false

0001359931

0001359931

2025-03-05

2025-03-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

March 5, 2025

Protara Therapeutics,

Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-36694 |

|

20-4580525 |

(State or other jurisdiction

of incorporation) |

|

(Commission File No.) |

|

(IRS Employer

Identification No.) |

|

345 Park Avenue South

Third Floor

New York, NY |

|

10010 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (646) 844-0337

N/A

(Former name or former address, if changed since

last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

|

TARA |

|

The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934

(§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial

Condition.

On March 5, 2025, Protara Therapeutics, Inc. (the “Company”)

announced its financial results for the quarter and year ended December 31, 2024 in the press release attached hereto as Exhibit 99.1

and incorporated herein by reference.

The information in this Item 2.02, including the attached

Exhibit 99.1, is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall it be deemed

incorporated by reference in any filing made by the Company under the Securities Act of 1933, as amended, or the Exchange Act, except

as shall be expressly set forth by specific reference in such a filing regardless of any general incorporation language.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

PROTARA THERAPEUTICS, INC. |

| |

|

|

| Date: March 5, 2025 |

By: |

/s/ Patrick Fabbio |

| |

|

Patrick Fabbio |

| |

|

Chief Financial Officer |

2

Exhibit 99.1

Protara Therapeutics Announces Fourth Quarter

and Full Year 2024 Financial Results and Provides a Business Update

| ● | Reported

positive six-month data from ADVANCED-2 trial of TARA-002 in patients with NMIBC; Announcement of initial data from 12-month evaluable

patients expected by mid-2025 |

| ● | Dosing

of first patient in THRIVE-3 registrational trial of IV Choline Chloride in patients dependent on parenteral support expected in 1H 2025 |

| ● | On

track to provide an interim update from the Phase 2 STARBORN-1 trial of TARA-002 in pediatric LMs patients by the end of 1H 2025 |

| ● | Cash,

cash equivalents and investments of $170 million as of December 31, 2024, including gross proceeds from $100 million public offering

in December 2024, expected to support planned operations into 2027 |

NEW YORK, March 5,

2025 – Protara Therapeutics, Inc. (Nasdaq: TARA), a clinical-stage company developing transformative therapies for

the treatment of cancer and rare diseases, today provided a business update and announced financial results for the fourth

quarter and full year ended December 31, 2024.

“Following a year of significant progress

and execution across our pipeline, we remain well positioned to deliver on our mission to bring transformative therapies to patients with

cancer and rare diseases,” said Jesse Shefferman, Chief Executive Officer of Protara Therapeutics. “Notably, supported by

positive six-month data from our Phase 2 ADVANCED-2 trial in non-muscle invasive bladder cancer (NMIBC), we continue to believe TARA-002

could represent a differentiated, meaningful addition to the treatment paradigm, both as a monotherapy and in potential combination with

other agents. We continue to expect to report initial data from 12-month evaluable patients in our ADVANCED-2 trial by mid-year.”

Mr. Shefferman added, “Beyond our NMIBC

program, we remain on track to commence our pivotal THRIVE-3 trial of intravenous (IV) Choline Chloride in the first half of the year.

We also look forward to providing an interim update from our ongoing Phase 2 STARBORN-1 trial of TARA-002 in lymphatic malformations (LMs)

by the end of the first half of 2025. With our cash runway extending into 2027, we look forward to achieving many critical milestones

across all of our development programs as we work to deliver new treatment options to patients in need.”

Recent Progress

and Highlights

| ● | The

Company is on track to report 12-month data by mid-year from its ongoing Phase 2 open-label

ADVANCED-2 trial in evaluable NMIBC patients with carcinoma in situ or CIS (± Ta/T1)

who are Bacillus Calmette-Guérin (BCG)-Unresponsive and BCG-Naïve. In December

2024, the Company reported positive interim results in which the complete response (CR) rate

across BCG exposures was 72% (13/18) at six months and 70% (14/20) at any time, with 100%

(9/9) of patients maintaining a CR from three months to six months. In addition, two of three

patients maintained a CR at nine months. TARA-002 showed a favorable safety profile, with

no Grade 2 or greater treatment-related adverse events and no treatment discontinuations

due to adverse events. |

| ● | Interim

results from approximately 25 six-month evaluable BCG-Unresponsive patients are expected

to be announced by the end of 2025. As previously communicated, the BCG-Unresponsive cohort

is designed to be registrational in alignment with the 2024 BCG-Unresponsive Non-muscle Invasive

Bladder Cancer: Developing Drugs and Biological Products for Treatment Draft Guidance for

Industry issued by the U.S. Food and Drug Administration (FDA). |

| ● | Following

regulatory alignment with the FDA, the Company expects to provide an update on the design

of its planned BCG-Naïve registrational trial by the end of the first half of 2025. |

| ● | Protara

continues to investigate systemic subcutaneous dosing through priming and maintenance combined

with intravesical dosing, as well as exploring combination treatment with TARA-002 in NMIBC

patients with CIS. Given what has been observed to date with TARA-002’s mechanism of action

and strong safety profile, the Company believes it holds significant potential for use in

both systemic dosing and combination therapy and is finalizing various opportunities. |

IV

Choline Chloride for Patients on Parenteral Support (PS)

| ● | The

Company plans to initiate THRIVE-3, a registrational Phase 3 clinical trial, in the first

half of 2025. THRIVE-3 is a seamless Phase 2b/3 trial with a dose confirmation portion (n=24)

followed by a double-blinded, randomized, placebo-controlled portion to assess the efficacy

and safety of IV Choline Chloride over 24 weeks in adolescents and adults on long-term PS

when oral or enteral nutrition is not possible, insufficient, or contraindicated (n=100).

IV Choline Chloride was previously granted Fast Track designation by the FDA. |

TARA-002

in LMs

| ● | Protara

remains on track to provide an interim update on the Phase 2 STARBORN-1 trial of TARA-002

in pediatric patients with macrocystic and mixed cystic LMs by the end of the first half

of 2025. The Company previously announced the completion of the study’s first

safety cohort, in which TARA-002 showed promising results and was generally well-tolerated. |

Fourth

Quarter and Full Year 2024 Financial Results

| ● | As

of December 31, 2024, cash and cash equivalents, and marketable debt securities totaled $170.3

million. The Company expects its cash and cash equivalents, and marketable debt securities

will be sufficient to fund its planned operations and data milestones into 2027. |

| ● | Research

and development expenses for the fourth quarter of 2024 increased to $9.5 million from $6.4

million for the prior year period, and for the full year increased to $31.7 million compared

to $25.0 million for 2023. The fourth quarter and full year increases were primarily

due to an increase in expenses related to clinical trial and non-clinical activities for

TARA-002 and IV Choline Chloride. |

| ● | General

and administrative expenses for the fourth quarter of 2024 increased to $4.8 million from $4.7

million for the prior year period, and for the full year decreased to $17.5 million compared

to $18.6 million for 2023. The full year decrease was primarily due to a decrease

in personnel-related expenses. |

| ● | For

the fourth quarter of 2024, Protara incurred a net loss of $12.8 million, or $0.48 per

share, compared with a net loss of $10.2 million, or $0.90 per share, for

the same period in 2023. Net loss for the year ended December 31, 2024 was $44.6

million, or $2.17 per share, compared with a net loss of $40.4 million, or $3.57 per

share, for the year ended December 31, 2023. Net loss for the fourth quarter of 2024

included approximately $0.9 million of stock-based compensation expenses. Net loss

for the year ended December 31, 2024 included approximately $4.1 million of

stock-based compensation expenses. |

About TARA-002

TARA-002 is an investigational cell therapy in development

for the treatment of NMIBC and of LMs, for which it has been granted Rare Pediatric Disease Designation by the U.S. Food and Drug Administration.

TARA-002 was developed from the same master cell bank of genetically distinct, group A Streptococcus pyogenes as OK-432, a broad immunopotentiator

marketed as Picibanil® in Japan by Chugai Pharmaceutical Co., Ltd. Protara has successfully shown manufacturing comparability between

TARA-002 and OK-432.

When TARA-002 is administered, it is hypothesized

that innate and adaptive immune cells within the cyst or tumor are activated and produce a pro-inflammatory response with release of cytokines

such as tumor necrosis factor (TNF)-alpha, interferon (IFN)-gamma IL-6, IL-10, IL-12. TARA-002 also directly kills tumor cells and triggers

a host immune response by inducing immunogenic cell death, which further enhances the antitumor immune response.

About Non-Muscle Invasive Bladder Cancer (NMIBC)

Bladder cancer is the 6th most common cancer in

the United States, with NMIBC representing approximately 80% of bladder cancer diagnoses. Approximately 65,000 patients are diagnosed

with NMIBC in the United States each year. NMIBC is cancer found in the tissue that lines the inner surface of the bladder that has not

spread into the bladder muscle.

About Lymphatic Malformations (LMs)

LMs are rare, congenital malformations of lymphatic

vessels resulting in the failure of these structures to connect or drain into the venous system. Most LMs are present in the head and

neck region and are diagnosed in early childhood during the period of active lymphatic growth, with more than 50% detected at birth and

90% diagnosed before the age of three years. The most common morbidities and serious manifestations of the disease include compression

of the upper aerodigestive tract, including airway obstruction requiring intubation and possible tracheostomy dependence; intralesional

bleeding; impingement on critical structures, including nerves, vessels, lymphatics; recurrent infection, and cosmetic and other functional

disabilities.

About IV Choline Chloride

IV Choline Chloride is an investigational, intravenous

phospholipid substrate replacement therapy in development for patients receiving parenteral support (PS). Choline is a known important

substrate for phospholipids that are critical for healthy liver function that also play an important role in modulating gene expression,

cell membrane signaling, brain development and neurotransmission, muscle function, and bone health. PS patients are unable to synthesize

choline from enteral nutrition sources, and there are currently no available PS formulations containing choline. Approximately 80% of

patients dependent on PS are choline-deficient and of those approximately 63% have some degree of liver dysfunction, which can lead to

hepatic failure. Every year in the U.S. there are approximately 90,000 people who require PS at home and of those approximately 30,000

are on long-term PS. IV Choline Chloride has the potential to become the first U.S. Food and Drug Administration (FDA) approved IV choline

formulation for PS patients. It has been granted Orphan Drug Designation by the FDA for the prevention and/or treatment of choline deficiency

in patients on long-term PN and been granted Fast Track Designation as a source of choline when oral or enteral nutrition is not possible,

insufficient, or contraindicated. The U.S. Patent and Trademark Office has issued us a U.S. patent claiming a choline composition and

a U.S. patent claiming a method for treating choline deficiency with a choline composition, each with a term expiring in 2041.

About Protara Therapeutics, Inc.

Protara is a clinical-stage biotechnology company

committed to advancing transformative therapies for people with cancer and rare diseases. Protara’s portfolio includes its lead

candidate, TARA-002, an investigational cell-based therapy in development for the treatment of non-muscle invasive bladder cancer (NMIBC)

and lymphatic malformations (LMs). The Company is evaluating TARA-002 in an ongoing Phase 2 trial in NMIBC patients with carcinoma in

situ (CIS) who are unresponsive or naïve to treatment with Bacillus Calmette-Guérin (BCG), as well as a Phase 2 trial in pediatric

patients with LMs. Additionally, Protara is developing IV Choline Chloride, an investigational phospholipid substrate replacement for

patients on parenteral support who are otherwise unable to meet their choline needs via oral or enteral routes. For more information,

visit www.protaratx.com.

Forward-Looking Statements

Statements contained in this press release regarding matters that are

not historical facts are “forward looking statements” within the meaning of the Private Securities Litigation Reform Act of

1995. Protara may, in some cases, use terms such as “predicts,” “believes,” “potential,” “proposed,”

“continue,” “designed,” “estimates,” “anticipates,” “expects,” “plans,”

“intends,” “may,” “could,” “might,” “will,” “should” or other

words or expressions referencing future events, conditions or circumstances that convey uncertainty of future events or outcomes to identify

these forward-looking statements. Such forward-looking statements include but are not limited to, statements regarding Protara’s

intentions, beliefs, projections, outlook, analyses or current expectations concerning, among other things: Protara’s business strategy,

including its development plans for its product candidates and plans regarding the timing or outcome of existing or future clinical trials

(including reporting initial data from 12-month evaluable patients in mid-2025); statements related to expectations regarding interactions

with the FDA; Protara’s financial position; statements regarding the anticipated safety or efficacy of Protara’s product candidates;

and Protara’s outlook for the remainder of the year and future periods. Because such statements are subject to risks and uncertainties,

actual results may differ materially from those expressed or implied by such forward-looking statements. Factors that contribute to the

uncertain nature of the forward-looking statements include: risks that Protara’s financial guidance may not be as expected, as well

as risks and uncertainties associated with: Protara’s development programs, including the initiation and completion of non-clinical

studies and clinical trials and the timing of required filings with the FDA and other regulatory agencies; general market conditions;

changes in the competitive landscape; changes in Protara’s strategic and commercial plans; Protara’s ability to obtain sufficient

financing to fund its strategic plans and commercialization efforts; having to use cash in ways or on timing other than expected; the

impact of market volatility on cash reserves; failure to attract and retain management and key personnel; the impact of general U.S. and

foreign, economic, industry, market, regulatory, political or public health conditions; the impact of government laws and regulations,

including the impacts on FDA’s staffing, resources and ability to timely review and process regulatory submissions and the impacts

of any executive orders or tariffs; and the risks and uncertainties associated with Protara’s business and financial condition in

general, including the risks and uncertainties described more fully under the caption “Risk Factors” and elsewhere in Protara’s

filings and reports with the United States Securities and Exchange Commission. All forward-looking statements contained in this press

release speak only as of the date on which they were made and are based on management’s assumptions and estimates as of such date. Protara

undertakes no obligation to update any forward-looking statements, whether as a result of the receipt of new information, the occurrence

of future events or otherwise, except as required by law.

Protara Therapeutics, Inc.

Consolidated Balance Sheets

(in thousands, except share and per share data)

| | |

December 31, | |

| | |

2024 | | |

2023 | |

| Assets | |

| | |

| |

| Current assets: | |

| | |

| |

| Cash and cash equivalents | |

$ | 162,798 | | |

$ | 39,586 | |

| Marketable debt securities | |

| 7,494 | | |

| 25,994 | |

| Prepaid expenses and other current assets | |

| 1,863 | | |

| 3,125 | |

| Total current assets | |

| 172,155 | | |

| 68,705 | |

| Restricted cash , non-current | |

| 745 | | |

| 745 | |

| Property and equipment, net | |

| 1,027 | | |

| 1,296 | |

| Operating lease right-of-use asset | |

| 4,255 | | |

| 5,264 | |

| Other assets | |

| 3,272 | | |

| 2,944 | |

| Total assets | |

$ | 181,454 | | |

$ | 78,954 | |

| Liabilities and Stockholders’ Equity | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 4,429 | | |

$ | 2,434 | |

| Accrued expenses and other current liabilities | |

| 5,408 | | |

| 2,732 | |

| Operating lease liability | |

| 1,124 | | |

| 983 | |

| Total current liabilities | |

| 10,961 | | |

| 6,149 | |

| Operating lease liability, non-current | |

| 3,359 | | |

| 4,484 | |

| Total liabilities | |

| 14,320 | | |

| 10,633 | |

| Commitments and contingencies | |

| | | |

| | |

| Stockholders’ Equity: | |

| | | |

| | |

| Preferred stock, $0.001 par value, authorized 10,000,000 shares: | |

| | | |

| | |

| Series 1 convertible preferred stock, 8,028 shares authorized at December 31, 2024 and 2023, 7,991 shares issued and outstanding as of December 31, 2024 and 2023. | |

| - | | |

| - | |

| Common stock, $0.001 par value, authorized 100,000,000 shares: | |

| | | |

| | |

| Common stock, 35,044,772 and 11,364,903 shares issued and outstanding as of December 31, 2024 and 2023, respectively. | |

| 35 | | |

| 11 | |

| Additional paid in capital | |

| 412,077 | | |

| 268,725 | |

| Accumulated deficit | |

| (244,980 | ) | |

| (200,384 | ) |

| Accumulated other comprehensive income (loss) | |

| 2 | | |

| (31 | ) |

| Total stockholders’ equity | |

| 167,134 | | |

| 68,321 | |

| Total liabilities and stockholders’ equity | |

$ | 181,454 | | |

$ | 78,954 | |

PROTARA THERAPEUTICS, INC. AND SUBSIDIARIES

Consolidated Statements of Operations and Comprehensive Loss

(in thousands, except share and per share data)

| | |

(Unaudited) | | |

(Audited) | |

| | |

For the Three Months Ended | | |

For the Years Ended | |

| | |

December 31, | | |

December 31, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Operating expenses: | |

| | |

| | |

| | |

| |

| Research and development | |

$ | 9,499 | | |

$ | 6,381 | | |

$ | 31,704 | | |

$ | 24,989 | |

| General and administrative | |

| 4,813 | | |

| 4,660 | | |

| 17,450 | | |

| 18,624 | |

| Total operating expenses | |

| 14,312 | | |

| 11,041 | | |

| 49,154 | | |

| 43,613 | |

| Income (Loss) from operations | |

| (14,312 | ) | |

| (11,041 | ) | |

| (49,154 | ) | |

| (43,613 | ) |

| Other income (expense), net: | |

| | | |

| | | |

| | | |

| | |

| Interest and investment income | |

| 1,156 | | |

| 820 | | |

| 4,171 | | |

| 3,193 | |

| Other income | |

| 387 | | |

| - | | |

| 387 | | |

| - | |

| Other income (expense), net | |

| 1,543 | | |

| 820 | | |

| 4,558 | | |

| 3,193 | |

| Net income (loss) | |

$ | (12,769 | ) | |

$ | (10,221 | ) | |

$ | (44,596 | ) | |

$ | (40,420 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other comprehensive income (loss): | |

| | | |

| | | |

| | | |

| | |

| Net unrealized gain (loss) on marketable debt securities | |

| (27 | ) | |

| 134 | | |

| 33 | | |

| 657 | |

| Other comprehensive income (loss) | |

| (27 | ) | |

| 134 | | |

| 33 | | |

| 657 | |

| Comprehensive income (loss) | |

$ | (12,796 | ) | |

$ | (10,087 | ) | |

$ | (44,563 | ) | |

$ | (39,763 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net income (loss) per share attributable to common stockholders, basic and diluted | |

$ | (0.48 | ) | |

$ | (0.90 | ) | |

$ | (2.17 | ) | |

$ | (3.57 | ) |

| Weighted-average shares outstanding, basic and diluted | |

| 26,432,563 | | |

| 11,364,903 | | |

| 20,592,847 | | |

| 11,331,338 | |

Company Contact:

Justine O’Malley

Protara Therapeutics

Justine.OMalley@protaratx.com

646-817-2836

7

v3.25.0.1

Cover

|

Mar. 05, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Mar. 05, 2025

|

| Entity File Number |

001-36694

|

| Entity Registrant Name |

Protara Therapeutics,

Inc.

|

| Entity Central Index Key |

0001359931

|

| Entity Tax Identification Number |

20-4580525

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

345 Park Avenue South

|

| Entity Address, Address Line Two |

Third Floor

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10010

|

| City Area Code |

(646)

|

| Local Phone Number |

844-0337

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

TARA

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

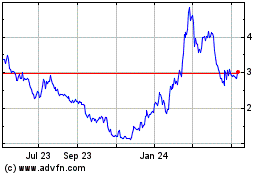

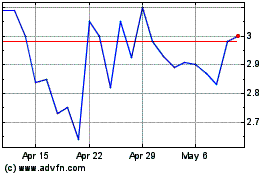

Protara Therapeutics (NASDAQ:TARA)

Historical Stock Chart

From Feb 2025 to Mar 2025

Protara Therapeutics (NASDAQ:TARA)

Historical Stock Chart

From Mar 2024 to Mar 2025