (the “Company”) entered into an Employment Agreement with Patrick C. Edwards, the Company’s Vice President, Chief Accounting Officer, Corporate Controller and Secretary (the “Agreement”). The Agreement provides for an initial term ending on June 30, 2023 and automatically renews for successive one-year periods thereafter, unless earlier terminated in accordance with its terms. The Agreement provides that Mr. Edwards will serve as Vice President, Chief Accounting Officer, Corporate Controller and Secretary of the Company with an annual base salary of $250,000, as adjusted from time to time by the Board.

Pursuant to the Agreement, upon the expiration of the term of the agreement, Mr. Edwards will be entitled to receive (i) that portion of his base salary that is earned but unpaid through the termination date, (ii) reimbursement for expenses that are not yet reimbursed and (iii) any vested benefits to which he is entitled under the Company’s employee benefit plans (collectively, the “Accrued Obligations”). In addition, if the Company elects not to renew the Agreement upon the expiration of its term and terminates Mr. Edwards’ employment (other than within two years following a change in control) without offering to pay him severance equal to 100% of his base salary, he will not be subject to the non-competition and non-solicitation provisions of the Agreement.

If Mr. Edwards’ employment is terminated by the Company for cause (as defined in the Agreement), by Mr. Edwards without good reason (as defined below), or as a result of his death or disability, Mr. Edwards will be entitled to receive the Accrued Obligations. If Mr. Edwards’ employment is terminated by the Company without cause or by Mr. Edwards for good reason (in each case, other than within two years following a change in control), Mr. Edwards will be entitled to the following: (a) the Accrued Obligations; and (b) subject to his compliance with the restrictive covenants set forth in the Agreement and his execution of a release agreement, (i) a lump sum amount equal to 100% of his base salary at the highest rate in effect at any time during the six months prior to the termination date, plus (ii) an amount equal to 12 times the monthly amount charged, as of his termination date, for continuation coverage under the Company’s group medical and dental plans pursuant to the Consolidated Omnibus Reconciliation Act of 1985 for the coverage options and coverage levels applicable to him and his covered dependents immediately prior to the termination date (the “COBRA Premium Rate”). Under the Agreement, “good reason” is defined to include a material reduction by the Company in Mr. Edwards’ base salary or a material breach of the Agreement by the Company.

If, within two years following a change in control, Mr. Edwards’ employment is terminated by the Company without cause or by Mr. Edwards for good reason, Mr. Edwards will be entitled to the following: (a) the Accrued Obligations; and (b) subject to his compliance with the restrictive covenants set forth in the Agreement and his execution of a release agreement, a lump sum amount equal to the sum of (i) 150% of his base salary at the highest rate in effect at any time during the six months prior to the termination date, and (ii) an amount equal to 18 times the COBRA Premium Rate.

Under the Agreement, Mr. Edwards is subject to non-competition, non-solicitation and non-disparagement provisions during the term of the Agreement and for a period of 12 months following termination of his employment.

The foregoing description of the terms of the Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Agreement, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits:

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

SHOE CARNIVAL, INC. |

|

|

|

(Registrant) |

|

Date: July 11, 2022 |

By: |

/s/ W. Kerry Jackson |

|

|

|

W. Kerry Jackson |

|

|

|

Senior Executive Vice President |

|

|

|

Chief Financial and Administrative Officer and Treasurer |

|

3

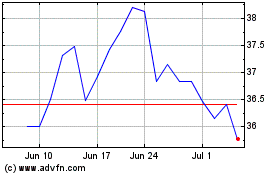

Shoe Carnival (NASDAQ:SCVL)

Historical Stock Chart

From Oct 2024 to Nov 2024

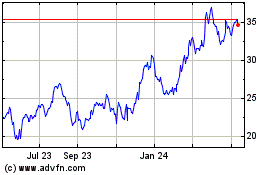

Shoe Carnival (NASDAQ:SCVL)

Historical Stock Chart

From Nov 2023 to Nov 2024