Cooperative Bankshares Reports 45% Increase in First Quarter Earnings

April 18 2007 - 3:30PM

Business Wire

Cooperative Bankshares, Inc. (NASDAQ:COOP) (the �Company�) reported

net income for the quarter ended March 31, 2007 of $2.1 million or

$0.32 per diluted share, an increase of 44.7% over the same quarter

last year. Net income for the quarter ended March 31, 2006 was $1.5

million or $0.22 per diluted share. The increase in net income from

the prior year period was mainly due to an increase in net interest

income caused primarily by growth in loans, a reduction to the

provision for loan losses and a gain recognized on the sale of a

building. Loans increased to $764.6 million at March 31, 2007

representing a 0.4% increase from December 31, 2006 and a 12.0%

increase from March 31, 2006. For the three-month period ended

March 31, 2007, the bulk of the increase in the loan portfolio

occurred in multi-family residential loans, which grew $5.6 million

(35.1%), and construction and land development loans, which grew

$4.8 million (2.9%). For the twelve-month period ended March 31,

2007, the majority of loan growth occurred in one-to-four family

loans, which grew $61.4 million (20.3%), and construction and land

development loans, which grew $28.7 million (20.2%). Loan growth

was primarily attributable to the markets in which the Company�s

wholly owned subsidiary, Cooperative Bank (the �Bank�), conducts

its business, the Bank�s improved branch network and a continued

emphasis on increasing overall loan production. The provision for

loan losses decreased to $300,000 for the quarter ended March 31,

2007 representing a 48.7% decrease from March 31, 2006. This

decrease in the provision for loan losses was primarily the result

of slower loan growth in the three-month period ended March 31,

2007 as compared to the three-month period ended March 31, 2006.

Also during the quarter ended March 31, 2007, the Company

recognized a $275,000 gain on the sale of a branch office that was

relocated in Morehead City. Total assets increased to $865.2

million at March 31, 2007, an increase of 0.6% compared to $860.1

million at December 31, 2006 and an increase of 10.5% compared to

$782.7 million at March 31, 2006. Asset growth was primarily the

result of continued loan growth, which was mostly funded by deposit

growth. Deposits at March 31, 2007 increased to $665.1 million from

$661.9 million at December 31, 2006 and from $591.9 million at

March 31, 2006 primarily as a result of the Bank�s improved branch

network, increasing brokered deposits and the Bank being located in

markets experiencing growth. At March 31, 2007, stockholders�

equity was $59.5 million, or $9.14 per share, and represented 6.88%

of assets, compared to $57.6 million, or $8.85 per share,

representing 6.70% of assets at December 31, 2006 and compared to

$52.1 million, or $8.05 per share, representing 6.66% of assets at

March 31, 2006. Cooperative Bankshares, Inc. is the parent company

of Cooperative Bank. Chartered in 1898, Cooperative Bank provides a

full range of financial services through 22 offices in Eastern

North Carolina. The Bank�s subsidiary, Lumina Mortgage, Inc., is a

mortgage banking firm, originating and selling residential mortgage

loans through two offices in North Carolina. Statements in this

news release that are not historical facts are forward-looking

statements as defined in the Private Securities Litigation Reform

Act of 1995. Such forward-looking statements, which contain words

such as �expects,� �intends,� �believes� or words of similar

import, are subject to numerous risks and uncertainties disclosed

from time to time in documents the Company files with the

Securities and Exchange Commission (the �SEC�), which could cause

actual results to differ materially from the results currently

anticipated. Undue reliance should not be placed on such

forward-looking statements. The Company has filed a Form 8-K with

the SEC containing additional financial information regarding the

three-months ended March 31, 2007.

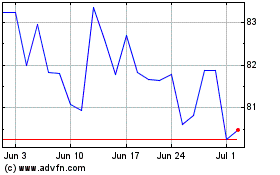

Mr Cooper (NASDAQ:COOP)

Historical Stock Chart

From Sep 2024 to Oct 2024

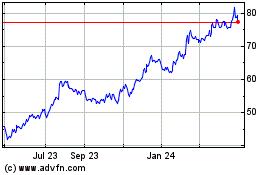

Mr Cooper (NASDAQ:COOP)

Historical Stock Chart

From Oct 2023 to Oct 2024