0001327567false2024Q17/31http://fasb.org/us-gaap/2023#PrepaidExpenseAndOtherAssetsCurrenthttp://fasb.org/us-gaap/2023#PrepaidExpenseAndOtherAssetsCurrentP3YP1YP1Y47534700013275672023-08-012023-10-3100013275672023-11-10xbrli:shares00013275672023-10-31iso4217:USD00013275672023-07-31iso4217:USDxbrli:shares0001327567us-gaap:ProductMember2023-08-012023-10-310001327567us-gaap:ProductMember2022-08-012022-10-310001327567us-gaap:ServiceMember2023-08-012023-10-310001327567us-gaap:ServiceMember2022-08-012022-10-3100013275672022-08-012022-10-310001327567us-gaap:RetainedEarningsMember2023-08-012023-10-310001327567us-gaap:RetainedEarningsMember2022-08-012022-10-310001327567us-gaap:CommonStockMember2023-07-310001327567us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2023-07-310001327567us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-310001327567us-gaap:RetainedEarningsMember2023-07-310001327567us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-08-012023-10-310001327567us-gaap:CommonStockMember2023-08-012023-10-310001327567us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2023-08-012023-10-310001327567us-gaap:CommonStockMember2023-10-310001327567us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2023-10-310001327567us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-10-310001327567us-gaap:RetainedEarningsMember2023-10-310001327567us-gaap:CommonStockMember2022-07-310001327567us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2022-07-310001327567us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-07-310001327567us-gaap:RetainedEarningsMember2022-07-3100013275672022-07-310001327567us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-08-012022-10-310001327567us-gaap:CommonStockMember2022-08-012022-10-310001327567us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2022-08-012022-10-310001327567us-gaap:CommonStockMember2022-10-310001327567us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2022-10-310001327567us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-10-310001327567us-gaap:RetainedEarningsMember2022-10-3100013275672022-10-310001327567country:US2023-08-012023-10-310001327567country:US2022-08-012022-10-310001327567panw:OtherAmericasMember2023-08-012023-10-310001327567panw:OtherAmericasMember2022-08-012022-10-310001327567srt:AmericasMember2023-08-012023-10-310001327567srt:AmericasMember2022-08-012022-10-310001327567us-gaap:EMEAMember2023-08-012023-10-310001327567us-gaap:EMEAMember2022-08-012022-10-310001327567srt:AsiaPacificMember2023-08-012023-10-310001327567srt:AsiaPacificMember2022-08-012022-10-310001327567panw:SubscriptionMember2023-08-012023-10-310001327567panw:SubscriptionMember2022-08-012022-10-310001327567panw:SupportMember2023-08-012023-10-310001327567panw:SupportMember2022-08-012022-10-3100013275672023-11-012023-10-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel1Member2023-10-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:MoneyMarketFundsMember2023-10-310001327567us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2023-10-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2023-10-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel1Member2023-07-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:MoneyMarketFundsMember2023-07-310001327567us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2023-07-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2023-07-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialPaperMemberus-gaap:FairValueInputsLevel1Member2023-10-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CommercialPaperMember2023-10-310001327567us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialPaperMember2023-10-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialPaperMember2023-10-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialPaperMemberus-gaap:FairValueInputsLevel1Member2023-07-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CommercialPaperMember2023-07-310001327567us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialPaperMember2023-07-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialPaperMember2023-07-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2023-10-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CorporateDebtSecuritiesMember2023-10-310001327567us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2023-10-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2023-10-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2023-07-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CorporateDebtSecuritiesMember2023-07-310001327567us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2023-07-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2023-07-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel1Member2023-10-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:USTreasuryAndGovernmentMember2023-10-310001327567us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasuryAndGovernmentMember2023-10-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasuryAndGovernmentMember2023-10-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel1Member2023-07-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:USTreasuryAndGovernmentMember2023-07-310001327567us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasuryAndGovernmentMember2023-07-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasuryAndGovernmentMember2023-07-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2023-10-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2023-10-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2023-10-310001327567us-gaap:FairValueMeasurementsRecurringMember2023-10-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2023-07-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2023-07-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2023-07-310001327567us-gaap:FairValueMeasurementsRecurringMember2023-07-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMemberus-gaap:CertificatesOfDepositMemberus-gaap:FairValueInputsLevel1Member2023-10-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:ShortTermInvestmentsMemberus-gaap:CertificatesOfDepositMember2023-10-310001327567us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMemberus-gaap:CertificatesOfDepositMember2023-10-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMemberus-gaap:CertificatesOfDepositMember2023-10-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMemberus-gaap:CertificatesOfDepositMemberus-gaap:FairValueInputsLevel1Member2023-07-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:ShortTermInvestmentsMemberus-gaap:CertificatesOfDepositMember2023-07-310001327567us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMemberus-gaap:CertificatesOfDepositMember2023-07-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMemberus-gaap:CertificatesOfDepositMember2023-07-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialPaperMemberus-gaap:ShortTermInvestmentsMemberus-gaap:FairValueInputsLevel1Member2023-10-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CommercialPaperMemberus-gaap:ShortTermInvestmentsMember2023-10-310001327567us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialPaperMemberus-gaap:ShortTermInvestmentsMember2023-10-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialPaperMemberus-gaap:ShortTermInvestmentsMember2023-10-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialPaperMemberus-gaap:ShortTermInvestmentsMemberus-gaap:FairValueInputsLevel1Member2023-07-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CommercialPaperMemberus-gaap:ShortTermInvestmentsMember2023-07-310001327567us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialPaperMemberus-gaap:ShortTermInvestmentsMember2023-07-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialPaperMemberus-gaap:ShortTermInvestmentsMember2023-07-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:ShortTermInvestmentsMemberus-gaap:FairValueInputsLevel1Member2023-10-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CorporateDebtSecuritiesMemberus-gaap:ShortTermInvestmentsMember2023-10-310001327567us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:ShortTermInvestmentsMember2023-10-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:ShortTermInvestmentsMember2023-10-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:ShortTermInvestmentsMemberus-gaap:FairValueInputsLevel1Member2023-07-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CorporateDebtSecuritiesMemberus-gaap:ShortTermInvestmentsMember2023-07-310001327567us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:ShortTermInvestmentsMember2023-07-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:ShortTermInvestmentsMember2023-07-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMemberus-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel1Member2023-10-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:ShortTermInvestmentsMemberus-gaap:USTreasuryAndGovernmentMember2023-10-310001327567us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMemberus-gaap:USTreasuryAndGovernmentMember2023-10-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMemberus-gaap:USTreasuryAndGovernmentMember2023-10-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMemberus-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel1Member2023-07-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:ShortTermInvestmentsMemberus-gaap:USTreasuryAndGovernmentMember2023-07-310001327567us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMemberus-gaap:USTreasuryAndGovernmentMember2023-07-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMemberus-gaap:USTreasuryAndGovernmentMember2023-07-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:ShortTermInvestmentsMemberus-gaap:FairValueInputsLevel1Member2023-10-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:ShortTermInvestmentsMember2023-10-310001327567us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:ShortTermInvestmentsMember2023-10-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:ShortTermInvestmentsMember2023-10-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:ShortTermInvestmentsMemberus-gaap:FairValueInputsLevel1Member2023-07-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:ShortTermInvestmentsMember2023-07-310001327567us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:ShortTermInvestmentsMember2023-07-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:ShortTermInvestmentsMember2023-07-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMemberus-gaap:ShortTermInvestmentsMemberus-gaap:FairValueInputsLevel1Member2023-10-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:AssetBackedSecuritiesMemberus-gaap:ShortTermInvestmentsMember2023-10-310001327567us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMemberus-gaap:ShortTermInvestmentsMember2023-10-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMemberus-gaap:ShortTermInvestmentsMember2023-10-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMemberus-gaap:ShortTermInvestmentsMemberus-gaap:FairValueInputsLevel1Member2023-07-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:AssetBackedSecuritiesMemberus-gaap:ShortTermInvestmentsMember2023-07-310001327567us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMemberus-gaap:ShortTermInvestmentsMember2023-07-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMemberus-gaap:ShortTermInvestmentsMember2023-07-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMemberus-gaap:FairValueInputsLevel1Member2023-10-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:ShortTermInvestmentsMember2023-10-310001327567us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMember2023-10-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMember2023-10-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMemberus-gaap:FairValueInputsLevel1Member2023-07-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:ShortTermInvestmentsMember2023-07-310001327567us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMember2023-07-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMember2023-07-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherLongTermInvestmentsMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2023-10-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:OtherLongTermInvestmentsMemberus-gaap:CorporateDebtSecuritiesMember2023-10-310001327567us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherLongTermInvestmentsMemberus-gaap:CorporateDebtSecuritiesMember2023-10-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherLongTermInvestmentsMemberus-gaap:CorporateDebtSecuritiesMember2023-10-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherLongTermInvestmentsMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2023-07-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:OtherLongTermInvestmentsMemberus-gaap:CorporateDebtSecuritiesMember2023-07-310001327567us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherLongTermInvestmentsMemberus-gaap:CorporateDebtSecuritiesMember2023-07-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherLongTermInvestmentsMemberus-gaap:CorporateDebtSecuritiesMember2023-07-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherLongTermInvestmentsMemberus-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel1Member2023-10-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:OtherLongTermInvestmentsMemberus-gaap:USTreasuryAndGovernmentMember2023-10-310001327567us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherLongTermInvestmentsMemberus-gaap:USTreasuryAndGovernmentMember2023-10-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherLongTermInvestmentsMemberus-gaap:USTreasuryAndGovernmentMember2023-10-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherLongTermInvestmentsMemberus-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel1Member2023-07-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:OtherLongTermInvestmentsMemberus-gaap:USTreasuryAndGovernmentMember2023-07-310001327567us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherLongTermInvestmentsMemberus-gaap:USTreasuryAndGovernmentMember2023-07-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherLongTermInvestmentsMemberus-gaap:USTreasuryAndGovernmentMember2023-07-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:OtherLongTermInvestmentsMemberus-gaap:FairValueInputsLevel1Member2023-10-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:OtherLongTermInvestmentsMember2023-10-310001327567us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:OtherLongTermInvestmentsMember2023-10-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:OtherLongTermInvestmentsMember2023-10-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:OtherLongTermInvestmentsMemberus-gaap:FairValueInputsLevel1Member2023-07-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:OtherLongTermInvestmentsMember2023-07-310001327567us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:OtherLongTermInvestmentsMember2023-07-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:OtherLongTermInvestmentsMember2023-07-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherLongTermInvestmentsMemberus-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueInputsLevel1Member2023-10-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:OtherLongTermInvestmentsMemberus-gaap:AssetBackedSecuritiesMember2023-10-310001327567us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherLongTermInvestmentsMemberus-gaap:AssetBackedSecuritiesMember2023-10-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherLongTermInvestmentsMemberus-gaap:AssetBackedSecuritiesMember2023-10-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherLongTermInvestmentsMemberus-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueInputsLevel1Member2023-07-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:OtherLongTermInvestmentsMemberus-gaap:AssetBackedSecuritiesMember2023-07-310001327567us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherLongTermInvestmentsMemberus-gaap:AssetBackedSecuritiesMember2023-07-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherLongTermInvestmentsMemberus-gaap:AssetBackedSecuritiesMember2023-07-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherLongTermInvestmentsMemberus-gaap:FairValueInputsLevel1Member2023-10-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:OtherLongTermInvestmentsMember2023-10-310001327567us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherLongTermInvestmentsMember2023-10-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherLongTermInvestmentsMember2023-10-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherLongTermInvestmentsMemberus-gaap:FairValueInputsLevel1Member2023-07-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:OtherLongTermInvestmentsMember2023-07-310001327567us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherLongTermInvestmentsMember2023-07-310001327567us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherLongTermInvestmentsMember2023-07-310001327567us-gaap:CommercialPaperMemberus-gaap:CashEquivalentsMember2023-10-310001327567us-gaap:CorporateDebtSecuritiesMemberus-gaap:CashEquivalentsMember2023-10-310001327567us-gaap:CashEquivalentsMemberus-gaap:USTreasuryAndGovernmentMember2023-10-310001327567us-gaap:CashEquivalentsMember2023-10-310001327567us-gaap:InvestmentsMemberus-gaap:CertificatesOfDepositMember2023-10-310001327567us-gaap:CommercialPaperMemberus-gaap:InvestmentsMember2023-10-310001327567us-gaap:InvestmentsMemberus-gaap:CorporateDebtSecuritiesMember2023-10-310001327567us-gaap:InvestmentsMemberus-gaap:USTreasuryAndGovernmentMember2023-10-310001327567us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:InvestmentsMember2023-10-310001327567us-gaap:InvestmentsMemberus-gaap:AssetBackedSecuritiesMember2023-10-310001327567us-gaap:InvestmentsMember2023-10-310001327567us-gaap:CommercialPaperMemberus-gaap:CashEquivalentsMember2023-07-310001327567us-gaap:CashEquivalentsMember2023-07-310001327567us-gaap:InvestmentsMemberus-gaap:CertificatesOfDepositMember2023-07-310001327567us-gaap:CommercialPaperMemberus-gaap:InvestmentsMember2023-07-310001327567us-gaap:InvestmentsMemberus-gaap:CorporateDebtSecuritiesMember2023-07-310001327567us-gaap:InvestmentsMemberus-gaap:USTreasuryAndGovernmentMember2023-07-310001327567us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:InvestmentsMember2023-07-310001327567us-gaap:InvestmentsMemberus-gaap:AssetBackedSecuritiesMember2023-07-310001327567us-gaap:InvestmentsMember2023-07-310001327567us-gaap:MoneyMarketFundsMemberus-gaap:CashAndCashEquivalentsMemberus-gaap:CashEquivalentsMember2023-10-310001327567us-gaap:MoneyMarketFundsMemberus-gaap:CashAndCashEquivalentsMemberus-gaap:CashEquivalentsMember2023-07-310001327567us-gaap:MoneyMarketFundsMemberus-gaap:CashAndCashEquivalentsMemberus-gaap:CashEquivalentsMember2023-08-012023-10-310001327567us-gaap:MoneyMarketFundsMemberus-gaap:CashAndCashEquivalentsMemberus-gaap:CashEquivalentsMember2022-08-012022-10-310001327567us-gaap:ForeignExchangeContractMember2023-08-012023-10-3100013275672022-08-012023-01-310001327567us-gaap:DevelopedTechnologyRightsMember2023-10-310001327567us-gaap:DevelopedTechnologyRightsMember2023-07-310001327567us-gaap:CustomerRelationshipsMember2023-10-310001327567us-gaap:CustomerRelationshipsMember2023-07-310001327567us-gaap:PatentsMember2023-10-310001327567us-gaap:PatentsMember2023-07-310001327567us-gaap:TrademarksAndTradeNamesMember2023-10-310001327567us-gaap:TrademarksAndTradeNamesMember2023-07-310001327567us-gaap:OtherIntangibleAssetsMember2023-10-310001327567us-gaap:OtherIntangibleAssetsMember2023-07-310001327567us-gaap:InProcessResearchAndDevelopmentMember2023-10-310001327567us-gaap:InProcessResearchAndDevelopmentMember2023-07-310001327567panw:A2023NotesMember2018-07-31xbrli:pure0001327567panw:A2025NotesMember2020-06-030001327567panw:A2025NotesMember2020-06-032020-06-03panw:day0001327567panw:A2025NotesOptionToConvertMemberpanw:Circumstance1Member2020-06-032020-06-030001327567panw:A2025NotesOptionToConvertMemberpanw:Circumstance2Member2020-06-032020-06-030001327567panw:A2025NotesMember2023-08-012023-10-310001327567panw:A2025NotesMember2023-10-310001327567panw:A2025NotesMember2023-07-310001327567us-gaap:FairValueInputsLevel2Memberpanw:A2025NotesMember2023-10-310001327567us-gaap:FairValueInputsLevel2Memberpanw:A2025NotesMember2023-07-310001327567panw:A2023NotesMember2023-08-012023-10-310001327567panw:A2023NotesMember2022-08-012022-10-310001327567panw:A2025NotesMember2022-08-012022-10-310001327567panw:A2023NotesMember2023-10-310001327567panw:A2023NotesMember2022-10-310001327567panw:A2025NotesMember2022-10-310001327567panw:A2025NoteHedgesMember2020-06-032020-06-030001327567panw:A2025NoteHedgesMember2023-08-012023-10-310001327567panw:A2023WarrantsMember2018-07-310001327567panw:A2023WarrantsMember2018-07-312018-07-310001327567panw:A2025WarrantsMember2020-06-030001327567panw:A2025WarrantsMember2020-06-032020-06-030001327567panw:A2023WarrantsMember2023-08-012023-10-310001327567panw:A2023WarrantsMember2023-10-310001327567us-gaap:RevolvingCreditFacilityMember2023-04-130001327567srt:MinimumMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:BaseRateMember2023-04-132023-04-130001327567srt:MaximumMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:BaseRateMember2023-04-132023-04-130001327567panw:SecuredOvernightFinancingRateSOFRMembersrt:MinimumMemberus-gaap:RevolvingCreditFacilityMember2023-04-132023-04-130001327567srt:MaximumMemberpanw:SecuredOvernightFinancingRateSOFRMemberus-gaap:RevolvingCreditFacilityMember2023-04-132023-04-130001327567srt:MinimumMemberus-gaap:RevolvingCreditFacilityMember2023-04-132023-04-130001327567srt:MaximumMemberus-gaap:RevolvingCreditFacilityMember2023-04-132023-04-130001327567us-gaap:RevolvingCreditFacilityMember2023-10-310001327567us-gaap:InventoriesMember2023-08-012023-10-310001327567us-gaap:InventoriesMember2023-10-310001327567panw:CloudAndOtherServicesMember2023-08-012023-10-310001327567panw:CloudAndOtherServicesMember2023-10-310001327567panw:ServiceProviderPurchaseCommitmentMember2023-08-012023-10-3100013275672019-02-2800013275672020-12-3100013275672021-08-3100013275672022-08-310001327567us-gaap:RestrictedStockUnitsRSUMember2023-07-310001327567panw:PerformanceStockUnitsPSUsMember2023-07-310001327567us-gaap:RestrictedStockUnitsRSUMember2023-08-012023-10-310001327567panw:PerformanceStockUnitsPSUsMember2023-08-012023-10-310001327567us-gaap:RestrictedStockUnitsRSUMember2023-10-310001327567panw:PerformanceStockUnitsPSUsMember2023-10-310001327567srt:MinimumMemberus-gaap:RestrictedStockUnitsRSUMember2023-08-012023-10-310001327567srt:MaximumMemberus-gaap:RestrictedStockUnitsRSUMember2023-08-012023-10-310001327567panw:PerformanceStockUnitsPSUsMembersrt:MinimumMember2023-08-012023-10-310001327567srt:MaximumMemberpanw:PerformanceStockUnitsPSUsMember2023-08-012023-10-310001327567panw:PerformanceStockUnitsPSUsSubjectToServicePerformanceAndMarketConditionsMember2023-08-012023-10-310001327567panw:PerformanceStockUnitsPSUsSubjectToServicePerformanceAndMarketConditionsMember2022-08-012022-10-310001327567srt:MinimumMemberpanw:PerformanceStockUnitsPSUsSubjectToServicePerformanceAndMarketConditionsMember2023-08-012023-10-310001327567srt:MaximumMemberpanw:PerformanceStockUnitsPSUsSubjectToServicePerformanceAndMarketConditionsMember2023-08-012023-10-310001327567srt:MinimumMemberpanw:PerformanceStockUnitsPSUsSubjectToServicePerformanceAndMarketConditionsMember2022-08-012022-10-310001327567srt:MaximumMemberpanw:PerformanceStockUnitsPSUsSubjectToServicePerformanceAndMarketConditionsMember2022-08-012022-10-310001327567panw:PerformanceStockOptionsWithServiceAndMarketConditionsMember2023-07-310001327567panw:PerformanceStockOptionsWithServiceAndMarketConditionsMember2022-08-012023-07-310001327567panw:PerformanceStockOptionsWithServiceAndMarketConditionsMember2023-08-012023-10-310001327567panw:PerformanceStockOptionsWithServiceAndMarketConditionsMember2023-10-310001327567us-gaap:CostOfSalesMemberus-gaap:ProductMember2023-08-012023-10-310001327567us-gaap:CostOfSalesMemberus-gaap:ProductMember2022-08-012022-10-310001327567us-gaap:CostOfSalesMemberus-gaap:ServiceMember2023-08-012023-10-310001327567us-gaap:CostOfSalesMemberus-gaap:ServiceMember2022-08-012022-10-310001327567us-gaap:ResearchAndDevelopmentExpenseMember2023-08-012023-10-310001327567us-gaap:ResearchAndDevelopmentExpenseMember2022-08-012022-10-310001327567us-gaap:SellingAndMarketingExpenseMember2023-08-012023-10-310001327567us-gaap:SellingAndMarketingExpenseMember2022-08-012022-10-310001327567us-gaap:GeneralAndAdministrativeExpenseMember2023-08-012023-10-310001327567us-gaap:GeneralAndAdministrativeExpenseMember2022-08-012022-10-310001327567us-gaap:StockCompensationPlanMember2023-08-012023-10-310001327567us-gaap:StockCompensationPlanMember2022-08-012022-10-310001327567panw:DigSecuritySolutionsLtdMember2023-10-292023-10-290001327567us-gaap:SubsequentEventMemberpanw:TalonCyberSecurityLtdMember2023-11-062023-11-060001327567us-gaap:SubsequentEventMember2023-11-162023-11-160001327567us-gaap:SubsequentEventMember2023-11-160001327567panw:DipakGolechhaMember2023-08-012023-10-310001327567panw:DipakGolechhaMember2023-10-310001327567panw:MaryPatMcCarthyMember2023-08-012023-10-310001327567panw:MaryPatMcCarthyMember2023-10-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

FORM 10-Q

_____________________

(Mark One)

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended October 31, 2023

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number 001-35594

PALO ALTO NETWORKS, INC.

(Exact name of registrant as specified in its charter)

| | | | | |

| Delaware | 20-2530195 |

(State or other jurisdiction of

incorporation or organization) | (I.R.S. Employer

Identification No.) |

|

3000 Tannery Way

Santa Clara, California 95054

(Address of principal executive offices, including zip code)

(408) 753-4000

(Registrant’s telephone number, including area code)

NA

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, $0.0001 par value per share | | PANW | | The Nasdaq Stock Market LLC (Nasdaq Global Select Market) |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ | Emerging growth company | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The number of shares outstanding of the registrant’s common stock as of November 10, 2023 was 315.3 million.

Table of Contents

| | | | | | | | |

| | |

| | Page |

| PART I - FINANCIAL INFORMATION | |

| Item 1. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| | |

| PART II - OTHER INFORMATION | |

| Item 1. | | |

| Item 1A. | | |

| Item 2. | | |

Item 5. | | |

| Item 6. | | |

| | |

Part I

Item 1. Financial Statements

PALO ALTO NETWORKS, INC.

| | | | | | | | | | | |

CONDENSED CONSOLIDATED BALANCE SHEETS (in millions, except per share data) |

| October 31, 2023 | | July 31, 2023 |

| (unaudited) | | |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 2,491.4 | | | $ | 1,135.3 | |

| Short-term investments | 1,402.4 | | | 1,254.7 | |

Accounts receivable, net of allowance for credit losses of $8.2 and $7.8 as of October 31, 2023 and July 31, 2023, respectively | 1,413.0 | | | 2,463.2 | |

| Short-term financing receivables, net | 445.9 | | | 388.8 | |

| Short-term deferred contract costs | 328.7 | | | 339.2 | |

| Prepaid expenses and other current assets | 396.2 | | | 466.8 | |

| Total current assets | 6,477.6 | | | 6,048.0 | |

| Property and equipment, net | 352.6 | | | 354.5 | |

| Operating lease right-of-use assets | 274.3 | | | 263.3 | |

| Long-term investments | 2,988.9 | | | 3,047.9 | |

| Long-term financing receivables, net | 639.8 | | | 653.3 | |

| Long-term deferred contract costs | 515.4 | | | 547.1 | |

| Goodwill | 2,926.8 | | | 2,926.8 | |

| Intangible assets, net | 290.5 | | | 315.4 | |

| Other assets | 342.6 | | | 344.8 | |

| Total assets | $ | 14,808.5 | | | $ | 14,501.1 | |

| Liabilities and stockholders’ equity | | | |

| Current liabilities: | | | |

Accounts payable | $ | 131.8 | | | $ | 132.3 | |

| Accrued compensation | 331.4 | | | 548.3 | |

| Accrued and other liabilities | 371.5 | | | 390.8 | |

| Deferred revenue | 4,732.0 | | | 4,674.6 | |

| Convertible senior notes, net | 1,946.7 | | | 1,991.5 | |

Total current liabilities | 7,513.4 | | | 7,737.5 | |

| | | |

| Long-term deferred revenue | 4,710.8 | | | 4,621.8 | |

| Long-term operating lease liabilities | 275.8 | | | 279.2 | |

| Other long-term liabilities | 138.0 | | | 114.2 | |

| Total liabilities | 12,638.0 | | | 12,752.7 | |

Commitments and contingencies (Note 9) | | | |

| | | |

| Stockholders’ equity: | | | |

Preferred stock; $0.0001 par value; 100.0 shares authorized; none issued and outstanding as of October 31, 2023 and July 31, 2023 | — | | | — | |

Common stock and additional paid-in capital; $0.0001 par value; 1,000.0 shares authorized; 313.7 and 308.3 shares issued and outstanding as of October 31, 2023 and July 31, 2023, respectively | 3,296.7 | | | 3,019.0 | |

| Accumulated other comprehensive loss | (93.0) | | | (43.2) | |

| Accumulated deficit | (1,033.2) | | | (1,227.4) | |

| Total stockholders’ equity | 2,170.5 | | | 1,748.4 | |

| Total liabilities and stockholders’ equity | $ | 14,808.5 | | | $ | 14,501.1 | |

| | | |

See notes to condensed consolidated financial statements.

PALO ALTO NETWORKS, INC.

| | | | | | | | | | | | | | | |

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited, in millions, except per share data) |

| | | Three Months Ended October 31, |

| | | | | 2023 | | 2022 |

| Revenue: | | | | | | | |

| Product | | | | | $ | 341.1 | | | $ | 330.0 | |

| Subscription and support | | | | | 1,537.0 | | | 1,233.4 | |

| Total revenue | | | | | 1,878.1 | | | 1,563.4 | |

| Cost of revenue: | | | | | | | |

| Product | | | | | 77.4 | | | 120.1 | |

| Subscription and support | | | | | 395.4 | | | 341.8 | |

| Total cost of revenue | | | | | 472.8 | | | 461.9 | |

| Total gross profit | | | | | 1,405.3 | | | 1,101.5 | |

| Operating expenses: | | | | | | | |

| Research and development | | | | | 409.5 | | | 371.8 | |

| Sales and marketing | | | | | 660.5 | | | 615.0 | |

| General and administrative | | | | | 120.1 | | | 99.5 | |

| Total operating expenses | | | | | 1,190.1 | | | 1,086.3 | |

Operating income | | | | | 215.2 | | | 15.2 | |

| Interest expense | | | | | (2.9) | | | (6.8) | |

| Other income, net | | | | | 70.3 | | | 26.0 | |

Income before income taxes | | | | | 282.6 | | | 34.4 | |

| Provision for income taxes | | | | | 88.4 | | | 14.4 | |

Net income | | | | | $ | 194.2 | | | $ | 20.0 | |

Net income per share, basic | | | | | $ | 0.63 | | | $ | 0.07 | |

Net income per share, diluted | | | | | $ | 0.56 | | | $ | 0.06 | |

Weighted-average shares used to compute net income per share, basic | | | | | 310.1 | | | 299.8 | |

Weighted-average shares used to compute net income per share, diluted | | | | | 349.8 | | | 338.4 | |

| | | | | | | |

See notes to condensed consolidated financial statements.

PALO ALTO NETWORKS, INC.

| | | | | | | | | | | | | | | |

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) (Unaudited, in millions) |

| | | Three Months Ended October 31, |

| | | | | 2023 | | 2022 |

Net income | | | | | $ | 194.2 | | | $ | 20.0 | |

| Other comprehensive income (loss), net of tax: | | | | | | | |

| Change in unrealized gains (losses) on investments | | | | | (18.2) | | | (27.8) | |

| Cash flow hedges: | | | | | | | |

| Change in unrealized gains (losses) | | | | | (40.9) | | | (42.5) | |

Net realized (gains) losses reclassified into earnings | | | | | 9.3 | | | 14.8 | |

| Net change on cash flow hedges | | | | | (31.6) | | | (27.7) | |

Other comprehensive loss | | | | | (49.8) | | | (55.5) | |

| Comprehensive income (loss) | | | | | $ | 144.4 | | | $ | (35.5) | |

| | | | | | | |

See notes to condensed consolidated financial statements.

PALO ALTO NETWORKS, INC.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY (Unaudited, in millions) |

| Three Months Ended October 31, 2023 |

| Common Stock and Additional Paid-In Capital | | Accumulated Other Comprehensive Loss | | Accumulated Deficit | | Total Stockholders’ Equity |

| Shares | | Amount | |

| Balance as of July 31, 2023 | 308.3 | | | $ | 3,019.0 | | | $ | (43.2) | | | $ | (1,227.4) | | | $ | 1,748.4 | |

| | | | | | | | | |

| Net income | — | | | — | | | — | | | 194.2 | | | 194.2 | |

| Other comprehensive loss | — | | | — | | | (49.8) | | | — | | | (49.8) | |

| Issuance of common stock in connection with employee equity incentive plans | 2.6 | | | 87.0 | | | — | | | — | | | 87.0 | |

| Taxes paid related to net share settlement of equity awards | — | | | (15.5) | | | — | | | — | | | (15.5) | |

Share-based compensation for equity-based awards | — | | | 273.1 | | | — | | | — | | | 273.1 | |

Repurchase and retirement of common stock | (0.3) | | | (66.7) | | | — | | | — | | | (66.7) | |

| Settlement of convertible notes | 0.3 | | | (0.2) | | | — | | | — | | | (0.2) | |

Settlement of note hedges | (0.3) | | | — | | | — | | | — | | | — | |

| | | | | | | | | |

| Settlement of warrants | 3.1 | | | — | | | — | | | — | | | — | |

| | | | | | | | | |

| | | | | | | | | |

| Balance as of October 31, 2023 | 313.7 | | | $ | 3,296.7 | | | $ | (93.0) | | | $ | (1,033.2) | | | $ | 2,170.5 | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended October 31, 2022 |

| Common Stock and Additional Paid-In Capital | | Accumulated Other Comprehensive Loss | | Accumulated Deficit | | Total Stockholders’ Equity |

| Shares | | Amount | |

| Balance as of July 31, 2022 | 298.8 | | | $ | 1,932.7 | | | $ | (55.6) | | | $ | (1,667.1) | | | $ | 210.0 | |

| | | | | | | | | |

Net income | — | | | — | | | — | | | 20.0 | | | 20.0 | |

| Other comprehensive loss | — | | | — | | | (55.5) | | | — | | | (55.5) | |

| Issuance of common stock in connection with employee equity incentive plans | 3.5 | | | 68.2 | | | — | | | — | | | 68.2 | |

| Taxes paid related to net share settlement of equity awards | — | | | (13.9) | | | — | | | — | | | (13.9) | |

| Share-based compensation for equity-based awards | — | | | 279.2 | | | — | | | — | | | 279.2 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Balance as of October 31, 2022 | 302.3 | | | $ | 2,266.2 | | | $ | (111.1) | | | $ | (1,647.1) | | | $ | 508.0 | |

| | | | | | | | | |

See notes to condensed consolidated financial statements.

PALO ALTO NETWORKS, INC.

| | | | | | | | | | | |

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited, in millions) |

| Three Months Ended October 31, |

| 2023 | | 2022 |

| Cash flows from operating activities | | | |

Net income | $ | 194.2 | | | $ | 20.0 | |

Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Share-based compensation for equity-based awards | 271.0 | | | 266.0 | |

| Depreciation and amortization | 64.3 | | | 70.7 | |

| | | |

| Amortization of deferred contract costs | 105.5 | | | 97.0 | |

Amortization of debt issuance costs | 1.0 | | | 1.8 | |

| Reduction of operating lease right-of-use assets | 12.4 | | | 12.1 | |

| Amortization of investment premiums, net of accretion of purchase discounts | (14.7) | | | 1.7 | |

| | | |

| | | |

Changes in operating assets and liabilities: | | | |

| Accounts receivable, net | 1,050.2 | | | 904.4 | |

| Financing receivables, net | (43.6) | | | (12.4) | |

| Deferred contract costs | (63.3) | | | (60.1) | |

| Prepaid expenses and other assets | 54.0 | | | (28.7) | |

| Accounts payable | (0.4) | | | (1.0) | |

| Accrued compensation | (216.9) | | | (192.3) | |

| Accrued and other liabilities | (34.1) | | | (28.1) | |

| Deferred revenue | 146.4 | | | 185.6 | |

| Net cash provided by operating activities | 1,526.0 | | | 1,236.7 | |

| Cash flows from investing activities | | | |

| Purchases of investments | (854.7) | | | (2,112.8) | |

| Proceeds from sales of investments | 304.6 | | | 485.0 | |

| Proceeds from maturities of investments | 457.9 | | | 347.6 | |

| | | |

Purchases of property, equipment, and other assets | (36.8) | | | (39.6) | |

| Net cash used in investing activities | (129.0) | | | (1,319.8) | |

| Cash flows from financing activities | | | |

Repayments of convertible senior notes | (46.0) | | | — | |

| | | |

| | | |

| | | |

Repurchases of common stock | (66.7) | | | (22.7) | |

Proceeds from sales of shares through employee equity incentive plans | 86.4 | | | 67.7 | |

Payments for taxes related to net share settlement of equity awards | (15.5) | | | (13.9) | |

| | | |

| | | |

Net cash provided by (used in) financing activities | (41.8) | | | 31.1 | |

| Net increase (decrease) in cash, cash equivalents, and restricted cash | 1,355.2 | | | (52.0) | |

| Cash, cash equivalents, and restricted cash - beginning of period | 1,142.2 | | | 2,124.8 | |

| Cash, cash equivalents, and restricted cash - end of period | $ | 2,497.4 | | | $ | 2,072.8 | |

| | | |

| Reconciliation of cash, cash equivalents, and restricted cash to the condensed consolidated balance sheets | | | |

| Cash and cash equivalents | $ | 2,491.4 | | | $ | 2,067.2 | |

| Restricted cash included in prepaid expenses and other current assets | 6.0 | | | 5.6 | |

| | | |

| Total cash, cash equivalents, and restricted cash | $ | 2,497.4 | | | $ | 2,072.8 | |

| | | |

| | | |

| | | |

See notes to condensed consolidated financial statements.

Notes to Condensed Consolidated Financial Statements (Unaudited)

1. Description of Business and Summary of Significant Accounting Policies

Description of Business

Palo Alto Networks, Inc. (the “Company,” “we,” “us,” or “our”), headquartered in Santa Clara, California, was incorporated in March 2005 under the laws of the State of Delaware and commenced operations in April 2005. We empower enterprises, organizations, service providers, and government entities to secure their users, networks, clouds, and endpoints by delivering comprehensive cybersecurity enabled by artificial intelligence and automation.

Basis of Presentation and Principles of Consolidation

The accompanying condensed consolidated financial statements have been prepared in conformity with U.S. generally accepted accounting principles (“U.S. GAAP”), consistent in all material respects with those applied in our Annual Report on Form 10-K for the fiscal year ended July 31, 2023, filed with the Securities and Exchange Commission (“SEC”) on September 1, 2023. The condensed consolidated financial statements include our accounts and our wholly owned subsidiaries. All significant intercompany balances and transactions have been eliminated in consolidation.

The condensed consolidated financial statements are unaudited but include all adjustments of a normal recurring nature necessary for a fair presentation of our quarterly results. Our condensed consolidated financial statements should be read in conjunction with the audited consolidated financial statements and related notes in our Annual Report on Form 10-K for the fiscal year ended July 31, 2023.

Use of Estimates

The preparation of condensed consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the amounts reported and disclosed in the condensed consolidated financial statements and the accompanying notes. We base our estimates on assumptions, both historical and forward looking, that we believe are reasonable. Actual results could differ materially from those estimates due to risks and uncertainties, including uncertainty in the current economic environment.

Summary of Significant Accounting Policies

There have been no material changes to our significant accounting policies as of and for the three months ended October 31, 2023, as compared to the significant accounting policies described in our Annual Report on Form 10-K for the fiscal year ended July 31, 2023.

2. Revenue

Disaggregation of Revenue

The following table presents revenue by geographic theater (in millions):

| | | | | | | | | | | | | | | |

| | | Three Months Ended October 31, |

| | | | | 2023 | | 2022 |

| Revenue: | | | | | | | |

| Americas | | | | | | | |

| United States | | | | | $ | 1,204.3 | | | $ | 1,006.3 | |

| Other Americas | | | | | 82.3 | | | 64.4 | |

| Total Americas | | | | | 1,286.6 | | | 1,070.7 | |

| Europe, the Middle East, and Africa (“EMEA”) | | | | | 364.9 | | | 307.9 | |

| Asia Pacific and Japan (“APAC”) | | | | | 226.6 | | | 184.8 | |

| Total revenue | | | | | $ | 1,878.1 | | | $ | 1,563.4 | |

The following table presents revenue for groups of similar products and services (in millions):

| | | | | | | | | | | | | | | |

| | | Three Months Ended October 31, |

| | | | | 2023 | | 2022 |

| Revenue: | | | | | | | |

| Product | | | | | $ | 341.1 | | | $ | 330.0 | |

| Subscription and support | | | | | | | |

| Subscription | | | | | 988.3 | | | 764.0 | |

| Support | | | | | 548.7 | | | 469.4 | |

| Total subscription and support | | | | | 1,537.0 | | | 1,233.4 | |

| Total revenue | | | | | $ | 1,878.1 | | | $ | 1,563.4 | |

Deferred Revenue

During the three months ended October 31, 2023 and 2022, we recognized approximately $1.4 billion and $1.1 billion of revenue pertaining to amounts that were deferred as of July 31, 2023 and 2022, respectively.

Remaining Performance Obligations

Remaining performance obligations were $10.4 billion as of October 31, 2023, of which we expect to recognize as revenue approximately $5.0 billion over the next 12 months and the remainder thereafter.

3. Fair Value Measurements

The following table presents our financial assets and liabilities measured at fair value on a recurring basis as of October 31, 2023 and July 31, 2023 (in millions):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | October 31, 2023 | | July 31, 2023 |

| | Level 1 | | Level 2 | | Level 3 | | Total | | Level 1 | | Level 2 | | Level 3 | | Total |

| | | | | | | | | | | | | | | | |

| Cash equivalents: | | | | | | | | | | | | | | | | |

| Money market funds | | $ | 1,595.3 | | | $ | — | | | $ | — | | | $ | 1,595.3 | | | $ | 476.1 | | | $ | — | | | $ | — | | | $ | 476.1 | |

| | | | | | | | | | | | | | | | |

| Commercial paper | | — | | | 297.0 | | | — | | | 297.0 | | | — | | | 151.4 | | | — | | | 151.4 | |

| Corporate debt securities | | — | | | 8.6 | | | — | | | 8.6 | | | — | | | — | | | — | | | — | |

| U.S. government and agency securities | | — | | | 24.9 | | | — | | | 24.9 | | | — | | | — | | | — | | | — | |

| | | | | | | | | | | | | | | | |

| Total cash equivalents | | 1,595.3 | | | 330.5 | | | — | | | 1,925.8 | | | 476.1 | | | 151.4 | | | — | | | 627.5 | |

| Short-term investments: | | | | | | | | | | | | | | | | |

| Certificates of deposit | | — | | | 34.0 | | | — | | | 34.0 | | | — | | | 48.1 | | | — | | | 48.1 | |

| Commercial paper | | — | | | 136.8 | | | — | | | 136.8 | | | — | | | 213.8 | | | — | | | 213.8 | |

| Corporate debt securities | | — | | | 1,038.2 | | | — | | | 1,038.2 | | | — | | | 798.0 | | | — | | | 798.0 | |

| U.S. government and agency securities | | — | | | 148.0 | | | — | | | 148.0 | | | — | | | 190.6 | | | — | | | 190.6 | |

| Non-U.S. government and agency securities | | — | | | 33.7 | | | — | | | 33.7 | | | — | | | — | | | — | | | — | |

| Asset-backed securities | | — | | | 11.7 | | | — | | | 11.7 | | | — | | | 4.2 | | | — | | | 4.2 | |

| Total short-term investments | | — | | | 1,402.4 | | | — | | | 1,402.4 | | | — | | | 1,254.7 | | | — | | | 1,254.7 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | October 31, 2023 | | July 31, 2023 |

| | Level 1 | | Level 2 | | Level 3 | | Total | | Level 1 | | Level 2 | | Level 3 | | Total |

| | | | | | | | | | | | | | | | |

Long-term investments: | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Corporate debt securities | | — | | | 2,367.0 | | | — | | | 2,367.0 | | | — | | | 2,484.3 | | | — | | | 2,484.3 | |

| U.S. government and agency securities | | — | | | 71.2 | | | — | | | 71.2 | | | — | | | 22.0 | | | — | | | 22.0 | |

| Non-U.S. government and agency securities | | — | | | 27.9 | | | — | | | 27.9 | | | — | | | 36.6 | | | — | | | 36.6 | |

| Asset-backed securities | | — | | | 522.8 | | | — | | | 522.8 | | | — | | | 505.0 | | | — | | | 505.0 | |

| Total long-term investments | | — | | | 2,988.9 | | | — | | | 2,988.9 | | | — | | | 3,047.9 | | | — | | | 3,047.9 | |

| Prepaid expenses and other current assets: | | | | | | | | | | | | | | | | |

| Foreign currency forward contracts | | — | | | 5.6 | | | — | | | 5.6 | | | — | | | 19.1 | | | — | | | 19.1 | |

| Total prepaid expenses and other current assets | | — | | | 5.6 | | | — | | | 5.6 | | | — | | | 19.1 | | | — | | | 19.1 | |

| Other assets: | | | | | | | | | | | | | | | | |

| Foreign currency forward contracts | | — | | | — | | | — | | | — | | | — | | | 1.7 | | | — | | | 1.7 | |

| Total other assets | | — | | | — | | | — | | | — | | | — | | | 1.7 | | | — | | | 1.7 | |

| Total assets measured at fair value | | $ | 1,595.3 | | | $ | 4,727.4 | | | $ | — | | | $ | 6,322.7 | | | $ | 476.1 | | | $ | 4,474.8 | | | $ | — | | | $ | 4,950.9 | |

| | | | | | | | | | | | | | | | |

| Accrued and other liabilities: | | | | | | | | | | | | | | | | |

| Foreign currency forward contracts | | $ | — | | | $ | 44.6 | | | $ | — | | | $ | 44.6 | | | $ | — | | | $ | 18.7 | | | $ | — | | | $ | 18.7 | |

| Total accrued and other liabilities | | — | | | 44.6 | | | — | | | 44.6 | | | — | | | 18.7 | | | — | | | 18.7 | |

| Other long-term liabilities: | | | | | | | | | | | | | | | | |

| Foreign currency forward contracts | | — | | | — | | | — | | | — | | | — | | | 1.6 | | | — | | | 1.6 | |

| Total other long-term liabilities | | — | | | — | | | — | | | — | | | — | | | 1.6 | | | — | | | 1.6 | |

| Total liabilities measured at fair value | | $ | — | | | $ | 44.6 | | | $ | — | | | $ | 44.6 | | | $ | — | | | $ | 20.3 | | | $ | — | | | $ | 20.3 | |

Refer to Note 8. Debt for the carrying amount and estimated fair value of our convertible senior notes as of October 31, 2023 and July 31, 2023.

4. Cash Equivalents and Investments

Available-for-sale Debt Securities

The following tables summarize the amortized cost, unrealized gains and losses, and fair value of our available-for-sale debt securities as of October 31, 2023 and July 31, 2023 (in millions):

| | | | | | | | | | | | | | | | | | | | | | | |

| October 31, 2023 |

| Amortized Cost | | Unrealized Gains | | Unrealized Losses | | Fair Value |

| Cash equivalents: | | | | | | | |

| | | | | | | |

| Commercial paper | $ | 297.0 | | | $ | — | | | $ | — | | | $ | 297.0 | |

| Corporate debt securities | 8.6 | | | — | | | — | | | 8.6 | |

| U.S. government and agency securities | 24.9 | | | — | | | — | | | 24.9 | |

| | | | | | | |

| Total available-for-sale cash equivalents | $ | 330.5 | | | $ | — | | | $ | — | | | $ | 330.5 | |

| Investments: | | | | | | | |

| Certificates of deposit | $ | 34.0 | | | $ | — | | | $ | — | | | $ | 34.0 | |

| Commercial paper | 136.9 | | | — | | | (0.1) | | | 136.8 | |

| Corporate debt securities | 3,453.7 | | | 0.1 | | | (48.6) | | | 3,405.2 | |

| U.S. government and agency securities | 219.9 | | | 0.1 | | | (0.8) | | | 219.2 | |

| Non-U.S. government and agency securities | 62.4 | | | — | | | (0.8) | | | 61.6 | |

| Asset-backed securities | 539.1 | | | 0.1 | | | (4.7) | | | 534.5 | |

| Total available-for-sale investments | $ | 4,446.0 | | | $ | 0.3 | | | $ | (55.0) | | | $ | 4,391.3 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| July 31, 2023 |

| Amortized Cost | | Unrealized Gains | | Unrealized Losses | | Fair Value |

| Cash equivalents: | | | | | | | |

| | | | | | | |

| Commercial paper | $ | 151.4 | | | $ | — | | | $ | — | | | $ | 151.4 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Total available-for-sale cash equivalents | $ | 151.4 | | | $ | — | | | $ | — | | | $ | 151.4 | |

| Investments: | | | | | | | |

| Certificates of deposit | $ | 48.1 | | | $ | — | | | $ | — | | | $ | 48.1 | |

| Commercial paper | 214.1 | | | — | | | (0.3) | | | 213.8 | |

| Corporate debt securities | 3,313.5 | | | 1.3 | | | (32.5) | | | 3,282.3 | |

| U.S. government and agency securities | 214.2 | | | — | | | (1.6) | | | 212.6 | |

| Non-U.S. government and agency securities | 37.2 | | | — | | | (0.6) | | | 36.6 | |

| Asset-backed securities | 512.0 | | | 0.2 | | | (3.0) | | | 509.2 | |

| Total available-for-sale investments | $ | 4,339.1 | | | $ | 1.5 | | | $ | (38.0) | | | $ | 4,302.6 | |

As of October 31, 2023, the gross unrealized losses that have been in a continuous unrealized loss position for less than 12 months were $40.4 million, which were related to $3.3 billion of available-for-sale debt securities, and the gross unrealized losses that have been in a continuous unrealized loss position for more than 12 months were $14.6 million, which were related to $922.5 million of available-for-sale debt securities. As of July 31, 2023 the gross unrealized losses that have been in a continuous unrealized loss position for less than 12 months were $30.7 million, which were related to $3.4 billion of available-for-sale debt securities, and the gross unrealized losses that have been in a continuous unrealized loss position for more than 12 months were $7.3 million, which were related to $481.8 million of available-for-sale debt securities.

Unrealized losses related to our available-for-sale debt securities are primarily due to interest rate fluctuations as opposed to credit quality. We do not intend to sell any of the securities in an unrealized loss position and it is not likely that we would be required to sell these securities before recovery of their amortized cost basis, which may be at maturity. We did not recognize any credit losses related to our available-for-sale debt securities during the three months ended October 31, 2023 and 2022.

The following table summarizes the amortized cost and fair value of our available-for-sale debt securities as of October 31, 2023, by contractual years-to-maturity (in millions):

| | | | | | | | | | | |

| Amortized Cost | | Fair Value |

| Due within one year | $ | 1,742.4 | | | $ | 1,732.9 | |

| Due between one and three years | 2,173.8 | | | 2,145.2 | |

| Due between three and five years | 743.4 | | | 728.1 | |

| Due between five and ten years | 61.3 | | | 60.8 | |

| Due after ten years | 55.6 | | | 54.8 | |

| Total | $ | 4,776.5 | | | $ | 4,721.8 | |

Marketable Equity Securities

Marketable equity securities consist of money market funds and are included in cash and cash equivalents on our condensed consolidated balance sheets. As of October 31, 2023 and July 31, 2023, the carrying values of our marketable equity securities were $1.6 billion and $476.1 million, respectively. There were no unrealized gains or losses recognized for these securities during the three months ended October 31, 2023 and 2022.

5. Financing Receivables

The following table summarizes our short-term and long-term financing receivables as of October 31, 2023 and July 31, 2023 (in millions):

| | | | | | | | | | | | | | |

| | October 31, 2023 | | July 31, 2023 |

| Short-term financing receivables, gross | | $ | 499.8 | | | $ | 435.1 | |

Unearned income | | (49.3) | | | (42.9) | |

| Allowance for credit losses | | (4.6) | | | (3.4) | |

| Short-term financing receivables, net | | $ | 445.9 | | | $ | 388.8 | |

| Long-term financing receivables, gross | | $ | 689.8 | | | $ | 698.6 | |

Unearned income | | (42.0) | | | (39.2) | |

| Allowance for credit losses | | (8.0) | | | (6.1) | |

| Long-term financing receivables, net | | $ | 639.8 | | | $ | 653.3 | |

Our financing receivables portfolio primarily consisted of high-quality investment-grade receivables as of October 31, 2023 and July 31, 2023. There was no significant activity in allowance for credit losses during the three months ended October 31, 2023 and 2022. Past due amounts on financing receivables were not material as of October 31, 2023 and July 31, 2023.

6. Derivative Instruments

We are exposed to foreign currency exchange risk. Our revenue is transacted in U.S. dollars, however, a portion of our operating expenditures are incurred outside of the United States and are denominated in foreign currencies, making them subject to fluctuations in foreign currency exchange rates. We enter into foreign currency derivative contracts with maturities of 24 months or less, which we designate as cash flow hedges, to manage the foreign currency exchange risk associated with our operating expenditures.

As of October 31, 2023 and July 31, 2023, the total notional amount of our outstanding foreign currency forward contracts was $777.9 million and $957.5 million, respectively. Refer to Note 3. Fair Value Measurements for the fair value of our derivative instruments as reported on our condensed consolidated balance sheets as of October 31, 2023 and July 31, 2023.

As of October 31, 2023, unrealized gains and losses in accumulated other comprehensive income (“AOCI”) related to our cash flow hedges were a $31.0 million net loss, of which $29.0 million in losses are expected to be recognized into earnings within the next 12 months. As of July 31, 2023, unrealized gains and losses in AOCI related to our cash flow hedges were a $0.7 million net gain.

7. Intangible Assets

Purchased Intangible Assets

The following table presents details of our purchased intangible assets as of October 31, 2023 and July 31, 2023 (in millions):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| October 31, 2023 | | July 31, 2023 |

| Gross Carrying Amount | | Accumulated Amortization | | Net Carrying Amount | | Gross Carrying Amount | | Accumulated Amortization | | Net Carrying Amount |

| Intangible assets subject to amortization: | | | | | | | | | | | |

| Developed technology | $ | 633.2 | | | $ | (448.5) | | | $ | 184.7 | | | $ | 633.2 | | | $ | (429.4) | | | $ | 203.8 | |

| Customer relationships | 172.7 | | | (79.3) | | | 93.4 | | | 172.7 | | | (73.9) | | | 98.8 | |

| Acquired intellectual property | 14.6 | | | (6.5) | | | 8.1 | | | 14.6 | | | (6.2) | | | 8.4 | |

| Trade name and trademarks | 9.4 | | | (9.4) | | | — | | | 9.4 | | | (9.4) | | | — | |

| Other | 0.9 | | | (0.5) | | | 0.4 | | | 0.9 | | | (0.4) | | | 0.5 | |

| Total intangible assets subject to amortization | 830.8 | | | (544.2) | | | 286.6 | | | 830.8 | | | (519.3) | | | 311.5 | |

| Intangible assets not subject to amortization: | | | | | | | | | | | |

| In-process research and development | 3.9 | | | — | | | 3.9 | | | 3.9 | | — | | | 3.9 | |

| Total purchased intangible assets | $ | 834.7 | | | $ | (544.2) | | | $ | 290.5 | | | $ | 834.7 | | | $ | (519.3) | | | $ | 315.4 | |

We recognized amortization expense of $24.9 million and $29.1 million for the three months ended October 31, 2023 and 2022, respectively.

The following table summarizes estimated future amortization expense of our intangible assets subject to amortization as of October 31, 2023 (in millions):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Fiscal years ending July 31, |

| Total | | Remaining 2024 | | 2025 | | 2026 | | 2027 | | 2028 | | 2029 and Thereafter |

| Future amortization expense | $ | 286.6 | | | $ | 73.0 | | | $ | 84.2 | | | $ | 62.4 | | | $ | 35.3 | | | $ | 13.7 | | | $ | 18.0 | |

8. Debt

Convertible Senior Notes

In July 2018, we issued $1.7 billion aggregate principal amount of 0.75% Convertible Senior Notes due 2023 (the “2023 Notes”) and in June 2020, we issued $2.0 billion aggregate principal amount of 0.375% Convertible Senior Notes due 2025 (the “2025 Notes,” and together with the 2023 Notes, the “Notes”). The 2023 Notes were converted prior to or settled on the maturity date of July 1, 2023 in accordance with their terms. The 2025 Notes bear interest at a fixed rate of 0.375% per year, payable semi-annually in arrears on June 1 and December 1 of each year, beginning on December 1, 2020. The 2025 Notes are governed by an indenture between us, as the issuer, and U.S. Bank National Association, as Trustee (the “Indenture”). The 2025 Notes are unsecured, unsubordinated obligations and the Indenture governing the 2025 Notes does not contain any financial covenants or restrictions on the payments of dividends, the incurrence of indebtedness, or the issuance or repurchase of securities by us or any of our subsidiaries. The 2025 Notes mature on June 1, 2025. We may redeem for cash all or any portion of the 2025 Notes, at our option, on or after June 5, 2023 and prior to the 31st scheduled trading day immediately preceding the maturity date if the last reported sale price of our common stock has been at least 130% of the conversion price then in effect for at least 20 trading days during any 30 consecutive trading day period ending on and including the trading day preceding the date on which we provide notice of redemption. The redemption will be at a price equal to 100% of the principal amount of the 2025 Notes and adjusted for interest. If we call any or all of the 2025 Notes for redemption, holders may convert such 2025 Notes called for redemption at any time prior to the close of business on the second scheduled trading day immediately preceding the redemption date.

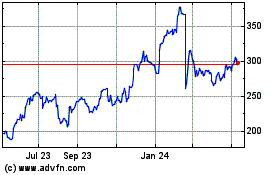

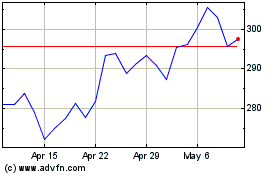

The 2025 Notes are convertible for an initial 20.1 million shares of our common stock at a conversion rate of approximately 10.0806 shares of common stock per $1,000 principal amount, which is equal to an initial conversion price of approximately $99.20 per share of common stock, subject to adjustments. Holders of the 2025 Notes may surrender their 2025 Notes for conversion at their option at any time prior to the close of business on the business day immediately preceding March 1, 2025 only under the following circumstances:

•during any fiscal quarter commencing after the fiscal quarters ending on October 31, 2020 (and only during such fiscal quarter), if the last reported sale price of our common stock for at least 20 trading days (whether or not consecutive) during a period of 30 consecutive trading days ending on the last trading day of the immediately preceding fiscal quarter is greater than or equal to 130% of the conversion price for the 2025 Notes on each applicable trading day (the “sale price condition”);

•during the five business day period after any five consecutive trading day period (the “measurement period”) in which the trading price per $1,000 principal amount of the 2025 Notes for each trading day of the measurement period was less than 98% of the product of the last reported sale price of our common stock and the conversion rate for the 2025 Notes on each such trading day; or

•upon the occurrence of specified corporate events.

On or after March 1, 2025, holders may surrender all or any portion of their 2025 Notes for conversion at any time prior to the close of business on the second scheduled trading day immediately preceding the maturity date regardless of the foregoing conditions, and such conversions will be settled upon the maturity date. Upon conversion, holders of the 2025 Notes will receive cash equal to the aggregate principal amount of the 2025 Notes to be converted, and, at our election, cash and/or shares of our common stock for any amounts in excess of the aggregate principal amount of the 2025 Notes being converted.

The conversion price will be subject to adjustment in some events. Holders of the 2025 Notes who convert their 2025 Notes in connection with certain corporate events that constitute a “make-whole fundamental change” under the Indenture are, under certain circumstances, entitled to an increase in the conversion rate. Additionally, upon the occurrence of a corporate event that constitutes a “fundamental change” under the Indenture, holders of the 2025 Notes may require us to repurchase for cash all or a portion of the 2025 Notes at a repurchase price equal to 100% of the principal amount of the 2025 Notes plus accrued and unpaid interest to, but excluding, the fundamental change repurchase date.

Holders of the 2025 Notes were able to early convert their 2025 Notes during the fiscal quarter ended October 31, 2023 as the sales price condition had been met during the fiscal quarter ended July 31, 2023. During the three months ended October 31, 2023, holders of the 2025 Notes converted $46.0 million in aggregate principal amount of the 2025 Notes, which we repaid in cash. We also issued 0.3 million shares of our common stock to the holders of the 2025 Notes for the conversion value in excess of the principal amount. These shares were fully offset by shares we received from the corresponding exercise of the associated note hedges.

The sale price condition for the 2025 Notes was met during the fiscal quarter ended October 31, 2023 and as a result, holders may convert their 2025 Notes during the fiscal quarter ending January 31, 2024. The net carrying amount of the 2025 Notes was classified as a current liability on our condensed consolidated balance sheet as of October 31, 2023.

The following table sets forth the net carrying amount of our 2025 Notes (in millions):

| | | | | | | | | | | | | | | | | | | |

| | | October 31, 2023 | July 31, 2023 |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Principal | | | $ | 1,953.3 | | | | | | | $ | 1,999.3 | | | |

Less: debt issuance costs, net of amortization | | | (6.6) | | | | | | | (7.8) | | | |

| Net carrying amount | | | $ | 1,946.7 | | | | | | | $ | 1,991.5 | | | |

| | | | | | | | | | | |

The total estimated fair value of the 2025 Notes was $4.8 billion as of October 31, 2023 and $5.0 billion as of July 31, 2023, respectively. The fair value was determined based on the closing trading price per $100 of the 2025 Notes as of the last day of trading for the period. We consider the fair value of the 2025 Notes as of October 31, 2023 and July 31, 2023 to be a Level 2 measurement. The fair value of the 2025 Notes is primarily affected by the trading price of our common stock and market interest rates.

The following table sets forth interest expense recognized related to the Notes (dollars in millions):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended October 31, |

| | | | | 2023 | | 2022 |

| | | | | | | | | | | | | 2023 Notes | | 2025 Notes | | Total | | 2023 Notes | | 2025 Notes | | Total |

| Contractual interest expense | | | | | | | | | | | | | $ | — | | | $ | 1.9 | | | $ | 1.9 | | | $ | 3.2 | | | $ | 1.8 | | | $ | 5.0 | |

| Amortization of debt issuance costs | | | | | | | | | | | | | — | | | 1.0 | | | 1.0 | | | 0.7 | | | 1.1 | | | 1.8 | |

| Total interest expense | | | | | | | | | | | | | $ | — | | | $ | 2.9 | | | $ | 2.9 | | | $ | 3.9 | | | $ | 2.9 | | | $ | 6.8 | |

| Effective interest rate | | | | | | | | | | | | | — | % | | 0.6 | % | | | | 0.9 | % | | 0.6 | % | | |

Note Hedges

To minimize the impact of potential economic dilution upon conversion of our convertible senior notes, we entered into separate convertible note hedge transactions (the “2023 Note Hedges,” with respect to the 2023 Notes, the “2025 Note Hedges,” with respect to the 2025 Notes, and the 2023 Note Hedges together with 2025 Note Hedges, the “Note Hedges”) with respect to our common stock concurrent with the issuance of each series of the Notes.

Upon the settlement of the 2023 Notes, we exercised the corresponding portion of our 2023 Note Hedges during the year ended July 31, 2023 and received shares of our common stock that fully offset the shares issued in excess of the principal amount of the converted 2023 Notes. The 2023 Note Hedges expired upon maturity of the 2023 Notes.

The 2025 Note Hedges cover up to 20.1 million shares of our common stock at a strike price per share that corresponds to the initial conversion price of the 2025 Notes, which are also subject to adjustment, and are exercisable upon conversion of the 2025 Notes. The 2025 Note Hedges will expire upon maturity of the 2025 Notes. The 2025 Note Hedges are separate transactions and are not part of the terms of the 2025 Notes. Holders of the 2025 Notes will not have any rights with respect to the 2025 Note Hedges. Any shares of our common stock receivable by us under the 2025 Note Hedges are excluded from the calculation of diluted earnings per share as they are antidilutive. We paid an aggregate amount of $370.8 million for the 2025 Note Hedges, which is included in additional paid-in capital on our condensed consolidated balance sheets.

As a result of the conversions of the 2025 Notes settled during the three months ended October 31, 2023, we exercised the corresponding portion of our 2025 Note Hedges and received 0.3 million shares of our common stock during the period.

Warrants

Separately, but concurrently with the issuance of each series of our convertible senior notes, we entered into transactions whereby we sold warrants (the “2023 Warrants,” with respect to the 2023 Notes, the “2025 Warrants,” with respect to the 2025 Notes, and the 2023 Warrants together with the 2025 Warrants, the “Warrants”) to acquire shares of our common stock, subject to anti-dilution adjustments. The 2023 Warrants and 2025 Warrants are exercisable over 60 scheduled trading days beginning October 2023 and September 2025, respectively.

The following table presents details of our Warrants (in millions, except per share data):

| | | | | | | | | | | | | | | | | |

| Initial Number of Shares | | Strike Price per Share | | Aggregate Proceeds |

| 2023 Warrants | 19.1 | | | $ | 139.27 | | | $ | 145.4 | |

| 2025 Warrants | 20.1 | | | $ | 136.16 | | | $ | 202.8 | |

The shares issuable under the Warrants are included in the calculation of diluted earnings per share when the average market value per share of our common stock for the reporting period exceeds the applicable strike price for such series of Warrants. The Warrants are separate transactions and are not part of either series of Notes or Note Hedges and are not remeasured through earnings each reporting period. Holders of the Notes of either series will not have any rights with respect to the Warrants. The aggregate proceeds received from the sale of the Warrants are included in additional paid-in capital on our condensed consolidated balance sheets.

During the three months ended October 31, 2023, we net settled a portion of the 2023 Warrants with 3.1 million shares of our common stock with a fair value of $763.5 million. The number of net shares issued was determined based on the number of 2023 Warrants exercised multiplied by the difference between the strike price of the 2023 Warrants and their daily volume-weighted-average stock price. As of October 31, 2023, up to 12.1 million shares of our common stock were issuable for gross settlement under the remaining outstanding 2023 Warrants, which will be net settled when exercised through the end of December 2023.

Revolving Credit Facility

On April 13, 2023, we entered into a credit agreement (the “Credit Agreement”) with certain institutional lenders that provides for a $400.0 million unsecured revolving credit facility (the “Credit Facility”), with an option to increase the amount of the Credit Facility by up to an additional $350.0 million, subject to certain conditions. The Credit Facility matures on April 13, 2028.

The borrowings under the Credit Facility bear interest, at our option, at a base rate plus a spread of 0.000% to 0.375%, or an adjusted term Secured Overnight Financing Rate (“SOFR”) plus a spread of 1.000% to 1.375%, in each case with such spread being determined based on our leverage ratio. We are obligated to pay an ongoing commitment fee on undrawn amounts at a rate of 0.090% to 0.150%, depending on our leverage ratio. The interest rates and commitment fees are also subject to upward and downward adjustments based on our progress towards the achievement of certain sustainability goals related to greenhouse gas emissions.

As of October 31, 2023, there were no amounts outstanding and we were in compliance with all covenants under the Credit Agreement.

9. Commitments and Contingencies

Purchase Commitments

Manufacturing Purchase Commitments

In order to reduce manufacturing lead times and plan for adequate supply, we enter into agreements with manufacturing partners and component suppliers to procure inventory based on our demand forecasts. The following table presents details of the aggregate future minimum or fixed purchase commitments under these arrangements, excluding obligations under contracts that we can cancel as of October 31, 2023 (in millions):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Fiscal years ending July 31, |

| Total | | Remaining 2024 | | 2025 | | 2026 | | 2027 | | 2028 | | 2029 and Thereafter |

Manufacturing purchase commitments | $ | 188.2 | | | $ | 113.2 | | | $ | 35.0 | | | $ | 40.0 | | | $ | — | | | $ | — | | | $ | — | |

Other Purchase Commitments

We have entered into various non-cancelable agreements with certain service providers, under which we are committed to minimum or fixed purchases. The following table presents details of the aggregate future non-cancelable purchase commitments under these agreements as of October 31, 2023 (in millions):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Fiscal years ending July 31, |

| Total | | Remaining 2024 | | 2025 | | 2026 | | 2027 | | 2028 | | 2029 and Thereafter |