UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of January, 2024

Commission File Number: 001-40024

MICROALGO INC.

(Registrant’s Name)

Unit 507, Building C, Taoyuan Street,

Long Jing High and New Technology Jingu Pioneer Park,

Nanshan

District, Shenzhen, People’s

Republic of China 518052

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

EXPLANATORY

NOTE

This

current report on Form 6-K, including the exhibit hereto, is incorporated by reference into the registration statement on Form F-3 of

the Company (File No. 333-276098) and

shall be a part thereof from the date on which this current report is furnished, to the extent not superseded by documents or reports

subsequently filed or furnished.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date:

January 5, 2024

| |

MicroAlgo Inc. |

| |

|

| |

/s/ Min Shu |

| |

Min Shu |

| |

Chief Executive Officer |

Exhibit

5.1

Our

ref VSL/815090-000001/28429343v1

MicroAlgo

Inc.

Unit

507, Building C, Taoyuan Street

Long

Jing High and New Technology Jingu Pioneer Park

Nanshan

District, Shenzhen

People’s

Republic of China

5

January 2024

Dear

Sirs

MicroAlgo

Inc.

We

have acted as Cayman Islands legal advisers to MicroAlgo Inc. (the “Company”) in connection with the Company’s

registration statement on Form F-3, including all amendments or supplements thereto (the “Registration Statement”),

initially filed on 18 December 2023 with the Securities and Exchange Commission under the U.S. Securities Act of 1933, as amended to

date relating to securities to be issued and sold by the Company from time to time, and the prospectus supplement dated 4 January 2024

(the “Prospectus Supplement”) relating to the sale of (a) up to US$4,000,000 ordinary shares of the Company of a par

value of US$0.001 each (the “Shares”) in accordance with the Securities Purchase Agreement dated 4 January 2024 entered

into between the Company and the Purchaser named therein (the “Securities Purchase Agreement”); and (b) up to 2,300,000

Shares underlying previously issued warrants by the Company in accordance with the Warrant Agreement of the Company dated 8 February

2021 entered into between the Company and the Purchaser named therein (the “Warrant Agreement”).

We

are furnishing this opinion and consent as Exhibit 5.1 to the Company’s current report on Form 6-K which will be incorporated by

reference into the Registration Statement and the Prospectus Supplement (the “Form 6-K”).

For

the purposes of this opinion, we have reviewed only originals, copies or final drafts of the following documents:

| 1.1 | The

certificate of incorporation of the Company dated 14 May 2018 and the certificate of incorporation on change of name of the Company dated

9 December 2022 issued by the Registrar of Companies in the Cayman Islands. |

| 1.2 | The

amended and restated memorandum and articles of association of the Company as adopted by a special resolution passed on 21 October 2022

with effect from 9 December 2022 (the “Memorandum and Articles”). |

| 1.3 | The

written resolutions of the board of directors of the Company dated 4 January 2024 (the “Directors’ Resolutions”),

and the corporate records of the Company maintained at its registered office in the Cayman Islands. |

| 1.4 | A

certificate from a director of the Company, a copy of which is attached hereto (the “Director’s Certificate”). |

| 1.5 | A

certificate of good standing dated 15 December 2023, issued by the Registrar of Companies in the Cayman Islands (the “Certificate

of Good Standing”). |

| 1.6 | The

Registration Statement and the Form 6-K. |

| 1.7 | The

Prospectus Supplement. |

| 1.8 | The

Securities Purchase Agreement. |

| 1.9 | The

Warrant Agreement. |

The

following opinions are given only as to, and based on, circumstances and matters of fact existing and known to us on the date of this

opinion letter. These opinions only relate to the laws of the Cayman Islands which are in force on the date of this opinion letter. In

giving these opinions we have relied (without further verification) upon the completeness and accuracy, as of the date of this opinion

letter, of the Director’s Certificate and the Certificate of Good Standing. We have also relied upon the following assumptions,

which we have not independently verified:

| 2.1 | Copies

of documents, conformed copies or drafts of documents provided to us are true and complete

copies of, or in the final forms of, the originals. |

| 2.2 | All

signatures, initials and seals are genuine. |

| 2.3 | There

is nothing under any law (other than the law of the Cayman Islands), which would or might

affect the opinions set out below. |

Based

upon the foregoing and subject to the qualifications set out below and having regard to such legal considerations as we deem relevant,

we are of the opinion that:

| 3.1 | The

Company has been duly incorporated as an exempted company with limited liability and is validly

existing and in good standing with the Registrar of Companies under the laws of the Cayman

Islands. |

| 3.2 | The

authorised share capital of the Company is US$200,000 divided into 200,000,000 ordinary shares

of a par value of US$0.001 each. |

| 3.3 | The

issue and allotment of the Shares have been duly authorised and when allotted, issued and

paid for as contemplated in the Registration Statement, the Prospectus Supplement and the

Securities Purchase Agreement, the Shares will be legally issued and allotted, fully paid

and non-assessable. As a matter of Cayman Islands law, a share is only issued when it has

been entered in the register of members (shareholders). |

| 3.4 | The

statements under the caption “Taxation” in the Prospectus Supplement forming

part of the Registration Statement, to the extent that they constitute statements of Cayman

Islands law, are accurate in all material respects and that such statements constitute our

opinion. |

The

opinions expressed above are subject to the following qualifications:

| 4.1 | To

maintain the Company in good standing under the laws of the Cayman Islands, annual filing

fees must be paid and returns made to the Registrar of Companies within the time frame prescribed

by law. |

| 4.2 | In

this opinion the phrase “non-assessable” means, with respect to the Shares in

the Company, that a shareholder shall not, solely by virtue of its status as a shareholder,

and in absence of a contractual arrangement, or an obligation pursuant to the memorandum

and articles of association, to the contrary, be liable for additional assessments or calls

on the Shares by the Company or its creditors (except in exceptional circumstances, such

as involving fraud, the establishment of an agency relationship or an illegal or improper

purpose or other circumstances in which a court may be prepared to pierce or lift the corporate

veil). |

Except

as specifically stated herein, we make no comment with respect to any representations and warranties which may be made by or with respect

to the Company in any of the documents or instruments cited in this opinion or otherwise with respect to the commercial terms of the

transactions, which are the subject of this opinion.

We

hereby consent to the filing of this opinion as an exhibit to the Form 6-K, and to the reference to our name under the headings “Enforcement

of Civil Liabilities” and “Legal Matters” and elsewhere in the prospectus included in the Registration Statement and

the Prospectus Supplement. In giving such consent, we do not thereby admit that we come within the category of persons whose consent

is required under Section 7 of the U.S. Securities Act of 1933, as amended, or the Rules and Regulations of the Commission thereunder.

Yours

faithfully

Maples

and Calder (Hong Kong) LLP

Exhibit 99.1

SECURITIES PURCHASE AGREEMENT

This Securities Purchase Agreement (this “Agreement”) is dated as of January 4, 2024, between MicroAlgo Inc., a Cayman Islands company (the “Company”), and WiMi Hologram Cloud Inc., a Cayman Islands company and the parent entity of the Company (the “Purchaser”).

WHEREAS, subject to the terms and conditions set forth in this Agreement and pursuant

to an effective registration statement under the Securities Act of 1933, as amended

(the “Securities Act”), the Company desires to issue and sell to the Purchaser, and the Purchaser desires to purchase from the Company, securities of the Company as more fully described

in this Agreement.

NOW, THEREFORE, IN CONSIDERATION of the mutual covenants contained in this Agreement,

and for other good and valuable consideration the receipt and adequacy of which are

hereby acknowledged, the Company and the Purchaser agree as follows:

ARTICLE I.

DEFINITIONS

1.1 Definitions. In addition to the terms defined elsewhere in this Agreement, for all purposes of

this Agreement, the following terms have the meanings set forth in this Section 1.1:

“Affiliate” means any Person that, directly or indirectly through one or more intermediaries,

controls or is controlled by or is under common control with a Person as such terms

are used in and construed under Rule 405 under the Securities Act.

“Board of Directors” means the board of directors of the Company.

“Business Day” means any day other than Saturday, Sunday or other day on which commercial banks

in The City of New York and the People’s Republic of China are authorized or required by law to remain closed.

“Closing” means the closing of the purchase and sale of the Securities pursuant to Section 2.1.

“Closing Date” means the Trading Day on which all of the Transaction Documents have been executed

and delivered by the applicable parties thereto, and all conditions precedent to (i)

the Purchaser’s obligations to pay the Subscription Amount, (ii) the Company’s obligations to deliver the Securities, in each case, have been satisfied or waived,

but in no event later than the second (2nd) Trading Day following the date hereof.

“Commission” means the United States Securities and Exchange Commission.

“Ordinary Shares” means the ordinary shares of the Company, par value $0.001 per share, and any other

class of securities into which such securities may hereafter be reclassified or changed.

“Exchange Act” means the Securities Exchange Act of 1934, as amended, and the rules and regulations

promulgated thereunder.

“Liens” means a lien, charge, pledge, security interest, encumbrance, right of first refusal,

preemptive right or other restriction.

“Material Permits” shall have the meaning ascribed to such term in Section 3.1(g).

“Per Share Purchase Price” equals US$0.50, subject to adjustment for reverse and forward stock splits, stock dividends, stock

combinations and other similar transactions of the Ordinary Share that occur after

the date of this Agreement.

“Person” means an individual or corporation, partnership, trust, incorporated or unincorporated

association, joint venture, limited liability company, joint stock company, government

(or an agency or subdivision thereof) or other entity of any kind.

“Proceeding” means an action, claim, suit, investigation or proceeding (including, without limitation,

an informal investigation or partial proceeding, such as a deposition) pending or,

to the Company’s knowledge, threatened in writing against or affecting the Company, any Subsidiary

or any of their respective properties before or by any court, arbitrator, governmental

or administrative agency or regulatory authority (federal, state, county, local or

foreign).

“Prospectus” means the final base prospectus filed for the Registration Statement and declared effective on December 27, 2023 by the Commission.

“Prospectus Supplement” means the supplement to the Prospectus complying with Rule 424(b) of the Securities Act that is filed with the Commission and delivered by the

Company to the Purchaser at the Closing.

“Registration Statement” means the effective registration statement with Commission File No. 333-276098 which registers the sale of the Shares.

“Required Approvals” shall have the meaning ascribed to such term in Section 3.1(c).

“Rule 424” means Rule 424 promulgated by the Commission pursuant to the Securities Act, as such Rule may

be amended or interpreted from time to time, or any similar rule or regulation hereafter

adopted by the Commission having substantially the same purpose and effect as such

Rule.

“SEC Reports” means all reports, schedules, forms, statements and other documents required to

be filed by the Company under the Securities Act and Exchange Act, including pursuant

to Section 13(a) or 15(d) thereof, for the 12 months preceding the date hereof, including the

exhibits thereto and documents incorporated by reference therein, together with the

Prospectus and the Prospectus Supplement.

“Securities” means the Shares.

“Securities Act” means the Securities Act of 1933, as amended, and the rules and regulations promulgated

thereunder.

“Shares” means the ordinary shares of issued or issuable to the Purchaser pursuant to this Agreement.

“Subsidiary”, for purpose of this Agreement, means any subsidiary of the Company, and shall,

where applicable, also include any direct or indirect subsidiary of the Company formed

or acquired after the date hereof.

“Trading Day” means a day on which the principal Trading Market is open for trading.

“Trading Market” means the Nasdaq Capital Market.

“Transaction Documents” means this Agreement, all exhibits and schedules thereto and hereto and any other

documents or agreements executed in connection with the transactions contemplated

hereunder.

“Transfer Agent” means Transhare Corporation, the current transfer agent of the Company, and any successor transfer agent of the

Company.

ARTICLE II.

PURCHASE AND SALE

2.1 Closing. On the Closing Date, upon the terms and subject to the conditions set forth herein,

the Company agrees to sell, and the Purchaser agrees to purchase 8,000,000 Shares each at the Per Share Purchase Price for an aggregate consideration of US$4,000,000. Upon satisfaction of the covenants and conditions set forth in Sections 2.2 and 2.3, the Closing shall occur at the offices of the Company.

2.2 Deliveries.

(a) On or prior to the Closing Date, the Company shall deliver or cause to be delivered

to the Purchaser the following:

(i) this Agreement duly executed by the Company;

(ii) the Prospectus and Prospectus Supplement.

(b) On or prior to the Closing Date, the Purchaser shall deliver or cause to be delivered to the Company the following:

(i) this Agreement duly executed by the Purchaser; and

(ii) $4,000,000, which shall be made available for “Delivery Versus Payment” settlement with the Company

or its designees, or in any manner reasonably satisfactory to the Company.

2.3 Closing Conditions.

(a) The obligations of the Company hereunder in connection with the Closing are subject

to the following conditions being met:

(i) the accuracy in all material respects when made and on the Closing Date of the

representations and warranties of the Purchaser contained herein;

(ii) all obligations, covenants and agreements of the Purchaser required to be performed at or prior to the Closing Date shall have been performed;

and

(iii) the delivery by the Purchaser of the items set forth in Section 2.2(b) of this Agreement.

(b) The respective obligations of the Purchasers hereunder in connection with the

Closing are subject to the following conditions being met:

(i) the accuracy in all material respects when made and on the Closing Date of the

representations and warranties of the Company contained herein;

(ii) all obligations, covenants and agreements of the Company required to be performed

at or prior to the Closing Date shall have been performed;

ARTICLE III.

REPRESENTATIONS AND WARRANTIES

3.1 Representations and Warranties of the Company. The Company hereby makes the following representations and warranties to the Purchaser:

(a) Organization and Qualification. The Company is an entity duly incorporated, validly existing and in good standing under the laws of the jurisdiction of its

incorporation with full right and corporate power and authority to enter into and to consummate the transactions contemplated

by the Transaction Documents and otherwise to carry out its obligations hereunder

and thereunder. The execution and delivery of the Transaction Documents and performance

by the Company of the transactions contemplated by the Transaction Documents have been duly authorized

by all necessary corporate action, as applicable. Each Transaction Document to which

it is a party has been duly executed by the Company, and when delivered by the Purchaser in accordance with the terms hereof, will constitute

the valid and legally binding obligation of the Company, enforceable against it in accordance with its terms.

(b) Authorization; Enforcement. The Company has the requisite corporate power and authority to enter into and to

consummate the transactions contemplated by this Agreement and each of the other Transaction

Documents and otherwise to carry out its obligations hereunder and thereunder. The

execution and delivery of this Agreement and each of the other Transaction Documents

by the Company and the consummation by it of the transactions contemplated hereby

and thereby have been duly authorized by all necessary action on the part of the Company

and no further action is required by the Company, the Board of Directors or the Company’s stockholders in connection herewith or therewith other than in connection with the

Required Approvals (as defined below).

(c) Issuance of the Securities; Registration. The Securities have been duly authorized and, when issued and paid for in accordance

with the applicable Transaction Documents, will be duly and validly issued, fully

paid and nonassessable, free and clear of all Liens imposed by the Company. The Company

has reserved from its duly authorized capital stock the maximum number of shares of

Common Stock issuable pursuant to this Agreement. The Company has prepared and filed

the Registration Statement in conformity with the requirements of the Securities Act,

which became effective on December 27, 2023 (the “Effective Date”), including the Prospectus, and such amendments and supplements thereto as may have

been required to the date of this Agreement. The Registration Statement is effective

under the Securities Act and no stop order preventing or suspending the effectiveness

of the Registration Statement or suspending or preventing the use of the Prospectus

has been issued by the Commission and no proceedings for that purpose have been instituted

or, to the knowledge of the Company, are threatened by the Commission. The Company,

if required by the rules and regulations of the Commission, shall file the Prospectus

Supplement with the Commission pursuant to Rule 424(b).

(d) Capitalization. Except as may be described in the SEC Reports, all of the issued share capital of

the Company has been duly and validly authorized and issued, is fully paid and non-assessable.

(e) SEC Reports. The Company has filed all reports, schedules, forms, statements and other documents

required to be filed by the Company under the Securities Act and Exchange Act, including

pursuant to Section 13(a) or 15(d) thereof, for the 12 months preceding the date hereof (or such shorter

period as the Company was required by law or regulation to file such material) on

a timely basis or has received a valid extension of such time of filing and has filed

any such SEC Reports prior to the expiration of any such extension.

(f) Regulatory Permits. The Company and the Subsidiaries possess all certificates, authorizations and permits

issued by the appropriate federal, state, local or foreign regulatory authorities

necessary to conduct their respective businesses as described in the SEC Reports,

except where the failure to possess such permits could not reasonably be expected

to result in a Material Adverse Effect (“Material Permits”), and neither the Company nor any Subsidiary has received any notice of proceedings

relating to the revocation or modification of any Material Permit.

3.2 Representations and Warranties of the Purchasers. The Purchaser hereby represents and warrants as of the date hereof and as of the Closing Date to

the Company as follows (unless as of a specific date therein, in which case they shall

be accurate as of such date):

(a) Organization; Authority. The Purchaser is an entity duly incorporated and validly existing and in good standing under the laws of the jurisdiction of its incorporation

with full right and corporate power and authority to enter into and to consummate the transactions contemplated

by the Transaction Documents and otherwise to carry out its obligations hereunder

and thereunder. The execution and delivery of the Transaction Documents and performance

by the Purchaser of the transactions contemplated by the Transaction Documents have

been duly authorized by all necessary corporate action, as applicable. Each Transaction

Document to which it is a party has been duly executed by the Purchaser, and when

delivered by the Purchaser in accordance with the terms hereof, will constitute the

valid and legally binding obligation of the Purchaser, enforceable against it in accordance

with its terms.

(b) Informed Investment Decision. Based on the information such Purchaser has deemed appropriate, it has independently

made its own analysis and decision to enter into the Transaction Documents. Such Purchaser

has sought its own accounting, legal and tax advice as it has considered necessary

to make an informed decision with respect to its acquisition of the Securities.

(c) No Intent to Effect a Change of Control; Ownership. Such Purchaser has no present intent to effect a “change of control” of the Company

as such term is understood under the rules promulgated pursuant to Section 13(d) of the Exchange Act and under the rules of the Nasdaq Capital Market.

ARTICLE IV.

OTHER AGREEMENTS OF THE PARTIES

4.1 Reservation of Ordinary Share. As of the date hereof, the Company has reserved and the Company shall continue to

reserve and keep available at all times, free of preemptive rights, a sufficient number

of ordinary shares for the purpose of enabling the Company to issue Shares pursuant

to this Agreement.

ARTICLE V.

MISCELLANEOUS

5.1 Termination. This Agreement may be terminated by the Company or the Purchaser by written notice to the other parties, if the Closing has not been consummated on

or before the 30th Trading Day following the date hereof;

5.2 Fees and Expenses. Except as expressly set forth in the Transaction Documents to the contrary, each

party shall pay the fees and expenses of its advisers, counsel, accountants and other

experts, if any, and all other expenses incurred by such party incident to the negotiation,

preparation, execution, delivery and performance of this Agreement. The Company shall

pay all Transfer Agent fees (including, without limitation, any fees required for

same-day processing of any instruction letter delivered by the Company and any exercise

notice delivered by a Purchaser), stamp taxes and other taxes and duties levied in

connection with the delivery of any Securities to the Purchaser.

5.3 Entire Agreement. The Transaction Documents, together with the exhibits and schedules thereto, the

Prospectus and the Prospectus Supplement, contain the entire understanding of the

parties with respect to the subject matter hereof and thereof and supersede all prior

agreements and understandings, oral or written, with respect to such matters, which

the parties acknowledge have been merged into such documents, exhibits and schedules.

5.4 Notices. Any and all notices or other communications or deliveries required or permitted

to be provided hereunder shall be in writing and shall be deemed given and effective

on the time of transmission by electronic mail.

5.5 Amendments; Waivers. No provision of this Agreement may be waived, modified, supplemented or amended

except in a written instrument signed by the Company and the Purchaser. No waiver of any default with respect to any provision, condition or requirement of

this Agreement shall be deemed to be a continuing waiver in the future or a waiver

of any subsequent default or a waiver of any other provision, condition or requirement

hereof, nor shall any delay or omission of any party to exercise any right hereunder

in any manner impair the exercise of any such right. Any amendment effected in accordance

with this Section 5.5 shall be binding upon the Purchaser and the Company.

5.6 Headings. The headings herein are for convenience only, do not constitute a part of this Agreement

and shall not be deemed to limit or affect any of the provisions hereof.

5.7 Successors and Assigns. This Agreement shall be binding upon and inure to the benefit of the parties and

their successors and permitted assigns. No party hereto may assign this Agreement

or any rights or obligations hereunder without the prior written consent of the Company

and the Purchaser.

5.8 No Third-Party Beneficiaries. This Agreement is intended for the benefit of the parties hereto and their respective

successors and permitted assigns and is not for the benefit of, nor may any provision

hereof be enforced by, any other Person.

5.9 Governing Law. All questions concerning the construction, validity, enforcement and interpretation

of the Transaction Documents shall be governed by and construed and enforced in accordance

with the internal laws of the State of New York, without regard to the principles

of conflicts of law thereof. Each party agrees that all legal proceedings concerning

the interpretations, enforcement and defense of the transactions contemplated by this

Agreement and any other Transaction Documents (whether brought against a party hereto

or its respective affiliates, directors, officers, shareholders, partners, members,

employees or agents) shall be commenced exclusively in the state and federal courts

sitting in the City of New York. Each party hereby irrevocably submits to the exclusive

jurisdiction of the state and federal courts sitting in the City of New York, Borough

of Manhattan for the adjudication of any dispute hereunder or in connection herewith

or with any transaction contemplated hereby or discussed herein (including with respect

to the enforcement of any of the Transaction Documents), and hereby irrevocably waives,

and agrees not to assert in any action or proceeding, any claim that it is not personally

subject to the jurisdiction of any such court, that such action or proceeding is improper

or is an inconvenient venue for such Proceeding. Each party hereby irrevocably waives

personal service of process and consents to process being served in any such action

or proceeding by mailing a copy thereof via registered or certified mail or overnight

delivery (with evidence of delivery) to such party at the address in effect for notices

to it under this Agreement and agrees that such service shall constitute good and

sufficient service of process and notice thereof. Nothing contained herein shall be

deemed to limit in any way any right to serve process in any other manner permitted

by law. If any party shall commence an action or proceeding to enforce any provisions

of the Transaction Documents, the prevailing party in such action or proceeding shall

be reimbursed by the non-prevailing party for its reasonable attorneys’ fees and other costs and expenses incurred with the investigation, preparation and

prosecution of such action or proceeding.

5.10 Survival. The representations and warranties contained herein shall survive the Closing and

the delivery of the Securities.

5.11 Execution. This Agreement may be executed in two or more counterparts, all of which when taken

together shall be considered one and the same agreement and shall become effective

when counterparts have been signed by each party and delivered to each other party,

it being understood that the parties need not sign the same counterpart. In the event

that any signature is delivered by facsimile transmission or by e-mail delivery of

a “.pdf” format data file, such signature shall create a valid and binding obligation

of the party executing (or on whose behalf such signature is executed) with the same

force and effect as if such facsimile or “.pdf” signature page were an original thereof.

5.12 Severability. If any term, provision, covenant or restriction of this Agreement is held by a court

of competent jurisdiction to be invalid, illegal, void or unenforceable, the remainder

of the terms, provisions, covenants and restrictions set forth herein shall remain

in full force and effect and shall in no way be affected, impaired or invalidated,

and the parties hereto shall use their commercially reasonable efforts to find and

employ an alternative means to achieve the same or substantially the same result as

that contemplated by such term, provision, covenant or restriction. It is hereby stipulated

and declared to be the intention of the parties that they would have executed the

remaining terms, provisions, covenants and restrictions without including any of such

that may be hereafter declared invalid, illegal, void or unenforceable.

(Signature Pages Follow)

IN WITNESS WHEREOF, the parties hereto have caused this Securities Purchase Agreement

to be duly executed by their respective authorized signatories as of the date first

indicated above.

| MicroAlgo inc. |

|

Address for Notice: |

| |

|

|

| By: |

/s/

Min Shu |

|

Fax: |

|

| Name: |

Min Shu |

|

E-mail: |

|

| Title: |

Chief Executive Officer

|

|

|

| |

|

|

|

| WIMI HOLOGRAM CLOUD INC. |

|

Address for Notice: |

| |

|

|

| By: |

/s/ Shuo Shi |

|

Fax: |

|

| Name: |

Shuo Shi |

|

E-mail: |

|

| Title: |

Chief Executive Officer

|

|

|

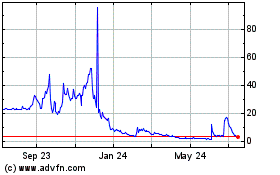

MicroAlgo (NASDAQ:MLGO)

Historical Stock Chart

From Oct 2024 to Nov 2024

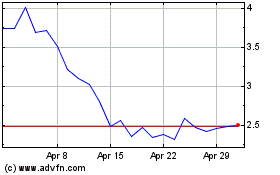

MicroAlgo (NASDAQ:MLGO)

Historical Stock Chart

From Nov 2023 to Nov 2024