UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY

STATEMENT SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the

Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ |

Definitive Proxy Statement |

| ☒ |

Definitive Additional Materials |

| ☐ |

Soliciting Material under §240.14a-12 |

Mr. Cooper Group Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☐ |

Fee paid previously with preliminary materials. |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules

14a-6(i)(l) and 0-11. |

2024 Annual Meeting Investor

Engagement

This presentation contains summarized

information concerning Mr. Cooper Group Inc. (“Mr. Cooper” or the “Company”) and the Company’s business, operations, financial performance and trends. No representation is made that the information in this presentation

is complete. For additional financial, statistical and business-related information, as well as information regarding business and segment trends, see the Company’s most recent Annual Report on Form 10-K (“Form 10-K”) and Quarterly

Reports on Form 10-Q filed with the U.S. Securities and Exchange Commission (the “SEC”), as well other reports filed with the SEC from time to time. Such reports are or will be available in the Investors section of the Company’s

website (www.mrcoopergroup.com) and the SEC’s website (www.sec.gov). Forward Looking Statements. This presentation contains forward-looking statements within the meaning of the U.S. federal securities laws. All statements other than statements

of historical or current fact included in this presentation that address activities, events, conditions or developments that we expect, believe or anticipate will or may occur in the future are forward-looking statements. Forward-looking statements

give our current expectations and projections relating to our financial condition, results of operations, plans, objectives, future performance and business and these statements are not guarantees of future performance. Forward-looking statements

may include the words “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “strategy,” “future,”

“opportunity,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Such forward-looking

statements involve risks and uncertainties that may cause actual events, results or performance to differ materially from those indicated by such statements. Certain of these risks are identified and discussed in documents Mr. Cooper has filed or

will file from time to time with the SEC. These risk factors will be important to consider in determining future results and should be reviewed in their entirety. These forward-looking statements are expressed in good faith, and Mr. Cooper believes

there is a reasonable basis for them. However, the events, results or trends identified in these forward-looking statements may not occur or be achieved. Forward-looking statements speak only as of the date they are made, and Mr. Cooper is not under

any obligation, and expressly disclaims any obligation, to update, alter or otherwise revise any forward-looking statement, except as required by law. Readers should carefully review the statements set forth in the reports that Mr. Cooper has filed

or will file from time to time with the SEC. Important information

Largest Servicer Proforma #2 Subservicer

GPTW Certified 5th year in a row with near 90% approval rate Google Customer Award Winner for our proprietary document reading technology 5.1 MILLION CUSTOMERS $1.1 TN SERVICING PORTFOLIO 4 out of 5 stars customer service rating on Trustpilot $12.8

BN Funded Volume over the last twelve months (LTM) Top 30 Originator Top 30 Direct Lender Top 15 Correspondent Lender Above-average servicer rating from Moody’s, Fitch, and S&P DEI Leadership Award Fannie Mae STAR performer for over ten

straight years (2012 – 2023) Freddie Mac SHARP award winner for customer service and superior portfolio performance Recognized by Fortune as Best Workplaces in Financial Services & Insurance Leading the industry to cloud-native servicing

platform technology High-touch special servicer HousingWire Tech100 award winner for third consecutive year (2022-2024) Note: Customer, Servicing portfolio, and funded volume as of March 31, 2024. Servicer and Originations rankings based on

Inside Mortgage Finance as of 4Q’23. Mr. Cooper at a glance “We exist to keep the dream of homeownership alive” With an unmatched focus on customer experience, a thriving workforce, and conservative balance sheet management, Mr.

Cooper acts as a champion for the American homeowner

(2) +299% +49% +37% Under our CEO’s

leadership, Mr. Cooper has significantly outperformed peers as a result of thoughtful strategic decisions and execution Performance exceeding the market 7/31/18: Jay Bray assumed CEO role 1/3/19: Announced $48 billion servicing transaction 8/1/23:

Completed acquisition of Home Point Capital, Roosevelt Management Company and Rushmore Servicing 2/5/19: Acquired Pacific Union Financial +18% Total shareholder returns since July 2018(1) 3/31/22: Completed agreement with Sagent to create the

mortgage industry’s first cloud-native servicing platform ⁽¹⁾ TSR measured from 7/31/18 to 12/31/23; start date reflects when CEO Jay Bray assumed CEO role of company created by the acquisition of Nationstar by WMIH Corp.

Source: S&P Capital IQ as of 4/26/24. (2) Executive Compensation Peers index includes peers disclosed in 2024 proxy that remain publicly traded: LDI, PFSI, RKT, RDN, UWMC, ZG, NLY, RITM, OMF, SOFI, and WD. Index weighted by market

cap.

ensuring SENIOR Leadership continuity as

we execute our strategy As part of a broader plan to secure continuity of leadership and facilitate an orderly transition for our retiring President, in October 2023, we entered into employment agreements with both our CEO and President to

facilitate CEO retention and orderly transition of our retiring President and in January 2024, we bolstered our team with a financial services and mortgage industry veteran Mr. Marshall announced his intention to retire by year-end 2024; he has been

instrumental in overseeing operations and implementing process improvements resulting in higher profitability and enhanced customer experience To support a smooth and orderly transition of his role and responsibilities, we’ve secured his

employment as Vice Chairman through the end of 2024 Under his employment agreement, Mr. Marshall’s total target direct compensation remains the same, but the mix of cash and equity, and form of equity, has changed, with a higher emphasis on

incentive cash and time-based restricted stock units, to reflect his role and to incentivize him to remain through the transition to his successor Mr. Bray is a demonstrated leader whose strategic vision and deep knowledge of our business and

industry make him uniquely qualified to unlock the next phase of growth for the Company Since Mr. Bray became CEO of Mr. Cooper’s predecessor company in 2012, he has delivered exceptional results, executed on several strategic initiatives and

grown our servicing portfolio The employment agreement and a one-time equity award incentivizes Mr. Bray to continue to serve during this important time while creating long-term value for our shareholders Chris Marshall, Vice Chairman & Former

President Jay Bray, Chairman & CEO Mr. Weinbach has more than 25 years of extensive financial services and mortgage industry experience in addition to senior leadership experience, having served as the CEO of Consumer Lending and as a member of

the firm's Operating Committee at Wells Fargo Previously, Mr. Weinbach served as CEO of Chase Home Lending at JP Morgan Chase, where he also held leadership roles in various departments within the Company Mr. Weinbach is responsible for leading the

company’s operations, including Originations, Servicing and Technology Mike Weinbach, President Joined January 2024

Performance-oriented equity award to our

ceo As part of his employment agreement, in October 2023, we granted a majority performance-based one-time equity award to Mr. Bray to encourage him to remain with Mr. Cooper and unlock our next phase of growth Award Structure Aligned to Shareholder

Interests: Requires significant value creation with a strong retention element Majority performance-based with targets linked to the company’s long-term business strategy and enterprise value Long vesting periods; limited termination-related

vesting Requires continued service as CEO or Chair to receive compensation Board’s consideration of the annualized value of the award The Board is committed to not granting Mr. Bray any future one- time awards during the five-year term of his

award Note: Please refer to the Mr. Cooper Group 4Q’23 10-K as-filed with the SEC for more information. Value-Driver Equity Award – Total $15M (Annualized Value of $3M) PSUs – $9M (60%) Tangible Book Value (50%) 50% measured over

3-years 50% measured over 5-years Rigorous targets and outperformance required to earn PSUs Threshold, target and max hurdles each set significantly higher than respective hurdle in annual LTI plan Annualized Tangible Book Value growth target of14%;

the target goal would represent an increase in Tangible Book Value of nearly $4.0 billion Above median relative TSR is required for the target number of rTSR PSUs to vest rTSR vs. Commercial & Residential Mortgage Finance Peers (50%) 50%

measured over 3-years 50% measured over 5-years Target vesting requires 55th percentile performance vs. peer set TSR must be positive as of the 3- and 5-year measurement periods for any PSUs of each duration to be earned RSUs – $6M (40%) Vest

over 5 years, with 50% vesting at 3 years and 50% 5 years after the date of grant Stockholders expressed support for the Board’s actions to incentivize and retain Mr. Bray, including the use of the performance-based equity award during recent

engagements Mr. Bray's total target direct compensation – including the annualized value of the value driver equity award – is below the 75th percentile of our peer group

OUR COMPENSATION PROGRAM ALIGNS PAY WITH

PERFORMANCE Our compensation program is focused on long-term objectives to ensure management pay is aligned with the interests our stockholders Element Vehicle 2023 Metrics & Key Characteristics Salary Cash Fixed compensation Executive

Management Incentive Plan (EMIP) Cash Metrics differ based on role and include: Financial Objectives (70%): Adjusted EBT Xome Adjusted EBT Core functional expense Strategic Objectives (30%): Employee engagement Customer experience/loyalty Long-term

strategy Compliance Governance Long-Term Incentive Plan (LTIP) PSUs Tangible Book Value (50%) Relative TSR measured against S&P Composite 1500 Financials index (50%) 3-year cliff vesting RSUs 3-year ratable vesting New 2023 PSU program design

reflects shareholder feedback: eliminated 1-year vesting period and added two evenly weighted performance metrics (Tangible Book Value and Relative TSR)

Mr. Bray’s target annual incentive

is aligned to the industry and size appropriate peer group developed by Mr. Cooper Ceo target annual incentive aligned to the market Overview of the 2023 Peer Group Mr. Cooper’s 2023 peer group consists of companies appropriately aligned to

its market cap, assets, and business It is comprised of Mortgage industry-related peers, FinTech organizations, Mortgage REITs, and Banks and Specialty Finance companies, all of which are in businesses similar to ours and/or are direct competitors

for business and talent Market Cap ($M) Annual Incentive Target (% of Base Salary) Annual Incentive Target ($ Value) Mr. Cooper $5,292 250% $2,500,000 Mr. Cooper Peer Co. Median $4,743 235% $2,350,000 CEO Target Alignment to Peer Group CEO’s

target annual incentive (as a % of base salary) is in line with peer median CEO’s target annual incentive ($ value) is in line with peer median Note: Information based on Company public filings. Peer Co. median does not include Mr.

Cooper.

qualified and diverse board Jay Bray Chair

& CEO, Mr. Cooper Group 30+ years of experience in the mortgage servicing and originations industry; played a critical role in leading the servicing market shift to non-banks following the financial crisis Michael Malone (Independent Lead

Director) Former Managing Director, Fortress Investment Group Extensive executive experience in financial services, including investment banking in relevant industries, and real estate Busy Burr Former Interim CEO, Rite Aid C-level leader with

experience across industries and depth in business development, branding, innovation, digital technology, and communications Roy Guthrie Former CFO, Discover Financial Services Expertise in financial services and extensive experience as an executive

officer and director of public companies Daniela Jorge SVP & Chief Design Officer, Capital One Consumer technology executive with experience leading product design at recognizable Fin-tech brands and expertise at deepening the customer

experience through emerging technologies Shveta Mujumdar SVP, Corporate Development, Intuit Software executive with extensive strategy, mergers & acquisitions, operational experience and experience in driving a customer obsessed product

innovation-oriented culture Tagar Olson Founder, Integrum Holdings LP, and Former Partner, KKR Extensive experience in corporate financings, mergers & acquisitions, investments and strategic transactions; has relationships in the investment

banking and private equity industries Steve Scheiwe President, Ontrac Advisors Broad experience serving as a board member of public and private companies, mergers & acquisitions, financing and legal acumen, and high level of financial literacy

88% Independent 38% Gender Diverse 25% Ethnically Diverse Average Tenure: 6.25 Years We maintain a highly engaged and independent Board with diverse backgrounds 2 5 1 Key Statistics Board Tenure

Questions?

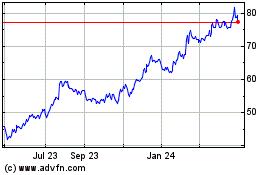

Mr Cooper (NASDAQ:COOP)

Historical Stock Chart

From Oct 2024 to Nov 2024

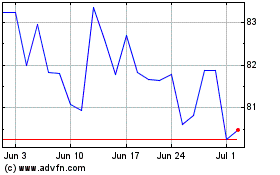

Mr Cooper (NASDAQ:COOP)

Historical Stock Chart

From Nov 2023 to Nov 2024