- Reported $214 million net income or $2.18 per diluted

share

- Generated strong pretax operating income of $348 million,

equivalent to a ROTCE of 50.9%, offset by a mark-to-market loss of

$29 million

- Tangible book value per share increased to $23.95 from $21.42

in the prior quarter

- Originations segment generated record pretax income of $438

million on record funded volume of $15.6 billion

- Xome reported pretax income of $15 million and pretax operating

income of $18 million

- As of October 25th, 2020, 6.1% of customers on forbearance,

down from peak of 7.2%

- Repurchased 1.2 million shares of common stock for $23.3

million

- Redeemed $950 million of senior notes with $100 million in cash

and issued new debt of $850 million at 5.5%

- Expanded total committed advance financing capacity to $2.0

billion, of which $1.5 billion was unused as of 3Q’20

- Quarter-end unrestricted cash of $946 million

Mr. Cooper Group Inc. (NASDAQ: COOP) (the “Company”), which

principally operates under the Mr. Cooper® and Xome® brands,

reported a third quarter net income of $214 million or $2.18 per

diluted share. Net income included $53 million in debt refinancing

costs related to senior note refinanced in the quarter and a

negative $29 million in mark-to-market. Excluding the

mark-to-market and other items, the Company reported pretax

operating income of $348 million. Items excluded from operating

income were negative $29 million in mark-to-market, net of the add

back of $25 million in fair value amortization that is included in

the full mark-to-market, $53 million in debt breakage, $1 million

in severance charges related to corporate actions, and $9 million

of intangible amortization.

Chairman and CEO Jay Bray commented, “The strong earnings this

quarter, including record origination fundings and a 51% operating

ROTCE, are the result of our key strengths - great people,

technology development as a core competency, and a business model

that balances servicing and originations.”

Chris Marshall, Vice Chairman and CFO added, “We continued to

strengthen the company’s balance sheet during the quarter,

redeeming $100 million in senior notes, refinancing $850 million at

a coupon of 5.5%, and extending our liquidity runway to almost 6

years. At the same time, we bolstered our advance funding capacity

with a $900 million committed facility for Ginnie Mae MSRs and

advances.”

Servicing

The Servicing segment is focused on providing a best-in-class

home loan experience for our 3.4 million customers while

simultaneously strengthening asset performance for investors. In

the third quarter, Servicing recorded pretax loss of $32 million,

reflecting a negative $29 million in mark-to-market. The total

servicing portfolio ended the quarter at $588 billion UPB.

Servicing earned pretax operating loss, excluding the full mark, of

$2 million, equivalent to a servicing margin of negative 0.1 bps.

At quarter end, the carrying value of the MSR was $2,669 million,

of which $2,663 million was at fair value equivalent to 100 bps of

MSR UPB and original cost basis of 86 bps.

Quarter Ended

($ in millions)

Q2'20

Q3'20

$

BPS

$

BPS

Operational revenue

$

294

19.2

$

273

18.5

Amortization, net of accretion

(102)

(6.6)

(112)

(7.6)

Mark-to-market

(261)

(17.1)

(29)

(2.0)

Total revenues

(69)

(4.5)

132

8.9

Total expenses

(122)

(8.0)

(99)

(6.7)

Total other expenses, net

(60)

(3.9)

(65)

(4.4)

Loss before taxes

(251)

(16.4)

(32)

(2.2)

Mark-to-market

261

17.1

29

2.0

Accounting items

—

—

1

0.1

Pretax operating income (loss) excluding

mark-to-market and accounting items

$

10

0.7

$

(2)

(0.1)

Quarter Ended

Q2'20

Q3'20

Ending UPB ($B)

$

596

$

588

Average UPB ($B)

$

612

$

591

60+ day delinquency rate at period end

4.7

%

5.9

%

Annualized CPR

26.0

%

30.1

%

Modifications and workouts

6,582

23,725

Originations

The Originations segment focuses on creating servicing assets at

attractive margins by acquiring loans through the correspondent

channel and principally refinancing existing loans in the

direct-to-consumer channel. Originations earned pretax income of

$438 million.

Mr. Cooper funded 58,140 loans in the third quarter, totaling

approximately $15.6 billion UPB, which was comprised of $9.1

billion in direct-to-consumer and $6.5 billion in correspondent.

Funded volume increased 45% quarter-over-quarter.

Quarter Ended

($ in millions)

Q2'20

Q3'20

Income before taxes

$

433

$

438

Accounting items

1

—

Pretax operating income excluding

accounting items

$

434

$

438

Quarter Ended

($ in millions)

Q2'20

Q3'20

Total pull through adjusted volume

$

12,394

$

19,794

Funded volume

$

10,729

$

15,598

Refinance recapture percentage

31

%

31

%

Recapture percentage

26

%

25

%

Purchase volume as a percentage of funded

volume

10

%

16

%

Xome

Xome provides real estate solutions including property

disposition, asset management, title, close, valuation, and field

services for Mr. Cooper and third-party clients. The Xome segment

recorded pretax income of $15 million and pretax operating income

of $18 million in the third quarter, which excluded intangible

amortization.

Quarter Ended

($ in millions)

Q2'20

Q3'20

Income before taxes

$

12

$

15

Intangible amortization

1

3

Pretax operating income excluding

intangible amortization

$

13

$

18

Quarter Ended

($ in millions)

Q2'20

Q3'20

Exchange property sold

1,191

860

Average Exchange property listings

17,438

15,067

Services orders completed

423,974

422,935

Percentage of revenue earned from

third-party customers

53

%

50

%

Conference Call Webcast and Investor

Presentation

The Company will host a conference call on October 29, 2020 at

9:00 A.M. Eastern Time. The conference call may be accessed by

dialing 855-874-2685, or 720-634-2923 internationally. Please use

the participant passcode 1498733 to access the conference call. A

simultaneous audio webcast of the conference call will be available

in the Investor section of www.mrcoopergroup.com. A replay will

also be available approximately two hours after the conclusion of

the conference call by dialing 855-859-2056, or 404-537-3406

internationally. Please use the passcode 1498733 to access the

replay. The replay will be accessible through November 13, 2020 at

11:59 P.M. Eastern Time.

Non-GAAP Financial

Measures

The Company utilizes non-GAAP financial measures as the measures

provide additional information to assist investors in understanding

and assessing the Company’s and our business segments’ ongoing

performance and financial results, as well as assessing our

prospects for future performance. The adjusted operating financial

measures facilitate a meaningful analysis and allow more accurate

comparisons of our ongoing business operations because they exclude

items that may not be indicative of or are unrelated to the

Company’s and our business segments’ core operating performance,

and are better measures for assessing trends in our underlying

businesses. These notable items are consistent with how management

views our businesses. Management uses these non-GAAP financial

measures in making financial, operational and planning decisions

and evaluating the Company’s and our business segment’s ongoing

performance. Pretax operating income (loss) in the servicing

segment eliminates the effects of mark-to-market adjustments which

primarily reflects unrealized gains or losses based on the changes

in fair value measurements of MSRs and their related financing

liabilities for which a fair value accounting election was made.

These adjustments, which can be highly volatile and material due to

changes in credit markets, are not necessarily reflective of the

gains and losses that will ultimately be realized by the Company.

Pretax operating income (loss) in each segment also eliminates, as

applicable, transition and integration costs, gains (losses) on

sales of fixed assets, certain settlement costs that are not

considered normal operational matters, intangible amortization, and

other adjustments based on the facts and circumstances that would

provide investors a supplemental means for evaluating the Company’s

core operating performance.

Forward Looking

Statements

Any statements in this release that are not historical or

current facts are forward looking statements. Forward looking

statements involve known and unknown risks, uncertainties and other

factors that may cause our actual results, performance, or

achievements to be materially different from any future results,

performance or achievements expressed or implied by the

forward-looking statements, including the severity and duration of

the COVID-19 pandemic; the pandemic’s impact on the U.S. and global

economies; federal, state, and local governmental responses to the

pandemic; borrower forbearance rates and availability of financing.

Results for any specified quarter are not necessarily indicative of

the results that may be expected for the full year or any future

period. Certain of these risks and uncertainties are described in

the “Risk Factors” section of Mr. Cooper Group’s most recent annual

reports and other required documents as filed with the SEC which

are available at the SEC’s website at http://www.sec.gov. Mr.

Cooper undertakes no obligation to publicly update or revise any

forward-looking statement or any other financial information

contained herein, and the statements made in this press release are

current as of the date of this release only.

Financial Tables

MR. COOPER GROUP INC. AND

SUBSIDIARIES

UNAUDITED CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS

(millions of dollars, except for

earnings per share data)

Three Months Ended June 30,

2020

Three Months Ended September 30,

2020

Revenues:

Service related, net, excluding

mark-to-market

$

273

$

256

Mark-to-market

(261

)

(29

)

Net gain on mortgage loans held for

sale

618

645

Total revenues

630

872

Total expenses:

419

431

Other expense, net:

Interest income

76

56

Interest expense

(177

)

(165

)

Other expense, net

—

(51

)

Total other expense, net

(101

)

(160

)

Income before income tax expense

110

281

Income tax expense

37

67

Net income

73

214

Net income attributable to non-controlling

interest

—

5

Net income attributable to Mr. Cooper

Group

73

209

Undistributed earnings attributable to

participating stockholders

1

2

Net income attributable to common

stockholders

$

72

$

207

Net income per share attributable to

common stockholders:

Basic

$

0.78

$

2.26

Diluted

$

0.77

$

2.18

Weighted average shares of common stock

outstanding (in millions):

Basic

92.0

91.7

Diluted

93.0

95.1

MR. COOPER GROUP INC. AND

SUBSIDIARIES

UNAUDITED CONDENSED

CONSOLIDATED BALANCE SHEETS

(millions of dollars)

June 30, 2020

September 30, 2020

Assets

Cash and cash equivalents

$

1,041

$

946

Restricted cash

260

229

Mortgage servicing rights

2,763

2,669

Advances and other receivables, net

668

745

Reverse mortgage interests, net

5,709

5,460

Mortgage loans held for sale at fair

value

3,179

3,817

Property and equipment, net

115

114

Deferred tax assets, net

1,391

1,344

Other assets

2,174

6,431

Total assets

$

17,300

$

21,755

Liabilities and

Stockholders' Equity

Unsecured senior notes, net

$

2,261

$

2,167

Advance and warehouse facilities, net

4,506

4,851

Payables and other liabilities

2,460

6,590

MSR related liabilities - nonrecourse at

fair value

1,173

1,091

Mortgage servicing liabilities

48

44

Other nonrecourse debt, net

4,707

4,671

Total liabilities

15,155

19,414

Total stockholders' equity

2,145

2,341

Total liabilities and stockholders'

equity

$

17,300

$

21,755

UNAUDITED SEGMENT STATEMENT

OF

OPERATIONS & EARNINGS

RECONCILIATION

(millions of dollars, except for

earnings per share data)

Three Months Ended June 30,

2020

Servicing

Originations

Xome

Corporate/ Other

Consolidated

Service related, net

$

(114

)

$

21

$

106

$

(1

)

$

12

Net gain on mortgage loans held for

sale

45

573

—

—

618

Total revenues

(69

)

594

106

(1

)

630

Total expenses

122

167

95

35

419

Other (expense) income, net:

Interest income

57

19

—

—

76

Interest expense

(117

)

(13

)

—

(47

)

(177

)

Other income (expense), net

—

—

1

(1

)

—

Total other (expense) income, net

(60

)

6

1

(48

)

(101

)

Pretax (loss) income

$

(251

)

$

433

$

12

$

(84

)

$

110

Income tax expense

37

Net income

73

Net income attributable to noncontrolling

interests

—

Net income attributable to common

stockholders of Mr. Cooper Group

73

Undistributed earnings attributable to

participating stockholders

1

Net income attributable to common

stockholders

$

72

Net income per share

Basic

$

0.78

Diluted

$

0.77

Non-GAAP Reconciliation:

Pretax (loss) income

$

(251

)

$

433

$

12

$

(84

)

$

110

Mark-to-market

261

—

—

—

261

Accounting items / other

—

1

—

—

1

Intangible amortization

—

—

1

6

7

Pretax income (loss), net of notable

items

10

434

13

(78

)

379

Fair value amortization (1)

(29

)

—

—

—

(29

)

Pretax operating (loss) income

$

(19

)

$

434

$

13

$

(78

)

$

350

Income tax expense

(85

)

Operating income

$

265

ROTCE

55.0

%

(1) Amount represents additional

amortization required under the fair value amortization method over

the cost amortization method.

UNAUDITED SEGMENT STATEMENT

OF

OPERATIONS & EARNINGS

RECONCILIATION

(millions of dollars, except for

earnings per share data)

Three Months Ended September 30,

2020

Servicing

Originations

Xome

Corporate/ Other

Consolidated

Service related, net

$

92

$

27

$

108

$

—

$

227

Net gain on mortgage loans held for

sale

40

605

—

—

645

Total revenues

132

632

108

—

872

Total expenses

99

195

94

43

431

Other (expense) income, net:

Interest income

40

16

—

—

56

Interest expense

(105

)

(15

)

—

(45

)

(165

)

Other income (expense), net

—

—

1

(52

)

(51

)

Total other (expense) income, net

(65

)

1

1

(97

)

(160

)

Pretax (loss) income

$

(32

)

$

438

$

15

$

(140

)

$

281

Income tax expense

67

Net income

214

Net income attributable to noncontrolling

interests

5

Net income attributable to common

stockholders of Mr. Cooper Group

209

Undistributed earnings attributable to

participating stockholders

2

Net income attributable to common

stockholders

$

207

Net income per share

Basic

$

2.26

Diluted

$

2.18

Non-GAAP Reconciliation:

Pretax (loss) income

$

(32

)

$

438

$

15

$

(140

)

$

281

Mark-to-market

29

—

—

—

29

Accounting items / other

1

—

—

53

54

Intangible amortization

—

—

3

6

9

Pretax (loss) income, net of notable

items

(2

)

438

18

(81

)

373

Fair value amortization (1)

(25

)

—

—

—

(25

)

Pretax operating (loss) income

$

(27

)

$

438

$

18

$

(81

)

$

348

Income tax expense

(84

)

Operating income

$

264

ROTCE

50.9

%

(1) Amount represents additional

amortization required under the fair value amortization method over

the cost amortization method.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20201029005395/en/

Investor Contact: Kenneth Posner, SVP Strategic Planning and

Investor Relations (469) 426-3633 Shareholders@mrcooper.com

Media Contact: Christen Reyenga, VP Corporate Communications

MediaRelations@mrcooper.com

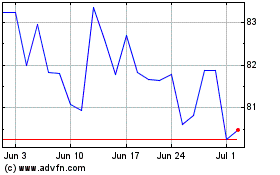

Mr Cooper (NASDAQ:COOP)

Historical Stock Chart

From Oct 2024 to Nov 2024

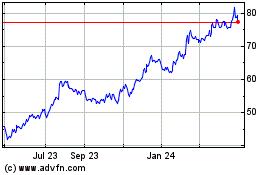

Mr Cooper (NASDAQ:COOP)

Historical Stock Chart

From Nov 2023 to Nov 2024