UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 11-K

(Mark One)

|

|

|

|

[x]

|

ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended:

December 31, 2016

OR

|

|

|

|

[ ]

|

TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from ____________ to _____________

Commission file number:

1-16725

The Principal Select Savings Plan for Employees

(Full title of the plan)

Principal Financial Group, Inc.

(Name of Issuer of the securities held pursuant to the plan)

711 High Street

Des Moines, Iowa 50392

(Address of principal executive offices) (Zip Code)

Report of Independent Registered Public Accounting Firm

The Benefit Plans Administration Committee Principal Financial Group, Inc.

We have audited the accompanying statements of net assets available for benefits of The Principal Select Savings Plan for Employees as of December 31, 2016 and 2015, and the related statement of changes in net assets available for benefits for the year ended December 31, 2016. These financial statements are the responsibility of the Plan's management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. We were not engaged to perform an audit of the Plan's internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Plan's internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the net assets available for benefits of The Principal Select Savings Plan for Employees at December 31, 2016 and 2015, and the changes in its net assets available for benefits for the year ended December 31, 2016, in conformity with U.S. generally accepted accounting principles.

The accompanying supplemental schedule of assets (held at end of year) as of December 31, 2016, has been subjected to audit procedures performed in conjunction with the audit of the Principal Select Savings Plan for Employee’s financial statements. The information in the supplemental schedule is the responsibility of the Plan’s management. Our audit procedures included determining whether the information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental schedule. In forming our opinion on the information, we evaluated whether such information, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the information is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ Ernst & Young LLP

Des Moines, Iowa

June 23, 2017

|

|

|

|

|

|

|

|

|

|

|

|

The Principal Select Savings Plan for Employees

|

|

|

|

|

|

|

|

|

Statements of Net Assets Available for Benefits

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31,

|

|

|

2016

|

|

2015

|

|

Assets

|

|

|

|

|

|

|

Investments at fair value:

|

|

|

|

|

|

|

Unallocated investment options:

|

|

|

|

|

|

|

Guaranteed interest accounts

|

$

|

31,850,344

|

|

|

$

|

32,414,952

|

|

|

Separate accounts

|

|

1,907,550,374

|

|

|

|

1,723,700,371

|

|

|

Principal Financial Group, Inc. Employee Stock

|

|

|

|

|

|

|

Ownership Plan

|

|

117,318,296

|

|

|

|

90,634,768

|

|

|

Collective investment trust

|

|

—

|

|

|

|

1,214,933

|

|

|

Self-directed brokerage account

|

|

807,420

|

|

|

|

—

|

|

|

Total invested assets at fair value

|

|

2,057,526,434

|

|

|

|

1,847,965,024

|

|

|

Plan interest in Master Trust at contract value

|

|

101,571,136

|

|

|

|

75,508,792

|

|

|

Total investments

|

|

2,159,097,570

|

|

|

|

1,923,473,816

|

|

|

|

|

|

|

|

|

|

Receivables:

|

|

|

|

|

|

|

Contributions receivable from employer

|

|

—

|

|

|

|

2,131

|

|

|

Contributions receivable from participants

|

|

236

|

|

|

|

409

|

|

|

Notes receivable from participants

|

|

22,493,123

|

|

|

|

21,896,623

|

|

|

Other receivables

|

|

580

|

|

|

|

41,668

|

|

|

Total receivables

|

|

22,493,939

|

|

|

|

21,940,831

|

|

|

Net assets available for benefits

|

$

|

2,181,591,509

|

|

|

$

|

1,945,414,647

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See accompanying notes.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Principal Select Savings Plan for Employees

|

|

|

|

|

|

Statement of Changes in Net Assets Available for Benefits

|

|

|

|

|

|

|

For the

|

|

|

year ended

|

|

|

December 31,

|

|

|

2016

|

|

Additions

|

|

|

|

Investment income:

|

|

|

|

Interest

|

$

|

260,170

|

|

Dividends

|

|

3,612,182

|

|

Net appreciation of investments

|

|

183,674,267

|

|

Interest in Master Trust

|

|

1,357,486

|

|

Total investment income

|

|

188,904,105

|

|

|

|

|

|

Interest income on notes receivable from participants

|

|

1,158,058

|

|

|

|

|

|

Contributions:

|

|

|

|

Employer

|

|

43,333,244

|

|

Employer - Other

|

|

1,131,755

|

|

Participants

|

|

90,385,417

|

|

Transfers from affiliated and unaffiliated plans, net

|

|

19,102,373

|

|

Total contributions

|

|

153,952,789

|

|

Total additions

|

|

344,014,952

|

|

|

|

|

|

Deductions

|

|

|

|

Benefits paid to participants

|

|

106,362,535

|

|

Administrative expenses

|

|

|

1,475,555

|

|

Total deductions

|

|

107,838,090

|

|

Net increase

|

|

236,176,862

|

|

|

|

|

|

Net assets available for benefits at beginning of year

|

|

1,945,414,647

|

|

Net assets available for benefits at end of year

|

$

|

2,181,591,509

|

|

|

|

|

|

See accompanying notes.

|

|

|

The Principal Select Savings Plan for Employees

Notes to Financial Statements

Year Ended December 31, 2016

1. Significant Accounting Policies

Basis of Accounting

The accounting records of The Principal Select Savings Plan for Employees (the Plan) are

maintained on the accrual basis of accounting.

Valuation of Investments and Income Recognition

Investments held by the Plan are stated at fair value, which is defined as the price that would be received to sell an asset in an orderly transaction between market participants at the measurement date (an exit price). See Note 4 for further discussion and disclosures related to fair value measurements.

Interest income is recorded as earned. Dividends are recorded on the ex-dividend date. Net appreciation includes the Plan’s gains and losses on investments bought and sold as well as held during the year.

Notes Receivable From Participants

The notes receivable from participants are reported at their unpaid principal balance plus any accrued but unpaid interest. Interest income on notes receivable from participants is recorded when earned.

Payment of Benefits

Benefits are recorded when paid.

Risks and Uncertainties

The Plan invests in various investment securities. Investment securities are exposed to various risks such as interest rate, market volatility, and credit risks. Due to the level of risk associated with certain investment securities, it is at least reasonably possible that changes in the values of investment securities will occur in the near term and that such changes could materially affect participants’ account balances and the amounts reported in the Statements of Net Assets Available for Benefits.

Use of Estimates

The preparation of financial statements in conformity with U.S. generally accepted accounting principles (GAAP) requires management to make estimates that affect the amounts reported in the financial statements and accompanying notes and supplemental schedule. Actual results could differ from those estimates.

The Principal Select Savings Plan for Employees

Notes to Financial Statements (continued)

1. Significant Accounting Policies (continued)

Recent Accounting Pronouncement

In February 2017, the Financial Accounting Standards Board (FASB) issued authoritative guidance that requires additional disclosures from master trusts. This guidance is effective for annual periods beginning after December 15, 2018, and will not have a material impact on the Plan’s financial statements.

In July 2015, the FASB issued authoritative guidance that simplifies the benefit-responsive investment contracts, investment and fair value measurement disclosure requirements. This guidance was adopted retrospectively in 2016 and did not have a material impact on the Plan’s financial statements.

In May 2015, the FASB issued authoritative guidance that removes the requirement to categorize within the fair value hierarchy all investments for which fair value is measured using the net asset value (NAV) per share practical expedient. This guidance was adopted retrospectively in 2016 and did not have a material impact on the Plan’s financial statements. See Note 4 for disclosures related to fair value measurements.

2. Description of the Plan

The Plan is a defined contribution 401(k) plan that was established January 1, 1985. The Plan is available to substantially all employees of Principal Life Insurance Company (Principal Life) and its subsidiaries or affiliates (the Company). Effective November 2016, the Plan Sponsor changed from Principal Life to Principal Financial Group, Inc. (PFG), the ultimate parent of Principal Life.

Information about the Plan, including eligibility, and benefit provisions is contained in the Summary Plan Description. Copies of the Summary Plan Description are available from Principal Life’s Human Resources Benefits Department or the Company’s intranet. The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended (ERISA).

The Plan Administrator is responsible for the control and administration of the Plan. The Plan Administrator is the Benefit Plans Administration Committee (BPAC). For the purposes of investment and protection of Plan assets, the named fiduciary of the Plan is the Benefit Plans Investment Committee. The Plan is funded through a trust fund that holds group annuity contracts issued by Principal Life. The PFG Employee Stock Ownership Plan (ESOP), which consists of common stock of PFG, is held in a separate trust. The Trustees of the Trust that hold the group annuity contracts are employees of Principal Life. Bankers Life is the Trustee of the Trust that holds PFG common stock in the ESOP. Delaware Charter Guarantee & Trust Company (DCG), doing business as Principal Trust Company, an affiliate of Principal Life, is the Trustee of the collective investment trust (CIT) and the Directed Trustee of the self-directed brokerage account (SDBA). Principal Life is the recordkeeper of the Plan.

The Principal Select Savings Plan for Employees

Notes to Financial Statements (continued)

2. Description of the Plan (continued)

Contributions

On January 1, 2006, the Company made several changes to the retirement program. Participants who were age 47 or older with at least ten years of service on December 31, 2005, could elect to retain the prior benefit provisions under the qualified defined benefit retirement plan and the Plan and forgo receipt of the additional benefits offered by amendments to the Plan. The participants who elected to retain the prior benefit provisions are referred to as “Grandfathered Choice Participants.”

Matching contributions for participants other than Grandfathered Choice Participants were increased from 50% to 75% of deferrals, with the maximum matching deferral increasing from 6% to 8% of eligible pay-period compensation.

Vesting

Participants are eligible for immediate entry into the Plan with vesting at 100% after three years. The funds accumulate along with interest and investment return and are available for withdrawal by participants at retirement, termination, or when certain withdrawal specifications are met. The participants may also obtain loans of their vested accrued benefit, subject to certain limitations described in the governing document (the Plan Document). The federal and state income taxes of the participant are deferred (except in the case of Roth deferrals) on the contributions until the funds are withdrawn from the Plan.

Forfeitures

Upon termination of employment, participants forfeit their non-vested balances. Forfeited amounts are used to reduce Company contributions. As of December 31, 2016 and 2015, forfeited non-vested account balances totaled $17,789 and $343,573, respectively. In 2016 and 2015, employer contributions were reduced by $1,077,789 and $1,389,205, respectively, from forfeited non-vested accounts.

Participant Loans

The Plan provides for loans to active participants, which are considered a participant-directed investment of his/her account. The loan is a Plan asset, but only the borrowing participant’s account shares in the interest paid on the loan or bears any expense or loss incurred because of the loan. The rate of interest is 2% higher than the Federal Reserve “Bank Prime Loan” rate at the time of the loan. The rate is set the day a loan is approved. Beginning December 15, 2016, the rate for loans issued was 5.75%. The rate for loans issued between December 17, 2015 and December 14, 2016 was 5.50%. The rate for loans prior to December 17, 2015 was 5.25%.

The Principal Select Savings Plan for Employees

Notes to Financial Statements (continued)

2. Description of the Plan (continued)

Plan Termination

Although it has not expressed any intent to do so, the Company has the right under the Plan to discontinue its contributions at any time and to terminate the Plan subject to the provisions of ERISA. In the event the Plan terminates, affected participants will become fully vested in their accounts.

3. Income Tax Status

The Plan has received a determination letter from the Internal Revenue Service (the IRS) dated July 9, 2012, stating that the Plan is qualified under Section 401(a) of the Internal Revenue Code (the Code) and, therefore, the related trust is exempt from taxation. Subsequent to this determination by the IRS, the Plan was amended and restated. The Plan is required to operate in conformity with the terms of the Plan Document and the Code to maintain its qualification. BPAC and the Company intend to operate the Plan in conformity with the provisions of the Plan Document and the Code. BPAC and the Company acknowledge that inadvertent errors may occur in the operation of the Plan. If such inadvertent errors occur, BPAC and the Company represent that they will take the necessary steps to bring the Plan’s operations into compliance with the Code, including voluntarily and timely correcting such errors in accordance with procedures established by the IRS.

Plan management is required to evaluate uncertain tax positions taken by the Plan. The financial statement effects of an uncertain tax position are recognized when the position is more likely than not, based on the technical merits, to be sustained upon examination by the IRS. BPAC relies on the representations of the corporate tax department regarding the tax positions taken by the Plan and has concluded that as of December 31, 2016, there are no uncertain positions taken or expected to be taken. The Plan has recognized no interest or penalties related to uncertain tax positions.

The Plan is subject to routine audits by taxing jurisdictions. Plan management believes the Plan is no longer subject to income tax examinations for years prior to 2013.

4. Fair Value of Financial Instruments (excluding interest in Master Trust)

Valuation Hierarchy

Fair value is defined as the price that would be received to sell an asset in an orderly transaction between market participants at the measurement date (an exit price). The fair value hierarchy prioritizes the inputs to valuation techniques used to measure fair value into three levels.

The Principal Select Savings Plan for Employees

Notes to Financial Statements (continued)

4. Fair Value of Financial Instruments (excluding interest in Master Trust) (continued)

|

|

|

|

•

|

Level 1 – Fair values are based on unadjusted quoted prices in active markets for identical assets. Our Level 1 assets include the Principal Financial Group, Inc. ESOP and the self-directed brokerage account.

|

|

|

|

|

•

|

Level 2– Fair values are based on inputs other than quoted prices within Level 1 that are observable for the asset, either directly or indirectly. Our Level 2 assets are separate accounts and the CIT and are reflected at NAV.

|

|

|

|

|

•

|

Level 3 – Fair values are based on significant unobservable inputs for the

asset. Our Level 3 assets are guaranteed interest accounts.

|

Transfers between fair value hierarchy levels are recognized at the beginning of the reporting period. There were no transfers between levels during 2016 and 2015.

Determination of Fair Value

The following discussion describes the valuation methodologies used for assets measured at fair value on a recurring basis. The techniques utilized in estimating the fair values of financial instruments are reliant on the assumptions used. Care should be exercised in deriving conclusions based on the fair value information of financial instruments presented below.

Fair value estimates are made at a specific point in time, based on available market information and judgments about the financial instrument. Such estimates do not consider the tax impact of the realization of unrealized gains or losses. In addition, the disclosed fair value may not be realized in the immediate settlement of the financial instrument. There were no significant changes to the valuation processes during 2016.

The unallocated investment options consist of guaranteed interest accounts under a guaranteed benefit policy (as defined in section 401(b) of ERISA) and separate accounts (as defined in ERISA section 3(17)) of Principal Life. The guaranteed interest accounts are reported at fair value and the separate accounts are reported at NAV as determined by Principal Life. These unallocated investment options are non-benefit-responsive.

Guaranteed Interest Accounts

The guaranteed interest accounts cannot be sold to a third party; thus, the only option to exit the guaranteed interest accounts is to withdraw or transfer the funds prior to maturity for an event other than death, disability, termination, or retirement. The fair value represents guaranteed interest account values adjusted to reflect current market interest rates only to the extent such market rates exceed contract crediting rates. This value represents contributions allocated to the guaranteed interest accounts, plus interest at the contractually guaranteed rate, less funds used to pay Plan

The Principal Select Savings Plan for Employees

Notes to Financial Statements (continued)

4. Fair Value of Financial Instruments (excluding interest in Master Trust) (continued)

benefits and Principal Life’s administrative expenses. The fair value of the guaranteed interest accounts is reflected in Level 3.

Separate Accounts

Separate accounts are designed to deliver safety and stability by preserving principal and accumulating earnings. The separate account assets include, but are not limited to, contributions invested in domestic and international common stocks, high-quality short-term debt securities, real estate, private market bonds and mortgages, and high-yield fixed income securities that are slightly below investment grade, all of which are valued at fair value. The NAV of each of the separate accounts is calculated in a manner consistent with GAAP for investment companies and is determinative of their fair value and represents the price at which the Plan would be able to initiate a transaction. The fair value of the underlying funds and securities is used to determine the NAV of the separate account, which is not publicly quoted. The fair value of the underlying mutual funds and equity securities are based on quoted prices of identical assets. The fair value of the underlying fixed income securities are based on third-party pricing vendors that utilize observable market information. As of December 31, 2016, all separate accounts are reflected in Level 2.

One separate account invests in real estate. The fair value of the underlying real estate is estimated using discounted cash flow valuation models that utilize public real estate market data inputs such as transaction prices, market rents, vacancy levels, leasing absorption, market cap rates, and discount rates. In addition, each property is appraised annually by an independent appraiser. The fair value of the separate account is based on NAV and is considered a Level 2 asset.

There are currently no redemption restrictions on these investments.

Principal Financial Group, Inc. ESOP

The ESOP is reported at fair value based on the quoted closing market price of PFG’s stock on the last business day of the Plan year and is reflected in Level 1.

Collective Investment Trust

The CIT invests in a variety of common stocks, bonds, U.S. government and government agency securities, senior floating rate interests (bank loans) and derivatives. The CIT values securities at market value using the last reported sale price when market quotations are readily available. If no sales are reported securities are valued using the last reported bid price or an evaluated bid price provided by a pricing service. Pricing services use modeling techniques that incorporate security characteristics, market conditions and dealer-supplied valuations to determine an evaluated bid price. When market quotations are not readily available, DCG determines the fair value. The NAV

The Principal Select Savings Plan for Employees

Notes to Financial Statements (continued)

4. Fair Value of Financial Instruments (excluding interest in Master Trust) (continued)

of the CIT is calculated in a manner consistent with GAAP for investment companies and is determinative of their fair value and represents the price at which the Plan would be able to initiate a transaction. The fair value of the underlying funds and securities is used to determine the NAV of the CIT. The Plan exited this investment in 2016.

Self-Directed Brokerage Account

Effective March 1, 2016 the Principal SDBA was added to the Plan. Plan participants have access to a limited number of mutual funds through the SDBA. The SDBA is reflected in Level 1.

Assets Measured at Fair Value on a Recurring Basis

Assets measured at fair value on a recurring basis are summarized below.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of December 31, 2016

|

|

|

Assets

|

|

|

Fair Value Hierarchy Level

|

|

|

measured

|

|

|

|

|

|

|

|

|

|

|

|

at fair

|

|

|

|

|

|

|

|

|

|

|

|

value

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Assets

|

|

|

|

|

|

|

|

|

|

|

|

|

Guaranteed interest accounts

|

$

|

31,850,344

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

31,850,344

|

|

|

Separate accounts

|

|

1,907,550,374

|

|

|

—

|

|

|

|

1,907,550,374

|

|

|

|

—

|

|

|

Principal Financial Group, Inc. ESOP

|

|

117,318,296

|

|

|

117,318,296

|

|

|

|

—

|

|

|

|

—

|

|

|

Self-directed brokerage account

|

|

807,420

|

|

|

807,420

|

|

|

|

—

|

|

|

|

—

|

|

|

Total invested assets, excluding Plan

|

|

|

|

|

|

|

|

|

|

|

|

|

interest in Master Trust

|

$

|

2,057,526,434

|

|

$

|

118,125,716

|

|

|

$

|

1,907,550,374

|

|

|

$

|

31,850,344

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of December 31, 2015

|

|

|

Assets

|

|

|

Fair Value Hierarchy Level

|

|

|

measured

|

|

|

|

|

|

|

|

|

|

|

|

at fair

|

|

|

|

|

|

|

|

|

|

|

|

value

|

|

|

Level 1

|

|

|

Level 2

|

|

|

Level 3

|

|

Assets

|

|

|

|

|

|

|

|

|

|

|

|

|

Guaranteed interest accounts

|

$

|

32,414,952

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

32,414,952

|

|

|

Separate accounts

|

|

1,723,700,371

|

|

|

—

|

|

|

|

1,723,700,371

|

|

|

|

—

|

|

|

Principal Financial Group, Inc. ESOP

|

|

90,634,768

|

|

|

90,634,768

|

|

|

|

—

|

|

|

|

—

|

|

|

Collective investment trust

|

|

1,214,933

|

|

|

—

|

|

|

|

1,214,933

|

|

|

|

—

|

|

|

Total invested assets, excluding Plan

|

|

|

|

|

|

|

|

|

|

|

|

|

interest in Master Trust

|

$

|

1,847,965,024

|

|

$

|

90,634,768

|

|

|

$

|

1,724,915,304

|

|

|

$

|

32,414,952

|

|

The Principal Select Savings Plan for Employees

Notes to Financial Statements (continued)

4. Fair Value of Financial Instruments (excluding interest in Master Trust) (continued)

Changes in Level 3 Fair Value Measurements

The reconciliation for all assets measured at fair value on a recurring basis using significant unobservable inputs (Level 3) for the years ended December 31, 2016 and 2015, was as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the year ended December 31, 2016

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Changes in

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized

|

|

|

|

Beginning

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Losses

|

|

|

|

Asset

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ending Asset

|

|

|

|

Included in Changes

|

|

|

|

Balance

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance

|

|

|

|

in Net Assets

|

|

|

|

as of

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transfers

|

|

|

|

as of

|

|

|

|

Available for

|

|

|

|

January 1,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In (Out) of

|

|

|

|

December 31,

|

|

|

|

Benefits Relating to

|

|

|

|

2016

|

|

|

|

Interest*

|

|

|

|

Purchases**

|

|

|

|

Sales**

|

|

|

|

Level 3

|

|

|

|

2016

|

|

|

|

Positions Still Held

|

|

Assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Guaranteed interest

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

accounts

|

$

|

32,414,952

|

|

|

$

|

256,237

|

|

|

$

|

10,817,320

|

|

|

$

|

(11,638,165)

|

|

|

$

|

—

|

|

|

|

$

|

31,850,344

|

|

|

$

|

(3,933)

|

|

Total

|

$

|

32,414,952

|

|

|

$

|

256,237

|

|

|

$

|

10,817,320

|

|

|

$

|

(11,638,165)

|

|

|

$

|

—

|

|

|

|

$

|

31,850,344

|

|

|

$

|

(3,933)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the year ended December 31, 2015

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Changes in

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized

|

|

|

|

Beginning

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Losses

|

|

|

|

Asset

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ending Asset

|

|

|

|

Included in Changes

|

|

|

|

Balance

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance

|

|

|

|

in Net Assets

|

|

|

|

as of

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transfers

|

|

|

|

as of

|

|

|

|

Available for

|

|

|

|

January 1,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In (Out) of

|

|

|

|

December 31,

|

|

|

|

Benefits Relating to

|

|

|

|

2015

|

|

|

|

Interest*

|

|

|

|

Purchases**

|

|

|

|

Sales**

|

|

|

|

Level 3

|

|

|

|

2015

|

|

|

|

Positions Still Held

|

|

Assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Guaranteed interest

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

accounts

|

$

|

35,395,260

|

|

|

$

|

143,990

|

|

|

$

|

12,457,002

|

|

|

$

|

(15,581,300)

|

|

|

$

|

—

|

|

|

|

$

|

32,414,952

|

|

|

$

|

(127,219)

|

|

Total

|

$

|

35,395,260

|

|

|

$

|

143,990

|

|

|

$

|

12,457,002

|

|

|

$

|

(15,581,300)

|

|

|

$

|

—

|

|

|

|

$

|

32,414,952

|

|

|

$

|

(127,219)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*Includes interest and unrealized gains or losses.

|

|

|

|

**

|

Includes contributions, transfers from affiliated and unaffiliated plans, transfers to other investments via participant election, benefits paid to participants, and administrative expenses.

|

The Principal Select Savings Plan for Employees

Notes to Financial Statements (continued)

4. Fair Value of Financial Instruments (excluding interest in Master Trust) (continued)

Quantitative Information about Level 3 Fair Value Measurements

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The following table provides quantitative information about the significant unobservable inputs used for recurring fair value measurements categorized within Level 3.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of December 31, 2016

|

|

|

|

|

Assets measured

|

|

|

Valuation

|

|

|

Unobservable

|

|

Input/range of inputs

|

|

|

|

|

at fair value

|

|

|

technique

|

|

|

input description

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

|

|

|

Guaranteed interest

|

|

$

|

31,850,344

|

|

|

See note (1)

|

|

|

Interest rate on account

|

|

0.10% – 2.36%

|

|

accounts

|

|

|

|

|

|

|

|

|

Applicable interest rate

|

|

1.31% – 2.59%

|

|

|

|

|

|

|

|

|

|

|

|

|

12/31/2016 –

|

|

|

|

|

|

|

|

|

|

|

Maturity date

|

|

12/31/2022

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of December 31, 2015

|

|

|

|

|

Assets measured

|

|

|

Valuation

|

|

|

Unobservable

|

|

Input/range of inputs

|

|

|

|

|

at fair value

|

|

|

technique

|

|

|

input description

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

|

|

|

Guaranteed interest

|

|

$

|

32,414,952

|

|

|

See note (1)

|

|

|

Interest rate on account

|

|

0.10% – 2.36%

|

|

accounts

|

|

|

|

|

|

|

|

|

Applicable interest rate

|

|

1.10% – 2.43%

|

|

|

|

|

|

|

|

|

|

|

|

|

12/31/2015 –

|

|

|

|

|

|

|

|

|

|

|

Maturity date

|

|

12/31/2021

|

|

|

|

|

(1)

|

If the applicable interest rate is equal to or less than the interest rate on the account, the fair market value is equal to the contract value.

|

If the applicable interest rate is greater than the interest rate on the account, the fair market value is the contract value reduced by a percentage. This percentage is equal to the difference between the applicable interest rate and the interest rate on the account, multiplied by the number of years (including fractional parts of a year) until the maturity date.

5. Interest in Principal Select Stable Value Separate Account

In 2016, the Principal Select Saving Stable Value Master Trust (Master Trust) was liquidated and transferred to the Principal Select Stable Value Separate Account (PSSVSA), which is reported as a Master Trust Investment Account (MTIA). The MTIA was established for the investment of assets of the Principal Select Savings Plan for Employees and the Principal Select Savings Plan for Individual Field (Plans). The Plans gain access to the PSSVSA through a group annuity contract (Contract) issued by Principal Life, an affiliate. Each participating plan has an undivided interest in the PSSVSA. The PSSVSA is an insurance company separate account that invests in the Morley Stable Income Bond Fund (Bond Fund) and the Principal Liquid Asset Separate Account (PLASA). The Bond Fund is a collective investment trust that invests in investment-grade fixed income securities. The Bond Fund was maintained by Principal Global Investors & Trust Company, an affiliate of Principal Life. The PSSVSA is valued at contract value as reported to the Plans by Principal Life.

The Principal Select Savings Plan for Employees

Notes to Financial Statements (continued)

5. Interest in Principal Select Stable Value Separate Account (continued)

In 2015, the Master Trust was utilized for the investment of assets of the Plans. Each participating plan had an undivided interest in the Master Trust. The Master Trust invested in a Short Term Investment Fund (STIF) and the Bond Fund. The Master Trust also entered into a fully benefit-responsive synthetic guaranteed investment contract (synthetic GIC) with Principal Life. The STIF, Bond Fund, and the synthetic GIC together were the holdings of the Stable Value Fund (Fund). The Fund was valued at contract value as reported to the Plan by Morley Capital Management, Inc., the investment manager of the Bond Fund and an affiliate of Principal Life.

As of December 31, 2016 and 2015, the Plan’s interest in the net assets of the MTIA and Master Trust was approximately 87% and 89%, respectively. Investment income and administrative expenses are allocated to the individual plans based upon the Plan’s interest in the MTIA and Master Trust.

The Contract provides a crediting rate that amortizes portfolio gains and losses over time and accounts for benefit payments to the Plans’ participants at the contract value. Under the Contract, Principal Life agrees to pay any deficiency if the investments in the PSSVSA have been exhausted for benefit payments and the contract value is greater than zero. The objective of the PSSVSA is to preserve capital, credit relatively stable returns consistent with its comparatively low risk profile, and provide liquidity for benefit-responsive payments. The crediting interest rate is based on a formula agreed upon with Principal Life, but it may not be less than 0%. Such interest rates are reviewed on a monthly basis for resetting.

Certain events limit the ability of the Plans to transact at contract value with Principal Life when material event withdrawals are made, including (1) certain termination of employment of a group of participants (including through layoffs or early retirement incentive programs instituted by the Company) of 25% or more of the Plan Members in any calendar year, (2) a certain spin-off or sale of the Company’s business entity or location that affect more than 25% of the Plan Members, (3) certain adoptions of amendments to one of the plans, any change in practice, or any change in participant withdrawal rights under one of the plans. The plans do not believe that the occurrence of any such material event is probable.

As required by Accounting Standards Codification (ASC) 962, Plan Accounting – Defined Contribution Pension Plans, the Statements of Net Assets Available for Benefits present the fair value of investments, excluding the fully benefit-responsive investment contract which is presented at contract value. The Statement of Changes in Net Assets Available for Benefits is prepared on a contract value basis.

The Principal Select Savings Plan for Employees

Notes to Financial Statements (continued)

5. Interest in Principal Select Stable Value Separate Account (continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The net assets, including investments, of the MTIA and Master Trust were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31,

|

|

|

|

|

|

2016

|

|

|

|

2015

|

|

|

|

|

|

|

|

|

|

|

|

|

PLASA

|

|

$

|

5,914,788

|

|

|

|

$

|

—

|

|

|

|

STIF

|

|

|

—

|

|

|

|

|

4,078,887

|

|

|

|

Bond Fund

|

|

|

110,325,057

|

|

|

|

|

80,426,608

|

|

|

|

Total assets

|

|

|

116,239,845

|

|

|

|

|

84,505,495

|

|

|

|

Receivables (payables)

|

|

|

(6,983)

|

|

|

|

|

231,732

|

|

|

|

Total net assets at contract value

|

|

$

|

116,232,862

|

|

|

|

$

|

84,737,227

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Plan interest in the MTIA and Master Trust

|

|

$

|

101,571,136

|

|

|

|

$

|

75,508,792

|

|

|

|

|

|

|

|

|

|

|

Investment income for the MTIA was as follows:

|

|

|

|

|

|

|

|

|

|

|

|

For the year ended

|

|

|

|

|

December 31,

|

|

|

|

|

2016

|

|

|

|

|

|

|

|

Interest income

|

$

|

1,657,486

|

|

|

Other income

|

|

215

|

|

|

Expenses

|

|

(127,058)

|

|

|

Total investment income

|

$

|

1,530,643

|

|

6. Related Party Transactions

In addition to the transactions with parties-in-interest discussed herein, Principal Life provides recordkeeping services to the Plan and receives fees. Beginning in March 2016, fees were paid by Plan participants. Prior to March 2016, fees were paid by Plan investments. These transactions are exempt from the prohibited transactions rules of ERISA. The Company may pay other Plan expenses from time to time. As part of the Principal Select Savings Stable Value Fund investment, the Plan purchases a wrap contract from Principal Life. The ESOP received $3,612,182 in dividends from PFG in 2016.

The Principal Select Savings Plan for Employees

Notes to Financial Statements (continued)

7. Form 5500

The following table reconciles net assets available for benefits per the Statements of Net Assets Available for Benefits to the Form 5500:

|

|

|

|

|

|

|

|

|

|

|

|

December 31,

|

|

|

|

|

2016

|

|

|

2015

|

|

|

Net assets available for benefits per the Statements of

|

|

|

|

|

|

|

|

Net Assets Available for Benefits

|

$

|

2,181,591,509

|

|

$

|

1,945,414,647

|

|

|

Adjustments from contract value to fair value for fully

|

|

|

|

|

|

|

|

benefit-responsive investment contract

|

|

(947,006)

|

|

|

(404,127)

|

|

|

Net assets available for benefits per the Form 5500

|

$

|

2,180,644,503

|

|

$

|

1,945,010,520

|

|

The following table reconciles the Statement of Changes in Net Assets Available for Benefits to the Form 5500:

|

|

|

|

|

|

|

|

|

|

|

|

December 31,

|

|

|

|

|

|

2016

|

|

|

Net change from contract value to fair value for fully benefit-responsive

|

|

|

|

|

|

investment contracts

|

|

$

|

(542,879)

|

|

|

Master Trust investment income

|

|

|

1,357,486

|

|

|

Net investment loss from Master Trust investment accounts per the Form 5500

|

|

$

|

814,607

|

|

GAAP requires that the Plan reports interest in fully benefit-responsive contracts at contract value, while the Form 5500 is required to report these investments at fair value.

The Principal Select Savings Plan for Employees

EIN: 42-1520346 Plan Number: 003

Schedule H, Line 4i – Schedule of Assets

(Held at End of Year)

December 31, 2016

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Description of

|

|

Current

|

|

Identity of Issuer

|

|

Investment

|

|

Value

|

|

|

|

|

|

|

|

|

Principal Life Insurance

|

|

|

|

|

|

|

Company*

|

|

Deposits in guaranteed interest accounts

|

|

$

|

31,850,344

|

|

|

|

|

|

|

|

|

Principal Life Insurance

|

|

Deposits in insurance company Small-Cap Value II

|

|

|

|

|

Company*

|

|

Separate Account

|

|

|

29,903,627

|

|

|

|

|

|

|

|

|

Principal Life Insurance

|

|

Deposits in insurance company Large-Cap

|

|

|

|

|

Company*

|

|

Growth Separate Account

|

|

|

65,971,460

|

|

|

|

|

|

|

|

|

Principal Life Insurance

|

|

Deposits in insurance company U.S. Property

|

|

|

|

|

Company*

|

|

Separate Account

|

|

|

215,490,632

|

|

|

|

|

|

|

|

|

Principal Life Insurance

|

|

Deposits in insurance company Core Plus Bond

|

|

|

|

|

Company*

|

|

Separate Account

|

|

|

98,180,091

|

|

|

|

|

|

|

|

|

Principal Life Insurance

|

|

Deposits in insurance company Diversified

|

|

|

|

|

Company*

|

|

International Separate Account

|

|

|

124,593,536

|

|

|

|

|

|

|

|

|

Principal Life Insurance

|

|

Deposits in insurance company Large-Cap Stock

|

|

|

|

|

Company*

|

|

Index Separate Account

|

|

|

266,256,185

|

|

|

|

|

|

|

|

|

Principal Life Insurance

|

|

Deposits in insurance company Government and

|

|

|

|

|

Company*

|

|

High Quality Bond Separate Account

|

|

|

31,280,151

|

|

|

|

|

|

|

|

|

Principal Life Insurance

|

|

Deposits in insurance company Mid-Cap Separate

|

|

|

|

|

Company*

|

|

Account

|

|

|

169,450,550

|

|

|

|

|

|

|

|

|

Principal Life Insurance

|

|

Deposits in insurance company International

|

|

|

|

|

Company*

|

|

Emerging Markets Separate Account

|

|

|

80,275,927

|

|

|

|

|

|

|

|

|

Principal Life Insurance

|

|

Deposits in insurance company Large-Cap

|

|

|

|

|

Company*

|

|

Value Separate Account

|

|

|

34,765,818

|

|

|

|

|

|

|

|

|

|

|

|

|

Description of

|

|

Current

|

|

Identity of Issue

|

|

Investment

|

|

Value

|

|

|

|

|

|

|

|

|

Principal Life Insurance

|

|

Deposits in insurance company Inflation Protection

|

|

|

|

|

Company*

|

|

Separate Account

|

|

$

|

16,460,315

|

|

|

|

|

|

|

|

|

Principal Life Insurance

|

|

Deposits in insurance company Large-Cap

|

|

|

|

|

Company*

|

|

Growth I Separate Account

|

|

|

40,268,586

|

|

|

|

|

|

|

|

|

Principal Life Insurance

|

|

Deposits in insurance company Lifetime Strategic

|

|

|

|

|

Company*

|

|

Income Separate Account

|

|

|

15,419,909

|

|

|

|

|

|

|

|

|

Principal Life Insurance

|

|

Deposits in insurance company Small-Cap

|

|

|

|

|

Company*

|

|

Growth I Separate Account

|

|

|

55,110,907

|

|

|

|

|

|

|

|

|

Principal Life Insurance

|

|

Deposits in insurance company Small-Cap Stock

|

|

|

|

|

Company*

|

|

Index Separate Account

|

|

|

156,753,279

|

|

|

|

|

|

|

|

|

Principal Life Insurance

|

|

Deposits in insurance company Equity Income

|

|

|

|

|

Company*

|

|

Separate Account

|

|

|

73,472,162

|

|

|

|

|

|

|

|

|

Principal Life Insurance

|

|

Deposits in insurance company Lifetime 2010

|

|

|

|

|

Company*

|

|

Separate Account

|

|

|

10,058,118

|

|

|

|

|

|

|

|

|

Principal Life Insurance

|

|

Deposits in insurance company Lifetime 2015

|

|

|

|

|

Company*

|

|

Separate Account

|

|

|

1,431,497

|

|

|

|

|

|

|

|

|

Principal Life Insurance

|

|

Deposits in insurance company Lifetime 2020

|

|

|

|

|

Company*

|

|

Separate Account

|

|

|

73,144,492

|

|

|

|

|

|

|

|

|

Principal Life Insurance

|

|

Deposits in insurance company Lifetime 2025

|

|

|

|

|

Company*

|

|

Separate Account

|

|

|

7,210,767

|

|

|

|

|

|

|

|

|

Principal Life Insurance

|

|

Deposits in insurance company Lifetime 2030

|

|

|

|

|

Company*

|

|

Separate Account

|

|

|

139,735,066

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Description of

|

|

Current

|

|

Identity of Issue

|

|

Investment

|

|

Value

|

|

|

|

|

|

|

|

|

Principal Life Insurance

|

|

Deposits in insurance company Lifetime 2035

|

|

|

|

|

Company*

|

|

Separate Account

|

|

$

|

5,813,781

|

|

|

|

|

|

|

|

|

Principal Life Insurance

|

|

Deposits in insurance company Lifetime 2040

|

|

|

|

|

Company*

|

|

Separate Account

|

|

|

108,919,137

|

|

|

|

|

|

|

|

|

Principal Life Insurance

|

|

Deposits in insurance company Lifetime 2045

|

|

|

|

|

Company*

|

|

Separate Account

|

|

|

4,237,061

|

|

|

|

|

|

|

|

|

Principal Life Insurance

|

|

Deposits in insurance company Lifetime 2050

|

|

|

|

|

Company*

|

|

Separate Account

|

|

|

70,664,213

|

|

|

|

|

|

|

|

|

Principal Life Insurance

|

|

Deposits in insurance company Lifetime 2055

|

|

|

|

|

Company*

|

|

Separate Account

|

|

|

3,708,884

|

|

|

|

|

|

|

|

|

Principal Life Insurance

|

|

Deposits in insurance company Lifetime 2060

|

|

|

|

|

Company*

|

|

Separate Account

|

|

|

6,392,912

|

|

|

|

|

|

|

|

|

Principal Life Insurance

|

|

Deposits in insurance company Diversified

|

|

|

|

|

Company*

|

|

Real Asset Separate Account

|

|

|

2,581,311

|

|

|

|

|

|

|

|

|

Principal Life Insurance

|

|

Self-directed brokerage account

|

|

|

|

|

Company*

|

|

|

|

|

807,420

|

|

|

|

|

|

|

|

|

Principal Financial

|

|

2,027,624 shares of Principal Financial Group,

|

|

|

|

|

Group, Inc.*

|

|

Inc. ESOP

|

|

|

117,318,296

|

|

|

|

|

|

|

|

|

Loans to participants*

|

|

Notes receivable from participants with varying

|

|

|

|

|

|

|

maturity dates and interest rates ranging from

|

|

|

|

|

|

|

3.25% to 10.50%

|

|

|

22,493,123

|

|

|

|

|

|

$

|

2,080,019,557

|

|

|

|

|

|

|

|

|

*Indicates party-in-interest to the Plan.

|

|

|

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the administrator of The Principal Select Savings Plan for Employees has duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

THE PRINCIPAL SELECT SAVINGS PLAN FOR

|

|

|

EMPLOYEES

|

|

|

|

|

|

by Benefit Plans Administration Committee

|

|

|

|

|

|

|

Date: June 23, 2017

|

By

/s/ Elizabeth L. Raymond

|

|

|

Elizabeth L. Raymond

|

|

|

Committee Chair

|

Exhibit Index

The following exhibit is filed herewith:

|

|

|

|

|

|

|

Page

|

|

23 - Consent of Ernst & Young LLP

|

22

|

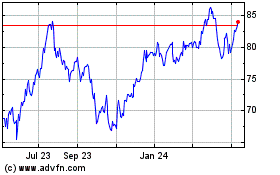

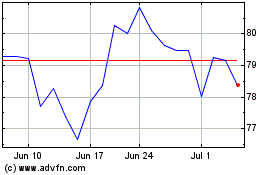

Principal Financial (NASDAQ:PFG)

Historical Stock Chart

From Jun 2024 to Jul 2024

Principal Financial (NASDAQ:PFG)

Historical Stock Chart

From Jul 2023 to Jul 2024