UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________________

SCHEDULE TO

(RULE 14d-100)

Tender Offer Statement under Section 14(d)(1)

or 13(e)(1)

of the Securities Exchange Act of 1934

(Amendment No. 1)

_______________________________________

Performance

Shipping Inc.

(Name of Subject Company (Issuer))

_______________________________________

Sphinx

Investment Corp.

(Offeror)

Maryport

Navigation Corp.

(Parent of Offeror)

George

Economou

(Affiliate of Offeror)

(Names of Filing Persons)

_______________________________________

Common shares, $0.01 par value

(including

the associated Preferred stock purchase rights)

(Title of Class of Securities)

Y67305105

(CUSIP Number of Class of Securities)

_______________________________________

Kleanthis Spathias

c/o Levante Services Limited

Leoforos Evagorou 31, 2nd Floor,

Office 21

1066 Nicosia, Cyprus

+35 722 010610

(Name, address and telephone number of person

authorized to receive notices and communications on behalf of filing persons)

_______________________________________

With a copy to:

Richard M. Brand

Kiran S. Kadekar

Cadwalader, Wickersham & Taft LLP

200 Liberty Street

New York, NY 10281

(212) 504-6000

_______________________________________

| ¨ | Check the box if the filing

relates solely to preliminary communications made before the commencement of a tender offer. |

Check

the appropriate boxes below to designate any transactions to which the statement relates:

| x | third-party tender offer subject

to Rule 14d-1. |

| ¨ | issuer tender offer subject to

Rule 13e-4. |

| ¨ | going-private transaction subject

to Rule 13e-3. |

| x | amendment to Schedule 13D under

Rule 13d-2. |

Check

the following box if the filing is a final amendment reporting the results of the tender offer: ¨

If

applicable, check the appropriate box(es) below to designate the appropriate rule provision(s) relied upon:

| ¨ | Rule 13e-4(i) (Cross-Border Issuer

Tender Offer) |

| ¨ | Rule 14d-1(d) (Cross-Border Third-Party

Tender Offer) |

As permitted by General Instruction G to

Schedule TO, this Schedule TO is also Amendment No. 6 to the Schedule 13D filed by Sphinx Investment Corp. (the “Offeror”),

Maryport Navigation Corp. and Mr. George Economou on August 25, 2023 (and amended on August 31, 2023, September 4, 2023, September 15,

2023, and twice on October 11, 2023) in respect of the Common Shares of the Company.

| |

| |

| |

1. |

Names of Reporting Persons

Sphinx Investment Corp. |

| |

|

|

| |

2. |

Check the Appropriate Box if a Member of a Group (See Instructions) |

| |

|

(a) |

o |

| |

|

(b) |

x |

| |

|

|

| |

3. |

SEC Use Only |

| |

|

|

| |

4. |

Source of Funds (See Instructions)

WC |

| |

|

|

| |

5. |

Check Box if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) o |

| |

|

|

| |

6. |

Citizenship or Place of Organization

Republic of the Marshall Islands |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7. |

Sole Voting Power

0 |

| 8. |

Shared Voting Power

1,033,859* |

| 9. |

Sole Dispositive Power

0 |

| 10. |

Shared Dispositive Power

1,033,859* |

| |

11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

1,033,859* |

| |

12. |

Check Box if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) o |

| |

13. |

Percent of Class Represented by Amount in Row (11)

8.8%** |

| |

14. |

Type of Reporting Person (See Instructions)

CO |

| |

|

|

|

|

|

* All reported Common Shares are held by Sphinx

Investment Corp. Sphinx Investment Corp. is a wholly-owned subsidiary of Maryport Navigation Corp., which is a Liberian company controlled

by Mr. Economou.

** Based on the 11,734,683 Common Shares stated

by the Issuer as being outstanding as at September 29, 2023 in its Report on Form 6-K, filed with the United States Securities and Exchange

Commission (the “SEC”) on September 29, 2023 (the “September 29 2023 6-K”).

| |

| |

| |

1. |

Names of Reporting Persons

Maryport Navigation Corp. |

| |

|

|

| |

2. |

Check the Appropriate Box if a Member of a Group (See Instructions) |

| |

|

(a) |

o |

| |

|

(b) |

x |

| |

|

|

| |

3. |

SEC Use Only |

| |

|

|

| |

4. |

Source of Funds (See Instructions)

AF |

| |

|

|

| |

5. |

Check Box if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) o |

| |

|

|

| |

6. |

Citizenship or Place of Organization

Liberia |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7. |

Sole Voting Power

0 |

| 8. |

Shared Voting Power

1,033,859* |

| 9. |

Sole Dispositive Power

0 |

| 10. |

Shared Dispositive Power

1,033,859* |

| |

11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

1,033,859* |

| |

12. |

Check Box if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) o |

| |

13. |

Percent of Class Represented by Amount in Row (11)

8.8%** |

| |

14. |

Type of Reporting Person (See Instructions)

CO |

| |

|

|

|

|

|

* All reported Common Shares are held by Sphinx

Investment Corp. Sphinx Investment Corp. is a wholly-owned subsidiary of Maryport Navigation Corp., which is a Liberian company controlled

by Mr. Economou.

** Based on the 11,734,683 Common Shares stated by the Issuer as being

outstanding as at September 29, 2023 in its September 29 2023 6-K.

| |

| |

| |

1. |

Names of Reporting Persons

George Economou |

| |

|

|

| |

2. |

Check the Appropriate Box if a Member of a Group (See Instructions) |

| |

|

(a) |

o |

| |

|

(b) |

x |

| |

|

|

| |

3. |

SEC Use Only |

| |

|

|

| |

4. |

Source of Funds (See Instructions)

AF |

| |

|

|

| |

5. |

Check Box if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) o |

| |

|

|

| |

6. |

Citizenship or Place of Organization

Greece |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7. |

Sole Voting Power

0 |

| 8. |

Shared Voting Power

1,033,859* |

| 9. |

Sole Dispositive Power

0 |

| 10. |

Shared Dispositive Power

1,033,859* |

| |

11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

1,033,859* |

| |

12. |

Check Box if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) o |

| |

13. |

Percent of Class Represented by Amount in Row (11)

8.8%** |

| |

14. |

Type of Reporting Person (See Instructions)

IN |

| |

|

|

|

|

|

* All reported Common Shares are held by Sphinx

Investment Corp. Sphinx Investment Corp. is a wholly-owned subsidiary of Maryport Navigation Corp., which is a Liberian company controlled

by Mr. Economou.

** Based on the 11,734,683 Common Shares stated

by the Issuer as being outstanding as at September 29, 2023 in its September 29 2023 6-K.

SCHEDULE TO

This Amendment No. 1 (this

“Amendment No. 1”) is filed by the Offeror (as defined below), Maryport (as defined below) and Mr. George Economou

and amends and supplements the Tender Offer Statement on Schedule TO originally filed with the Securities and Exchange Commission (the

“SEC”) on October 11, 2023 (such original Tender Offer Statement on Schedule TO (including any exhibits and annexes

attached thereto), the “Original Schedule TO”), and as hereby amended and supplemented (including by the exhibits

and annexes hereto), together with any subsequent amendments and supplements thereto, this “Schedule TO”) by Sphinx

Investment Corp., a corporation organized under the laws of the Republic of the Marshall Islands (the “Offeror”),

Maryport Navigation Corp., a corporation organized under the laws of the Republic of Liberia that is the direct parent of the Offeror

(“Maryport”), and Mr. George Economou, who directly owns Maryport and controls each of the Offeror and Maryport. This

Schedule TO relates to the tender offer by the Offeror to purchase all of the issued and outstanding common shares, par value $0.01

per share (the “Common Shares”), of Performance Shipping Inc., a corporation organized under the laws of the

Republic of the Marshall Islands (the “Company”) (including the associated preferred stock purchase rights

(the “Rights”, and together with the Common Shares, the “Shares”) issued pursuant to the Stockholders’

Rights Agreement, dated as of December 20, 2021, between the Company and Computershare

Inc. as Rights Agent (as it may be amended from time to time)), for $3.00 per Share in cash, without interest, less any applicable

withholding taxes, upon the terms and subject to the conditions set forth in (a) the Amended and Restated Offer to Purchase, dated October

30, 2023, a copy of which is attached as Exhibit (a)(1)(G) (the “Offer to Purchase”), (b) the related revised Letter

of Transmittal, a copy of which is attached as Exhibit (a)(1)(H) (the “Letter of Transmittal”), and (c) the related

revised Notice of Guaranteed Delivery, a copy of which is attached as Exhibit (a)(1)(I) (the “Notice of Guaranteed Delivery”)

(which three documents, including any amendments or supplements thereto, collectively constitute the “Offer”).

As permitted by General

Instruction G to Schedule TO, this Schedule TO is also Amendment No. 6 to the Schedule 13D filed by the Offeror, Maryport and Mr. Economou

on August 25, 2023 (and amended on August 31, 2023, September 4, 2023, September 15, 2023, and twice on October 11, 2023) in respect

of the Common Shares.

All the information

set forth in the Offer to Purchase, including Schedule I and Schedule II thereto, is incorporated by reference herein in response to Items

1 through 9 and Item 11 of this Schedule TO, and is supplemented by the information specifically provided in this Schedule TO.

All information

regarding the Offer as set forth in the Original Schedule TO, including all exhibits and annexes thereto that were filed with the Original

Schedule TO, is hereby expressly incorporated by reference into this Amendment No. 1, except that such information is hereby amended

and supplemented to the extent specifically provided for herein and in the exhibits and annexes filed herewith.

| Item 1. | Summary Term Sheet. The information set forth in the section of the Offer to Purchase entitled

“Summary Term Sheet” is incorporated herein by reference. |

| Item 2. | Subject Company Information. |

(a) The

name of the subject company is Performance Shipping Inc. The address of its principal executive offices is 373 Syngrou Avenue, 175 64

Palaio Faliro, Athens, Greece. Its telephone number is + 30-216-600-2400.

(b) The

information set forth in the sections of the Offer to Purchase entitled “Summary Term Sheet” and “Introduction”

is incorporated herein by reference.

(c) The

information set forth in Section 6 of the Offer to Purchase entitled “Price Range of the Shares; Dividends” is incorporated

herein by reference.

| Item 3. | Identity and Background of Filing Person. |

This Schedule TO is filed by the Offeror,

Maryport and George Economou. The information set forth in the section of the Offer to Purchase entitled “Summary Term Sheet”;

Section 8 of the Offer to Purchase entitled “Certain Information Concerning the Offeror”; and Schedule I to the Offer to Purchase

is incorporated herein by reference.

| Item 4. | Terms of the Transaction. |

The information set forth in the Offer to Purchase

is incorporated herein by reference.

| Item 5. | Past Contacts, Transactions, Negotiations and Agreements. |

The information set forth in the section

of the Offer to Purchase entitled “Introduction”; Section 8 of the Offer to Purchase entitled “Certain Information Concerning

the Offeror”; Section 10 of the Offer to Purchase entitled “Background of the Offer; Past Contacts and Negotiations with

the Company”; Section 11 of the Offer to Purchase entitled “Purpose of the Offer; Plans for the Company”; and Section

12 of the Offer to Purchase entitled “Certain Effects of the Offer” is incorporated herein by reference.

| Item 6. | Purposes of the Transaction and Plans or Proposals. |

The information set forth in the section

of the Offer to Purchase entitled “Introduction”; Section 11 of the Offer to Purchase entitled “Purpose of the Offer;

Plans for the Company”; and Section 12 of the Offer to Purchase entitled “Certain Effects of the Offer” is incorporated

herein by reference.

| Item 7. | Source and Amount of Funds or Other Consideration. |

The information set forth in Section 9 of the

Offer to Purchase entitled “Source and Amount of Funds” is incorporated herein by reference.

| Item 8. | Interest in the Securities of the Subject Company. |

The information set forth in the section of the

Offer to Purchase entitled “Introduction” and Section 8 of the Offer to Purchase entitled “Certain Information Concerning

the Offeror” is incorporated herein by reference.

| Item 9. | Persons/Assets, Retained, Employed, Compensated or Used. |

The information set forth

in Section 10 of the Offer to Purchase entitled “Background of the Offer; Past Contacts and Negotiations with the Company”;

Section 11 of the Offer to Purchase entitled “Purpose of the Offer; Plans for the Company”; Section 12 of the Offer to

Purchase entitled “Certain Effects of the Offer” and Section 16 of the Offer to Purchase entitled “Fees and Expenses”

is incorporated herein by reference.

| Item 10. | Financial Statements. |

Not applicable. In accordance with Instruction

2 to Item 10 of Schedule TO, the financial statements of the Offeror, Maryport and George Economou are not material because (a) the consideration

offered consists solely of cash; (b) the Offer is not subject to any financing condition; and (c) the Offer is for all outstanding securities

of the subject class.

| Item 11. | Additional Information. |

(a)(1) The information

set forth in Section 8 of the Offer to Purchase entitled “Certain Information Concerning the Offeror”; Section 10 of the Offer

to Purchase entitled “Background of the Offer; Past Contacts and Negotiations with the Company”; and Section 12 of the

Offer to Purchase entitled “Certain Effects of the Offer” is incorporated herein by reference.

(a)(2), (3) The information

set forth in Section 14 of the Offer to Purchase entitled “Conditions of the Offer”, Section 15 of the Offer to Purchase entitled

“Certain Legal Matters; Regulatory Approvals; Appraisal Rights”, and Section 18 of the Offer to Purchase entitled “Legal

Proceedings” is incorporated herein by reference.

(a)(4) The information

set forth in Section 12 of the Offer to Purchase entitled “Certain Effects of the Offer” is incorporated herein by reference.

(a)(5) The information

set forth in Section 15 of the Offer to Purchase entitled “Certain Legal Matters; Regulatory Approvals; Appraisal Rights”

and Section 18 of the Offer to Purchase entitled “Legal Proceedings” is incorporated herein by reference.

(c) The information

set forth in the Offer to Purchase, the Letter of Transmittal and the Notice of Guaranteed Delivery is incorporated herein by reference.

| Exhibit |

Description |

| |

|

| (a)(1)(A) |

Offer

to Purchase* |

| (a)(1)(B) |

Form

of Letter of Transmittal* |

| (a)(1)(C) |

Form

of Notice of Guaranteed Delivery* |

| (a)(1)(D) |

Form

of Letter to Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees* |

| (a)(1)(E) |

Form

of Letter to Clients for Use by Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees* |

| (a)(1)(F) |

Form

of Summary Advertisement as published in the New York Times on October 11, 2023 * |

| (a)(1)(G) |

Amended and Restated Offer to Purchase** |

| (a)(1)(H) |

Form of revised Letter of Transmittal** |

| (a)(1)(I) |

Form

of revised Notice of Guaranteed Delivery** |

| (a)(1)(J) |

Form of revised Letter to Brokers, Dealers,

Commercial Banks, Trust Companies and Other Nominees** |

| (a)(1)(K) |

Form of revised Letter to Clients for Use by

Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees** |

| (a)(1)(L) |

Complaint filed by Sphinx Investment Corp.

in the Supreme Court of the State of New York located in the County of New York** |

| (b) |

Not applicable. |

| (d) |

Not applicable. |

| (g) |

Not applicable. |

| (h) |

Not applicable. |

| 107

|

Filing

Fee Table* |

| Item 13. | Information Required by Schedule 13E-3 |

Not applicable.

SIGNATURES

After due inquiry and to the

best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Date: October 30, 2023

| |

SPHINX INVESTMENT CORP. |

| |

|

| |

By: Levante Services Limited |

| |

|

| |

By: /s/ Kleanthis Costa Spathias |

| |

Kleanthis Costa Spathias |

| |

Director |

| |

|

| |

MARYPORT NAVIGATION CORP. |

| |

|

| |

By: Levante Services Limited |

| |

|

| |

By: /s/ Kleanthis Costa Spathias |

| |

Kleanthis Costa Spathias |

| |

Director |

| |

|

| |

George Economou |

| |

|

| |

/s/ George Economou |

| |

George Economou |

EXHIBIT

INDEX

| Exhibit |

|

Description |

| |

|

|

| (a)(1)(A) |

|

Offer

to Purchase* |

| (a)(1)(B) |

|

Form

of Letter of Transmittal* |

| (a)(1)(C) |

|

Form

of Notice of Guaranteed Delivery* |

| (a)(1)(D) |

|

Form

of Letter to Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees* |

| (a)(1)(E) |

|

Form

of Letter to Clients for Use by Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees* |

| (a)(1)(F) |

|

Form

of Summary Advertisement as published in the New York Times on October 11, 2023 * |

| (a)(1)(G) |

|

Amended and Restated Offer to Purchase** |

| (a)(1)(H) |

|

Form of revised Letter of Transmittal** |

| (a)(1)(I) |

|

Form of revised Notice of Guaranteed Delivery** |

| (a)(1)(J) |

|

Form of revised Letter to Brokers, Dealers,

Commercial Banks, Trust Companies and Other Nominees** |

| (a)(1)(K) |

|

Form of revised Letter to Clients for Use by

Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees** |

| (a)(1)(L) |

|

Complaint filed by Sphinx Investment Corp.

in the Supreme Court of the State of New York located in the County of New York** |

| (b) |

|

Not applicable. |

| (d) |

|

Not applicable. |

| (g) |

|

Not applicable. |

| (h) |

|

Not applicable. |

| 107

|

|

Filing

Fee Table* |

Exhibit (a)(1)(G)

Amended and Restated Offer to Purchase for

Cash

All of the Outstanding Common Shares

(Including the Associated Preferred Stock Purchase

Rights)

of

Performance

Shipping Inc.

for

$3.00 Per Common Share (including the Associated

Preferred Stock Purchase Right)

by

Sphinx

Investment Corp.

THE

OFFER AND WITHDRAWAL RIGHTS WILL EXPIRE AT 11:59 p.m., NEW YORK CITY TIME, ON NOVEMBER 15, 2023, UNLESS THE OFFER IS EXTENDED (SUCH DATE

AND TIME, AS IT MAY BE EXTENDED, THE “EXPIRATION DATE and Time”).

THE

OFFER IS BEING MADE BY Sphinx Investment Corp., A corporation ORGANIZED UNDER THE LAWS OF THE Republic of the Marshall Islands (THE

“OFFEROR”), TO PURCHASE ALL OF THE ISSUED AND OUTSTANDING COMMON SHARES, PAR VALUE $0.01 PER SHARE (THE

“COMMON SHARES”), OF Performance Shipping Inc., A corporation organized under the laws of the Republic of the

Marshall Islands (THE “COMPANY” OR “PERFORMANCE”) (INCLUDING THE ASSOCIATED preferred stock

purchase RIGHTS (THE “RIGHTS”, AND TOGETHER WITH THE COMMON SHARES, THE “SHARES”) ISSUED

PURSUANT TO THE Stockholders’ Rights Agreement, DATED as of December 20, 2021, BETWEEN THE COMPANY AND

Computershare Inc. as Rights Agent (AS IT MAY BE AMENDED FROM TIME TO TIME, THE “RIGHTS AGREEMENT”), FOR

$3.00 PER SHARE IN CASH, WITHOUT INTEREST, LESS ANY APPLICABLE WITHHOLDING TAXES (THE “OFFER PRICE”), UPON THE

TERMS AND SUBJECT TO THE CONDITIONS SET FORTH IN THIS AMENDED AND RESTATED OFFER TO PURCHASE (as it may be FURTHER amended or

supplemented, THE “OFFER TO PURCHASE”) AND IN THE RELATED revised LETTER OF TRANSMITTAL (the “letter of

transmittal”) and THE RELATED REVISED Notice of Guaranteed Delivery (the “notice of guaranteed delivery”) (as each

may be further revised, amended or supplemented) (this offer to purchase, TOGETHER with the letter of transmittal and NOTICE

OF GUARANTEED DELIVERY, COLLECTIVELY CONSTITUTE THE “OFFER”). UNDER NO CIRCUMSTANCES WILL INTEREST BE PAID ON

THE OFFER PRICE FOR THE SHARES, REGARDLESS OF ANY EXTENSION OF THE OFFER.

THE OFFEROR

IS A WHOLLY-OWNED DIRECT SUBSIDIARY OF MARYPORT NAVIGATION CORP., a corporation organized under the laws of the Republic of Liberia (“MARYPORT”)

AND AN AFFILIATE OF INVESTOR AND BUSINESSMAN MR. GEORGE ECONOMOU, A CITIZEN OF GREECE.

ON

September 15, 2023 AND AGAIN ON SEPTEMBER 25, 2023, THE OFFEROR DELIVERED TO THE COMPANY A NOTICE OF (i) NOMINATION OF Ioannis

(JOHN) Liveris (THE “SPHINX NOMINEE”) for election to THE COMPANY’S BOARD OF DIRECTORS (the “BOARD”)

AS A CLASS II DIRECTOR AT THE next annual Meeting OF THE COMPANY’S SHAREHOLDERS (INCLUDING ANY and all adjournments, postponements,

continuations or reschedulings thereof, or any other meetings of shareholders of the Company held in lieu thereof, THE “2024

SHAREHOLDER MEETING”) and (ii) the Offeror’s proposal to bring before the 2024 Shareholder Meeting (a) an advisory,

nonbinding proposal that the Board be declassified prior to the first Annual Meeting of the Company’s shareholders to be held after

the 2024 Shareholder Meeting (the “Declassification Proposal”), and (b) four advisory, non-binding proposals

(each, a “Vote of No-Confidence Proposal”) that the Company’s shareholders request the resignation from the

Board of each of Andreas Michalopoulos, Loïsa Ranunkel, Alex Papageorgiou and Mihalis Boutaris.

The Offer

is not conditioned upon the Sphinx Nominee being elected to the Board or on the passage of the declassification proposal or any vote

of non-confidence proposal. THE OFFER IS also NOT CONDITIONED UPON THE OFFEROR OBTAINING FINANCING OR UPON ANY DUE DILIGENCE REVIEW OF

THE COMPANY.

THE

OFFER IS SUBJECT TO THE SATISFACTION or waiver, at or before THE EXPIRATION DATE and time, OF CERTAIN CONDITIONS SET FORTH IN THIS OFFER

TO PURCHASE, INCLUDING, AMONG OTHER THINGS, the following conditions: (i) there shall have been validly tendered into the Offer

and not withdrawn a number of Shares which, together with any Shares then-owned by the Offeror, represents at least a majority of the

issued and outstanding Shares on a fully-diluted basis (assuming the exercise or conversion of all then-outstanding options (as

defined below) and other derivative securities regardless of the exercise or conversion price, the vesting schedule or other terms and

conditions thereof) (the “Minimum Tender Condition”); (ii) either (a) the Rights Agreement shall have been

validly terminated and the rights shall have been redeemed, and the Certificate of Designation, Preferences and Rights of Series A

Participating Preferred Stock (such certificate, the “Series A Certificate” and such stock, the “Series a

Preferred Stock”) shall have been validly cancelled and no Series A Preferred Stock shall be outstanding, or (b) the

Rights Agreement shall have been otherwise made inapplicable to the Offer and the Offeror and its affiliates (the applicable of clause

(a) and clause (b), the “Poison Pill Condition”); (iii) the Board shall have validly waived the applicability

of Article K of the Company’s Amended and Restated Articles of Incorporation (“Article K”) to the

purchase of the Shares by the Offeror in the Offer so that the provisions of Article K would not, at or at any time following consummation

of the Offer, prohibit, restrict or apply to any “business combination”, as defined in Article K, involving the Company

and the Offeror or any affiliate or associate of the Offeror (the “Article K Condition”); (iv) the

Company shall not have any securities outstanding, authorized or proposed for issuance other than (a) the Shares, (b) authorized

Series A Preferred Stock (none of which shall have been issued), (c) the number of shares of Series B Convertible Cumulative

Perpetual Preferred Stock (the “Series B Preferred Stock”) outstanding as of OCTOBER 10, 2023, (d) the warrants

outstanding as of OCTOBER 10, 2023 (which shall not be exercisable in the aggregate for more than the 7,904,221 Shares disclosed by the

Company in its Form 6-K on September 29, 2023, and the terms of which such warrants shall not have been amended on or after

october 11, 2023), (e) (1) the options to purchase Shares under the Company’s Amended and Restated 2015 Equity Incentive

Plan (as such plan was in effect as of OCTOBER 10, 2023) (the “Equity Incentive Plan”) outstanding, and subject to

the terms as in effect, as of OCTOBER 10, 2023, and (2) any options to purchase shares under the Equity Incentive Plan that are

issued pursuant to the Equity Incentive Plan on or after october 11, 2023 in the ordinary and usual course of business, consistent with

past practice (clause (1) and clause (2), collectively, the “Options”); (f) Shares authorized for issuance

but not yet subject to awards under the Equity Incentive Plan (none of which shall, on or after october 11, 2023, have been issued other

than in the ordinary and usual course of business, consistent with past practice); and (g) the Remedial Rights(as defined below) and

the Remedial Shares (as defined below) (with none of the remedial shares having been issued) (the “Equity Condition”);

(v) either (a) (1) Section 4 of the Certificate of Designation, preferences and rights of Series C Convertible Cumulative

Redeemable Perpetual Preferred Stock (such certificate, the “Series C Certificate” and such stock, the “Series C

Preferred Stock”) shall no longer be in effect, (2) any and all shares of the Series C Preferred Stock held as of

october 11, 2023 by any of Mango Shipping Corp. (“Mango”), Mitzela Corp. (“Mitzela”), and Giannakis

(John) Evangelou, Antonios Karavias, Christos Glavanis, and Reidar Brekke, or by any “affiliate” (as such term is defined

in Rule 12b-2 of the General Rules and Regulations under the United States Securities and Exchange Act of 1934, as amended (the “Exchange

Act”) of any of the foregoing (collectively, the “Insider Holders”), and any and all Shares purported to have

been issued pursuant to the purported conversion of any such shares of Series C Preferred Stock, shall have been validly cancelled

for no consideration and (3) no other shares of Series C Preferred Stock shall be outstanding; or (b) (1) there shall have

been issued upon each Share outstanding from time to time aN UNCERTIFICATED right (which such right SHALL BE STAPLED TO THE ASSOCIATED

SHARE AND shall, immediately and solely following the Offeror’s deposit with the Tender Offer Agent of the proceeds required to

consummate the Offer, be freely exercisable at any time in exchange for nominal consideration (and shall not be exercisable prior to

the Offeror’s deposit with the Tender Offer Agent of the proceeds required to consummate the Offer, and shall not be subject to

involuntary redemption or repurchase)) (each, a “Remedial Right”) to purchase such number of shares of Series C Preferred

Stock (and/or such number of shares of a new class of preferred stock of the Company) (the “Remedial Shares”) that

would, once issued to the holder of such Share, put the holder of such Share in the same economic, voting, governance and other position

as the holder of such Share would have been in had the Series C Preferred Stock issued to the Insider Holders been cancelled for no consideration,

(2) no Remedial Shares (or rights to acquire Remedial Shares other than the Remedial Rights) shall have been issued to any Insider Holder

or any “associate” (as such term is defined in Rule 12b-2 of the General Rules and Regulations under the Exchange Act) of

an Insider Holder and (3) any Remedial Right beneficially owned from time to time by any Insider Holder, any “associate”

(as such term is defined in Rule 12b-2 of the General Rules and Regulations under the Exchange Act) of an Insider Holder or any direct

or indirect transferee of an Insider Holder or of any such “associate” shall be rendered unexercisable pursuant to the definitive

documentation for such Remedial Rights (the applicable of clause (a) and clause (b), the “Series C Condition”);

(vi) the Certificate of Designation, Preferences and Rights of Series B Preferred Stock (the “Series B Certificate”)

either (a) shall have been validly cancelled or (b) shall not have been amended (the applicable of clause (a) and clause

(b), the “Series B Condition”), and (vii) the size of the Board shall remain fixed at five members, with

at least three of such authorized five Board seats either (a) then-being occupied by persons having been designated by us, (b) then-being

vacant, with the company having publicly committed on a binding basis to fill such vacancies with persons designated by us or (c) then-being

occupied by directors who shall have publicly submitted their irrevocable resignations from the board, effective no later than the Offeror’s

purchase of the Shares tendered in the Offer, which such resignations shall have been publicly accepted by the Company (with the Company

having publicly committed on a binding basis to fill the resulting vacancies with persons designated by us) (the applicable of clause

(a), clause (b) and clause (c), the “Board Representation Condition”). THE OFFER IS ALSO SUBJECT TO THE SATISFACTION

OR WAIVER OF OTHER CUSTOMARY CONDITIONS SET FORTH IN THIS OFFER TO PURCHASE. SEE SECTION 14 — “CONDITIONS OF THE OFFER”.

THE CONDITIONS TO THE OFFER MUST BE SATISFIED AT OR BEFORE THE EXPIRATION DATE AND TIME, as it may be extended.

THE COMPLETION OF THE OFFER, EITHER ALONE OR

TOGETHER WITH ANY CHANGES IN THE COMPOSITION OF THE COMPANY MANAGEMENT TEAM, MAY TRIGGER “CHANGE OF CONTROL” PROVISIONS

IN CERTAIN MATERIAL CONTRACTS THAT THE COMPANY HAS PUBLICLY FILED WITH THE SECURITIES AND EXCHANGE COMMISSION (THE “SEC”),

AND/OR OTHER COMPANY CONTRACTS THAT HAVE NOT BEEN MADE AVAILABLE TO THE OFFEROR. SEE SECTION 12 — “CERTAIN EFFECTS OF

THE OFFER”. FOR THE AVOIDANCE OF DOUBT, NONE OF THE EFFECTS DESCRIBED THEREIN WILL AFFECT THE CONSUMMATION OF THE OFFER IF ALL

THE CONDITIONS TO THE OFFER ARE SATISFIED.

THIS OFFER

TO PURCHASE REFERS TO A PROXY SOLICITATION. THIS OFFER TO PURCHASE IS NOT INTENDED TO AND DOES NOT CONSTITUTE (I) A SOLICITATION

OF ANY PROXY, CONSENT OR AUTHORIZATION FOR OR WITH RESPECT TO THE 2024 Shareholder Meeting OR ANY OTHER MEETING OF COMPANY SHAREHOLDERS

OR (II) A SOLICITATION OF ANY CONSENT OR AUTHORIZATION IN THE ABSENCE OF ANY SUCH MEETING. ANY SUCH SOLICITATION Is being or WILL

BE MADE ONLY PURSUANT TO PROXY OR CONSENT SOLICITATION MATERIALS THAT COMPLY WITH THE APPLICABLE PROVISIONS OF MARSHALL ISLANDS LAW.

ShareHOLDERS ARE ADVISED TO READ THE PROXY STATEMENT THAT WAS FURNISHED ON SCHEDULE 13D on october 11, 2023 AS IT MAY BE AMENDED

OR SUPPLEMENTED FROM TIME TO TIME (THE “PROXY STATEMENT”) AND (as, WHEN AND IF THEY BECOME AVAILABLE) ANY OTHER DOCUMENTS

RELATED TO THE SOLICITATION OF PROXIES BY THE OFFEROR AND ITS AFFILIATES FROM THE SHAREHOLDERS OF THE COMPANY FOR USE AT the 2024 Shareholder

Meeting, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. A PROXY STATEMENT AND A FORM OF PROXY is AVAILABLE AT NO CHARGE AT THE

SEC’S WEBSITE AT HTTP://WWW.SEC.GOV.

Subject to applicable law, the Offeror reserves

the right to amend the Offer in any respect (including amending the Offer Price).

A summary of the principal terms of the Offer

begins on page ii. You should read this entire Offer to Purchase, the Letter of Transmittal and the Notice of Guaranteed Delivery

carefully before deciding whether to tender your Shares in the Offer. Questions and requests for assistance or additional copies

of this Offer to Purchase, the Letter of Transmittal, and the Notice of Guaranteed Delivery may be directed to the information agent

for the Offer, Innisfree M&A Incorporated (whom we refer to as the “Information Agent”) at the location and

telephone number set forth on the back cover of this Offer to Purchase. Shareholders may also contact their broker, dealer, commercial

bank or trust company for assistance concerning the Offer.

This Amended and Restated Offer to Purchase,

dated October 30, 2023 (this “Offer to Purchase”) hereby amends and restates the Offer to Purchase dated October 11, 2023

and filed with the SEC on such date (the “Original Offer to Purchase”). Except as otherwise set forth in this Offer to Purchase,

the terms and conditions set forth in the Original Offer to Purchase are applicable in all respects to the Offer. Where the information

in the Original Offer to Purchase is in conflict with or is supplemented or replaced by information in this Offer to Purchase, the information

provided in this Offer to Purchase governs.

The Information Agent for this Offer is:

Innisfree M&A Incorporated

501 Madison Avenue, 20th Floor

New York, New York 10022

Shareholders May Call Toll Free: (877) 800-5190

Banks and Brokers May Call Collect: (212)

750-5833

October 30, 2023

IMPORTANT INFORMATION

If you are a holder of Shares, regardless of

where you are located, and you desire to tender all or any portion of your Shares to the Offeror pursuant to the Offer, you must follow

the applicable procedures set forth below:

| · | If

you are a registered holder of Shares, you should: |

(a) properly complete and sign

the Letter of Transmittal for the Offer, which is enclosed with this Offer to Purchase and also available from the Information Agent,

in accordance with the instructions contained in the Letter of Transmittal, and mail or deliver the Letter of Transmittal (or a manually

executed facsimile thereof) and any other documents required by the Letter of Transmittal to Continental Stock Transfer & Trust

Company, in its capacity as Tender Offer Agent for the Offer (the “Tender Offer Agent”), such that they are received

by the Tender Offer Agent before the Expiration Date and Time, and

(b) (i) if your Shares are

certificated, deliver the certificates for your Shares and, if certificates have been issued in respect of the associated Rights prior

to the Expiration Date and Time, certificates representing the associated Rights, to the Tender Offer Agent along with the Letter of

Transmittal (or a manually executed facsimile thereof), such that they are received by the Tender Offer Agent before the Expiration Date

and Time or (ii) if your Shares are held via book-entry, tender your Shares by book-entry transfer by following the procedures described

in Section 2 — “PROCEDURES FOR ACCEPTING THE OFFER AND TENDERING SHARES”, such that they are received by the Tender

Offer Agent before the Expiration Date and Time.

Do not send your Shares or any other

documents directly to the Offeror, Maryport, Mr. George Economou or the Information Agent.

| · | If

you hold your Shares through a broker, dealer, commercial bank, trust company or other nominee,

you must contact that institution and have that institution tender your Shares on your behalf,

such that they are received by the Tender Offer Agent before the Expiration Date and Time.

Such institutions are likely to establish cutoff times and dates earlier than the Expiration

Date and Time to receive instructions to tender Shares into the Offer. You should contact

your broker, dealer, commercial bank, trust company or other nominee to determine the cutoff

time and date that is applicable to you. If you are unable to perform the procedures described

above prior to the Expiration Date and Time, you may still be able to tender your Shares

to the Offeror pursuant to the Offer by following the procedures for guaranteed delivery

described in Section 2 — “PROCEDURES FOR ACCEPTING THE OFFER AND TENDERING

SHARES”. |

* * * * *

Questions

and requests for assistance regarding the Offer or any of the terms of the Offer may be directed to Innisfree M&A Incorporated, as

Information Agent, at the address and telephone number set forth below. Requests for additional copies of this Offer to Purchase, the

Letter of Transmittal, the Notice of Guaranteed Delivery, and other tender offer materials may be directed to the Information Agent.

You may also contact your broker, dealer, commercial bank, trust company or other nominee for assistance. Copies of these materials are

also freely available at the website maintained by the SEC at http://www.sec.gov.

The

Information Agent for the Offer is:

501 Madison Avenue, 20th Floor

New York, New York 10022

Shareholders May Call Toll Free: (877) 800-5190

Banks and Brokers May Call Collect: (212)

750-5833

This Offer to Purchase, the Letter of Transmittal

and the Notice of Guaranteed Delivery contain important information, and you should read such documents carefully and in their entirety

before making a decision with respect to the Offer. THIS TRANSACTION HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY STATE SECURITIES

COMMISSION OR THE SECURITIES REGULATORY AUTHORITIES OF ANY OTHER JURISDICTION, NOR HAS THE SEC OR ANY STATE SECURITIES COMMISSION OR

THE SECURITIES REGULATORY AUTHORITIES OF ANY OTHER JURISDICTION PASSED UPON THE FAIRNESS OR MERITS OF SUCH TRANSACTION OR UPON THE ACCURACY

OR ADEQUACY OF THE INFORMATION CONTAINED IN THIS OFFER TO PURCHASE, THE LETTER OF TRANSMITTAL OR the

Notice of Guaranteed Delivery. ANY REPRESENTATION TO THE CONTRARY IS UNLAWFUL.

THE OFFER DOES NOT CONSTITUTE AN OFFER TO

BUY OR A SOLICITATION OF AN OFFER TO SELL ANY OF THE SECURITIES OF THE COMPANY TO ANY PERSON IN ANY JURISDICTION WHERE IT IS UNLAWFUL

TO MAKE SUCH AN OFFER OR SOLICITATION.

NO PERSON HAS BEEN AUTHORIZED TO GIVE ANY

INFORMATION OR MAKE ANY REPRESENTATION ON BEHALF OF THE OFFEROR OR ITS AFFILIATES NOT CONTAINED IN THIS OFFER TO PURCHASE OR IN THE RELATED

LETTER OF TRANSMITTAL and Notice of Guaranteed Delivery, AND, IF GIVEN OR MADE, SUCH

INFORMATION OR REPRESENTATIONS MUST NOT BE RELIED UPON AS HAVING BEEN AUTHORIZED BY THE OFFEROR OR ANY OF ITS AFFILIATES.

TABLE OF CONTENTS

Page

| FORWARD-LOOKING STATEMENTS |

i |

| |

|

| SUMMARY TERM SHEET |

ii |

| |

|

| INTRODUCTION |

1 |

| |

|

| THE TENDER OFFER |

4 |

| |

|

| 1. |

TERMS OF THE OFFER |

4 |

| |

|

| 2. |

PROCEDURES FOR ACCEPTING THE OFFER AND TENDERING SHARES |

6 |

| |

|

| 3. |

WITHDRAWAL RIGHTS |

10 |

| |

|

| 4. |

ACCEPTANCE FOR PAYMENT AND PAYMENT FOR SHARES |

11 |

| |

|

| 5. |

TAX CONSIDERATIONS |

12 |

| |

|

| 6. |

PRICE RANGE OF THE SHARES; DIVIDENDS |

14 |

| |

|

| 7. |

CERTAIN INFORMATION CONCERNING THE COMPANY |

15 |

| |

|

| 8. |

CERTAIN INFORMATION CONCERNING THE OFFEROR |

16 |

| |

|

| 9. |

SOURCE AND AMOUNT OF FUNDS |

18 |

| |

|

| 10. |

BACKGROUND OF THE OFFER; PAST CONTACTS OR NEGOTIATIONS

WITH THE COMPANY |

18 |

| |

|

| 11. |

PURPOSE OF THE OFFER; PLANS FOR THE COMPANY |

20 |

| |

|

| 12. |

CERTAIN EFFECTS OF THE OFFER |

23 |

| |

|

| 13. |

DIVIDENDS AND DISTRIBUTIONS |

26 |

| |

|

| 14. |

CONDITIONS OF THE OFFER |

27 |

| |

|

| 15. |

CERTAIN LEGAL MATTERS; REGULATORY APPROVALS; APPRAISAL

RIGHTS |

29 |

| |

|

| 16. |

FEES AND EXPENSES |

30 |

| |

|

| 17. |

MISCELLANEOUS |

30 |

| |

|

| 18. |

LEGAL PROCEEDINGS |

31 |

| |

|

| SCHEDULE I |

I-1 |

| |

|

| SCHEDULE II |

II-1 |

FORWARD-LOOKING

STATEMENTS

This

Offer to Purchase contains certain forward-looking statements with respect to certain of the Offeror’s, Maryport’s and Mr. George

Economou’s current expectations and projections about future events. These statements, which sometimes use words such as “anticipate,”

“believe,” “intend,” “estimate,” “expect,” “project,” “strategy,”

“opportunity,” “future,” “plan,” “will likely result,” “will,” “shall,”

“may,” “aim,” “predict,” “should,” “would,” “continue,” and words

of similar meaning and/or other similar expressions that are predictions of or indicate future events and/or future trends, reflect the

beliefs and expectations of the applicable of the Offeror, Maryport and Mr. George Economou at the date of this Offer to Purchase

and involve a number of risks, uncertainties and assumptions that could cause actual results and performance to differ materially from

any expected future results or performance expressed or implied by the forward-looking statement.

Any or all forward-looking statements may

turn out to be wrong. They can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. Statements contained

in this Offer to Purchase regarding past trends or activities should not be taken as a representation that such trends or activities

will continue in the future. Except as required by applicable law, none of the Offeror, Maryport, Mr. George Economou or any of

their respective affiliates assumes any responsibility or obligation to publicly correct, update or review any of the forward-looking

statements contained herein. You should not place undue reliance on forward-looking statements, which speak only as of the date of this

Offer to Purchase.

SUMMARY

TERM SHEET

The

information contained herein is a summary only, is not complete, and is not meant as a substitute for the more detailed descriptions

and information contained elsewhere in this Offer to Purchase and in the related Letter of Transmittal and Notice of Guaranteed

Delivery. You are urged to read carefully, in its entirety, each of this Offer to Purchase and the related Letter of Transmittal and

Notice of Guaranteed Delivery, which contain additional important information. The information concerning Performance contained herein

and elsewhere in this Offer to Purchase has been taken from or is based upon publicly available documents or records of Performance on

file and freely available from the SEC, or other public sources at the time of the filing of this Offer to Purchase. Questions or requests

for assistance may be directed to the Information Agent at the address and telephone number set forth for the Information Agent on the

back cover of this Offer to Purchase. Unless otherwise indicated in this Offer to Purchase or the context otherwise requires, all references

in this Offer to Purchase to “we”, “our” or “us” refer to the Offeror.

| Securities

Sought: |

|

All

of the issued and outstanding Shares. Each Share is comprised of one Common Share of Performance, par value $0.01, together

with one associated Right issued pursuant to the Rights Agreement.

|

| Offer

Price Per Share: |

|

$3.00

per Share, without interest, in cash, less any applicable withholding taxes (the “Offer Price”), for each

Share validly tendered and accepted for payment in the Offer. |

| Scheduled Expiration Date and Time of the Offer: |

|

11:59

P.M., New York City time, on November 15, 2023, unless extended. |

| Offeror: |

|

Sphinx

Investment Corp., a corporation organized under the laws of the Republic of the Marshall Islands. |

The

remainder of this Summary Term Sheet includes some of the questions that you, as a holder of Shares, may have about the Offer, along

with answers to those questions. As stated in more detail above, we urge you to read carefully the remainder of this Offer to Purchase

and the Letter of Transmittal and Notice of Guaranteed Delivery because the information in this summary term sheet is a

summary only, is not complete, and is not meant as a substitute for the more detailed descriptions and information contained elsewhere

in this Offer to Purchase and in the related Letter of Transmittal and Notice of Guaranteed Delivery.

WHO IS OFFERING TO BUY MY SHARES?

Sphinx

Investment Corp., a corporation organized under the laws of the Republic of the Marshall Islands (the “Offeror”),

is offering to buy your Shares. The Offeror is a wholly-owned direct subsidiary of Maryport Navigation Corp., a corporation organized

under the laws of the Republic of Liberia (“Maryport”), which itself is directly wholly-owned by Mr. George Economou,

who controls both of the Offeror and Maryport. The Offeror is the sole bidder in the Offer. The Offeror, Maryport and Mr. Economou

beneficially own an aggregate of approximately 8.8% of the issued and outstanding Shares, based on the number of Shares publicly

disclosed by the Company as outstanding as of September 29, 2023. See “Introduction” to this Offer to Purchase and Section 8

— “CERTAIN INFORMATION CONCERNING THE OFFEROR”.

WHAT ARE THE CLASSES AND AMOUNTS OF SECURITIES

SOUGHT IN THE OFFER?

We are offering to purchase all of the issued

and outstanding Shares. Each Share is comprised of one Common Share, par value $0.01, of Performance, together with one associated Right

issued pursuant to the Rights Agreement. See the “Introduction” and Section 1 — “TERMS OF THE OFFER”.

According

to the Company’s Form 6-K filed with the SEC on September 29, 2023, there were 11,734,683 Common Shares outstanding

as of September 29, 2023.

WHAT ARE THE ASSOCIATED RIGHTS?

The associated Rights are preferred stock purchase

rights issued pursuant to the Rights Agreement, dated December 20, 2021, between Performance and Computershare Inc., as Rights Agent,

that are issued and outstanding. The Rights were issued to all of the holders of Common Shares, but (insofar as we are aware based on

the Company’s current disclosures) currently are not represented by separate certificates. A tender of your Shares will include

a tender of both your Common Shares and the associated Rights, unless certificates representing the Rights have been issued as provided

in the Rights Agreement prior to the completion of the Offer, in which circumstance your Rights must be validly tendered alongside your

Common Shares in order for you to validly tender into the Offer.

WHAT ARE THE REMEDIAL RIGHTS?

Currently, no Remedial Rights exist. In

the Series C Condition, we are providing optionality for the Series C Condition to be satisfied, in lieu of cancellation of the shares

of the Series C Preferred Stock (the “Series C Preferred Shares”) held by the Insider Holders, via the issuance of

Remedial Rights, which would for nominal consideration be exercisable for Remedial Shares that would put the holder thereof in the same

economic, voting, governance and other position as it would have been in had the Series C Preferred Shares issued to the Insider Holders

been cancelled. Whether any Remedial Rights are issued will be at the discretion of the Company and the members of its Board or,

in the alternative, a court of competent jurisdiction, and it is possible that no Remedial Rights are ever issued (including without

limitation due to the Series C Condition having been satisfied through a cancellation of the Series C Preferred Shares issued to the

Insider Holders).

In order to satisfy the Series C Condition, any

Remedial Right that is issued would be required to be uncertificated and “stapled” to the associated Share, meaning that

it could not be traded or otherwise transferred independently from the associated Share, but would, in the event that the associated

Share is transferred to a new holder, transfer to such new holder along with the associated Share. Consequently, if Remedial Rights

were issued and you tendered your Shares into the Offer, you would also be tendering the associated Remedial Rights into the Offer for

no additional consideration. If Remedial Rights are issued, for your Shares to be validly tendered into the Offer, the tender of

your Shares must be accompanied by a tender of the associated Remedial Rights. Since the Remedial Rights, if issued, are required by

the terms of this Offer to be uncertificated and stapled to the associated Shares, the valid tender of such Shares into the Offer shall

also constitute a valid tender of such Remedial Right into the Offer.

The U.S. federal income tax treatment of the

issuance of Remedial Rights, and the issuance of Remedial Shares on exercise of the Remedial Rights, is uncertain, and may be a taxable

event to U.S. holders. For a more detailed explanation of certain U.S. federal income tax considerations relevant to an issuance

of Remedial Rights and the Remedial Shares, see Section 5 — “TAX CONSIDERATIONS — MATERIAL UNITED STATES FEDERAL INCOME

TAX CONSIDERATIONS —Treatment of the Issuance of Remedial Rights and Remedial Shares”.

If

Remedial Rights are issued, can I tender my Shares into the Offer and keep the Remedial Rights?

No. Since the Remedial Rights, if issued, are required by the terms

of this Offer to be uncertificated and stapled to the associated Shares, if the Remedial Rights are issued, the valid tender of a Share

into the Offer shall also constitute a valid tender of such Remedial Right into the Offer and the valid withdrawal from the Offer of

a Share shall also constitute a valid withdrawal from the Offer of the associated Remedial Right.

WHAT ARE YOUR PURPOSES FOR THE OFFER AND PLANS

FOR THE COMPANY AFTER THE OFFER IS COMPLETED?

The Offeror believes that

the Shares are currently undervalued due in part to the Company’s current dual class capital structure. The purpose of the Offer

is to acquire at least a majority, and up to 100%, of the issued and outstanding Shares on a fully-diluted basis (assuming the

exercise or conversion of all then-outstanding Options and other derivative securities regardless of the exercise or conversion price,

the vesting schedule or other terms and conditions thereof), which would following the consummation of the Offer represent at least a

majority of the voting power of the Company securities, and the Shares will be the sole Company securities outstanding having the right

or purporting to have the right to vote with respect to the election of directors. Following the successful consummation of the Offer

(assuming it is consummated), the Offeror, Maryport and Mr. George Economou will have acquired beneficial ownership of a majority

of the issued and outstanding Shares on a fully-diluted basis and will have designated a majority of the Board, and may be deemed to

control the Company.

If, and to the extent that,

the Offeror acquires control of the Company, the Offeror intends to conduct a review, subject to applicable law, of the Company and its

assets, corporate structure, capitalization, operations, properties, policies, management and personnel and consider and determine what,

if any, changes would be desirable in light of the circumstances which then exist, which may include selling all or any portion of the

Shares acquired by the Offeror in the Offer and/or causing the Company to sell all or any portion of the assets of the Company or conduct

one or more strategic transactions. In addition, if the Offeror acquires control of the Company, the Offeror expects to take further

steps to improve the governance and management of the Company, which may among other things include making changes to the composition

of the management team of the Company and/or making changes to the organizational documents of the Company, including, without limitation,

the Company’s Amended and Restated Articles of Incorporation (the “Articles”) and the Amended and Restated Bylaws

(the “Bylaws”). See also the immediately following the Q&A entitled “Mr. George

Economou directly or indirectly owns or controls other companies in the shipping industry. If the Offer is consummated, will the Company

or any Company assets be integrated or combined with or sold to any such other shipping companies?”

If we consummate the Offer,

the Offeror further expects to seek to implement the declassification of the Board and to seek to effect the removal and replacement

of all current members of the Board remaining on the Board. See Section 11 — “PURPOSE OF THE OFFER; PLANS FOR THE

COMPANY”.

If we consummate the Offer,

depending upon the number of Shares we acquire and other factors relevant to our equity ownership in the Company, we may in our discretion

(but do not undertake any obligation to), subsequent to completion of the Offer, seek to acquire additional Shares through open market

purchases, privately negotiated transactions, further tender or exchange offers or other transactions or a combination of the foregoing

on such terms and at such prices as we shall determine, which may be more or less favorable than those of the Offer. We also reserve

the right to dispose of the Shares that we have acquired and/or may acquire at any time for any reason or no reason, subject to any applicable

legal restrictions.

The Offer is subject to the

satisfaction or waiver, at or before the Expiration Date and Time, of, the following conditions, along with the other conditions described

in Section 14 of the Offer to Purchase (such other conditions described in Section 14 of the Offer to Purchase, together with

the conditions set forth below, the “Offer Conditions”): (i) there shall have been validly tendered into the

Offer and not withdrawn a number of Shares which, together with any Shares then-owned by the Offeror, represents at least a majority

of the issued and outstanding Shares on a fully-diluted basis (assuming the exercise or conversion of all then-outstanding Options

and other derivative securities regardless of the exercise or conversion price, the vesting schedule or other terms and conditions thereof)

(i.e., the Minimum Tender Condition); (ii) either (a) the Rights Agreement shall have been validly terminated and the

Rights shall have been redeemed, and the Series A Certificate shall have been validly cancelled and no Series A Preferred Stock

shall be outstanding, or (b) the Rights Agreement shall have been otherwise made inapplicable to the Offer and the Offeror and its

affiliates (i.e.,, the Poison Pill Condition); (iii) the Board shall have validly waived the applicability of Article K

to the purchase of the Shares by the Offeror in the Offer so that the provisions of Article K would not, at or at any time following

consummation of the Offer, prohibit, restrict or apply to any “business combination”, as defined in Article K, involving

the Company and the Offeror or any affiliate or associate of the Offeror (i.e., the Article K Condition); (iv) the

Company shall not have any securities outstanding, authorized or proposed for issuance other than (a) the Shares, (b) authorized

Series A Preferred Stock (none of which shall have been issued), (c) the number of shares of Series B Preferred Stock

outstanding as of October 10, 2023, (d) the warrants outstanding as of October 10, 2023 (which shall not be exercisable in the aggregate

for more than the 7,904,221 Shares disclosed by the Company in its Form 6-K on September 29, 2023, and the terms of which such

warrants shall not have been amended on or after October 11, 2023), (e) (1) the Options to purchase Shares under the Equity

Incentive Plan (as such plan was in effect as of October 10, 2023) outstanding, and subject to the terms as in effect, as of October

10, 2023, and (2) any Options to purchase shares under the Equity Incentive Plan that are issued pursuant to the Equity Incentive

Plan on or after October 11, 2023 in the ordinary and usual course of business, consistent with past practice; (f) Shares authorized

for issuance but not yet subject to awards under the Equity Incentive Plan (none of which shall, on or after October 11, 2023, have been

issued other than in the ordinary and usual course of business, consistent with past practice); and (g) the Remedial Rights and the Remedial

Shares (with none of the Remedial Shares having been issued) (i.e., the Equity Condition); (v) either (a) (1) Section 4

of the Series C Certificate shall no longer be in effect, (2) any and all shares of the Series C Preferred Stock

held as of October 11, 2023 by any Insider Holder, and any and all Shares purported to have been issued pursuant to the purported conversion

of any such shares of Series C Preferred Stock, shall have been validly cancelled for no consideration and (3) no other shares

of Series C Preferred Stock shall be outstanding; or (b) (1) there shall have been issued upon each Share outstanding from time

to time an uncertificated “Remedial Right” (which such right shall be stapled to the associated Share and shall, immediately

and solely following the Offeror’s deposit with the Tender Offer Agent of the proceeds required to consummate the Offer, be freely

exercisable at any time in exchange for nominal consideration (and shall not be exercisable prior to the Offeror’s deposit with

the Tender Offer Agent of the proceeds required to consummate the Offer, and shall not be subject to involuntary redemption or repurchase))

to purchase such number of the Remedial Shares that would, once issued to the holder of such Share, put the holder of such Share

in the same economic, voting, governance and other position as the holder of such Share would have been in had the Series C Preferred

Stock issued to the Insider Holders been cancelled for no consideration, (2) no Remedial Shares (or rights to acquire Remedial Shares

other than the Remedial Rights) shall have been issued to any Insider Holder or any “associate” (as such term is defined

in Rule 12b-2 of the General Rules and Regulations under the Exchange Act) of an Insider Holder and (3) any Remedial Right beneficially

owned from time to time by any Insider Holder, any “associate” (as such term is defined in Rule 12b-2 of the General Rules

and Regulations under the Exchange Act) of an Insider Holder or any direct or indirect transferee of an Insider Holder or of any such

“associate” shall be rendered unexercisable pursuant to the definitive documentation for such Remedial Rights (i.e., the

Series C Condition); (vi) the Series B Certificate either (a) shall have been validly cancelled or (b) shall

not have been amended (i.e., the Series B Condition), and (vii) the size of the Board shall remain fixed at five members,

with at least three of such authorized five Board seats either (a) then-being occupied by persons having been designated by us,

(b) then-being vacant, with the company having publicly committed on a binding basis to fill such vacancies with persons designated

by us or (c) then-being occupied by directors who shall have publicly submitted their irrevocable resignations from the Board, effective

no later than the Offeror’s purchase of the Shares tendered in the Offer, which such resignations shall have been publicly accepted

by the Company (with the Company having publicly committed on a binding basis to fill the resulting vacancies with persons designated

by us) (i.e., the Board Representation Condition).

The Offer Conditions must be satisfied at or

before the Expiration Date and Time, as it may be extended, or waived by the Offeror.

See Section 11 — “PURPOSE OF

THE OFFER; PLANS FOR THE COMPANY” and Section 14 — “CONDITIONS OF THE OFFER”.

MR. GEORGE ECONOMOU DIRECTLY OR INDIRECTLY

OWNS OR CONTROLS OTHER COMPANIES IN THE SHIPPING INDUSTRY. IF THE OFFER IS CONSUMMATED, WILL THE COMPANY OR ANY COMPANY ASSETS BE INTEGRATED

OR COMBINED WITH OR SOLD TO ANY OF SUCH OTHER SHIPPING COMPANIES?

None of the Offeror, Maryport or Mr. George

Economou has made any final decision as to whether, if the Offer is consummated, the Company or any Company assets will be transferred

to or combined or integrated with any other assets directly or indirectly owned or controlled by any of them; however, they reserve the

right to do so in accordance with applicable law. Whether or not the Offeror, Maryport or Mr. George Economou would determine to

do so would depend, among other things, on their assessment of the outcome of the post-Offer review of the Company and its assets, corporate

structure, capitalization, operations, properties, policies, management and personnel referred to above. See the Q&A directly above

entitled “What are your purposes for the Offer and plans for the Company after the Offer

is completed?”

HOW MUCH ARE YOU OFFERING TO PAY, AND WHAT

IS THE FORM OF PAYMENT?

We are offering to pay $3.00

per Share, without interest, in cash, less any applicable withholding taxes, for each Share validly tendered and accepted for

payment in the Offer. If Remedial Rights are issued, the valid tender of each Share into the Offer shall also constitute a valid tender

of the associated Remedial Right into the Offer for no additional consideration. See the “Introduction” and Section 11

— “PURPOSE OF THE OFFER; PLANS FOR THE COMPANY”.

IS THERE AN AGREEMENT GOVERNING THE OFFER?

No, there is no agreement governing the Offer.

WHAT IS THE MARKET VALUE OF MY SHARES AS OF

A RECENT DATE?

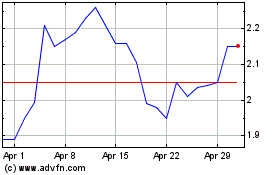

On

October 10, 2023, the last full trading day before the commencement of the Offer, the closing price of the Shares on the Nasdaq

Capital Market was $1.68 per Share. On October 27, 2023, the last full trading day before the filing

of this Offer to Purchase on Amendment No. 1 to the Schedule TO (the “Amendment No. 1”) filed by the Offeror in connection

with this Offer, the closing price of Common Shares reported on the Nasdaq Capital Market was $

1.71 per Share. The Offer represents a premium of 78.6% over the Company’s

closing Share price on October 10, 2023, and a premium of 75% over the Company’s closing Share price on October 27, 2023.

We advise you to obtain a recent quotation for the Shares and further consult with your financial and other advisors in deciding whether

to tender your Shares. See Section 6 — “PRICE RANGE OF THE SHARES; DIVIDENDS”.

WILL I HAVE TO PAY ANY FEES OR COMMISSIONS?

If

you are the record owner of your Shares and you tender your Shares to the Offeror in the Offer, you will not have to pay brokerage fees

or similar expenses to tender your Shares. If you own or hold your Shares through a broker, dealer, commercial bank, trust company

or other nominee, and your broker, dealer, commercial bank, trust company or other nominee tenders your Shares on your behalf, your broker,

dealer, commercial bank, trust company or other nominee may charge you a fee for doing so, which may reduce the net proceeds you would

receive from tendering into the Offer. You should consult your broker, dealer, commercial bank, trust company or other nominee to determine

whether any charges will apply. See “Introduction” to this Offer to Purchase.

WHAT DOES THE BOARD OF DIRECTORS OF PERFORMANCE

THINK OF THE OFFER?

According

to the Solicitation/Recommendation Statement (the “Schedule 14D-9”) under Section 14(d)(4) of the Exchange

Act filed by the Company on October 25, 2023 (the “Company Recommendation”), a special committee of allegedly

independent directors, consisting of Alex Papageorgiou, Loïsa Ranunkel and Mihalis Boutaris (the “Special Committee”)

unanimously determined that, in the view of the Special Committee, the Offer is not in the best interests of the Company or its shareholders

and recommended that the Company’s shareholders reject the offer and not tender any Shares pursuant to the Offer. To support of

such recommendation, the Company in the Company Recommendation gives the following “reasons”.

1. The

Special Committee believes that the Company’s net asset value per Common Share exceeds the consideration represented by the Offer

and that the Offer therefore undervalues the outstanding Shares.

2. The

Special Committee believes that the several conditions to the Offer, including conditions which in the view of the Special Committee

are not within the authority of the Board or the Company, create significant doubt that the Offer will ever be consummated, and in particular,

significant doubt as to whether the Offer will be consummated by the stated expiration date of the Offer. The Special Committee

cites as an alleged example that pursuant to the Series C Condition, the Offer is conditioned on the cancellation of the Company’s

outstanding shares of Series C Preferred Stock (and certain Common Shares issued in respect of the conversion thereof), and that the

Special Committee believes that the Company’s governing documents and applicable law do not grant the Company, the Board or the

Special Committee the authority to effect such an outcome at this time. The Company Recommendation also states that the Special

Committee believes that the Offer is illusory because, the Special Committee alleges, the Offeror has complete discretion as to whether

to waive these conditions and consummate the Offer.

The Offeror strongly disagrees with the Company

Recommendation, and the recommendation and conclusions regarding the Offer and the Company’s characterization of the terms of the

Offer as set forth in the Company Recommendation. See Section 11 — “PURPOSE OF THE OFFER; PLANS FOR THE COMPANY”

for additional information, including our responses to certain of the statements alleged by the Special Committee in the Company Recommendation.

THE COMPANY CLAIMS THAT THE SATISFACTION OF

THE SERIES C CONDITION IS NOT WITHIN THE CONTROL OF THE COMPANY, THE BOARD OR THE SPECIAL COMMITTEE. WHAT IS THE OFFEROR’S

POSITION?

The Company Recommendation states that “the

Special Committee believes that the Company’s governing documents and applicable law do not grant the Company, the Board or the

Special Committee the authority” to cancel the Series C Shares held by Mango, Mitzela, Giannakis (John) Evangelou, Antonios Karavias,

Christos Glavanis and Reidar Brekke. Because the Offeror disagrees, on October 27, 2023, the Offeror initiated legal proceedings

in the Supreme Court of the State of New York located in the County of New York against the Company, Chairperson Aliki Paliou, Company

Chief Executive Officer Andreas Michalopoulos, former Company directors Symeon Palios, Giannakis (John) Evangelou, Antonios Karavias,

Christos Glavanis and Reidar Brekke and controlling shareholders Mango and Mitzela, to, among other things, seek such cancellation.

See Section 18 – “legal proceedings” for further information regarding this

litigation.

DO YOU HAVE THE FINANCIAL RESOURCES TO MAKE

PAYMENT?

Yes. The Offeror has sufficient cash on hand

to purchase all of the Shares validly tendered into the Offer. See Section 9 — “SOURCE AND AMOUNT OF FUNDS”.

IS YOUR FINANCIAL CONDITION RELEVANT TO MY

DECISION TO TENDER IN THE OFFER?

We

do not think our financial condition is relevant to your decision whether to tender in the Offer because (i) the Offer is

being made for all outstanding Shares (other than the Shares beneficially owned by the Offeror and its affiliates), (ii) you

will receive payment solely in cash for any Shares that you tender into the Offer, (iii) as stated above, we have all of the financial

resources necessary to consummate the Offer, and (iv) the Offer is not conditioned upon the Offeror obtaining financing. See Section

9 — “SOURCE AND AMOUNT OF FUNDS”.

DO YOU INTEND TO CONDUCT A PROXY SOLICITATION

TO REPLACE ANY MEMBERS OF THE PERFORMANCE BOARD OF DIRECTORS OR TO PASS ANY OTHER PROPOSALS?

Yes. As disclosed by the Offeror, Maryport and

Mr. George Economou in the Proxy Statement that was furnished on Schedule 13D on October 11, 2023, we are currently soliciting proxies

(the “Proxy Solicitation”) for the election of the Sphinx Nominee to the Board at the upcoming 2024 Shareholder Meeting.

If elected to the Board, the Sphinx Nominee would succeed Aliki Paliou, chairperson of the Board and sole shareholder of Mango, the Company’s

controlling shareholder, whose current term on the Board expires at the 2024 Shareholder Meeting. We are also currently soliciting proxies

in favor of the Declassification Proposal and the Vote of No Confidence Proposals.

If the Offer is consummated, the Offeror will

have acquired at least a majority of the issued and outstanding Shares on a fully diluted basis (assuming the exercise or conversion

of all then-outstanding Options and other derivative securities regardless of the exercise or conversion price, the vesting schedule

or other terms and conditions thereof), which will represent at least a majority of the voting power of the Company securities, and the

Shares will be the sole Company securities outstanding having the right or purporting to have the right to vote with respect to the election

of directors. If the Offer is consummated prior to the record date established for the 2024 Shareholder Meeting, the Offeror intends

to vote all of its Shares acquired in the Offer in favor of the election to the Board of the Sphinx Nominee and in favor of the Declassification

Proposal and each Vote of No-Confidence Proposal. If the Offer is consummated, and irrespective of whether such consummation occurs before

or after the record date for the 2024 Shareholder Meeting, the Offeror expects to seek to implement the declassification of the Board

and seek to effect the removal and replacement of any members of the current Board then-remaining on the Board.

Currently,

the Company has a classified Board, which is divided into three classes, with two directors serving in each of Class I and

Class III, and one director serving in Class II. The term of a Class II director expires at the 2024 Shareholder Meeting.

Under the Articles, a director may be removed only for cause and only by the affirmative vote of the holders of at least two-thirds of

the Common Shares. Any vacancies in the Board for any reason, and any created directorships resulting from any increase in the

number of directors, may be filled by the vote of not less than a majority of the members of the Board then in office.

The affirmative vote of the holders of two-thirds

or more of the outstanding Common Shares entitled to vote generally in the election of directors is required to amend, alter, change

or repeal Article I of the Articles relating to the structure and composition of the Board, including the declassification of the

Board.

Neither

this Offer to Purchase nor the Offer constitutes (i) a solicitation of any proxy, consent or authorization for or with respect to

the 2024 Shareholder Meeting or any other meeting of Company shareholders or (ii) a solicitation of any consent or authorization

in the absence of any such meeting. Any such solicitation is being or will be made only pursuant to separate proxy or consent solicitation

materials that comply with the applicable provisions of Marshall Islands law. Shareholders are advised to read the Proxy Statement that

was furnished by the Offeror on Schedule 13D on October 11, 2023, and (as, when and if they become available) other documents related

to the solicitation of proxies by the Offeror and its affiliates from the shareholders of the Company for use at the 2024 Shareholder

Meeting, because they will contain important information. A Proxy Statement and a form of proxy is being made available at no charge

at the SEC’s website at http://www.sec.gov.

IS THE OFFER CONDITIONED UPON THE SPHINX NOMINEE

BEING ELECTED TO THE BOARD?

No. The Offer is not conditioned upon the

Sphinx Nominee being elected to the Board. The Offer and the nomination of the Sphinx Nominee for election to the Board are independent

of each other.

IS

THE OFFER CONDITIONED UPON THE PASSAGE OF ANY OTHER SHAREHOLDER PROPOSAL EXPECTED TO BE MADE BY OFFEROR AT THE 2024 Shareholder

MEETING?

No. The Offer is not conditioned upon the

passage of any other shareholder proposal expected to be made by the Offeror at the 2024 Shareholder Meeting, including, without limitation,

the Declassification Proposal or any Vote of No-Confidence Proposal. The Offer and such shareholder proposals are independent of each

other.

WHAT ARE THE MOST SIGNIFICANT OFFER CONDITIONS?

| · | We

are not obligated to purchase any Shares unless there shall have been validly tendered into

the Offer and not withdrawn a number of Shares which, together with any Shares then-owned

by the Offeror, represents at least a majority of the issued and outstanding Shares on a

fully-diluted basis (assuming the exercise or conversion of all then-outstanding Options

and other derivative securities regardless of the exercise or conversion price, the vesting

schedule or other terms and conditions thereof) (referred to as the Minimum Tender Condition). |

| · | We

are not obligated to purchase any Shares unless either (a) the Rights Agreement shall

have been validly terminated and the Rights shall have been redeemed, and the Series A

Certificate shall have been validly cancelled and no Series A Preferred Stock shall

be outstanding, or (b) the Rights Agreement shall have been otherwise made inapplicable

to the Offer and the Offeror and its affiliates (the applicable of clause (a) and clause

(b) is referred to as the Poison Pill Condition). THIS CONDITION IS SOLELY WITHIN

THE CONTROL OF THE COMPANY AND THE MEMBERS OF ITS BOARD. |

| · | We