false000166530000016653002024-11-072024-11-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): November 07, 2024 |

Phunware Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-37862 |

30-1205798 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

1002 West Avenue |

|

Austin, Texas |

|

78701 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 512 693-4199 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.0001 per share |

|

PHUN |

|

The Nasdaq Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Current Report on Form 8-K (this “Report”) includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements are intended to be covered by the safe harbor for forward-looking statements provided by the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical facts contained in this Report, including statements regarding our future results of operations and financial position, business strategy and plans, and our objectives for future operations, are forward-looking statements. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “will,” “would” and similar expressions that convey uncertainty of future events or outcomes are intended to identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements contained in this Report are based on our current expectations and beliefs concerning future developments and their potential effects on us. Future developments affecting us may not be those that we have anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) and other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described under the heading “Risk Factors” in our filings with the Securities and Exchange Commission (SEC), including our reports on Forms 10-K, 10-Q, 8-K and other filings that we make with the SEC from time to time. Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. These risks and others described under “Risk Factors” may not be exhaustive.

By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. We caution you that forward-looking statements are not guarantees of future performance and that our actual results of operations, financial condition and liquidity, and developments in the industry in which we operate may differ materially from those made in or suggested by the forward-looking statements contained in this Report. In addition, even if our results of operations, financial condition and liquidity, and developments in the industry in which we operate are consistent with the forward-looking statements contained in this Report, those results or developments may not be indicative of results or developments in subsequent periods.

Item 2.02 Results of Operations and Financial Condition.

On November 7, 2024, Phunware, Inc. (the "Company") issued a press release announcing its financial results for the third quarter ended September 30, 2024. A copy of the press release issued concerning the foregoing results is furnished herewith as Exhibit 99.1 and is incorporated herein by reference.

The information contained herein, including Exhibit 99.1, is furnished and shall not be deemed "filed" for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or subject to the liabilities of that Section or Section 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information contained herein and in the accompanying exhibit shall not be incorporated by reference into any filing with the Securities and Exchange Commission made by the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

The Company is making reference to non-GAAP financial information in the press release. A reconciliation of these non-GAAP financial measures to the nearest comparable GAAP financial measures is contained in the attached Exhibit 99.1 press release.

Item 3.01 Notice of Delisting or Failure to Satisfy a Listing Rule or Standard; Transfer of Listing.

On November 7, 2024, the Company received a letter (the "Letter") from The Nasdaq Stock Market LLC ("Nasdaq") notifying the Company that, as previously disclosed, as a result of the resignation of Stephen Chen, from the Company's audit committee, the Company is not in compliance with Nasdaq’s audit committee composition requirements as set forth in Nasdaq Listing Rule.

Pursuant to Nasdaq Listing Rule 5605(c)(2)(A), a listed company must have an audit committee of at least three members, each of whom must be an Independent Director as defined under Nasdaq Listing Rule 5605(a)(2) and meet the criteria for independence set forth in Rule 10A-3(b)(1) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) (subject to the exemptions provided in Rule 10A-3(c) under the Exchange Act). With Mr. Chen’s resignation from the Company's audit committee, the Company’s audit committee is currently comprised of only two members, Elliot Han and Rahul Mewawalla, each of whom meet the independence requirements set forth in Nasdaq Rule 5605(a)(2) and Rule 10-A3(b)(1) of the Exchange Act.

The Letter further provides that, pursuant to Nasdaq Listing Rule 5605(c)(4), the Company is entitled to a cure period to regain compliance with Nasdaq Listing Rule 5605, which cure period will expire the earlier of the Company's next annual stockholders' meeting or October 22, 2025; or if the next annual stockholders' meeting is held before April 21, 2025, then the cure period will expire on April 21, 2025.

If the Company does not regain compliance within the cure period, Nasdaq will provide written notification to the Company that its securities will be delisted. At that time, the Company may appeal the delisting determination to a hearings panel. The Company is in the process of reviewing and evaluating potential options to regain compliance with Nasdaq audit committee requirements as set forth in Nasdaq Listing Rule 5605 within the cure period provided by Nasdaq. However, there can be no assurance the Company will regain compliance with Nasdaq Listing Rule 5605 or maintain compliance with other Nasdaq Listing Rules.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

* Furnished herewith

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Phunware, Inc. |

|

|

|

|

Date: |

November 7, 2024 |

By: |

/s/ Troy Reisner |

|

|

|

Troy Reisner

Chief Financial Officer |

Phunware Reports Third Quarter 2024 Financial Results

AUSTIN, Texas, November 7, 2024 (GLOBE NEWSWIRE) -- Phunware, Inc. (“Phunware” or the “Company”) (NASDAQ: PHUN), a leader in enterprise cloud solutions for mobile applications, announces its financial results for the quarter ended September 30, 2024.

Financial Highlights

●Steady progress in reducing net loss; Net loss from continuing operations was $2.8 million, or ($0.25) per share, for Q3 2024, as compared to a net loss of $13.7 million, or ($5.72) per share, for Q3 20231

●Net cash used in operating activities from continued operations was $10.4 million for Q3 2024, as compared to $14.6 million for Q3 2023

●Year-to-date software and subscription bookings up 300% over prior year

●Cash and cash equivalents as of September 30, 2024 was $35.5 million

●Subsequent to the end the third quarter and based on proceeds from the Company’s use of the at-the-market (ATM) financing facility, the Company’s cash and cash equivalents as of November 6, 2024 was approximately $110 million.

1 Based on 11.1 million weighted average shares outstanding as of September 30, 2024 and 2.4 million weighted shares outstanding as of September 30, 2023. Basic and diluted shares outstanding are the same and all figures reflect the effectuation of a 50:1 reverse stock split in February 2024

Recent Business Highlights

●Issued a Letter to Stockholders

●Appointed Stephen Chen as Interim CEO following the retirement of former CEO Mike Snavely

●Appointed global technology and AI leader Rahul Mewawalla as Chairman of the Board

●Signed a term sheet to acquire a controlling interest in MyCanvass, LLC, which is currently indirectly majority owned and controlled by Campaign Nucleus, a SaaS platform company founded by Brad Parscale

Phunware Interim CEO Stephen Chen commented, “As we look ahead, Phunware’s future direction is centered on innovation that empowers both enterprises and public sector entities to navigate the complexities of the digital age with confidence and security. We are committed to helping companies and federal agencies unlock the potential of AI in ways that support their operational goals while safeguarding their proprietary data. Our secure, localized AI frameworks will give our partners the tools to apply generative AI without compromising control over sensitive information. This approach reflects our dedication to being a trusted ally across corporate and federal landscapes, enabling sectors from healthcare and finance to national security to leverage advanced capabilities that meet the highest standards of security and compliance.

“Our expanded focus includes developing and delivering AI-driven platforms that make real-time, on-demand coordination and engagement accessible to organizations of all sizes, allowing them to scale their efforts and achieve targeted outcomes efficiently. Phunware’s commitment aligns with our broader vision of supporting secure and transformative digital solutions that meet the unique needs of government and corporate clients alike. In the coming years, Phunware will continue to lead with data integrity, operational excellence, and customer-centricity, empowering our partners to achieve sustainable success in an era where digital trust is paramount. Lastly, our CFO, Troy Reisner, has made the decision step down from his position and depart Phunware by November 30, 2024. I would like to thank Troy for his service to Phunware and acknowledge his pivotal role in

leading the financial side of our Company, including our capital markets programs, during his tenure and we wish him the best,” Mr. Chen concluded.

Third Quarter 2024 Earnings Conference Call

Phunware management will host a live conference call today at 4:30 p.m. ET to review financial results and provide an update on corporate developments. Following management’s formal remarks, there will be a question-and-answer session.

To listen to the conference call, interested parties within the U.S. should dial 1-888-506-0062 (domestic) or 973-528-0011 (international). All callers should dial in approximately 10 minutes prior to the scheduled start time and use Participant Access Code 704558 to be joined into the Phunware conference call.

The conference call will also be available through a live webcast that can be accessed at Phunware 3Q24 Earnings Webcast. A webcast earnings call replay will be available approximately one hour after the live call until November 7, 2025 with this same weblink.

A telephonic replay of the call will be available until November 21, 2024 by dialing 1-877-481-4010 (or 919-882-2331 for international callers) and using replay access code 51482.

About Phunware

Phunware, Inc. (NASDAQ: PHUN) is an enterprise software company specializing in mobile app solutions with integrated intelligent capabilities. We provide businesses with the tools to create, implement, and manage custom mobile applications, analytics, digital advertising, and location-based services. Phunware is transforming mobile engagement by delivering scalable, personalized, and data-driven mobile app experiences.

Phunware’s mission is to achieve unparalleled connectivity and monetization through widespread adoption of Phunware mobile technologies, leveraging brands, consumers, partners, digital asset holders, and market participants. Phunware is poised to expand its software products and services audience through its new platform, utilize and monetize its patents and other intellectual property, and reintroduce its digital asset ecosystem for existing holders and new market participants.

For more information on Phunware, please visit www.phunware.com. To better understand and leverage generative AI and Phunware’s mobile app technologies, visit https://ai.phunware.com/advocacy

Safe Harbor / Forward-Looking Statements

This press release includes forward-looking statements. All statements other than statements of historical facts contained in this press release, including statements regarding our future results of operations and financial position, business strategy and plans, and our objectives for future operations, are forward-looking statements. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “expose,” “intend,” “may,” “might,” “opportunity,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “will,” “would” and similar expressions that convey uncertainty of future events or outcomes are intended to identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. For example, Phunware is using forward-looking statements when it discusses the proposed offering and the timing and terms of such offering and its intended use of proceeds from such offering should it occur.

The forward-looking statements contained in this press release are based on our current expectations and beliefs concerning future developments and their potential effects on us. Future developments affecting us may not be those that we have anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) and other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described under the heading “Risk Factors” in our filings with the SEC, including our reports on Forms 10-K, 10-Q, 8-K and other filings that we make with the SEC from time to time. Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. These risks and others described under “Risk Factors” in our SEC filings may not be exhaustive.

By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. We caution you that forward-looking statements are not guarantees of future performance and that our actual results of operations, financial condition and liquidity, and developments in the industry in which we operate may differ materially from those made in or suggested by the forward-looking statements contained in this press release. In addition, even if our results or operations, financial condition and liquidity, and developments in the industry in which we operate are consistent with the forward-looking statements contained in this press release, those results or developments may not be indicative of results or developments in subsequent periods.

Investor Relations Contact:

Chris Tyson, Executive Vice President

MZ Group - MZ North America

949-491-8235

PHUN@mzgroup.us

www.mzgroup.us

Phunware Media Contact:

Joe McGurk, Managing Director

917-259-6895

PHUN@mzgroup.us

Financial Tables Follow

Phunware, Inc.

Condensed Consolidated Balance Sheets

(In thousands, except share and per share information)

|

|

|

|

|

|

|

|

|

|

|

September 30, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

Assets: |

|

(Unaudited) |

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

35,537 |

|

|

$ |

3,934 |

|

Accounts receivable, net of allowance for doubtful accounts of $118 and $86 as of September 30, 2024 and December 31, 2023, respectively |

|

|

1,078 |

|

|

|

550 |

|

Digital currencies |

|

|

19 |

|

|

|

75 |

|

Prepaid expenses and other current assets |

|

|

3,133 |

|

|

|

374 |

|

Current assets of discontinued operation |

|

|

- |

|

|

|

28 |

|

Total current assets |

|

|

39,767 |

|

|

|

4,961 |

|

Property and equipment, net |

|

|

27 |

|

|

|

40 |

|

Right-of-use asset |

|

|

943 |

|

|

|

1,451 |

|

Other assets |

|

|

276 |

|

|

|

276 |

|

Total assets |

|

$ |

41,013 |

|

|

$ |

6,728 |

|

|

|

|

|

|

|

|

Liabilities and stockholders' equity |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

4,776 |

|

|

$ |

7,836 |

|

Accrued expenses |

|

|

3,005 |

|

|

|

437 |

|

Lease liability |

|

|

339 |

|

|

|

629 |

|

Deferred revenue |

|

|

1,153 |

|

|

|

1,258 |

|

PhunCoin subscription payable |

|

|

1,202 |

|

|

|

1,202 |

|

Debt |

|

|

- |

|

|

|

4,936 |

|

Current liabilities of discontinued operation |

|

|

- |

|

|

|

205 |

|

Total current liabilities |

|

|

10,475 |

|

|

|

16,503 |

|

|

|

|

|

|

|

|

Deferred revenue |

|

|

713 |

|

|

|

651 |

|

Lease liability |

|

|

700 |

|

|

|

1,031 |

|

Total liabilities |

|

|

11,888 |

|

|

|

18,185 |

|

|

|

|

|

|

|

|

Commitments and contingencies (see Note 7) |

|

|

|

|

|

|

Stockholders' equity (deficit) |

|

|

|

|

|

|

Common stock, $0.0001 par value; 1,000,000,000 shares authorized; 11,748,780 shares issued and 11,738,650 shares outstanding as of September 30, 2024; and 3,861,578 shares issued and 3,851,448 shares outstanding as of December 31, 2023 |

|

|

1 |

|

|

|

- |

|

Treasury stock at cost; 10,130 shares as of September 30, 2024 and December 31, 2023 |

|

|

(502 |

) |

|

|

(502 |

) |

Additional paid-in capital |

|

|

340,731 |

|

|

|

292,467 |

|

Accumulated other comprehensive loss |

|

|

(418 |

) |

|

|

(418 |

) |

Accumulated deficit |

|

|

(310,687 |

) |

|

|

(303,004 |

) |

Total stockholders' equity (deficit) |

|

|

29,125 |

|

|

|

(11,457 |

) |

Total liabilities and stockholders' equity (deficit) |

|

$ |

41,013 |

|

|

$ |

6,728 |

|

Phunware, Inc.

Condensed Consolidated Statements of Operations and Comprehensive Loss

(In thousands, except share and per share information)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

|

|

|

September 30, |

|

|

September 30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Net revenues |

|

$ |

665 |

|

|

$ |

1,252 |

|

|

$ |

2,597 |

|

|

$ |

3,892 |

|

|

Cost of revenues |

|

|

343 |

|

|

|

621 |

|

|

|

1,281 |

|

|

|

2,651 |

|

|

Gross profit |

|

|

322 |

|

|

|

631 |

|

|

|

1,316 |

|

|

|

1,241 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales and marketing |

|

|

619 |

|

|

|

839 |

|

|

|

1,671 |

|

|

|

2,837 |

|

|

General and administrative |

|

|

2,281 |

|

|

|

2,985 |

|

|

|

7,051 |

|

|

|

11,397 |

|

|

Research and development |

|

|

612 |

|

|

|

1,042 |

|

|

|

1,592 |

|

|

|

4,023 |

|

|

Impairment of goodwill |

|

|

- |

|

|

|

9,043 |

|

|

|

- |

|

|

|

9,043 |

|

|

Total operating expenses |

|

|

3,512 |

|

|

|

13,909 |

|

|

|

10,314 |

|

|

|

27,300 |

|

|

Operating loss |

|

|

(3,190 |

) |

|

|

(13,278 |

) |

|

|

(8,998 |

) |

|

|

(26,059 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

(10 |

) |

|

|

(264 |

) |

|

|

(126 |

) |

|

|

(1,354 |

) |

|

Interest income |

|

|

381 |

|

|

|

- |

|

|

|

760 |

|

|

|

- |

|

|

Gain (loss) on extinguishment of debt |

|

|

- |

|

|

|

(237 |

) |

|

|

535 |

|

|

|

(237 |

) |

|

Gain on sale of digital currencies |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

5,310 |

|

|

Other income, net |

|

|

59 |

|

|

|

62 |

|

|

|

146 |

|

|

|

497 |

|

|

Total other income (expense) |

|

|

430 |

|

|

|

(439 |

) |

|

|

1,315 |

|

|

|

4,216 |

|

|

Loss before taxes |

|

|

(2,760 |

) |

|

|

(13,717 |

) |

|

|

(7,683 |

) |

|

|

(21,843 |

) |

|

Income tax expense |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Net loss from continuing operations |

|

|

(2,760 |

) |

|

|

(13,717 |

) |

|

|

(7,683 |

) |

|

|

(21,843 |

) |

|

Net loss from discontinued operation |

|

|

- |

|

|

|

(5,262 |

) |

|

|

- |

|

|

|

(7,929 |

) |

|

Net loss |

|

|

(2,760 |

) |

|

|

(18,979 |

) |

|

|

(7,683 |

) |

|

|

(29,772 |

) |

|

Other comprehensive loss (income) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cumulative translation adjustment |

|

|

- |

|

|

|

(37 |

) |

|

|

- |

|

|

|

9 |

|

|

Comprehensive loss |

|

$ |

(2,760 |

) |

|

$ |

(19,016 |

) |

|

$ |

(7,683 |

) |

|

$ |

(29,763 |

) |

|

Net loss from continuing operations per share, basic and diluted |

|

$ |

(0.25 |

) |

|

$ |

(5.72 |

) |

|

$ |

(0.88 |

) |

|

$ |

(9.98 |

) |

|

Net loss from discontinued operations per share, basic and diluted |

|

$ |

- |

|

|

$ |

(2.19 |

) |

|

$ |

- |

|

|

$ |

(3.62 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average shares used to compute net loss per share, basic and diluted |

|

|

11,104,174 |

|

|

|

2,398,873 |

|

|

|

8,755,908 |

|

|

|

2,188,101 |

|

|

Phunware, Inc.

Condensed Consolidated Statements of Cash Flows

(In thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended |

|

|

|

September 30, |

|

|

|

2024 |

|

|

2023 |

|

Operating activities |

|

|

|

|

|

|

Net loss |

|

$ |

(7,683 |

) |

|

$ |

(29,772 |

) |

Net loss from discontinued operation |

|

|

- |

|

|

|

(7,929 |

) |

Net loss from continuing operations |

|

|

(7,683 |

) |

|

|

(21,843 |

) |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

Gain on sale of digital assets |

|

|

- |

|

|

|

(5,310 |

) |

Gain (loss) on extinguishment of debt |

|

|

(535 |

) |

|

|

237 |

|

Impairment of goodwill |

|

|

- |

|

|

|

9,043 |

|

Stock based compensation |

|

|

1,532 |

|

|

|

3,662 |

|

Other adjustments |

|

|

653 |

|

|

|

1,383 |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

Accounts receivable |

|

|

(561 |

) |

|

|

(189 |

) |

Prepaid expenses and other assets |

|

|

(2,759 |

) |

|

|

198 |

|

Accounts payable and accrued expenses |

|

|

(457 |

) |

|

|

(349 |

) |

Lease liability payments |

|

|

(560 |

) |

|

|

(761 |

) |

Deferred revenue |

|

|

(43 |

) |

|

|

(625 |

) |

Net cash used in operating activities from continued operations |

|

|

(10,413 |

) |

|

|

(14,554 |

) |

Net cash used in operating activities from discontinued operations |

|

|

(177 |

) |

|

|

(1,315 |

) |

Net cash used in operating activities |

|

|

(10,590 |

) |

|

|

(15,869 |

) |

Investing activities |

|

|

|

|

|

|

Proceeds received from sale of digital currencies |

|

|

- |

|

|

|

15,390 |

|

Net cash provided by investing activities - continuing operations |

|

|

- |

|

|

|

15,390 |

|

Net cash used in investing activities - discontinued operation |

|

|

- |

|

|

|

(7 |

) |

Net cash provided by investing activities |

|

|

- |

|

|

|

15,383 |

|

Financing activities |

|

|

|

|

|

|

Payments on borrowings |

|

|

- |

|

|

|

(5,056 |

) |

Proceeds from sales of common stock, net of issuance costs |

|

|

42,193 |

|

|

|

6,879 |

|

Proceeds from exercise of options to purchase common stock |

|

|

- |

|

|

|

58 |

|

Payments on stock repurchases |

|

|

- |

|

|

|

(502 |

) |

Net cash provided by financing activities |

|

|

42,193 |

|

|

|

1,379 |

|

|

|

|

|

|

|

|

Effect of exchange rate on cash |

|

|

- |

|

|

|

9 |

|

Net increase in cash and restricted cash |

|

|

31,603 |

|

|

|

902 |

|

Cash and cash equivalents at the beginning of the period |

|

|

3,934 |

|

|

|

1,955 |

|

Cash and cash equivalents at the end of the period |

|

$ |

35,537 |

|

|

$ |

2,857 |

|

|

|

|

|

|

|

|

Supplemental disclosure of cash flow information |

|

|

|

|

|

|

Interest paid |

|

$ |

22 |

|

|

$ |

1,140 |

|

Income taxes paid |

|

$ |

40 |

|

|

$ |

- |

|

Supplemental disclosures of non-cash financing activities: |

|

|

|

|

|

|

Issuance of common stock upon conversion of the 2022 Promissory Note |

|

$ |

4,505 |

|

|

$ |

800 |

|

Issuance of common stock for payment of bonuses and consulting fees |

|

$ |

35 |

|

|

$ |

379 |

|

Non-cash exchange of digital assets |

|

$ |

- |

|

|

$ |

557 |

|

Issuance of common stock under the 2018 Employee Stock Purchase Plan, previously accrued |

|

$ |

- |

|

|

$ |

47 |

|

Non-GAAP Financial Measures and Reconciliation

Non-GAAP financial measures should be considered in addition to, not as a substitute for, or superior to, financial measures calculated in accordance with GAAP. They are not measurements of our financial performance under GAAP and should not be considered as alternatives to revenue or net loss, as applicable, or any other performance measures derived in accordance with GAAP and may not be comparable to other similarly titled measures of other businesses. Our non-GAAP financial measures have limitations as analytical tools and should not be considered in isolation or as a substitute for analysis of our operating results as reported under GAAP. Some of these limitations include: (i) non-cash compensation is and will remain a key element of our overall long-term incentive compensation package, although we exclude it as an expense when evaluating its ongoing operating performance for a particular period, (ii) our non-GAAP financial measures do not reflect the impact of certain charges resulting from matters we consider not to be indicative of ongoing operations, and (iii) other companies in our industry may calculate our non-GAAP financial measures differently than we do, limiting their usefulness as comparative measures.

We compensate for these limitations to our non-GAAP financial measures by relying primarily on our GAAP results and using our non-GAAP financial measures only for supplemental purposes. Our non-GAAP financial measures include adjustments for items that may not occur in future periods. However, we believe these adjustments are appropriate because the amounts recognized can vary significantly from period to period, do not directly relate to the ongoing operations of our business and complicate comparisons of our internal operating results and operating results of other peer companies over time. Each of the normal recurring adjustments and other adjustments described in this paragraph help management with a measure of our operating performance over time by removing items that are not related to day-to-day operations or are non-cash expenses.

Reconciliation of GAAP to Non-GAAP Financial Measures

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

(in thousands) |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Net loss from continuing operations |

|

$ |

(2,760 |

) |

|

$ |

(13,717 |

) |

|

$ |

(7,683 |

) |

|

$ |

(21,843 |

) |

Add back: Depreciation |

|

|

4 |

|

|

|

21 |

|

|

|

12 |

|

|

|

63 |

|

Add back: Interest expense |

|

|

10 |

|

|

|

264 |

|

|

|

126 |

|

|

|

1,354 |

|

Less: Interest income |

|

|

(381 |

) |

|

|

- |

|

|

|

(760 |

) |

|

|

- |

|

EBITDA |

|

|

(3,127 |

) |

|

|

(13,432 |

) |

|

|

(8,305 |

) |

|

|

(20,426 |

) |

Add back: Stock-based compensation |

|

|

242 |

|

|

|

838 |

|

|

|

1,532 |

|

|

|

3,662 |

|

Add back/less: Loss (gain) on extinguishment of debt |

|

|

- |

|

|

|

237 |

|

|

|

(535 |

) |

|

|

237 |

|

Add back: Impairment of goodwill |

|

|

- |

|

|

|

9,043 |

|

|

|

- |

|

|

|

9,043 |

|

Less: Gain on sale of digital assets |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(5,310 |

) |

Adjusted EBITDA |

|

$ |

(2,885 |

) |

|

$ |

(3,314 |

) |

|

$ |

(7,308 |

) |

|

$ |

(12,794 |

) |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

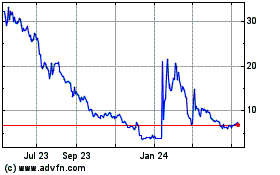

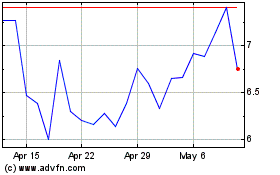

Phunware (NASDAQ:PHUN)

Historical Stock Chart

From Oct 2024 to Nov 2024

Phunware (NASDAQ:PHUN)

Historical Stock Chart

From Nov 2023 to Nov 2024