SOUTHFIELD, Mich., March 13 /PRNewswire-FirstCall/ -- Origen

Financial, Inc. (NASDAQ:ORGN), a real estate investment trust that

is in the business of originating and servicing manufactured

housing loans, today announced a net loss of $39.1 million for the

quarter ended December 31, 2007, representing $1.54 per share on a

fully-diluted basis, as compared to net income of $2.0 million, or

$0.08 per share on a fully-diluted basis for the quarter ended

December 31, 2006. Net loss for the full year of 2007 was $31.8

million or $1.26 per fully-diluted share, as compared to net income

of $7.0 million, or $0.28 per fully-diluted share for the full year

of 2006. Origen's Board of Directors did not declare a common stock

dividend payment for the fourth quarter of 2007. Due to the nature

of the items which created the loss for 2007, REIT net taxable

income for 2007 was not affected, and there will be no

re-characterization of dividends reported to stockholders for the

tax year 2007. Recent and current conditions in the credit markets

have adversely impacted Origen's business and financial condition.

Subsequent to Origen's annual evaluation of asset impairment at

December 31, 2007, the company determined that its recorded

goodwill was fully impaired. The extended decline of the company's

share price resulting from turmoil in the credit markets led Origen

to record a non-cash goodwill impairment charge in the fourth

quarter of $32.3 million. In addition, Origen had credit facilities

structured as repurchase agreements backed by four asset-backed

bonds. In February 2008, Origen sold one of its asset-backed bonds

to eliminate pressure from its lender. The proceeds from the sale

of this bond retired all debt under repurchase agreements secured

by this bond and three others that the company continues to hold.

Origen consequently re-characterized the sold bond as available for

sale as of December 2007 and recognized an other-than-temporary

impairment charge of $9.2 million. Without the non-cash impairment

charge for goodwill and the sale of the bond, Origen earned $9.7

million for the 2007 year. Current Market Conditions and their

Effect on Origen's Business Origen's business model is dependent on

the availability of credit, both for the funding of newly

originated loans and for the periodic securitization of pools of

loans that have been originated and funded by short-term borrowings

from warehouse lenders. The securitization process permits Origen

to sell bonds secured by the loans it has originated. The proceeds

from the bond sales are used to pay off the warehouse lenders and

recharge the availability of funding for newly originated loans. If

warehouse funding is not available, or is available only on terms

that do not permit Origen to profit from loan origination, Origen's

origination of loans only can be continued at a loss. If there is

no market for securitization at rates of interest and leverage

levels acceptable to Origen, Origen's only alternative for

satisfying its obligations under its warehouse line is to sell the

manufactured housing loans to a purchaser. If purchasers are

unwilling to pay at least the full amount advanced to borrowers

plus all related fees and costs, sales of loans are not profitable

for Origen. During 2007, the credit markets that Origen depends

upon for warehouse lending for originations and for securitization

of its originated loans, as well as the whole loan market for

acquisition of loans originated by Origen, deteriorated. This

situation began with problems in the sub-prime loan market and

subsequently has had the same effect on lenders and investors in

asset classes other than sub-prime mortgages, such as Origen's

manufactured housing loans. Despite actions by the Federal Reserve

Bank to lower interest rates and increase liquidity, uncertainty

among lenders and investors has continued to reduce liquidity,

drive up the cost of lending and drive down the value of assets in

these markets relied upon by Origen. The specific effects are that

banks and other lenders have reported large losses, have demanded

that borrowers reduce the credit exposure to these assets resulting

in "margin calls" or reductions in borrowing availability, and have

caused massive sales of underlying assets that collateralize the

loans. The consequence of these sales has been further downward

pressure on market values of the underlying assets, such as

Origen's manufactured housing loans, despite the continued high

intrinsic quality of Origen's loans in terms of borrower

creditworthiness and low rates of delinquencies, defaults and

repossessions. For Origen, the effect of these conditions has been

as follows: -- The company's stock price has steadily declined to a

point where it is well below its tangible net book value. As a

consequence, the company recorded a non-cash impairment charge,

writing off its entire goodwill of $32.3 million in December 2007.

-- In February 2008, to satisfy its primary lender, the company

sold an asset-backed bond for $22.5 million, in order to fully pay

off $19.6 million of obligations secured by this bond and three

others that the company continues to hold. Sale of this bond

resulted in the company recording an asset impairment charge in

2007 of $9.2 million. -- Origen's warehouse facility, which has an

outstanding loan balance of approximately $146.4 million, expires

on March 14, 2008. As Origen depends on securitization of its loans

to pay down its warehouse line, the absence of a profitable

financing in the securitization market requires that Origen sell

its loans that are currently on its warehouse line in order to pay

off the warehouse line. -- The absence of a profitable exit in the

securitization market and reduced pricing in the whole loan market

requires that Origen suspend originating loans for its own account

until these markets recover. Origen will continue to provide its

third-party loan origination services. -- Origen has approximately

$50 million outstanding under its supplemental advance residual

facility that expires on March 14, 2008. Origen's lender under this

facility has agreed to extend the due date of this facility until

June 13, 2008, subject to certain conditions. The Board of

Directors is assessing the best possible courses of action for the

company to realize the highest value for its stockholders,

including (a) continuation of the company's business, currently

pared down to its third-party fee business and management of its $1

billion loan portfolio; (b) a possible sale of certain company

assets; or (c) the possible sale of the entire company. Despite

exceptional operating results, excluding impairments, and continued

outstanding credit performance on Origen's loan portfolio during

the last year, the specific actions noted above were taken by the

company as a consequence of the described market conditions. The

actions do not reflect on the credit performance or long-term

realizable value of Origen's loan portfolio, which in management's

opinion continues to remain very high. Sale of Un-securitized Loans

The company has been in discussions and expects to sell its

un-securitized loans soon and will use most of the proceeds to pay

off its warehouse facility. The loan sale is subject to final

agreement and customary closing conditions. Continuing Operations

As noted above, Origen has determined to suspend portfolio loan

originations and has taken steps to right-size its workforce. At

the present time, Origen retains and operates its third-party loan

origination business and management of its loan portfolio. Ronald

A. Klein, Origen's Chief Executive Officer, stated, "Despite the

extreme market difficulties we faced last year, we were

nevertheless able to increase our overall originations, complete

two successful securitizations, and our portfolio performance has

been exceptional. During a period of extreme turmoil in the credit

markets, we increased our already high credit standards.

Additionally, our third party originations increased substantially

over the prior year. Most importantly, the credit performance of

our loan portfolio continues to exceed our expectations. In 2007,

we had record low default rates, record low charge-offs, record low

delinquencies, and record high recovery rates. This loan portfolio

continues to perform at record levels to date notwithstanding the

general turmoil in the housing market. We continue to work

tirelessly to protect and maximize stockholder value as we examine

our alternatives." "We have been negatively impacted by the global

credit and liquidity crunch generally attributed to have started

with sub-prime mortgage defaults and foreclosures occasioned by

falling housing values and lenient lending practices. Credit

tightening and resulting asset repricing has impacted companies

like Origen that had no direct exposure to sub-prime mortgage

loans. We have been subjected to margin calls and market value

adjustments on our credit facilities despite our continued

excellent loan performance. The ongoing uncertainty and credit

stress in the housing and capital markets, and the resulting lack

of liquidity have curtailed access to the securitization market.

Further securitization financings of our loans have effectively

become unavailable to us on a profitable basis. In the end, our

management and Board had no practical choice but to suspend funding

new loans until market conditions allow us to earn a profit from

those activities." "Despite our decision to sell our un-securitized

loans, the company continues to hold assets believed by management

to have significant value. Our Board and management continue to

strive to maximize the value of these assets and operations for our

stockholders." Earnings Call and Webcast A conference call and

webcast have been scheduled for March 14, 2008, at 11:00 a.m.

Eastern Time to discuss fourth quarter and year-end results and

current operations. The call may be accessed on Origen's web site

at http://www.origenfinancial.com/ or by dialing 877-419-6590. A

replay will be available through March 24, 2008 by dialing

888-203-1112 passcode 3845644. You may also access the replay on

Origen's website for 90 days after the call. Forward-Looking

Statements This press release contains various "forward-looking

statements" within the meaning of the Securities Act of 1933 and

the Securities Exchange Act of 1934, and Origen intends that such

forward-looking statements will be subject to the safe harbors

created thereby. The words "will," "may," "could," "expect,"

"anticipate," "believes," "intends," "should," "plans,"

"estimates," "approximate" and similar expressions identify these

forward-looking statements. These forward-looking statements

reflect Origen's current views with respect to future events and

financial performance, but involve known and unknown risks and

uncertainties, both general and specific to the matters discussed

in this press release. These risks and uncertainties may cause

Origen's actual results to be materially different from any future

results expressed or implied by such forward-looking statements.

Such risks and uncertainties include, among others, the foregoing

assumptions and those risks referenced under the headings entitled

"Factors That May Affect Future Results" or "Risk Factors"

contained in Origen's filings with the Securities and Exchange

Commission. The forward-looking statements contained in this press

release speak only as of the date hereof and Origen expressly

disclaims any obligation to provide public updates, revisions or

amendments to any forward-looking statements made herein to reflect

changes in Origen's expectations or future events.

ORGN-E,ORGN-D,ORGN-G About Origen Financial, Inc. Origen is an

internally managed and internally advised company that has elected

to be taxed as a real estate investment trust. Origen is based in

Southfield, Michigan, with significant operations in Ft. Worth,

Texas. For more information about Origen, please visit

http://www.origenfinancial.com/. Financial Tables Follow ... ORIGEN

FINANCIAL, INC. CONSOLIDATED BALANCE SHEETS (Dollars in thousands,

except for share data) ASSETS (Unaudited) December 31, December 31,

2007 2006 Assets Cash and Equivalents $10,791 $2,566 Restricted

Cash 16,290 15,412 Investment Securities 32,393 41,538 Loans

Receivable-Net 1,193,916 950,226 Servicing Advances 6,298 7,741

Servicing Rights 2,146 2,508 Premises & Equipment 2,974 3,513

Repossessed Houses 4,981 3,046 Goodwill - 32,277 Other Assets

14,412 14,240 Total Assets $1,284,201 $1,073,067 LIABILITIES AND

STOCKHOLDERS' EQUITY Liabilities Warehouse Financing $173,072

$131,520 Securitization Financing 884,650 685,013 Repurchase

Agreements 17,653 23,582 Note Payable 14,593 2,185 Other

Liabilities 45,848 26,303 Total Liabilities 1,135,816 868,603

Equity 148,385 204,464 Total Liabilities and Equity $1,284,201

$1,073,067 ORIGEN FINANCIAL, INC. CONSOLIDATED STATEMENT OF

EARNINGS (Dollars in thousands, except for share data) Twelve

Months Ended (Unaudited) December 31, December 31, Increase 2007

2006 (Decrease) Interest Income Total Interest Income $92,127

$74,295 $17,832 Total Interest Expense 59,758 43,498 16,260 Net

Interest Income Before Loan Losses and Impairment 32,369 30,797

1,572 Provision for Loan Losses 8,739 7,069 1,670 Impairment of

Purchased Loan Pool - 485 (485) Net Interest Income After Loan

Losses and Impairment 23,630 23,243 387 Non-interest Income 22,040

17,787 4,253 Non-interest Expenses: Total Personnel 24,449 23,847

602 Total Loan Origination & Servicing 1,985 1,619 366 Goodwill

Impairment 32,277 - 32,277 Investment Impairment 9,179 114 9,065

Total Other Operating 9,487 8,501 986 Total Non-interest Expenses

77,377 34,081 43,296 Net Income (Loss) Before Income Taxes and

Before Cumulative Effect of Change in Accounting Principle (31,707)

6,949 (38,656) Income Tax Expense 60 24 36 Net Income (Loss) Before

Cumulative Effect of Change in Accounting Principle (31,767) 6,925

(38,692) Cumulative Effect of Change in Accounting Principle - 46

(46) Net Income (Loss) (31,767) 6,971 (38,646) Weighted Average

Common Shares Outstanding, Basic 25,316,278 25,125,472 190,806

Weighted Average Common Shares Outstanding, Diluted 25,316,278

25,181,654 134,624 Earnings Per Share on Basic Average Shares

Outstanding $(1.26) $0.28 $(1.54) Earnings Per Share on Diluted

Average Shares Outstanding $(1.26) $0.28 $(1.54) ORIGEN FINANCIAL,

INC. CONSOLIDATED STATEMENT OF EARNINGS (Dollars in thousands,

except for share data) (Unaudited) Quarter Ended December 31,

December 31, Increase 2007 2006 (Decrease) Interest Income Total

Interest Income $25,064 $20,223 $4,841 Total Interest Expense

17,121 12,170 4,951 Net Interest Income Before Losses and

Impairment 7,943 8,053 (110) Provision for Loan Losses 2,954 2,145

809 Impairment of Purchased Loan Pool - 485 (485) Net Interest

Income After Losses and Impairment 4,989 5,423 (434) Non-interest

Income 6,112 5,037 1,075 Non-interest Expenses: Total Personnel

5,586 5,861 (275) Total Loan Origination & Servicing 531 505 26

Goodwill Impairment 32,277 - 32,277 Investment Impairment 9,179 -

9,179 Total Other Operating 2,556 2,037 519 Total Non-interest

Expenses 50,129 8,403 41,726 Net Income Before Income Taxes

(39,028) 2,057 (41,085) Income Tax Expense 103 24 79 Net Income

$(39,131) $2,033 $(41,164) Weighted Average Common Shares

Outstanding, Basic 25,395,205 25,203,558 191,647 Weighted Average

Common Shares Outstanding, Diluted 25,395,205 25,203,558 191,647

Earnings Per Share on Basic Average Shares Outstanding $(1.54)

$0.08 $(1.62) Earnings Per Share on Diluted Average Shares

Outstanding $(1.54) $0.08 $(1.62) DATASOURCE: Origen Financial,

Inc. CONTACT: W. Anderson Geater, Chief Financial Officer of Origen

Financial, Inc., 1-866-4-ORIGEN; or Leslie Loyet of Financial

Relations Board, +1-312-640-6672, Web site:

http://www.origenfinancial.com/

Copyright

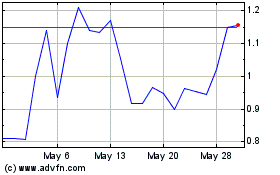

Origin Materials (NASDAQ:ORGN)

Historical Stock Chart

From Jun 2024 to Jul 2024

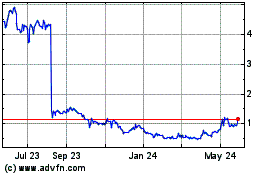

Origin Materials (NASDAQ:ORGN)

Historical Stock Chart

From Jul 2023 to Jul 2024