0001103982FALSE00011039822025-02-182025-02-180001103982us-gaap:CommonClassAMember2025-02-182025-02-180001103982mdlz:OnePointSixTwentyFivePercentNotesDue2027Member2025-02-182025-02-180001103982mdlz:ZeroPointTwoFiftyPercentNotesDue2028Member2025-02-182025-02-180001103982mdlz:ZeroPointSevenFiftyPercentNotesDue2033Member2025-02-182025-02-180001103982mdlz:TwoPointThreeSeventyFivePercentNotesDue2035Member2025-02-182025-02-180001103982mdlz:FourPointFivePercentNotesDue2035Member2025-02-182025-02-180001103982mdlz:OnePointThreeSeventyFivePercentNotesDue2041Member2025-02-182025-02-180001103982mdlz:ThreePointEightSeventyFivePercentNotesDue2045Member2025-02-182025-02-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________

FORM 8-K

___________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): February 18, 2025

___________________________________

MONDELĒZ INTERNATIONAL, INC.

(Exact name of registrant as specified in its charter)

___________________________________

| | | | | | | | |

Virginia (State or other jurisdiction of incorporation) | 1-16483 (Commission File Number) | 52-2284372 (I.R.S. Employer Identification Number) |

905 West Fulton Market, Suite 200, Chicago, IL 60607 |

(Address of principal executive offices, including zip code) |

(847) 943-4000 |

(Registrant's telephone number, including area code) |

___________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: |

Title of each class | Trading Symbol | Name of each exchange on which registered |

| Class A Common Stock, no par value | MDLZ | The Nasdaq Global Select Market |

| 1.625% Notes due 2027 | MDLZ27 | The Nasdaq Stock Market LLC |

| 0.250% Notes due 2028 | MDLZ28 | The Nasdaq Stock Market LLC |

| 0.750% Notes due 2033 | MDLZ33 | The Nasdaq Stock Market LLC |

| 2.375% Notes due 2035 | MDLZ35 | The Nasdaq Stock Market LLC |

| 4.500% Notes due 2035 | MDLZ35A | The Nasdaq Stock Market LLC |

| 1.375% Notes due 2041 | MDLZ41 | The Nasdaq Stock Market LLC |

| 3.875% Notes due 2045 | MDLZ45 | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 12b-2 of the Exchange Act of 1934 (17 CFR 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 7.01. Regulation FD Disclosure.

On February 18, 2025, we issued a press release relating to the presentation made by Mondelēz International executives at the 2025 Consumer Analyst Group of New York conference. A copy of the press release is being furnished as Exhibit 99.1 to this Current Report on Form 8-K.

A listen-only webcast of the presentation will be available in the investors section of our website

(www.mondelezinternational.com), and a replay of the presentation with accompanying slides will also be available on our website.

This information, including Exhibit 99.1, will not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities under that section and it will not be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

Exhibits | | Description |

| 99.1 | | |

| 104 | | The cover page from Mondelēz International, Inc.’s Current Report on Form 8-K, formatted in Inline XBRL (included as Exhibit 101). |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| MONDELĒZ INTERNATIONAL, INC. |

| |

By: | /s/ Luca Zaramella |

Name: | Luca Zaramella |

Title: | Executive Vice President and Chief Financial Officer |

Date: February 18, 2025

| | | | | | | | |

| Contact: | Tracey Noe (Media) | Shep Dunlap (Investors) |

| +1 847 943 5678 | +1 847 943 5454 |

| news@mdlz.com | ir@mdlz.com

|

Mondelēz International Showcases Continued Progress on Sustainable Growth, Highlights Attractive Cakes and Pastries Opportunities at 2025 CAGNY Conference

•Doubling down on core categories of chocolate, biscuits and baked snacks supported by sustainable reinvestment

•Unique opportunity to win in large, fast-growing cakes and pastries adjacency

CHICAGO, February 18, 2025 – Mondelēz International, Inc. (NASDAQ: MDLZ) today will highlight its continued growth, portfolio transformation, and commitment to long-term value creation at the 2025 Consumer Analyst Group of New York (CAGNY) Conference. Chairman and Chief Executive Officer Dirk Van de Put and Chief Financial Officer Luca Zaramella will provide insights into the company’s strategic priorities and market leadership across key categories, including growth in attractive adjacencies like cakes and pastries.

“Our strong foundation of iconic brands and attractive categories position us for continued value creation,” said Dirk Van de Put, Chair and CEO of Mondelēz International. “We’re excited about our strong playbook to win in large and attractive adjacencies, like cakes and pastries, that provide a significant runway of growth opportunities.”

Delivering Resilient Growth

Mondelēz International has continued to deliver against its long-term growth algorithm, including 4.3% organic net revenue growth and 5.1% adjusted gross profit dollar growth in 2024, despite record cocoa input cost inflation, demonstrating consumers’ continued loyalty to their favorite chocolate, biscuits, and baked snacks brands. The Company’s $2 billion cakes and pastries business, which currently holds a #3 global share position, is growing share and is well-positioned to accelerate growth.

Mondelez International Internal

“We have always remained focused on a simple but proven playbook: Acquiring the right opportunities, executing a strong integration plan, and accelerating growth in our newly acquired brands through expanded distribution and elevated marketing capabilities,” said Chief Financial Officer Luca Zaramella.

Today’s CAGNY presentation will focus on four key areas of the Company’s strategy:

•Continuing progress on long-term, sustainable growth strategy – advancing portfolio reshaping and strong execution to deliver 90% of revenue from chocolate, biscuits and baked snacks

•Navigating record cocoa input costs while growing market leadership across trusted and loved brands

•Winning in the fast-growing, $97 billion cakes and pastries category, executing the Company’s proven playbook, and launching unique extensions of its widely loved chocolate and biscuit brands

•Unlocking value through cash generation and disciplined capital allocation – focusing on expanded free cash flow, growth-accretive M&A and balance sheet flexibility

Presentation and Materials

Simultaneous with the webcast for CAGNY participants, today’s presentation and accompanying slides will be available in the investor section of the Company’s website www.mondelezinternational.com and will remain available on the website following the webcast.

About Mondelēz International

Mondelēz International, Inc. (Nasdaq: MDLZ) empowers people to snack right in over 150 countries around the world. With 2024 net revenues of approximately $36.4 billion, MDLZ is leading the future of snacking with iconic global and local brands such as Oreo, Ritz, LU, Clif Bar and Tate's Bake Shop biscuits and baked snacks, as well as Cadbury Dairy Milk, Milka and Toblerone chocolate. Mondelēz International is a proud member of the Standard and Poor’s 500, Nasdaq 100 and Dow Jones Sustainability Index. Visit www.mondelezinternational.com or follow the company on X at www.x.com/MDLZ.

Forward-Looking Statements

This press release contains forward-looking statements. Words, and variations of words, such as “will,” “may,” “expect,” “plan,” “continue” and similar expressions are intended to identify these forward-looking statements, including, but not limited to, statements of belief or expectation and statements about Mondelēz International’s leadership position in snacking. These forward-looking statements are subject to change and to inherent risks and uncertainties, many of which are beyond Mondelēz International’s control, which could cause Mondelēz International’s actual results or outcomes to differ materially from those projected or assumed in these forward-looking statements. Please also see Mondelēz International’s risk factors, as they may be amended from time to time, set forth in its filings

with the U.S. Securities and Exchange Commission, including its most recently filed Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q. There may be other factors not presently known to Mondelēz International or which it currently considers to be immaterial that could cause Mondelēz International’s actual results to differ materially from those projected in any forward-looking statements it makes. Mondelēz International disclaims and does not undertake any obligation to update or revise any forward-looking statement in this press release, except as required by applicable law or regulation.

v3.25.0.1

Cover

|

Feb. 18, 2025 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 18, 2025

|

| Entity Registrant Name |

MONDELĒZ INTERNATIONAL, INC.

|

| Entity Incorporation, State or Country Code |

VA

|

| Entity Address, Address Line One |

905 West Fulton Market, Suite 200

|

| Entity Address, City or Town |

Chicago

|

| Entity Address, State or Province |

IL

|

| Entity Address, Postal Zip Code |

60607

|

| City Area Code |

847

|

| Local Phone Number |

943-4000

|

| Entity File Number |

1-16483

|

| Entity Tax Identification Number |

52-2284372

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001103982

|

| Class A Common Stock, no par value |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Class A Common Stock, no par value

|

| Trading Symbol |

MDLZ

|

| Security Exchange Name |

NASDAQ

|

| 1.625% Notes due 2027 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

1.625% Notes due 2027

|

| Trading Symbol |

MDLZ27

|

| Security Exchange Name |

NASDAQ

|

| 0.250% Notes due 2028 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

0.250% Notes due 2028

|

| Trading Symbol |

MDLZ28

|

| Security Exchange Name |

NASDAQ

|

| 0.750% Notes due 2033 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

0.750% Notes due 2033

|

| Trading Symbol |

MDLZ33

|

| Security Exchange Name |

NASDAQ

|

| 2.375% Notes due 2035 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

2.375% Notes due 2035

|

| Trading Symbol |

MDLZ35

|

| Security Exchange Name |

NASDAQ

|

| 4.500% Notes due 2035 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

4.500% Notes due 2035

|

| Trading Symbol |

MDLZ35A

|

| Security Exchange Name |

NASDAQ

|

| 1.375% Notes due 2041 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

1.375% Notes due 2041

|

| Trading Symbol |

MDLZ41

|

| Security Exchange Name |

NASDAQ

|

| 3.875% Notes due 2045 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

3.875% Notes due 2045

|

| Trading Symbol |

MDLZ45

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=mdlz_OnePointSixTwentyFivePercentNotesDue2027Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=mdlz_ZeroPointTwoFiftyPercentNotesDue2028Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=mdlz_ZeroPointSevenFiftyPercentNotesDue2033Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=mdlz_TwoPointThreeSeventyFivePercentNotesDue2035Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=mdlz_FourPointFivePercentNotesDue2035Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=mdlz_OnePointThreeSeventyFivePercentNotesDue2041Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=mdlz_ThreePointEightSeventyFivePercentNotesDue2045Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

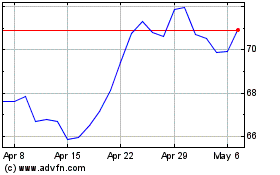

Mondelez (NASDAQ:MDLZ)

Historical Stock Chart

From Jan 2025 to Feb 2025

Mondelez (NASDAQ:MDLZ)

Historical Stock Chart

From Feb 2024 to Feb 2025