false

0001285819

0001285819

2024-08-07

2024-08-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 7, 2024

OMEROS CORPORATION

(Exact name of Registrant as Specified in Its Charter)

|

Washington

|

001-34475

|

91-1663741

|

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission File Number)

|

(IRS Employer

Identification No.)

|

| |

|

|

|

201 Elliott Avenue West

Seattle, WA

|

|

98119

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s Telephone Number, Including Area Code: (206) 676-5000

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities Registered Pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common stock, $0.01 par value per share

|

OMER

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 7, 2024, Omeros Corporation issued a press release announcing financial results for the three and six months ended June 30, 2024. A copy of such press release is furnished herewith as Exhibit 99.1 and is incorporated herein by reference.

The information in this Current Report on Form 8-K, including the exhibit hereto, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to liability under that Section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information contained herein and in the accompanying exhibit, including any information contained on or accessible through any website reference in the exhibit shall not be incorporated by reference into any filing with the United States Securities and Exchange Commission made by Omeros Corporation, whether made before or after the date hereof, regardless of any general incorporation language in such filing. The inclusion of any website address in this Current Report on Form 8-K by incorporation by reference of the press release is as an inactive textual reference only.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit

Number

|

|

Description

|

| |

|

|

|

99.1

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

|

| |

OMEROS CORPORATION

|

| |

|

|

|

Date: August 7, 2024

|

By:

|

/s/ Gregory A. Demopulos

|

| |

|

Gregory A. Demopulos, M.D.

|

| |

|

President, Chief Executive Officer and

|

| |

|

Chairman of the Board of Directors

|

Exhibit 99.1

Omeros Corporation Reports Second Quarter 2024 Financial Results

– Conference Call Today at 4:30 p.m. ET

SEATTLE, WA – August 7, 2024 – Omeros Corporation (Nasdaq: OMER), a clinical-stage biopharmaceutical company committed to discovering, developing and commercializing small-molecule and protein therapeutics for large-market and orphan indications targeting immunologic disorders including complement-mediated diseases, as well as cancers and addictive and compulsive disorders, today announced recent highlights and developments as well as financial results for the second quarter ended June 30, 2024, which include:

● Net loss for the second quarter of 2024 was $56.0 million, or $0.97 per share, compared to a net loss of $37.3 million, or $0.59 per share for the second quarter of 2023. For the six months ended June 30, 2024, our net loss was $93.2 million, or $1.60 per share, compared to a net loss of $71.0 million, or $1.13 per share in the prior year period. The second quarter of 2024 includes a $17.6 million charge for narsoplimab drug substance delivered during the quarter, the manufacturing of which commenced in October 2023, a $21.2 million payment for term loan-related debt repurchase, and $1.9 million of term loan-related transaction costs. These significant cash outlays, representing a total of $40.7 million dollars, are not expected to be repeated in the foreseeable future.

● On June 3, 2024, we entered into a Credit and Guaranty Agreement (the “Credit Agreement”) with funds managed by Athyrium Capital Management (collectively, “Athyrium”) and funds managed by Highbridge Capital Management (collectively, “Highbridge”) as lenders (the “Lenders”). Under the Credit Agreement, we entered into an initial senior secured term loan of $67.1 million (the “Initial Term Loan”) and paid $21.2 million to the Lenders in exchange for $118.1 million aggregate principal amount of Omeros’ existing 5.25 percent convertible senior notes due on February 15, 2026 (the “2026 Notes”) held by the Lenders and representing 55 percent of our total 2026 Notes. The Credit Agreement also provides for a $25.0 million delayed draw term loan available to be drawn on request by Omeros on or prior to June 3, 2025 contingent on regulatory approval of narsoplimab in hematopoietic stem cell transplant-associated thrombotic microangiopathy (“TA-TMA”). All loans under the Credit Agreement have a stated maturity date of June 3, 2028.

ο The purchase price in the debt exchange and repurchase of our outstanding 2026 Notes represents a discount from notional value of approximately 25 percent.

ο Neither the Initial Term Loan nor the delayed draw term loan includes equity consideration for the Lenders, preventing any shareholder dilution as a consequence of these transactions.

ο After giving effect to the repurchase, we had approximately $98 million principal amount of our 2026 Notes outstanding.

● At June 30, 2024, we had $158.9 million of cash and short-term investments available for operations and debt servicing, a decrease of $12.9 million from December 31, 2023.

● As previously disclosed, we submitted an analysis plan to assess our existing clinical trial data along with other evidence proposed to be included in a resubmission of our biologics license application (“BLA”) for narsoplimab in TA-TMA. We are engaged in ongoing discussions with the FDA regarding the analysis plan and the other evidence proposed to be included in the submission. An additional meeting with FDA has been scheduled and we expect to provide a further update on our plans for resubmission and anticipated timing when more definitive information becomes available.

● We continued advancing our lead MASP-3 inhibitor antibody zaltenibart (also known as OMS906) through a Phase 2 development program in paroxysmal nocturnal hemoglobinuria (“PNH”) comprised of two fully enrolled clinical trials and a long-term extension study in which patients who have completed either of the first two studies are eligible to enroll. Patients continue to accrue to the extension study and we remain on track to initiate our Phase 3 program for zaltenibart in PNH later this year.

● Enrollment is ongoing in our Phase 2 clinical trial evaluating zaltenibart for the treatment of complement 3 glomerulopathy (“C3G”). A Phase 3 program in C3G is planned to begin in early 2025.

“Throughout the second quarter, we continued rapidly progressing our clinical programs while significantly strengthening our balance sheet,” said Gregory A. Demopulos, M.D., Omeros’ chairman and chief executive officer. “Through the term loan and note repurchase transaction completed in June, we reduced by more than half the outstanding balance of our 2026 convertible notes at a substantial discount to par value without diluting shareholders. With the new secured term loan in place, a substantial portion of our outstanding debt is now maturing in 2028, the Company is well positioned to address the remaining balance of our 2026 convertible notes, and we have access to an additional term loan of up to $25 million to fund the commercial launch of narsoplimab in TA-TMA. Although the lengthy regulatory process is a continuing source of frustration for our team, our shareholders and, most especially, the TA-TMA patients in need of an effective treatment for this often-lethal condition, we believe that the evidence we have proposed to submit with our BLA is highly compelling and we remain dedicated to making narsoplimab the first approved product for the treatment of TA-TMA. We look forward to providing a further update on the outcome of our ongoing discussions with FDA. In parallel, our MASP-3 inhibitor zaltenibart continues to advance rapidly, generating consistently – and compared to other marketed and developing alternative pathway inhibitors – strong data, and it remains on track to initiate a Phase 3 program in PNH later this year and, in C3G, early in 2025.”

Second Quarter and Recent Clinical Developments

● Recent developments regarding narsoplimab, our lead monoclonal antibody targeting mannan-binding lectin-associated serine protease-2 (“MASP-2”), include the following:

o We previously submitted to FDA an analysis plan to assess already existing clinical trial data, existing data from an historical control population available from an external source, data from the narsoplimab expanded access (i.e., compassionate use) program, and data directed to the mechanism of action of narsoplimab. We are having ongoing discussions with the agency regarding the proposed analysis plan and FDA’s requirements for our resubmission of our BLA. An additional meeting with FDA has been scheduled and we expect to provide a further update on our plans for resubmission and the anticipated timing when more definitive information becomes available.

o FDA recently announced the establishment of the Rare Disease Innovation Hub, which will serve as a single point of connection and engagement within the FDA to support the development of treatments and products for rare diseases. The hub will have a particular focus on products intended for smaller populations or for diseases where the natural history is variable and not fully understood. FDA’s focus on these issues and their responsiveness to the rare disease community’s advocacy is encouraging, and we view the establishment of the hub as a tangible demonstration of FDA’s commitment to recognizing and addressing the unique challenges faced in developing therapies for these conditions.

ο In addition to previous publications on narsoplimab in TA-TMA, international transplant experts are preparing two manuscripts – one directed to the results of a survival comparison between our pivotal trial of narsoplimab in TA-TMA and an external control population of TA-TMA patients and the second detailing the survival data obtained from narsoplimab treatment of TA-TMA patients in our expanded access program. Physicians continue to request access to narsoplimab under this program for their patients with TA-TMA. Given that there is no approved treatment for this life-threatening condition, we continue to do what we can to help these patients.

● Recent developments regarding OMS1029, our long-acting, next-generation MASP-2 inhibitor, include:

o Both the single- and multiple-ascending-dose Phase 1 studies of OMS1029 have now been completed. The results support once-quarterly dosing, administered either subcutaneously or intravenously. Data from the multiple-ascending-dose study will be utilized to inform dose selection for continued clinical development. Consistent with the results of the single-ascending-dose Phase 1 clinical trial of OMS1029 completed in early 2023, OMS1029 was generally well tolerated at all doses evaluated in the multiple-ascending-dose study, with no significant safety concern identified to date.

o We continue to evaluate large market indications for Phase 2 clinical development of OMS1029. These include neovascular age-related macular degeneration, sometimes referred to as “wet AMD.” MASP-2 inhibition previously showed efficacy in a pre-clinical murine model of wet AMD and we are currently engaged in a primate study comparing OMS1029 to Eylea (afibercept), a product currently approved to treat wet AMD. If shown to be effective, OMS1029 administered systemically (e.g., either intravenously or subcutaneously) could represent a significantly more attractive treatment experience compared to Eylea and other currently approved treatments for wet AMD, which require frequent injections directly into the posterior chamber of the eye.

● Recent developments regarding OMS906, our lead monoclonal antibody targeting mannan-binding lectin-associated serine protease-3 (“MASP-3”), the key activator of the alternative pathway, include:

o The United States Adopted Names Council (“USAN”), in consultation with the World Health Organization’s International Nonproprietary Names Expert Committee (“INN”), recently selected the nonproprietary name “zaltenibart” for OMS906. The USAN Council, by working closely with the INN Programme of the World Health Organization and various national nomenclature groups, aims for global standardization and unification of drug nomenclature to ensure that drug information is communicated accurately and unambiguously. Going forward, we will use the name zaltenibart to refer to our lead MASP-3 antibody in publications, at conferences and across other forums.

o Our Phase 2 trial evaluating two doses of zaltenibart in PNH patients who have had an unsatisfactory response to the C5 inhibitor ravulizumab has continued to produce encouraging data. The study utilizes a “switch-over” design, enrolling PNH patients who are receiving ravulizumab and adding zaltenibart to provide combination therapy with ravulizumab for 24 weeks. Those patients who demonstrate a hemoglobin response with the combination therapy are then switched to zaltenibart monotherapy. In June, at the annual congress of the European Hematology Association, interim analysis results from the combination therapy portion of the trial were presented by Dr. Morag Griffin, an internationally recognized PNH expert from St. James University Hospital in England. During the adjunctive therapy period, the statistically significant mean hemoglobin improvement from baseline was 3.27 g/dL and 10 of 12 patients advanced to monotherapy. Absolute reticulocyte count also demonstrated statistically significant improvement. Zaltenibart was safe and well tolerated. An abstract providing results of the zaltenibart monotherapy stage has been submitted to the American Society of Hematology for presentation at their annual meeting in December. The efficacy and safety profiles of zaltenibart as monotherapy remain strong, including demonstration of sustained and clinically meaningful improvements in hemoglobin levels and absolute reticulocyte counts, as well as prevention of both extravascular and intravascular hemolysis.

o Our Phase 2 study of zaltenibart in PNH patients who have not previously received treatment with a complement inhibitor (i.e., naïve patients) is also ongoing and continues to progress well. Results from an interim analysis of subcutaneous zaltenibart treatment were presented at the American Society of Hematology meeting held in December 2023. Following that presentation, we amended the study protocol to identify the plasma concentrations and the level of MASP-3 inhibition required to inhibit breakthrough hemolysis. These data, in combination with data derived from our “switch-over” PNH study and from our Phase 1 studies in healthy subjects, are expected to provide all the data needed to finalize selection of the zaltenibart dose for our upcoming Phase 3 clinical trials.

o We plan to conduct two trials in our Phase 3 program for zaltenibart in PNH. Similar to our Phase 2 program, one will enroll complement inhibitor-naïve patients and the other will employ a “switch over” design. Through our recent advisory boards with experts in PNH and focus-group PNH patients, we have received valuable input to inform the design of our Phase 3 studies and our positioning of zaltenibart in the marketplace, if approved. The zaltenibart drug substance necessary to supply our Phase 3 clinical trials has been manufactured, upcoming pre-Phase 3 meetings with both European and U.S. regulators have been scheduled or requested, and the other activities required to initiate our Phase 3 program have also been completed or are progressing as planned. We remain on track to initiate the program later this year.

● Recent developments regarding OMS527, our phosphodiesterase 7 (“PDE7”) inhibitor program focused on addictions and compulsive disorders as well as movement disorders, include:

o In April 2023 we were awarded a three-year, $6.69 million grant by the National Institute on Drug Abuse (“NIDA”) to pursue development of our lead orally administered PDE7 inhibitor compound for the treatment of cocaine use disorder (“CUD”). We expect to complete by the end of this year a grant-funded preclinical cocaine interaction study, which is a safety prerequisite to initiation of the randomized, placebo-controlled, inpatient clinical study evaluating the safety and effectiveness of OMS527 in patients with CUD, which is also contemplated to be funded with proceeds of the NIDA award.

Financial Results

Net loss for the second quarter of 2024 was $56.0 million, or $0.97 per share, compared to a net loss of $37.3 million, or $0.59 per share for the second quarter of 2023. For the six months ended June 30, 2024, our net loss was $93.2 million, or $1.60 per share, compared to a net loss of $71.0 million, or $1.13 per share in the prior year period. The second quarter of 2024 includes a $17.6 million charge for narsoplimab drug substance that was delivered during the quarter, the manufacturing of which commenced in October 2023, a $21.2 million payment for debt repurchase, and $1.9 million of costs related to the debt transaction. We expense all manufacturing activities until approval in the U.S. and Europe is reasonably assured.

At June 30, 2024, we had $158.9 million of cash and short-term investments available for operations and debt service, a decrease of $12.9 million from December 31, 2023.

For the second quarter of 2024, we earned OMIDRIA royalties of $10.9 million on Rayner’s U.S. net sales of $36.4 million. This compares to earned OMIDRIA royalties of $10.7 million during the second quarter of 2023 on U.S. net sales of $35.7 million.

Total operating expenses for the second quarter of 2024 were $59.2 million compared to $40.9 million for the second quarter of 2023. The difference was primarily due to a $17.6 million charge for delivery of narsoplimab drug substance and $1.9 million of costs related to the debt transaction. In addition, zaltenibart clinical research costs also increased but were offset by decreased clinical expenditures on narsoplimab due to the termination of our IgA nephropathy program.

Interest expense during the second quarter of 2024 was $9.2 million compared to $7.9 million during the prior year quarter. The increase was due to the additional $115.5 million of borrowing under the royalty obligation with DRI Healthcare Acquisitions LP in February 2024. These increases were partially offset by decreased interest upon retiring the 2023 convertible notes in November 2023 and repurchasing and retiring the majority of the 2026 Notes in December 2023 and June 2024.

During the second quarter of 2024, we earned $3.2 million in interest and other income compared to $4.5 million in the second quarter of 2023. The difference is primarily due to lesser cash and investments available to invest in the second quarter.

Net income from discontinued operations, net of tax, was $9.1 million, or $0.15 per share, in the second quarter of 2024 compared to $7.0 million, or $0.11 per share, in the second quarter of 2023. The increase was primarily attributable to increased non-cash interest earned on the OMIDRIA contract royalty asset and higher remeasurement adjustments in the current quarter.

Conference Call Details

Omeros’ management will host a conference call and webcast to discuss the financial results and to provide an update on business activities. The call will be held today at 1:30 p.m. Pacific Time; 4:30 p.m. Eastern Time.

For online access to the live webcast of the conference call, go to Omeros’ website at https://investor.omeros.com/upcoming-events.

To access the live conference call via phone, participants must register at the following URL https://register.vevent.com/register/BIcbf11bdb8ab84f58a90a501bd3a6beb9 to receive a unique PIN. Once registered, you will have two options: (1) Dial in to the conference line provided at the registration site using the PIN provided to you, or (2) choose the “Call Me” option, which will instantly dial the phone number you provide. Should you lose your PIN or registration confirmation email, simply re-register to receive a new PIN.

A replay of the call will be made accessible online at https://investor.omeros.com/archived-events.

About Omeros Corporation

Omeros is an innovative biopharmaceutical company committed to discovering, developing and commercializing small-molecule and protein therapeutics for large-market and orphan indications targeting immunologic disorders including complement-mediated diseases, as well as cancers and addictive and compulsive disorders. Omeros’ lead MASP-2 inhibitor narsoplimab targets the lectin pathway of complement and is the subject of a biologics license application pending before FDA for the treatment of hematopoietic stem cell transplant-associated thrombotic microangiopathy. Omeros’ long-acting MASP-2 inhibitor OMS1029 is currently in a Phase 1 multi-ascending-dose clinical trial. OMS906, Omeros’ inhibitor of MASP-3, the key activator of the alternative pathway of complement, is advancing toward Phase 3 clinical trials for paroxysmal nocturnal hemoglobinuria and complement 3 glomerulopathy. Funded by the National Institute on Drug Abuse, Omeros’ lead phosphodiesterase 7 inhibitor OMS527 is in clinical development for the treatment of cocaine use disorder and, in addition, is being developed as a therapeutic for other addictions as well as for a major complication of treatment for movement disorders. Omeros also is advancing a broad portfolio of novel immuno-oncology programs comprised of two cellular and three molecular platforms. For more information about Omeros and its programs, visit www.omeros.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, which are subject to the “safe harbor” created by those sections for such statements. All statements other than statements of historical fact are forward-looking statements, which are often indicated by terms such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “goal,” “intend,” “likely,” “look forward to,” “may,” “objective,” “plan,” “potential,” “predict,” “project,” “should,” “slate,” “target,” “will,” “would” and similar expressions and variations thereof. Forward-looking statements, including statements regarding the anticipated next steps in relation to the biologics license application for narsoplimab, the timing of regulatory events, the availability of clinical trial data, the prospects for obtaining FDA approval of narsoplimab in any indication, expectations regarding the initiation or continuation of clinical trials evaluating Omeros’ drug candidates and the anticipated availability of data therefrom, expectations regarding future cash expenditures, and expectations regarding the sufficiency of our capital resources to fund operations, are based on management’s beliefs and assumptions and on information available to management only as of the date of this press release. Omeros’ actual results could differ materially from those anticipated in these forward-looking statements for many reasons, including, without limitation, unanticipated or unexpected outcomes of regulatory processes in relevant jurisdictions, unproven preclinical and clinical development activities, our financial condition and results of operations, regulatory processes and oversight, challenges associated with manufacture or supply of our investigational or clinical products, changes in reimbursement and payment policies by government and commercial payers or the application of such policies, intellectual property claims, competitive developments, litigation, and the risks, uncertainties and other factors described under the heading “Risk Factors” in our Annual Report on Form 10-K filed with the Securities and Exchange Commission on April 1, 2024. Given these risks, uncertainties and other factors, you should not place undue reliance on these forward-looking statements, and we assume no obligation to update these forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable law.

Contact:

Jennifer Cook Williams

Cook Williams Communications, Inc.

Investor and Media Relations

IR@omeros.com

OMEROS CORPORATION

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(In thousands, except share and per share data)

|

|

|

Three Months Ended

|

|

|

Six Months Ended

|

|

|

|

|

June 30,

|

|

|

June 30,

|

|

|

|

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Costs and expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development

|

|

$ |

45,349 |

|

|

$ |

29,639 |

|

|

$ |

72,119 |

|

|

$ |

54,249 |

|

|

Selling, general and administrative

|

|

|

13,808 |

|

|

|

11,260 |

|

|

|

26,072 |

|

|

|

22,363 |

|

|

Total costs and expenses

|

|

|

59,157 |

|

|

|

40,899 |

|

|

|

98,191 |

|

|

|

76,612 |

|

|

Loss from operations

|

|

|

(59,157 |

) |

|

|

(40,899 |

) |

|

|

(98,191 |

) |

|

|

(76,612 |

) |

|

Interest expense

|

|

|

(9,215 |

) |

|

|

(7,932 |

) |

|

|

(17,446 |

) |

|

|

(15,865 |

) |

|

Interest and other income

|

|

|

3,247 |

|

|

|

4,537 |

|

|

|

6,662 |

|

|

|

8,500 |

|

|

Net loss from continuing operations

|

|

|

(65,125 |

) |

|

|

(44,294 |

) |

|

|

(108,975 |

) |

|

|

(83,977 |

) |

|

Net income from discontinued operations, net of tax

|

|

|

9,084 |

|

|

|

7,000 |

|

|

|

15,760 |

|

|

|

12,982 |

|

|

Net loss

|

|

$ |

(56,041 |

) |

|

$ |

(37,294 |

) |

|

$ |

(93,225 |

) |

|

$ |

(70,995 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted net income (loss) per share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss from continuing operations

|

|

$ |

(1.12 |

) |

|

$ |

(0.70 |

) |

|

$ |

(1.87 |

) |

|

$ |

(1.34 |

) |

|

Net income from discontinued operations

|

|

|

0.15 |

|

|

|

0.11 |

|

|

|

0.27 |

|

|

|

0.21 |

|

|

Net loss

|

|

$ |

(0.97 |

) |

|

$ |

(0.59 |

) |

|

$ |

(1.60 |

) |

|

$ |

(1.13 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average shares used to compute basic and diluted net income (loss) per share

|

|

|

57,944,016 |

|

|

|

62,837,125 |

|

|

|

58,374,716 |

|

|

|

62,832,991 |

|

OMEROS CORPORATION

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEET

(In thousands)

|

|

|

June 30,

|

|

|

December 31,

|

|

|

|

|

2024

|

|

|

2023

|

|

|

Assets

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

2,120 |

|

|

$ |

7,105 |

|

|

Short-term investments

|

|

|

156,792 |

|

|

|

164,743 |

|

|

OMIDRIA contract royalty asset, current

|

|

|

29,665 |

|

|

|

29,373 |

|

|

Receivables

|

|

|

8,080 |

|

|

|

8,096 |

|

|

Prepaid expense and other assets

|

|

|

6,273 |

|

|

|

8,581 |

|

|

Total current assets

|

|

|

202,930 |

|

|

|

217,898 |

|

|

OMIDRIA contract royalty asset, non-current

|

|

|

133,428 |

|

|

|

138,736 |

|

|

Right of use assets

|

|

|

16,868 |

|

|

|

18,631 |

|

|

Property and equipment, net

|

|

|

2,034 |

|

|

|

1,950 |

|

|

Restricted investments

|

|

|

1,054 |

|

|

|

1,054 |

|

|

Total assets

|

|

$ |

356,314 |

|

|

$ |

378,269 |

|

|

|

|

|

|

|

|

|

|

Liabilities and shareholders’ equity (deficit)

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$ |

6,502 |

|

|

$ |

7,712 |

|

|

Accrued expenses

|

|

|

27,966 |

|

|

|

31,868 |

|

|

OMIDRIA royalty obligation, current

|

|

|

19,434 |

|

|

|

8,576 |

|

|

Lease liabilities, current

|

|

|

5,573 |

|

|

|

5,160 |

|

|

Total current liabilities

|

|

|

59,475 |

|

|

|

53,316 |

|

|

Convertible senior notes, net

|

|

|

96,888 |

|

|

|

213,155 |

|

|

Long-term debt, net

|

|

|

94,506 |

|

|

|

— |

|

|

OMIDRIA royalty obligation

|

|

|

212,323 |

|

|

|

116,550 |

|

|

Lease liabilities, non-current

|

|

|

15,632 |

|

|

|

18,143 |

|

|

Other accrued liabilities, non-current

|

|

|

2,088 |

|

|

|

2,088 |

|

|

Shareholders’ equity (deficit):

|

|

|

|

|

|

|

|

|

|

Common stock and additional paid-in capital

|

|

|

722,157 |

|

|

|

728,547 |

|

|

Accumulated deficit

|

|

|

(846,755 |

) |

|

|

(753,530 |

) |

|

Total shareholders’ deficit

|

|

|

(124,598 |

) |

|

|

(24,983 |

) |

|

Total liabilities and shareholders’ equity (deficit)

|

|

$ |

356,314 |

|

|

$ |

378,269 |

|

v3.24.2.u1

Document And Entity Information

|

Aug. 07, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

OMEROS CORPORATION

|

| Document, Type |

8-K

|

| Document, Period End Date |

Aug. 07, 2024

|

| Entity, Incorporation, State or Country Code |

WA

|

| Entity, File Number |

001-34475

|

| Entity, Tax Identification Number |

91-1663741

|

| Entity, Address, Address Line One |

201 Elliott Avenue West

|

| Entity, Address, City or Town |

Seattle

|

| Entity, Address, State or Province |

WA

|

| Entity, Address, Postal Zip Code |

98119

|

| City Area Code |

206

|

| Local Phone Number |

676-5000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock

|

| Trading Symbol |

OMER

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001285819

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

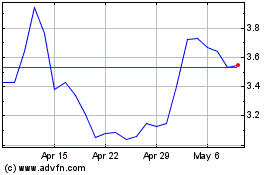

Omeros (NASDAQ:OMER)

Historical Stock Chart

From Oct 2024 to Nov 2024

Omeros (NASDAQ:OMER)

Historical Stock Chart

From Nov 2023 to Nov 2024