Biden’s Withdrawal From Presidential Race Seemingly Welcomed By Wall Street

July 22 2024 - 9:06AM

IH Market News

The major U.S. index futures are currently pointing to a higher

open on Monday, with stocks likely to move to the upside following

the mixed performance seen last week.

The upward momentum on Wall Street comes after President Joe

Biden announced his decision to drop out of the presidential race

and endorsed his Vice President Kamala Harris.

Biden has been under pressure to step aside after his disastrous

debate performance raised questions about his fitness to serve

another term as president.

While Republican nominee Donald Trump is seen as a more

pro-business candidate, his return to the White House could also

lead to increased trade tensions with China.

“The market appears to have welcomed Joe Biden’s withdrawal from

the presidential race, given how futures prices imply a decent

opening for Wall Street,” said Dan Coatsworth, investment analyst

at AJ Bell.

“However, there is still a lot of uncertainty until the new

Democratic candidate is confirmed,” he added. “That means we could

see heightened volatility over the next few weeks, with assets

quickly changing direction depending on the latest comments from

Washington.”

Later in the week, focus is likely to shift to a report on

personal income and spending in June, which includes readings on

inflation said to be preferred by the Federal Reserve.

The data could have a significant impact on the outlook for

interest rates, with the Fed currently widely expected to lower

interest rates by a quarter point in September.

Stocks moved mostly lower during trading on Friday, with the

Nasdaq and the S&P 500 extending the steep drop seen over the

two previous sessions. The narrower Dow also moved to the downside,

pulling back further off the record closing high set on

Wednesday.

The major averages all finished the day firmly in negative

territory. The Dow slumped 377.49 points or 0.9 percent to

40,287.53, the Nasdaq slid 144.28 points or 0.8 percent to

17,726.94 and the S&P 500 fell 39.59 points or 0.7 percent to

5,505.00.

For the week, the major averages turned in a mixed performance.

The tech-heavy Nasdaq plunged by 3.7 percent and the S&P 500

tumbled by 2.0 percent, but the Dow climbed by 0.7 percent.

With concerns about the outlook for tech stocks recently

weighing on Wall Street, negative sentiment may have been generated

by a major IT outage.

The operations of major banks, media outlets, hospitals and

airlines worldwide were affected due to the widespread outage,

which was purportedly caused by an update by cybersecurity firm

CrowdStrike (NASDAQ:CRWD).

“CrowdStrike is actively working with customers impacted by a

defect found in a single content update for Windows hosts,” the

company’s CEO George Kurtz said on X. “Mac and Linux hosts are not

impacted.”

“This is not a security incident or cyberattack,” he continued.

“The issue has been identified, isolated and a fix has been

deployed.”

Shares of CrowdStrike plunged by 11.1 percent, while shares of

Microsoft (NASDAQ:MSFT) have also moved to the downside as many of

the software giant’s users have also been impacted by the

issue.

“The underlying cause has been fixed, however, residual impact

is continuing to affect some Microsoft 365 apps and services. We’re

conducting additional mitigations to provide relief,” Microsoft

said on X.

Overall trading activity was somewhat subdued, however, with a

lack of major U.S. economic keeping some traders on the

sidelines.

Semiconductor stocks saw substantial weakness on the day,

dragging the Philadelphia Semiconductor Index down by 3.1 percent

to its lowest closing level in over a month.

A steep drop by the price of crude oil also contributed to

significant weakness among energy stocks, with the Philadelphia Oil

Service Index and the NYSE Arca Oil Index falling by 1.4 percent

and 1.2 percent, respectively.

Considerable weakness was also visible among computer hard

stocks, as reflected by the 1.3 percent loss posted by the NYSE

Arca Computer Hardware Index.

Gold, networking and tobacco stocks also saw notable weakness,

while pharmaceutical stocks regained ground following Thursday’s

sell-off.

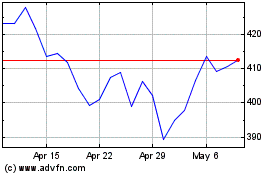

Microsoft (NASDAQ:MSFT)

Historical Stock Chart

From Oct 2024 to Nov 2024

Microsoft (NASDAQ:MSFT)

Historical Stock Chart

From Nov 2023 to Nov 2024