Filed Pursuant to Rule 424(b)(5)

Registration No. 333-275059

PROSPECTUS SUPPLEMENT

(To Prospectus dated October 30, 2023)

Nxu, Inc.

Up to $14,726,892

Shares of

Class A Common Stock

We have entered into a At-The-Market Offering

Agreement for an at-the-market offering (the “Sales Agreement”) with H.C. Wainwright & Co., LLC (“Wainwright”)

as sales agent, dated as of November 24, 2023, relating to shares of our Class A common stock, par value $0.0001 per share (“Class

A common stock”), offered by this prospectus supplement and the accompanying prospectus. In accordance with the terms of the Sales

Agreement, we may offer and sell shares of our Class A common stock having an aggregate offering price of up to $14,726,892 from time

to time through Wainwright acting as sales agent or principal. The offering of shares of our Class A common stock pursuant to this prospectus

supplement will terminate upon the earlier of the sale of all of the shares of our Class A common stock provided for in this prospectus

supplement or termination of the Sales Agreement as permitted therein.

Sales of our Class A common stock, if any,

under this prospectus supplement and the accompanying prospectus will be made in sales deemed to be an “at-the-market

offering” as defined in Rule 415(a)(4) promulgated under the Securities Act of 1933, as amended (the “Securities

Act”) including sales made directly on or through the Nasdaq Capital Market (“Nasdaq”) or any other existing

trading market in the United States for our Class A common stock, sales made to or through a market maker other than on an exchange

or otherwise, directly to Wainwright as principal, in negotiated transactions at market prices prevailing at the time of

sale or at prices related to such prevailing market prices and/or in any other method permitted by law. If we and Wainwright agree

on a method of distribution other than sales of shares of our Class A common stock on or through the Nasdaq Capital Market or

another existing U.S. trading market at market prices, we will file a further prospectus supplement providing all information about

such offering as required by Rule 424(b) under the Securities Act. Wainwright is not required to sell any specific number or dollar

amount of Class A common stock, but as instructed by us will make all sales using commercially reasonable efforts, consistent with

its normal trading and sales practices and applicable laws and regulations, subject to the terms and conditions of the Sales

Agreement on mutually agreed terms. There is no arrangement for funds to be received in any escrow, trust or similar arrangement. We

provide more information about how the shares of common stock will be sold in the section entitled “Plan of

Distribution.”

Wainwright will be entitled to cash compensation

at a fixed commission rate of 3.0% of the gross sales price per share sold. See “Plan of Distribution” for additional information

regarding compensation to be paid to Wainwright. In connection with the sale of the Class A common stock on our behalf, Wainwright will

be deemed to be an “underwriter” within the meaning of the Securities Act and the compensation of Wainwright will be deemed

to be underwriting commissions or discounts. We have also agreed to provide indemnification and contribution to Wainwright with respect

to certain liabilities, including liabilities under the Securities Act and the Exchange Act of 1934, as amended (the “Exchange Act”).

We have also agreed to reimburse certain expenses of Wainwright in connection with the offering as further described in the “Plan

of Distribution”.

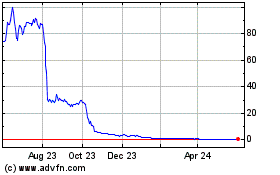

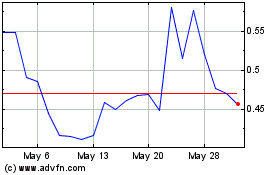

Our Class A common stock is listed on Nasdaq under

the symbol “NXU.” On November 22, 2023, the last reported sales price of our Class A common stock as reported on Nasdaq was

$0.0238 per share.

We are an “emerging growth

company” as that term is used in the Jumpstart Our Business Startups Act of 2012 and as such, are subject to reduced public

company disclosure standards for this prospectus supplement, the accompanying prospectus and our filings with the Securities and

Exchange Commission. See “Prospectus Supplement Summary—Implications of Being an Emerging Growth Company and Smaller

Reporting Company.”

As of November 24, 2023, the aggregate market

value of our outstanding Class A common stock held by non-affiliates was approximately $44.2 million, which was calculated based on 221,124,518

shares of outstanding Class A common stock held by non-affiliates as of November 24, 2023, at a price per share of $0.1998, which was

the closing price of our Class A common stock on Nasdaq on September 28, 2023. Pursuant to General Instruction I.B.6 of Form

S-3, in no event will we sell the securities described in this prospectus supplement in a public primary offering with an aggregate market

value exceeding more than one-third of the aggregate market value of our Class A common stock held by non-affiliates in any 12 calendar

month period, so long as the aggregate market value of our outstanding Class A common stock held by non-affiliates remains below $75 million.

During the 12 calendar months prior to and including the date of this prospectus supplement, we have not offered or sold any securities

pursuant to General Instruction I.B.6 of Form S-3.

Investing in our securities involves a high

degree of risk. You should carefully read this prospectus and any prospectus supplement or amendment before you invest. See the section

entitled “Risk Factors” beginning on page S-8 and in other documents and information contained or incorporated by reference

in this prospectus supplement and the accompanying base prospectus. You also should read the information included throughout this prospectus

for information on our business and our financial statements, including information related to our predecessor.

Neither the Securities and Exchange Commission

(the “SEC”) nor any state securities commission has approved or disapproved of these securities or determined if this prospectus

is truthful or complete. Any representation to the contrary is a criminal offense.

H.C. Wainwright & Co.

Prospectus Supplement dated November 24, 2023.

TABLE OF CONTENTS

Prospectus Supplement

Prospectus

You should rely only on the information we

have provided or incorporated by reference in this prospectus supplement or in the accompanying prospectus. We have not, and Wainwright

has not, authorized anyone to provide you with information different from that contained or incorporated by reference in this prospectus

supplement or in the accompanying prospectus.

This prospectus supplement and the accompanying

prospectus is an offer to sell only the securities offered hereby, but only under circumstances and in jurisdictions where it is lawful

to do so.

You should assume that the information contained

in this prospectus supplement and the accompanying prospectus is accurate only as of their respective dates and that any information we

have incorporated by reference is accurate only as of the date of the document incorporated by reference, regardless of the time of delivery

of this prospectus supplement and the accompanying prospectus for any sale of securities.

ABOUT THIS PROSPECTUS SUPPLEMENT

A registration statement on Form S-3 (File No.

333-275059) utilizing a shelf registration process relating to the securities described in this prospectus supplement was initially filed

with the SEC on October 17, 2023, and declared effective on October 30, 2023. Under the shelf registration statement, of which this offering

is a part, we may, from time to time, sell up to an aggregate of $75.0 million of our Class A common stock, preferred stock, debt securities,

warrants, rights and units.

This document contains two parts. The first part

is this prospectus supplement, which describes the terms of this offering of our Class A common stock by us, and also adds, updates and

changes information contained in the accompanying prospectus and the documents incorporated herein and therein by reference. The second

part is the accompanying prospectus, which gives more general information about us, some of which may not apply to this offering. To the

extent the information contained in this prospectus supplement differs or varies from the information contained in the accompanying prospectus

or any document filed prior to the date of this prospectus supplement and incorporated herein by reference, the information in this prospectus

supplement will supersede and govern. In addition, this prospectus supplement and the accompanying prospectus do not contain all of the

information provided in the registration statement that we filed with the SEC. For further information about us, you should refer to that

registration statement, which you can obtain from the SEC as described elsewhere in this prospectus supplement under “Where You

Can Find Additional Information” and “Incorporation of Certain Information by Reference.”

This prospectus supplement does not contain all

of the information that is important to you. You should read the accompanying prospectus as well as the documents incorporated by reference

in this prospectus supplement and the accompanying prospectus. See “Incorporation by Reference” in this prospectus supplement

and “Where You Can Find Additional Information; Incorporation of Certain Information by Reference” in the accompanying prospectus.

You should rely only on the information contained

in or incorporated by reference into this prospectus supplement and the accompanying prospectus. We have not, and Wainwright has not,

authorized anyone to provide you with information that is different. No dealer, salesperson or other person is authorized to give any

information or to represent anything not contained in this prospectus supplement and the accompanying prospectus. This prospectus supplement

is not an offer to sell or solicitation of an offer to buy these securities in any circumstances under which the offer or solicitation

is unlawful. We are offering to sell, and seeking offers to buy, our Class A common stock offered hereby only in jurisdictions where offers

and sales are permitted. You should not assume that the information we have included in this prospectus supplement or the accompanying

prospectus is accurate as of any date other than the date of this prospectus supplement or the accompanying prospectus, respectively,

or that any information we have incorporated by reference is accurate as of any date other than the date of the document incorporated

by reference, regardless of the time of delivery of this prospectus supplement or of any of our securities. Our business, financial condition,

results of operations and prospects may have changed since those dates. This prospectus supplement incorporates by reference market data

and industry statistics and forecasts that are based on independent industry publications and other publicly available information. Although

we believe these sources are reliable, we do not guarantee the accuracy or completeness of this information and we have not independently

verified this information. In addition, the market and industry data and forecasts that may be included or incorporated by reference in

this prospectus supplement may involve estimates, assumptions and other risks and uncertainties and are subject to change based on various

factors, including those discussed under the heading “Risk Factors” contained in this prospectus supplement and the accompanying

prospectus and under similar headings in other documents that are incorporated by reference into this prospectus. Accordingly, investors

should not place undue reliance on this information.

Unless otherwise indicated or the context otherwise

requires, all references in this prospectus supplement to the terms “Nxu,” the “Company,” “we,” “our”

or “us” refer to Nxu, Inc., a Delaware corporation, and, immediately prior to the reorganization merger, to its predecessor,

Atlis Motor Vehicles Inc., a Delaware corporation, either individually or together with its consolidated subsidiaries, as the context

requires.

MARKET AND INDUSTRY DATA

Market and industry data and forecasts used in

this prospectus supplement have been obtained from independent industry sources as well as from research reports prepared for other purposes.

We are responsible for all of the disclosure in this prospectus supplement, and although we believe these third-party sources to be reliable,

we have not independently verified the data obtained from these sources, and we cannot assure you of the accuracy or completeness of the

data. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and uncertainties

as the other forward-looking statements in this prospectus supplement.

TRADEMARKS, TRADE NAMES AND SERVICE MARKS

This document contains references to trademarks,

trade names and service marks belonging to other entities. Solely for convenience, trademarks, trade names and service marks referred

to in this prospectus supplement may appear without the ® or TM symbols, but such references are not intended to indicate, in any

way, that the applicable licensor will not assert, to the fullest extent under applicable law, its rights to these trademarks and trade

names. We do not intend our use or display of other companies’ trade names, trademarks or service marks to imply a relationship

with, or endorsement or sponsorship of us by, any other companies.

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights selected information

contained elsewhere or incorporated by reference into this prospectus supplement and the accompanying prospectus and does not contain

all of the information that is important to you in making an investment decision. You should read the entire prospectus supplement and

the accompanying prospectus carefully, including the documents incorporated by reference therein, including the information under the

headings “Risk Factors,” “Cautionary Note Regarding Forward-Looking Statements” and “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” and the financial statements and the notes to those financial

statements contained herein or otherwise incorporated by reference in this prospectus supplement and the accompanying prospectus.

Overview

Nxu is a U.S.-based technology company manufacturing

innovative battery cells and battery packs for use in advanced energy storage systems, megawatt charging stations, and mobility products.

We believe that widespread adoption of electric vehicles (“EVs”) by the commercial and industrial markets requires high performing

battery and pack solutions that can effectively compete with legacy diesel-based products. Nxu designs, engineers, and plans to build

proprietary lithium-ion (“Li-ion”) battery cells and packs, 1 megawatt plus charging stations, energy storage solutions and

a suite of software and services designed to allow an easy transition from diesel to electric for our target segment.

Our battery technology is expected to offer considerable

advantages in battery capacity, charging rate, safety, and lifespan while keeping costs low. We are confident that these advantages will

be highly beneficial to Original Equipment Manufacturers (“OEMs”) in the automotive and medium to heavy duty equipment segments

as it would encourage customers to transition to electrification. We are designing our Li-ion batteries to fully charge in about 15 minutes

or less, thereby allowing for a more competitive EV experience to match fossil fuel vehicles, something that current EVs using conventional

batteries are unable to achieve. We believe Nxu technology may be used to power medium and super-duty pick-up trucks, last mile delivery

vehicles, garbage trucks, cement trucks, vans, RVs, box trucks, light to heavy-duty equipment and more. In addition, our batteries could

be used for commercial and residential energy storage devices.

Implications of Being an Emerging Growth Company

and Smaller Reporting Company

We qualify as an “emerging growth company”

under the Jumpstart Our Business Startups Act of 2012, as amended (the “JOBS Act”). As a result, we are permitted to, and

intend to, rely on exemptions from certain disclosure requirements. For so long as we are an emerging growth company, we will not be required

to:

| · | have an auditor report on our internal controls over financial reporting pursuant to Section 404(b) of

the Sarbanes-Oxley Act of 2022, as amended; |

| · | comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding

mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial

statements (i.e., an auditor discussion and analysis); |

| · | submit certain executive compensation matters to stockholder advisory votes, such as “say-on-pay,”

“say-on-frequency” and pay ratio; and |

| · | disclose certain executive compensation related items such as the correlation between executive compensation

and performance and comparisons of the chief executive officer’s compensation to median employee compensation. |

In addition, Section 107 of the JOBS Act also provides that an emerging

growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying

with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards

until those standards would otherwise apply to private companies.

We will remain an “emerging growth company”

for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our total annual gross revenues are

$1.235 billion or more, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange

Act, which would occur if the market value of our Class A common stock that are held by non-affiliates exceeds $700 million as of the

last business day of our most recently completed second fiscal quarter, or (iii) the date on which we have issued more than $1 billion

in non-convertible debt during the preceding three year period.

We are also a “smaller reporting company”

as defined by Rule 12b-2 of the Exchange Act. We may continue to be a smaller reporting company even after we are no longer an emerging

growth company. We may take advantage of certain of the scaled disclosures available to smaller reporting companies and will be able to

take advantage of these scaled disclosures for so long as the market value of our voting and non-voting Class A common stock held by non-affiliates

is less than $250.0 million measured on the last business day of our second fiscal quarter, or our annual revenue is less than $100.0

million during the most recently completed fiscal year and the market value of our voting and non-voting Class A common stock held by

non-affiliates is less than $700.0 million measured on the last business day of our second fiscal quarter.

October 2023 Financing

On October 23, 2023, we consummated a public offering of an aggregate

of 86,000,000 shares of our Class A common stock through Maxim Group LLC, as the exclusive

placement agent.

Proposed Reverse Stock Split

To regain compliance with Nasdaq’s minimum bid price requirement,

on November 2, 2023, our board of directors (“Board”) approved, and recommended that our stockholders approve, an amendment

to our Certificate of Incorporation to effect a reverse stock split of our issued and outstanding Class A common stock and Class B common

stock, by a ratio of any whole number in the range of 1-for-50 to 1-for-500, with such ratio to be determined at the discretion of the

Board and with such action to be effected at such time and date as determined by the Board (the “Reverse Stock Split”). Also

on November 2, 2023, the holders of a majority of the voting power of our issued and outstanding capital stock approved the Reverse Stock

Split by means of an action taken by written consent (the “Written Consent”). On November 17, 2023, we filed a preliminary

information statement on Schedule 14C to inform our stockholders of record as of November 2, 2023 of the Written Consent. The

Written Consent will become effective no earlier than the 20th calendar day after the date on which the definitive information statement

on Schedule 14C has been provided to our stockholders of record as of November 2, 2023.

Corporate Information

We were originally incorporated under the laws

of the State of Delaware on November 9, 2016 under the name “Atlis Motor Vehicles Inc.” In connection with our reorganization

merger, Nxu was incorporated under the laws of the State of Delaware on March 10, 2023. Our principal executive offices are located at

1828 North Higley Road, Mesa, AZ 85205. Our website address is www.nxu.com. The information provided on or accessible through our website

(or any other website referred to in the registration statement, of which this prospectus supplement or the accompanying prospectus forms

a part, or the documents incorporated by reference herein) is not part of the registration statement, of which this prospectus supplement

or the accompanying prospectus forms a part forms a part, and is not incorporated by reference as part of the registration statement,

of which this prospectus supplement or the accompanying prospectus forms a part.

THE OFFERING

| Issuer |

|

Nxu, Inc., a Delaware corporation |

| |

|

|

| Class A Common Stock Offered |

|

Shares of our Class A common stock having an aggregate offering price

of up to $14,726,892 |

| |

|

|

| Class A Common Stock Outstanding After this Offering |

|

Up to 750,284,281 shares, assuming the sale of up to 531,656,750 shares

of our Class A common stock at a price of $0.0277 per share, which was the closing price of our Class A common stock on Nasdaq on November

14, 2023. The actual number of shares issued will vary depending on the sales price under this offering. |

| |

|

|

| Manner of Offering |

|

“At the market offering”

as defined in Rule 415(a)(4) under the Securities Act that may be made from time to time on Nasdaq or other market for out Class A common

stock in the United States through Wainwright. Wainwright will make all sales using commercially reasonable efforts consistent with its

normal trading and sales practices and applicable laws and regulations, on mutually agreeable terms between Wainwright. See “Plan

of Distribution” on page S-17 of this prospectus supplement. |

| |

|

|

| Use of Proceeds |

|

We intend to use the net proceeds from this offering primarily for general corporate purposes, which may include, but is not limited to, operating expenses, working capital, and the continued development and deployment of our charging products. The amounts that we actually spend for any specific purpose may vary significantly, and will depend on a number of factors including, but not limited to, the pace of progress of our product development, market conditions, and our ability to secure supply of goods and services for both equipment and raw material. See the section titled “Use of Proceeds” appearing elsewhere in this prospectus supplement for more information. |

| |

|

|

| Dividend Policy |

|

We have never declared or paid any cash dividends on our Class A common stock, and we do not anticipate paying any cash dividends on our Class A common stock in the foreseeable future. It is presently intended that we will retain our earnings for future operations and expansion. |

| |

|

|

| Risk Factors |

|

See “Risk Factors” and the other information included and incorporated by reference in this prospectus supplement and the accompanying prospectus for a discussion of factors you should carefully consider before deciding to invest in our securities. |

| |

|

|

| Market Symbol |

|

Our shares of Class A common stock are listed on Nasdaq under the symbol “NXU.” |

The above discussion is based on 218,627,531 shares of our Class A

common stock outstanding as of November 1, 2023 and excludes, as of that date, the following: (a) 38,831,637 shares of Class A common

stock issuable upon the exercise of options outstanding prior to this offering at a weighted average exercise price equal to approximately

$7.00 per share; (b) up to an aggregate of 5,714,286 shares of Class A common stock issuable upon the conversion of our outstanding convertible

notes (assuming conversion at a conversion price equal to the floor price of $0.035); and (c) up to an aggregate of 39,465,764 shares

of Class A common stock issuable upon the exercise of our outstanding warrants at a weighted average exercise price equal to approximately

$0.67 per share.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

The information in this prospectus supplement,

the accompanying prospectus and our SEC filings that are incorporated by reference into this prospectus supplement includes “forward-looking

statements” within the meaning of Section 27A of the Securities Act, and Section 21E of the Exchange Act. All statements, other

than statements of present or historical fact included in this prospectus supplement, regarding Nxu’s strategy, future operations,

financial position, estimated revenues, and losses, projected costs, prospects, plans and objectives of management are forward-looking

statements. When used in this prospectus supplement, including any oral statements made in connection therewith, the words “could,”

“should,” “will,” “may,” “believe,” “anticipate,” “intend,” “estimate,”

“expect,” “project,” the negative of such terms and other similar expressions are intended to identify forward-looking

statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on

management’s current expectations and assumptions about future events and are based on currently available information as to the

outcome and timing of future events. Except as otherwise required by applicable law, Nxu disclaims any duty to update any forward-looking

statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date

of this prospectus supplement. Nxu cautions you that these forward-looking statements are subject to all of the risks and uncertainties,

most of which are difficult to predict and many of which are beyond the control of Nxu, incident to the development, production, gathering

and sale of oil, natural gas and natural gas liquids.

In addition, Nxu cautions you that the forward-looking

statements regarding Nxu, which are contained in this prospectus supplement, are subject to the following factors:

| · | suspension of trades or delisting of our Class A common stock by Nasdaq; |

| · | U.S. and global economic conditions and political and economic developments; |

| · | economic and competitive conditions; |

| · | the availability of capital resources; |

| · | capital expenditures and other contractual obligations; |

| · | the availability of goods and services; |

| · | legislative, regulatory or policy changes; |

| · | the securities or capital markets and related risks such as general credit, liquidity, market and interest-rate

risks. |

Should one or more of the risks or uncertainties

described in this prospectus supplement occur, or should underlying assumptions prove incorrect, actual results and plans could differ

materially from those expressed in any forward-looking statements. Additional information concerning these and other factors that may

impact the operations and projections discussed herein can be found in the section entitled “Risk Factors” herein and in Nxu’s

periodic filings with the SEC. Nxu’s SEC filings are available publicly on the SEC’s website at www.sec.gov.

RISK FACTORS

An investment in our Class A common stock involves

a high degree of risk. You should consider the risks, uncertainties and assumptions described below as well as under Item 1A, “Risk

Factors,” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, as well as subsequently filed Annual Reports

on Form 10-K and Quarterly Reports on Form 10-Q we file after the date of this prospectus supplement, which risk factors are incorporated

herein by reference, and may be amended, supplemented or superseded from time to time by other reports we file with the SEC in the future.

The risks and uncertainties we have described below and in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022

and subsequent Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q we file after the date of this prospectus supplement are

not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also

affect our operations. The occurrence of any of these known or unknown risks might cause you to lose all or part of your investment in

the offered securities.

RISKS RELATED TO THIS OFFERING, OUR CAPITAL STRUCTURE AND OWNERSHIP

OF OUR CLASS A COMMON STOCK

Our Class A common stock may be delisted from Nasdaq if we do

not maintain compliance with Nasdaq’s continued listing requirements. If our Class A common stock is delisted, it could negatively

impact the Company.

Continued listing of a security on Nasdaq is conditioned upon compliance

with various continued listing standards. On April 11, 2023, we received a notice from Nasdaq stating that the Company is not in compliance

with the $1.00 minimum bid price requirement set forth in Nasdaq Listing Rule 5550(a)(2) for continued listing on Nasdaq. On August 29,

2023, we received a notice from Nasdaq stating that the Company’s reported stockholders’ equity no longer meets the minimum

stockholders’ equity of $2,500,000 required for continued listing of the Company’s Class A common stock on Nasdaq under Nasdaq

Listing Rule 5550(b)(1). On October 10, 2023, we received a notice from Nasdaq stating that we did not regain compliance with the minimum

bid price requirement within the 180-day period provided and are not eligible for a second 180-day period because we do not comply with

the $5 million initial listing requirement for Nasdaq. As a result, Nasdaq determined that, unless we timely requested a hearing before

the Nasdaq Hearings Panel (the “Panel”), our Class A common stock would be suspended. We timely requested a hearing, and on

October 17, 2023, we received formal notice from Nasdaq that such hearing is scheduled to be held on December 14, 2023. The delisting

action has been stayed, pending a final written decision by the Panel. At the hearing, the Company will present a plan to the Panel that

includes a discussion of the events that it believes will enable it to regain compliance. In particular, in order to regain

compliance with Nasdaq’s minimum bid price requirement, the Board and the Company’s stockholders approved an amendment to

our Certificate of Incorporation to effect the Reverse Stock Split. See “Prospectus Supplement Summary – Proposed Reverse

Stock Split” for more information. However, even if there is a positive effect on the market price for the Class A common stock

immediately following the Reverse Stock Split, performance of the Company’s business and financial results, general economic conditions

and the market perception of the Company’s business, and other adverse factors which may not be in the Company’s control,

could lead to a decrease in the price of the Class A common stock following the Reverse Stock Split.

No assurances can be provided

that Nasdaq will overturn the delisting determination, even if we regain compliance with the minimum bid price requirement within the

appeal period. If the Company’s Class A common stock ultimately were to be delisted for any reason, it could negatively

impact the Company by (i) reducing the liquidity and market price of the Company’s Class A common stock; (ii) reducing the number

of investors willing to hold or acquire the Company’s Class A common stock, which could negatively impact the Company’s ability

to raise equity financing; (iii) limiting the Company’s ability to use a registration statement to offer and sell freely tradable

securities, thereby preventing the Company from accessing the public capital markets; and (iv) impairing the Company’s ability to

provide equity incentives to its employees.

You may incur substantial and immediate

dilution of the price you pay for your shares of Class A common stock and may experience additional dilution of your investment in the

future.

The shares sold in this offering, if any, will

be sold from time to time at various prices. The price of our shares of Class A common stock may be substantially higher than the net

tangible book value per share of the outstanding Class A common stock issued after this offering and you may suffer immediate and substantial

dilution. The conversion of outstanding convertible notes and the exercise of outstanding stock options and warrants may result in further

dilution of your investment. See the section titled “Dilution” below for a more detailed discussion of the dilution you will

incur if you purchase shares of Class A common stock in this offering. Further, because we may need to raise additional capital to fund

our anticipated level of operations, we may in the future sell substantial amounts of Class A common stock or securities convertible into

or exchangeable for Class A common stock, including under the Share Purchase Agreement with GEM Global Yield LLC SCS and GEM Yield Bahamas

Limited, dated as of June 25, 2021 and amended on September 19, 2023, pursuant to which we may issue and sell up to a number of shares

of Class A common stock having an aggregate value of $300,000,000 in our sole discretion. These future issuances of equity or equity-linked

securities, together with the conversion of outstanding convertible notes and the exercise of outstanding stock options and warrants,

will likely result in further dilution to investors.

The Class A common stock offered hereby

will be sold in “at the market offerings” and investors who buy shares at different times will likely pay different prices.

Investors who purchase shares in this offering

at different times will likely pay different prices, and accordingly may experience different levels of dilution and different outcomes

in their investment results. We will have discretion, subject to market demand, to vary the timing, prices and number of shares sold in

this offering. In addition, subject to the final determination by our Board or any restrictions we may place in any applicable placement

notice, there is no minimum or maximum sales price for shares to be sold in this offering. Investors may experience a decline in the value

of the shares they purchase in this offering as a result of sales made at prices lower than the prices they paid.

The actual number of shares of Class A common

stock we may issue under the Sales Agreement and the aggregate proceeds resulting from those sales, at any one time or in total, is uncertain.

Subject to certain limitations in the Sales Agreement

and compliance with applicable laws, we have the discretion to deliver a placement notice to Wainwright at any time throughout the term

of the Sales Agreement. The number of shares that are sold through Wainwright after delivering a placement notice will fluctuate based

on a number of factors, including the market price of our common stock during the sales period, the limits we set with Wainwright in any

applicable placement notice, and the demand for our common stock during the sales period. Because the price of each share sold will fluctuate

during the sales period, it is not currently possible to predict the number of shares of common stock that will ultimately be issued by

us under the Sales Agreement or aggregate proceeds to be raised in connection with those sales.

Our outstanding convertible notes and our

outstanding warrants are convertible and exercisable into shares of our Class A common stock and when converted or exercised, the issuance

of additional shares of Class A common stock may result in downward pressure on the trading price of our Class A common stock.

As of November 1, 2023, there was an aggregate

of approximately $0.2 million of convertible notes outstanding, which are convertible into up to an aggregate of 5,714,286 shares of Class

A common stock (assuming conversion at a conversion price equal to the floor price of $0.035). We believe that as holders convert their

convertible notes into Class A common stock, they will immediately sell their shares of Class A common stock. The sale of such shares

of Class A common stock may result in downward pressure on the trading price of our Class A common stock resulting in a lower stock price.

Additionally, as of November 1, 2023, we have 39,465,764 outstanding warrants to purchase 39,465,764 shares of Class A common stock.

Management has ultimate discretion over

the actual use of proceeds derived from this offering.

The net proceeds from this offering will be used

for the purposes described under “Use of Proceeds.” However, we reserve the right to use the funds obtained from this

offering for other similar purposes not presently contemplated which we deem to be in the best interests of the Company and our stockholders

in order to address changed circumstances or opportunities. As a result of the foregoing, our success will be substantially dependent

upon the discretion and judgment of the Board with respect to application and allocation of the net proceeds of this offering. Investors

who purchase Shares will be entrusting their funds to our Board, upon whose judgment and discretion the investors must depend. The failure

of our management to apply these funds effectively could harm our business. Pending their use, we may also invest the net proceeds from

this offering in a manner that does not produce income or that loses value.

If our Class A common stock is delisted

from Nasdaq and the price of our Class A common stock declines below $5.00 per share, our Class A common stock would come within the definition

of “penny stock”.

Transactions in securities that are traded in

the United States that are not traded on Nasdaq or on other securities exchange by companies, with net tangible assets of $5,000,000 or

less and a market price per share of less than $5.00, may be subject to the “penny stock” rules. The market price of our Class

A common stock is currently less than $5.00 per share. If our Class A common stock is delisted from Nasdaq and the price of our Class

A common stock remains below $5.00 per share and our net tangible assets remain $5,000,000 or less, our Class A common stock would come

within the definition of “penny stock”.

Under these penny stock rules, broker-dealers

that recommend such securities to persons other than institutional accredited investors:

● must make a special

written suitability determination for the purchaser;

● receive the purchaser’s

written agreement to a transaction prior to sale;

● provide the purchaser

with risk disclosure documents which identify risks associated with investing in “penny stocks” and which describe the market

for these “penny stocks” as well as a purchaser’s legal remedies; and

● obtain a signed and

dated acknowledgment from the purchaser demonstrating that the purchaser has actually received the required risk disclosure document before

a transaction in a “penny stock” can be completed.

As a result of these requirements, if our Class

A common stock is at such time subject to the “penny stock” rules, broker-dealers may find it difficult to effectuate customer

transactions and trading activity in these shares in the United States may be significantly limited. Accordingly, the market price of

the shares may be depressed, and investors may find it more difficult to sell the shares.

The dual class structure of our common stock has the effect of

concentrating voting power with members of our management team, which will limit your ability to influence the outcome of important transactions,

including a change in control.

Our Class B common stock has 10 votes per share, and our Class A common

stock, which is the stock we are offering by means of this prospectus supplement, has one vote per share. Members of our management team

together hold all of the issued and outstanding shares of our Class B common stock. Accordingly, as of November 1, 2023, the Company’s

Chief Executive Officer, Mark Hanchett, and the Company’s President, Annie Pratt, together control approximately 62% of the voting

power of our outstanding common stock prior to this offering.. Therefore, our management team, individually or together, will be able

to significantly influence matters submitted to our stockholders for approval, including the election of directors, amendments of our

organizational documents and any merger, consolidation, sale of all or substantially all of our assets or other major corporate transactions.

This amount of control gives him substantial ability to determine the future of our Company, and as such, they may elect to close the

business, change the business plan or make any number of other major business decisions without the approval of the remaining stockholders.

These members of our management team, individually or together, may have interests that differ from yours and may vote in a way with which

you disagree and which may be adverse to your interests. This concentrated control may have the effect of delaying, preventing or deterring

a change in control of our Company, could deprive our stockholders of an opportunity to receive a premium for their capital stock as part

of a sale of our Company and might ultimately affect the market price of our Class A common stock. In addition, future issuances of our

Class B common stock to Mark Hanchett, Annie Pratt or other members of our management team may be dilutive to holders of our Class A common

stock.

We cannot predict the impact our dual class

structure may have on our stock price.

We cannot predict whether our dual class structure

will result in a lower or more volatile market price of our Class A common stock or in adverse publicity or other adverse consequences.

For example, because of our dual class structure, we will likely be excluded from certain indexes, and we cannot assure you that other

stock indexes will not take similar actions. Given the sustained flow of investment funds into passive strategies that seek to track certain

indexes, exclusion from stock indexes would likely preclude investment by many of these funds and could make our Class A common stock

less attractive to other investors. As a result, the market price of our Class A common stock could be adversely affected.

We do not anticipate dividends to be paid

on our Class A common stock and you may lose the entire amount of your investment.

A dividend has never been declared or paid in

cash on our Class A common stock and we do not anticipate such a declaration or payment for the foreseeable future. We expect to use future

earnings, if any, to fund business growth. Therefore, stockholders will not receive any funds absent a sale of their Class A common stock.

We cannot assure stockholders of a positive return on their investment when they sell their Class A common stock, nor can we assure that

stockholders will not lose the entire amount of their investment. Any payment of dividends on our capital stock will depend on our earnings,

financial condition and other business and economic factors affecting us at such a time as the Board may consider it relevant. If we do

not pay dividends, our Class A common stock may be less valuable because a return on your investment will only occur if the Class A common

stock price appreciates.

The market price of our Class A common stock

has fluctuated, and may continue to fluctuate, significantly and you may lose all or part of your investment.

The market prices for securities of startup companies

have historically been highly volatile, and the market has from time-to-time experienced significant price and volume fluctuations that

are unrelated to the operating performance of particular companies. The market price of our Class A common stock has fluctuated, and may

continue to fluctuate, significantly in response to numerous factors, some of which are beyond our control, such as:

| · | actual or anticipated adverse results or delays in our research and development efforts; |

| · | our ability to regain and maintain compliance with Nasdaq listing standards; |

| · | our failure to fully develop, scale manufacturing and commercialize our battery and charging technologies; |

| · | our failure to commercialize our XP Platform and XT pickup truck; |

| · | unanticipated serious safety concerns related to the use of our products; |

| · | adverse regulatory decisions; |

| · | legal disputes or other developments relating to proprietary rights, including patents, litigation matters

and our ability to obtain patent protection for our intellectual property, government investigations and the results of any proceedings

or lawsuits, including patent or stockholder litigation; |

| · | changes in laws or regulations applicable to the Li-ion battery or to the electric vehicle industry; |

| · | our dependence on third party suppliers; |

| · | announcements of the introduction of new products by our competitors; |

| · | market conditions in the Li-ion battery, charging infrastructure, energy storage solutions or to the electric

vehicle industry; |

| · | announcements concerning product development results or intellectual property rights of others; |

| · | future issuances of our common stock or other securities; |

| · | the addition or departure of key personnel; |

| · | actual or anticipated variations in quarterly operating results; |

| · | announcements of significant acquisitions, strategic partnerships, joint ventures or capital commitments by us or our competitors; |

| · | our failure to meet or exceed the estimates and projections of the investment community; |

| · | issuances of debt or equity securities; |

| · | trading volume of our common stock; |

| · | sales of our Class A common stock by us or our stockholders in the future; |

| · | overall performance of the equity markets and other factors that may be unrelated to our operating performance or the operating performance

of our competitors, including changes in market valuations of similar companies; |

| · | failure to meet or exceed any financial guidance or expectations regarding development milestones that we may provide to the public; |

| · | ineffectiveness of our internal controls; |

| · | general political and economic conditions; |

| · | effects of natural or man-made catastrophic events; |

| · | scarcity of raw materials necessary for battery production; and |

| · | other events or factors, many of which are beyond our control. |

Further, price and volume fluctuations may result

in volatility in the price of our Class A common stock, which could cause a decline in the value of our common stock. Price volatility

of our Class A common stock might worsen if the trading volume of our shares is low. The realization of any of the above risks or any

of a broad range of other risks, including those described in these “Risk Factors,” could have a dramatic and material

adverse impact on the market price of our Class A common stock.

A sale, or the perception of future sales,

of a substantial number of shares of Class A common stock may cause the share prices to decline.

If you sell, or the market perceives that you

intend to sell for various reasons, substantial amounts of our Class A common stock in the public market, including shares issued in connection

with the exercise of outstanding options, the market price of our shares could fall. Sales of a substantial number of shares of our common

stock may make it more difficult for us to sell equity or equity-related securities in the future at a time and price that we deem reasonable

or appropriate. We may become involved in securities class action litigation that could divert management’s attention and harm our

business. The stock markets have from time-to-time experienced significant price and volume fluctuations that have affected the market

prices for the common stock of automotive companies. These broad market fluctuations may cause the market price of our common stock to

decline. In the past, securities class action litigation has often been brought against a company following a decline in the market price

of a company’s securities. We may become involved in this type of litigation in the future. Litigation often is expensive and diverts

management’s attention and resources, which could adversely affect our business.

USE OF PROCEEDS

We may issue and sell shares of our Class A common stock having aggregate

gross sales proceeds of up to $14,726,892 from time to time before deducting the sales commissions and estimated offering expenses payable

by us under this prospectus supplement and accompanying prospectus. The amount of proceeds from this offering will depend upon the number

of shares of our Class A common stock sold, if any, and the market price at which they are sold and will be reduced by commissions and

other expenses of this offering. There can be no assurance that we will be able to sell any shares under or fully utilize the Sales Agreement

with Wainwright as a source of financing. Because there is no minimum offering amount required as a condition to close this offering,

the net proceeds to us, if any, are not determinable at this time.

We intend to use the net proceeds of this offering

primarily for general corporate purposes, which may include, but is not limited to, operating expenses, working capital, and the continued

development and deployment of our charging products. The amounts that we actually spend for any specific purpose may vary significantly,

and will depend on a number of factors including, but not limited to, the pace of progress of our product development, market conditions,

and our ability to secure supply of goods and services for both equipment and raw material.

We cannot specify with certainty the amount or

particular uses of the net proceeds that we will receive from this offering. However, our business is particularly capital intensive,

both with respect to our core business activities and potential acquisition opportunities. We may find it necessary or advisable to use

the net proceeds for other purposes, and accordingly, we will have broad discretion in using these proceeds, and investors will be relying

on our judgment regarding the application of the net proceeds from this offering. See “Risk Factors” for a discussion of certain

risks that may affect our intended use of the net proceeds from this offering. Pending the use of proceeds from this offering as described

above, we may invest the net proceeds that we receive in this offering in short-term, investment grade, interest-bearing instruments.

DIVIDEND POLICY

We have never declared or paid any cash dividend and do not anticipate

paying any dividends in the foreseeable future. We currently intend to retain future earnings, if any, to finance operations and expand

our business. Our Board has sole discretion whether to pay dividends. If our Board decides to pay dividends, the form, frequency and amount

will depend upon our future operations and earnings, capital requirements and surplus, general financial condition, contractual restrictions

and other factors that our directors may deem relevant.

DILUTION

If you invest in this offering, your interest

will be diluted to the extent of the difference between the public offering price per share you pay and the net tangible book value per

share of Class A common stock after the offering. Dilution results from the fact that the per share offering price is substantially in

excess of the book value per share attributable to the existing shareholders for our presently outstanding shares of Class A common stock.

Our historical net tangible book value attributable

to shareholders on September 30, 2023 was $(4.3) million or approximately $(0.07) per share of Class A common stock. Net tangible book

value per outstanding share represents the total assets less intangible assets and total liabilities, divided by the number of shares

of Class A common stock outstanding.

The following table sets forth the difference

between the assumed offering price of the Shares being offered by us, the net tangible book value per share before this offering after

giving effect to the issuance of (i) 34,000,000 shares of Class A common stock to Global Yield LLC SCS and warrants to purchase 340,374

shares of Class A common stock to GEM Yield Bahamas Limited, on October 2, 2023, as commitment fee, pursuant to the Share Purchase Agreement,

as amended by the Letter Agreement, and the Registration Rights Agreement, which warrants remain unexercised, (ii) 86,000,000 shares of

Class A common stock on October 23, 2023 upon the closing of a public offering for net proceeds of approximately $2.5 million and (iii)

32,591,116 shares of Class A common stock upon conversion of our convertible notes from October 25, 2023 through November 2, 2023, and

the net tangible book value per share after giving effect to this offering (assuming the sale of an aggregate of approximately $14.7 million

of our Class A common stock at an assumed offering price of $0.0277 per share, the last reported sale price of our Class A common

stock on Nasdaq on November 14, 2023), after deducting estimated fees and offering expenses payable by us.

| Assumed public offering price per share | |

$ | 0.0277 | |

| | |

| | |

| Historical net tangible book value per share of Class A common stock as of September 30, 2023 | |

$ | (0.07 | ) |

| | |

| | |

| As adjusted net tangible book value per share of Class A common stock before this offering | |

$ | (0.01 | ) |

| | |

| | |

| As further adjusted net tangible book value per share of Class A common stock after this offering | |

$ | 0.02 | |

| | |

| | |

| Increase per share of Class A common stock attributable to payment by investors in this offering | |

$ | 0.03 | |

| | |

| | |

| Dilution per share of Class A common stock to investors in this offering | |

$ | 0.0077 | |

The above table is based on 58,622,086 shares

of our Class A common stock outstanding as of September 30, 2023 and excludes, as of that date, the following: (a) 38,831,637 shares of

Class A common stock issuable upon the exercise of options outstanding prior to this offering at a weighted average exercise price equal

to approximately $7.00 per share; (b) up to an aggregate of 2,857,143 shares of Class A common stock issuable upon the conversion of our

outstanding convertible notes (assuming conversion at a conversion price equal to the floor price of $0.035); and (c) up to an aggregate

of 39,705,764 shares of Class A common stock issuable upon the exercise of our outstanding warrants.

To the extent that our outstanding options, convertible

notes or warrants are exercised or converted, as applicable, you could experience further dilution. To the extent that we raise additional

capital through the sale of additional equity, the issuance of any of our shares of Class A common stock could result in further dilution

to our stockholders.

The information discussed above is illustrative

only and will adjust based on the actual number of shares that are sold in this offering, if any, and the prices at which such sales are

made.

PLAN

OF DISTRIBUTION

We have entered into the Sales Agreement with

Wainwright, pursuant to which we may issue and sell from time to time shares of our Class A common stock through Wainwright as

our sales agent. Sales of the shares of Class A common stock, if any, will be made by any method permitted by law deemed to be an “at-the-market

offering” as defined in Rule 415 promulgated under the Securities Act. If we and Wainwright agree on any

method of distribution other than sales of shares of Class A common stock on or through Nasdaq or another existing trading market in the

United States at market prices, we will file a further prospectus supplement providing all information about such offering as required

by Rule 424(b) under the Securities Act.

Wainwright will offer shares of our Class

A common stock at prevailing market prices subject to the terms and conditions of the Sales Agreement as agreed upon by us and Wainwright.

We will designate the number of shares which we desire to sell, the time period during which sales are requested to be made, any limitation

on the number of shares that may be sold in one day and any minimum price below which sales may not be made. Subject to the terms and

conditions of the Sales Agreement, Wainwright will use its commercially reasonable efforts consistent with its normal trading

and sales practices and applicable laws and regulations to sell on our behalf all of the shares requested to be sold by us. We or Wainwright may

suspend the offering of the shares of Class A common stock being made through Wainwright under the Sales Agreement at any time

upon proper notice to the other party.

Settlement for sales of Class A common stock will occur on the second

trading day, and on and after May 28, 2024, on the first trading day or any such shorter settlement cycle as may be in effect under Exchange

Act Rule 15c6-1 from time to time, following the date on which any sales are made, or on some other date that is agreed

upon by us and Wainwright in connection with a particular transaction, in return for payment of the net proceeds to us. Sales

of our shares of our Class A common stock as contemplated in this prospectus supplement and the accompanying prospectus will be settled

through the facilities of The Depository Trust Company or by such other means as we and Wainwright may agree upon. There is

no arrangement for funds to be received in an escrow, trust or similar arrangement.

We will pay Wainwright a cash commission

of 3.0% of the gross sales price of the shares of our Class A common stock that Wainwright sells pursuant to the Sales Agreement.

Because there is no minimum offering amount required as a condition to this offering, the actual total offering amount, commissions and

proceeds to us, if any, are not determinable at this time. Pursuant to the terms of the Sales Agreement, we agreed to reimburse Wainwright for

the documented fees and costs of its legal counsel reasonably incurred in connection with entering into the transactions contemplated

by the Sales Agreement in an amount not to exceed $65,000 in the aggregate, in addition to up to a maximum of $2,500 per due diligence

update session conducted in connection with each such date the Company files its Quarterly Reports on Form 10-Q and $5,000 per due diligence

session conducted in connection with each such date the Company files its Annual Report on Form 10-K, for Wainwright’s counsel’s

fees and any incidental expenses to be reimbursed by us. We will report at least quarterly the number of shares of our Class A common

stock sold through Wainwright under the Sales Agreement, the net proceeds to us and the compensation paid by us to Wainwright in

connection with the sales of shares of our Class A common stock.

In connection with the sales of shares of our

Class A common stock on our behalf, Wainwright will be deemed to be an “underwriter” within the meaning of the Securities

Act, and the compensation paid to Wainwright will be deemed to be underwriting commissions or discounts. We have agreed in the

Sales Agreement to provide indemnification and contribution to Wainwright against certain liabilities, including liabilities

under the Securities Act.

The offering of shares of our Class A common stock

pursuant to this prospectus supplement will terminate upon the earlier of the sale of all of the shares of our Class A common stock provided

for in this prospectus supplement or termination of the Sales Agreement as permitted therein.

To the extent required by Regulation M, Wainwright will

not engage in any market making activities involving our Class A common stock while the offering is ongoing under this prospectus supplement.

Wainwright and certain of its affiliates

may in the future engage in investment banking and other commercial dealings in the ordinary course of business with us or our affiliates. Wainwright and

such affiliates may in the future receive customary fees and expenses for these transactions. In addition, in the ordinary course of its

various business activities, Wainwright and its affiliates may make or hold a broad array of investments and actively trade

debt and equity securities (or related derivative securities) and financial instruments (which may include bank loans) for their own account

and for the accounts of their customers. Such investments and securities activities may involve securities and/or instruments of ours

or our affiliates. Wainwright or its affiliates may also make investment recommendations and/or publish or express independent

research views in respect of such securities or financial instruments and may hold, or recommend to clients that they acquire, long and/or

short positions in such securities and instruments.

This prospectus supplement and the accompanying

prospectus may be made available in electronic format on a website maintained by Wainwright, and Wainwright may distribute

this prospectus supplement and the accompanying prospectus electronically.

The foregoing does not purport to be a complete

statement of the terms and conditions of the Sales Agreement. A copy of the Sales Agreement will be included as an exhibit to our Current

Report on Form 8-K that will be filed with the SEC and incorporated by reference into the registration statement of which this prospectus

supplement and the accompanying base prospectus form a part. See “Where You Can Find Additional Information” and “Incorporation

of Certain Information by Reference.”

LEGAL MATTERS

The validity of the issuance of the Class A common

stock offered by this prospectus supplement will be passed upon for us by Winston & Strawn LLP, Houston, Texas. Wainwright is being

represented in connection with this offering by Haynes and Boone, LLP, New York, New York.

EXPERTS

The financial statements of Nxu, Inc. incorporated

by reference in this prospectus supplement have been audited by Prager Metis CPAs LLP, an independent registered public accounting firm,

as stated in their report appearing therein (which report expresses an unqualified opinion and includes an explanatory paragraph as to

the Company’s ability to continue as a going concern). Such financial statements have been so included in reliance upon the report

of such firm given upon their authority as experts in accounting and auditing.

WHERE YOU CAN FIND ADDITIONAL INFORMATION

We file annual, quarterly and current reports,

proxy statements and other information with the SEC. Our SEC filings are available to the public on a website maintained by the SEC located

at www.sec.gov. We also maintain a website at www.nxu.com. Through our website, we make available, free of charge, annual, quarterly and

current reports, proxy statements and other information as soon as reasonably practicable after they are electronically filed with, or

furnished to, the SEC. The information contained on, or that may be accessed through, our website is not part of, and is not incorporated

into, this prospectus supplement or the accompanying prospectus.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The following documents filed by us with the SEC

are incorporated by reference in this prospectus supplement:

| · | our Current Reports on Form 8-K, filed with the SEC on January

6, 2023, January 30, 2023, February

15, 2023, February 22, 2023, April 17,

2023, April 20, 2023, April

28, 2023, May 10, 2023, May

12, 2023, May 12, 2023, June

8, 2023, June 22, 2023, August

14, 2023, September 1, 2023, September

18, 2023, October 11, 2023, October 18,

2023 and October 23, 2023; and |

We also incorporate by reference all documents

we file pursuant to Section 13(a), 13(c), 14 or 15 of the Exchange Act (other than any portions of filings that are furnished rather than

filed pursuant to Items 2.02 and 7.01 of a Current Report on Form 8-K) after the date of the initial registration statement of which this

prospectus supplement and the accompanying prospectus is a part and prior to effectiveness of such registration statement. All documents

we file in the future pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of this prospectus supplement and

prior to the termination of the offering are also incorporated by reference and are an important part of this prospectus.

Any statement contained in a document incorporated

or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for the purposes of this prospectus supplement

to the extent that a statement contained herein or in any other subsequently filed document which also is or deemed to be incorporated

by reference herein modifies or supersedes such statement. Any statement so modified or superseded shall not be deemed, except as so modified

or superseded, to constitute a part of this prospectus supplement or the accompanying prospectus.

You may request a copy of these filings, excluding

the exhibits to such filings which we have not specifically incorporated by reference in such filings, at no cost, by writing to or calling

us at:

Nxu, Inc.

Attn: Chief Legal Officer and Secretary

1828 N Higley Rd., Suite 116

Mesa, Arizona 85205

(760) 515-1133

This prospectus supplement is part of a registration

statement we filed with the SEC. You should only rely on the information or representations contained in this prospectus supplement and

the accompanying prospectus. We have not authorized anyone to provide information other than that provided in this prospectus supplement

and the accompanying prospectus. We are not making an offer of the securities in any state where the offer is not permitted. You should

not assume that the information in this prospectus supplement and the accompanying prospectus is accurate as of any date other than the

date on the front of the document.

PROSPECTUS

Nxu, Inc.

$75,000,000

Class A Common Stock

Preferred Stock

Debt Securities

Warrants

Rights

Units

From time to time, we may offer and sell, in one

or more offerings, up to $75,000,000 of any combination of the securities described in this prospectus. We may also offer securities as

may be issuable upon conversion, redemption, repurchase, exchange or exercise of any securities registered hereunder, including any applicable

anti-dilution provisions.

We will provide specific terms of any offering

in a supplement to this prospectus. Any prospectus supplement may also add, update, or change information contained in this prospectus.

You should carefully read this prospectus and the applicable prospectus supplement as well as the documents incorporated or deemed to

be incorporated by reference in this prospectus before you purchase any of the securities offered hereby.

Our Class A common stock is listed on the Nasdaq

Stock Market LLC (“Nasdaq”) under the symbol “NXU.” On October 16, 2023, the last reported sales price of our

Class A common stock, $0.0001 par value per share (“Class A common stock”), as reported on Nasdaq was $0.07 per share.

We recommend that you obtain current market quotations

for our Class A common stock prior to making an investment decision. We will provide information in any applicable prospectus supplement

regarding any listing of securities other than shares of our Class A common stock on any securities exchange. This prospectus may not

be used to sell our securities unless it is accompanied by a prospectus supplement.

We may offer and sell our securities to or through

one or more agents, underwriters, dealers or other third parties or directly to one or more purchasers on a continuous or delayed basis.

If agents, underwriters or dealers are used to sell our securities, we will name them and describe their compensation in a prospectus

supplement. The price to the public of our securities and the net proceeds we expect to receive from the sale of such securities will

also be set forth in a prospectus supplement. For additional information on the methods of sale, you should refer to the section entitled

“Plan of Distribution” in this prospectus.

As of October 13, 2023, the aggregate market value

of our outstanding Class A common stock held by non-affiliates was approximately $22.0 million, which was calculated based on 96,050,651

shares of outstanding common stock held by non-affiliates, at a price per share of $0.2294, which was the closing price of our Class A

common stock on Nasdaq on August 22, 2023. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell the securities

described in this prospectus in a public primary offering with an aggregate market value exceeding more than one-third of the aggregate

market value of our Class A common stock held by non-affiliates in any 12-month period, so long as the aggregate market value of our outstanding

Class A common stock held by non-affiliates remains below $75 million. During the 12 calendar months prior to and including the date of

this prospectus, we have not offered or sold any securities pursuant to General Instruction I.B.6 of Form S-3.

We are an “emerging growth company”

as that term is defined under the federal securities laws and, as such, we have elected to comply with certain reduced reporting requirements

for this prospectus and may elect to do so in future filings.

Our Company has a dual class structure. Our Class

A common stock, which is the stock we are offering by means of this prospectus, has one vote per share and our Class B common stock, $0.0001

par value per share (the “Class B common stock” and together with the Class A common stock, “common stock”), has

no economic rights and has 10 votes per share. See “Risk Factors – The dual class structure of our common stock has the effect

of concentrating voting power with members of our management team, which will limit your ability to influence the outcome of important

transactions, including a change in control” and “Risk Factors – We cannot predict the impact our dual class structure

may have on our stock price” for more information. For more information on our capital stock, see the section titled “Description

of Securities.”

Our Class B common stock is owned solely by our

Chief Executive Officer, Mark Hanchett, and our President, Annie Pratt, who own 25,903,676 and 9,721,696 shares of our Class B common

stock, respectively. Mr. Hanchett and Ms. Pratt hold approximately 58% and 22% of the voting power of our outstanding capital stock, respectively,

for an aggregate of approximately 79% of the voting power of our outstanding capital stock.

As a result of our Chief Executive Officer’s

ownership of our Class B common stock, we are a “controlled company” within the meaning of the corporate governance standards

of Nasdaq. As a result, our stockholders do not have the same protections afforded to stockholders of companies that cannot rely on such

exemptions.

You should carefully read this prospectus and

any prospectus supplement or amendment before you invest. See the section entitled “Risk Factors” beginning on page 12,

as well as those contained in the applicable prospectus supplement and any related free writing prospectus, and in the other documents

that are incorporated by reference into this prospectus or the applicable prospectus supplement. You also should read the information

included throughout this prospectus for information on our business and our financial statements, including information related to our

predecessor.

Neither the Securities and Exchange Commission

(the “SEC”) nor any state securities commission has approved or disapproved of these securities or determined if this prospectus

is truthful or complete. Any representation to the contrary is a criminal offense.

Prospectus dated October 30,

2023.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement

filed with the Securities and Exchange Commission (the “SEC”), using a “shelf” registration process. Under this

shelf registration process, we may sell the securities described in this prospectus in one or more offerings. This prospectus provides

you with a general description of the securities which may be offered. Each time we offer securities for sale, we will provide a prospectus

supplement that contains specific information about the terms of that offering. Any prospectus supplement may also add or update information

contained in this prospectus. You should read both this prospectus and any prospectus supplement together with additional information

described below under “Where You Can Find Additional Information” and “Incorporation of Certain Information

by Reference.”

You should rely only on the information contained

or incorporated by reference in this prospectus, and in any prospectus supplement. We have not authorized any other person to provide

you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not

making offers to sell or solicitations to buy the securities described in this prospectus in any jurisdiction in which an offer or solicitation

is not authorized, or in which the person making that offer or solicitation is not qualified to do so or to anyone to whom it is unlawful

to make an offer or solicitation. You should not assume that the information in this prospectus or any prospectus supplement, as well

as the information we file or previously filed with the SEC that we incorporate by reference in this prospectus or any prospectus supplement

is accurate as of any date other than its respective date. Our business, financial condition, results of operations and prospects may

have changed since those dates.

This prospectus contains summaries of certain

provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information.

All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have

been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a

part, and you may obtain copies of those documents as described below under the heading “Where You Can Find Additional Information”.

Unless otherwise indicated or the context otherwise

requires, all references in this prospectus to the terms “Nxu,” the “Company,” “we,” “our”

or “us” refer to Nxu, Inc., a Delaware corporation, and, immediately prior to the Reorganization Merger (as defined herein),