0001801169false2024Q212/31http://fasb.org/us-gaap/2024#ResearchAndDevelopmentExpensehttp://fasb.org/us-gaap/2024#ResearchAndDevelopmentExpenseP2Y0.0519926xbrli:sharesiso4217:USDiso4217:USDxbrli:sharesopen:homexbrli:pureopen:employee00018011692024-01-012024-06-3000018011692024-07-2500018011692024-06-3000018011692023-12-310001801169us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2024-06-300001801169us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-12-3100018011692024-04-012024-06-3000018011692023-04-012023-06-3000018011692023-01-012023-06-300001801169us-gaap:CommonStockMember2024-03-310001801169us-gaap:AdditionalPaidInCapitalMember2024-03-310001801169us-gaap:RetainedEarningsMember2024-03-310001801169us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-3100018011692024-03-310001801169us-gaap:CommonStockMember2024-04-012024-06-300001801169us-gaap:AdditionalPaidInCapitalMember2024-04-012024-06-300001801169us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-04-012024-06-300001801169us-gaap:RetainedEarningsMember2024-04-012024-06-300001801169us-gaap:CommonStockMember2024-06-300001801169us-gaap:AdditionalPaidInCapitalMember2024-06-300001801169us-gaap:RetainedEarningsMember2024-06-300001801169us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-300001801169us-gaap:CommonStockMember2023-12-310001801169us-gaap:AdditionalPaidInCapitalMember2023-12-310001801169us-gaap:RetainedEarningsMember2023-12-310001801169us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001801169us-gaap:CommonStockMember2024-01-012024-06-300001801169us-gaap:AdditionalPaidInCapitalMember2024-01-012024-06-300001801169us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-06-300001801169us-gaap:RetainedEarningsMember2024-01-012024-06-300001801169us-gaap:CommonStockMember2023-03-310001801169us-gaap:AdditionalPaidInCapitalMember2023-03-310001801169us-gaap:RetainedEarningsMember2023-03-310001801169us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-3100018011692023-03-310001801169us-gaap:CommonStockMember2023-04-012023-06-300001801169us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300001801169us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-300001801169us-gaap:RetainedEarningsMember2023-04-012023-06-300001801169us-gaap:CommonStockMember2023-06-300001801169us-gaap:AdditionalPaidInCapitalMember2023-06-300001801169us-gaap:RetainedEarningsMember2023-06-300001801169us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-3000018011692023-06-300001801169us-gaap:CommonStockMember2022-12-310001801169us-gaap:AdditionalPaidInCapitalMember2022-12-310001801169us-gaap:RetainedEarningsMember2022-12-310001801169us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-3100018011692022-12-310001801169us-gaap:CommonStockMember2023-01-012023-06-300001801169us-gaap:AdditionalPaidInCapitalMember2023-01-012023-06-300001801169us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-06-300001801169us-gaap:RetainedEarningsMember2023-01-012023-06-300001801169open:AtTheMarketEquityOfferingMember2024-05-310001801169srt:MaximumMember2024-01-012024-06-300001801169srt:MinimumMemberus-gaap:RestrictedStockUnitsRSUMember2024-01-012024-06-300001801169us-gaap:RestrictedStockUnitsRSUMembersrt:MaximumMember2024-01-012024-06-300001801169srt:MinimumMemberus-gaap:RestrictedStockUnitsRSUMember2024-01-012024-03-310001801169us-gaap:CashMember2024-06-300001801169us-gaap:MoneyMarketFundsMember2024-06-300001801169us-gaap:CorporateDebtSecuritiesMember2024-06-300001801169us-gaap:CashMember2023-12-310001801169us-gaap:MoneyMarketFundsMember2023-12-310001801169us-gaap:CorporateDebtSecuritiesMember2023-12-310001801169us-gaap:LineOfCreditMemberopen:AssetBackedSeniorRevolvingCreditFacilityMemberopen:RevolvingFacility20182Member2024-06-300001801169us-gaap:LineOfCreditMemberopen:RevolvingFacility20183Memberopen:AssetBackedSeniorRevolvingCreditFacilityMember2024-06-300001801169open:RevolvingFacility20191Memberus-gaap:LineOfCreditMemberopen:AssetBackedSeniorRevolvingCreditFacilityMember2024-06-300001801169us-gaap:LineOfCreditMemberopen:AssetBackedSeniorRevolvingCreditFacilityMemberopen:RevolvingFacility20192Member2024-06-300001801169us-gaap:LineOfCreditMemberopen:RevolvingFacility20193Memberopen:AssetBackedSeniorRevolvingCreditFacilityMember2024-06-300001801169open:AssetBackedSeniorTermDebtFacilityMemberus-gaap:LineOfCreditMemberopen:TermDebtFacility2021S1Member2024-06-300001801169open:TermDebtFacility2021S2Memberopen:AssetBackedSeniorTermDebtFacilityMemberus-gaap:LineOfCreditMember2024-06-300001801169open:TermDebtFacility2021S3Memberopen:AssetBackedSeniorTermDebtFacilityMemberus-gaap:LineOfCreditMember2024-06-300001801169open:AssetBackedSeniorTermDebtFacilityMemberus-gaap:LineOfCreditMemberopen:TermDebtFacility2022S1Member2024-06-300001801169open:AssetBackedSeniorFacilitiesMemberus-gaap:LineOfCreditMember2024-06-300001801169us-gaap:LineOfCreditMemberopen:MezzanineTermDebtFacilitiesMemberopen:TermDebtFacility2020M1Member2024-06-300001801169open:TermDebtFacility2022M1Memberus-gaap:LineOfCreditMemberopen:MezzanineTermDebtFacilitiesMember2024-06-300001801169us-gaap:LineOfCreditMemberopen:MezzanineTermDebtFacilitiesMember2024-06-300001801169us-gaap:LineOfCreditMember2024-06-300001801169us-gaap:LineOfCreditMemberopen:AssetBackedSeniorRevolvingCreditFacilityMemberopen:RevolvingFacility20182Member2023-12-310001801169us-gaap:LineOfCreditMemberopen:RevolvingFacility20183Memberopen:AssetBackedSeniorRevolvingCreditFacilityMember2023-12-310001801169open:RevolvingFacility20191Memberus-gaap:LineOfCreditMemberopen:AssetBackedSeniorRevolvingCreditFacilityMember2023-12-310001801169us-gaap:LineOfCreditMemberopen:AssetBackedSeniorRevolvingCreditFacilityMemberopen:RevolvingFacility20192Member2023-12-310001801169us-gaap:LineOfCreditMemberopen:RevolvingFacility20193Memberopen:AssetBackedSeniorRevolvingCreditFacilityMember2023-12-310001801169open:AssetBackedSeniorTermDebtFacilityMemberus-gaap:LineOfCreditMemberopen:TermDebtFacility2021S1Member2023-12-310001801169open:TermDebtFacility2021S2Memberopen:AssetBackedSeniorTermDebtFacilityMemberus-gaap:LineOfCreditMember2023-12-310001801169open:TermDebtFacility2021S3Memberopen:AssetBackedSeniorTermDebtFacilityMemberus-gaap:LineOfCreditMember2023-12-310001801169open:AssetBackedSeniorTermDebtFacilityMemberus-gaap:LineOfCreditMemberopen:TermDebtFacility2022S1Member2023-12-310001801169open:AssetBackedSeniorFacilitiesMemberus-gaap:LineOfCreditMember2023-12-310001801169us-gaap:LineOfCreditMemberopen:MezzanineTermDebtFacilitiesMemberopen:TermDebtFacility2020M1Member2023-12-310001801169open:TermDebtFacility2022M1Memberus-gaap:LineOfCreditMemberopen:MezzanineTermDebtFacilitiesMember2023-12-310001801169us-gaap:LineOfCreditMemberopen:MezzanineTermDebtFacilitiesMember2023-12-310001801169us-gaap:LineOfCreditMember2023-12-310001801169us-gaap:LineOfCreditMemberopen:NonRecourseAssetBackedDebtMember2024-06-300001801169us-gaap:RevolvingCreditFacilityMemberopen:AssetBackedSeniorRevolvingCreditFacilityMemberopen:MultipleSeniorRevolvingCreditFacilitiesMember2024-06-300001801169us-gaap:RevolvingCreditFacilityMemberopen:AssetBackedSeniorTermDebtFacilityMemberopen:MultipleTermLoanFacilitiesMember2024-06-300001801169us-gaap:RevolvingCreditFacilityMemberopen:MezzanineTermDebtFacilitiesMemberopen:MultipleSeniorRevolvingCreditFacilitiesMember2024-06-300001801169us-gaap:RevolvingCreditFacilityMemberopen:MultipleSeniorRevolvingCreditFacilitiesMember2024-01-012024-06-300001801169us-gaap:RevolvingCreditFacilityMemberopen:AssetBackedSeniorTermDebtFacilityMemberopen:MultipleTermLoanFacilitiesMember2024-01-012024-06-300001801169us-gaap:RevolvingCreditFacilityMemberopen:MezzanineTermDebtFacilitiesMember2024-01-012024-06-300001801169us-gaap:ConvertibleDebtMemberopen:SeniorConvertibleNotes2026Member2021-08-310001801169us-gaap:ConvertibleDebtMemberopen:SeniorConvertibleNotes2026Member2024-06-300001801169open:Repurchased2026NotesMemberus-gaap:ConvertibleDebtMember2023-12-310001801169open:Repurchased2026NotesMemberus-gaap:ConvertibleDebtMember2023-01-012023-12-310001801169open:AdditionalRepurchased2026NotesMemberus-gaap:ConvertibleDebtMember2023-12-310001801169us-gaap:ConvertibleDebtMemberopen:SeniorConvertibleNotes2026Member2024-04-012024-06-300001801169us-gaap:ConvertibleDebtMemberopen:SeniorConvertibleNotes2026Member2024-01-012024-06-300001801169us-gaap:ConvertibleDebtMemberopen:SeniorConvertibleNotes2026Member2023-04-012023-06-300001801169us-gaap:ConvertibleDebtMemberopen:SeniorConvertibleNotes2026Member2023-01-012023-06-300001801169us-gaap:CallOptionMember2021-08-012021-08-3100018011692021-08-310001801169us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2024-06-300001801169us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2024-06-300001801169us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2024-06-300001801169us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMember2024-06-300001801169us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquitySecuritiesMember2024-06-300001801169us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquitySecuritiesMember2024-06-300001801169us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquitySecuritiesMember2024-06-300001801169us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel3Member2024-06-300001801169us-gaap:FairValueMeasurementsRecurringMember2024-06-300001801169us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2024-06-300001801169us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2024-06-300001801169us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2024-06-300001801169us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2023-12-310001801169us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2023-12-310001801169us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2023-12-310001801169us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMember2023-12-310001801169us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquitySecuritiesMember2023-12-310001801169us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquitySecuritiesMember2023-12-310001801169us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquitySecuritiesMember2023-12-310001801169us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel3Member2023-12-310001801169us-gaap:FairValueMeasurementsRecurringMember2023-12-310001801169us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001801169us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001801169us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2023-12-310001801169us-gaap:CarryingReportedAmountFairValueDisclosureMember2024-06-300001801169us-gaap:EstimateOfFairValueFairValueDisclosureMember2024-06-300001801169us-gaap:FairValueInputsLevel1Member2024-06-300001801169us-gaap:FairValueInputsLevel2Member2024-06-300001801169open:RestrictedCashMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2024-06-300001801169open:RestrictedCashMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2024-06-300001801169us-gaap:FairValueInputsLevel1Memberopen:RestrictedCashMember2024-06-300001801169us-gaap:FairValueInputsLevel2Memberopen:RestrictedCashMember2024-06-300001801169us-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310001801169us-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001801169us-gaap:FairValueInputsLevel1Member2023-12-310001801169us-gaap:FairValueInputsLevel2Member2023-12-310001801169open:RestrictedCashMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310001801169open:RestrictedCashMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001801169us-gaap:FairValueInputsLevel1Memberopen:RestrictedCashMember2023-12-310001801169us-gaap:FairValueInputsLevel2Memberopen:RestrictedCashMember2023-12-310001801169us-gaap:SoftwareDevelopmentMember2024-06-300001801169us-gaap:SoftwareDevelopmentMember2023-12-310001801169us-gaap:ComputerEquipmentMember2024-06-300001801169us-gaap:ComputerEquipmentMember2023-12-310001801169open:SecuritySystemsMember2024-06-300001801169open:SecuritySystemsMember2023-12-310001801169us-gaap:OfficeEquipmentMember2024-06-300001801169us-gaap:OfficeEquipmentMember2023-12-310001801169us-gaap:FurnitureAndFixturesMember2024-06-300001801169us-gaap:FurnitureAndFixturesMember2023-12-310001801169us-gaap:LeaseholdImprovementsMember2024-06-300001801169us-gaap:LeaseholdImprovementsMember2023-12-310001801169open:SoftwareImplementationCostsMember2024-06-300001801169open:SoftwareImplementationCostsMember2023-12-3100018011692023-01-012023-12-310001801169us-gaap:DevelopedTechnologyRightsMember2024-06-300001801169us-gaap:CustomerRelationshipsMember2024-06-300001801169us-gaap:TrademarksMember2024-06-300001801169us-gaap:DevelopedTechnologyRightsMember2023-12-310001801169us-gaap:CustomerRelationshipsMember2023-12-310001801169us-gaap:TrademarksMember2023-12-310001801169us-gaap:RestrictedStockUnitsRSUMember2023-12-310001801169us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-06-300001801169us-gaap:RestrictedStockUnitsRSUMember2024-06-300001801169us-gaap:EmployeeStockMemberopen:EmployeeStockPurchasePlanMember2024-06-300001801169us-gaap:EmployeeStockMembersrt:MinimumMemberopen:EmployeeStockPurchasePlanMember2024-06-300001801169us-gaap:EmployeeStockMembersrt:MaximumMemberopen:EmployeeStockPurchasePlanMember2024-06-300001801169us-gaap:EmployeeStockMemberopen:EmployeeStockPurchasePlanMember2024-01-012024-06-300001801169us-gaap:EmployeeStockMembersrt:MinimumMemberopen:EmployeeStockPurchasePlanMember2024-01-012024-06-300001801169us-gaap:EmployeeStockMembersrt:MaximumMemberopen:EmployeeStockPurchasePlanMember2024-01-012024-06-300001801169us-gaap:GeneralAndAdministrativeExpenseMember2024-04-012024-06-300001801169us-gaap:GeneralAndAdministrativeExpenseMember2023-04-012023-06-300001801169us-gaap:GeneralAndAdministrativeExpenseMember2024-01-012024-06-300001801169us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-06-300001801169us-gaap:SellingAndMarketingExpenseMember2024-04-012024-06-300001801169us-gaap:SellingAndMarketingExpenseMember2023-04-012023-06-300001801169us-gaap:SellingAndMarketingExpenseMember2024-01-012024-06-300001801169us-gaap:SellingAndMarketingExpenseMember2023-01-012023-06-300001801169us-gaap:ResearchAndDevelopmentExpenseMember2024-04-012024-06-300001801169us-gaap:ResearchAndDevelopmentExpenseMember2023-04-012023-06-300001801169us-gaap:ResearchAndDevelopmentExpenseMember2024-01-012024-06-300001801169us-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-06-300001801169open:UnvestedStockOptionsAndRestrictedSharesMember2024-06-300001801169open:UnvestedStockOptionsAndRestrictedSharesMember2024-01-012024-06-300001801169open:MarketingWarrantsMemberopen:ZillowIncMember2022-07-280001801169open:MarketingWarrantsMemberopen:ZillowIncMember2024-06-300001801169open:ArizonaOfficeLeaseMember2023-05-310001801169open:ArizonaOfficeLeaseMember2023-05-012023-05-310001801169open:ArizonaOfficeLeaseMember2023-01-012023-06-300001801169open:A2023RestructuringActivitiesMember2023-01-012023-12-310001801169us-gaap:SubsequentEventMemberopen:MainstayLabsInc.Member2024-07-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2024

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ___________ to ____________.

Commission file number 001-39253

Opendoor Technologies Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 30-1318214 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | | |

| 410 N. Scottsdale Road, | Suite 1600 | | |

| Tempe, | AZ | | | 85288 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(480) 618-6760

Registrant's telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

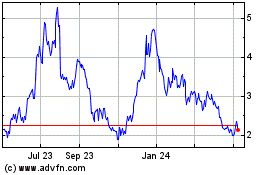

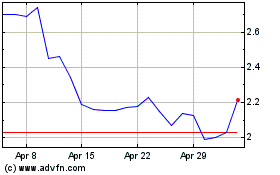

| Common stock, $0.0001 par value per share | OPEN | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The number of shares of registrant’s common stock outstanding as of July 25, 2024 was approximately 703,004,574.

OPENDOOR TECHNOLOGIES INC.

TABLE OF CONTENTS

OPENDOOR TECHNOLOGIES INC.

As used in this Quarterly Report on Form 10-Q, unless the context requires otherwise, references to “Opendoor,” the “Company,” “we,” “us,” and “our,” and similar references refer to Opendoor Technologies Inc. and its wholly owned subsidiaries following the Business Combination (as defined herein) and to Opendoor Labs Inc. prior to the Business Combination.

FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements other than statements of historical facts contained in this Quarterly Report on Form 10-Q, including, without limitation, statements regarding: current and future health and stability of the real estate housing market and general economy; volatility of mortgage interest rates and expectations regarding future shifts in behavior by consumers and partners; the health and status of our financial condition; anticipated future results of operations or financial performance; priorities of the Company to achieve future financial and business goals; our ability to continue to effectively navigate the markets in which we operate; anticipated future and ongoing impacts and benefits of acquisitions, partnership channel expansions, product innovations and other business decisions; health of our balance sheet to weather ongoing market transitions and any expectation to quickly re-scale in the future upon market stabilization; our ability to adopt an effective approach to manage economic and industry risk, as well as inventory health; our expectations with respect to the future success of our partnerships and our ability to drive significant growth in sales volumes through such partnerships; our business strategy and plans, including plans to expand into additional markets; market opportunity and expansion and objectives of management for future operations, including statements regarding the benefits and timing of the roll out of new markets, products, or technology; and the expected diversification of funding sources, are forward-looking statements. When used in this Quarterly Report on Form 10-Q, words such as “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “forecast,” “future,” “guidance,” “intend,” “may,” “might,” “opportunity,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “strategy,” “strive,” “target,” “vision,” “will,” or “would,” any negative of these words or other similar terms or expressions may identify forward-looking statements. The absence of these words does not mean that a statement is not forward-looking.

These forward-looking statements are based on information available as of the date of this Quarterly Report on Form 10-Q and current expectations, forecasts and assumptions, which involve a number of judgments, risks and uncertainties, including without limitation, risks related to:

•the current and future health and stability of the economy, financial conditions and residential housing market, including any extended downturns or slowdowns;

•changes in general economic and financial conditions (including federal monetary policy, interest rates, inflation, actual or anticipated recession, home price fluctuations, and housing inventory), as well as the probability of such changes occurring, that may impact demand for our products and services, lower our profitability or reduce our access to future financings;

•our real estate assets and increased competition in the U.S. residential real estate industry;

•ability to operate and grow our core business products, including the ability to obtain sufficient financing and resell purchased homes;

•investment of resources to pursue strategies and develop new products and services that may not prove effective or that are not attractive to customers and real estate partners or that do not allow us to compete successfully;

•our ability to acquire and resell homes profitably;

•our ability to grow market share in our existing markets or any new markets we may enter;

•our ability to manage our growth effectively;

•our ability to expeditiously sell and appropriately price our inventory;

•our ability to access sources of capital, including debt financing and securitization funding to finance our real estate inventories and other sources of capital to finance operations and growth;

•our ability to maintain and enhance our products and brand, and to attract customers;

•our ability to manage, develop and refine our digital platform, including our automated pricing and valuation technology;

•our ability to comply with multiple listing service rules and requirements to access and use listing data, and to maintain or establish relationships with listings and data providers;

•our ability to obtain or maintain licenses and permits to support our current and future business operations;

OPENDOOR TECHNOLOGIES INC.

•acquisitions, strategic partnerships, joint ventures, capital-raising activities or other corporate transactions or commitments by us or our competitors;

•actual or anticipated changes in technology, products, markets or services by us or our competitors;

•our success in retaining or recruiting, or changes required in, our officers, key employees and/or directors;

•the impact of the regulatory environment within our industry and complexities with compliance related to such environment;

•any future impact of pandemics or epidemics, including any future resurgences of COVID-19 and its variants, or other public health crises on our ability to operate, demand for our products or services, or general economic conditions;

•changes in laws or government regulation affecting our business; and

•the impact of pending or any future litigation or regulatory actions.

Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the effect of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this report may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. Accordingly, forward-looking statements should not be relied upon as representing our views as of any subsequent date, and we do not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

As a result of a number of known and unknown risks and uncertainties, including, without limitation, those described in the “Risk Factors” section of this Quarterly Report on Form 10-Q and on Part I. Item 1A “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023 (the “Annual Report”), our actual results or performance may be materially different from those expressed or implied by these forward-looking statements. You should not place undue reliance on these forward-looking statements.

PART I – FINANCIAL INFORMATION

Item 1. Financial Statements.

OPENDOOR TECHNOLOGIES INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In millions, except share data)

(Unaudited)

| | | | | | | | | | | | | | |

| | June 30,

2024 | | December 31,

2023 |

| ASSETS | | | | |

| CURRENT ASSETS: | | | | |

| Cash and cash equivalents | | $ | 790 | | | $ | 999 | |

| Restricted cash | | 121 | | | 541 | |

| Marketable securities | | 19 | | | 69 | |

| Escrow receivable | | 24 | | | 9 | |

| | | | |

| Real estate inventory, net | | 2,234 | | | 1,775 | |

Other current assets | | 61 | | | 52 | |

| Total current assets | | 3,249 | | | 3,445 | |

| PROPERTY AND EQUIPMENT – Net | | 71 | | | 66 | |

| RIGHT OF USE ASSETS | | 23 | | | 25 | |

| GOODWILL | | 4 | | | 4 | |

| INTANGIBLES – Net | | 2 | | | 5 | |

| OTHER ASSETS | | 23 | | | 22 | |

| TOTAL ASSETS | (1) | $ | 3,372 | | | $ | 3,567 | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | |

| CURRENT LIABILITIES: | | | | |

| Accounts payable and other accrued liabilities | | $ | 73 | | | $ | 64 | |

Non-recourse asset-backed debt – current portion | | 315 | | | — | |

| | | | |

| | | | |

| | | | |

| Interest payable | | 1 | | | 1 | |

Lease liabilities – current portion | | 4 | | | 5 | |

| Total current liabilities | | 393 | | | 70 | |

| NON-RECOURSE ASSET-BACKED DEBT – Net of current portion | | 1,739 | | | 2,134 | |

| CONVERTIBLE SENIOR NOTES | | 377 | | | 376 | |

| | | | |

| LEASE LIABILITIES – Net of current portion | | 18 | | | 19 | |

| OTHER LIABILITIES | | — | | | 1 | |

| Total liabilities | (2) | 2,527 | | | 2,600 | |

COMMITMENTS AND CONTINGENCIES (See Note 13) | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| SHAREHOLDERS’ EQUITY: | | | | |

Common stock, $0.0001 par value; 3,000,000,000 shares authorized; 698,843,166 and 677,636,163 shares issued, respectively; 698,843,166 and 677,636,163 shares outstanding, respectively | | — | | | — | |

| Additional paid-in capital | | 4,379 | | | 4,301 | |

| Accumulated deficit | | (3,534) | | | (3,333) | |

| Accumulated other comprehensive loss | | — | | | (1) | |

| Total shareholders’ equity | | 845 | | | 967 | |

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | | $ | 3,372 | | | $ | 3,567 | |

________________

(1)The Company’s consolidated assets at June 30, 2024 and December 31, 2023 include the following assets of certain variable interest entities (“VIEs”) that can only be used to settle the liabilities of those VIEs: Restricted cash, $110 and $530; Real estate inventory, net, $2,183 and $1,735; Escrow receivable, $22 and $8; Other current assets, $21 and $10; and Total assets of $2,336 and $2,283, respectively.

(2)The Company’s consolidated liabilities at June 30, 2024 and December 31, 2023 include the following liabilities for which the VIE creditors do not have recourse to Opendoor: Accounts payable and other accrued liabilities, $34 and $28; Current portion of non-recourse asset-backed debt, $315 and $—; Interest payable, $1 and $1; Non-recourse asset-backed debt, net of current portion, $1,739 and $2,134; and Total liabilities, $2,089 and $2,163, respectively.

See accompanying notes to condensed consolidated financial statements.

OPENDOOR TECHNOLOGIES INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In millions, except share amounts which are presented in thousands, and per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| REVENUE | $ | 1,511 | | | $ | 1,976 | | | $ | 2,692 | | | $ | 5,096 | |

| COST OF REVENUE | 1,382 | | | 1,827 | | | 2,449 | | | 4,777 | |

GROSS PROFIT | 129 | | | 149 | | | 243 | | | 319 | |

| OPERATING EXPENSES: | | | | | | | |

| Sales, marketing and operations | 116 | | | 124 | | | 229 | | | 312 | |

| General and administrative | 48 | | | 44 | | | 95 | | | 110 | |

| Technology and development | 37 | | | 39 | | | 78 | | | 79 | |

| | | | | | | |

| Restructuring | — | | | 10 | | | — | | | 10 | |

| Total operating expenses | 201 | | | 217 | | | 402 | | | 511 | |

LOSS FROM OPERATIONS | (72) | | | (68) | | | (159) | | | (192) | |

| | | | | | | |

(LOSS) GAIN ON EXTINGUISHMENT OF DEBT | (1) | | | 104 | | | (1) | | | 182 | |

| INTEREST EXPENSE | (30) | | | (53) | | | (67) | | | (127) | |

OTHER INCOME – Net | 12 | | | 41 | | | 27 | | | 60 | |

(LOSS) INCOME BEFORE INCOME TAXES | (91) | | | 24 | | | (200) | | | (77) | |

| INCOME TAX EXPENSE | (1) | | | (1) | | | (1) | | | (1) | |

NET (LOSS) INCOME | $ | (92) | | | $ | 23 | | | $ | (201) | | | $ | (78) | |

| | | | | | | |

| | | | | | | |

Net (loss) income per share attributable to common shareholders: | | | | | | | |

| Basic | $ | (0.13) | | | $ | 0.04 | | | $ | (0.29) | | | $ | (0.12) | |

| Diluted | $ | (0.13) | | | $ | 0.03 | | | $ | (0.29) | | | $ | (0.12) | |

| Weighted-average shares outstanding: | | | | | | | |

| Basic | 693,445 | | | 646,062 | | | 687,951 | | | 646,750 | |

| Diluted | 693,445 | | | 667,159 | | | 687,951 | | | 646,750 | |

See accompanying notes to condensed consolidated financial statements.

OPENDOOR TECHNOLOGIES INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE (LOSS) INCOME

(In millions)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

NET (LOSS) INCOME | $ | (92) | | | $ | 23 | | | $ | (201) | | | $ | (78) | |

OTHER COMPREHENSIVE (LOSS) INCOME: | | | | | | | |

Unrealized gain on marketable securities | — | | | 1 | | | 1 | | | 2 | |

| | | | | | | |

COMPREHENSIVE (LOSS) INCOME | $ | (92) | | | $ | 24 | | | $ | (200) | | | $ | (76) | |

| | | | | | | |

| | | | | | | |

See accompanying notes to condensed consolidated financial statements.

OPENDOOR TECHNOLOGIES INC.

CONDENSED CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

(In millions, except number of shares)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Shareholders’ Equity |

| | | | | | | | | | | | Common Stock | | Additional

Paid-in

Capital | | Accumulated

Deficit | | Accumulated

Other

Comprehensive

Loss | | | | Total Shareholders’ Equity |

| | | | | | | | | | | | | | | | | | | | | | Shares | | Amount | | | | | |

| BALANCE–March 31, 2024 | | | | | | | | | | | | | | | | | | | | | | 688,560,794 | | | $ | — | | | $ | 4,341 | | | $ | (3,442) | | | $ | — | | | | | $ | 899 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Issuance of common stock for settlement of RSUs, net of shares withheld for participant taxes | | | | | | | | | | | | | | | | | | | | | | 10,197,935 | | | — | | | — | | | — | | | — | | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Exercise of stock options | | | | | | | | | | | | | | | | | | | | | | 84,437 | | | — | | | — | | | — | | | — | | | | | — | |

| Issuance of common stock under employee stock purchase plan, net of shares withheld for participant taxes | | | | | | | | | | | | | | | | | | | | | | — | | | — | | | — | | | — | | | — | | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Stock-based compensation | | | | | | | | | | | | | | | | | | | | | | — | | | — | | | 38 | | | — | | | — | | | | | 38 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Other comprehensive income | | | | | | | | | | | | | | | | | | | | | | — | | | — | | | — | | | — | | | — | | | | | — | |

| Net loss | | | | | | | | | | | | | | | | | | | | | | — | | | — | | | — | | | (92) | | | — | | | | | (92) | |

| BALANCE–June 30, 2024 | | | | | | | | | | | | | | | | | | | | | | 698,843,166 | | | $ | — | | | $ | 4,379 | | | $ | (3,534) | | | $ | — | | | | | $ | 845 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Shareholders’ Equity |

| | | | | | | | | | | | Common Stock | | Additional

Paid-in

Capital | | Accumulated

Deficit | | Accumulated

Other

Comprehensive

Loss | | | | Total Shareholders’ Equity |

| | | | | | | | | | | | | | | | | | | | | | Shares | | Amount | | | | | |

| BALANCE–December 31, 2023 | | | | | | | | | | | | | | | | | | | | | | 677,636,163 | | | $ | — | | | $ | 4,301 | | | $ | (3,333) | | | $ | (1) | | | | | $ | 967 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Issuance of common stock for settlement of RSUs, net of shares withheld for participant taxes | | | | | | | | | | | | | | | | | | | | | | 19,395,881 | | | — | | | — | | | — | | | — | | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Exercise of stock options | | | | | | | | | | | | | | | | | | | | | | 193,794 | | | — | | | — | | | — | | | — | | | | | — | |

| Issuance of common stock under employee stock purchase plan, net of shares withheld for participant taxes | | | | | | | | | | | | | | | | | | | | | | 1,617,328 | | | — | | | 2 | | | — | | | — | | | | | 2 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Stock-based compensation | | | | | | | | | | | | | | | | | | | | | | — | | | — | | | 76 | | | — | | | — | | | | | 76 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Other comprehensive income | | | | | | | | | | | | | | | | | | | | | | — | | | — | | | — | | | — | | | 1 | | | | | 1 | |

| Net loss | | | | | | | | | | | | | | | | | | | | | | — | | | — | | | — | | | (201) | | | — | | | | | (201) | |

| BALANCE–June 30, 2024 | | | | | | | | | | | | | | | | | | | | | | 698,843,166 | | | $ | — | | | $ | 4,379 | | | $ | (3,534) | | | $ | — | | | | | $ | 845 | |

OPENDOOR TECHNOLOGIES INC.

CONDENSED CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

(In millions, except number of shares)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Shareholders’ Equity |

| | | | | | | | | | | | Common Stock | | Additional

Paid-in

Capital | | Accumulated

Deficit | | Accumulated

Other

Comprehensive

Loss | | | | Total Shareholders’ Equity |

| | | | | | | | | | | | | | | | | | | | | | Shares | | Amount | | | | | |

| BALANCE–March 31, 2023 | | | | | | | | | | | | | | | | | | | | | | 647,607,920 | | | $ | — | | | $ | 4,198 | | | $ | (3,159) | | | $ | (3) | | | | | $ | 1,036 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Issuance of common stock for settlement of RSUs, net of shares withheld for participant taxes | | | | | | | | | | | | | | | | | | | | | | 8,894,761 | | | — | | | — | | | — | | | — | | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Exercise of stock options | | | | | | | | | | | | | | | | | | | | | | 834,885 | | | — | | | 1 | | | — | | | — | | | | | 1 | |

| Issuance of common stock under employee stock purchase plan, net of shares withheld for participant taxes | | | | | | | | | | | | | | | | | | | | | | — | | | — | | | — | | | — | | | — | | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Stock-based compensation | | | | | | | | | | | | | | | | | | | | | | — | | | — | | | 25 | | | — | | | — | | | | | 25 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Other comprehensive income | | | | | | | | | | | | | | | | | | | | | | — | | | — | | | — | | | — | | | 1 | | | | | 1 | |

| Net income | | | | | | | | | | | | | | | | | | | | | | — | | | — | | | — | | | 23 | | | — | | | | | 23 | |

| BALANCE–June 30, 2023 | | | | | | | | | | | | | | | | | | | | | | 657,337,566 | | | $ | — | | | $ | 4,224 | | | $ | (3,136) | | | $ | (2) | | | | | $ | 1,086 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Shareholders’ Equity |

| | | | | | | | | | | | Common Stock | | Additional

Paid-in

Capital | | Accumulated

Deficit | | Accumulated

Other

Comprehensive

Loss | | | | Total Shareholders’ Equity |

| | | | | | | | | | | | | | | | | | | | | | Shares | | Amount | | | | | |

| BALANCE–December 31, 2022 | | | | | | | | | | | | | | | | | | | | | | 637,387,025 | | | $ | — | | | $ | 4,148 | | | $ | (3,058) | | | $ | (4) | | | | | $ | 1,086 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Issuance of common stock for settlement of RSUs, net of shares withheld for participant taxes | | | | | | | | | | | | | | | | | | | | | | 17,136,256 | | | — | | | — | | | — | | | — | | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Exercise of stock options | | | | | | | | | | | | | | | | | | | | | | 2,169,854 | | | — | | | 2 | | | — | | | — | | | | | 2 | |

| Issuance of common stock under employee stock purchase plan, net of shares withheld for participant taxes | | | | | | | | | | | | | | | | | | | | | | 644,431 | | | — | | | 1 | | | — | | | — | | | | | 1 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Stock-based compensation | | | | | | | | | | | | | | | | | | | | | | — | | | — | | | 73 | | | — | | | — | | | | | 73 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Other comprehensive income | | | | | | | | | | | | | | | | | | | | | | — | | | — | | | — | | | — | | | 2 | | | | | 2 | |

| Net loss | | | | | | | | | | | | | | | | | | | | | | — | | | — | | | — | | | (78) | | | — | | | | | (78) | |

| BALANCE–June 30, 2023 | | | | | | | | | | | | | | | | | | | | | | 657,337,566 | | | $ | — | | | $ | 4,224 | | | $ | (3,136) | | | $ | (2) | | | | | $ | 1,086 | |

See accompanying notes to condensed consolidated financial statements.

OPENDOOR TECHNOLOGIES INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In millions)

(Unaudited)

| | | | | | | | | | | |

| Six Months Ended

June 30, |

| 2024 | | 2023 |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | |

| Net loss | $ | (201) | | | $ | (78) | |

Adjustments to reconcile net loss to cash, cash equivalents, and restricted cash (used in) provided by operating activities: | | | |

| Depreciation and amortization | 26 | | | 39 | |

| Amortization of right of use asset | 3 | | | 4 | |

| | | |

| Stock-based compensation | 66 | | | 63 | |

| | | |

| | | |

| Inventory valuation adjustment | 41 | | | 37 | |

| | | |

| Changes in fair value of equity securities | 4 | | | (7) | |

| | | |

| | | |

| | | |

| Other | 3 | | | (1) | |

| | | |

| Proceeds from sale and principal collections of mortgage loans held for sale | — | | | 1 | |

Loss (gain) on extinguishment of debt | 1 | | | (182) | |

| Changes in operating assets and liabilities: | | | |

| Escrow receivable | (15) | | | 17 | |

| Real estate inventory | (498) | | | 3,259 | |

| Other assets | (10) | | | (3) | |

| Accounts payable and other accrued liabilities | 7 | | | (31) | |

| Interest payable | — | | | (10) | |

| Lease liabilities | (4) | | | (6) | |

Net cash (used in) provided by operating activities | (577) | | | 3,102 | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | | |

| Purchase of property and equipment | (16) | | | (17) | |

| | | |

| | | |

| Proceeds from sales, maturities, redemptions and paydowns of marketable securities | 47 | | | 61 | |

| | | |

| Proceeds from sale of non-marketable equity securities | — | | | 1 | |

| | | |

| | | |

| Net cash provided by investing activities | 31 | | | 45 | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Repurchase of convertible senior notes | — | | | (270) | |

| | | |

| Proceeds from exercise of stock options | — | | | 2 | |

| Proceeds from issuance of common stock for ESPP | 2 | | | 1 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Proceeds from non-recourse asset-backed debt | 217 | | | 236 | |

| Principal payments on non-recourse asset-backed debt | (302) | | | (2,099) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Payment for early extinguishment of debt | — | | | (4) | |

Net cash used in financing activities | (83) | | | (2,134) | |

NET (DECREASE) INCREASE IN CASH, CASH EQUIVALENTS, AND RESTRICTED CASH | (629) | | | 1,013 | |

| CASH, CASH EQUIVALENTS, AND RESTRICTED CASH – Beginning of period | 1,540 | | | 1,791 | |

| CASH, CASH EQUIVALENTS, AND RESTRICTED CASH – End of period | $ | 911 | | | $ | 2,804 | |

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION – Cash paid during the period for interest | $ | 62 | | | $ | 126 | |

| DISCLOSURES OF NONCASH ACTIVITIES: | | | |

| Stock-based compensation expense capitalized for internally developed software | $ | 10 | | | $ | 10 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| RECONCILIATION TO CONDENSED CONSOLIDATED BALANCE SHEETS: | | | |

| Cash and cash equivalents | $ | 790 | | | $ | 1,120 | |

| Restricted cash | 121 | | | 1,684 | |

| Cash, cash equivalents, and restricted cash | $ | 911 | | | $ | 2,804 | |

See accompanying notes to condensed consolidated financial statements.

OPENDOOR TECHNOLOGIES INC.

Notes to Condensed Consolidated Financial Statements

(Tabular amounts in millions, except share and per share amounts, ratios, or as noted)

(Unaudited)

1.DESCRIPTION OF BUSINESS AND ACCOUNTING POLICIES

Description of Business

Opendoor Technologies Inc. (the “Company” and “Opendoor”) including its consolidated subsidiaries and certain variable interest entities (“VIEs”), is a managed marketplace for residential real estate. By leveraging its centralized digital platform, Opendoor is working towards a future that enables sellers and buyers of residential real estate to experience a simple and certain transaction that is dramatically improved from the traditional process. The Company was incorporated in Delaware on December 30, 2013.

The Company completed a business combination with Social Capital Hedosophia Holdings Corp. II (“SCH”), a Cayman Islands exempted company formed for the purpose of effecting a merger, share exchange, asset acquisition, share purchase, reorganization or similar business combination with one or more businesses (the “Business Combination”). The Business Combination, pursuant to which Opendoor Labs Inc. became a wholly owned subsidiary of SCH and SCH changed its name from “Social Capital Hedosophia Holdings Corp. II” to “Opendoor Technologies Inc.”, was completed on December 18, 2020, and was accounted for as a reverse recapitalization, in accordance with GAAP.

Basis of Presentation and Principles of Consolidation

The accompanying unaudited condensed consolidated financial statements have been prepared pursuant to generally accepted accounting principles in the United States of America (“GAAP”). The condensed consolidated financial statements as of June 30, 2024 and December 31, 2023 and for the three and six month periods ended June 30, 2024 and 2023 include the accounts of Opendoor, its wholly owned subsidiaries and VIEs where the Company is the primary beneficiary. The accompanying unaudited condensed consolidated financial statements reflect all adjustments which are, in the opinion of management, necessary to a fair statement of the results for the interim periods presented. All significant intercompany accounts and transactions have been eliminated in the condensed consolidated financial statements herein. Certain prior period amounts in the condensed consolidated financial statements and accompanying notes have been reclassified to conform to the current period’s presentation.

The accompanying interim condensed consolidated financial statements and these related notes should be read in conjunction with the consolidated financial statements and related notes included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 (“Annual Report”) filed on February 15, 2024.

At-The-Market Equity Offering

In May 2024, the Company entered into an at-the-market equity offering sales agreement (the “ATM Agreement”) with Barclays Capital Inc. and Virtu Americas LLC, as sales agents (the "Agents"), pursuant to which the Company may offer and sell, from time to time, through the Agents, shares of the Company’s common stock having an aggregate offering price of up to $200 million. Under the ATM Agreement, the Agents may sell shares by any method deemed to be an “at-the-market offering.” During the three and six months ended June 30, 2024, there was no activity pursuant to the ATM Agreement.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that have a material impact on the amounts reported in the financial statements and accompanying notes. Significant estimates, assumptions and judgments made by management include, among others, the determination of the fair value of common stock, share-based awards, warrants, and inventory valuation adjustment. Management believes that the estimates and judgments upon which management relies are reasonable based upon information available to management at the time that these estimates and judgments are made. To the extent there are material differences between these estimates, assumptions and judgments and actual results, the carrying values of the Company's assets and liabilities and the results of operations will be affected. The health of the residential housing market and interest rate environment have introduced additional uncertainty with respect to judgments, estimates and assumptions, which may materially impact the estimates previously listed, among others.

OPENDOOR TECHNOLOGIES INC.

Notes to Condensed Consolidated Financial Statements

(Tabular amounts in millions, except share and per share amounts, ratios, or as noted)

(Unaudited)

Significant Risks and Uncertainties

The Company operates in a dynamic industry and, accordingly, can be affected by a variety of factors. For example, the Company believes that changes in any of the following areas could have a significant negative effect on the Company in terms of its future financial position, results of operations or cash flows: its rates of revenue growth; its ability to manage inventory; engagement and usage of its products; the effectiveness of its investment of resources to pursue strategies; competition in its market; the stability of the residential real estate market; the impact of interest rate changes on demand for and pricing of its products and on the cost of capital; changes in technology, products, markets or services by the Company or its competitors; its ability to maintain or establish relationships with listings and data providers; its ability to obtain or maintain licenses and permits to support its current and future businesses; actual or anticipated changes to its products and services; changes in government regulation affecting its business; the outcomes of legal proceedings; natural disasters and catastrophic events, such as pandemics or epidemics (including any future resurgence of COVID-19 or its variants); scaling and adaptation of existing technology and network infrastructure; its management of its growth; its ability to attract and retain qualified employees and key personnel; its ability to successfully integrate and realize the benefits of its past or future strategic acquisitions or investments; the protection of customers’ information and other privacy concerns; the protection of its brand and intellectual property; and intellectual property infringement and other claims, among other things.

Concentrations of Credit Risk

Financial instruments, which potentially subject the Company to concentrations of credit risk, consist primarily of cash and cash equivalents, restricted cash, and investments in marketable securities. The Company places cash and cash equivalents and investments with major financial institutions, which management assesses to be of high credit quality, in order to limit exposure of the Company’s investments.

Significant Accounting Policies

The Company’s significant accounting policies are discussed in “Part II – Item 8 – Financial Statements and Supplementary Data – Note 1. Description of Business and Accounting Policies” in the Annual Report. There have been no changes to these significant accounting policies for the six-month period ended June 30, 2024, except as noted below.

Impairment of Long-Lived Assets

Long-lived assets, such as property and equipment and definite-lived intangible assets, among other long-lived assets, are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. If circumstances require a long-lived asset or asset group be tested for possible impairment, the Company first compares undiscounted cash flows expected to be generated by that asset or asset group to its carrying amount. If the carrying amount of the long-lived asset or asset group is not recoverable on an undiscounted cash flow basis, an impairment loss is recognized to the extent the carrying amount of the underlying asset exceeds its fair value. The impairment loss recognized for the periods presented is primarily related to impairment of certain internally developed software projects. The impairment loss recognized during the periods presented is as follows (in millions):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| Technology and development | $ | — | | | $ | 1 | | | 3 | | | 3 | |

| Total impairment loss | $ | — | | | $ | 1 | | | $ | 3 | | | $ | 3 | |

Stock-Based Compensation

RSUs

Prior to its listing, the Company granted restricted stock units (“RSUs”) with a performance condition, based on a liquidity event, as defined by the share agreement, as well as a service condition to vest, which was generally four years. The Company determined the fair value of RSUs based on the valuation of the Company’s common stock as of the grant date. No compensation expense was recognized for performance-based awards until the liquidity event occurred in February 2021.

OPENDOOR TECHNOLOGIES INC.

Notes to Condensed Consolidated Financial Statements

(Tabular amounts in millions, except share and per share amounts, ratios, or as noted)

(Unaudited)

Subsequent to the occurrence of the liquidity event, compensation expense was recognized on an accelerated attribution basis over the requisite service period of the awards.

After the Company became listed, the Company began granting RSUs subject to a service condition to vest, which is generally two to four years. Compensation expense is recognized on a straight-line basis subject to a floor of the vested number of shares for each award. In the quarter ended March 31, 2024, the Company began granting RSUs to certain executive employees that contain a performance condition and service condition to vest. If the award is deemed probable of being earned, compensation expense is recognized on an accelerated attribution basis over the requisite service period of the award, which is generally three years. The Company reassesses the probability of achieving the performance condition at each reporting date during the performance period. The Company determines the fair value of RSUs based on the Company’s grant date closing stock price and recognizes forfeitures as they occur.

Recently Issued Accounting Standards

Recently Adopted Accounting Standards

In July 2023, the FASB issued ASU 2023-03 which amends various paragraphs in the Accounting Standards Codification pursuant to the issuance of Commission Staff Bulletin No. 120. These updates were effective immediately and did not have a material impact on the Company’s condensed consolidated financial statements.

Recently Issued Accounting Standards Not Yet Adopted

In October 2023, the FASB issued ASU 2023-06 which is intended to clarify or improve disclosure and presentation requirements of a variety of topics. It will allow users to more easily compare entities subject to the U.S. Securities and Exchange Commission's ("SEC") existing disclosures with those entities that were not previously subject to the requirements and align the requirements in the FASB accounting standard codification with the SEC's regulations. The effective date for each amendment will be the date on which the SEC's removal of that related disclosure from Regulation S-X or Regulation S-K becomes effective, or if the SEC has not removed the applicable disclosure requirement by June 30, 2027, the amendment will not be effective for any entity. Early adoption is prohibited. The Company is currently assessing the impact on the Company's disclosures.

In November 2023, the FASB issued ASU 2023-07, which expands reportable segment disclosure requirements, primarily through enhanced disclosures about significant segment expenses. This guidance is effective for fiscal years beginning after December 15, 2023 and for interim periods within fiscal years beginning after December 15, 2024. Early adoption is permitted and retrospective application to all prior periods presented in the financials is required. The Company is currently assessing the impact on the Company's condensed consolidated financial statements and disclosures.

In December 2023, the FASB issued ASU 2023-09, which expands income tax disclosure requirements to include additional information related to the rate reconciliation of effective tax rates to statutory rates as well as additional disaggregation of taxes paid. This guidance is effective for fiscal years beginning after December 15, 2024, and early adoption is permitted. The Company is currently assessing the impact on the Company's disclosures.

2.REAL ESTATE INVENTORY

The following table presents the components of inventory, net of applicable inventory valuation adjustments of $42 million and $27 million, as of June 30, 2024 and December 31, 2023, respectively (in millions):

| | | | | | | | | |

| June 30,

2024 | | December 31,

2023 |

| Work in progress | $ | 406 | | | $ | 640 | |

| Finished goods: | | | |

| Listed for sale | 1,343 | | | 882 | |

| Under contract for sale | 485 | | | 253 | |

| Total real estate inventory | $ | 2,234 | | | $ | 1,775 | |

OPENDOOR TECHNOLOGIES INC.

Notes to Condensed Consolidated Financial Statements

(Tabular amounts in millions, except share and per share amounts, ratios, or as noted)

(Unaudited)

As of June 30, 2024, the Company was in contract to purchase 1,793 homes for an aggregate purchase price of $607 million.

During the three and six months ended June 30, 2024, the Company recorded inventory valuation adjustments for real estate inventory of $34 million and $41 million, respectively, in Cost of revenue in the condensed consolidated statements of operations. During the three and six months ended June 30, 2023, the Company recorded inventory valuation adjustments for real estate inventory of $14 million and $37 million, respectively, in Cost of revenue in the condensed consolidated statements of operations.

3.CASH, CASH EQUIVALENTS, AND INVESTMENTS

The amortized cost, gross unrealized gains and losses, and fair value of cash, cash equivalents, and marketable securities as of June 30, 2024 and December 31, 2023, are as follows (in millions): | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| June 30, 2024 |

| Cost Basis | | Unrealized Gains | | Unrealized Losses | | Fair Value | | Cash and Cash Equivalents | | Marketable Securities |

| Cash | $ | 75 | | | $ | — | | | $ | — | | | $ | 75 | | | $ | 75 | | | $ | — | |

| | | | | | | | | | | |

| Money market funds | 715 | | | — | | | — | | | 715 | | | 715 | | | — | |

| | | | | | | | | | | |

| Corporate debt securities | 8 | | | — | | | — | | | 8 | | | — | | | 8 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Equity securities | 11 | | | — | | | — | | | 11 | | | — | | | 11 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Total | $ | 809 | | | $ | — | | | $ | — | | | $ | 809 | | | $ | 790 | | | $ | 19 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| December 31, 2023 |

| Cost Basis | | Unrealized Gains | | Unrealized Losses | | Fair Value | | Cash and Cash Equivalents | | Marketable Securities |

| Cash | $ | 63 | | | $ | — | | | $ | — | | | $ | 63 | | | $ | 63 | | | $ | — | |

| Money market funds | 936 | | | — | | | — | | | 936 | | | 936 | | | — | |

| | | | | | | | | | | |

| Corporate debt securities | 55 | | | — | | | (1) | | | 54 | | | — | | | 54 | |

| | | | | | | | | | | |

| Equity securities | 15 | | | — | | | — | | | 15 | | | — | | | 15 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Total | $ | 1,069 | | | $ | — | | | $ | (1) | | | $ | 1,068 | | | $ | 999 | | | $ | 69 | |

During the three and six months ended June 30, 2024, the Company recognized $2 million and $4 million of net unrealized losses, respectively in the condensed consolidated statements of operations related to marketable equity securities held as of June 30, 2024. During the three and six months ended June 30, 2023, the Company recognized $6 million and $7 million of net unrealized gains, respectively, in the condensed consolidated statements of operations related to marketable equity securities held as of June 30, 2023.

A summary of debt securities with unrealized losses aggregated by period of continuous unrealized loss is as follows (in millions):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Less than 12 Months | | 12 Months or Greater | | Total |

| June 30, 2024 | | Fair Value | | Unrealized Losses | | Fair Value | | Unrealized Losses | | Fair Value | | Unrealized Losses |

| | | | | | | | | | | | |

| Corporate debt securities | | $ | — | | | $ | — | | | $ | 6 | | | $ | — | | | $ | 6 | | | $ | — | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Total | | $ | — | | | $ | — | | | $ | 6 | | | $ | — | | | $ | 6 | | | $ | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Less than 12 Months | | 12 Months or Greater | | Total |

| December 31, 2023 | | Fair Value | | Unrealized Losses | | Fair Value | | Unrealized Losses | | Fair Value | | Unrealized Losses |

| | | | | | | | | | | | |

| Corporate debt securities | | $ | — | | | $ | — | | | $ | 54 | | | $ | (1) | | | $ | 54 | | | $ | (1) | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Total | | $ | — | | | $ | — | | | $ | 54 | | | $ | (1) | | | $ | 54 | | | $ | (1) | |

OPENDOOR TECHNOLOGIES INC.

Notes to Condensed Consolidated Financial Statements

(Tabular amounts in millions, except share and per share amounts, ratios, or as noted)

(Unaudited)

There were no material net unrealized losses of the Company's available-for-sale debt securities as of June 30, 2024. Net unrealized losses of the Company's available-for-sale debt securities as of December 31, 2023 were $1 million. These unrealized losses are associated with the Company’s investments in corporate debt securities and were due to interest rate increases, and not credit-related events. The Company does not expect to be required to sell the investments before recovery of the amortized cost bases. As such, no allowance for credit losses is required as of June 30, 2024 or December 31, 2023.

The scheduled contractual maturities of debt securities as of June 30, 2024 are as follows (in millions):

| | | | | | | | | | | | | | | | | | | | |

| June 30, 2024 | | Fair Value | | Within 1 Year | | After 1 Year through 5 Years |

| Corporate debt securities | | $ | 8 | | | $ | 8 | | | $ | — | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Total | | $ | 8 | | | $ | 8 | | | $ | — | |

A summary of equity method investment balances as of June 30, 2024 and December 31, 2023 are as follows (in millions):

| | | | | | | | | |

| June 30,

2024 | | December 31,

2023 |

| Equity method investments | $ | 20 | | | $ | 20 | |

| | | |

| Total | $ | 20 | | | $ | 20 | |

4.VARIABLE INTEREST ENTITIES

The Company utilizes VIEs in the normal course of business to support the Company’s financing needs. The Company determines whether the Company is the primary beneficiary of a VIE at the time it becomes involved with the VIE and reconsiders that conclusion on an on-going basis.

The Company established certain special purpose entities (“SPEs”) for the purpose of financing the Company’s purchase and renovation of real estate inventory through the issuance of asset-backed debt. The Company is the primary beneficiary of the various VIEs within these financing structures and consolidates these VIEs. The Company is determined to be the primary beneficiary based on its power to direct the activities that most significantly impact the economic outcomes of the SPEs through its role in designing the SPEs and managing the real estate inventory they purchase and sell. The Company has a potentially significant variable interest in the entities based upon the equity interest the Company holds in the VIEs.

The following table summarizes the assets and liabilities related to the VIEs consolidated by the Company as of June 30, 2024 and December 31, 2023 (in millions):

| | | | | | | | | | | |

| June 30,

2024 | | December 31,

2023 |

| Assets | | | |

| | | |

Restricted cash | $ | 110 | | | $ | 530 | |

| Real estate inventory, net | 2,183 | | | 1,735 | |

Other(1) | 43 | | | 18 | |

| Total assets | $ | 2,336 | | | $ | 2,283 | |

| Liabilities | | | |

| Non-recourse asset-backed debt | $ | 2,054 | | | $ | 2,134 | |

Other(2) | 35 | | | 29 | |

| Total liabilities | $ | 2,089 | | | $ | 2,163 | |

________________

(1)Includes escrow receivable and other current assets.

OPENDOOR TECHNOLOGIES INC.

Notes to Condensed Consolidated Financial Statements

(Tabular amounts in millions, except share and per share amounts, ratios, or as noted)

(Unaudited)

(2)Includes accounts payable and other accrued liabilities and interest payable.

The creditors of the VIEs generally do not have recourse to the Company’s general credit solely by virtue of being creditors of the VIEs. However, certain of the financial covenants included in the inventory financing facilities to which the VIEs are party are calculated by reference to Opendoor Labs Inc. and its consolidated subsidiaries' assets and liabilities. As a result, under certain circumstances, this may limit the Company's flexibility to transfer assets from Opendoor subsidiaries to the Parent Company. See “Note 5 — Credit Facilities and Long-Term Debt” for further discussion of the recourse obligations with respect to the VIEs.

5.CREDIT FACILITIES AND LONG-TERM DEBT

The following tables summarize certain details related to the Company's credit facilities and long-term debt as of June 30, 2024 and December 31, 2023 (in millions, except interest rates):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Outstanding Amount | | | | | | |

| June 30, 2024 | | Borrowing Capacity | | Current | | Non-Current | | Weighted Average Interest Rate | | End of Revolving / Withdrawal Period | | Final Maturity Date |

| Non-Recourse Asset-backed Debt: | | | | | | | | | | | | |

| Asset-backed Senior Revolving Credit Facilities | | | | | | | | | | | | |

| Revolving Facility 2018-2 | | $ | 1,000 | | | $ | — | | | $ | — | | | — | % | | June 24, 2026 | | June 24, 2026 |

| Revolving Facility 2018-3 | | 1,000 | | | 162 | | | — | | | 8.27 | % | | September 29, 2026 | | September 29, 2026 |

| Revolving Facility 2019-1 | | 300 | | | — | | | — | | | — | % | | August 15, 2025 | | August 15, 2025 |

| Revolving Facility 2019-2 | | 550 | | | — | | | — | | | — | % | | October 3, 2025 | | October 2, 2026 |

| Revolving Facility 2019-3 | | 100 | | | 53 | | | — | | | 8.29 | % | | April 4, 2025 | | April 3, 2026 |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Asset-backed Senior Term Debt Facilities | | | | | | | | | | | | |

| Term Debt Facility 2021-S1 | | 100 | | | 100 | | | — | | | 3.48 | % | | January 2, 2025 | | April 1, 2025 |

| Term Debt Facility 2021-S2 | | 400 | | | — | | | 300 | | | 3.20 | % | | September 10, 2025 | | March 10, 2026 |

| Term Debt Facility 2021-S3 | | 1,000 | | | — | | | 750 | | | 3.75 | % | | January 31, 2027 | | July 31, 2027 |

| Term Debt Facility 2022-S1 | | 250 | | | — | | | 250 | | | 4.07 | % | | March 1, 2025 | | September 1, 2025 |

| | | | | | | | | | | | |

| Total | | $ | 4,700 | | | $ | 315 | | | $ | 1,300 | | | | | | | |

| Issuance Costs | | | | — | | | (9) | | | | | | | |

| Carrying Value | | | | $ | 315 | | | $ | 1,291 | | | | | | | |

| | | | | | | | | | | | |

| Asset-backed Mezzanine Term Debt Facilities | | | | | | | | | | | | |

| | | | | | | | | | | | |

| Term Debt Facility 2020-M1 | | 1,800 | | | — | | | 300 | | | 10.00 | % | | April 1, 2025 | | April 1, 2026 |

| Term Debt Facility 2022-M1 | | 500 | | | — | | | 150 | | | 10.00 | % | | September 15, 2025 | | September 15, 2026 |

| Total | | $ | 2,300 | | | $ | — | | | $ | 450 | | | | | | | |

| Issuance Costs | | | | | | (2) | | | | | | | |

| Carrying Value | | | | | | $ | 448 | | | | | | | |

| | | | | | | | | | | | |

| Total Non-Recourse Asset-backed Debt | | $ | 7,000 | | | $ | 315 | | | $ | 1,739 | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

OPENDOOR TECHNOLOGIES INC.

Notes to Condensed Consolidated Financial Statements

(Tabular amounts in millions, except share and per share amounts, ratios, or as noted)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | |

| | Outstanding Amount | | |

| December 31, 2023 | | Current | | Non-Current | | Weighted Average Interest Rate |

| Non-Recourse Asset-backed Debt: | | | | | | |

| Asset-backed Senior Revolving Credit Facilities | | | | | | |

| | | | | | |

| Revolving Facility 2018-2 | | $ | — | | | $ | — | | | 7.49 | % |

| Revolving Facility 2018-3 | | — | | | — | | | 6.82 | % |

| Revolving Facility 2019-1 | | — | | | — | | | 7.34 | % |

| Revolving Facility 2019-2 | | — | | | — | | | 6.83 | % |

| Revolving Facility 2019-3 | | — | | | — | | | — | % |

| | | | | | |

| | | | | | |

| Asset-backed Senior Term Debt Facilities | | | | | | |

| Term Debt Facility 2021-S1 | | — | | | 100 | | | 3.48 | % |

| Term Debt Facility 2021-S2 | | — | | | 300 | | | 3.20 | % |

| Term Debt Facility 2021-S3 | | — | | | 750 | | | 3.75 | % |

| Term Debt Facility 2022-S1 | | — | | | 250 | | | 4.07 | % |

| | | | | | |

| Total | | $ | — | | | $ | 1,400 | | | |

| Issuance Costs | | — | | | (12) | | | |

| Carrying Value | | $ | — | | | $ | 1,388 | | | |

| | | | | | |

| Asset-backed Mezzanine Term Debt Facilities | | | | | | |

| | | | | | |

| Term Debt Facility 2020-M1 | | $ | — | | | $ | 600 | | | 10.00 | % |

| Term Debt Facility 2022-M1 | | $ | — | | | $ | 150 | | | 10.00 | % |

| Total | | $ | — | | | $ | 750 | | | |

| Issuance Costs | | | | (4) | | | |

| Carrying Value | | | | $ | 746 | | | |

| | | | | | |

| Total Non-Recourse Asset-backed Debt | | $ | — | | | $ | 2,134 | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

Non-Recourse Asset-backed Debt

The Company utilizes inventory financing facilities consisting of asset-backed senior debt facilities and asset-backed mezzanine term debt facilities to provide financing for the Company’s real estate inventory purchases and renovation. These inventory financing facilities are typically secured by some combination of restricted cash, equity in real estate owning subsidiaries and related holding companies, and, for senior facilities, the real estate inventory financed by the relevant facility and/or beneficial interests in such inventory.

Each of the borrowers under the inventory financing facilities is a consolidated subsidiary of Opendoor and a separate legal entity. Neither the assets nor credit of any such borrower subsidiaries are generally available to satisfy the debts and other obligations of any other Opendoor entities. The inventory financing facilities are non-recourse to the Company and are non-recourse to Opendoor subsidiaries not party to the relevant facilities, except for limited guarantees provided by an Opendoor subsidiary for certain obligations involving “bad acts” by an Opendoor entity and certain other limited circumstances.

As of June 30, 2024, the Company had total borrowing capacity with respect to its non-recourse asset-backed debt of $7.0 billion. Borrowing capacity amounts under non-recourse asset-backed debt as reflected in the table above are in some cases not fully committed and any borrowings above the committed amounts are subject to the applicable lender’s discretion. Any amounts repaid for senior term and mezzanine term debt facilities reduce total borrowing capacity as repaid amounts are not available to be reborrowed. As of June 30, 2024, the Company had committed borrowing capacity with respect to the Company’s non-recourse asset-backed debt of $2.3 billion; this committed borrowing capacity is comprised of $400 million for senior revolving credit facilities, $1.4 billion for senior term debt facilities, and $450 million for mezzanine term debt facilities.

OPENDOOR TECHNOLOGIES INC.

Notes to Condensed Consolidated Financial Statements

(Tabular amounts in millions, except share and per share amounts, ratios, or as noted)

(Unaudited)

Asset-backed Senior Revolving Credit Facilities

The Company classifies the senior revolving credit facilities as current liabilities on the Company’s condensed consolidated balance sheets as amounts drawn to acquire and renovate homes are required to be repaid as the related real estate inventory is sold, which the Company expects to occur within 12 months.

The senior revolving credit facilities are typically structured with an initial revolving period of up to 24 months during which time amounts can be borrowed, repaid and borrowed again. The borrowing capacity is generally available until the end of the applicable revolving period as reflected in the table above. Outstanding amounts drawn under each senior revolving credit facility are required to be repaid on the facility maturity date or earlier if accelerated due to an event of default or other mandatory repayment event. The final maturity dates and revolving period end dates reflected in the table above are inclusive of any extensions that are at the sole discretion of the Company. These facilities may also have extensions subject to lender discretion that are not reflected in the table above.

Borrowings under the senior revolving credit facilities accrue interest at various floating rates based on a secured overnight financing rate ("SOFR"), plus a margin that varies by facility. The Company may also pay fees on certain unused portions of committed borrowing capacity. The Company’s senior revolving credit facility arrangements typically include upfront fees that may be paid at execution of the applicable agreements or be earned at execution and payable over time. These facilities are generally fully prepayable at any time without penalty other than customary breakage costs.