false

0001093691

0001093691

2024-05-09

2024-05-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

May 9, 2024

Plug Power Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

1-34392 |

|

22-3672377 |

| (State or other jurisdiction |

|

(Commission File |

|

(IRS Employer |

| of incorporation) |

|

Number) |

|

Identification No.) |

| |

|

|

|

|

968 Albany Shaker Road,

Latham, New York |

|

12110 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (518) 782-7700

N/A

(Former name or former address, if changed

since last report.)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which

registered |

| Common Stock, par value $0.01 per share |

|

PLUG |

|

The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth

company ¨

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02 Results of Operations and Financial Condition.

On May 9, 2024, Plug Power Inc., a Delaware corporation

(the “Company”), issued a press release regarding its financial results for the first quarter ended March 31, 2024. A copy

of the press release is furnished herewith as Exhibit 99.1. The Company will be hosting a conference call at 8:30 a.m. Eastern Time regarding

its financial results for the first quarter ended March 31, 2024. The conference call will be available through the Company's website

at www.plugpower.com. A copy of the presentation that will be made available in connection with the conference call is attached as Exhibit 99.2 to this Current

Report on Form 8-K.

The information in this Item 2.02 of this Current

Report on Form 8-K, including Exhibit 99.1 and Exhibit 99.2 hereto, shall not be deemed “filed” for purposes of Section 18

of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section,

nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”),

or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 7.01 Regulation FD Disclosure.

The information contained in Item 2.02 of this

Current Report on Form 8-K is incorporated herein by reference.

The information included in this Item 7.01, Exhibit

99.1 and Exhibit 99.2 of this Current Report on Form 8-K is not deemed to be “filed” for purposes of Section 18 of the Exchange

Act, or otherwise subject to the liabilities of that section, nor shall this item, Exhibit 99.1 or Exhibit 99.2 be incorporated by reference

into the Company’s filings under the Securities Act or the Exchange Act, except as expressly set forth by specific reference in

such future filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

Plug Power Inc. |

| |

|

| Date: May 9, 2024 |

By: |

/s/ Paul Middleton |

| |

|

Name: Paul Middleton |

| |

|

Title: Chief Financial Officer |

Exhibit 99.1

Plug Announces

First Quarter 2024 Financial Results

LATHAM, N.Y.,

May 9, 2024 — Plug Power Inc. (NASDAQ: PLUG) (the “Company”), a global leader in comprehensive hydrogen solutions

for the green hydrogen economy, announced its financial results and operational milestones for the first quarter of 2024.

First-Quarter

Results

| ● | Earnings-Per-Share

(EPS) and Revenue: The Company reported revenue of $120.3 million and EPS loss of $0.46

for the quarter ended March 31, 2024. |

| ● | Enhanced

Focus on Cash Management: Net cash used in operating activities and capital expenditures

(includes purchases of property, plant, and equipment and purchases of equipment related

to power purchase agreements and equipment related to fuel delivered to customers) collectively

decreased 38% quarter-over-quarter (QoQ), and 42% year-over-year (YoY), with incremental

improvement expected as internal hydrogen supply and pricing increases make an impact in

coming quarters. Inventory reduction remains a key priority in our cash management strategy

for 2024. |

| ● | Gross

Margins: The Company saw headwinds on equipment margins given focus on lowering inventory

and limiting production, coupled with lower sales level collectively generating unfavorable

overhead absorption; but given the restructuring announced coupled with ramp on volume for

the balance of the year, the Company is postured to drive overhead leverage to improve equipment

margins. The Company saw improvements in the quarter’s gross margins for Fuel Delivered,

Service, and Power Purchase Agreements versus the first and fourth quarters of 2023, as well

as lower operating expenses. |

Consistently with

past seasonality and continued new product scaling, Plug expects that one-third of its full year revenue will be in the first half of 2024. As of the Q1 2024 earnings date, Plug currently has 20

electrolyzer systems undergoing commissioning at third-party customer sites, with further deliveries to be made over the balance of 2024.

The Company is also experiencing rebounding sales in its material handling business following the recalibration of pricing and changing

of the business model to direct sales or customer-financed leases. In Q1 2024, for example, Plug expanded its partnership with Uline,

extending hydrogen infrastructure and fuel cell solutions to an additional four sites and secured a substantial deal with a leading U.S.

automotive manufacturer to provide its extensive new 6 square-mile manufacturing campus with Plug's hydrogen infrastructure and fuel

cell solutions. These commercial successes are clear demonstrations on Plug’s value proposition following changes to our pricing

and sales model.

Hydrogen Generation

Network Milestones and Advancement

In Q1 2024, Plug’s

hydrogen generation network reached significant milestones. The Georgia and Tennessee plants have produced at nameplate capacity, with

a combined liquid hydrogen production capacity of 25 tons-per-day (TPD). Additionally, Plug’s Louisiana plant is on track for completion

and first production in 2024, adding 15 TPD and bringing the Company’s total liquid hydrogen production capacity to 40 TPD. The

addition of the Louisiana plant capacity will effectively meet the majority of Plug’s customer demand through its internal hydrogen

generation network.

Plug continues

to advance the pending loan guarantee from the Department of Energy (DOE) and awaits conditional commitment approval announcement; this

program is expected to bolster the build out of Plug’s liquid hydrogen facilities throughout the U.S. Commensurately, the Company

has commenced a process with advisors to complement its anticipated DOE project with project equity investors and/or project

finance partners to finance the build out of the plants.

DOE Grants to

Advance Capacities at State-of-the-Art Manufacturing Facilities

Through a highly

competitive process, Plug, alongside project partners, secured awards from the DOE for grants of up to $163

million for use in Clean Hydrogen Electrolysis, Manufacturing, and Recycling projects. These grants will continue to advance Plug’s

fuel cell and electrolyzer manufacturing capacities at its state-of-the art facilities in Rochester and Albany NY. Plug received the

most awards in the $750 million total funding aimed to reduce the cost of hydrogen in the U.S., showcasing its leadership and commitment

in the hydrogen and fuel cell industry.

Continued

Growth in Electrolyzer Basic Engineering and Design Package (BEDP) Offering

Recent

announcements in Q1 2024, bring the Company’s total amount of global BEDP contracts to ~4.5

gigawatts (GW) for Projects in the U.S. and Europe. Electrolyzer sales present a substantial growth lever for Plug, and the BEDP success

underscores Plug’s strong industry positioning and market growth, while enabling customers to reach Final Investment Decision (FID)

on their hydrogen projects.

Expansion in

Cryogenic Sales

Plug has seen ongoing

expansion in cryogenic equipment sales with customer agreements encompassing storage tanks, trailers, vaporizers, and portable units,

both domestically in the U.S. and internationally. Additionally, Plug has delivered several first-of-its-kind liquid hydrogen portable

refuelers to transit agencies and trucking fleet customers.

Financial Updates

| ● | Q1

Financial Performance: Sales of $120M reflect seasonality in our equipment sales and

timing impacts from electrolyzer deployments. |

| ● | Internal

Hydrogen Supply: With Plug now producing up to ~25 TPD from our Georgia and Tennessee

hydrogen plants, the Company will be able to displace higher cost third-party fuel with our

own internal supply. |

| ● | Pricing Increases: To better reflect the

economic value of our product offering, Plug has worked with customers to put in place price increases across our entire product

portfolio with a specific focus on hydrogen pricing. We expect to see a positive impact to our margins in coming quarters

as a result of these actions. |

| ● | Restructuring,

Impairment, and Other Provisions: As a result of the evolving market dynamics, Plug mobilized

certain cost down actions in the first quarter. This included headcount reduction, rooftop

consolidation, and non-payroll cost downs. This resulted in restructuring costs of ~$6 million

in the quarter. In addition, given certain business dyanmics, the Company wrote down certain

assets which resulted in non-cash charges recorded in Q1 2024 of ~$40 million. Further details

regarding these charges are provided in our Quarterly Report on Form 10-Q for the quarter

ended March 31, 2024. |

Plug CEO Andy Marsh

stated: “We continue to make steady progress by following our established goals and business priorities. As we enhance our financial

performance in the upcoming quarters, Plug is set to retain its leadership role in advancing the hydrogen economy, which is anticipated

to experience swift expansion and widespread adoption globally in the future decades.”

Conference Call

Plug Power has

scheduled a conference call today, May 9, at 8:30 am ET to review the Company’s results for the first quarter of 2024. Interested

parties are invited to listen to the conference call by calling 877-407-9221 / +1 201-689-8597.

The webcast can

be accessed at:

https://event.webcasts.com/starthere.jsp?ei=1666679&tp_key=8ea4578409

A playback of the call will be available

online for a period following the event. A presentation will be made available in connection with the call at: https://www.ir.plugpower.com/events-and-presentations/default.aspx

About Plug

Plug is building

an end-to-end green hydrogen ecosystem, from production, storage, and delivery to energy generation, to help its customers meet their

business goals and decarbonize the economy. In creating the first commercially viable market for hydrogen fuel cell technology, the company

has deployed more than 69,000 fuel cell systems and over 250 fueling stations, more than anyone else in the world, and is the largest

buyer of liquid hydrogen.

With plans to operate

a green hydrogen highway across North America and Europe, Plug built a state-of-the-art Gigafactory to produce electrolyzers and fuel

cells and is developing multiple green hydrogen production plants targeting commercial operation by year-end 2028. Plug delivers its

green hydrogen solutions directly to its customers and through joint venture partners into multiple environments, including material

handling, e-mobility, power generation, and industrial applications.

For more information,

visit www.plugpower.com.

Plug Media Contact

Fatimah Nouilati

Allison

PlugPR@allisonworldwide.com

Plug Power Safe Harbor Statement

This communication

contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 that involve

significant risks and uncertainties about Plug Power Inc. (“Plug”), including but not limited to statements about Plug’s

projections regarding its future financial and market outlook, including timing of expected revenue for 2024 and timing of impacts to

margins; Plug’s expectations with respect to grants and conditional commitment with respect to loans awarded by the United States

Department of Energy (DOE); Plug’s expectation of incremental improvements as internal hydrogen supply and pricing increases make

an impact and the timing thereof; Plug’s ability to execute on its cash management strategy for 2024, including inventory reduction;

Plug’s belief that it can drive overhead leverage to improve equipment margins; Plug’s expected timing with respect to delivery

of electrolyzer systems; Plug’s belief that fuel pricing increases and internal hydrogen production will create positive impacts;

the anticipated benefits, capacity, capabilities, and output of Plug’s hydrogen plants, including the timing of hydrogen production

at its plant located in Louisiana; Plug’s ability to meet customer demand and displace higher cost third-party fuel through its

own internal hydrogen generation network; and Plug’s ability to successfully execute its business plan and achieve profitability

in the future.

You are cautioned

that such statements should not be read as a guarantee of future performance or results as such statements are subject to risks and uncertainties.

Actual performance or results may differ materially from those expressed in these statements as a result of various factors, including,

but not limited to, the following: the risk that we may continue to incur losses and might never achieve or maintain profitability; the

risk that we may not realize the anticipated benefits and actual savings in connection with the restructuring; the risk that we may not

be able to raise additional capital to fund our operations and such capital may not be available to us on favorable terms or at all;

the risk that we may not be able to expand our business or manage our future growth effectively; the risk that we may not be able to

remediate the material weaknesses identified in internal control over financial reporting as of December 31, 2023, or otherwise

maintain an effective system of internal control over financial reporting; the risk thar global economic uncertainty, including inflationary

pressures, fluctuating interest rates, currency fluctuations, and supply chain disruptions, may adversely affect our operating results;

the risk that we may not be able to obtain from our hydrogen suppliers a sufficient supply of hydrogen at competitive prices or the risk

that we may not be able to produce hydrogen internally at competitive prices; the risk that delays in or not completing our product and

project development goals may adversely affect our revenue and profitability; the risk that our estimated future revenue may not be indicative

of actual future revenue or profitability; the risk of elimination, reduction of, or changes in qualifying criteria for government subsidies

and economic incentives for alternative energy products, including the Inflation Reduction Act; and the risk that we may not be able

to manufacture and market products on a profitable and large-scale commercial basis. For a further description of the risks and uncertainties

that could cause actual results to differ from those expressed in these forward-looking statements, as well as risks relating to the

business of Plug in general, see Plug’s public filings with the Securities and Exchange Commission, including the “Risk Factors”

section of Plug’s Annual Report on Form 10-K for the year ended December 31, 2023 as well as any subsequent filings.

Readers are cautioned not to place undue reliance on these forward-looking statements. The forward-looking statements are made as of

the date hereof and are based on current expectations, estimates, forecasts and projections as well as the beliefs and assumptions of

management. We disclaim any obligation to update forward-looking statements except as may be required by law.

Plug Power Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

(In thousands, except share and per share amounts)

(Unaudited)

| | |

March 31, | |

December 31, | |

| | |

2024 | |

2023 | |

| Assets | |

| |

| |

| Current assets: | |

| | |

| | |

| Cash and cash equivalents | |

$ | 172,873 | |

$ | 135,033 | |

| Restricted cash | |

| 219,616 | |

| 216,552 | |

| Accounts receivable, net of allowance of $7,351 at March 31, 2024 and $8,798 at December 31, 2023 | |

| 148,822 | |

| 243,811 | |

| Inventory, net | |

| 975,898 | |

| 961,253 | |

| Contract assets | |

| 129,994 | |

| 126,248 | |

| Prepaid expenses and other current assets | |

| 119,370 | |

| 104,068 | |

| Total current assets | |

| 1,766,573 | |

| 1,786,965 | |

| | |

| | |

| | |

| Restricted cash | |

$ | 775,595 | |

$ | 817,559 | |

| Property, plant, and equipment, net | |

| 1,453,991 | |

| 1,436,177 | |

| Right of use assets related to finance leases, net | |

| 56,131 | |

| 57,281 | |

| Right of use assets related to operating leases, net | |

| 389,201 | |

| 399,969 | |

| Equipment related to power purchase agreements and fuel delivered to customers, net | |

| 115,109 | |

| 111,261 | |

| Contract assets | |

| 30,380 | |

| 29,741 | |

| Intangible assets, net | |

| 183,325 | |

| 188,886 | |

| Investments in non-consolidated entities and non-marketable equity securities | |

| 66,691 | |

| 63,783 | |

| Other assets | |

| 10,310 | |

| 11,116 | |

| Total assets | |

$ | 4,847,306 | |

$ | 4,902,738 | |

| | |

| | |

| | |

| Liabilities and Stockholders’ Equity | |

| | |

| | |

| Current liabilities: | |

| | |

| | |

| Accounts payable | |

$ | 285,546 | |

$ | 257,828 | |

| Accrued expenses | |

| 154,814 | |

| 200,544 | |

| Deferred revenue and other contract liabilities | |

| 179,902 | |

| 204,139 | |

| Operating lease liabilities | |

| 65,250 | |

| 63,691 | |

| Finance lease liabilities | |

| 9,602 | |

| 9,441 | |

| Finance obligations | |

| 85,175 | |

| 84,031 | |

| Current portion of long-term debt | |

| 2,786 | |

| 2,716 | |

| Contingent consideration, loss accrual for service contracts, and other current liabilities | |

| 128,369 | |

| 142,410 | |

| Total current liabilities | |

| 911,444 | |

| 964,800 | |

| | |

| | |

| | |

| Deferred revenue and other contract liabilities | |

$ | 75,900 | |

$ | 84,163 | |

| Operating lease liabilities | |

| 278,220 | |

| 292,002 | |

| Finance lease liabilities | |

| 33,673 | |

| 36,133 | |

| Finance obligations | |

| 264,610 | |

| 284,363 | |

| Convertible senior notes, net | |

| 209,802 | |

| 195,264 | |

| Long-term debt | |

| 1,013 | |

| 1,209 | |

| Contingent consideration, loss accrual for service contracts, and other liabilities | |

| 143,522 | |

| 146,679 | |

| Total liabilities | |

| 1,918,184 | |

| 2,004,613 | |

| | |

| | |

| | |

| Stockholders’ equity: | |

| | |

| | |

| Common stock, $.01 par value per share; 1,500,000,000 shares authorized; Issued (including shares in treasury): 705,604,549 at March 31, 2024 and 625,305,025 at December 31, 2023 | |

$ | 7,057 | |

$ | 6,254 | |

| Additional paid-in capital | |

| 7,823,209 | |

| 7,494,685 | |

| Accumulated other comprehensive loss | |

| (9,078 | ) |

| (6,802 | ) |

| Accumulated deficit | |

| (4,785,520 | ) |

| (4,489,744 | ) |

| Less common stock in treasury: 19,242,215 at March 31, 2024 and 19,169,366 at December 31, 2023 | |

| (106,546 | ) |

| (106,268 | ) |

| Total stockholders’ equity | |

| 2,929,122 | |

| 2,898,125 | |

| Total liabilities and stockholders’ equity | |

$ | 4,847,306 | |

$ | 4,902,738 | |

Plug Power Inc. and Subsidiaries

Condensed Consolidated Statements of Operations

(In thousands, except share and per share amounts)

(Unaudited)

| | |

Three months ended | |

| | |

March 31 | |

| | |

2024 | | |

2023 | |

| Net revenue: | |

| | | |

| | |

| Sales of equipment, related infrastructure and other | |

$ | 68,295 | | |

$ | 182,094 | |

| Services performed on fuel cell systems and related infrastructure | |

| 13,023 | | |

| 9,097 | |

| Power purchase agreements | |

| 18,304 | | |

| 7,937 | |

| Fuel delivered to customers and related equipment | |

| 18,286 | | |

| 10,142 | |

| Other | |

| 2,356 | | |

| 1,016 | |

| Net revenue | |

$ | 120,264 | | |

$ | 210,286 | |

| Cost of revenue: | |

| | | |

| | |

| Sales of equipment, related infrastructure and other | |

| 135,125 | | |

| 158,320 | |

| Services performed on fuel cell systems and related infrastructure | |

| 12,957 | | |

| 12,221 | |

| Provision for loss contracts related to service | |

| 15,745 | | |

| 6,889 | |

| Power purchase agreements | |

| 55,228 | | |

| 46,816 | |

| Fuel delivered to customers and related equipment | |

| 58,573 | | |

| 54,501 | |

| Other | |

| 1,711 | | |

| 935 | |

| Total cost of revenue | |

$ | 279,339 | | |

$ | 279,682 | |

| | |

| | | |

| | |

| Gross loss | |

$ | (159,075 | ) | |

$ | (69,396 | ) |

| | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | |

| Research and development | |

| 25,280 | | |

| 26,535 | |

| Selling, general and administrative | |

| 77,959 | | |

| 104,016 | |

| Restructuring | |

| 6,011 | | |

| — | |

| Impairment | |

| 284 | | |

| 1,083 | |

| Change in fair value of contingent consideration | |

| (9,200 | ) | |

| 8,769 | |

| Total operating expenses | |

$ | 100,334 | | |

$ | 140,403 | |

| | |

| | | |

| | |

| Operating loss | |

| (259,409 | ) | |

| (209,799 | ) |

| | |

| | | |

| | |

| Interest income | |

| 9,277 | | |

| 17,632 | |

| Interest expense | |

| (11,325 | ) | |

| (10,650 | ) |

| Other expense, net | |

| (6,996 | ) | |

| (4,771 | ) |

| Realized loss on investments, net | |

| — | | |

| (1 | ) |

| Change in fair value of equity securities | |

| — | | |

| 5,075 | |

| Loss on equity method investments | |

| (13,113 | ) | |

| (5,317 | ) |

| Loss on extinguishment of convertible senior notes | |

| (14,047 | ) | |

| — | |

| | |

| | | |

| | |

| Loss before income taxes | |

$ | (295,613 | ) | |

$ | (207,831 | ) |

| | |

| | | |

| | |

| Income tax (expense)/benefit | |

| (163 | ) | |

| 1,270 | |

| | |

| | | |

| | |

| Net loss | |

$ | (295,776 | ) | |

$ | (206,561 | ) |

| | |

| | | |

| | |

| Net loss per share: | |

| | | |

| | |

| Basic and diluted | |

$ | (0.46 | ) | |

$ | (0.35 | ) |

| | |

| | | |

| | |

| Weighted average number of common stock outstanding | |

| 641,256,134 | | |

| 589,205,165 | |

Plug Power Inc. and Subsidiaries

Condensed Consolidated Statements of Cash Flows

(In thousands)

(Unaudited)

| | |

Three months ended March 31, | |

| | |

2024 | | |

2023 | |

| Operating activities | |

| | | |

| | |

| Net loss | |

$ | (295,776 | ) | |

$ | (206,561 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Depreciation of long-lived assets | |

| 16,606 | | |

| 9,789 | |

| Amortization of intangible assets | |

| 4,725 | | |

| 4,959 | |

| Lower of cost or net realizable value inventory adjustment and provision for excess and obsolete inventory | |

| 39,675 | | |

| 2,009 | |

| Stock-based compensation | |

| 13,704 | | |

| 43,302 | |

| Loss on extinguishment of convertible senior notes | |

| 14,047 | | |

| - | |

| (Recoveries)/provision for losses on accounts receivable | |

| (1,447 | ) | |

| 237 | |

| Amortization of debt issuance costs and discount on convertible senior notes | |

| 330 | | |

| 621 | |

| Provision for common stock warrants | |

| 4,495 | | |

| 14,175 | |

| Deferred income tax expense/(benefit) | |

| 163 | | |

| (947 | ) |

| Impairment | |

| 284 | | |

| 1,083 | |

| Loss on service contracts | |

| 3,809 | | |

| 221 | |

| Fair value adjustment to contingent consideration | |

| (9,200 | ) | |

| 8,769 | |

| Net realized loss on investments | |

| - | | |

| 1 | |

| Accretion of premium on available-for-sale securities | |

| - | | |

| (5,945 | ) |

| Lease origination costs | |

| (1,331 | ) | |

| (2,660 | ) |

| Change in fair value for equity securities | |

| - | | |

| (5,075 | ) |

| Loss on equity method investments | |

| 13,113 | | |

| 5,317 | |

| Changes in operating assets and liabilities that provide (use) cash: | |

| | | |

| | |

| Accounts receivable | |

| 96,436 | | |

| 1,493 | |

| Inventory | |

| (38,312 | ) | |

| (131,581 | ) |

| Contract assets | |

| 1,356 | | |

| (14,677 | ) |

| Prepaid expenses and other assets | |

| (14,496 | ) | |

| (5,522 | ) |

| Accounts payable, accrued expenses, and other liabilities | |

| 25,755 | | |

| 13,821 | |

| Payments of contingent consideration | |

| (9,164 | ) | |

| - | |

| Deferred revenue and other contract liabilities | |

| (32,500 | ) | |

| (9,748 | ) |

| Net cash used in operating activities | |

$ | (167,728 | ) | |

$ | (276,919 | ) |

| | |

| | | |

| | |

| Investing activities | |

| | | |

| | |

| Purchases of property, plant and equipment | |

| (92,621 | ) | |

| (168,565 | ) |

| Purchases of equipment related to power purchase agreements and equipment related to fuel delivered to customers | |

| (6,072 | ) | |

| (11,389 | ) |

| Proceeds from maturities of available-for-sale securities | |

| - | | |

| 315,827 | |

| Cash paid for non-consolidated entities and non-marketable equity securities | |

| (21,891 | ) | |

| (40,077 | ) |

| Net cash (used in)/provided by investing activities | |

$ | (120,584 | ) | |

$ | 95,796 | |

| | |

| | | |

| | |

| Financing activities | |

| | | |

| | |

| Payments of contingent consideration | |

| (836 | ) | |

| (2,000 | ) |

| Proceeds from public and private offerings, net of transaction costs | |

| 305,346 | | |

| - | |

| Payments of tax withholding on behalf of employees for net stock settlement of stock-based compensation | |

| (278 | ) | |

| (2,590 | ) |

| Proceeds from exercise of stock options | |

| 41 | | |

| 674 | |

| Principal payments on long-term debt | |

| (300 | ) | |

| (330 | ) |

| Proceeds from finance obligations | |

| - | | |

| 27,927 | |

| Principal repayments of finance obligations and finance leases | |

| (20,908 | ) | |

| (16,500 | ) |

| Net cash provided by financing activities | |

$ | 283,065 | | |

$ | 7,181 | |

| Effect of exchange rate changes on cash | |

| 4,187 | | |

| (2,096 | ) |

| Increase/(decrease) in cash and cash equivalents | |

| 37,840 | | |

| (215,769 | ) |

| (Decrease)/increase in restricted cash | |

| (38,900 | ) | |

| 39,731 | |

| Cash, cash equivalents, and restricted cash beginning of period | |

| 1,169,144 | | |

| 1,549,344 | |

| Cash, cash equivalents, and restricted cash end of period | |

$ | 1,168,084 | | |

$ | 1,373,306 | |

| | |

| | | |

| | |

| Supplemental disclosure of cash flow information | |

| | | |

| | |

| Cash paid for interest, net of capitalized interest of $2.1 million and $2.0 million | |

$ | 9,111 | | |

$ | 7,869 | |

Exhibit 99.2

Copyright 202 2 , Plug Power Inc. Plug Power NASDAQ: PLUG Copyright 2024, Plug Power Inc .

2 This presentation contains “forward - looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 that involve significant risks and uncertainties about Plug Power Inc . (“Plug”), including but not limited to statements about Plug’s projections regarding its future financial and market outlook, including timing of expected revenue for 2024 ; Plug’s expectations with respect to grants and conditional commitment with respect to loans awarded by the United States Department of Energy (DOE) ; Plug’s ability to execute on its short - term business priorities, including its cash management and financing goals and its operational execution goals ; Plug’s ability to successfully eliminate its Power Purchase Agreement model and transition to a direct sales model ; Plug’s belief that its strategic priorities will enable growth reacceleration ; Plug’s ability to execute on its strategic priorities, including with respect to financing opportunities, converting Basic Engineering and Design Packages (BEDP) to orders, and delivering on pipeline ; Plug’s ability to grow equipment sales ; Plug’s belief that consolidation of operational sites and restructuring will achieve improved cost structure and the timing of such achievement ; Plug’s ability to attract customers with its updated pricing structure ; Plug’s belief that fuel pricing increases and internal hydrogen production will create positive impacts ; the anticipated benefits, capacity, capabilities, and output of Plug’s hydrogen plants, including the timing of hydrogen production at its plant located in Louisiana ; Plug’s ability to successfully reduce its existing inventory ; and Plug’s ability to execute on its priority pieces for profitability . You are cautioned that such statements should not be read as a guarantee of future performance or results as such statements are subject to risks and uncertainties . Actual performance or results may differ materially from those expressed in these statements as a result of various factors, including, but not limited to, the following : the risk that we may continue to incur losses and might never achieve or maintain profitability ; the risk that we may not be able to raise additional capital to fund our operations and such capital may not be available to us on favorable terms or at all ; the risk that we may not be able to expand our business or manage our future growth effectively ; the risk that we may not be able to remediate the material weaknesses identified in internal control over financial reporting as of December 31 , 2023 , or otherwise maintain an effective system of internal control over financial reporting ; the risk thar global economic uncertainty, including inflationary pressures, fluctuating interest rates, currency fluctuations, and supply chain disruptions, may adversely affect our operating results ; the risk that we may not be able to obtain from our hydrogen suppliers a sufficient supply of hydrogen at competitive prices or the risk that we may not be able to produce hydrogen internally at competitive prices ; the risk that delays in or not completing our product and project development goals may adversely affect our revenue and profitability ; the risk that our estimated future revenue may not be indicative of actual future revenue or profitability ; the risk of elimination, reduction of, or changes in qualifying criteria for government subsidies and economic incentives for alternative energy products, including the Inflation Reduction Act ; and the risk that we may not be able to manufacture and market products on a profitable and large - scale commercial basis . For a further description of the risks and uncertainties that could cause actual results to differ from those expressed in these forward - looking statements, as well as risks relating to the business of Plug in general, see Plug’s public filings with the Securities and Exchange Commission, including the “Risk Factors” section of Plug’s Annual Report on Form 10 - K for the year ended December 31 , 2023 as well as any subsequent filings . Readers are cautioned not to place undue reliance on these forward - looking statements . The forward - looking statements are made as of the date hereof and are based on current expectations, estimates, forecasts and projections as well as the beliefs and assumptions of management . We disclaim any obligation to update forward - looking statements except as may be required by law . Cautionary Note on Forward Looking Statements

3 1Q 2024 Overview and Business Update Hydrogen Plant Buildout Reaching Key Milestones • Production of liquid hydrogen at Georgia and Tennessee plants in Q1 Department of Energy (DOE) Manufacturing Grants • Plug is the prime awardee on ~$79M for investment at US manufacturing sites, as well as a subcontractor on additional ~$84M, for participation up to $163M • Plug received the most awards in ~$750M total funding aimed to reduce the cost of clean hydrogen in the US Recalibration of Material Handling Business • Implementing price increases and service enhancement roadmap • Eliminating Power Purchase Agreement model: Move to direct sales and customer - financed leases Continued Validation of Product Platform with Key Customers • ~ 4.5GW of Basic Engineering and Design Packages (BEDP) work for electrolyzer customers • 20 electrolyzer systems currently undergoing commissioning activities at customer sites • Material Handling orders from Uline and auto OEM with updated pricing structure Positive Impact From Strategic Initiatives to Lower Cash Burn Plug continues to advance the pending loan guarantee from the Department of Energy (DOE) and awaits conditional commitment ap pro val announcement

4 Cash Management and Financing Goals • Continue to Pursue Financing Partners and Opportunities • Working Capital Management • Inventory Reduction is a Key Priority • Pricing Increases Across Product Portfolio Operational Execution Goals • Recalibrating the Material Handling Business Model • Hydrogen Production in Georgia, Tennessee • Completing Construction in Louisiana • Prioritizing Equipment Sales Across Product Portfolio • Continue BEDPs for Large - Scale ELX and Liquefier Customers Short - Term Business Priorities

5 Exploring Financing Opportunities Converting 4.5GW in BEDP to Orders Developing US and EU Plant Network Manufacturing Scale to Meet Demand Hydrogen Plants Electrolyzers Delivering on Meaningful Pipeline Growing Storage and On - Road Offerings Developing Large - Scale Product Launching Mobile Refueler Product Liquefaction Cryogenics Recalibrating Existing Sales Platforms Optimizing Early Product Deployments Expanding Customer Diversification Advancing Datacenter Pilots Material Handling Stationary Power Strategic Priorities To Enable Growth Reacceleration

6 Financial Update Net cash used in operating activities combined with capex 1 down 38% QoQ and 42% YoY • Capex 1 down 47% QoQ and 45% YoY • Consolidation of operational sites and restructuring to achieve improved cost structure in coming quarters Hydrogen production and new pricing structure expected to significantly impact margins • Price increases across entire product portfolio with a specific focus on hydrogen pricing • Georgia and Tennessee reaching nameplate capacity, and Louisiana production targeted for 2024 Equipment sales expected to drive top - line growth and margin improvement • Maturing of product lines and greater volume expected to allow fixed - cost absorption and margin expansion • ~1/3 of revenue for 2024 expected in 1H 2024 Q1 Sales of $120.3M reflect seasonality in equipment sales and new product scale up • Rebound in material handling installations beginning in Q2 • New ELX product launches and customer scale ups working through maturity curve Margins impacted by hydrogen availability, lower fixed cost absorption, and non - cash charges • Fuel pricing increases and internal hydrogen production expected to create positive impacts going forward • Growth in equipment sales expected to improve labor and overhead leverage 1: Capex includes purchases of property, plant, and equipment and purchases of equipment related to power purchase agreements an d equipment related to fuel delivered to customers

7 Priority Pieces Towards Profitability Vertical Integration with Plug Hydrogen Network Pricing Increases Across the Material Handling Portfolio Equipment Sales Growth Increases Leverage on Fixed Manufacturing Costs Supply Chain Efficiency and Cost Downs Service Cost Improvement Roadmap Inventory and Asset Monetization Sustainable Operating Cost Profile Consolidation of Operational Sites

VP, Investor Relations Roberto Friedlander rfriedlander@plugpower.com Manager, Investor Relations Kevin O’Brien kobrien@plugpower.com Corporate Headquarters 8 British America Boulevard, Latham, New York, 12110 www.plugpower.com

v3.24.1.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

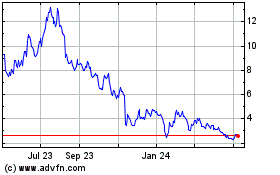

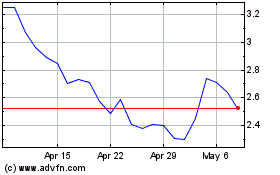

Plug Power (NASDAQ:PLUG)

Historical Stock Chart

From Oct 2024 to Nov 2024

Plug Power (NASDAQ:PLUG)

Historical Stock Chart

From Nov 2023 to Nov 2024